Daimler Is Rolling In Money

Who says an automaker needs at least 5 million units per year to survive? Daimler in Germany made $6.7 billion EBIT on sales of just 989,386 units in the first half year. Unlike other car companies who are sitting on such a big pile of accrued losses that no taxes will be due in the foreseeable future, Daimler made a healthy contribution to the government’s finances. Even after tax, the company is left with $4.2 billion for the first half year. This according to emailed statements by Daimler.

Ford Profitability Slides, Earns $2.4b Anyway

Ford’s Q2 results [ Presentation in PDF here] were mixed, as deliveries and revenue improved (7% and 13% respectively, compared to Q2 2010) but profitability slipped, but the automaker still ended the quarter with $2.4b in profit and $2.3b in operating cash flow. Debt was reduced by $2.6 from the first quarter of this year, and total Automotive debt landed at $14b, while gross Automotive cash landed at $22b. So, what happened to Ford’s operating profit margin?

Chrysler Loses $370m In Q2 On Loan Payback Costs

Despite a $370m loss, Chrysler’s Q2 and first-half results [ presentation in PDF here] were presented in a relatively upbeat tone, as a number of key metrics showed signs of improving. Chrysler’s revenue was up by over $3b in the second quarter compared to last year, EBITDA hit $1.3b, and “modified operating profit” was $507m, or about 3.7% of net revenues. Depreciation and Amortization costs were up slightly, as were income tax and net interest expenses, but the big loss that pushed Chrysler into the red was a $551m one-time charge associated with Chrysler’s payback of government bailout loans. Gross debt was up by about a billion dollars, to $12.287b, but net debt was down by over a billion to $2.1b, and Chrysler sees greatly reduced interest costs going forward, eliminating $2.6b in planned debt payments this year. And though free cash flow slowed considerably compared to Q2 2010 ($174m compared to $491m), Chrysler finished the half with $10.2b, up from $9.9b at the end of the first quarter.

Saab: Collections Comes Calling "In A Few Days," Can Antonov Save The Day?

Over the weekend we told you Saab-watchers to “expect a run on the bankruptcy court in the coming days and weeks,” and according to Bloomberg the process has already begun. Christina Lindberg of the Swedish Debt Enforcement Agency tells the news service that eight suppliers have requested that their portion of the 104 debts registered with the agency be collected and that

We will start the collection process in a few days.

The good news? A previous request to place a Saab subsidiary in bankruptcy has been revoked as the supplier in question there was paid off. Now, however, with eight more debts going to collections (worth an undisclosed amount, we know that one debt alone is worth around $70m and estimates put the total at around $1b), the situation has become dire once again. The answer? Vladimir Antonov, of course! Thelocal.se reports that suppliers are pushing for the EIB to approve Antonov’s ownership stake, seeing the Russian as the only way out of the situation. And because the EIB will clearly never approve Antonov, another report that’s just breaking now says that Saab is seeking to “replace” the EIB loan in order to bring Antonov on board. The looming question: who on earth is going to lend this bleeding-out corpse of a company $350m? Does Antonov even have a billion to spare for his pet project? Needless to say, nobody has the faintest clue… they just know it has to happen. Yikes!

Profits, Pattern Bargaining, Performance Pay On The Docket As UAW Negotiations Begin

With the Detroit Free Press reporting that combined Q2 profits for the Detroit automakers could hit $4b, the quadrennial negotiations with the UAW which opened today with a meeting between Chrysler and the union could be a tough slog. And because the profit outlook is mixed, with GM and Chrysler likely to improve profitability and Ford likely to see a drop in net takings, the long-standing tradition of “pattern bargaining” could come to an end. Ford currently pays about a dollar more per hour than GM and about $2 per hour more than Chrysler (which is partially owned by the UAW’s VEBA trust fund), and Ford also shoulders more of workers’ health care costs than its cross-town rivals. And UAW president Bob King admits

Being really blunt about it, when you don’t represent the overwhelming majority of an industry, which we don’t any more, then you can’t do pattern bargaining

Already unfairly disadvantaged by the UAW (Ford is the only Detroit-based automaker without a no-strike contract) and facing falling profitability, Ford is telling the union not to expect wage increases. But does that mean the union’s only choice is to bring GM and Chrysler up to Ford’s pay and benefit levels?

We Are Sorry To Inform You That The Big Turnaround Has Been Postponed For Another Year

14 millions Americans are out of work. The government is facing default. U.S. home prices are at their lowest level since 2003, and Robert Shiller, the economist who co- founded the S&P/Case-Shiller index of U.S. home prices, said a decline in property values up to 25 percent in the next five years “wouldn’t surprise me at all.” From Bernanke on down, everybody is scaling back the rhetoric that economic growth is just around the corner. Suddenly, automakers aren’t so sure anymore about all that pent-up demand that will bring back U.S. car sales back to their old glory. Reuters asked around and didn’t come back with good news.

Supplier President: Saab's Days Are Numbered"

Last week, a small Swedish parts supplier by the name of SwePart did not want to wait any longer and asked a Swedish court to declare a key Saab subsidiary, Saab Automobile Tools, bankrupt. Bankruptcy of the subsidiary would have meant the end for Saab as well. Hectic activity ensued. On Friday afternoon, there was an announcement that the matter had been settled and the bankruptcy petition was withdrawn. Expect a run on the bankruptcy court in the coming days and weeks.

