Vehicle Miles Traveled On The Rise Again

In March, vehicle miles traveled (VMT) rebounded to pre-pandemic levels. According to the Auto Care Association, this was the first month since August 2019 that VMT topped 300 million miles. To give you some perspective, the distance between the earth and the moon is only 238,856 miles, according to Wikipedia.

Chart Of The Day: Subaru Sets Monthly U.S. WRX/STI Sales Record In July 2015

After two consecutive years of growth, including record-setting U.S. sales achievements in 2014, what does the Subaru WRX do for an encore performance?

An all-time monthly record of 3,716 WRX/STI sales in July 2015 starts the second-half off strongly after a first-half in which sales of Subaru’s rally-inspired nameplate jumped ahead of last year’s sales pace by 14 percent.

When setting a brand-wide sales record in 2014, Subaru’s WRX/STI-specific record of 25,492 units accounted for 5 percent of the brand’s total U.S. sales volume.

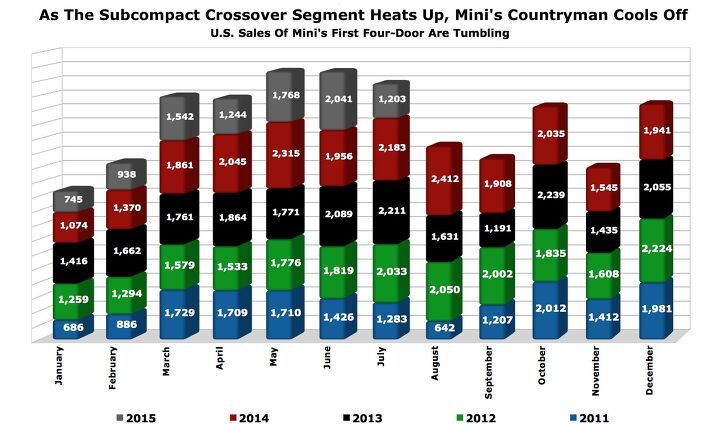

Chart Of The Day: Mini Countryman Sales Are Crumbling In The United States

A rising tide lifts all boats?

Not in the Mini Countryman’s case.

One of the oldest models on the block, the Countryman, is suffering from a sharp decline in U.S. sales even as consumers develop greater interest in subcompact crossovers.

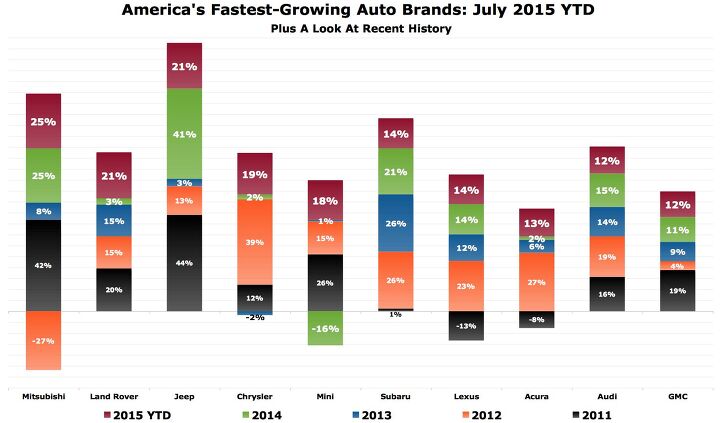

Chart Of The Day: Mitsubishi Is America's Fastest Growing Auto Brand, Sort Of

Relative to their own achievements during the first seven months of 2014, no auto brand in America is growing faster through the first seven months of 2015 than Mitsubishi.

Mitsubishi?

Yes, Mitsubishi.

Chart Of The Day: Volvo XC90 Sales Are Way Up, Now Double It

We’re finally beginning to see the impact a new SUV can have in Volvo showrooms.

The second-generation XC90 posted a 209% year-over-year increase to 1,176 U.S. sales in July 2015. That equalled 796 more sales this July than last and the highest monthly total for the XC90 since December 2010.

So is Volvo back? Well, not quite. Not yet.

Because the auto market is so seasonal, year-over-year change is a valid figure to consider, but it’s less useful when the previous year in the year-over-year comparison was the 13th year in the model’s lifespan. XC90 sales in July 2014, for instance, were 88% lower than in July 2004.

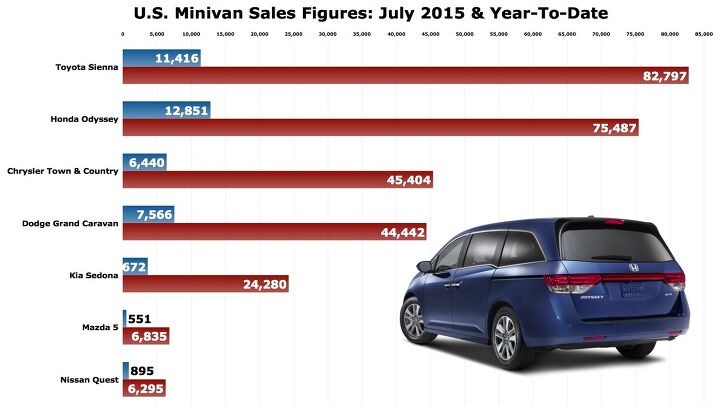

Chart Of The Day: Honda Odyssey Puts An End To Toyota Sienna's Best Seller Streak

Not since January of last year had the Honda Odyssey finished a month as America’s top-selling minivan. Indeed, not since October of last year had the Toyota Sienna not been America’s best-selling minivan.

But in July 2015, Odyssey sales jumped 18 percent, year-over-year, enough to overtake the Sienna on a monthly basis.

Chart Of The Day: U.S. SUV/Crossover Market Share Surges In July 2015

U.S. sales of SUVs and crossovers jumped 14 percent in July 2015, a year-over-year improvement equal to more than 67,000 extra sales compared with July 2014.

As a result, just under 36 percent of the U.S. auto industry’s volume was produced by utility vehicles in July 2015, a three-percentage-point increase over the same period one year ago.

Passenger car volume, meanwhile, slid 3 percent last month, a drop of around 18,000 sales as the overall market grew by more than 5 percent, or 75,000 units.

Chart Of The Day: 2014's U.S. Full-Size SUV Sales Pace Wasn't Sustainable

There were six new full-size SUVs from General Motors. Ford refreshed the Expedition. Lincoln did the same with their upmarket Expedition, the Navigator.

The year was 2014, and U.S. sales of Detroit’s biggest, baddest, full-size SUVs were booming, relative to the recent past.

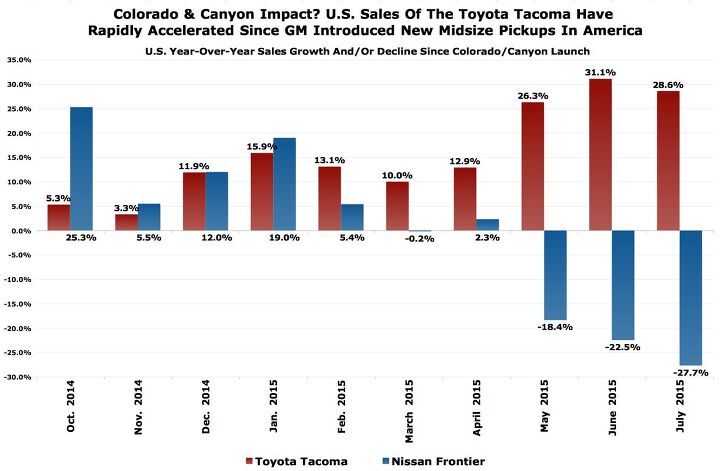

Chart Of The Day: Toyota Tacoma U.S. Sales Growth Is A Thing To Behold

In each of the last 28 months, the Toyota Tacoma has been America’s fifth-best-selling pickup truck nameplate.

