Buy Your Toyota Now. These Prices Won't Last

Unless you plan a trip to Toyko, you probably aren’t concerned about the exchange rate of the yen. Is a Japanese car on the list of your possible purchases? Then you should be concerned. Those prices will go up.

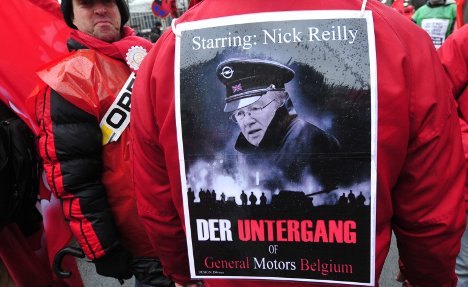

What Would GM Be Without Opel? Rich

Oh, to be a fly on the wall of the GM boardroom:

“Did you see the latest Opel numbers?”

“Jeez! Horrible!”

“What are these clowns thinking? We have an IPO to close.”

“Talk about timing. We should have sold them to the Russians. Who was the moron that cancelled that deal?”

“I hope the next rattlesnake wins.”

Indeed, the news from Rüsselsheim aren’t good, and with the IPO closing this coming week, they could not have come at a more inopportune time.

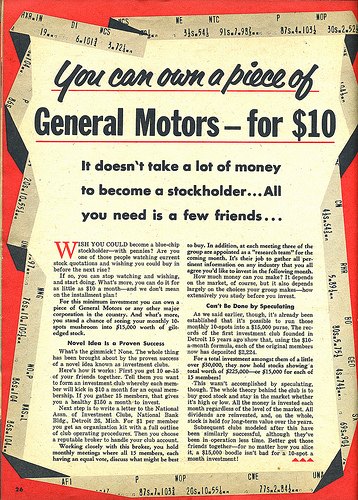

(Chinese) Government Motors

When the all new GM share starts trading on 11/18, the bulk of the new issue will most likely not be owned by widows and orphans, but by foreign governments and their proxies. One of the largest new shareholders could be Chinese. GM is in the final negotiation stage to sell a good chunk of their new stock to their old pals and Chinese joint venture partners SAIC, reports Reuters, citing the usual “two people familiar with the matter.” And don’t think they are just talking percentages, there is much more on the table.

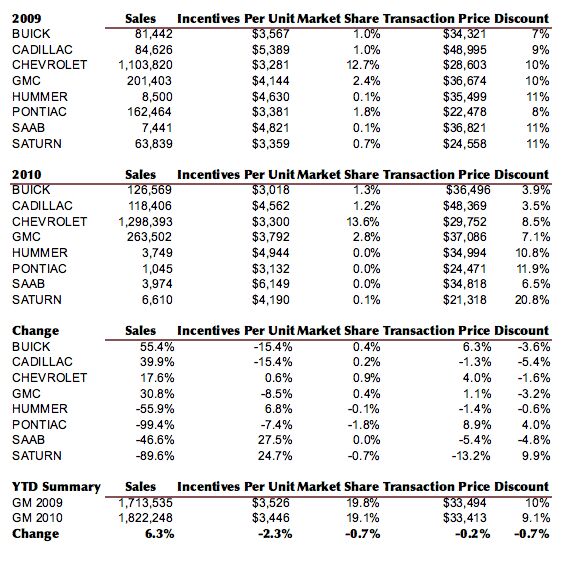

GM Releases Non-GAAP Q3 Results

Tata Will Get By With A Little Help From Their Friends

When Tata bought Jaguar Land Rover (JLR) from Ford in 2008, the general consensus was that Ford was off-loading a massive problem, and that Tata should have their collective heads examined. JLR had been nothing but a cash drain on Ford. Sucking up resources which other divisions (cough-Lincoln-cough) sorely needed. The Jaguar brand was damaged due to the X-Type “fiasco” (note the inverted commas, because I still love my X-Type!) and Land Rover wasn’t really held in much higher regard. Even I, a big Jag-fan, had to concede that I was seeing the final days of JLR. How wrong was I?

