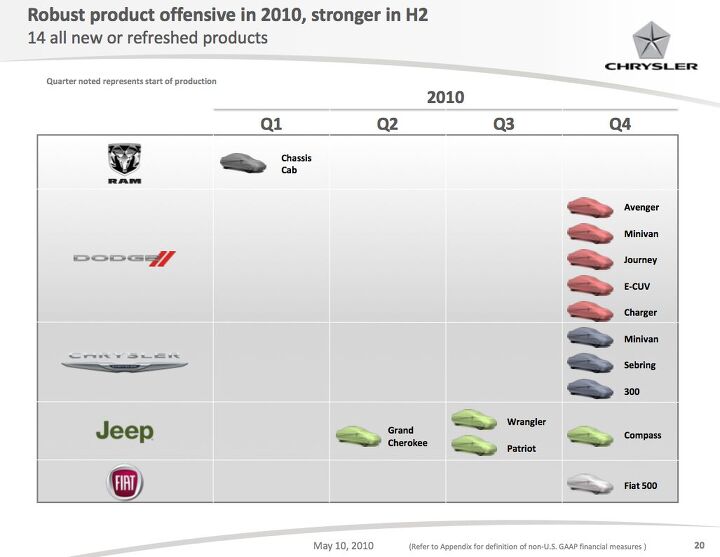

A Marchionne Miracle! Chrysler Generates Cash

Last Friday, Chrysler celebrated the first anniversary of its miraculous emergence from bankruptcy. What did the employees get in observance of this occasion? A watch? A bonus?

GM Invests $1.1 Billion. In Brazil

GM is tired of playing third fiddle in the growth market of Brazil. Come on, being outdone by Italians and Germans? Gotta pay to play, so GM do Brasil announced a new investment package for operations in Brazil. That according to car site Webmotors. The money will be pouring in to the tune of R$2 billion or US$1.1b. GM corporate honchos said R$1.4 billion (US$777 million) will go to raise production capacity and modernize its plant in Gravataí, Rio Grande do Sul. The gaúcho plant now produces the Celta and derivatives. The objective, according to the suits, is to (finally!) retire the Celta line in Brazil and other emerging markets and substitute it with the Onyx family line. Will that get GM ahead?

Nissan Wants S&P Say A

Wasn’t there a carmageddon? Forget about it! Nissan wants to be essentially debt free for the first time in three years in the fiscal year ending March 2011, says The Nikkei [sub]. Nissan’s net cash position gauge is expected to swing from $546m in the red to about $1b in the green.

Canada Won't Sell GM Stake In IPO… What About The US?

Quote Of The Day: Wall Street's Burden Edition

Handling [GM’s] IPO assignment is something of a vanity project for the Wall Street banks, given the relatively small fees the banks will earn through the process. One person familiar with the offering said that the banks may earn less than 1% of the overall deal. At a valuation of $10 billion, that would equal a total fee pool of $100 million.

The Wall Street Journal [sub]’s take on the forthcoming GM IPO. Persons anonymous tell The Journal that Morgan Stanley and JPMorganChase are the frontrunners in the vanity project sweepstakes. But as charitable as the one-percent arrangement seems, the Wall Street mavens have their work cut out for them…

Opel: Brdelerle Denies Government Aid

So today’s the day when the fate of Opel was to be decided – according to plan. The committee met today – and decided to decide nothing. They couldn’t come to a conclusion. They handed the decision to Minister Brüderle. Brüderle’s decision: Nein. No government money to Opel, reports Focus. There still is a glimmer of hope for Opel …

Black Wednesday For Opel?

On Wednesday, June 9 2010, the German government will decide whether they’ll grant Opel live support. Or whether Berlin gives Opel a pat on the head and best wishes for their future endeavors. That’s the current plan, says Die Zeit, based on reports by the German wire service DPA. Plans can change, as they did in the past.

It looks grim for Opel.

Daimler Wouldn't Mind Chinese Owners – Of Their Company

China is an important market for Daimler. China already buys more S-Class cars than any other country. Why not buy a chunk of Daimler and get it over with? The Chinese would find open doors: Daimler’s CFO Bodo Uebber “would welcome it if there are Chinese names in our shareholder structure.”

