Volkwagen Enters Insurance Biz

In Europe, Volkswagen is a full service operation. You can buy your car at a Volkswagen (Audi, Seat etc.) dealer. You can finance it at the Volkswagen Bank. (They give you a credit card, and higher interest for your savings.) You can insure it with the Volkswagen Versicherungs Dienst VVD. Both are subsidiaries of Volkswagen Financial Services. The VVD is not a real insurance, they act as an agent for Europe’s insurance giant Allianz. Put that in the past tense. After 62 years with Allianz, Volkswagen does its first baby steps into the insurance business itself.

Japanese Carmakers Below Invoice! Buy Now?

Psssst! Want to buy Japanese car makers below book value? Now is the time. Spooked by the strong Japanese Yen, stocks of export-heavy Japanese automakers such as Toyota and Suzuki can be had for less than the assets on the books.

BYD Prepares Stock Offering Amid Falling Sales, Foxconn Lawsuit

Think GM has a tough sell for its coming IPO? Chinese battery/automaker BYD is preparing its own $420m stock offering, likely to be floated on the Shenzhen A-Shares exchange, in the midst of a Chinese-market downturn, and an ongoing lawsuit with electronics manufacturing giant Foxconn. And all this comes after a long run of good news for the Hong Kong-listed BYD, which had been running strong on optimism generated by Warren Buffet’s major investment in the firm nearly two years ago. So, is BYD in real trouble of having its overvalued stock burst, or is the company strong enough to weather the storm that’s swirling around it?

Marchionne Blames Bailout For Profit-Free 2010

We’re hardly shocked by the idea that Chrysler won’t turn profit this year. After all, Auburn Hills has barely made its minimum monthly sales volumes (at best, and with rampant incentives and fleet mix) this year, and lost $50m+ in “industrial inefficiencies” on the Jeep Grand Cherokee launch alone [ Q2 results analysis here]. With plans to close out the year with a non-stop barrage of product launches and attendant media spending, it would take a minor miracle for Chrysler to break even. But we’ve essentially known this all for some time… what’s truly shocking is that Chrysler’s CEO Sergio Marchionne actually admitted to the media that Chrysler won’t turn a profit.

TV Show Investor Rescues Peel, Makers Of The World's Smallest Car

Automakers Push Financing As China Market Growth Slows

Some of the world’s biggest automakers are relying on continued strong growth in the Chinese market in the face of sluggish US and European sales, but those plans are facing a challenge as Chinese sales have slowed this summer. Total vehicle sales grew 14.4 percent over July 2009 levels last month (sales grew 70 percent year-over-year in July 2009), the lowest rate of growth the Chinese car market has seen since March of last year. China’s government is doing its part, instituting a $443 subsidy for cars with 1.6 liters displacement or less in the beginning of July. But that doesn’t seem to be helping much, as the percentage of cars with 1.6 liter engines or smaller actually declined last month. What’s a growth-addicted automaker to do (besides slash prices)? The same thing they do in every other market: extend credit in hopes of boosting sales and upselling customers on more expensive cars.

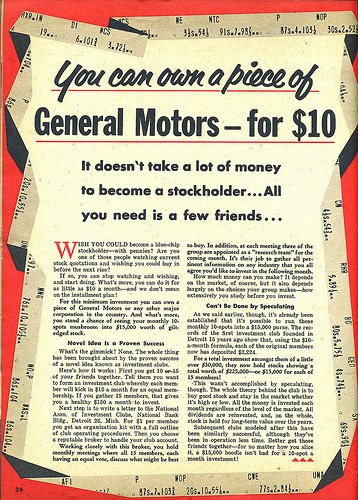

Quote(s) Of The Day: The Coming IPO Edition

Editor’s Note: With GM’s S-1 IPO filing hitting the web today, every IPO and auto industry analyst is weighing in on the offering, and the state of GM. Here’s a collection of some of today’s more notable comments.

It looks to me that GM should be worth no more than Ford. If that’s the case, then the taxpayers will lose about 50% on their investment.

Francis Gaskins, president of IPOdesktop.com, commenting in the WSJ [sub] on GM’s IPO. More analyst commentary on GM’s just-released S-1 filing after the jump.

GM's S-1 IPO Filing: The Risks

The most interesting section of every S-1 filing is undoubtedly the “risks” section, in which companies are legally compelled to disclose all possible material risks associated with investing in their IPOs. Unfortunately, these risks are typically overstated, as no firm on the verge of going public wants to run into trouble with the SEC for under-reporting risk. As a result, many of the risks disclosed are fairly mundane, everyday risks in the world of business (currency, commodity price, and other economic fluctuations, etc). At the same time, companies rarely give reporters a full tour of their major risk areas the way these sections do, so they’re usually worth a read. GM’s just-released S-1 filing is no exception…

Red GM's S-1 Filing Here

GM has filed its S-1 paperwork with the Securities and Exchange Commission. Read the entire document here.