Green Cars In The Reds

When I was a very young and very green copywriter, Dr. Carl Hahn, at the time CEO of Continental Tires and later CEO of Volkswagen, said in an agency brief: “We lose 10 Deutschmarks on every tire we sell.”

“Then we better stop advertising them,” said I.

Hahn gave me a pained look. The look was followed by real and massive pain in my left foot, because my Creative Director had kicked me viciously.

“Ouch!” I said.

“You’ve got that right,” said Hahn.

That little story crossed my mind when I read in The Nikkei [sub] that “Mitsubishi Motors Corp.’s electric vehicles and other eco-friendly offerings are expected to begin contributing to the firm’s bottom line in two years.”

Saab Subsidiary Narrowly Avoids Bankruptcy As Suppliers Lose Faith

One of Saab’s suppliers, SwePart Verktyg AB, asked a Swedish court to declare a key Saab subsidiary, Saab Automobile Tools, bankrupt today reports Automotive News [sub]. Saab Tools owed about $935,000 to SwePart for tooling, and according to the supplier

More than one week has passed from the summons and payment has not yet been made. Saab Automobile should therefore be considered insolvent… We don’t want them to go into bankruptcy, I wish you understand that, that would be horrible, but we are a small company and for us that is a lot of money

Saab Tools was created to guarantee EIB loans for tooling, so had the “subsidiary” been declared insolvent, the whole ship would have gone down. But before a judge could act, Saab somehow managed to put out the fire, as a company press release proclaims

Swedish Automobile N.V. confirms that Saab Automobile Tools AB reached agreement on payment terms with the supplier that filed for bankruptcy, thereby resolving the issue.

Once again, Saab pulls the fat from the fire at the last minute… but the clouds are dark and rolling in fast. Many suppliers are still looking for money, Saab Automobile has 104 claims pending against it, and SwePart’s bankruptcy request won’t be formally withdrawn until Monday. And with the Swedish government and EIB seemingly unwilling to lift a finger to help, even the faithful are losing hope. This feels like the beginning of the end of the end…

Chrysler Is Now Officially An Italian Company, Total Taxpayer Cost: $1.3b

Saab To Stay Shuttered Through August

After spending much of this year not producing vehicles, Saab is anxious to get to work on its 11,000 vehicle backlog of orders, and production was supposed to start on August 9 after workers return from Summer vacation. But a Saab press release reveals that the troubles aren’t over, with short term financing and supplier agreements still to hammer out, and that production won’t resume until August 29 at the earliest. Gunnar Brunius, Vice President of Production and Purchasing explains:

I am positive about the progress we made on the payment terms with our suppliers and it is good to see that we all want to make it work. What we need now is a full commitment on supply of parts into our factory to be able to restart production and secure a stable manufacturing operation. We are now working hard with our suppliers to nail down these plans, commit to a delivery schedule and start building the close to 11,000 cars that we currently have in our order books. The industry-wide summer break at our suppliers caused certain key suppliers not to be able to supply us in time. Saab Automobile hopes to restart production earliest in week 35 provided that it is able to commit to a delivery schedule with its suppliers.

But wait, there is some good news! Saab’s Communications Manager Eric Geers tells GP.se

I can promise one hundred percent to the salaries paid next week. Where the money comes from is not important, the main thing is that we pay [emphasis added]

That kind of sums up the whole Saab situation nicely, doesn’t it?

Toyota Is Circling The Wagons To Fend Off The Yen

“Producing in Japan will remain extremely difficult as long as the conditions don’t change,” said Akio Toyoda today, and appealed to the Japanese government to “level the playing field.” Toyota did some leveling of its own. In a big board meeting, Toyota leveled swaths of corporate structures.

GM Goosing Stock By Overstocking Dealers With Trucks?

It has been around the net since yesterday that “trucks are piling up on auto lots” and that this could spell “trouble for GM.”

Bloomberg reports that GM did bet on a strong recovery and built more trucks to fill the imaginary demand. “The strategy is backfiring.”

The National Legal and Policy Center has more sinister suspicions. It states that “it looks like General Motors is up to its old tricks as it stuffs inventory channels with higher profit trucks.” The center is accusing GM and the Obama administration of “fudging earnings.”

Japanese Automakers: Sayonara, Japan

Japanese automakers will move their production elsewhere if the yen keeps rising. This is what Toshiyuki Shiga, chairman of the Japan Automobile Manufacturers Association, told The Nikkei [sub] in a very blunt interview. Shiga, who is also the COO of Nissan, said that power shortfalls and the strong yen are the biggest impediment to Japan’s most important industry.

$36m Bridge Loan "Saves" Saab, Workers Paid, Production Could Resume. So What's Sweden's Problem?

Almost two months ago, Saab was able to restart production after Gemini Investment Fund extended a €30m six-month convertible loan to the struggling Swedish automaker. Now, after another shutdown, it seems that Gemini has once again ridden to Saab’s rescue, as the company announces another six-month convertible loan from Gemini.