SEC Seeks Three-Year Securities Work Ban On Rattner

Somewhere under a “Mission Accomplished” banner on an aircraft carrier, former car czar Steve Rattner is starting to get a bit lonely. Reuters reports that the Securities and Exchange Commission is seeking a three year ban on Rattner that would prevent him from working in the securities field. The ban stems from a recently-settled investigation into kickback allegations at Rattner’s former investment firm Quadrangle Group (involving a distribution deal for his brother’s low-budget movie “Chooch,” no less).

Treasury Hires Lazard As GM Moves Towards IPO

The Detroit News reports that the Treasury Department has hired Lazard Frères & Co. as an advisor to GM’s forthcoming IPO sale. And with news of the hiring comes confirmation that GM’s IPO really is coming soon: the investment bank will receive half a million dollars, according to the DetN, but that amount will drop to $250,000 if the IPO isn’t completed within one year. If you’re one of the GM boosters who believes that an IPO will repay all or most of the government’s investment in GM, it’s time to start saving those pennies. You have less than a year now to put your money where your mouth has been.

Tesla's Musk Is Broke

Actually, he’s been broke for since last October.

“About four months ago, I ran out of cash,” Musk wrote in a court filing with the Superior Court of Los Angeles on Feb. 23. “I had to obtain emergency loans from personal friends. These loans are the exclusive source of cash I have. If I did not take these loans, I would have no liquid assets left.” Tough when you make only 8 grand a month and have two high maintenance women.

Germany Answering Opel's Prayers? Not Exactly

It's A Miracle: Opel And Unions Cut A Deal

Opel has received a new lease on life. Nobody knows how long the lease will last, but Opel is an important step ahead and gained an even more important ally in its beggathon for state aid. Opel cut a deal with its unions, led by labor leader Klaus Franz.

“For much of the past year, Klaus Franz has been a thorn in General Motors Co.’s side,” wrote the Wall Street Journal. Franz “has blamed the European car unit’s troubles on its American parent, saying GM was ‘filled with yes-men’ and that it had a ‘centralized planning system worse than in East Germany.’ Now, GM needs to make nice with Mr. Franz.” With their backs to the wall, GM finally paid the price and made nice.

EV Startup Coda Snags $58m Investment

On the strength of Coda Automotive’s plan to launch a $45,000 EV conversion of a Chinese Hafei sedan, our coverage of the EV startup (formed from the ashes of Miles Electric Vehicles) has pretty much been limited to the conclusion that it “make the Volt look good.” And as the competition has moved forward, the venture isn’t looking any better by comparison. With news that Nissan will be able to manufacture its Leaf batteries for the low, low price of under $400 per kWh ( if all goes to plan, anyway) rocking the EV community, Coda’s proposition of asking $45,000 for a 33.8 kWh lithium-ion battery with a Chinese compact sedan attached to it has not aged well (conservatively assuming the Hafei costs $15k, that still breaks out to nearly $900 per battery kWh, as crude as the comparison may be). But don’t let a little common sense worry you about Coda’s future: according to a company press release [via PRNewswire] the firm just scored a cool $58m in an oversubscribed fundraising round that leaves it with over $125 in total investments.

Chinese Lease Special: Only $1,860 Per Month!

Whenever the insane growth rates of Chinese car sales come up, there is one inevitable comment: ”Wait until credit tightens. Those sales will come crashing down.” My (in the meantime canned) answer: “China isn’t America. In China, people usually buy their car with cash. Financing is rare. Leasing highly uncommon.” Apart from being smart not to pay interest on a depreciating asset, the Chinese have all reason not to lease. Case in point: An email I received today.

Chrysler Beats GM To Non-Prime Loan Deal

As non-executive vice-chairman of the Swiss bank UBS, Chrysler CEO Sergio Marchionne has deep connections with the European banking community. Now, under threat of losing its primary lender Ally Financial to GM’s dreams of a return to in-house, subprime lending, Marchionne has leveraged that experience into a non-prime lending deal with a US division of Spain’s Banco Santander. Automotive News [sub] reports that Santander and Chrysler have reached a deal to provide loans to Chrysler customers with sub-650 credit scores that ChryCo reckons could result in an additional 2,000 sales each month.

Germany May Take Its Toll. Europe To Follow

As Americans have noted, bailouts can get costly. Europe has just decided on a trillion dollar bailout for their southern European deadbeats member states. Who’s going to pay for all that? In Germany, raising taxes is taboo (for the moment.) Lowering taxes had been one of the wedding vows of the ruling coalition. They didn’t say exactly when, but raising taxes would be politically – not very smart. So how else to raise money? Where else than from our darling piggy bank, the hapless motorist.