One might imagine, however, that its ability to succeed in its own sub-category of small/midsize trucks would have weakened over the last ten months. With the introduction of new midsize pickup trucks from General Motors, the best-selling manufacturer of pickup trucks in America, the number of Tacoma competitors increased from one, the Nissan Frontier, to three.

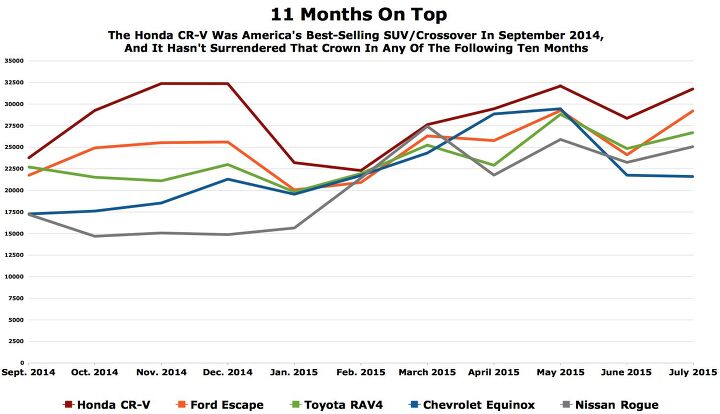

Chart Of The Day: July Marks 11 Months On Top For The Honda CR-V

Beginning in September 2014, the Honda CR-V began a streak as America’s best-selling SUV/crossover, a streak which has now extended through July 2015. Eleven consecutive months is no mean feat — the Toyota Camry’s current streak as America’s best-selling car is only six months long.

The CR-V is strengthening, however. In July, year-over-year volume jumped 11 percent to 31,785 units, 2,532 units more than the second-ranked Ford Escape managed. During this increasingly lengthy period of dominance, no one challenger has really stood up to take the fight to the CR-V.

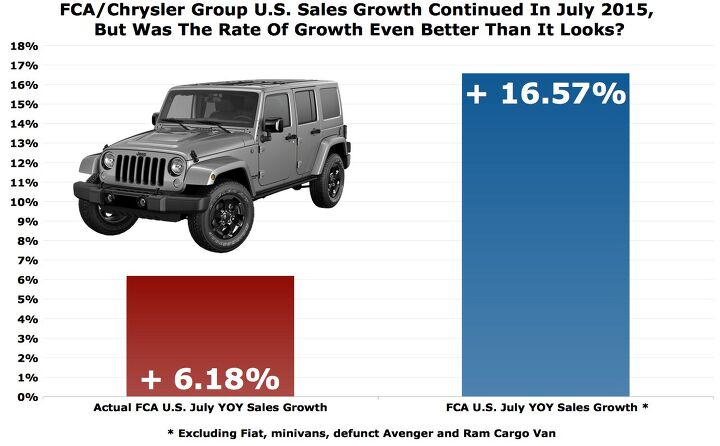

Chart Of The Day: Many Parts Of FCA's Lineup Are Growing Faster Than The FCA Lineup

Each and every month, a great deal of attention is paid to the length of Fiat Chrysler Automobiles’ U.S. growth streak. July 2015, for example, was the 64th consecutive month in which FCA, formerly known as the Chrysler Group, reported a year-over-year sales gain.

Yet so much of FCA’s rate of expansion in the U.S. market is muddied by dreadful results in a few small corners of their lineup.

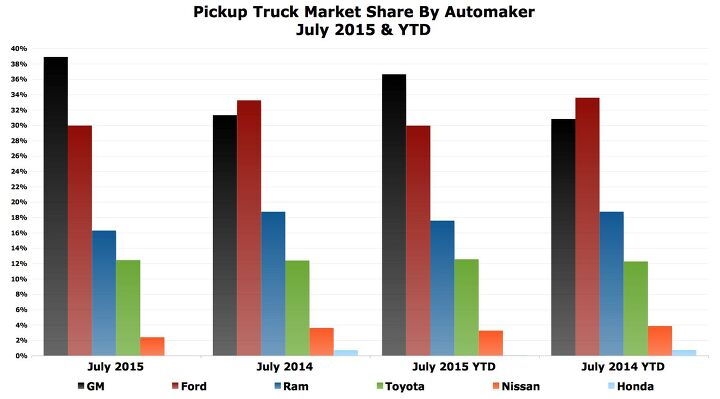

Chart Of The Day: GM's Pickup Truck Market Share Soars In July

General Motors reported 86,051 U.S. pickup truck sales in July 2015, the highest figure for a seventh month of the year since 2006, GM says.

It does not appear as though the advent of new midsize GM trucks – Colorado and Canyon – have had any measurably negative impact on their full-size siblings. Combined, the Chevrolet Silverado and GMC Sierra outsold the class-leading Ford F-Series by 9,900 copies in July. They lead the F-Series by more than 29,000 units heading into August.

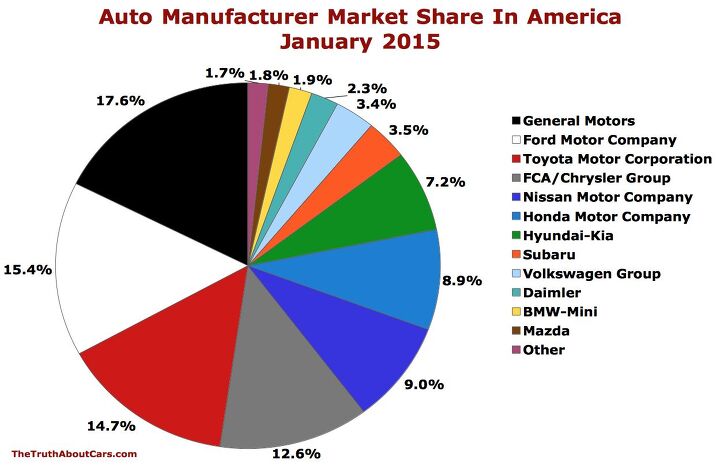

Chart Of The Day: Automaker Market Share In America – July 2015

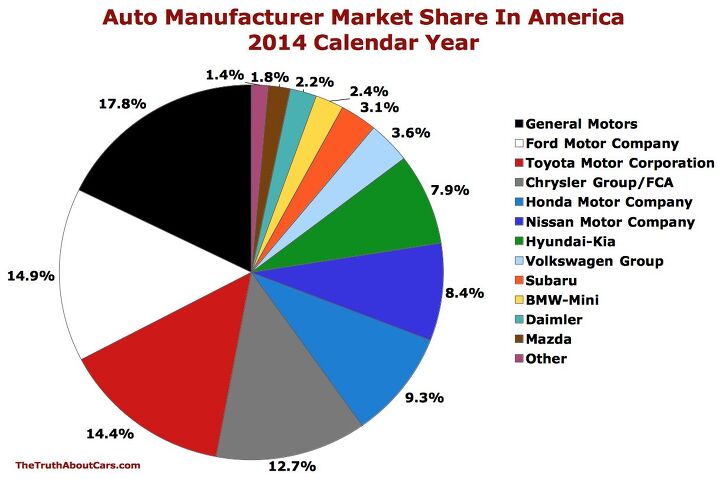

As the U.S. auto industry’s sales volume grew by more than 5 percent to 1.5 million units in July 2015, General Motors increased its July market share from 17.8 percent in 2014 to 18.0 percent in July 2015. GM says their retail sales jumped 14% last month. Total GM sales were up 6%.

Toyota Motor Sales saw their share of the U.S. market fall from 15 percent in July 2014 to 14.4 percent in July 2015 even as their premium Lexus division ended the month with more sales than BMW or Mercedes-Benz.