Tesla Lost $34.9m In Q3, Dropped $103m Year-To-Date

California EV maker Tesla has reported its Q3 results, and they’re a sizable helping of not great. But before we dive into the messy reality, let’s check in with CEO Elon Musk for an unreasonably rosy take on the loss:

We are very pleased to report steady top-line growth and significant growth in gross margin, driven by the continued improvement in Roadster orders and our growing powertrain business. Roadster orders in this quarter hit a new high since the third quarter of 2008, having increased over 15% from last quarter. While some of this is due to seasonal effects associated with selling a convertible during the summer months, we are pleased with the global expansion of the Roadster business and the continued validation of Tesla’s technology leadership position evidenced by our new and expanding strategic relationships

Translation: Toyota is investing in us… now get out of here with your awkward questions. Unfortunately for Mr Musk, it isn’t quite that simple…

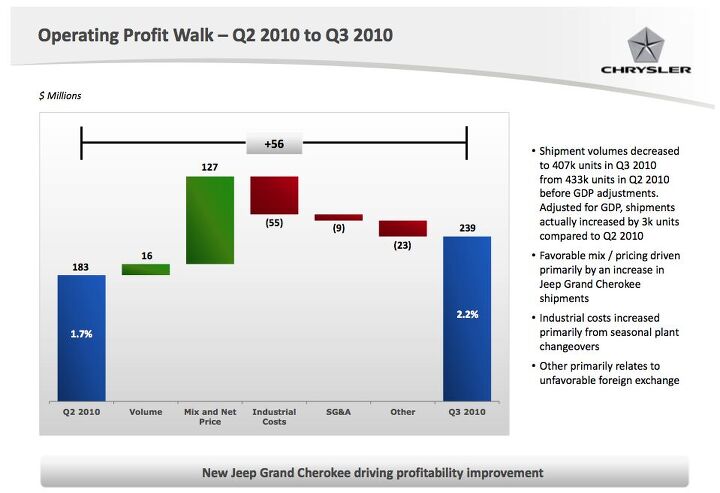

Carried By New Grand Cherokee, Chrysler Loses $84m In Q3

Chrysler lost $84m last quarter on an operating profit of $239m, showing slow but consistent progress from last quarter’s $172m loss [Press release here, slides here, both in PDF]. Chrysler has lost $453m since the beginning of this year. Overall deliveries and sales were down slightly compared to Q2 2010, but thanks to a strong launch for the profit-generating Grand Cherokee, revenues were up just over 5 percent to $11b. As the slide above proves, “Mix and Net Price” accounts for one of the biggest contributions to operating profit, and that’s largely thanks to the new Grand Cherokee which (at 12,721 units last month) is the second-best selling vehicle in Chrysler’s lineup after Ram pickups. That’s a good sign for the future of a company that needed a hero, but there are some troubling signs under the surface.

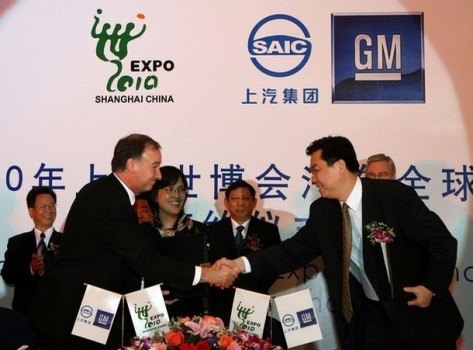

SAIC Will Buy Into GM

It’s a done deal, says Sinocast via Trading Markets. Chen Hong, president of China’s SAIC has gone to the US. He’s not there to visit Niagara Falls and Yosemite. He’s there to negotiate how much of SAIC’s $5.7b in cash and cash equivalents will be converted into GM stock on November 18.

Government Motors: Chinese Government, Kuwaiti Government …

The Freep says GM has appointed a Vice President of diversity. And they’ll need one. GM’s post-IPO ownership roster shapes up to be quite, well, diverse. China’s SAIC appears to be gung-ho for the IPO. And it’s not just the Chinese government that likes the idea of owning a little bit of America.

Toyota To Japanese Government: If The Yen Gets Any Stronger, We Go

Despite the riproaring profit numbers, there is trouble in Toyota City. The ever appreciating yen is gobbling up ToMoCo’s profits. Message from Toyota to the Japanese government: “Do something, or we leave.”

