Suzuki Sues – In A Year

Attempts to ratchet-down the rhetoric in the Suzuki/Volkswagen row have failed. Suzuki launched a heavy missile in the direction of Wolfsburg. Suzuki will take the case to court, The Nikkei [sub] heard before a scheduled press conference in Tokyo. But fear not, Volkswagen gets a whole year to make up its mind.

Treasury: Loss On GM Bailout Rises To $23.6B

One of the great mysteries to many inside the auto industry is why is GM’s stock price so low? Though the company had a weak third quarter, its stock price has been stuck well below its IPO price for much of the last year, despite a return to profitability. Though GM faces challenges, few inside the auto industry understand why its stock price remains so low. One theory: the government’s mere continued presence as a major stockholder creates uncertainty around the company. If this is the case, it creates something of a vicious cycle: the lower the stock price, the less likely the government is to sell its shares, leaving it lingering with no exit strategy, in turn driving the stock lower. Though that’s not likely to be the whole story, one thing is certain: the government has been forced to increase its loss estimate for the GM bailout. The Detroit News reports that the Treasury’s losses on GM are now estimated at $23.6b, up from $14.4b. And with an election looming, it seems likely that the White House will sell within the next six months. But will the government’s desire to protect itself politically trade off with GM’s PR? After all, whatever the Treasury’s final loss is, that number will be pinned to GM as a symbol of what it owes the American people. On the other hand, with most analysts insisting that GM stock is undervalued, another year of government ownership could convince investors to bid up the price, greatly reducing GM’s public debt. Too bad electoral politics will probably prevent that from happening….

Saab's Supposed Savior Antonov Debanked

Vladimir Antonov, the Russian “financier” who was feted by the acolytes of the zombie Saab as the second (after Victor Muller) coming of the dear Jesus, had his bank taken away from him.

More than $392 million of assets of Antonov-controlled Snoras Bank may be unaccounted for, central bank Governor Vitas Vasiliauskas told Bloomberg. Snoras’s operations were halted, and a state administrator was appointed by the Lithuanian government after the bank ignored recommendations to reduce its credit risk.

As a precautionary measure, government and bank traded accusations of felonious conduct. Reports Reuters:

“The government and central bank said they had found a risk of insolvency and possible criminality. The bank meanwhile has accused the government of ‘robbery’.”

Just to be sure, Swedish Radio mentions that “Antonov lent a large sum to Victor Muller which allowed Spyker to buy Saab.”

Our Daily Saab: With Plans Expired And Dealers Waiting On Cash, GM Takes The Wheel

Saab’s Memorandum of Understanding with PangDa and Youngman expired today, returning Saab to what must by now be a rather comforting, familiar state of limbo. Of course, the MoU in question was already dead, as GM had publicly nixed it, saying it wouldn’t supply parts or license technology to a 100% Chinese-owned Saab. But now, without an official agreement to rally around, Swedish Automobile, PangDa and Youngman are desperately pitching new ownership structures to GM in hopes of approval. Swedish Auto’s Victor Muller tells the WSJ [sub]

We are submitting an information package to GM and we will have to await the feedback that GM has on that package and then we’ll know.

Muller says the lesson of the failed MoU is that GM won’t accept Chinese control, and as a result the new proposed ownership structure is “very carefully crafted” so that none of the three partners has complete control. But since the previous deal, in which PangDa and Youngman would split a 54% stake in Saab, is also off the table, it’s tough to say what Muller’s “carefully crafted structure” entails. And while Saab and its Chinese suitors wait for GM approval that may never come (but don’t tell Keith Crain [sub] that!), it seems both time and money are getting tight. Again. Still.

Porsche: Why Build The "Baby Boxster" When We Have A "Baby Cayenne"?

Do you badly want a new mid-engined Porsche? Is the Boxster/Cayman combo still a bit rich for your blood, given the weak economy? Chances are you have been waiting patiently for news about Porsche’s “Baby Boxster,” the long-discussed, entry-level, flat-four-powered version of Volkswagen’s Bluesport concept. The sad news: you may be waiting quite a bit longer. In an interview with the FT Deutschland, Porsche CEO Matthias Mueller says

There is no decision to develop this car into production. The decision is due soon, but they may well drag on into next year

Why? Well that’s easy: Porsche’s number one priority is to remain the world’s most profitable automaker, with “at least” a 15% operating margin and a 21% return on capital. And it can hit its 200k sales by 2018 goal without adding a sixth or seventh model… thanks to the fact that its fifth model is an entry-level SUV, called the Cajun.

China's Government Seventh Largest Stockholder Of Honda

The Honda share is edging closer and closer to its 2009 carmageddon lows. And guess who knows a good bargain when they see one? The Chinese. The Nikkei [sub] reports that a “stealth” Chinese fund has emerged as a major shareholder in Honda.

Our Daily Saab: SWAN Examines The Endgame Options

With Saab’s latest MOU with PangDa and Youngman expiring on Tuesday, the heat is on for parent company Swedish Automobile (SWAN) to hash out the many problems and disagreements between GM and the proposed Chinese buyers. And now that it’s fairly obvious that a deal won’t happen, as GM and the Chinese Government seem fairly well set against it, the question is “what next?” How do you plan an endgame that should have been initiated months, if not years ago? That’s the challenge being considered by the few remaining shareholders in SWAN, who are meeting in Holland to pick through the none-too appealing options.