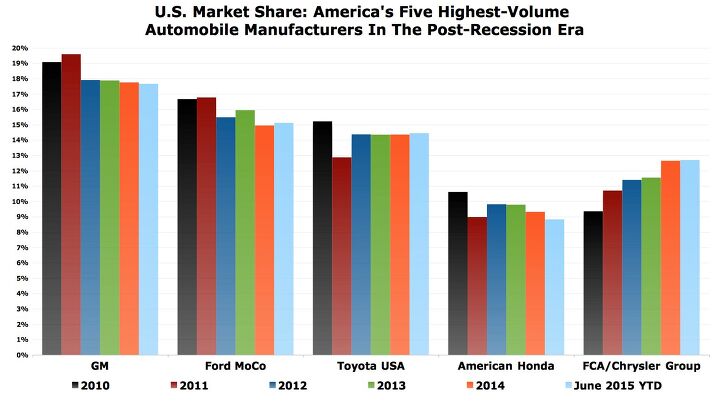

Chart Of The Day: Post-Recession Automaker Market Share In America

Since 2010 — when America’s auto industry was in tatters but also in recovery — General Motors, Ford Motor Company, Toyota USA, and American Honda have lost 5.5 percentage points of market share.

Through the first half of 2015, those four automobile manufacturers produced 56.1 percent of all new vehicle sales in the United States, down from 61.6 percent in calendar year 2010.

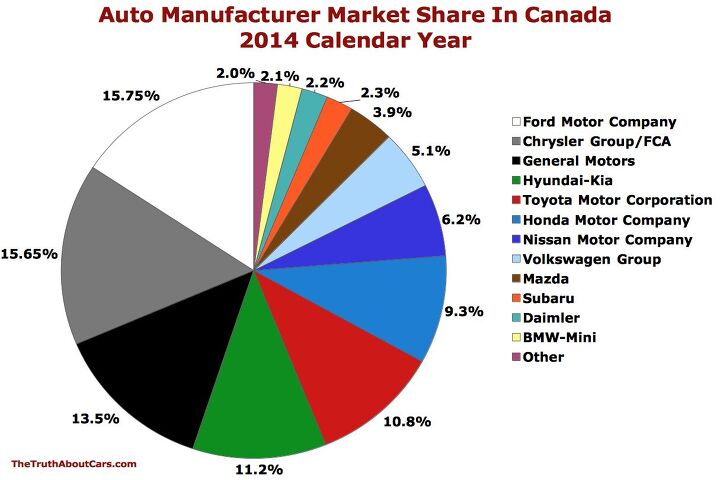

Chart Of The Day: Canada Loves FCA And Small Cars, But Not The Dodge Dart

FCA Canada only sold 220 Dodge Darts in June 2015, a 79-percent year-over-year decline. Through the first six months of 2015, Dart volume is down 55 percent to only 1,979 sales, one-fifteenth the total achieved by the best-selling Honda Civic and equal to just 1.1% of the compact car market.

The Dart’s market share in the United States, meanwhile, grew from 3.4 percent in the first-half of 2014 to 4.2 percent in the first half of 2015. Though no industry observer would suggest that the Dart’s U.S. uptick relates purely to increased desirability and demand – and not to cash allowances and fleet-friendliness – the car’s Canadian dive speaks volumes about FCA’s emphasis on light trucks and SUVs north of the 49th parallel.

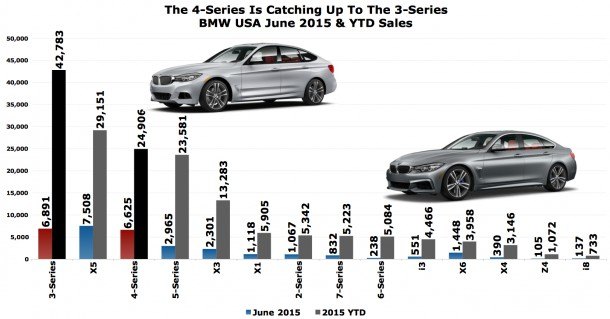

Chart Of The Day: BMW 4-Series Is Selling Almost As Often As The 3-Series

In June 2015, BMW USA finally began providing a breakdown in their monthly sales report for the 3-Series and 4-Series. We’re grateful.

You’ll recall that in prior generations, the 4-Series was the 3-Series. The 3-Series was the 3-Series, too, but the 4-Series cars were versions of the 3-Series with two doors.

The story is still the same, except now you can get a version of the 4-Series with four doors and a hatch. You can get a 3-Series with four doors and a hatch, too, except it’s ugly. The 4-Series with four doors and a hatch is a decent looker.

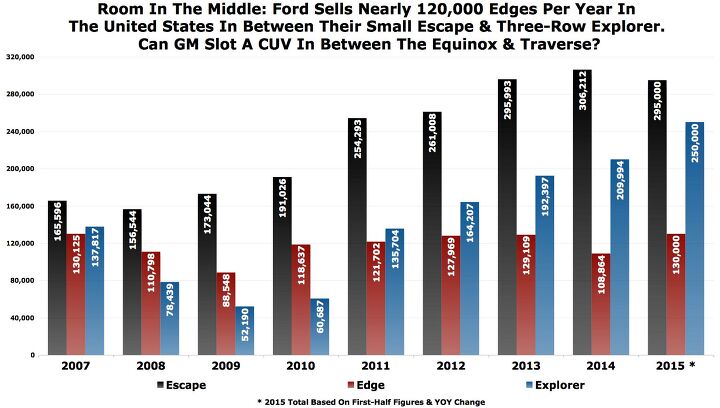

Chart Of The Day: Is There Room In The Middle For GM's Crossovers? Ford Says Yes

As General Motors prepares to carve out space in between their best-selling utility vehicle, the Equinox, and their large three-row crossover, the Traverse, Ford reports significant improvement with the launch of their second-generation tweener crossover.

U.S. sales of the Ford Edge jumped 44 percent to 40,083 units in the second-quarter of 2015. The May 2015 total of 14,399 units was the best May ever for the Edge, which slots in between the Escape, one of America’s best-selling utility vehicles, and rubs up alongside the longer, three-row Explorer.

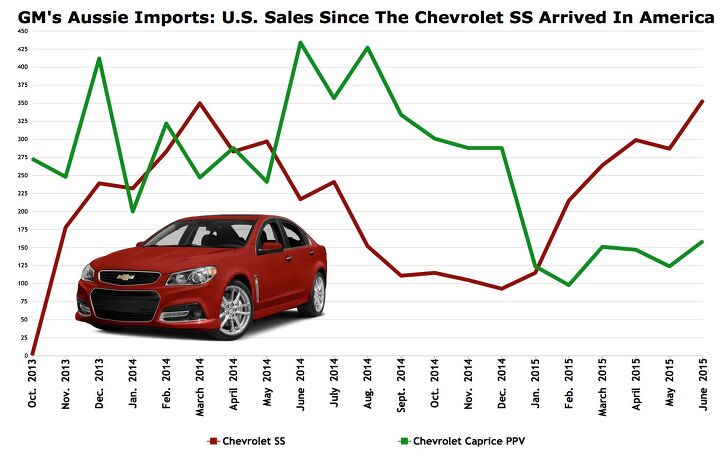

Chart Of The Day: GM Set A Chevrolet SS Sales Record In June, Caprice PPV Sales Plunge

Often criticized for flopping in the U.S. marketplace, Chevrolet set a sales record with the Aussie-built SS in June 2015.

Prior to June’s “surge” up to a still rather paltry 354 units, Chevrolet hadn’t sold more than 300 SS sedans since March of last year, the only other time the SS has crested the 300-unit mark. June 2015 SS volume was four units stronger than the March record.

Chart of the Day: America's Favorite Expensive Vehicles in 2015's First Six Months

So many upper-crust products sit at the top of their respective automaker’s lineup and do little more than look pretty. They are flagships, technological showcases, standard bearers.

On the other hand, there’s the Mercedes-Benz S-Class, with its base price of more than $95,000 in the United States. Flagship? Yes. Technological showcase? That, too. Standard-bearer? Of course. But the S-Class is also popular.