Chrysler Repays Federal Loan

What, you want more context from a headline? It’s not like we’ve lied to you or anything. Technically, every word of it is true. OK, OK, here’s the fine print: CGI Holding, owners of “Old Chrysler” and Chrysler Financial paid $1.9b of a $4b pre-bankruptcy TARP loan, according to Automotive News [sub]. Though far less than face value, that payback “is significantly more” than what Treasury was expecting in return. In other words, this is great news if you thought the bailout would be a complete loss. Otherwise, it means that the various remains of Chrysler have repaid $3.9b of the $14.3 invested by taxpayers into the company pre-bankruptcy… and unless Chrysler’s IPO brings in about $100b, Treasury will still take a bath on the rescue.

GM Captive Finance Push Explained: The General Wants More Subprime Business

When we first heard that GM was eying a return to in-house financing, our first reaction was to worry that

the potential for falling back into old bad habits can’t be ignored.

Clearly our concern wasn’t wasted, as the AP [via Google] reports that The General’s major motivation for considering re-creating a captive lender is to chase subprime business its current major lender won’t touch. And considering that that lender is GM’s bailed-out former captive finance lender GMAC (now Ally Financial), which was badly burned by subprime mortgages, it’s not surprising that GM is frustrated by GMAC’s tentative approach. But should The General charge into the low-standard lending sectors where Ally fears to tread?

GM Q1 Profit: $865m After Dividends

What??? Egypt Probes Daimler For Bribery

The other day I heard a saying which I think is rather apt for this article:

“You can shear a sheep many times, but you can only skin it once”. Except in this article the “shear” is “fleecing” and the sheep is “Daimler.” Bah, bah, bah. Firstly, the U.S Government did a little shakedown of Daimler to the tune of $185 million. When that succeeded, our friends in Russia decided to check this gold mine for any left over deposits. Word spread of them thar gold in Sindelfingen. Incoming golddiggers! Forexyard (via Reuters) reports that Egyptian authorities are going to investigate the matter in relation to bribery in Egypt.

Yes, in Egypt.

Daimler Dumps New York Stock Exchange

One of the last vestiges of the Daimler-Chrysler union is being swept away, as Daimler has announced that it will delist from the NYSE. Daimler initially listed itself on Wall Street in 1993, as it began its “marriage made in heaven” with Chrysler. Since then, Daimler says advances in electronic trading make it easier for traders to buy and sell its Frankfurt listings, and that the low volume of NYSE trading isn’t worth all the financial regulation that comes with a Wall Street listing. According to the company, less than five percent of its trading volume comes through its US listing. This means no more SEC filings from the German firm, although it insists that the US market remains important to its business and that it wants to maintain open communication with American investors who own 17 percent of Daimler’s shares. And it definitely has nothing to do with the company’s recent settlement of a bribery investigation by the DOJ. Or the fact that Chrysler could find itself back on the exchange within another year.

Ford Shareholders Meeting: Profit This Year, But No Dividend

After four straight profitable quarters, Alan Mulally’s forecast today of a “solidly profitable” 2010 shouldn’t come as a huge surprise. But, as Executive Chairman Bill Ford put it to Ford shareholders at the company’s annual meeting [via AP],

It is the very early days in our recovery. We still have a lot of debt

And he’s not kidding. As of the end of Q1 2010, Ford was carrying $34b in debt. And though Ford faces a higher cost of borrowing because of its staggering debts, Bill Ford was clear that he wouldn’t trade places with Ford’s Detroit competitors, which cleaned out their balance books, at the expense of government bailouts and accompanying PR problems. After all, while GM and Chrysler were rebuilding, Ford managed to outperform both of them last year by gaining sales and market share. And Ford’s leadership sees that momentum carrying forward into next year.

GM And Chrysler Racing Towards Captive Finance?