GM Well On Its Way To World's Largest Carmaker

GM’s net income in the 3rd quarter was $1.7 billion, down a bit from $2 billion in the same quarter of last year. What was up though was total global production. According to data published by GM, global production in the first 9 months rose to 6.95 million, up 7.8 percent from the same period in 2010 when 6.45 million were made. If GM maintains that pace in the 4th quarter, and there is no reason not to, GM should end the year with a global production well over 9 million.

Toyota Wants To Learn From Nissan

None of the approximately 100 journalists that packed Toyota’s basement meeting room in Tokyo today was surprised when the midterm results of the current fiscal year were announced, and there was an operating loss of 32.6 billion yen ($417 million). The loss was a little higher than expected, but expected it was. If you lose 689,000 units in sales, then you are bound to lose some money. The surprise came in the form of an unexpected new benchmark: Nissan.

The Ultimate Money Machine: BMW Has Best Quarter Ever

Nine months in to the year, the BMW Group already delivered 1,232,584 units to customers, up 16 percent from the same period in the previous year. BMW is well on track of meeting its 1.6 million goal this year. And who says you can only make money when you are one of the top 5 carmakers?

Musk Sees Tesla Profit In 2013, But Losses (And Issues) Are Still Piling Up

According to Tesla CEO Elon Musk, the EV luxury brand has pre-sold all 6,500 units of its new Model S to be built next year, and the company is on-track for a 2013 profit. Bt if you’re comparing Tesla to the erstwhile EV darling BYD in order for it to look good, you have to wonder how good things really are. If anything, Tesla should be compared to Audi, an established (and hot) luxury brand with the same EV technology and one of Tesla’s founders on board. Losses for this fiscal year are estimated at $437m, and Tesla’s crucial loans from the Department of Energy are attracting a distracting investigation in the wake of the Solyndra scandal (but hey, Musk is “personally guaranteeing” those loans, so no worries…). And, in a truly puzzling move, Tesla is ignoring the SAE J1772 protocol for rapid EV charging because it isn’t sexy looking enough. As EV guru Chelsea Sexton puts it to the New York Times

It’s hardly unusual for Tesla to zig where the rest of the industry zags. But it’s particularly counterintuitive not to use the J1772 standard, since Model S drivers will be more interested in public charging than Roadster owners. Tesla’s proprietary connector choice requires getting customers to care about form over function on one of the most utilitarian aspects of the car. How many people stare at a gas nozzle and think, ‘If only that were better looking’?

Selling out of a first-year production run is good news, but hardly surprising (all plug-in vehicles are currently capacity-constrained). Preventing buyers from using public charging infrastructure because it’s unsexy is the kind of surprising news that could seriously damage Tesla’s long-term efforts. Meanwhile, we still don’t know how this company will do with regards to manufacturing quality and reliability, especially as volumes ramp up to 20k units per year. After all, Tesla’s hype and niche marketing efforts are well-proven… it’s all the other aspects of building and selling cars that we’re still unsure about.

Our Daily Saab: Saab "Saved" As 100% Chinese Firm… Pending Those Pesky Approvals

On the last possible day to work out a deal before being forced into bankruptcy, the Victor Muller era has ended at Saab. The Swedish brand will now become a completely Chinese-owned company… if all goes to plan. A press release explains

Swedish Automobile N.V. (Swan) announces that it entered into a memorandum of understanding with Pang Da and Youngman for the sale and purchase of 100% of the shares of Saab Automobile AB (Saab Automobile) and Saab Great Britain Ltd. (Saab GB) for a consideration of EUR 100 million…

…The administrator in Saab Automobile’s voluntary reorganisation, Mr. Guy Lofalk, has withdrawn his application to exit reorganisation. The MOU is valid until November 15 of this year, provided Saab Automobile stays in reorganisation.

But remember, this is Saab… and its fate rests in the hands of many, many people not named Victor Muller. Despite the air of finality that is surrounding some of the media coverage of this latest announcement, this is not a done deal. The Saab saga rolls on…

Chrysler's Making Bank

In the post-bailout, post-giveaway, billion-dollar-bonus-baby and occupied-Wall-Street era, it seems almost impossible to correlate reported financials to anything substantive. Nor does a single swallow make a summer.

Chrysler, however, is hoping that today’s third quarter report is merely the vanguard of a Capistranian return to profitability.

Our Daily Saab: Pang Da And Youngman Bail After Muller Rejects Buyout

With a Halloween deadline to get its restructuring back on track looming, Swedish Automobile has rejected an offer by Youngman and Pang Da to buy 100% of Saab’s shares. Moreover, the struggling Swedish brand has canceled the existing agreement with Youngman and Pang Da, its erstwhile would-be rescuers. A Saab presser notes:

Today, Swedish Automobile N.V. (Swan) announced that it has given notice of termination with immediate effect of the Subscription Agreement of July, 2011 entered into by Swan, Pang Da and Youngman.