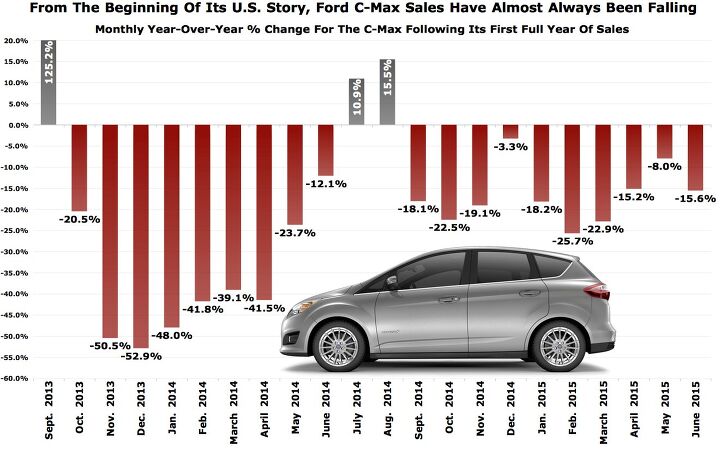

Ford C-Max Sales Have Perpetually Declined In America

Following Ford’s announcement that production of the Focus and C-Max would leave Wayne, Michigan in the next few years, sales personnel at Ford dealers across America were heard asking their managers, “We still sell the C-Max?”

No, that’s not entirely true. Ford is moving Focus and C-Max production out of Wayne by 2018, but we weren’t privy to the conversations inside Ford showrooms. That question may or may not have been asked.

Through the first-half of this year, Ford’s U.S. dealers only sold an average of four C-Max Hybrids and C-Max Energis per dealer per month.

Chart Of The Day: Month After Month, Most Midsize Cars Are Posting Declining U.S. Sales

As U.S. sales of the best-selling midsize car — and best-selling car overall – declined 3% during the first-half of 2015, one would assume that an opportunity opens up for its nearest rivals. But while the Camry has fallen slightly, the Honda Accord tumbled 16% and the Nissan Altima slipped 3%.

Surely then, the second tier of candidates would make real headway? No, in the midst of this convenient moment, the Ford Fusion is down 7%. In fact, on a year-over-year basis, Fusion sales have declined in eight consecutive months.

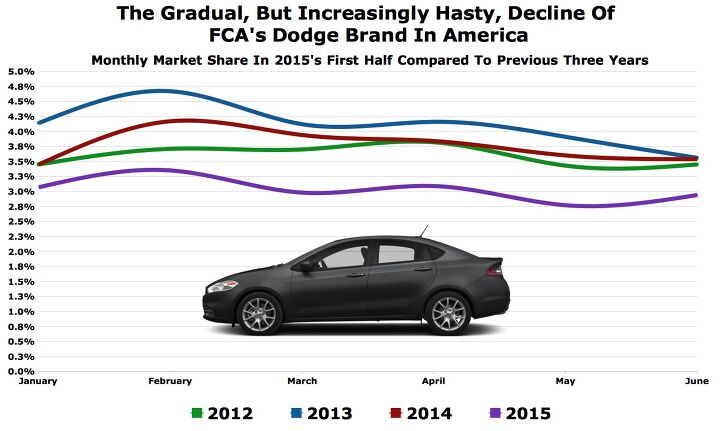

Chart Of The Day: The Dodge Brand's Decline Can Not Be Surprising To You

Dodge’s share of the U.S. market has been sliding with great consistency for years. Much of the blame for the dramatic drop-off in 2009 — Dodge’s market share fell from 5.9% in 2008 to 3.1% the next year — was a direct result of losing Ram trucks to a self-titled Ram division.

But even the post-Ram Dodge of today owns a significantly smaller portion of the market than the post-Ram Dodge of, for instance, 2013. Although America’s midsize car market is declining, it certainly does Dodge no favours that the brand now possesses no midsize car. The Chrysler 200 is now left to avenge the Avenger’s blood.

Chart Of The Day: 2015's First-Half U.S. Pickup Truck Sales Wars

U.S. sales of pickup trucks increased 10% through the first six months of 2015, a gain of more than 107,000 units over the span of 2015’s first-half.

Ford’s F-Series continues to be the category’s top seller, but F-Series volume has decreased in each of the last five months. Second-quarter sales slid 6.5%. As Ford properly equips its dealers with truck inventory and as the automaker figures out precisely how to price the new range of F-150s, we can expect to see F-Series numbers stabilize.

In the meantime, GM’s full-size twins have taken full advantage of the F-Series’ slide.

Chart Of The Day: America's 15 Best-Selling American Vehicles In The First Half Of 2015

Remember when the U.S. auto industry was very much an American auto industry? No? I don’t, either.

But there was a time when an American car was an American car because it was made by an American car company in America.

Chart Of The Day: U.S. Automaker Market Share In America – June 2015 YTD

General Motors generated 17.7% of the U.S. auto industry’s new vehicle sales in the first-half of 2015, a slight decline from the 17.8% market share earned by GM in the same period one year ago.

GM, the top-selling automobile manufacturer in the United States, posted a 3.4% year-over-year sales improvement through the first six months of 2015, but that was a full percentage point off the pace set by the industry as a whole.

Chart Of The Day: NX Boosting Lexus In The Time Of The RX's Need

Conventionally pretty, it is not. But the Lexus NX is a hit.

The NX200t and NX300h combined to generate 4,014 U.S. sales in May 2015, the best month yet for the six-month-old NX line. Year-to-date, 16,546 copies of the NX have been sold in America. Since the end of November, 19,473 NXs have found their way into driveways across America.

Lexus, of course, has a tradition of building wildly popular premium crossovers. The RX is perennially America’s top-selling premium utility vehicle.

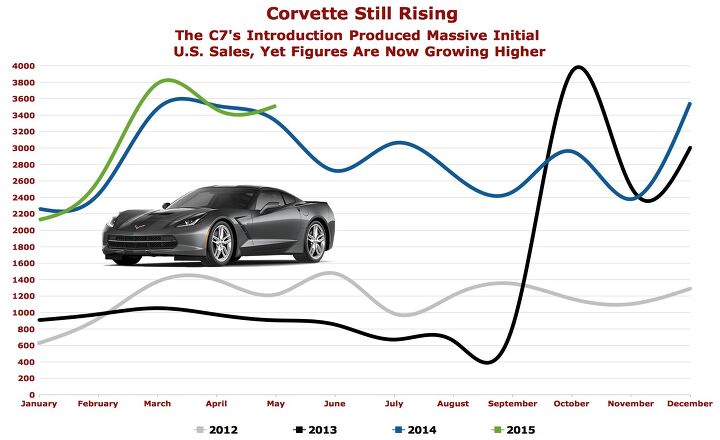

Chart Of The Day: Like Horsepower, Corvette Interest Grows Over Time

After averaging fewer than 1,200 monthly spring sales in 2010, 2011, 2012, and 2013, the launch of the C7 presented Chevrolet with more than 3,000 sales in March and in April and in May 2014.

Surely that’s all because of pent-up demand, right? After the C6 battled quite respectably through a recession, the craziness of the C7 was bound to generate a great deal of initial demand.

And yet one year later, long since its launch, the Corvette is selling just as well. Better, in fact.

Chart Of The Day: 2015 Will Be Ford Fiesta's Seventh Consecutive Year As UK's Best-Selling Car

The Ford Fiesta is on track in 2015 to celebrate a seventh consecutive year as the best-selling vehicle in the United Kingdom. A streak which began in 2009 – following the Focus’s own tenure atop the leaderboard – appears completely secure now that the Fiesta has outsold its nearest rival by 19,000 units over the course of just five months.

The Fiesta is not a popular car by the standards with which Americans identify popularity. On this side of the pond, for example, the Ford F-Series is America’s best-selling line of vehicles, but the F-Series accounts for 4.3% of the overall auto industry’s volume. The Fiesta generates 5.3% of UK auto industry volume.