The Revenge Of The GM Bondholders

Want in on GM’s IPO without being a sovereign wealth fund or Goldman Sachs? Join the BDSM lifestyle for fun and (possible) profit. Buy the very much troubled pre-bankruptcy bond, and you could make out like a banshee. Reuters has the surprising news that bonds issued by GM’s bankrupt predecessor are a good investment. “GM’s 8.375 percent bonds due July 2033, which were issued by old General Motors Corp. and convert to shares in the new GM, rose 0.375 cent to 35.875 cents on the dollar at 4:29 p.m. in New York.” The day before, the bonds had jumped 2.25 cents, the biggest gain since June 14.

Why the sudden interest in the converting bond?

Will SAIC Buy Into GM? Decision Imminent

In the politically and emotionally charged discussion whether Chinese interests will buy a chunk of GM in their IPO, one decision appears imminent: Will SAIC, GM’s joint venture partner in China, take the bite or eschew the lure? India’s Economic Times, always with a wary eye on happenings on the other side of the Himalaya, says that “top Chinese automaker SAIC Motor is close to making a decision on whether to buy a stake in its long-time partner General Motors as the US auto firm goes public.”

Toyota's Profits. Whodunnit?

When GM was in its final throes (about 2000 onwards) it was quite easy to see that GM would go under. Even though they were posting records profits, anyone but the shills knew that these profits came from the SUV boom and not from any long term sustainable plan. That’s fair to say, right? So now let’s move to Toyota. The cry I hear, these days, is “Toyota is the new GM! Toyota is the new GM!” (Why people have to say things twice, I’ve no idea. I’m not deaf, just stupid.) And there is certainly some evidence to suggest that. Piling on the incentives, suspect quality, etc. But then something comes along which, seemingly, blows that theory out of the water.

BMW's Profit Margins Are Something. To Worry About

BMW is on a roll at the moment. They’ve booted Mercedes-Benz (their most hated rival) off the number one slot in India, they’re making big steps in China and their profit is rising fast. That last point is the fulcrum of this article. You see, profit is where BMW is forecast to have problems. Not lack of profits, but the size of them.

China Likes Daimler So Much, They Bought The Company - Well, A Chunk Of It

Worried about the Chinese grabbing a piece of GM while it’s cheap? Don’t feel like the lone ranger. China is joining an illustrious circle of investors from Kuwait, Abu Dhabi and around the world and grabbed a “notable” stake in Daimler. An unnamed Chinese institutional investor has bought a chunk of Daimler, as their CFO Bodo Uebber told the Frankfurter Allgemeine Zeitung (FAZ), which sent an advance copy to Reuters.

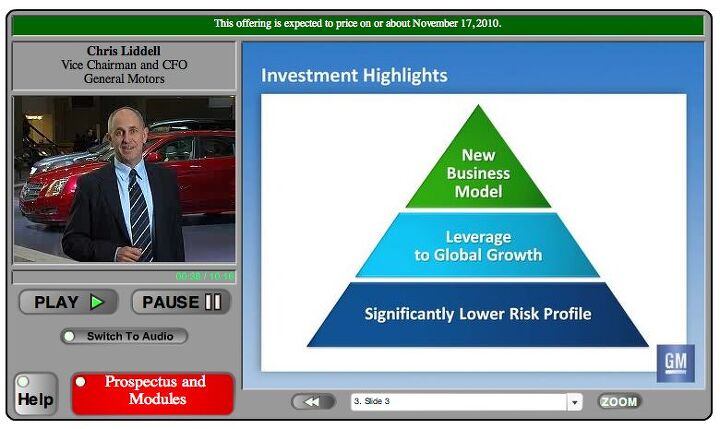

Watch GM's IPO Pitch Here

GM Releases Preliminary Q3 Results, Estimates $2b Net Income

Honda: Stronger Yen? We'll Make It Up With Volume

Honda is finally doing something against the ever stronger yen: They are selling more cars to make up the difference. Honda’s CFO Yoichi Hojo told The Nikkei [sub] today that his company can make profits, even with the yen at its current near-record high against the dollar, if it can increase its global sales by 200,000 vehicles per year. The figure is already in their current budget. In the current fiscal, which ends March 31,2011, the want to sell 3.615m vehicles worldwide, modestly up from 3.392m a year earlier. They’ll probably do better.