Swan took this step in view of the fact that Pang Da and Youngman failed to confirm their commitment to the Subscription Agreement and the transactions on the agreed terms contemplated thereby as well as to explicit and binding agreements made on October 13, 2011 related to providing bridge funding to Saab Automobile AB (Saab Automobile) while in reorganization under Swedish law.

Pang Da and Youngman have presented Swan on October 19 and 22 with certain conditional offers for an alternative transaction for the purchase of 100 percent of the shares in Saab Automobile which are unacceptable to Swan. However, discussions between the parties are ongoing

Quote Of The Day "Bankruptcy Is No Option For Saab" Edition

Lyssna: Saabs vd, Victor Muller, om företagets situation

Whenever a CEO says “bankruptcy is not an option,” you know the game is up. After complaining in this Swedish Radio interview (in English) that his court-appointed administrator is trying to sell Saab off wholesale to the Chinese, Victor Muller trots out Churchillian and Nietszchian calls to arms… in fact, he does everything short of bursting into a spirited rendition of “I Will Survive.” Unfortunately, Muller’s credibility is long gone, and he doesn’t help himself by trying to portray Lofalk as some traitorous backstabber. With Saab months (years? decades?) into its death-flails, and the most recent “rescuer” turning out to be a non-player, is it any wonder Lofalk wants to hand over the mess to the only viable companies involved (especially when Muller calls North Street a “strong partner”)? Muller continues to labor under two basic delusions: first, that he can sell a majority share to the Chinese while keeping Saab an essentially Swedish (or at least European) company and second, that anyone cares whether Saab becomes a Chinese company. Sorry Victor, there’s just nothing left here to fight for…

Our Daily Saab: This Man Gives His Last Shirt To Save Saab

The man in the weineresque photograph is Alex Mascioli, head of North Street Capital in Greenwich, Conn. Supposedly, he will come up with $70 million by this weekend to save Saab form the abyss once more. Not much is known about the man – Wait, I take that back.

Our Daily Saab: Another Day, Another "Rescue"

With both China’s NRDC and Sweden’s NDO appearing unready to approve the Chinese takeover of Saab before a Halloween bankruptcy deadline, it seemed that Saab was properly borked. Without Vladimir Antonov or Gemini Investment Fund to hit up for yet another “bridge loan,” we fully expected to see Saab placed into bankruptcy a week from Monday. But if Saab’s parent company, Swedish Automobile, had found a private equity fund that was gullible enough to rush in where Antonov feared to tread and drop $44m on Spyker… well, we should have known that North Street Capital would be fool enough to get sucked into the Saab maelstrom. And sure enough, Reuters reports that

The private equity firm of racing car enthusiast Alex Mascioli, which bought the luxury sports car business of the Dutch owner of Saab in September, is to invest $70 million in the cash-strapped car maker as Chinese bridge financing looks uncertain.

Here we go… again.

Why A Bad Euro Is Good

Everybody has heard that Europe and the Euro are in trouble. So why does it take so long to save it? We’ll let you in on a little known secret. First, let’s go to Slovakia. The eurozone’s second poorest member quietly turned into an automotive powerhouse. Ever hear much of the Slovakian auto industry? You won’t. Global automakers such as Volkswagen, Peugeot, Kia have discreetly set up car plants in Slovakia. Parts makers followed. Wages are low – 780 euros a month on the average. Without anyone looking, Slovakia turned into the world’s top auto maker per capita. They want to keep it that way. And that’s why they don’t want to help Greece.

Porsche Has Something Expensive To Sell You

No, it’s not a special-edition 911 with a few extra horsepower and leather-wrapped mirror-adjustment levers. Nor is it a water pipe built to the most exacting standards ever imagined by German engineers. No, Porsche has a freaking palace for sale, Schloss Bullachberg to be precise. Conveniently located in Bavaria’s castle district, near some of Germany’s most famous castles, Bullachberg was once the seat of the von Thurn und Taxis dynasty… and can now be yours for an undisclosed sum. The Frankfurter Allgemeine Zeitung reports that Porsche bought the property five years ago, for some six million Euros, with plans to turn it into a luxury resort hotel for “kaufkräftig” (literally purchase-powerful) customers and management retreats. Fast forward through one financial crisis and one overambitious attempt to buy Volkswagen, and Porsche has decided to let the property go. But be warned, as the FAZ reports that

only the most necessary work was done on the building’s upkeep.

Now that Ferrari even has its own amusement park (conveniently begun before the financial crisis), there’s no way Porsche will ever match its Italian rival in terms of cross-branded destination tourism. Which is fine. After all, we’re talking about car companies here… right?

Japanese Auto Industry: We're Outta Here

Again and again, Japanese automakers had been warning that they cannot stomach the strong yen, and that it will eventually cost jobs. Today, the yen stood at 76.6 to the dollar, and Japanese carmakers are packing.

Our Daily Saab: Are These People Serious?

Yesterday, we reported that Saab was waiting for some $93 million to arrive from China. The matter has not changed. Now, people on the inside get the impression that yellow knight Youngman wants out. This morning, Swedens’s Dagens Industri cited an inside source that says that Youngman wants out, and another Chinese maker wants in. Yeah, sure.