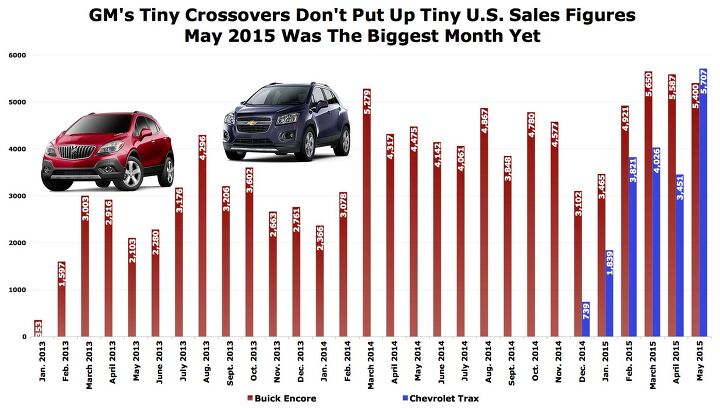

Chart Of The Day: May 2015 Was The Best Month Yet For GM's Subcompact Crossovers

During a month in which American Honda reported the brand’s first 6,381 HR-V sales, a month in which Subaru and Mitsubishi reported record XV Crosstrek and Outlander Sport sales, a month in which Jeep sold another 4,416 Renegades, GM’s smallest crossovers combined for their highest sales total thus far, as well.

11,107 Buick Encores and Chevrolet Traxes (Traxi? Trai?) were sold in the United States in May 2015.

Chart Of The Day: Can The New Nissan Maxima Reverse This Downward Trend?

Nissan USA’s Maxima sales figures are about to look very good. Oh, not in comparison with, for instance, Nissan’s own Altima, one of America’s best-selling cars, but rather, in comparison with recent Nissan Maxima sales figures.

New, eighth-generation Maximas are beginning to arrive at dealers. These cars, as you might expect, replace the seventh-generation Maxima, a car that was launched back in 2008, just at the onset of a recession.

The aged Maxima, therefore, has appeared particularly unwell of late. With poor demand and few available Maximas to speak of, May 2015 volume was cut in half in the United States, year-over-year.

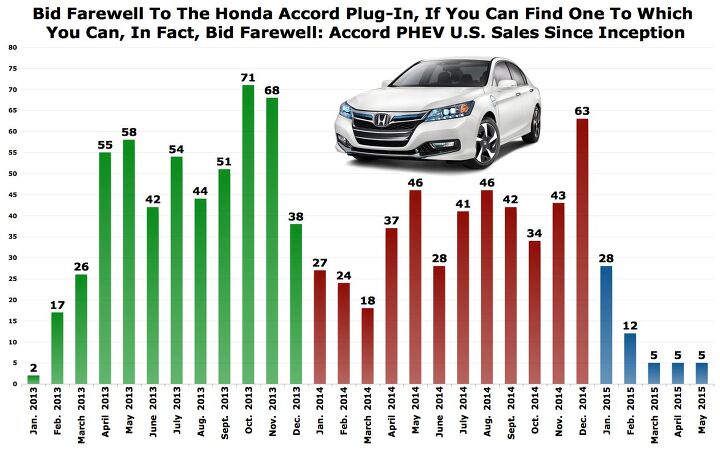

Chart Of The Day: The Discontinued Honda Accord Plug-In Hybrid Was All Kinds Of Rare

You thought you saw one once, didn’t you? A hint of blue trim was visible in the distance; some unique badging, as well.

But then when you Googled the images at home later, you realized that no, the front fascia was too normal. You saw the ninth-generation Honda Accord’s hybrid model, not the plug-in hybrid.

Indeed, spotting a Honda Accord Plug-In Hybrid is now statistically not all that different from catching a glimpse of a Porsche 918 Spyder. You roar ahead, trying to get a closer look, but it’s already pulled into Jerry Seinfeld’s exclusive parking garage. Or in the case of the Plug-In Hybrid, a Honda executive’s enclosed charging station.

As if Honda dealers haven’t had a hard enough time stocking Accord Hybrids, the Accord Plug-In Hybrid was so rarely built that only 1,030 have been sold in the United States since the car arrived in January 2013. That’s an average of 36 sales per month. No wonder Honda is, wait for it, pulling the plug.

Chart Of The Day: Is Kia About To Catch Hyundai In U.S. Sales?

Hyundai’s U.S. operations produced record sales in calendar year 2014 and in the process outsold Kia – which also reported record sales last year – by an average of 12,000 sales per month. That gap was narrower than in 2013, when Hyundai typically outsold Kia by more than 15,000 sales per month.

But after outselling its Kia partner by 6,206 units in January of this year, 8475 units in February, 16,248 in March (Hyundai Motor America’s best ever month), and 14,727 units in April, Hyundai’s favourable gap narrowed to only 1,177 units in May.

Chart Of The Day: Cadillac CTS Sales Are Down 41% In 2015

In each of the last five months, General Motors has failed to sell more than 1,800 copies of the CTS. Sub-2K CTS sales months are unheard-of. Even in 2012, when CTS volume slid 15%, Cadillac averaged 3,914 CTS sales per month in the United States and never fell below 2,300.

CTS volume dropped 31% in 2013 and another 4% in 2014. However, over the course of the last two calendar years, Cadillac averaged 2,644 CTS sales per month and never slid below the 2,000-unit mark.

In 2015, the CTS has been hit even harder.

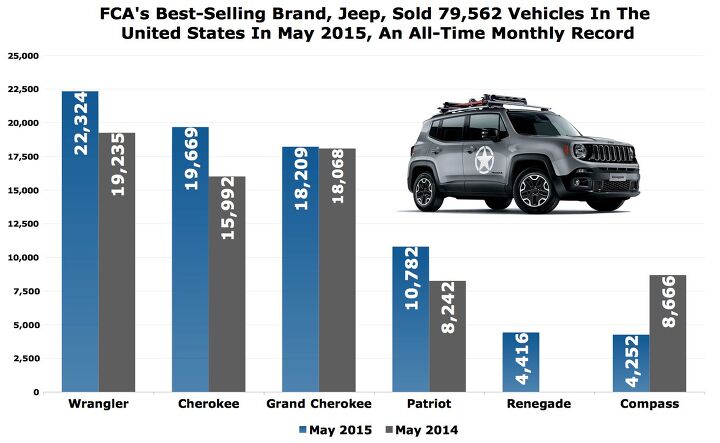

Chart Of The Day: Here's How Jeep Reported An All-Time Monthly U.S. Sales Record In May 2015

Four out of every ten new vehicles sold in May 2015 in the United States by Fiat Chrysler Automobiles were Jeeps, ten years after Jeep accounted for just 20% of Chrysler Group’s U.S. sales.

The automaker’s 4% year-over-year improvement was powered in large part by Jeep’s 13% gain. FCA volume improved by 8,000 units despite a 58% decrease in minivan volume. How’d they do it?

Chart Of The Day: U.S. Midsize Car Market Faltering, Leaders Earning Greater Market Share

Through the first five months of 2015, the Toyota Camry opened up a lead of nearly 36,000 units over the Nissan Altima in the race to end the year as America’s best-selling midsize car.

Aside from popularity, the Camry and Altima – as well as nearly every intermediate car on the market – share another factor in common: their sales are declining.

Chart Of The Day: U.S. SUV/Crossover Market Share Rises To 34% In May 2015

In May 2015, for the fifth consecutive month, more than one-third of the new vehicles sold in the United States were SUVs and crossovers. Year-over-year, the share of the market earned by utility vehicles increased from slightly less than 32% to slightly more than 34%, a gain equal to 50,000 extra sales in a market which saw passenger car volume tumble by nearly 30,000 units.