GM Carry-Forwards Worth $45b Off Future Tax Bills

Spicy Porsche Stories: Never Give A Saga A Legal Break

The Sixth Sense. The “Saw” movies. The Vanishing (Original Dutch version). The Fight Club. What do all these films have in common? They are like the “Porsche-Volkswagen” saga. Always an unexpected twist. Let’s start at the beginning. When Porsche tried to takeover Volkswagen, it really was a case of the mouse biting the lion. The reality set in, the credit markets collapsed, and Volkswagen went from being the takeovee to the takeover…er (how I managed to pass English is a complete mystery to me). [ED. Takeoveror?] But like any good saga, there’s got to be a final bite and there’s a 30 percent chance this one will happen.

GM IPO: $10b Of Common Stock, $3b Of Preferred Stock

Reuters has followed up its look inside the Government’s involvement in GM with a breaking report on the specifics of The General’s IPO. According to Reuters sources, the IPO will include 365 million common shares for $26 to $29 each, for a total of between $9.5b and $10b. The Treasury is expected to sell between $1.5b and $2b of its 61 percent stake in GM, likely to “four or five sovereign wealth funds,” bringing its stake down to 43.3 percent. The Canadian and Ontario governments are expected to sell down their stake from 11.7 percent to 9.6 percent, while the UAW VEBA trust-owned stake is likely to to drop from 17.5 percent to 15 percent. A Reuters source concludes that

The IPO would likely value the entire company at close to $60 billion, below the $67 billion needed if U.S. taxpayers are to break even on the common stock held by the Treasury

At the midpoint of the proposed price range, GM’s stock outstanding, including warrants, would be worth about $50 billion, roughly the same level as Ford Motor Co. The IPO’s underwriters are hoping to sell at the top end of the range, and for the stock to rise 20% or more when trading begins. At that level, GM could be worth $60 billion or more.

Ford's Flying High, But Staying Grounded

What’s that up in the sky? Is it a bird? Is it a plane? No, it’s the blue oval! Yes, everyone favorite car company is flying high. Fresh off the news that it made $1.7 billion between July and September and that they paid off some more of their big debts, people are talking big of Ford. “They’re in the best shape that they’ve been in for years,” said Shelly Lombard of Gimme Credit (I checked it out, they have their own website) via TMCnet.com. But Ford, through whatever reason, but I reckon it’s fiscal prudence, is staying cautious.

Chrysler Seeks Government Loan Re-Fi

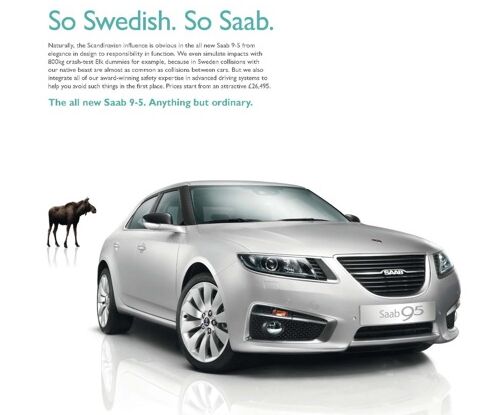

Saab-Spyker Burns $160m In 2010, Cuts Sales Projection To 30k

GM To Buy Government Preferred Stock

Despite Currency Woes, Hyundai Earned $1.2b In The First Three Quarters Of 2010

Nissan. Coming Soon To A Factory Near You?

As the Japanese Yen reaches new highs against the US Dollar, so does the anxiety in Japanese boardrooms. How does an export-heavy country like Japan cope with an ever appreciating currency? That’s the topic of conversation at Nissan HQ. The Wall Street Journal reports that Nissan’s COO, Toshiyuki Shiga, is concerned. Extremely concerned.