Our Daily Saab: The Chinese Deal

At Saab, which is working (well, not really working) under court protection from creditors, the big question is: “Did the money come in?”

The money is the €70 million ($93 million) promised by the Chinese bus manufacturer Youngman as a bridge loan. Saab needs cash desperately. Court protection means no new loans. Cash is king. No cash has arrived from China. Saab is not the only party in Sweden that is waiting for answers from China. Sweden’s National Debt office is waiting for answers also. Let’s have a look.

Ghosn On Crusade Against Japanese Yen

If anyone again mentions that the Japanese manipulate their currency to get an unfair advantage in international markets, then I will strangle him. Or make him pay my Tokyo restaurant, taxi, and even subway bills in converted dollars. Strangling would be the more humane punishment.

Nissan CEO Carlos Ghosn has an even more painful option in store: He’ll leave the island. “If the Japanese government wants to really safeguard and develop employment, then something has to be done,” Ghosn told Reuters editors Paul Ingrassia and Kevin Krolicki in an interview in New York.

Moody's: Fiat Is Junk. Bad Junk

Today, credit rating agency Moody’s cut the rating on Fiat’s bonds down two notches from Ba1 to Ba3. Merrill Lynch wrote in a letter to customers that it is ”worth remembering that Fiat debt is already junk rated so there will not be a change in the credit investor base for Fiat, but cost of refinancing goes up.”

Officially, bonds in the Ba family are regarded to be of “questionable credit quality”. In the business, “Ba1” is known as junk, B3 as “bad junk”. It is interesting what got Fiat the demerits: Chrysler.

Carlos Ghosn: The Yen Is Abnormal, And We Won't Live Much Longer With That Deviant

When we went on the plane this morning for the some 600 mile trip to see a Nissan plant in Kyushu, the southernmost of the four main Japanese islands, we asked ourselves: Why?

After all, the plant had been there since 1975. What’s new? We soon should find out: Nissan CEO Carlos Ghosn went on a full frontal attack against the high yen, threatened several times that Nissan and most of the Japanese industry would pack up and leave, and delivered an ultimatum: “If six months down the road we are still in this situation, then this will provoke a rethinking of our industrial strategy.”

Our Daily Saab: A Very Iffy Situation

Writing these Saab stories is becoming as much fun as visiting a fading relative in a hospice: You have to do it, but you want to get it behind you, quickly. Today is the day a court in Sweden will decide whether it admits Saab’s appeal of a prior court decision that would have forced the Swedes into bankruptcy. In the meantime, Victor Muller came up with another plan.

Our Daily Saab: Could Be Done By Tuesday

That’s not us making the prediction. Stockholm News says that “Saab’s fate could be decided on Tuesday.” On Monday, the Court of Appeals will meet and will deliberate whether Saab will be allowed to appeal the District Court’s denial of a reconstruction.

Stockholm News does not expect a decision until Tuesday. But it predicts:

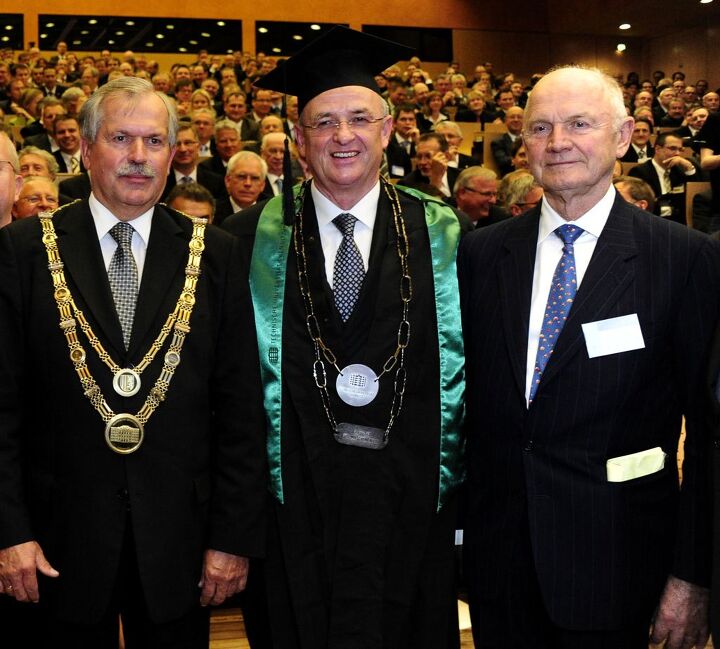

Volkswagen Bets $86 Billion On Its Future

One of the reasons why Volkswagen is hitting on all cylinders (don’t be U.S. myopic – always measure a car company by global success) is that they did not stop investing in the wake of the 2008 crash. They did not have to: Sales in the U.S. were low, and where you don’t have a lot, you can’t lose a lot. At the same time, VW had the big luck of being a major player in China. While U.S. and Japanese car companies stopped or severely dialed back their investments into R&D and capacities, Volkswagen kept on spending. This has a delayed effect of 3 to 5 years, and what we are seeing now is just the beginning of this effect. It is also the beginning of an even greater spending spree.

DOE "Green Car Retooling" Loan Program Under Republican Assault, Are Chrysler's Finances At Risk?