Led by the Honda CR-V, which was actually down 1% in May 2015, the U.S. SUV/crossover market was strengthened by new products last month. May was the second full month for the Jeep Renegade in what turned out to be the highest-volume month in the Jeep brand’s history. Not only did Jeep sell more than 20,000 Wranglers for the first time ever, not only did Jeep break the Cherokee’s sales record, but they also sold 4,416 copies of the Renegade.

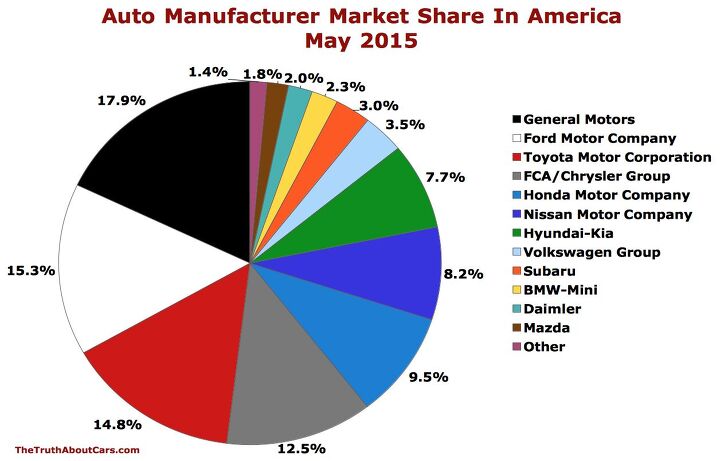

Chart Of The Day: Auto Brand Market Share In America In May 2015

General Motors earned 17.9% of the U.S. auto industry’s sales volume in May 2015, a drop from 18.5% one month ago but a slight improvement compared with May 2014, when GM’s market share stood at 17.7%.

In May 2015, GM’s U.S. sales grew at a 3% clip, twice the rate of improvement posted by the overall auto industry. GM’s gains came mainly as a result of improved pickup truck volume and a strong month for Lambda crossovers.

Chart Of The Day: 19 Months Of Midsize Pickup Truck Market Share In America

Midsize pickups have increased their share of the overall pickup truck category by around four percentage points since GM launched the second-generation Chevrolet Colorado and GMC Canyon.

Compared with a period when the twins weren’t on sale, the volume sent the direction of midsize pickups jumped 50% over the first four months of 2015. That gain of 39,000 units wasn’t simply down to the GM twins, either, as the class-leading Toyota Tacoma is growing faster than the overall pickup truck category.

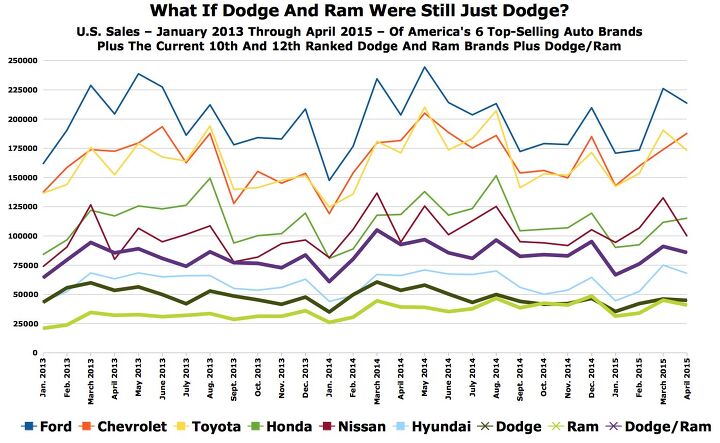

Chart Of The Day: What If Dodge And Ram Were Still Just Dodge?

As recently as 2009, Dodge was the sixth-best-selling auto brand in the United States.

But through the first four months of 2015, Dodge is the tenth-best-selling auto brand in America. Granted, Dodge volume has fallen 15% year-over-year, but the real reason for Dodge’s lower ranking is that the Dodge of today isn’t the Dodge of yesterday.

Chart Of The Day: 52 Months Of Record Audi USA Sales

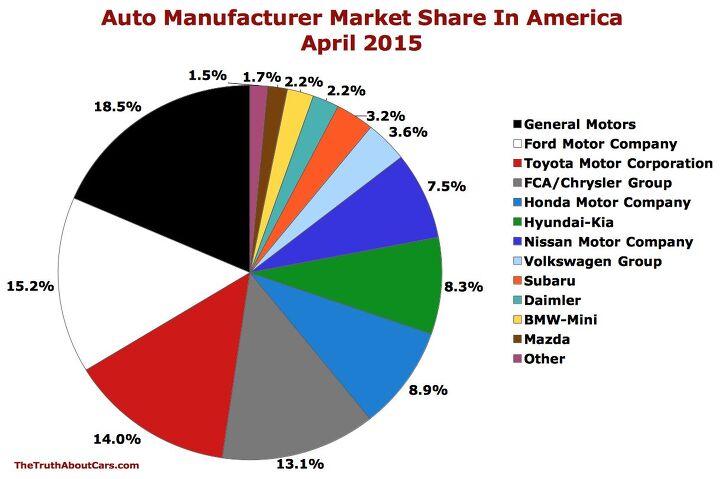

Chart Of The Day: Auto Brand Market Share In America In April 2015

Compared with the prior month, General Motors’ U.S. market share increased by more than two percentage points to 18.5% in April 2015. Toyota’s trio of brands lost slightly more than half a percentage point. American Honda jumped from 8.2% to 8.9%.

Nissan and Infiniti dropped by nearly two percentage points as the automaker suffered its normal, anticipated, severe drop-off in April volume. The auto industry’s size decreased 6% between March and April; Nissan USA’s sales fell 24% during the same period.

Chart Of The Day: Imagine The U.S. Auto Industry Without Pickup Trucks

With 29% and 30% of their U.S. sales coming from pickup trucks, respectively, General Motors and Ford Motor Company fall from the top two positions to the second and third when auto manufacturer sales are compared without pickups.

Toyota, therefore, becomes the top dog with 507,000 non-pickup sales through the first-quarter of 2015, 21,000 more cars, vans, SUVs, and crossovers than General Motors.

Excluding Frontiers, Titans, and Ridgelines doesn’t change the fact that Nissan and Infiniti are still outselling Honda and Acura. Fiat Chrysler Automobiles nearly pulls level with Ford MoCo when the Ram and dominant F-Series, America’s best-selling vehicle line, are left out of the equation.

Chart Of The Day: The Rise Of Commercial Van Sales In America – 2015 Q1

Commercial van sales are on the rise in the United States. But of greater interest than the improvements – total sales jumped 14% to 356,814 units in 2014 and are up 26% to 87,866 year-to-date – is the constant change in the category.

Chart Of The Day: Fiat Chrysler Automobiles US Is Very Much An SUV-Oriented Automaker

Not surprisingly, one of only a couple automakers with an SUV-only auto brand is enjoying record sales at that SUV brand in an era of booming utility vehicle sales.

At this stage in 2013, Fiat Chrysler Automobiles/Chrysler Group was selling more cars in the United States than SUVs and crossovers. Those figures flipped one year later and became even more disparate in the first-quarter of 2015.

