Quote Of The Day: A Sucker Born Every Minute Edition

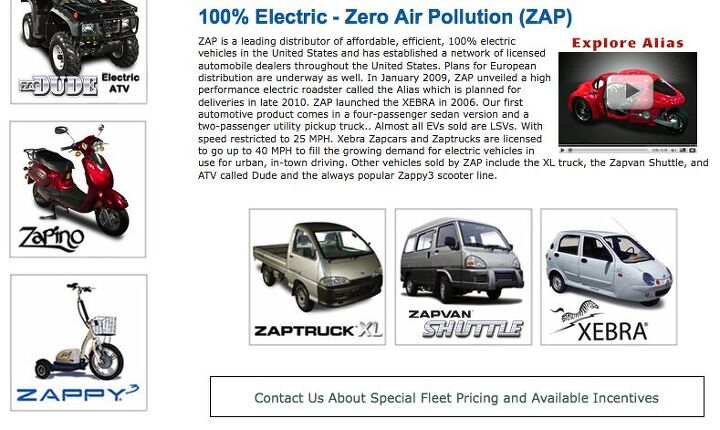

Does Tesla’s S-1 SEC filing leave you worried about the state of EV startups? The great thing about the seamy underbelly of the EV industry is that there’s always a shadier prospect out there to make even marginal cases like Tesla look good. Our perennial favorite in the EV vapor game is ZAP, the erstwhile maker of the Xebra EV (interestingly, the Xebra still shows up on ZAP’s webpage). Zap’s latest play in its never-ending quest for press-release fodder: a tie-up with (get this) a South Korean optics company, best known for its camera lenses and closed circuit TV security systems. Because sometimes you have to cross an ocean to find a sucker big enough to say things like:

Samyang decided to partner with ZAP because of its extensive industry knowledge in electric vehicle production and the breadth and maturity of its current line of electric vehicles

Oh dear.

What's Wrong With Tesla? How Much Time Do You Have?

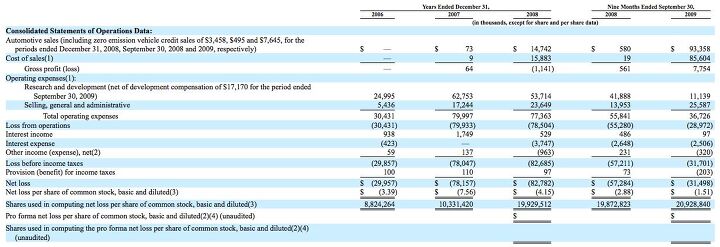

I’ve been warned before by the B&B not to read too much into the forward-looking statements in SEC filings, especially the ones where companies ruminate over all the things that could still go wrong with their struggling firms. These legal disclosures of worst-case-scenarios often reflect unlikely scenarios and can be downright misleading, so we held off from diving too deep into Tesla’s IPO S-1 filing [complete document here]. Others around the web have jumped in without compunction, and this week has yielded a steady drip of troubling revelations. It’s a wild and woolly collection of issues, but given that people are going to be asked to invest in this nightmare of a company, it’s only fair that we give the grievances an airing.

Toyota: Recall To Cost $2b This Quarter, Dent Improved Financial Outlook

Agressive cost-cutting and improved sales yielded $1.68b in net profit for Toyota in the three months ending December 31, reports a press release in the WSJ. Sales revenue climbed 10 percent to $58.2b in the October-December quarter, boosting operating profit to about $2b. This quarter alone though, Toyota reckons the recall could cost the company $2b in repair costs and lost sales. For the fiscal year, ending on March 31, Toyota says the final impact should be limited to about $900m in losses on an operating basis, and has revised its fiscal year net profit projection to about $900m (compared to a $2.2b loss projected in November).

Volkswagen Guns For Number One

Former DCX CEO Juergen Schrempp had a vision. He had a vision of creating a Welt AG. He wanted to dominate the world. In order to create that vision, he set about paying for car companies like Chrysler and a controlling stake in Mitsubishi. 10 years later, DaimlerChrysler is nothing but a footnote in the automotive history books. Now Volkswagen want to emulate that vision, only this time, they want to do it properly.

Tesla's Profit Claims Are Lies

S&P Sticks With "Buy" Rating For Toyota Stock

Toyota Sienna boy band, Boyota from Jennifer Vuong on Vimeo.

Standard & Poors Equity Research [via BNET] says you shouldn’t dump that Toyota stock just yet.