Swedish Automobile N.V. (SWAN) announces that it entered into a EUR 25 million convertible bridge loan agreement with Gemini Investment Fund Limited (Gemini), thereby securing additional short-term funding.

SWAN entered into a EUR 25 million convertible bridge loan agreement with Gemini with a 6 months maturity. The interest rate of the loan is 10% per annum and the conversion price is EUR 1.38 per share (the volume weighted average price over the past 10 trading days). SWAN may at any time during the loan’s term redeem it without penalty and it intends to do so once the funding from Pang Da and Youngman is received, in which case no dilution as a result of this bridge loan will occur.

Attention Chinese, Swedish and European Investment Bank regulators: you’d better cut through that red tape and approve the Pang Da and Youngman investments post-haste, or Saab will be back in the drink when these short-term loans mature. After all, hasn’t Valdimir Antonov been waiting for approval to buy into Saab since.. oh, 2009?

Pfffft: The Air Escapes From The Big Nissan-Renault-AvtoVaz Takeover Story

Yesterday, The Nikkei was all worked up about a takeover of Russia’s largest automaker AvtoVaz by the Renault-Nissan Alliance. The Nikkei became so excited that it forgot simple logic. More on that here. The Nikkei had it on not so good authority that Nissan would soon buy 25 percent of the Russians, and together with Renault’s 25 percent and change, Japan and France would finally achieve what had been tried before: Rule Russia. We had our doubts.

Do you hear the big hissing sound? That’s the lukewarm air coming out of the story.

Not True: "Nissan-Renault To Take Control Of Russia's AvtoVaz"

Rumors of Renault and Nissan taking over Russia’s AvtoVaz have been around for a while. We have a new one! The Nikkei [sub] picked up indications that Nissan and Renault will take a majority in AvtoVaz, Russia’s largest automaker. Except that The Nikkei doesn’t report it as a rumor. The headline “Nissan-Renault To Take Control Of Russia’s AvtoVaz” sounds quite definite. Sadly, it is not true.

Saab Referred To Collections. Bankruptcy Threatened

A group of businesses that are owed anywhere between $198 and $744,083 could force ailing Saab to declare bankruptcy. They have turned to the Swedish Enforcement Agency, better known (and feared) in Sweden as the “Kronofogden.” That agency introduces itself as follows:

“Is there a bill you cannot pay? Or are you not getting paid by someone who owes you money? In both cases, it will be Kronofogden that you come into contact with. A debt that is not paid ends up in Kronofogden´s register. This register is open for all to consult. As a result, anyone wishing to find out how someone else manages their finances can check the register. If a person´s name appears in the register, he/she can find it difficult to buy on hire purchase, borrow money or rent an apartment.”

Currently, there are 48 entries on that list that claim that Saab owes them. Lots of suppliers. A few bill collectors. A patent attorney. One of the world’s largest CPA firms, Pricewaterhouse-Coopers, demands $104,904.

Swedish online newspaper GT published a list of all the claims allegedly reported up to Tuesday. Here it is:

Antonov Drops Out Of Saab Real Estate Leaseback, Youngman Deal Doubted

Strap on the man-pants, Saab fans, because there’s another heaping load of bad news for the Swedish brand this morning. First off, Saab’s mysterious Russian backer Vladimir Antonov has backed out of a deal in which he was to buy property at Saab’s Trollhättan plant and lease it back to the company, stabilizing its short-term cash position. Automotive News [sub] quotes an Antonov rep as saying

The property sale is now being discussed with external investors

Apparently the Swedish real estate investor Hemfosa has stepped into the breach and sources say a deal could happen quickly. Antonov’s man added that his boss was still interested in securing a shareholding in Saab, a move that has been awaiting approval by the European Investment Bank for some time now. But despite Antonov’s insistence that he’s not going anywhere, the real estate deal pullout is troubling. After all, if Antonov were really the Saab zealot he claims to be, willing to support and revamp the brand at any cost, wouldn’t he want to own the Trollhättan plant? Wouldn’t he want deed to the factory in case Saab, as it exists now, goes into bankruptcy? This is the first indication that Antonov is treating his Saab involvement as an investment rather than a crusade, which is frankly a bad sign for what’s left of the Swedish brand. On the other hand, with Chinese firms chopping up Saab, what’s a businessman to do?

Tsunami Trauma: Honda Forecasts Heavy Hit On Results

Honda joins other Japanese automakers in a delayed post-tsunami forecast. Percentage-wise, Honda expects to be much harder hit than Toyota. Honda expects a net profit of 195 billion yen ($ 2.43 billion) when the current fiscal year ends in March 2012.through March. Last year, there were 534 billion yen ($6.65 billion) left below the bottom line. That’s a decrease of 63.5 percent.

Analysts are shocked.

Saab Firmly Under Chinese Control (If All Goes Well)

The assembly lines in Trollhättan are still down and will be down for a while. With Spyker & Saab gasping for money, another Chinese party threw them a life line today. The price: Saab will be in Chinese control if and when all is approved.