Reuters reports:

Republican leaders in the House of Representatives want to halve the balance of a U.S. government loan fund established to help the auto industry make more fuel efficient cars and trucks.

If plans to shift some $1.5 billion from the Energy Department advanced technology fund to disaster assistance are carried out, serious questions would be raised about Chrysler’s ability to fully capitalize on its bid for new financing.

That the DOE loan program is under attack comes as no surprise: it’s been savaged by both the GAO ( twice) and the Center for Public Integrity for a lack of clear goals, weak oversight, misappropriation, and political patronage (more on the patronage bit here). And with the Solyndra DOE loan scandal blossoming, it’s no surprise to see ATVM going under the axe (although Rep Steny Hoyer is leading the Democrat pushback). What’s worrying about this development, however, is that Fiat-Chrysler CEO Sergio Marchionne has said that the DOE loan was “a crucial part” of negotiations over its recent Wall Street bailout loan refinancing. When GM quit the program earlier this year, Marchionne also said that

I have neither the arrogance nor the cash to show any disdain toward the DOE process.

Chrysler also cites its ability to secure the DOE loans as a major risk factor in its latest 10-Q SEC filing. And with only about $10.2b in cash and equivalents on hand at the end of June, there’s a chance that this attack on the ATVM loan program could deal a body blow to Chrysler’s finances. Here’s hoping Sergio has kept the runt of the bailed-out automaker litter from dependence on this apparently corrupt, and politically vulnerable loan program.

Are You Ready For: An American Volvo?

The national character of auto brands is a tricky thing. For decades, Volvo wore its Swedishness on its sleeve, emphasizing the values that made Ikea, Abba and Swedish porn so popular in the US… even when it was an outpost of the Ford empire. And then the unthinkable happened: Chinese up-and-comer Li Shufu bought the brand and rolled it into his Geely empire. In the world of national-character-branding, being bought by a Chinese firm is something like hiring Casey Anthony as a brand ambassador, or using a mascot called “Mr Melamine Milk” (another nightmare scenario can be found here). So, how does a brand like Volvo, that was built on Swedishness, get past the “China Factor”? By doubling down on Swedishness? How about by building cars in the US?

Our Daily Saab: Bankruptcy Filing And A Hat Trick

The white-collar unions Unionen and Ledarna filed bankruptcy petitions today against Saab, everybody from Associated Press to inside.saab reports. On the same day, Saab announced that it had licensed its PhoeniX architecture to China’s Youngman at firesale prices – a move that could possibly buy another month or two. But first things first:

Victor Muller Plays Maharajah While Suppliers Go Belly-Up

Whenever we report about the machinations around Saab, the faithful remind us that there are real people affected. They are right. Some of the real people work for IAC for instance, one of Saab’s largest suppliers. Half of the production of its factory in Färgelanda went to Saab.IAC Sweden could be bankrupt in a few weeks because they don’t’ have the money to pay a 95 million kronor ($ 14.8 million) tax bill, Sweden’s Göteborg Posten reports.

Sweden To Muller: Hand Over The Money Or Go To Jail

As if Victor Muller doesn’t have enough problems. He has managed to upset Sweden’s state collection agency Kronofogden so much that they are threatening arrest. Muller claimed there is enough money to pay the employees, but if he does that, the state collection agency will get its hands on the money. The collection agency says that Muller has to hand over the cash or go to jail. This quote by Victor Muller sent Hans Ryberg, head of the enforcement agency in Uddevalla to the ceiling:

Bertel Schmitt Fired From TTAC - Saab Saved

This was the headline many Saab aficionados were looking for (and we have the emails to prove it.) On Saab’s darkest day, we might as well put a smile on the faces of Saab’s most militant missionaries – even if the smile lasts only a few seconds.

Two days ago, Saab filed for court protection – the Swedish variant of Chapter 11. That must be approved by the court – and today, the court denied it. Says the Wall Street Journal:

Saab Files For Court Protection - Everything is Beautiful

Yesterday, Sweden’s Dagens Industri reported that Saab would seek court protection today. We did not report it, because honestly, we are tired of the story. On the other hand, there were signs that things are heading to the court: Saabsunited tried its hand again on amateur spin and wrote that bankruptcy, should it happen, wouldn’t be all that bad: “It does NOT mean that SAAB is in any way dead tomorrow!” Glad this is cleared up.

This morning, employees of Saab were woken from sleep (they’ve become used to sleeping in since April) and called for an all hands meeting at 12 noon. At the meeting, they heard:

Saab In Trouble Deep, Goose Cooked, Reputation Shot

If the Shanghai Daily isn’t hallucinating (their writing is pretty sober, if not sobering), and if their source is reliable (the source is Pang Qinghua, chairman of Pang Da, the yellow knight from China that was supposed to save Saab from the abyss,) then Saab’s goose is cooked.

Chairman Pang told the Shanghai Daily that “Pang Da Automobile Trade Co and Zhejiang Youngman Lotus Automobile Co have not submitted an application to the Chinese government to inject much-needed funds in Saab, increasing fears that the Swedish carmaker may drive into bankruptcy due to a cash crunch.”