Will the aggressive action of cutting production and recalling so many vehicles scare away potential Toyota buyers, or will consumers think the abundantly cautious response shows a commitment to customer care and quality? We think it is too early to tell, but we believe resilience and global growth of vehicle demand will help TM (Toyota Motors)

You know, until mechanics actually start finding malignant hellspawn demons within Toyota electronic throttle control units. In which case you should invest heavily in law firms. Meanwhile, Toyota is apparently hiring shamans to cleanse their new product of metaphysical infestation by way of bizarre voodoo ceremonies like the one shown above [Hat Tip: Vanity Fair Gay Cars blog].

Spyker Claims 2012 Profit Goal For Saab

Spyker has set the goal of turning a profit with its newly-purchased Saab division by 2012, reports Automotive News [sub]. That effort will be led by a total of three Saab products: the existing 9-3 (with a new version rumored for 2011), the forthcoming 9-5 sedan and, later next year, the GM-built Saab 9-4X Crossover. Other models, including a 9-1 compact are being hinted at, but Spyker acknowledges that such a product would require about a billion dollars more than Saab-Spyker currently has access to. Meanwhile, those three vehicles will have to generate 100k-125k annual sales in order to keep the business plan rolling along. Saab-Spyker honcho Victor Muller has an almost shockingly confident take on this possibility, telling Reuters:

It’s all about the restoration of the confidence in the company. Customers have been very reluctant to buy because of the uncertainty surrounding the brand… Saab has to do nothing but regain its existing and old customers because that in itself would be in enough to create a very strong business model..

Saab sold a total of 8,680 vehicles in the US over the course of 2009. Globally, the firm sold 39,903 units last year, down from 94,751 in 2008. Perhaps the challenge is a bit more difficult than Muller lets on.

Hyundai Quadruples Fourth Quarter Profit

Saab: EU Can Spike The Spyker Deal

So you thought the Saab deal is done? A deal is never done until the check clears. Speaking of clearing, Laurence Stassen, a member of the European Parliament, and a member of the Dutch Partij voor de Vrijheid (a right-of-the-center party in the Netherlands) is seeking clarification from Competition Commissioner Neelie Kroes.

Vrouw Stassen wants to know if there is any forbidden state aid involved in the Saab/Spyker deal, the Dutch news site NU.NL reports. The Swedish government guarantees a loan of €400m, which Spyker then is supposed to get from the European Investment Bank. Spyker is, well, banking on that money.

Ford, Ford Credit Record 2009 Profit

The Ford Motor Company [full results in PDF format here] earned net income of $2.7b last year, on pre-tax operating profits of $454m. The company enjoyed a strong fourth quarter with $868m in net income and an after-tax operating profit of $1.6b (excluding special items). Ford Motor Credit [full release in PDF format here] earned $1.3b in net income and $2b in pre-tax operating profit last year. Ford Credit’s receivables were down at the end of 2009 compared to 2008, with $93b receivable compared to $116b at the end of 2008, and leverage of 7.3 to 1.

Spyker Stocks Soar, But Sergio Isn't Buying

Here’s a situation in a hypothetical tense for you. If you were the CEO of a car company which never made a profit in 11 years and you offered to pay $74 million for a car company which hasn’t made a profit since 2001 and had a badly damaged brand, how would you expect your share price to go? Trust me, you’re not even close. MarketWatch.com reports that Spyker shares soared as much as 74% when they announced they had reached an agreement to buy Saab from General Motors. Spyker’s market capitalisation is now €107 million, four times more than when GM first put Saab up for sale.

Beyond The Revenge Of The Son Of The Hedge Funds: Porsche Sued For Stock Fraud

Old GM Stock Rallies Again. Good News For GM IPO?

Fisker Lines Up $115.3 In Funding, Still Needs To Spend $169m On Karma Engineering

With the economy desperately looking for signs that a bottom has been reached, news that Fisker has raised $115m in new funding might indicate that (if nothing else) the money markets are back to their good old speculative selves. At least it might if there weren’t so many darn extenuating circumstances. On the one hand, Fisker seems like the kind of business that has little business attracting much, well, business. Its $90k+ Karma brings little more to the table than some competition for Tesla in the EV-glamor-bauble segment, and like Tesla it’s trying to leverage its first model into ever cheaper, higher-volume vehicles. So why are VC firms giving Fisker the time of day?

GM-Daewoo Stayin' Alive. Barely.