News that GM is considering a number of options for a return to captive finance, has lit a fire under Chrysler CEO Sergio Marchionne, who tells the Detroit News that

One of the things that we do not wish under any circumstance is to have an uncompetitive relationship vis-À-vis GM

That would certainly be the case if GM bought up its recently-bailed-out former captive finance arm, GMAC (now known as Ally Financial). Chrysler relies on GMAC for leasing and loans just as much as GM does at the moment, so an Ally buyout would create major long-term problems. But even if GM created a new finance arm, Chrysler doesn’t seem to think that it will be able to survive without forming its own in-house finance department. Which would then compete with GM and Ally, to say nothing of the industry’s other finance competitors. But is the rush to captive finance going to be good for anyone?Opel: No Decision, No Money

As expected, the Loan Guarantee Committee decided not to decide anything in their meeting at the Economics Ministry in Berlin. Opel had requested €1.3b in state aid from Germany. They are making the rounds in Europe to collect another €500m. Countries that committed money, such as the U.K., will only pay if Germany pays.

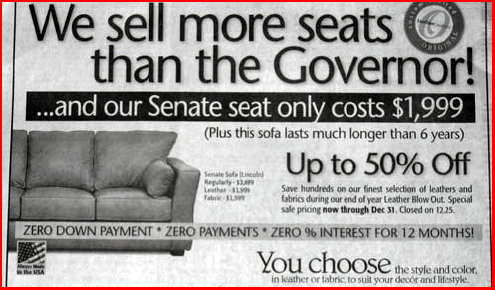

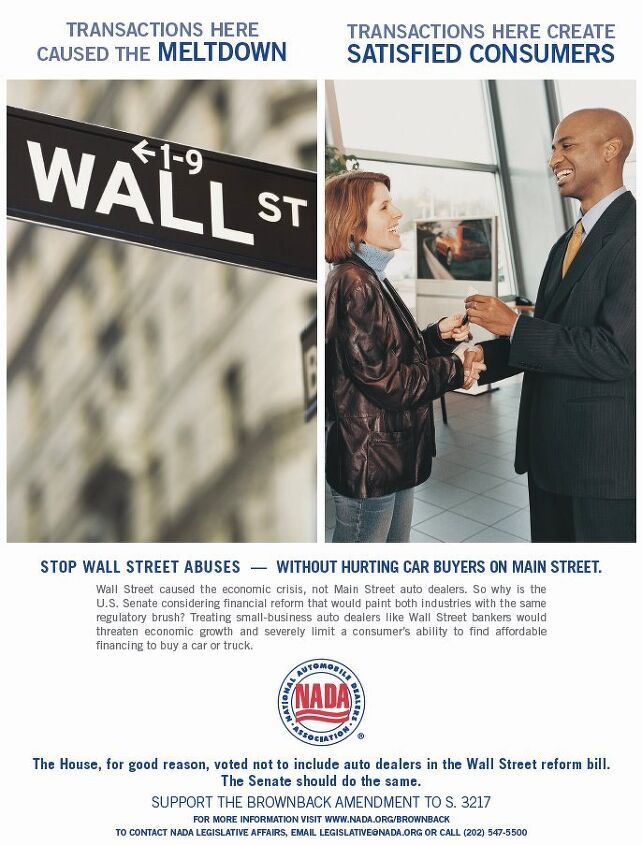

Obama: Dealer Finance Must Be Regulated

President Obama has weighed in on a crucial matter facing legislators attempting to overhaul America’s financial system: whether or not auto dealer finance should be subject to regulation by the new Consumer Protection Agency. Unsurprisingly, he has come down on the side of regulation, specifically echoing concerns voiced earlier by the Pentagon. The National Automobile Dealers Association has vowed to fight attempts to regulate dealer finance.

Statement by President Obama on Financial Reform

Throughout the debate on Wall Street reform, I have urged members of the Senate to fight the efforts of special interests and their lobbyists to weaken consumer protections. An amendment that the Senate will soon consider would do exactly that, undermining strong consumer protections with a special loophole for auto dealer-lenders. This amendment would carve out a special exemption for these lenders that would allow them to inflate rates, insert hidden fees into the fine print of paperwork, and include expensive add-ons that catch purchasers by surprise. This amendment guts provisions that empower consumers with clear information that allows them to make the financial decisions that work best for them and simply encourages misleading sales tactics that hurt American consumers. Unfortunately, countless families – particularly military families – have been the target of these deceptive practices.

Opel: Will They Get Their Money Today?