Opel Soap, Day 3: Unions Demand Clarity, Deep Throat Speaks

Opel workers in Germany are getting increasingly frustrated and are banging the table. Rainer Einenkel, head of the works council in Bochum, today demanded that GM management in Detroit “immediately makes a clear and unambiguous statement, and to deny the plans of a sale without ifs and buts.” Rainel Einenkel writes on the website of the works council in Bochum that “ambiguous statements aren’t helpful, neither for the workers nor for our products.”

Yesterday, Germany’s chancellor Angela Merkel also demanded clarification from Detroit after the German newspaper Die Welt had written that China’s BAIC had made an offer for Opel. The paper said that GM’s board is tilting towards cutting Opel loose. On Thursday, Der Spiegel and Auto Bild had written that “GM is slowly wising up to the fact that the reasons that led to the planned Opel sale in 2009 have not changed.” Media reports said that GM CEO Dan Akerson is getting impatient.

Now, it seems, there is impatience all around.

In the meantime, I finally tracked down my former Opel executive who always had been a dependable source.

Toyota's Forecast: The Tsunami Won't Kill Us, But The Yen Might

Today, Toyota finally delivered its delayed outlook for this fiscal year. It usually is delivered at the annual results conference, but the tsunami had muddled the waters, so to speak. Now, Toyota has a bit more visibility. Today, Toyota did forecast a 35 percent fall in profit for the fiscal year ending March 31, 2012. Toyota expects to end the fiscal with a net income of 280 billion yen ($3.5 billion).

According to Reuters, that’s “well short of the consensus for a 434 billion yen profit in a poll of 23 forecasts by Thomson Reuters I/B/E/S.” I am proud of the optimism of the forecasters. Personally, after looking at the disaster in Japan, I hadn’t expected any profits.

DOE Loan Program Knocked For Lax Oversight, Risk-Related Costs

The Department of Energy’s Advanced Technology Vehicle Manufacturing (ATVM) loan program has come under fire from the Government Accountability Office before, and was the subject of a patronage investigation by the Center for Public Integrity and ABC News. And the bad news keeps piling up, with yet another nasty GAO report [ PDF] taking the program to task for running up higher-than-expected lending costs due to “industry risks” and for failing to provide required technical oversight.

GM Financial To Compete With Ally For Floorplans, Increase Number Of Junk Loans

“I want to compete with Ally, but I don’t want to be head-to-head,” Akerson said in a recent interview. “I want to be there when they’re not in a market, but I want them to know I can come in at any time.

With the above statement, which was clearly inspired by the chorus from Billy Idol’s “Flesh For Fantasy”, the bullet-headed madman at General Motors’ rickety helm has launched a new offensive. “GM Financial”, formerly known as the subprime lender “AmeriCredit”, has just sold $500 million worth of bonds with one objective in mind: the occasionally lucrative, and just as occasionally disastrous, dealer floorplan market.

Japanese Automakers And Unions To Government: Lower Then Yen, Or We Are Out Of Here

In an (especially for Japanese tastes) strongly worded joint statement, Toshiyuki Shiga. Chairman of Japan Automobile Manufacturers Association, and Koichiro Nishihara, President of the Confederation of Japan Automobile Workers’ Unions threw down the gauntlet to the Japanese government. Executive summary: “We are sick as hell of the high yen and we can’t take it anymore. Do something, or kiss those jobs sayonara.”

Treasury Won't Sell GM Until Stock Improves. GM To The Rescue?

Bloomberg reports that a “person familiar with the matter” says the US Treasury won’t sell its remaining stake in GM as long as the automaker trades below its $33/share IPO price. Previously the government’s auto team had said it would not try to “time the market” and our analysis showed that the Treasury was likely to sell sometime late this Summer. But it’s been months since GM spent more than a few days above its IPO price, indicating that Treasury may be waiting considerably longer if the IPO-price floor is set in stone. And with $36.5b in cash equivalents on hand and only $5b in debt, GM’s $45b market cap is hardly encouraging… especially with investors waiting for The General to match Ford’s profitability levels. Heavier discounts mean a lower operating profit for GM in the US market, and the first quarter shows a $1b swing in pricing between the two firms (with Ford improving $700m and GM dropping $300m) according to Bloomberg. Lower finance earnings are also holding The General back relative to Ford. So, what’s GM’s response?

GM To China: Recall! We Want Our Shares Back!

In December 2009, freshly government owned GM cut a deal with its Chinese joint venture partner SAIC: For the chump change of $84.5 million, GM sold SAIC one percent of their Chinese joint venture. It was not just any one percent. It was THE one percent, the golden share that brought SAIC’s holdings to 51 percent. It allowed SAIC to consolidate the profits of the GM China JV in its books. And now, GM wants the golden one percent back.

Saab Shuts Down Again, Situation "Tense," No End In Sight

Saab was supposed to reach 100% production speed sometime in the middle of last week after enduring a nearly two-month shutdown. But now it seems that more “material shortages” have brought the Trollhättan plant to its knees again, as Steve Wade of inside.saab.com reports

Yesterday, production at Saab Automobile stopped at lunchtime due to material shortages. We have now stopped again today for the same reasons…

The liquidity situation is still tense, and depends on several different financing solutions falling into place, long-term as well as short-term. Some milestones have been achieved, such as the letter of intent signed with Pang Da and the additional funding that their order of Saab cars means. An example of things that still await a solution is the sale and leaseback of Saab AB Property, which we have addressed in previous communications. Representatives from Spyker and Saab will continue to work with these solutions, while the dialogue between Saab and suppliers progresses.