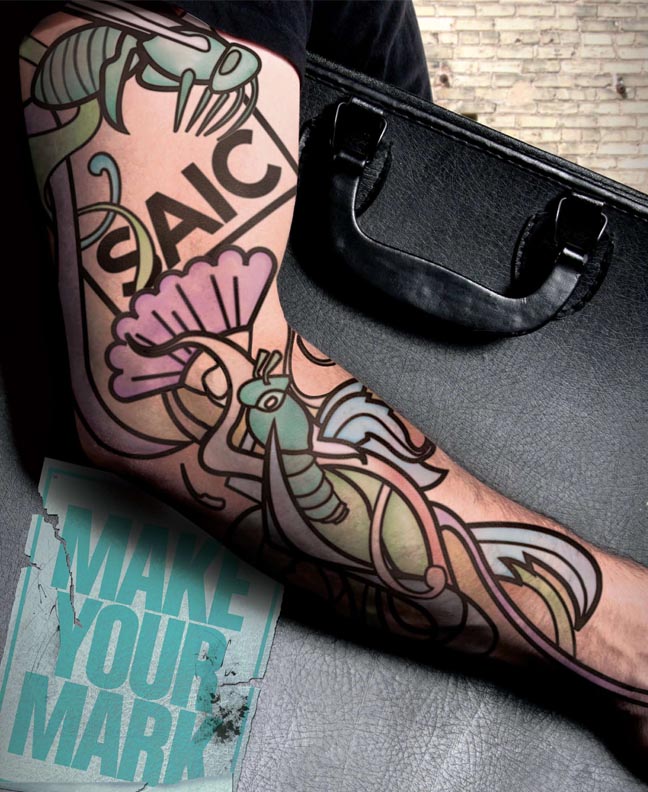

GM And SAIC Strengthen Ties Ahead Of IPO

With GM’s IPO S-1 now set for a Wednesday filing, The General is announcing a joint engine development project with its Chinese partner SAIC, spurring on rumors that the Shanghai-based automaker could buy into GM’s forthcoming IPO. Reuters reports that GM and SAIC have signed an agreement to develop a new range of 1.0-1.5 liter direct-injection, turbocharged engines in the vein of Ford’s EcoBoost mills. The ground-up joint engine development is significant because, as the WSJ [sub] reports

it marks the first time when GM and SAIC – partners for more than a decade already – are going to develop “base” propulsion technology, going a step further than simply integrating existing engine and gearbox technologies into automobiles.

GM has already moved much of its advanced technology development to new Chinese R&D labs, and this attack on Ford’s EcoBoost technology is likely to become a global engine. But what does the ever-increasing cooperation between GM and SAIC (which recently bought out GM’s controlling interest in their Shanghai GM joint venture) portend for the GM IPO?

Ask The Best And Brightest: Who Will Be GM's "Cornerstone Investors"?

GM’s IPO filing still has yet to appear on the SEC’s EDGAR database, but while we wait for the S-1 form to clear, Reuters has some details on what to expect from the sale. The big news:

GM is mulling a plan under which sovereign wealth funds or pension funds would serve as “cornerstone investors,” a technique often used for large initial public offerings to show that key investors are supporting the deal, four people said…

Each cornerstone investor would likely be asked to commit to buying 2 percent to 10 percent of the IPO and cornerstone investors would likely account for 10 percent to 30 percent of the total IPO, one of the sources said.

On the other hand, another source says GM is targeting 15 percent of its equity towards cornerstone investors, with 20-25% is aimed at the retail investment market. Either way, Reuters points out that another recent large IPO of a government-owned business, the Agricultural Bank of China, relied heavily on cornerstone investors… but that the politics of such a strategy could be risky.

Redflex Demands More Cash From Toll Road Firm Macquarie

Redflex Traffic Systems of today reported to the Australian Securities Exchange that it had rebuffed the $275 million offer from toll road giant Macquarie Bank for outright control of the company. The Australian red light camera maker believes that it can spark a bidding war to drive up the purchase price and enrich shareholders.

GM To File IPO Paperwork Tomorrow, Opel Woes Cited As Major Concern

Reuters [via ABC] reports that GM has completed its S1 filing and will file Monday, after a Friday the 13th filing was delayed in order to

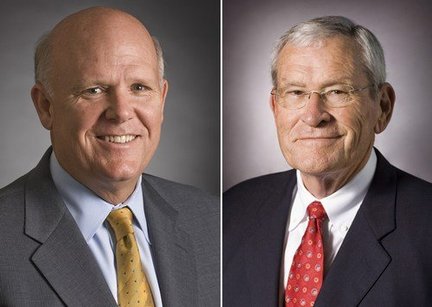

add a management risk factor after Chief Executive Ed Whitacre announced on Thursday he would step down and be succeeded by Dan Akerson effective September.

And that won’t be the only “risk factor” warning to investors in GM’s S-1. Bloomberg found a number of analysts ready to support the headline

GM’s Akerson to Struggle in Proving to IPO Investors Europe Fixable

Any bets on the number of times the word “Opel” appears in tomorrow’s filing?