Today could be a big day for Opel. Probably, it won’t. The Loan Guarantee Committee is meeting in the Economics Ministry in Berlin. On the agenda: Opel’s request for €1.5b in state aid. The timing is not coincidental: Last weekend, elections were held in the Opel state of North Rhine Westphalia, which ended in a mess. Coalition discussions are on-going with unsure results. So let’s move quickly while Berlin can make decisions? Not exactly …

GM Eying Return To Captive Finance?

2010 GM And Chrysler IPOs Looking More Likely

Chrysler crowed over its 9.1 percent market share in its Q1 results conference call yesterday, and though CEO Sergio Marchionne refused to be pinned down on an exact time frame, an IPO this year looks more likely than ever. Similarly, BusinessWeek reports that GM’s Ed Whitacre has hinted that a Q1 profit is likely, as is an IPO in Q4 of this year or early next year. This improvement in both bailed-out automakers was underlined by former Presidential Auto Task Force head Steve Rattner, who said the two firms were “meeting expectations,” at a Detroit-area conference. But Rattner also put his expectations into some context by saying

When we did this restructuring we never expected a full recovery of our investment. If it ends up costing us $10 billion we should consider it a success. For about $10 billion we avoided economic and human calamities… I would suggest that that’s a pretty effective cost of government stimulus

That assessment is down considerably from Rattner’s last prediction, which expected a taxpayer profit on the auto bailout.

Toyota Reports Profit. Prepare To Be Surprised

Toyota has published its financials for the 2009 fiscal year that ended on March 31. The matter had been a center of speculations for months. First, a loss was predicted. Then, there were speculations that Toyota would report a slight gain, of $500m. Last weekend, Japan’s Yomiuri newspaper said the gain could be as large as $1.1b . They were all wrong. The official numbers are in. And the numbers are …

What's Wrong With This Picture: Here Comes The (Chrysler) Avalanche

A Cool $1.1b Profit For Toyota?

Toyota still hasn’t announced its final numbers for the 2009 fiscal year that ended on March 31. And the musings continue. Previously, a loss was assumed as certainty. Come on, how can a car company the size of Toyota escape carmageddon and pedal-gate unscathed? Then, there were speculations that Toyota would report a slight gain, of say, $500m. Now, there are people who think it will be more …

GMAC Renames Itself Ally Financial

Perhaps the most fundamental challenge facing bailed-out financial and auto firms is convincing consumers to leave aside their anti-bailout prejudices and start buying their products. For GM, the first step in this process was as simple as repaying a loan and airing a “Mission Accomplished” advertisement that did everything but show Ed Whitacre landing on an aircraft carrier. For GM’s former captive finance arm, GMAC, escaping the stain of the bailout is a more prosaic matter. Having already launched an online consumer-oriented banking arm by the name of “Ally Bank,” the finance company is adopting the innocuous Ally moniker for its entire business, reports the Detroit News.

Brussels Has Issues With Government Loan To Renault. A Lecture For Opel?

It’s tough to be a European car maker with a governmental sugar daddy. First you have to make nice with your sugar daddy, and commit unspeakable acts until he shakes loose a few hundred million Euro. Then, the prudes from Brussels shoot the stipend down. Your sugar daddy can say: “Darling, I tried.” He then can go on with the business of bailing out Mediterranean states. So it happened with Renault. So it might happen with Opel.

Question Of The Day: Is Ford On Shaky Ground?

To anyone who reads my articles, (that’d be Bertel and my mother) you’d know that I’m not a big fan of Ford. Mark Fields is Susan Docherty for Ford, their cars underwhelm me, and I don’t really like the company as a whole. Having said that, I am a journalist. (Don’t laugh! I am!) And I am professionally impartial. So, when I was on the train last night, I decided to do a quick rundown of Ford’s situation. Currently, they are the darlings of the North American market and Europe loves them, too. They turned a big profit in the first quarter of this year and confidence is growing in the company. But despite all of the this, the markets aren’t convinced.

The Sky Is Falling: DetN Disses GM

The Detroit News, by some regarded as the in-house organ of GM, has issues with GM. The DetN doesn’t like GM’s latest TV ad (“some future models shown”) in which Ed Whitacre proclaims that GM paid back its “loan, in full, with interest, years ahead of schedule.”

The “GM ad glosses over the reality” complains the headline of the article in which the former unofficial organ of GM rips Whitacre a new one. Says the DetN: “He’s technically correct because he clearly uses the word “loan.” Otherwise vague? Yes. Misleading? Depends on your perspective.”