Sergio Marchionne And The UAW Play Poker. In The Pot: $ 5 Billion

After the U.S. and Canadian government are out of the car business, at least as far as Chrysler is concerned, Fiat will own 52 percent. Who owns the rest? A large chunk, 45.7 percent, is owned by the UAW. By the UAW’s VEBA healthcare fund, to be exact. And the union is in no great hurry to change that. The UAW has a big “HOLD” on their share of Chrysler, hoping that the value goes up. That’s what “two people familiar with the fund’s strategy” told Reuters today.

Forza Italia: Fiat Takes Control Of Chrysler, Gummint Gone

Fiat has reached an agreement with the U.S. Government that will give Fiat 52 percent of the shares in Chrysler and therefore the final controlling majorioty. The Treasury said on Thursday it will sell its remaining 6 percent equity stake in Chrysler to Italy’s Fiat in a deal that will net Washington $560 million, Reuters reports.

Quote Of The Day: The State Of The Bailout Bill Edition

According to the White House’s just-released report titled “The Resurgence of the American Automotive Business” [ PDF here]:

The U.S. Government provided a total of $80 billion to stabilize the U.S. automotive industry through investments in General Motors (GM), Chrysler, Chrysler Financial, Ally Financial, and programs to support automotive suppliers and guarantee warranties. As of today, $40 billion has been returned to taxpayers. While the government does not anticipate recovering all of the funds that it invested in the industry, the Treasury’s loss estimates have consistently improved – from more than 60 percent in 2009 to less than 20 percent today.

Independent analysts estimate that the Administration’s intervention saved the federal government tens of billions of dollars in direct and indirect costs, including transfer payments like unemployment insurance, foregone tax receipts, and costs to state and local governments.

This is as close as we’ve gotten to a thorough accounting of the full cost of the auto industry bailout, as both GM and Chrysler have erred on the side of counting as little of their own taxpayer support as possible (leaving out aid to their predecessor firms, finance companies and suppliers). On the other hand, it’s also two short paragraphs in a ten page report… and the rest of the document hews pretty closely to Democrat strategist Ron Klain’s advice to the White House, specifically

tell the story with fewer numbers and more emotion; less prose and more poetry

While the media debates whether this means the bailout bill will come to $14b or $16b, it’s becoming clear that the final number won’t make a big difference… at least politically.

Ask The Best And Brightest: Are You Buying Fiat's "Old Carco" Kiss-Off?

When Chrysler celebrated its payback of “every penny that had been loaned less than two years ago” last week, I noted that CEO Sergio Marchionne’s triumphant line was technically correct, but hardly represented the whole truth of the story. I pointed to $1.5b in supplier aid that helped keep Chrysler afloat, as well $1.9b worth of the Bush Administration’s “bridge loan” to “Old Chrysler,” prior to its government-guided bankruptcy and sale to Fiat. Apparently my more-inclusive accounting of the price of Chrysler’s rescue (which was picked up elsewhere in the online media) caused Mr Gualberto Ranieri, Chrysler VP of Communication, to spend some part of his Memorial Day Weekend writing a response of sorts, outlining Chrysler Group LLC’s perspective on the situation. Hit the jump for Ranieri’s statement, and my brief answer to the headline’s question.

Chrysler's California Dealer Battle: Wider War Already In Progress?

It took a bit of research to fully parse the California New Car Dealer Association’s complaint against Chrysler and its partially company-owned store in Los Angeles, and our finding is that the CNCDA is actually gunning for Chrysler with gusto. But, argued some of the B&B, surely Chrysler doesn’t want to be kicked out of California? Surely Chrysler’s California dealers don’t want to see their manufacturer banned from selling vehicles in the state? Well, it turns out we were missing a little context that seems to indicate why Chrysler’s California dealers are willing to go to war over a single dealership: Chrysler is overhauling its California retail presence with the help of Wall Street hedge funds. Having used the bailout to wipe out 789 dealerships across the country, Chrysler appears to be working around franchise law to exert more control over its retail network in the Golden State. No wonder then that California’s dealers are standing together to attack Motor Village, the most egregious example of Chrysler’s new retail model. And there’s no knowing where the conflict could end…

Saab Restarts Production

With €30m from PangDa and €30m from Gemini Investments, Saab restarted production today at its Trollhättan factory. According to SaabsUnited, the line will run at 80% speed today and Monday, before moving to 100% (over 200 cars per day) by the middle of next week. Speaking at a press conference, CEO Victor Muller reflected:

It’s been an interesting lesson. A company like Saab, that lives in a glass house, should never be caught in a situation where there is not enough cash to withstand the storm as the one we have seen now. What happened seemed like a very insignificant situation became a very significant situation, and next thing you know, you are losing six weeks of production… it was very, very tough and we’ve had some very adverse circumstances that we’ve had to live with, but we got out of it. I think that if you got through 2009-2010 as Saab has been, anything else is relatively easy. We will definitely ensure that this will not happen again. This means that we will be on a quest to ensure that we have sufficient funds at all times to overcome adveersities like this because we can’t afford to have another production stoppage with all the relating downsides, such as disappointed customers, upset suppliers and media attention… that is definitely not in our interests.