GM Board Pushed Whitacre Out For IPO

From the moment GM’s Chairman Ed Whitacre took over for Fritz Henderson as CEO, many wondered how long the 68-year-old Texan would stick around. Apparently GM’s board was not immune from such uncertainty either, as Bloomberg reports that it gave Whitacre an ultimatum: commit to the long haul or get out now. According to reports, several Wall Street banks asked Whitacre whether he would be leading GM long-term during pre-IPO meetings. Whitacre didn’t answer at the time, but the pressure from Wall Street clearly pressed the board’s hand. Since Whitacre ultimately didn’t want to stick around for an extended term (posibly due to the Treasury’s unwillingness to dump all of its stock during GM’s IPO), the board picked Dan Akerson to take over. But how will an unexpected handoff to an unknown executive with no industry experience affect GM’s IPO?

GM Moving To File $12b-$16b IPO Paperwork On Friday The 13th?

One might imagine that GM wouldn’t want to scare anyone away from its forthcoming IPO, but triskadecaphobes might just want to sit this one out. With a $5b credit line reportedly secured from a group of “at least 15” banks, Reuters [via Automotive News [sub]] reports that GM could file its S1 with the SEC as soon as tomorrow. In case that date is too pregnant with superstition, GM could wait until next Monday to file paperwork. Either way, GM is expected to go public by the Thanksgiving holiday.

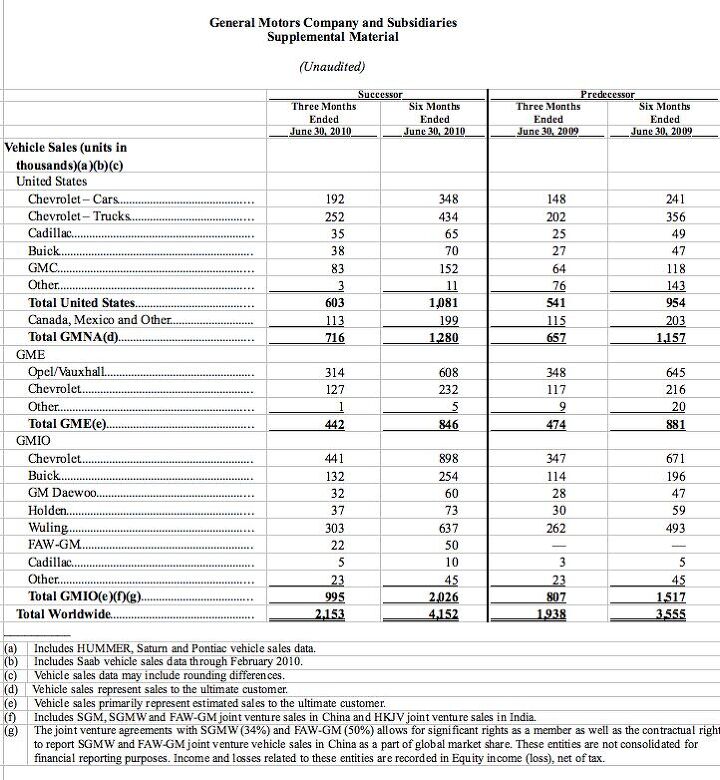

GM Announces $1.3b Q2 Profit

GM has released its Q2 earnings, and it’s pulled off a $1.3b net profit on improved North American revenue, and narrower losses on GM Europe. Revenues for GM International, however, were down to about half of their Q1 level. Despite over $1b in capital expenditures last quarter, GM managed to improve free cash flow from $970m in Q1 to $2.834b in Q2. Full chart packet available in .doc format here, presentation slides available in PDF format here.

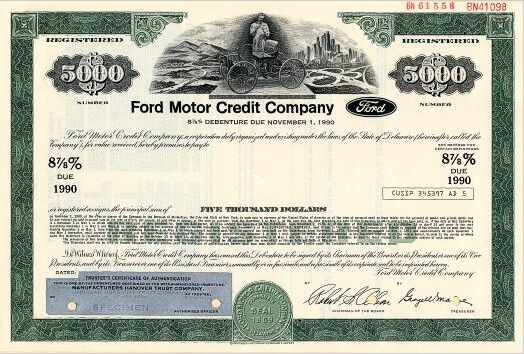

Government Loan Guarantees Help Ford Beat The Debt

At the end of the second quarter of this year, Ford’s overall automotive debt totaled $25.8 billion. Just three months before, its debt level was at $32.6 billion. The debt reduction is all part of CEO Alan Mulally’s plant to earn an investment-grade debt rating by the end of 2011, a move that will lower Ford’s cost of borrowing as well as lowering interest payments. And though Ford’s been making a healthy profit, America’s bailout-free automaker has had more than its fair share of government help to beat the debt. According to the WSJ [sub], Ford’s extensive collection of government loan guarantees has been key to its ability to pay down more expensive debt accumulated during Ford’s 2006 restructuring.