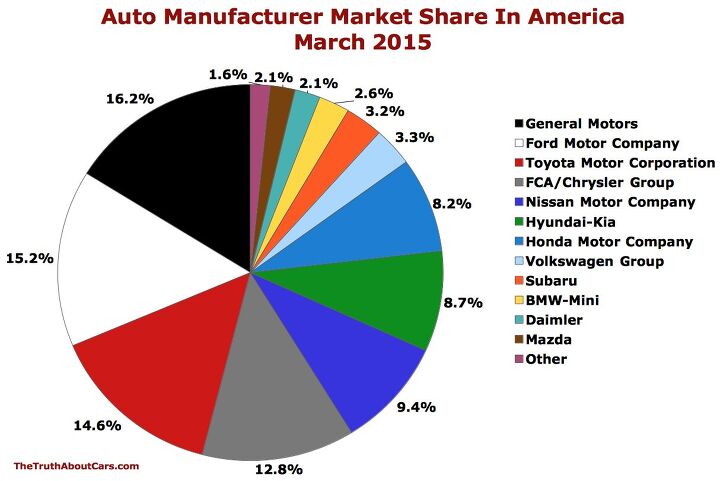

Chart Of The Day: Auto Brand Market Share In America In March 2015

Chart Of The Day: GM's U.S. Sales By Brand Over The Last Decade

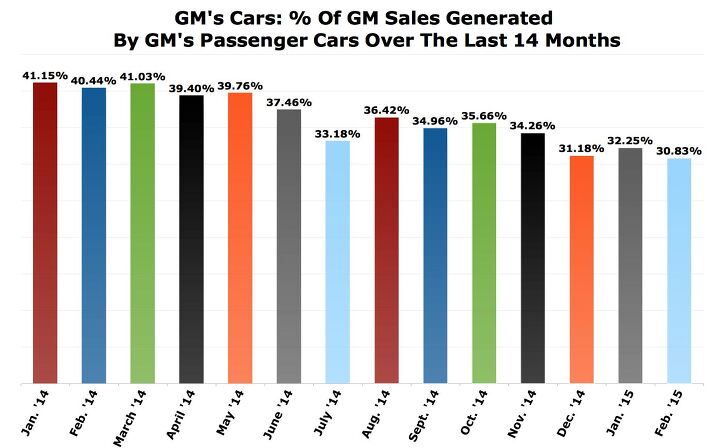

Two weeks ago we published a chart that showed GM’s decreasing passenger car emphasis over the last 14 months. Last Saturday, we showed GM’s annual U.S. sales volume by vehicle type. This week, we’re continuing the GM examination with a look at the brand allotment over the last decade.

Aside from the Chrysler Group, no automaker has undergone such a dramatic restructuring during the last decade. The public face of the GM restructuring, apart from the shuttering of dealerships, congressional hearings, and a revolving door of new faces in the executive’s chair, was the dismissal of a number of brands. Hummer, Saturn, Oldsmobile, and Pontiac were killed off. Saab is still kind of a thing, but not GM’s thing.

Chart Of The Day: GM's Gradual Car Sales Decrease

GM passenger car volume decreased 15% through the first two months of 2015 in the United States, tumbling by more than 18,000 units, or 21%, in February alone.

With vastly improved U.S. pickup truck volum e, steadily growing full-size SUV sales, and growth from the brand’s crossovers, GM was easily able to overcome the car deficit to post a 10% overall sales improvement in America through the end of February.

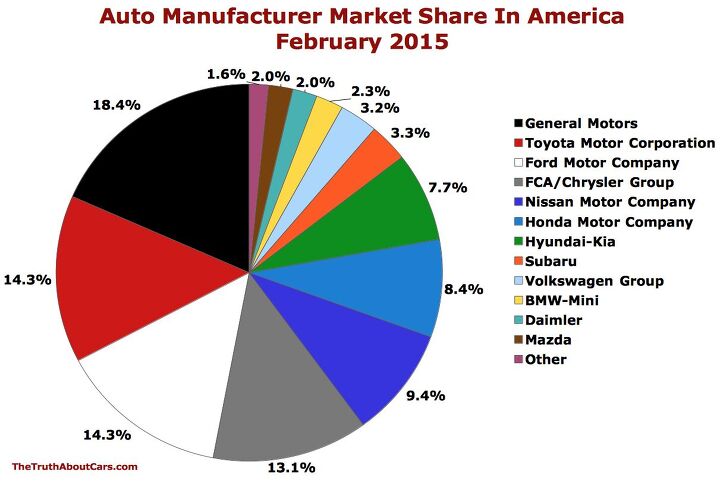

Chart Of The Day: Auto Brand Market Share In America In February 2015

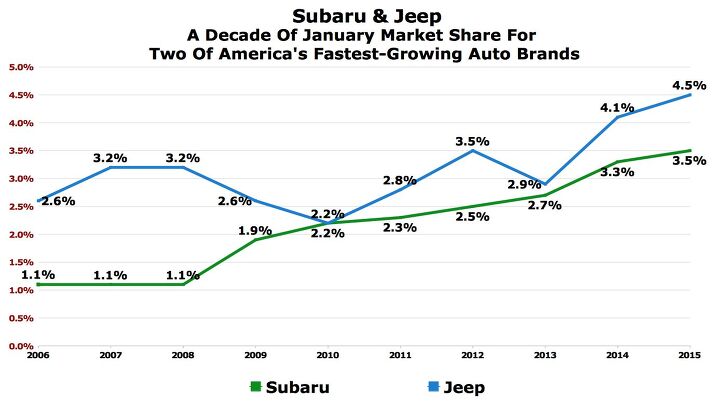

Chart Of The Day: A Decade Of January Market Share Improvement For Winter's Auto Brands

Subaru and Jeep are consistently two of America’s fast-growing auto brands. Aided by expanding portfolios and clearly understood branding, Jeep volume jumped 41% in 2014; Subaru sales shot up 21%.

Are any two auto brands more easily identified with winter than Subaru and Jeep?

Chart Of The Day: Is Minivan Fuel Mileage A Big Part Of The Problem?

So said I earlier this week in my review of the updated 2015 Toyota Sienna, the only remaining all-wheel-drive minivan.

The Sienna was America’s top-selling minivan in each of the last three months. And although the accompanying chart displays its official EPA mileage ratings at 16/23 mpg on the city and highway, front-wheel-drive Siennas are rated at 18/25. Forget the 14.4 mpg we saw during our test. Temperatures were brutal, the vehicle spent much of its time idling as we attempted to clear it (along with every other car on the street) of multiple inches of ice, the city streets on which the Sienna spent most of its stay were mostly snow-covered, and the van was fresh off the assembly line.

But could we have reasonably expected more than 16 mpg in city driving? Not according to the EPA.

Chart Of The Day: Auto Brand Market Share In America In January 2015

Chart Of The Day: Cars Vs. Light Trucks Over The Last Decade

After selling in virtually identical numbers in 2013, light truck sales in the United States overtook car sales in 2014 for the first time since 2011.

Light trucks, a category which encompasses everything from pickups and body-on-frame SUVs to minivans and commercial vans to SUVs and very car-like crossovers, accounted for 52% of U.S. new vehicle volume in 2014, up from 49.9% in 2013.

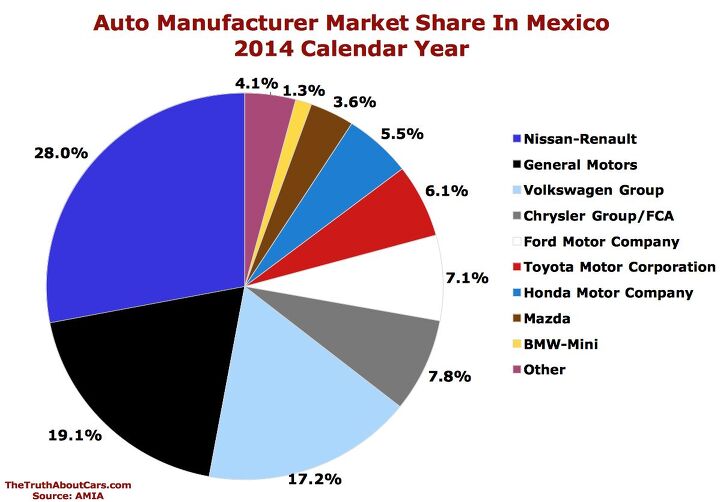

Chart Of The Day: Auto Brand Market Share In Mexico In 2014

The Asociación Mexicana de la Industria Automotriz reported a 7% increase to 1.1 million new vehicle sales in 2014.

Nissan is Mexico’s best-selling auto brand. Sales at the Nissan brand jumped 11% to 291,729 units in 2014. Combined with Infiniti and Renault volume, the Alliance owned 28% of the overall Mexican auto market, up slightly more than a percentage point compared with 2013.