Then, the sky is falling once again.

Strong Yen Drives Japanese Auto Makers Out Of The Country

If anybody will again blather about a “weak yen” that has been “manipulated by the Japanese government,” then I’ll personally come visit, with the intent to insert a sock in the mouth. For reasons explicable only to forex mavens, the currency of the economic basked case Japan keeps on getting stronger. Japan’s car manufacturers think this will continue, and they are taking precautions. More precisely, they are taking production out of Japan.

Opel: The Bleeding Continues

To stay alive, Opel wants to scale down. The factory in Antwerp is being closed. With amazing results for Opel’s bottom line: Closing the factory costs GM around €400m ($532m) in termination benefits. GM and the unions reached an agreement on the termination benefits earlier this week, reports Reuters. There are 2,600 workers in Antwerp. Now do the math: $532m divvied up amongst 2600 workers is a little bit over $200,000 per worker. Ouch! Wait, there is more pain …

China's Car Makers Are Raking It In

Expo-nential growth

While (usually foreign) analysts are dead worried about the Chinese car bubble to pop and never to be seen again, Chinese car companies are happily raking it in. Western companies, mortgaged to the hilt, or on government life support, are developing a serious case of China-envy.

Senate Moves On Auto Safety, NHTSA "Revolving Door" Legislation, Stands Firm On Dealer Finance Oversight

The Treasury may be standing by GM’s “payback” claims, but the Congress hasn’t exactly been looking for ways to do the auto industry any favors. In fact, a toxic brew of political fallout from the financial crisis, auto bailout, and Toyota recall scandal has seems to have inspired a backlash against the industry that came to a head this week in the US Senate. Legislation has been introduced that would prevent NHTSA officials from taking jobs with automakers for up to three years after they leave the agency, and yet more is being drafted which could require a vast array of standard safety equipment on all cars sold in the US and could even add a federal fee to new car sales. Adding insult to injury, a much-hoped for exception to dealer financing oversight in the new financial reform bill appears to have fallen victim to Senate negotiations. Did nobody tell the old guys that they’re investors in the auto industry?

Treasury: GM "Payback" Claims Not Misleading

In response to Senator Chuck Grassley’s concern that GM’s claim to have paid back taxpayer loans was misleading, the US Treasury is now saying that it has no problem with The General’s statements. According to the Freep, a Treasury letter to Grassley explains that:

GM’s decision to pay off the loan signaled the automaker did not face “extraordinary expenses,” and that Treasury approved the loan payoff.

“The fact that GM made the determination and repaid the remaining $4.7 billion to the U.S. government now is good news for the company, our investment and the American people,” said Herbert Allison, assistant Treasury secretary for financial stability.

Strictly speaking, GM’s claim to have paid back all US Government loans is correct. The only issue is that GM’s ad touting the payback makes no reference to the fact that it still owes the Treasury upwards of $40b. If that misleads folks, well, apparently the Treasury Department isn’t going to do anything about it.

Ford Pulls In $2.08 Billion Q1 Profit

The Ford Motor Company released its first quarter earnings today [Full report here, Slide presentation here (both PDF)], revealing that it gained over $2b in net profit on rising revenue and improved operating margins. Sales receipts rose to over $28b, and with each of Ford’s regional units posted operating profits, Ford’s gross automotive cash rose by $400m to $25.3b (although operating cash flow was $100m in the red). North American operations earned $1.2b in pre-tax operating profit, South America earned $203m, Europe recorded $107m and Asia-Pacific-Africa brought in $23m. Ford Credit racked up $828 in pre-tax profits, as lower depreciation levels improved results. Despite these fine results, Ford finished the quarter with $34.3b in automotive debt, a $700m increase from the beginning of the year. Ford paid $492m in interest on that debt in the first quarter.

Volkswagen Dumps More Money Into China

Toyota's Final Numbers: Gain Or Loss?

Grassley: Was GM's "Payback" Shuffle About Avoiding The TARP Tax?

While the White House and most of the media spent the last two days parroting GM’s claim that it “paid back” taxpayers, Senator Chuck Grassley was busy writing a letter to the Secretary of the Treasury [ letter available in PDF here]. The three-page note opens:

Dear Secretary Geithner:

General Motors (GM) yesterday announced that it repaid its TARP loans. I am concerned, however, that this announcement is not what it seems. In fact, it appears to be

nothing more than an elaborate TARP money shuffle.