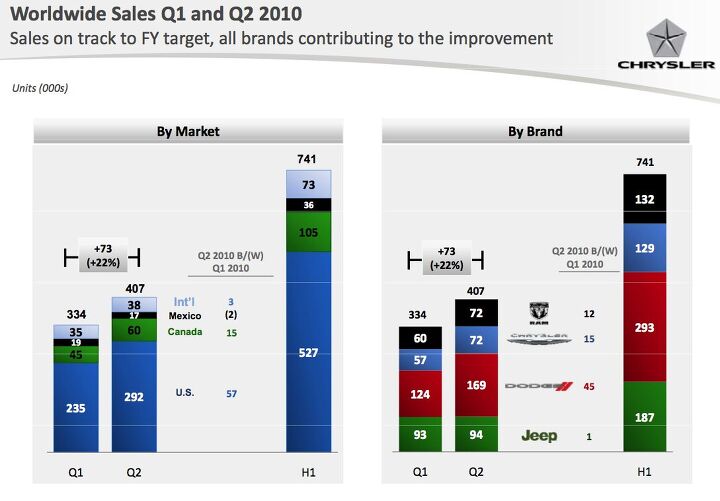

Chrysler Loses $172m In Q2

Chrysler recorded another small quarterly loss this quarter, as increased expenditures wiped out modest gains in revenues and earnings. Press release in PDF here, webcast presentation slides in PDF here. More analysis after the jump.

What's Wrong With That Video? WTO Edition

Doesn’t it bug you when other countries give their carmakers money? Doesn’t it bug you a hell of a lot when other countries give their carmakers money with they express purpose to increase exports? Shouldn’t those felonious countries be dragged in front of the WTO and shot? Well, there are exceptions.

Quote Of The Day: Escape From Government Motors Edition

We want the government out, period. We don’t want to be known as Government Motors.

GM Chairman and CEO Ed Whitacre channels his inner Rick “Bankruptcy is not an option” Wagoner in the New York Times, telling the taxpayers who put him in charge of a bailout-rinsed General Motors to get lost. Sure Ed, we’ll all go NSFW ourselves just as soon as we get our $49.5 billion back. Talk about putting the throat-clearing guttural in chutzpah…

Japan's Automakers Officially Out Of The Woods. On The Average

Three Japanese automakers, Honda, Nissan, and Fuji Heavy are officially out of the woods, at least financially. The Nikkei [sub] says they “put the global financial crisis behind them, reporting net profits that surpassed those from two years earlier in the April-June quarter.”

Toyota Declares Q1 Profit. Guess How Much?

The suspense-filled wait for Toyota Motor Corp’s first quarter profits is finally over. Some expected (hoped?) that ToMoCo would pay dearly for the recalls. Others consulted their crystal ball that said that Toyota might have netted more than a billion US in the first quarter. They were all wrong. Way off the mark. Not even on the same planet.

Last Chance For China To Buy Secrets For Cheap

For more than a year, I had been on my very own propaganda mission in China (and I’m still here in Beijing to tell it.) I had urged Chinese parts manufacturers to go overseas and to buy parts houses at firesale prices. By moving closer to the customer and up the value chain, by turning from contract manufacturer to marketer, the Chinese manufacturers could realize much higher profits. By turning from contract supplier to systems house, they would be about 5 years ahead of the technology curve: A systems house is tied into the development of a car. The Boschs, Magnas, Federal Moguls of this world harbor more secrets than a Tom Clancy novel. A year ago, I wrote in China’s Gasgoo: “While the idea of buying a foreign car brand for cheap is good, the practicable choices are limited. So it’s back to buying foreign parts companies. There will be many bankrupt foreign parts companies this year to choose from, all quite cheap, most with an established presence and manufacture in China.”

Someone seems to listen, finally. But maybe a little late …

Quote Of The Day: Chrysler Could Be Rich If There Wouldn't Be That Nasty Mortgage

“The only reason we are not making money on the net is that I pay interest on the borrowings I took from the government and I have money in the bank to cover that debt. Actually, against the Treasury we owe them nothing. We have enough cash to pay it all off. But you can’t run a business without cash, so it’s just a function of our capital structure. If we had taken those funds as equity as GM did, we would have been making money, net, right now.”

Toyota's H1 Production Up 46.8 Percent - But Where Are The Profit Numbers?

ToMoCo is keeping the suspense up on their long awaited and h otly rumored first quarter profit numbers. Daihatsu has reported stellar numbers. Hino has reported a nice set of financials. Now, “nine major Toyota Motor Corp. group companies all reported group net profits in the April-June quarter thanks to a recovery in the auto industry,” says The Nikkei [sub]. No word yet from the mother ship. EMCON. Strict radio silence.

At Audi, Luxury Is Back With A Vengeance

How things change: Last year, the death of the automobile was prognosticated. Maybe little cheap econoboxes. Luxury cars? Forget it, dead as dinosaurs. Don’t even mention dinosaurs. This year … just have a look at Audi.

