Toyota's Forecast: The Tsunami Won't Kill Us, But The Yen Might

Today, Toyota finally delivered its delayed outlook for this fiscal year. It usually is delivered at the annual results conference, but the tsunami had muddled the waters, so to speak. Now, Toyota has a bit more visibility. Today, Toyota did forecast a 35 percent fall in profit for the fiscal year ending March 31, 2012. Toyota expects to end the fiscal with a net income of 280 billion yen ($3.5 billion).

According to Reuters, that’s “well short of the consensus for a 434 billion yen profit in a poll of 23 forecasts by Thomson Reuters I/B/E/S.” I am proud of the optimism of the forecasters. Personally, after looking at the disaster in Japan, I hadn’t expected any profits.

Message to all competing companies: Expect the Japanese to come out with guns blazing once the supply lines are back in shape.

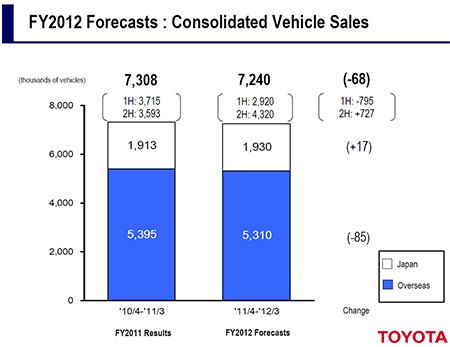

Where Toyota sees a loss is in vehicle sales. Toyota closed out the last fiscal with 7.308 million units sold. Toyota lowered its projection for Fiscal 2012 to 7.24 million vehicles. That’s 68,000 units less.

On a calendar year basis, this will look nastier. April through September 2011, Toyota sees 795,000 units less than last year, to be followed by 727,000 units more than in the preceding year for the October 2011 through March 2012 period.

What this means is that Toyota will end the calendar year 2011 in all likelihood in third place behind GM and Volkswagen. The party line at Toyota is “We don’t want to have the most sales, we want to have the most satisfied customers.” But dropping from top to 3 will hurt the pride, even if the face is brave.

The big caveat: The projections are based on an exchange rate of 82 yen to the dollar.

Toyota CFO Satoshi Ozawa, who presented the forecast today in Tokyo, warned again that the strong yen is the biggest obstacle facing Toyota. In the May conference, Ozawa had said that the break even point for profitable production in Japan is 85 yen to the dollar. Today, the dollar already buys 5 yen less. “We are in a situation where it is becoming impossible for Japan’s manufacturing industry to do business,” Ozawa said today.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Zipper69 "At least Lincoln finally learned to do a better job of not appearing to have raided the Ford parts bin"But they differentiate by being bland and unadventurous and lacking a clear brand image.

- Zipper69 "The worry is that vehicles could collect and share Americans' data with the Chinese government"Presumably, via your cellphone connection? Does the average Joe in the gig economy really have "data" that will change the balance of power?

- Zipper69 Honda seem to have a comprehensive range of sedans that sell well.

- Oberkanone How long do I have to stay in this job before I get a golden parachute?I'd lower the price of the V-Series models. Improve the quality of interiors across the entire line. I'd add a sedan larger then CT5. I'd require a financial review of Celestiq. If it's not a profit center it's gone. Styling updates in the vision of the XLR to existing models. 2+2 sports coupe woutd be added. Performance in the class of AMG GT and Porsche 911 at a price just under $100k. EV models would NOT be subsidized by ICE revenue.

- NJRide Let Cadillac be Cadillac, but in the context of 2024. As a new XT5 owner (the Emerald Green got me to buy an old design) I would have happy preferred a Lyriq hybrid. Some who really like the Lyriq's package but don't want an EV will buy another model. Most will go elsewhere. I love the V6 and good but easy to use infotainment. But I know my next car will probably be more electrified w more tech.I don't think anyone is confusing my car for a Blazer but i agree the XT6 is too derivative. Frankly the Enclave looks more prestigious. The Escalade still has got it, though I would love to see the ESV make a comeback. I still think GM missed the boat by not making a Colorado based mini-Blazer and Escalade. I don't get the 2 sedans. I feel a slightly larger and more distinctly Cadillac sedan would sell better. They also need to advertise beyond the Lyriq. I don't feel other luxury players are exactly hitting it out of the park right now so a strengthened Cadillac could regain share.

Comments

Join the conversation

If Toyota were more successful in Europe (rather than the dismal