Chinese Car Sales: Boomlet Or Bustlet?

There is a war of opinions over the direction of the Chinese car market. Bloomberg says that “China’s auto sales may fall 10 percent this year with the end of government stimulus policies and restrictions on car licenses, according to the China Automotive Technology & Research Center.” Bloomberg’s colleagues at Reuters called Chen Hong, President of China’s largest automaker SAIC as a witness. He expects the Chinese car market to grow 7.4 percent to end up at 19.7 million units by year’s end. Who’s right? Who’s wrong?

Tesla Sells. More Shares

Say what you want about Tesla, but people are buying. Not so much the cars, more so shares in the company. According to a regulatory filing, Tesla plans to sell 5.3 million new shares to the public, and up to 795,000 more to the underwriter, at $26 each. That would raise up to $158.5 million. According to Businessweek, “CEO and co-founder Elon Musk will also buy 1.5 million shares at the same price in a private sale. Blackstar Investco LLC, an affiliate of Daimler AG, will buy 644,475 shares directly from Tesla at the public offering price. That would bring total proceeds of $214.3 million.” The proceeds are mostly for developing a crossover Tesla.

Chrysler Celebrates "Payback," Acknowledges Outstanding Obligations (Sort Of)

Chrysler’s bailout “thank you” event today was long on praise for the redemptive power of its government bailout and short on talk of remaining challenges, but at least one important fact was acknowledged: this highly-touted “payback” was only for 85% of the money loaned to Chrysler during the bailout period. Although, to be perfectly accurate, it wasn’t exactly Chrysler who acknowledged the outstanding obligation [the firm avoids any such nuance in its release], as CEO Sergio Marchionne simply stated that

We received confirmation this morning at 10.13 am from Citigroup that Chrysler Group repaid, with interest, by wire transfer to the United States Treasury and by bank transfer to the Canadian government, every penny that had been loaned less than two years ago. [Emphasis added]

That last bit was the important part… as in, the part that was most often repeated in Chrysler’s presentation and in subsequent media reports. But it’s not the whole story…

CCT: Chinese Government Issues Warning To Parties Involved In The Saab Deal. Antonov Still Hopeful

Supposedly, the idea of the Saab / Pangda deal was to skirt requirements to obtain Chinese government approval. As we have explained on the day the MoU (as Muller sees it) or contract (as Pangda sees it) was signed, it would be most silly to try to get around the Chinese government. They have a whole array of measures to demonstrate their displeasure if they don’t like a deal.

If ChinaCarTimes is correctly informed, the paperwork was barely dry and the Chinese government already made its annoyance felt. According to a CCT report, the Chinese government issued a warning to Pangda. The story is written in Chinglish, but this is what it seems to be saying:

Quote Of The Day: Escape From Trollhttan Edition

Pangda CEO About Saab: We Will Take Over the Importation From 2012 Onwards."

For people with a sober mind, for people who do not suffer from a Stockholm Syndrome where hostages express empathy and have positive feelings towards their captors, the shotgun marriage between Saab and Chinese car distributor Pangda left many questions open. What was related through Spyker channels did not sound like business the way it is done in China.

Pangda’s CEO and founder Pang Qing Hua talked about his plans for Saab in an interview with the Chinese website, Auto Sohu. ChinaCarTimes supplied the translation into English, you can read the full version here.

What you will read will make much more sense than the breathless announcements by Victor Muller.

The interview answers some questions we had asked all along, for instance the question of the miraculous arrival of €30 million by last Tuesday. Pang Qing Hua explains:

Saab Has Enough Money For Muller's Bonus, But Does It Have Enough To Restart Production?

Saab has received wire transfers of around €30m from both Gemini Investments and the Chinese dealer group PangDa, reports Aftonbladet, and it will be using that money to pay off its supplier debts which could use up most of that cash (Saab’s supplier debts are estimated by DI.se at between two hundred and four hundred million kroner, or as much as €44m). Leaving aside the issue of how that money was able to be transferred from China to Sweden in a matter of two days (more on that from Bertel here, the short version: the deal should need Chinese government approval), there are serious questions about Saab’s ability to restart production. After all, the €30m from Gemini is debt, while Saab owes PengDa for an undisclosed number of vehicles that it bought with its investment. Unless those cars are sitting somewhere waiting to be shipped, Saab will have to pay off its suppliers and then build the cars on what is essentially credit from PengDa. Meanwhile, that’s not the only demand on Saab’s finances and attention, as CEO Victor Muller is planning on taking a bonus of over half a million dollars, a decision that is creating fresh problems of its own.