Volvo Could Be Chinese By Next Week. Maybe

Things did quiet down since March after Geely signed the contract to buy Volvo from Ford. A lot of people think Geely already owns Volvo. Geely doesn’t own Volvo until the deal is closed. But Geely might own Volvo as early as next week.

Perception Gap, Made In Germany: Volkswagen Triples 2010 Half Year Profit

Did we mention that there is a remake of the economic miracle in Europe going on? Despite tanking car sales, despite daily stories about near bankrupt EU-countries, European manufacturers are in high gear. Did we mention that despite imploding sales at home, Volkswagen delivered 16 percent more units to customers in the first six months of 2010? One would think that might have some bearing on VeeDub’s financials. It sure did.

Daihatsu's Profits Up Nearly Fivefold – Good Omen For Toyota

The market took note when little Daihatsu announced that its group net profit jumped 460 percent year on year to 19.9 billion yen ($227m) in the April-June quarter of the Japanese fiscal year. Daihatsu is a Toyota company, and the market is eagerly expecting Toyota’s results.

Toyota May Have Earned Over $1b In Q1 Of Fiscal Year

Toyota Motor Corp. is expected to report a group operating profit of about 100 billion yen ($1.14b) for the April-June period, The Nikkei [sub]. That would be a huge improvement over the same quarter loss of 194.8 billion yen ($2.23b) in 2009. In case you are wondering about the strange quarters: Japan goes by the fiscal year that ends on March 31. The April-June period is the first quarter of the new year, and times are good at TMC.

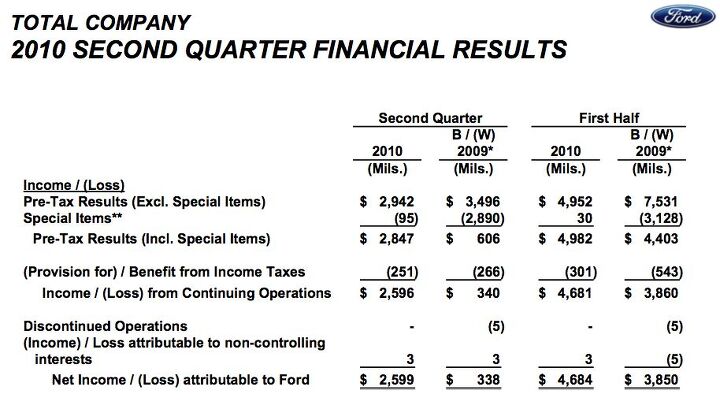

Ford Reports $2.6b Q2 Profit

GM Drops $3.5b On Subprime Lender AmeriCredit

After months of speculation about GM’s re-entry into the subprime lending market, The General has announced a deal in which it will purchase the lender AmeriCredit for $3.5b. Founded in 1992, and managing assets worth $10b, AmeriCredit has been pursued by GM for the last month, according to GM CFO Chris Liddell in the WSJ [sub]. GM paid AmeriCredit stockholders $24.50 per share for a controlling interest in the firm, a 24 percent premium over its $19.70 closing price yesterday. Still, GM insists that acquiring AmeriCredit will have “a minimal impact” on its balance sheet, although no explanation is given as to how. $3.5b is at least ten percent of GM’s cash pile at this point, and it’s not clear if that qualifies it as a “minimal impact” or if GM is using some kind of financial instrument to purchase the firm. AmeriCredit says it will “expand its offerings” to support GM, likely in the area of lease deals, but it will also continue to offer loans to non-GM-brand car deals.

Big Yucky Disaster: Buyers Abandon BYD

In most parts of the world, electric vehicles are treated as the second coming of Jesus. Meanwhile in Omaha, Warren Buffett is having doubts whether it was such a good idea to pay $230m for 10 percent of China’s cellphonebattery/car/EV/appliance/house builder BYD.

BYD’s share price has fallen by more than 40 percent over the past three months, China’s First Financial Daily remarks (via Gasgoo.) Can you guess the main reason for the serious drubbing?

SAIC Quadruples Half Year Profit

If GM wants to pull off a smashing IPO, they need smashing numbers. There are people they can learn from: Their friends and joint venture partners at China’s SAIC. China’s largest automaker (they have joint ventures with both GM and Volkswagen, can’t get any bigger), said first-half profit may have more than quadrupled from a year earlier, reports Bloomberg. And the secret to their success?

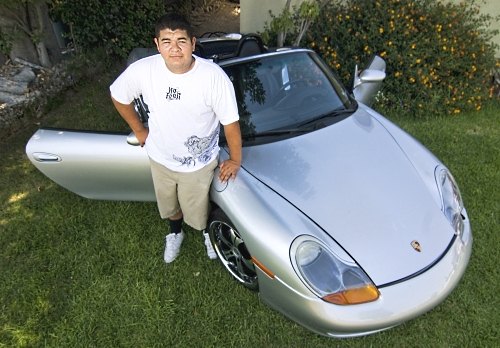

Buy And Cell

17 year-old Steven Ortiz is the envy of his friends at Charter Oak High School. The reason? He drives a Porsche Boxster S to school. And before you say it, it doesn’t belong to his parents. It’s legally his. Now I know what you’re thinking at this stage, “How does this punk drive a Porsche to school and I had to make do with a Ford Pinto?” Well, the answer lies with 3 things, an old mobile phone, a little time and Craigslist.