No surprises there: TTAC has been all over this ruse for months now. Grassley does sum the situation up nicely, stating that “A debt-for-equity swap is not a repayment,” but the most interesting part of his letter is his theory for why GM and the Administration approved the tax-money reshuffle. Thus far, we’ve assumed that PR was the driving concern in this transparent deception. According to Grassley though, there may be another reason…

Hyundai Nets Over $1b, Breaks Quarterly Profit Record Again

Fiat Five Year Plan: Cars Stay, Trucks and Tractors Go

Much of the speculation in the leadup to Fiat’s five year plan announcement centered on a long-rumored spin-off of Fiat’s auto business from the rest of the industrial conglomerate. Speculators even drove up Fiat’s share price considerably yesterday on hopes that the long-awaited spin-off would be announced today. And sure enough, Fiat did announce today that it would be spinning off part of its business. The only problem, according to Automotive News [sub], is that the newly-formed unit isn’t made up of Fiat, Alfa and Lancia, but Iveco and New Case Holland. Instead of its car operations, Fiat is bundling off its heavy commercial truck and tractor business into a new entity known as Fiat Industrial S.p.A. (Fiat-branded light commercial vehicles and Fiat Powertrain will remain behind).

Fiat Five Year Plan: More Profit From Ferrari, Cheaper Maseratis

Given Ferrari’s pricing politics, it seems safe to assume that Ferrari/Maserati is a fairly profitable enterprise for its 85 percent owner, Fiat. Indeed, with over $2.5b in combined revenues last year and an 11.5 percent operating margin, the Italian sportscar brands aren’t exactly dying of economic downturn-related causes. But at today’s presentation of Fiat’s five year plan, CEO Sergio Marchionne revealed that his firm has big plans for Ferrari/Maserati, and gave unprecedented planning details as proof of the brands’ path towards even greater profitability.

Quote Of The Day: Mission Accomplished Edition

Taxpayers, your partial refund is in. Now quick, make with the pension bailout and EV subsidies. Oh, and be sure to pick up a new Chevy, Cadillac, Buick or GMC as a “thank you” present for this act of patriotic largess.

5 Year Plan Day At Fiat: "Only A War Could Have Been More Devastating."

Let's carry out the five year plan in 4 years! Picture courtesy nhikmetran at flickr.com

Today is the day. Today, Sergio Marchionne will present his 5 year plan for Fiat. 5 year plans are usually reserved for a reunion of unreformed communist party elders. But Fiat respects traditional values.

In his opening remarks, Marchionne took a shot at the mongers of gloom and doom. He had two words for analyst reports that dissed Chrysler’s operating profits: “Boulevard press.” This is Euro-slang for tabloids, or the business section of the National Enquirer.

“As we all know,” said Sergio, “in business it is ultimately only facts that prevail.”

Then, the facts were presented.

Un Miracolo Dell'Evoluzione: Chrysler Posts A Profit

Be extra careful when you read Bloomberg this morning. It will make you think you had one too many last night. The financial news service reports that Chrysler posted a $143 million operating profit in the first quarter,“after cutting costs and introducing a big pickup.” It’s a miracle alright.

Luxury Cars: "We're Baaack!"

Increasing signs that reports of the death of luxury cars are greatly exaggerated are emerging from Sindelfingen. To the joy of Daimler stockholders, and to the amazement of pundits who predicted we’ll be driving scooters, Daimler nearly doubled its profit guidance. According to the new reckoning, between €2.5 and €3b should appear below the bottom line as EBIT (earnings before interest and taxes) by the end of this year, says Daimler according to Das Autohaus. That came as quite a surprise.

Montezemolo Out As Fiat Moves Towards Auto Spin-Off

Fiat Chairman Luca Cordero Di Montezemolo will be leaving the firm to pursue a career in Italian politics, according to Automotive News [sub]. Montezemolo will remain on Fiat’s board, and will continue to serve as chairman of Ferrari, but he will be replaced atop the Fiat empire by vice-chairman and Agnelli family heir John Elkann. Fiat’s shares rallied considerably this morning, according to Bloomberg Businessweek, but not because Montezemolo is on the way out. Rather, Fiat has finally announced the news that speculators have been waiting patiently for: the firm now confirms that it plans to spin off its auto business.