Why does that mean that the goose is good for eating? Because Saab says so.

Saab "Close" To $157m Bridge Loan, Situation "Dire"

Bloomberg [via the Financial Post] reports that “one of the five biggest European banks” is “close” to loaning Saab $157m so that it may pay workers and suppliers, in order to move towards restarting production. According to DI.se, the deal is predicated on Saab securitizing the loan with shares of Saab Great Britain or other “alternative assets.” But apparently whatever the banks ask for, Saab will try to give, as Theodoor Gilissen Bankiers analyst Tom Muller explains

They need the money immediately. I hope they solve it this week, otherwise I think it’s over for Saab. It’s a very dire situation.

He’s not kidding…

Japanese Proverb: No Money, No Action. No Action, No Satisfaction

The chief reason for the recent decline of the fortunes of Japanese automakers was not, as posited by pop pundits, the recalls or the tsunami. It was something more insidious, something regularly overlooked by most outsiders and many insiders. It was a reduction in development spending – an eventually deadly bottom line therapy also popular by cash-starved American peers. Japanese automakers have realized the error of their ways and have returned to funding the finding of that insanely great next generation car.

Some Swedes Can't Wait For Saab Going Down The Drain

Sweden’s Dagens Indudstri, the financial paper most hated by the Saab faithful, has dug up another interesting twist in Saab’s concentric circles around the drain: There is one party that is checking daily whether Saab has finally gone belly-up: The consortium of real estate developers that a month ago bought 50.1 percent of Saab’s land, factories and improvements for around $40 million.

This was considered about 30 percent below market. Nevertheless, a lot of people doubted the sanity of the consortium, which is backed by a large Swedish insurance agency. After all, the tenant is Saab, and with its current references, the company would have a hard time renting an apartment in downtown Stockholm. Dagens Industri just found out why the consortium is quite happy with its distressed tenant: If Saab can’t pay the rent, the consortium gets the whole shebang for no extra money.

Saab Refuses To Confirm (Or Rule Out) Court-Protected Reorganization

Swedish radio cites an unnamed source close to Saab as saying the troubled automaker was preparing to file for court-protected reorganization, as it struggles to pay workers and restart production. Under that scenario, Sweden would pay worker salaries while reorganization takes place. But at the company’s official mouthpiece, inside.saab.com, a press release refuses to deny or rule out that Saab has chosen this route. The release reads:

Swedish Automobile N.V. (Swan) is aware of certain reports in Swedish media related to a possible filing by Saab Automobile AB (Saab Automobile) for a voluntary reorganization under Swedish law.

Swan confirms its earlier announcements that it is in discussions with several parties to secure the short and medium term funding of Saab Automobile to restart and sustain production. In order to secure the continuity of Saab Automobile, Swan and Saab Automobile are evaluating all available options. Swan will update the market in case of new developments.

This non-denial might be read as a confirmation that Saab is considering filing for court protection, but hasn’t yet decided on that course of action. Meanwhile, Saab has delayed its latest financial report, and its online PR rep continues to blame the media for concluding that because Saab can’t sell cars, pay suppliers, restart production or even pay salaries on time it’s destined for bankruptcy court.

Saab Unions: Bankruptcy Two Weeks Away If Pay Is Delayed (And It Will Be)

Saab has already warned its workers that paychecks due tomorrow could be delayed until “committed” funds from investors arrive, but Bloomberg reports that the warning may not be enough. According to the report

Any delay in the August payments will prompt the unions immediately to start a process aimed at ensuring state coverage of wages in the event of the carmaker’s failure, officials from the IF Metall and Unionen labor groups said. The unions, after gaining employees’ backing, would first file payment requests with Saab. If salaries remain unpaid in seven days, the unions may then ask a district court to declare Saab bankrupt.

That could put Saab into bankruptcy in as little as two weeks. Saab’s long nightmare seems to be drawing to a close.

Redflex Reports Drop in US Traffic Camera Revenue

Opponents of red light cameras and speed cameras have had an impact on the bottom line of one of the world’s largest photo enforcement providers. Redflex Traffic Systems reported a “slowdown in the level of new contracts signed” that dragged the firm’s US traffic camera revenue down $2.4 million in the 2011 financial year. Redflex lost $1.5 million worth of US contracts this year.

New Volkswagen Reliability: Consistently Good Numbers

Volkswagen may have garnered a bad rap for being in the shop too much. Their sales performance however continues without a single breakdown. According to the July data (global, consolidated, all companies), the Volkswagen Group had a 16.3 percent unit sale rise in July (compared to July 2010) . From January to July, 4.75 million vehicles were sold worldwide, a 14.4 percent increase.

Scary Chinese Experiment Proves: Swedish Cars Can Make Money

Volvo, given up as beyond salvage by former owner Ford, was sold off to China’s Geely in the automotive equivalent of a yardsale at $1.8 billion. Saying no is always easier than saying yes (well, there are certain exceptions), so most augurs said: “This won’t work.” Asked why, they answered: “It was tried it before, and it failed.”

Wonders of wonders, it appears to be working: Volvo Cars reported an EBIT of 600 million kronor (about 93 million U.S. dollars) in the second quarter, 40 percent more than in the same period of the previous year, a statement from Volvo Cars says.