GM Asks IPO Underwriters To Buy Its Cars

Bloomberg reports that GM has already pulled off one of the ballsiest IPO moves ever, by asking banks bidding to underwrite its IPO to use fees to subsidize the purchase of GM vehicles by its employees. According to the report, a GM document sent to bidding banks solicited

ideas as to how we can use the IPO to reposition GM and its vehicles within the investment community including your firm’s willingness to reinvest any portion of any underwriting fees into the purchase of GM vehicles for your employees and/or company use.

So Ford Wants Government Money After All

EU Clears Volvo Sale To Geely

The European Commission concluded that the sale of Volvo to China’s Geely would not significantly impede competition in Europe (well, that would have been a stretch), and approved the transaction, says Reuters.

Japanese Car Makers Worried About Sumo-Sized Yen

There was a time, in summer of 2007, when a dollar bought more than 120 yen. Once you arrived in Tokyo, you quickly wished it would have bought more. Now, the dollar buys about a third less. The dollar/yen rate had been at a downward trajectory since that summer of 2007. What made the yen really expensive was a company called Lehman Brothers, and the fallout following their bankruptcy in 2008. For inexplicable reasons, the yen is seen as a safer currency than the greenback. Should you make the mistake of stepping off the plane with Euros in your pocket, you would be in for an even bigger shock. In July 2008, a Euro bought 170 yen. Now, it’s down to 109. For even more inexplicable reasons, some mentally unstable people still talk about an undervalued yen.

You may not travel to Tokyo frequently enough to give a hoot. But Japanese auto manufacturers don’t want to take it any more.

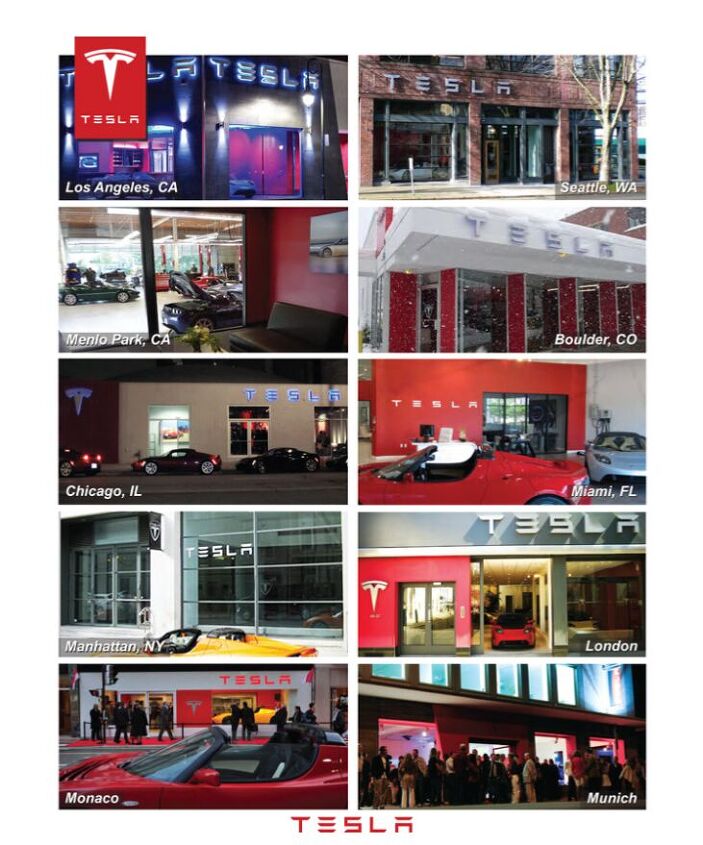

After One Week On Nasdaq, Tesla Stock Falls Below IPO Price

Dearth And Taxes In Australia

Toyota’s having some pretty rotten luck recently. First was “acceler-gate”, the mass hysteria of how Toyota cars were going out of control and murdering innocent people. Then came stories of people blaming Toyota cars for accidents, when in reality it was the driver’s fault (or in the case of Jim Sikes, a scam). You would have thought this would pour oil over troubled waters for Toyota, right? Nope. The malaise continued. Then came the public humiliation of the senate hearings. Did anybody in the media point out the conflict of interest for the senate? Well, if they did, nobody listened. So, while Toyota is fire fighting in North America and is having a bit of a rough time in Europe, at least things are OK in Australia. A market where Toyota dominated for 5 years. Well…

Japanese Carmakers Are Leaving The Country

Still convinced that the Yen is undervalued? Japanese carmakers beg to differ. They think the Japanese currency became so expensive that it gets cheaper for them to build abroad and to import to Japan. We’ve reported that Nissan is moving the production of their Micra (called March in Asia) to Thailand. When they did this, The Nikkei [sub] saw “huge implications for the future of the Japanese auto industry as a whole.” It certainly looks like Nissan’s exodus to the Land Of Smiles ( and occasional riots) started a trend.