Study Says: Japan Troubles And Sub-Prime Consumers Golden Opportunity For U.S. Car Industry

A study of A.T. Kearney Management Consultants (for what such a study is worth) foresees that 13.2 million cars will be sold in the U.S. this year. It could be more, but the consultants reckon that “in the aftermath of the earthquake and tsunami, parts shortages will impact 2011 U.S. new vehicle sales by 200,000 units.” In the disaster, A.T. Kearney sees a golden opportunity: “Given what we know about production downtime, in 2011 we see 328,000 U.S. customers of the affected brands up for grabs, and more if the time to wait for a particular brand begins to extend.”

Chrysler: No Product Changes For Loans

Does that headline seem ripped from the pages of TTAC’s 2008-2009 headlines, or what? But really, who’s shocked? Chrysler spent early 2009 trying to convince the government that it was worth a (second) taxpayer-funded second chance, and now that it’s looking for a private-sector bailout in order to escape the terms of its publicly-funded bailout, Chrysler’s still got some ‘splaining to do. The DetN reports:

Chrysler Group LLC does not intend to speed up plans for new cars despite media reports that investors see a high degree of risk in an automaker that has been so dependent on truck sales…

“Nothing has changed from the five-year plan,” [Chrysler Group VP of Design and Dodge boss Ralph Gilles] said.

New small and midsize cars for Chrysler, engineered by Fiat, “are coming strong and heavy,” Gilles told reporters following a speech. “There is no need to speed up.”

Now, nobody would suggest that Chrysler should mess with its product timing simply to please some bankers. If it’s even remotely possible to hurry new products to launch without cutting serious corners, Chrysler should/would be doing it anyway ( ask Sergio). Still, Gilles’ “nothing has changed” sound bite isn’t exactly true.

Chrysler Debt Effort Stalls: Goverment Loans Not So "Shyster" After All?

As Steve Rattner described in his book “Overhaul,” the Presidential Auto Task Force very nearly decided not to rescue Chrysler, with the decision coming down to a single vote. Now, it seems, that with Chrysler blaming the “shyster” interest rates on its government loans for its lack of profitability, Chrysler’s viability now depends on rounding up a “lender of second to last resort.” And, according to the latest reports, that rescue-of-a-rescue effort is still very much hanging in the balance as well. If CEO Sergio Marchionne thought the government’s loan terms were “shyster”-ish, he was clearly in need of some context from Wall Street… and he doesn’t seem to be liking it.

Want To Own The Auto Industry? Now You Can…

GM Share Turns Starchy Analysts Into Snarksters

Jefferies is one of those starchy global investment banks and institutional securities firms where a two tone collared shirt is their idea of casual Friday. It is also a place where highly paid financial analysts outsnark the most ruthless TTAC writer, Yesterday, Jefferies sent its “Jefferies institutional clients that include investment managers, insurance companies, hedge funds and pension funds worldwide” a research note that my pal who owns a hedge fund volunteered to share with TTAC readers, as long as we guarantee full anonymity. No problem.

The note is titled “Is GM Turning into a Busted Thesis?” and deals – you guessed it – with the GM stock. H. Peter Nesvold, CFA, and Thomas Fogarty, CFA, both equity analysts at Jefferies, are underwhelmed by the GM share.

At The Toyota Financial Results Conference: We Doubled Our Profit, And The Yen Is Killing Us

When I arrived at Toyota’s downtown Tokyo basement conference room, I bumped into Toyota spokesman Paul Nolasco, who was in the grips of stage fright. Annual results conferences with the world watching can do that to a spokesman. Trying to cheer Paul up in my charming way, I said: “Come on Paul. This one will be great. It’s the next ones that will be rotten as hell.” Paul gave me a pained look.

When I left an hour and a half later, I had changed my mind. Toyota will survive this crisis just like it survived the previous two: Stronger. Not unscathed, but not as badly affected as some officially fear and silently hope. What may not survive are Japanese jobs.

GAO: $34b Left On Bailout Bill

Some taxpayer-funded turnarounds just have a little more turnaround than others, according to the GAO’s recent report on the auto bailout [ PDF here], which tracks the progress of the Detroit patients and considers their futures. Sure, GM received quite a bit more government money than Chrysler, but the improvements in GM’s financial performance compared to Chrysler’s are clear. But the GAO still has a number of concerns about the “more than $34 billion” of taxpayer value that’s still floating around, unrecouped, in the rescued automakers. Feel free to peruse the GAO’s full 59-page report, or you can hit the jump for the highlights.

Breaking: Toyota's Profit Nearly Doubles to $5 Billion – Company Ready For Rough Road Ahead – Might Pack Up And Leave Japan If Yen Gets Stronger

Suzuki Profits Rocket Up, Future Unsure

‘Tis the season when Japanese companies publish annual results. They all work on a fiscal year that runs from April 1 through March 31. Then, they need a good month to count the beans, to be ready in mid May. Suzuki was first to announce, and the announcement was good:

Redflex Shareholders Reject Buyout Offer

Australian investors in the photo enforcement firm Redflex Traffic Systems voted down a buyout offer from toll road giant Macquarie Bank and the asset management firm Carlyle Group at a general meeting in Melbourne today. The recently sweetened deal would have paid A$2.75 per share, or $305 million total, to take over the speed camera and red light camera business.