An interview with Forbes the boss of the Korean Development Bank, which GM-Daewoo still owes several billion dollars, reveals that GM’s South Korean unit had a debt-to-equity ratio of 912 percent as recently as last June. GM “rescued” its crucial small-car development center by buying up all $413m of GM-Daewoo’s recent share offering, keeping the the KDB from imposing its will on the automaker. That was enough to keep the wolf from Daewoo’s door in the short term, but if Daewoo is ever going to develop a new generation of GM small cars and global products, it will have to address its $2b KDB debt and raise additional funds. For now though, GM-Daewoo is just hoping to keep a little momentum going.

Mississippi To Toyota: Can We Have Our Money Now?

Mississippi is starting to get a bit shirty with Toyota. ABC News reports that Mississippi legislators are getting annoyed with Toyota because of the lack of clarity as to when Toyota will start paying the interest on the money the state borrowed to bring Toyota’s car plant to Mississippi. Tate Reeves, State treasurer, told lawmakers during a briefing that discussions are ongoing about when Toyota would begin making payments. The State of Mississippi has already paid about $16.7 million in interest. However, Toyota have a different take on affairs.

Denials Du Jour

A lot of what we have written in the last few days, even what we have not yet written, is utterly wrong, say the objects of our writings. Here are the denials of the day.

Congressional Oversight Panel: Why Did We Bail Out GMAC Again?

The TARP bailout of GM finance partner GMAC is being criticized by a congressional oversight panel [full report in PDF format here], reports the Detroit Free Press. The panel alleges that the Treasury

has not yet articulated a specific and convincing reason to support the company… It has never stated that a GMAC failure would result in substantial negative consequences for the national economy. If Treasury has made such a determination, then it should say so publicly.

Toyota Stumbles Towards Another North America Loss

With the Japanese Yen hovering around the 91 to 1 U.S Dollar exchange rate, a bullish VW focusing on boosting their market share in North America and Ford rising up, Toyota are probably a bit depressed. Business Week reports that, for the second year in a row, Toyota have resigned themselves to the notion that their North American division will post a loss this fiscal year. This will, almost certainly, have a knock-on effect in Toyota’s ability to turn a profit in the North American market, even after more cost cutting. “The finance company is having a solid year, so if you include that it will be so much easier to say positive things,” Yoshimi Inaba, Toyota’s North American chief executive, told reporters in Detroit. “We are still trying hard to improve (sales and manufacturing operations).”

Debt Rating Upgrade Fuels Ford Resurgence

EV Startup Scores $25m, Ford Still Banking With Uncle Sam

According to Detroit lore, Henry Kaiser once loudly threatened to throw one hundred million dollars in 1940s money towards the greater glory of Kaiser Motors, drawing a bemused chuckle from GM Chairman Alfred Sloan who quipped “give the man one chip.” Fast forward to 2009, and Coda Automotive, a firm hoping to sell Californians a $45k EV-ified Hafei Saibao Sedan, just scored $25m in funding reports Earth2Tech. That gives the firm a total of $74m raised so far, although the current round of funding won’t closed for another few months, say spokespeople. The latest money, from Aeris Capital, will be spent on “final safety certification testing,” as well as scaling up battery production. In short, Coda is almost-not-quite all the way to one chip in the car game… but that’s still only good for one roll of the dice. Even the weakest automakers have many multiples of that sum in their Treasury escrow accounts. And even the allegedly “bailout free” automakers get to raise debt with a little help from their government friend, TALF.

Ford Completes $13.2b Health Care Liability Transfer To VEBA

Ford has wrapped up some much-needed financial wrangling today, as it struggles with with its monstrous pile of debt. According to Automotive News [sub], Ford transferred $13.2b in debt and about $4b in cash to the UAW-run health care trust fund, completing a long-awaited liability consolidation. $1.4b of the transfer was a scheduled payment on a $6.7b note, while $500m more was a prepayment on that note. Ford paid $610m (cash) on another $6.5 billion note, transferred $620m from a temporary account and $3.5b from an internal VEBA fund and handed over warrants to purchase 362 million shares of Ford common stock at $9.20 per share. All together, the move reportedly adds $7b in debt to Ford’s balance sheet.

Bailout Watch 579: GMAC To Score $3.5b More

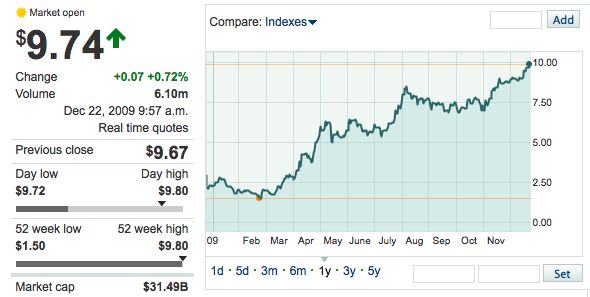

Is Ford's Stock Price Sustainable?