F Word O.K. Again

It’s safe to buy Ford again. Ford as in the F share. After trading at close to $15 in April, it could be had below $10 yesterday. A bargain. Or so it seems.

Tesla Saves Toyota's Bacon

So Tesla lost $30m last quarter. Do you know who made $20m in profits on Tesla in one day?

What's Wrong With This Picture: The Case For GM's IPO Edition

Will the North American market for cars go up 45 percent in the next four years? I’m not convinced. Certainly the momentum hasn’t shown up yet. But this slide is from GM’s “Global Business Conference” which the company is holding in Michigan this week to drum up support for its forthcoming IPO. So… a little over-optimism is hardly surprising. But we’re not the only ones skeptical of GM’s ability to take flight as a public company. Automotive News [sub] reports that

Mirko Mikelic, a fixed income portfolio manager at Fifth Third Bank in Grand Rapids, Michigan, said he expected GM to face grilling about the risks of a return to recession in the United States.

“There’s concern about a double dip out there. That’s probably the biggest thing that’s weighing over GM coming to the market because that’s going to keep (auto sales) down for another year or two,” he said.

Check out the complete presentation in PDF format here, and decide for yourself if The General is worth an investment. The slides after the jump are certainly more convincing…

Some Advice For Tesla's First Day Of Trading

Far be it from us to tell you to take Jim Cramer’s word as gospel… but he does seem to have Tesla’s IPO figured out. And now that the stock is public (NASDAQ: TSLA), he wants you to run away screaming. We find it difficult to disagree… but feel free to keep an eye on the stock yourself.

Tesla IPO Priced At $17/Share, Market Cap Estimated At $1.6b

A source tells Reuters [UPDATE: Tesla confirms in press release] that Tesla has

sold 13.3 million shares for $17 each, raising about $226 million. It raised the number of shares it hoped to sell by 20 percent. It had planned to sell 11.1 million shares for $14 to $16 each.

That’s more than the “as much as $213m” number floated earlier, but with a recent Toyota deal and an EV-infrastructure bill in congress, Tesla has as much wind at its back as it can ask for. But if investors do get to start trading Tesla stock starting tomorrow, they’ll have a gut check before long. Tesla lost $30m last quarter, and it the second quarter ends on Wednesday. If those numbers show another healthy loss, investors will look away knowing that they’re in a risky, long-term investment. But can a $1.6b market-cap firm really compete in development, design and manufacturing with the giants of the automotive world simply by taking in two times its 2009 revenue in one IPO?

Mulally, As In Moolah

As much as it pains me to admit it, Ford is a company to be admired. When bailouts were handed around like doobies in the Summer of Love, they didn’t partake (argue that point amongst yourselves, but you know what I mean). Their cars are interesting (to say the least) and their reliability is now being thought of in the same vein as Toyota, Honda and Hyundai. All of this is down to one man, Mr Alan “I bet you wish to made me CEO now! Eh, Boeing?!” Mulally. He put forward a vision of Ford divisions and subsidiaries working together to create a global product. He pared down the extraneous brands. He put the axe to Mercury and he didn’t need a bankruptcy to do it. In short, Mr Mulally has done well at Ford. The question is how well?

Export Boom In Germany Raises Red Flags

Every day, German auto managers go on their knees and pray that the financial troubles in Greece, Spain and elsewhere continue. Why? The troubles keep the Euro low, and a low Euro is high octane fuel for German car exports. In May, German car exports rose 46 percent. For the first five months, German car exports are up 50 percent. Despite a lackluster home market, the German car industry is hitting on all cylinders: For the first five months, German production is up 26 percent to 2.3m units, driven mostly be strong demand from China and the U.S. However, red flags are going up. Literally.

All Clear: Your Audi Will Remain Pure German

American Audiphiles can rest assured that their future four-ringed purchases will be Made in Germany and not somewhere in what is sometimes euphemistically called “North America.” Plans to build an Audi plant over here have been put on ice for an indefinite period. Worries about a tainted Aryan Audi race (in the motorsports connotation, of course) can be put aside. “We don’t need an American plant to reach our goal of 1.5m Audis a year by 2015,” said Audi Boss Rupert Stadler to Automobilwoche [sub]. “We could build a car in the U.S. in six months,” said Stadler, referring to the VW plant in Chattanooga. “Building a plant somewhere in the boonies would take three years.” And what’s the real reason?