With Less Than $1m In The Bank, Saab Hits Up The Wall Street Loan Sharks

I know I’ve said this several times before, but the end really is near for Saab. The WSJ [sub] reports that Sweden’s Debt Enforcement Agency began auditing Saab’s finances after several debts came due earlier this week, and found only 5.1 Kroner ($796,291) in its Skandinaviska Enskilda Banken account. That’s barely enough to cover the 5.06m Kroner in debts that came due this week alone… and Saab’s total outstanding debt is ten times that amount, around 50m Kroner. And as if the financial trouble weren’t dire enough, key stakeholders are abandoning Saab in embarrassment, like Benny Holmgren, one of Sweden’s largest car dealers. Holmgren tells SvD.se that his contract to sell Saabs has expired and that he won’t renew, explaining

“For me, it is important to be proud of the brands that we have in our halls. Saab does not deliver cars they promised, they do not pay wages to their employees, nor debts to their suppliers while the owners pick out big money. It does not feel right for a [my] car dealers.”

But among the hardcore Saab faithful, today is not a day of sorrowful resignation… but a day of totally overblown and unrealistic hope for their dying brand. Yes, really…

Saab Board Pay Bump Sparks Union Anger

With debt collectors closing in on all sides, Saab’s shaky PR took another hit today as the Swedish media repotred that members of the board of Swedish Automobile (SWAN), Saab’s parent company, received pay increases of some 633 percent over 2010. Thelocal.se reports that

New chairman of the board, Hans Hugenholtz, received a raise of 633 percent, from 147,150 kronor (about $23k) to 611,163 kronor (about $950k). Others also had their pay increased significantly.

Though the amounts are relatively small, and the dwindling ranks of unquestioning Saab supporters argue that the compensation is low compared to the Dutch average (SWAN is incorporated in The Netherlands), this is just the latest PR disaster to hit the struggling automaker. One Saab employee sums up the mood:

It feels like everyone is out to grab what they can get.

And no wonder they feel that way. Not only did worker paychecks arrive late, but Sweden’s national debt office has begun foreclosing on the first of its outstanding claims… and the initial amount (about $58k) could have been covered by the chairman’s pay increase alone. Sending the message that board compensation is more important than staying out of insolvency has to be some of the worst PR imaginable. Still, some will defend Saab no matter what…

Aptera Refunding Deposits: Run While You Can!

Better Place Announces Business Plan, Signs Israeli Lease Deal

One of the biggest clouds hovering over Better Place’s venture in Israel – and globally – is what stands behind the well-prepared presentations and thoroughly thought out, customer-oriented marketing. What makes the seemingly adventurous venture appealing to the business hounds investing their best capital in it? Such questions from journalists are usually answered with a neat smile, a corporate joke and a dry statement.

While Better Place still isn’t revealing its global business plan, it finally sheds some light on the numbers behind its Israeli venture, as part of a worldwide roadshow in preparation for the company’s upcoming $300 million capital raising.

Sergio Marchionne's Economic Forecast

Three Suppliers Request Saab Bankruptcy, August 16 Is Judgement Day

Just three weeks after Saab narrowly avoided being pushed into bankruptcy by supplier SwePart, SvD.se reports that three other suppliers have now initiated the bankruptcy process by requesting that Sweden’s national debt bailiffs pursue their debts. One Spanish supplier is reported to be foreclosing on €2m ($2.8m in debt), while two of the rebelling German firms are said to be owed at least €5m each. And though Saab says it is meeting with the Spanish firm to try to hammer out a deal, SvD reports that four of the 14 outstanding claims against Saab have run out of time. Lars Holmqvist, head of the European Association of Automotive Suppliers argues that, by paying some suppliers and not others, Saab is de facto bankrupt, and that a trustee should be brought in to pay suppliers in order of priority, rather than order of Saab’s necessity. Meanwhile, Saab CEO Victor Muller has been in Brazil and the US, trying to bring new investors on board, as its Chinese funding won’t be approved for two-to-three months, if ever. Meanwhile, “taxes and fees” must be paid by Friday, August salaries are due in just two weeks, and Muller cut his latest money-raising trip short to reassure workers back in Trolhättan. But according to thelocal.se, even the most optimistic of union leaders hope Saab will have a new CEO soon. Do I hear the fat lady warming up her vocal cords?

Saab: Money Dispose-All, Made In Sweden

Saab is living off charitable donations and newly issued stock to allow its workers to live from paycheck to paycheck while doing nothing. Over at the Blog of Good Hope every little donation to the cause is praised as the Final Deliverance. According of a Blog of Good Hope post, representatives of the Chinese savior Pangda are in Trollhättan this weekend. One of the questions undoubtedly will be “how long, how much?” Or in the language of venture capitalists “how long until we run out of runway?”