The Wall Street Journal‘s Liam Denning figures it isn’t. He writes:

Ford expects to resume profitability in 2011, and the consensus forecast is for per-share earnings of $1.13. The implied price/earnings multiple of 8.6 times doesn’t sound too demanding. But as Chris Ceraso of Credit Suisse points out, it translates to a margin of earnings before interest, tax, depreciation and amortization of nearly 10%, something Ford hasn’t enjoyed since the late 1990s.

GM Names Chris Liddell As CFO

GM’s embattled finance department is getting new blood today, as The General has poached Microsoft’s Chris Liddell to take over as Chief Financial Officer. GM’s CFO position is being vacated by Ray Young, who was rumored to be on his way out as far back as last summer. Young will become a VP for international operations. The 51 year old Liddell has been Microsoft’s CFO since 2005, and is (irony of ironies) best known for reducing the software giant’s legendary cash position through buybacks and dividends. The Wall Street Journal estimates Liddell oversaw the return of $14b to Microsoft stockholders last fiscal year alone.

Spyker Stock Soars On Saab Speculation

Death Of Saab: Sweden's Prime Minister "Not Surprised"

Sweden’s prime minister Fredrik Reinfeldt had his fill of failed negotiations. Returning home from round-the-clock talks at the Copenhagen climate conference, he said that he saw the Saab collapse coming. Sweden’s prime minister is “unsurprised” by the collapse of the sale, says Reuters. Asked if he was surprised, Reinfeldt said: “No, the process was built around a loss-making company and an American owner that owned Saab for 20 years and made a profit in one of the 20. It’s clear that it was not successful enough.” Sweden’s head blames GM for the failure.

Auto Loan Delinquencies To Rise In 2010?

Whitacre: GM-SAIC Deal Was Henderson's Idea

Ford: Modest Production, More Merit Pay

Ford will be taking a conservative approach to 2010, according to Chairman Bill Ford, who tells Automotive News [sub] that unemployment makes him most pessimistic about the year to come.

We’re not planning for a huge pickup next year. If we get one, great, we’ll ride it. We’re planning conservatively. Just as we did this year, we’ve kept our inventories low. If things start to pop for the better, we’ll adjust our production upward and go that way

And why not? Ford’s stock price has soared over the last year, since falling under $2 a year ago. This despite the fact that the Blue Oval is mortgaged to the hilt and will miss profitability for 2009. But because Ford believes that, as President of the Americas Mark Fields puts it, “our plan is working,” the bonuses are coming back for Ford’s white-collar employees.

Volt Birth Watch 177: Can't We Spend $100m On Something?

“A Flush GM to Lavish Cash On New Vehicles,” goes the NY Times headline, forshadowing the kind of profligacy that only happens when you have $42.6 billion of taxpayer money burning a hole in the corporate pockets. From the next generation of truck and SUV platforms to the Cadillac Alpha (known in-house as “BMW Fighter”), that money is going towards products…. at least it is when it’s not going to faltering overseas operations. And in most cases that’s a good thing. For example, Mark Reuss explains “ with the BMW fighter, the steering in that vehicle is going to be absolutely critical. In the past we would have gone to the lowest cost source, but not anymore.” Well, good on ya, mate. When it comes to the Volt though, the money doesn’t seem like it’s being quite as well spent.

PSA-Mitsu Deal Doomed By Debt?

A few days ago, TTAC reported that PSA and Mitsubishi were looking to forge closer ties with either a cross holding format, like Renault-Nissan, or by PSA taking a 30-50 percent stake in Mitsubishi. According to Bloomberg, analysts like Oppenheim’s Jens Schattner are ruling out equity acquisitions, saying the two firms should concentrate more on co-operation. “Peugeot doesn’t have the liquidity to take a major Mitsubishi stake in cash” he says, and he’s not the only one splashing cold water on the hook-up. Eric-Alain Michelis, an analyst at Societe Generale adds that PSA may have to issue new shares to pay for that stake in Mitsubishi they want, which will not please the Peugeot family as it will dilute their holding. Otherwise, “raising the finance would not be a walk in the park,” he reminds. Were PSA to issue shares to cover €1 billion of the $3.7billion needed for a 50% stake in Mitsubishi Motors, it would reduce the Peugeot family’s investment to 25%. Quelle horror!