Quote Of The Day: You Can Trust Your Dealership After All Edition

Throughout the debate on Wall Street reform, I have urged members of the Senate to fight the efforts of special interests and their lobbyists to weaken consumer protections. An amendment that the Senate will soon consider would do exactly that, undermining strong consumer protections with a special loophole for auto dealer-lenders. This amendment would carve out a special exemption for these lenders that would allow them to inflate rates, insert hidden fees into the fine print of paperwork, and include expensive add-ons that catch purchasers by surprise. This amendment guts provisions that empower consumers with clear information that allows them to make the financial decisions that work best for them and simply encourages misleading sales tactics that hurt American consumers. Unfortunately, countless families – particularly military families – have been the target of these deceptive practices.

This is what president Obama said just six weeks ago about efforts to exclude car dealership financing from consumer protection measures included in the forthcoming Financial Reform bill. With that bill moving towards Obama’s desk, all that stands in the way of its passage are angry dealers who don’t want to be subject to oversight. And despite the tough talk about standing up to financial interests to pass this reform, it seems Obama has caved to America’s auto dealers.

Desperately Seeking Subprime: White House Admits GM's IPO Dash Hurting Ally's TARP Payback

The WSJ [sub] reports that GM is officially looking outside of its former captive finance arm Ally Financial (formerly GMAC) as it seeks more subprime loan deals to drive sales volume ahead of its IPO. GM execs tell the WSJ that The General could do even better with an in-house finance arm, but that these deals will help. And, according to Experian Automotive’s Melinda Zabritski, GM needs the help because

By not financing [subprime] consumers, they are locking out about 40% of the U.S. population

GM’s restructuring consultants AlixPartners add that loyalty improves for customers who buy using a captive lender. The downsides? Higher default risks, the temptation to overload on incentives, and then there’s one more biggy…

GM Filing IPO Paperwork As Soon As Next Week

Who's Unhappy About Higher Wages, Stronger Currency in China? The Japanese. For Starters

It stands to reason that Japanese car makers would rejoice over rising wages in competing China and over an appreciating Chinese currency. Rising wages make production there more expensive, a rising Yuan makes exports more expensive. Both should give the Japanese more breathing room. That reasoning is falling by the wayside. The Nikkei [sub] reports that these developments pose ”serious threats to Toyota’s profitability in China, strategic challenges that other Japanese companies must also deal with.” Just goes to show that you need to be careful what you wish for. And wait who else should worry.

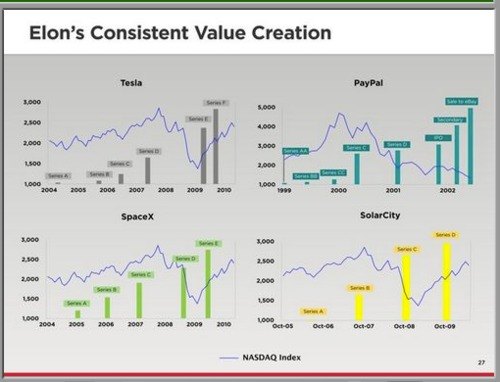

Chart Of The Day: Musk Versus The Market Edition

Porsche's Business Up. Guess Why

In the first nine months of the current fiscal year Porsche sold slighty fewer cars than in the same period of the previous year. But they made more money: They are looking at operating profits of €0.6b on sales of €5.2b. That’s a double digit operating profit, ladies and gentlemen, and none of the put and call hanky-panky is included. Now what do you think is the catalyst for the wunderbar numbers? Are you sitting down?

Volkswagen To Significanty Exceed" 2009

When Volkswagen CFO Hans Dieter Poetsch was asked to make some forward looking statements on April 29, he was reasonably confident that Veedub could improve sales and operating profit from the 2009 level, “but that’s it.” Now suddenly, Volkswagen throw caution to the wind and says that the company would “significantly” exceed last year’s results when 2010 is over, says Reuters. That assessment, made by a usually very cautious company, is bolstered by a forecast-beating performance in the first five months.

Tesla Revises IPO To $178m-$185m

How Big Will GM's IPO Be?

Ed does things that are bolder and bigger rather than small and timid. All things being equal, Ed would like it bigger versus small. But all things aren’t equal. He needs to get the government the best value for its stake, too.

Former AT&T exec James Kahan tells BusinessWeek what kind of IPO GM’s Chairman would prefer. Unfortunately for “Big Ed,” that’s not up to him. GM’s value must be determined by the market, and due to political pressure on the government to end its ownership of GM and Chrysler, it will have to happen as soon as possible. A fourth-quarter IPO with “about half of the government stake [being sold] to the 20 top institutional investors” is in the cards. So we know the government won’t get out of GM entirely in the IPO… but how much will the market give the Treasury for half of its 61 percent stake?

Toll Road Giant Makes A Move On Red Light Camera Company

Toll road giant Macquarie Bank this week announced its intention to acquire the leading operator of red light cameras and speed cameras in the US. Macquarie, known for its skill in harnessing government guarantees to make itself a “millionaire’s factory,” made an offer to purchase Redflex Traffic Systems of Australia at the bargain price of A$2.50 a share.

Recent Comments