With Opel Back In Black, GM Records $2.5b Profit in Q2

GM has announced its Q2 earnings [ Analyst slides in PDF here], and the firm has recorded a healthy $2.5b profit for the quarter on strong North American performance and an end to losses from the European Opel division. In fact, on an EBIT (earnings before interest and taxes) basis, all of GM’s global divisions were in the black last quarter, although GM Europe and GM South America both recorded modest $100m gains and GMIO (which includes the lucrative Chinese market) recorded a $600m EBIT. The powerhouse continues to be GM North America, which recorded $2.2b in EBIT, continuing North America’s post-bailout importance as the driver of GM’s financial results. Globally, a $600m reduction in EBIT due to costs and “other” was offset by the same amount of gains in volume/mix, while pricing added a billion dollars to overall EBIT. And though fleet sales were up in North America, incentives for the quarter appear to have hit record lows. [Hit the jump for global deliveries and market share/fleet data, via GM’s financial highlights release].

Saab Wants To Sell Shares To Meet Payroll. Union: "We Have Not Seen Any Money Yet"

Swedish Automobile NV, the artist formerly known as Spyker, and owner of struggling Swedish car maker Saab, said today it plans to issue new shares to raise cash in order to meet overdue payroll. Response of the union: “Show me the money.”

Toyota's Financials Hit By Earthquake

Toyota today announced financial results for the quarter ended June 30, 2011. It was the first full quarter after the March 11 earthquake and tsunami which severely affected production and sales at home and abroad. The results reflect this.

Mazda Loses $327m In Q2, Vows To Fight On

Mazda lost $327m in the second quarter, falling below analyst expectations as tsunami-related supply interruptions and currency woes battered the company’s bottom line. According to the Detroit News, this was Mazda’s third straight quarter of losses and the firm has lost money during its last three fiscal years. But, as this video (which, as far as I know has not yet been shown in the US) argues, the “Hiroshima spirit” which allowed locals to rebuild after the devastation of the nuclear attack in 1945, flows through Mazda. The company has a bold new design direction, an “enthusiast howl” of an ad campaign, and it says it will return to profitability when its fiscal year ends in March. But its projected profit for the full year is only $12.8m, which means Mazda is cutting it real close… and as the last quarter proved, projections can always be missed. Here’s hoping the last independent, mass-market, enthusiast-oriented automaker is able to turn things around this year and keep fighting the good fight.

Saab Soap, The Endgame: Antonov Wants War!

In the Saab soap, it looks like Vladimir Antonov does no longer want to be invited back. Swedish Aftonbladet reports that “Vladimir Antonov is pissed” (at least that’s Google’s translation for “Vladimir Antonov är förbannad”) and is looking into legal action against Sweden’s Prime Minister Fredrik Reinfeldt, Finance Minister Anders Bork and Maud Olofsson, Minister for Enterprise and Energy.

Saab: Antonov Considers EIB Lawsuit, While Questions Arise Over "Management Services" Money

SvD.se reports that would-be Saab rescuer Vladimir Antonov is considering legal action against the European Investment Bank and the Swedish Government, for keeping him out of an ownership stake at the failing Swedish automaker. Says Antonov

I have therefore decided to investigate the possibility of taking legal action, including but not limited to claims for damages, which may be of interest to various parties, including myself, the EIB, some officials at the EIB, the Swedish government and some government officials personally. By denying SWAN (Swedish Automobile) and Saab Automobile access to the funding that I offer, what these companies want and still desperately want, both the Bank and the Swedish government acted against all involved parties concerned, particularly against Saab and SWAN’s employees , suppliers, traders, lenders and shareholders

Antonov is reportedly investigating whether he can sue individual ministers of the Swedish government, while the ministers in question angrily deny that they are working against the interests of the Swedish auto industry. Meanwhile, far from calling for the overthrow of the government, the Swedish press is investigating Saab’s outlays for “management services” in recent years, and has found that CEO Victor Muller may be siphoning cash off to the tax haven of Curacao.

EIB Says No To Antonov. Suppliers Say No Scrooge McDuck Will Save Saab

Now that it has been first leaked then confirmed that the European Investment Bank EIB will not let Russian financier Vladimir Antonov get close to Saab, Antonov says he had known that all along.

Antonov’s spokesman Lars Carlstrom told Reuters that his boss “has known for a few weeks that the EIB would not let him invest in the iconic Swedish car firm,” Reuters reports. That revelation should come as another blow to Saab’s crumbling bastion of enthusiasm, Saabsunited, which had reported just yesterday that “Antonov is trying to save the situation.”

With the troops left dazed and demoralized, the generals practice the ancient art of finger pointing.

Volkswagen's 6 Month Profit Likely To Exceed Combined Detroit 3

While natural and man-made disasters rattled the globe, Volkswagen, Europe’s largest and by the end of the year most likely the world’s second largest auto manufacturer, reports eye-popping numbers for the first half year of 2011.

Including China, Volkswagen made $13.5 billion in the first half of 2011. How did they pull off that economic miracle?

Saab's Last Gasp

Checking in on Saab, which becomes as cheerful as visiting a relative in a hospice, we hear that Saab can’t make payroll again. Says The Local: “Saab informed white-collar staff on Tuesday that they would not receive their salaries on time this month. According to a report in the Dagens Industri (DI) business daily, the money will be delayed due to the non-payment of a installment from Bahamas-registered fund Gemini.” The natives are getting restless: A local politician demands Victor Muller’s head.

Recent Comments