“Your directors unanimously recommend that shareholders vote in favor of the improved scheme proposal, in the absence of a superior proposal,” Redflex Chairman Max Findlay told assembled shareholders. “I can confirm that no superior proposal has been received.”

GM Q1 Profits Triple

GM solidly trounced analysts’ expectations and delivered $3.2 billion if Q1 2011 net income. The consensus of a Bloomberg panel was $1.74 billion. Compared with the first quarter of 2010, revenue increased $4.7 billion to $36.2 billion, says GM press release. GM’s first-quarter profit more than tripled to its highest in at least 21 years.

Size Doesn't Matter: BMW Delivers Big Boy Profits

Didn’t they say that you have to be a monster car company with at least 5 million units, just to survive? BMW did not get the memo. Aiming for sales of just 1.5 million units this year, BMW delivered a first quarter 2011 net profit before tax of €1.812 billion ($2.691 billion), surprising analysts that had expected something in the neighborhood of $2 billion.

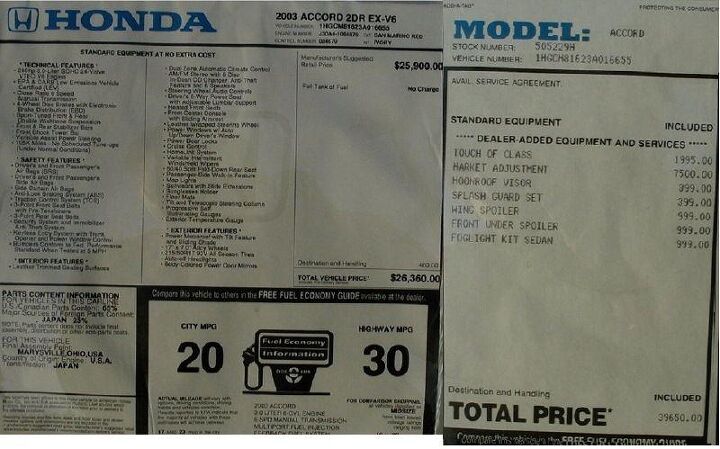

This Is An Additional Dealer Markup Sticker. You'll Be Seeing More Of It Soon

How many Civics could a Honda make, if a Honda could make Civics? Here’s a hint: “half as many” would be too optimistic a guess. Honda has warned its dealers to expect “severe shortages” in supply of the new 2012 model, and virtually every other Honda model will have the same availability issues until later this year. Toyota’s in the same boat.

What does this mean for TTACers who want to buy a Japanese-brand car?

Saab Secures Short-Term Loan, Will Restart Production Next Week

Saab’s got a new short-term lease on life, as Automotive News Europe [sub] reports that the Swedish brand has secured a €30m, six-month convertible loan from Gemini Investment Fund. Saab is also requesting a €29.1 drawdown of its EIB loan, and when that is approved next week, Saab will reach the €59.1m in liquidity it needs to restart production. According to another piece by Automotive News [sub], Saab is still in talks with the Chinese automakers Great Wall Motor Co., China Youngman Automobile Group Co. and Jiangsu Yueda Group Co. in hopes of securing an additional investment in the struggling Swedish automaker, as well as a joint venture for Chinese production of the next-generation 9-3, and a possible Chinese market distribution deal.

Meanwhile, Saabsunited reports that several companies have been told to stop development on that next-gen 9-3 while the company gets back on its feet, meaning it could be delayed into the 2013 timeframe. And while Saab sacrifices long-term development for short-term survival, the recent production shutdown is taking its toll: Swedish sales of the 9-3 are up, but the new 9-5 is falling off (128 sold last month) as stocks dry up. The drama continues…

Chrysler Reports $116m Q1 Profit

Chrysler’s Q1 conference call is just beginning, and though you can’t listen in unless you’re registered media, you can download the slide set here [PDF] and the press release here. Besides, I’ll be updating this post with the latest as it happens, so why bother? Marchionne is just noting that Chrysler’s $116m Q1 profit is the first since 2009, although he seems more excited about “modified operating profit” of $477m, and free cash flow of other $2.526b.

German Investment Funds Prepare Billion Dollar Court Case Against Volkswagen

Volkswagen was all grins when litigating hedgies lost the first round in court in the U.S. (it’s on appeal) and when the public prosecutor in Stuttgart dropped some of the investigation into former Porsche CEO Wendelin Wiedeking and former CFO Holger Härter (only to add new angles.) Until the matters are cleared, Volkswagen and Porsche officially are not married, unofficially, they share all available beds.

Now, a new lawsuit causes frozen faces and acid reflux at the very top of Volkswagen: German investment funds intend to involve prominent supervisory board members of Volkswagen AG in a billion dollar court case.

Saab's Workers Told To Stay At Home

So Saab had called an all hands meeting for today. 3,700 employees attended with great expectations or knots in their stomachs. This could have been the first day of a great future or the last of Saab. Instead ….

Ford Brings In The Q1 Bacon

Ford beat expectations with a first quarter 2011 net income of $2.6 billion, an increase of $466 million from the first quarter 2010. First quarter 2011 pre-tax operating profit was $2.8 billion. Ford Credit contributed $713 million to the pre-tax operating profit.

Recent Comments