15 Views

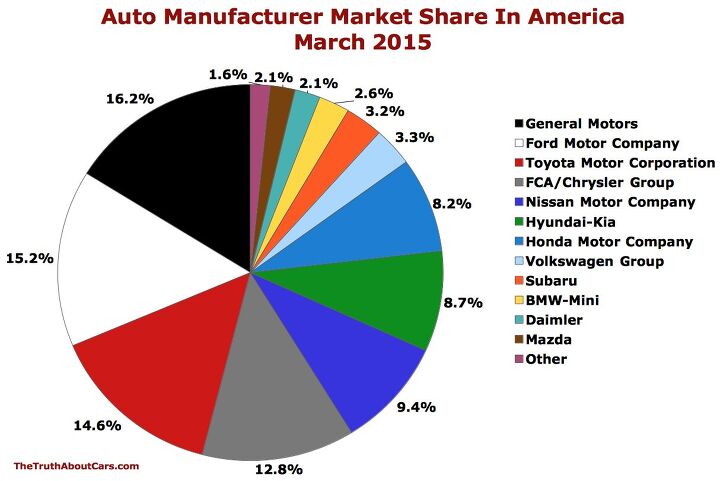

Chart Of The Day: Auto Brand Market Share In America In March 2015

by

Timothy Cain

(IC: employee)

Published: April 4th, 2015

Share

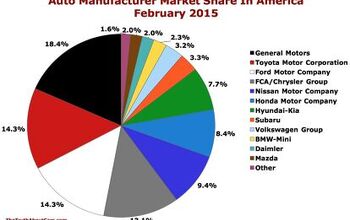

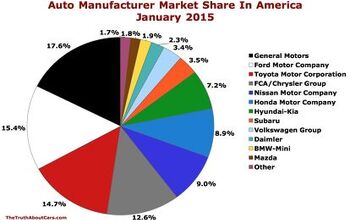

GM’s U.S. market share declined from 18.4% in February 2015 to 16.1% the following month as the automaker’s sales slid 2%, year-over-year, in a market which expanded marginally. GM earned 16.7% of the U.S. auto industry’s volume in March 2014.

Compared with February, Toyota, Ford, Hyundai-Kia, and the BMW Group all produced market share improvements worthy of mention. Honda’s share fell slightly from 8.4% to 8.2%; FCA was down from 13.1% in February to 12.8% in March.

The industry’s 1.55M new vehicle sales represented the best March since 2005.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures.

Timothy Cain

More by Timothy Cain

Published April 4th, 2015 8:49 AM

Comments

Join the conversation

Maybe this has been the case for a while and I just noticed now, but Hyundai-Kia has passed Honda?

GM: 16.2%. Wow. Think it was close to thirty around 1990 and near fifty percent by the late 70s. I'm sure half of that figure are truck sales (Ford's is prob 2/3rds truck sales)

Yeah GM's market share is pretty bad. Maybe with a whole slew of new Chevys they will improve? I mean a new Malibu, Volt, Spark, and Cruze in about a year has to do something for their volume right?

world's worst marketing led by the completely incompetent Gerosa protege' Steve Hill. for years I have continuously claimed reduced share ahead as GM refuses to listen to their top salesman of all time. I predicted 15% NA share and by all indications, I will again be proven correct.