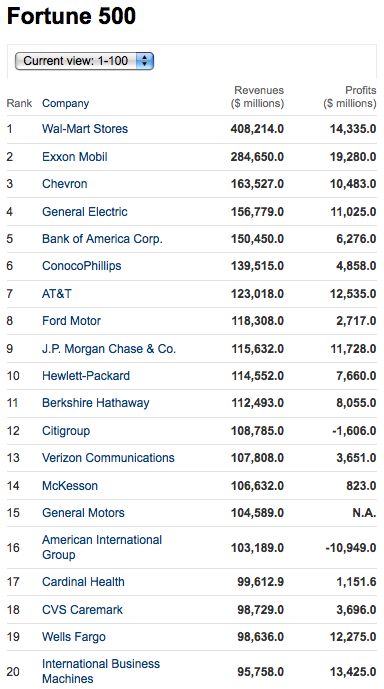

Is GM Worth More Than Ford?

Since GM has only recently come out with GAAP-approved financials, determining the company’s value isn’t easy. Still, The Detroit Free Press‘s Tom Walsh reckons The General is worth more than Ford, despite the fact that GM recently fell out of the Fortune 500’s top ten (and below Ford) for the first time in its 100+ years of history. What gives?

Just Like A Good Neighbor: State Farm Joins Toyota Shake-Down

More and more Americans have recently detected that they have a rich uncle in Japan. The uncle’s name is Toyota. From LaHood to a bevy of lawyers, all have a yen for Toyota’s money. Latest (but surely not last) to join the fray: State Farm. You know, that same insurance company that had disclosed all those claims to NHTSA and never received an answer. They went public with the story a few days before the congressional hearings. Now we know why: Like a good neighbor, State Farms wants its money back.

“Armed with reports of accidents for which they’ve already paid claims, State Farm insurance has asked Toyota to repay them for any crashes related to unintended acceleration by its vehicles,” reports USA Today. The request for a little Farm Aid is just the beginning.

Other insurance companies are expected to – make that will follow and ask for money. In the trade, this is called “subrogation.” No, it’s not a kinky sex practice.

Did GM Lose Money Again In Q1?

Don’t ask Chairman/CEO Ed Whitacre. His only comments so far on GM’s Q1 2010 performance comes from a memo leaked to Reuters, in which he says:

In January, I said we could earn a profit in 2010, if everything falls into place. Our first quarter financial results will show us an important milestone, and I’m pleased to say that I anticipate solid operating results when we report our first quarter financials in May

“Important milestones”? “Solid operating results?” What the hell is Whitacre trying to say?China's Dongfeng On The Prowl For Western Beauties

Western auto makers in distress are in the cross-hairs of Chinese auto makers that are riding one of the largest car booms in history. When Geely closed its deal with Ford over Volvo, we wrote: “Government owned companies like FAW, SAIC, Dongfeng, or BAIC will watch closely how privately owned Geely will digest the Volvo purchase. If successful, western car companies will be on their shopping list again.” They already are.

Ford's Resale Values Up, Up, And Away

TTAC readers must be a truly un-American bunch. Americans love a deal, or so the saying goes. TTAC readers hate deals, or so it seems. TTAC readers are up in arms whenever it rains generous discounts to prop up flagging car sales. “The resale value will suffer if they do that!” is the echo from our dear readers. If they would only drive Fords, they would change their minds.

China's SAIC Sells More Cars Than All Of Germany

China’s SAIC is basking in the glow of another bang-up quarter. China’s biggest automaker told Reuters that their first-quarter net profit rose more than four times from the year-ago result. Detailed numbers will be released with SAIC’s full first-quarter earnings report on April 28. Keep in mind that last year’s results already were 9 times those of 2008. In March, SAIC sold 336,387 units, sales for the first quarter were up 64 percent from a year earlier to 891,795 units. To put it into perspective: All of Germany sold 670,410 cars in the first three months of 2010. SAIC singlehandedly outsold Germany by 221,385 units.

Menage Trois? Ghosn Wants A Group Grope

Having just sealed the three-way tie-up between Renault, Nissan, and Daimler, Carlos Ghosn already lusts for more. At a press conference in Brussels, Ghosn said the alliance is open to new partners to get in bed with. Muses The Nikkei [sub]: “He may envision a grand coalition of Japanese, European and U.S. automakers.”

Recent Comments