2014 Canada Auto Sales Recap: Records, Records Everywhere

2014 was a record-setting year for auto sales in Canada, a fitting follow-up to a record-setting twelve-month period one year earlier.

Auto sales in Canada jumped 6% to 1.85 million, an increase of 107,000 units. Pickup truck and minivan sales growth lagged slightly behind the overall industry’s pace, commercial van volume jumped 16%, and SUV/crossover sales rose 15%.

• Record sales achieved by 15 auto brands

• F-Series, Civic, Escape, Grand Caravan lead categories

• Six auto brands report YOY declines

Car sales were flat, which resulted in a market share decline from 44.6% in 2014 to 42.1% in 2014. In December, even with a somewhat impressive 11% improvement, passenger cars accounted for less than 38% of all new vehicle sales.

The fastest-growing auto brands were not so afflicted. Jeep volume shot up 58% to a record-setting 70,503 units. Jeep, of course, does not market any passenger cars.

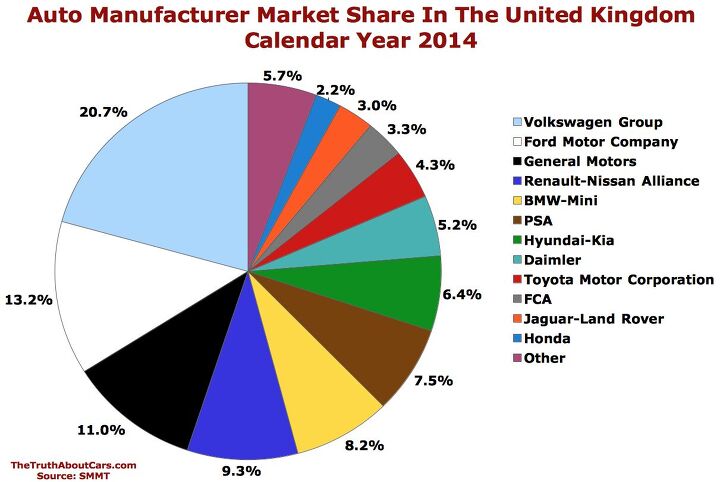

Chart Of The Day: Auto Brand Market Share In The United Kingdom In 2014

We haven’t shied away from discussing the error of Volkswagen USA’s ways here on TTAC nor the results of those ways. Yet while the brand saw its U.S. market share fall from a measly 2.6% in 2013 to 2.2% in 2014 and group-wide market share fell from 3.9% to 3.6%, year-over-year, VW Group market share in the United Kingdom grew by half a percentage point to 20.7% in 2014.

True, the Volkswagen brand itself saw its market share fall despite year-over-year volume growth of 4%. Volkswagen is the UK’s third-best-selling brand behind Ford and GM’s Vauxhall.

The Heavy Lifters: 2014 U.S. Auto Sales Growth Was Mostly Powered By An Elite Few

Subtract the growth achieved by America’s 19 most meaningfully improved vehicles in 2014 and the U.S. auto industry was up just 1.0%, not 5.9%, last year.

The Audi A3; BMW 3-Series/4-Series; Chevrolet Cruze and Silverado; GMC Sierra; Honda Accord and CR-V; Jeep Cherokee; Kia Soul; Nissan Sentra, Rogue, and Versa; Ram P/U; Subaru Forester and Outback; and Toyota’s Camry, Corolla, RAV4, and 4Runner all produced in excess of 20,000 more sales in 2014 than in 2013, combining for 764,885 extra sales in a market which grew by approximately 927,000 units.

Charts Of The Day: U.S. Auto Market Share In December And 2014

Compared with the prior year, the Ford Motor Company lost one full percentage point of market share in the United States in 2014. While preparing to replace their F-150, Ford/Lincoln market share fell from 15.9% to 14.9% as F-Series sales predictably stalled in an expanding market and as Ford brand car sales slid 4%.

Poised to pickup Ford’s share was Fiat Chrysler Automobiles. The company’s Alfa Romeo, Chrysler, Dodge, Fiat, Jeep, Maserati, and Ram brands boosted FCA’s U.S. market share from 11.6% in 2013 to 12.7% in 2014. Maserati, Jeep, and Ram were America’s fastest-growing auto brands.

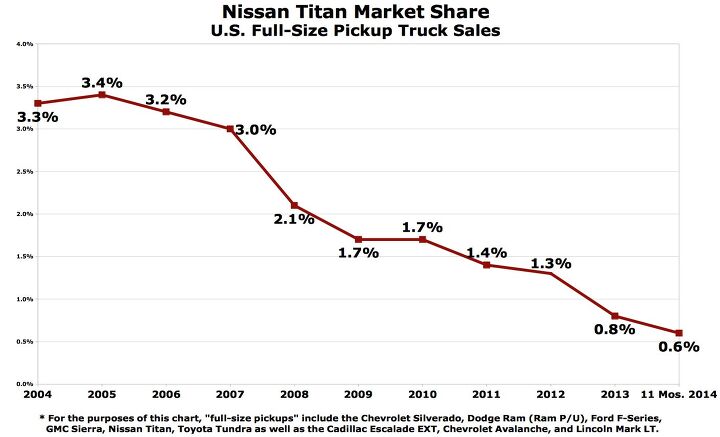

Chart Of The Day: 11 Years Of Nissan Titan Market Share

Nissan USA announced on December 16, 2014, that the next Titan, the second Titan, the first all-new Titan since 2003, will be introduced at 2015’s NAIAS in Detroit on January 12, 2015.

Hardly altered since the production truck arrived for the 2004 model year, the Titan is now somewhat embarrassing. Yet while the truck never had the potential to tackle full-size pickup trucks from Ford, General Motors, and Ram – Toyota can’t either – in the same way Nissan’s Altima can outsell their midsize sedans and Nissan’s Versa their subcompacts, initial U.S. volume was respectable.

Chart Of The Day: How Important Is The TLX In Acura Showrooms?

Even in the Acura TLX’s best sales month, the brand’s MDX and RDX crossovers still accounted for 55% of Acura sales in the United States.

With the TLX now consistently generating around three out of every ten Acura sales in America, it’s safe to say that Acura’s passenger car division is, for the moment, in safer hands than it was with the TL and TSX last year. Together, they generated 25% of Acura’s total volume in calendar year 2013, down from 40% in 2012 and 50% in 2011.

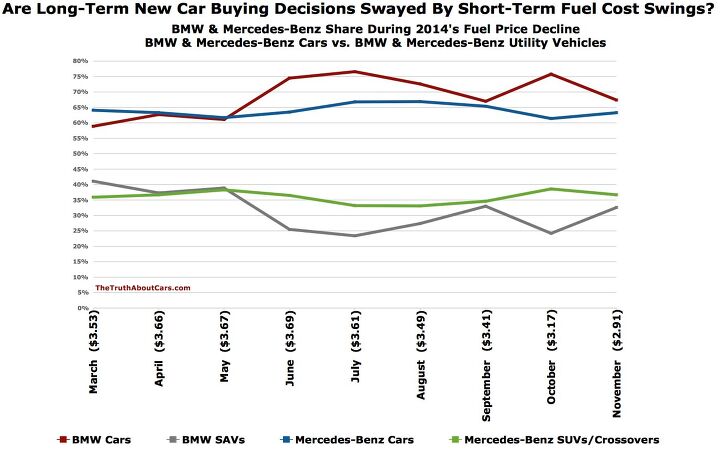

Lower Fuel Prices Not Slowing U.S. Car Sales At BMW

Passenger car sales in the United States are up just 1% as the overall industry has grown more than 5% through the first eleven months of 2014. America’s two best-selling premium brands, however, are enjoying more encouraging passenger car numbers in 2014. Quickly decreasing fuel prices are not, as of yet, slowing car volume at BMW in the least.

Recent Comments