One Percent Of GM China Worth $85m

Fresh details on GM’s Asian wranglings are coming in, and it seems that SAIC paid The General a mere $85m for the one percent needed to control the joint venture. GM’s Nick Reilly tells the New York Times:

the 51 percent stake would give S.A.I.C. the right to approve the venture’s budget, future plans and senior management. But the venture has a cooperative spirit in which S.A.I.C. has already been able to do so… S.A.I.C. wanted to have a majority stake to consolidate the venture in its financial reporting

Which is about as credible as the conclusion that the Shanghai and India deals are going to provide GM International with a meaningful amount of cash with which to rescue its European and Korean divisions. As it turns out, the Indian deal isn’t going to translate into free cash for GM. GM and SAIC will set up a joint Hong Kong-based investment company, which GM will give its Indian operations and SAIC will fund with $300-$530m, bringing its overall value to $650m.

Strong Yen Spells Big Trouble For Toyota

Ford Pushes Back $7.2b Of Logo-Backed Debt

Managing debt is a most American exercise, and after finishing the third quarter of this year owing $26.9b in debt, Ford is in management mode. According to Reuters, Ford will repay $1.9b of its $10.7b “ mother of all subprime mortgages” revolving credit line, part of $23.5b in loans Ford backed with all of its assets (up to and including its logo) in 2006. $7.2 billion of revolver debt is being pushed on down the road though, from November 2011 to November 2013, and $724m has been converted to a term loan due in December 2013. More worryingly, lenders refused to roll over $886m of the debt Ford requested, bringing it due in December 2011.

Opel Rescue Up To European Taxpayers?

Tesla IPO in the Works?

Reuters reports that Tesla is planning an Initial Public Offering, after postponing planned IPOs in 2008 and 2009. Tesla reportedly hopes to capitalize on the recent success of battery developer A123 Systems, on the assumption that the A123 IPO has raised interest in electric auto firms. According to one of Reuters’ sources, Tesla’s IPO filing could be made “within days.” And the Silicon Valley startup, which currently has only one product, the $100k+ Tesla Roadster, will most likely have to hurry. Both Nissan and General Motors plan to enter the electric car market this year, marking the initial entries by established auto OEMs into the American EV market. Both of their initial products, the estimated $30k Nissan Leaf and the estimated $40k Chevrolet Volt, will cost considerably less than Tesla’s estimated $50k Model S sedan and will beat it to market by at least a year. Acquiring funding after cheaper competing models go on sale could be extremely challenging for a boutique automaker like Tesla.

Fiat Downgraded: Marchionne Eying PSA?

Swedish Government: Saab's Books Were Cooked

Looks like GM may have done some creative accounting after all – at least according to Swedish Government and their consulting firm KPMG. As we’ve reported the last couple of days, Saab’s rescue has been hanging by a thread due to questions around the company’s financial situation prior to the start of the financial crisis. Saab needs the EU to approve the Swedish Government’s guarantee of an EIB loan to Koenigsegg group if the deal is going to go through. If Saab, during the summer of 2008 – when the financial crisis started – were not in sound financial condition, the EU cannot, will not, approve Swedish government’s guarantees to the EIB loan, and the loan will not be granted. And reports from di.se yesterday almost laid that possibility to rest, with reports that GM had lost $ 5.100,- on each Saab-car sold during the last 8 years. Now, as commentator dlfcohn and others at ttac, as well as several commentators at di.se have pointed out, creative accounting can be useful in major corporates i.e to avoid taxes in tax-heavy countries. This, apparently (at least according to Swed.gov’t/KPMG) was the case with GM/Saab.

Abu Dhabi Wants A Second Date With Daimler

Reuters reports that Aabar Investments is considering increasing their stake in Daimler AG from 9.1% to 15%. Aabar is already Daimler largest shareholder and this move, should it happen, will further cement this position. The Abu Dhabi investment fund paid $2.7 billion for the 9.1% stake when the share price €20.77. Since then, the share price of Daimler has rocketed 77% and on the news of Aabar mulling a bigger stake, the share price rose by 4.4% to €35.81 per share. Daniel Schwarz, an analyst with Commerzbank AG said “It’s a positive signal that a large shareholder is showing a long term commitment”. But the strength of the fund’s love for Daimler doesn’t just extend to this increased stake.

Recent Comments