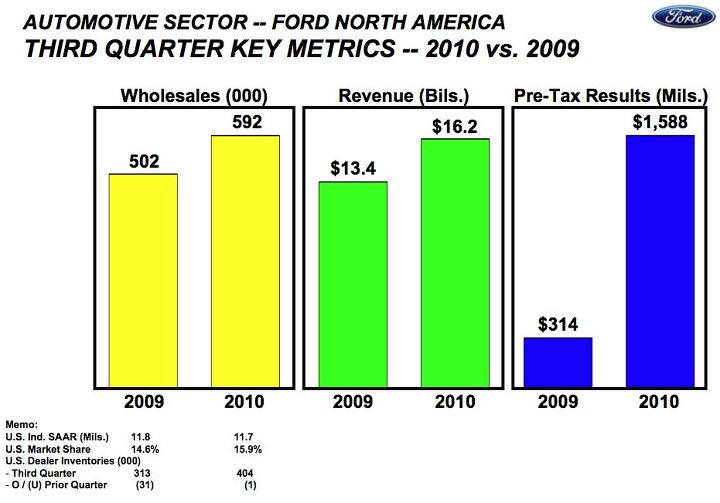

Ford Reports $1.7b Profit For Q3

Ford’s profitability outstripped even yesterday‘s $1.37b estimate, coming in at a whopping $1.68b, as Ford made mad money in the North American market in the 3rd Quarter of this year, for a fifth consecutive profitable quarter. Global revenue was down by about $1b, but excluding Volvo from Q33 2009 results, revenue was actually up $1.7b. $1.6b of Ford’s profitability came from North America, as its most crucial market carried the company over weak overseas results. And with $900m in positive cash flow, Ford says its “automotive cash” will equal its debt by the year’s end, sooner than it had previously forecast. Ford paid of $2b of its revolving credit line last quarter, and plans to pay off the final $3.6b it owes the UAW VEBA trust in Q4. By the end of the year, Ford estimates it will have reduced its overall debt by $10.8b over the course of 2010. Hit the jump for a few key slides from Ford’s Q3 financial presentation.

VeeDub Is Raking It In

Volkswagen is rolling in money. In the first nine months, VW registered an after tax profit of more than €4b ($5.57b). No funky EBITA, no “gains before restructuring charges,” straight bankable after tax profit. That’s six times the €655m the company reported in the same period of the prior year. (While most other car makers reported hefty losses.)

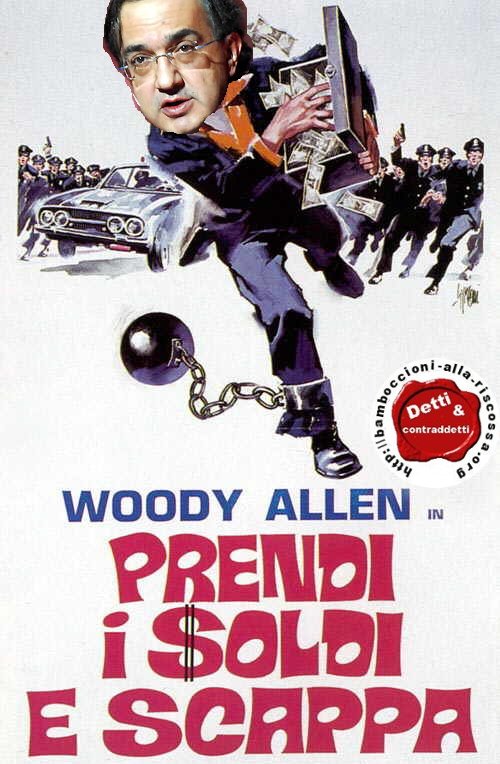

Fiat To Tighten Grip On Chrysler

It’s easy to see why Sergio is feeling mighty pleased with himself. Fiat is predicted to turn a €400 million profit this year (that’s about $556m) and Fiat is expanding in Brazil, a huge car market. So can some of this good fortune rub off onto Chrysler? Possibly 35 percent of it can, if Sergio has his way.

The Freep reports that Sergio Marchionne, CEO of Fiat and Chrysler, has told analysts that Fiat is planning to raise its stake in Chrysler from 20 percent to 35 percent by the end of next year “barring unforeseen circumstances”. A big vote of confidence, indeed. When Fiat took its initial stake in Chrysler, it was given the option to increase its stake by 5 percent tranches, provided it could meet certain goals.

Fiat Invests Big To Stay Big In Brazil

GM is the market leader in the United States. Volkswagen has Europe. Toyota has Australia and Japan. Fiat has…. Brazil? That’s right. Fiat is the number one in Brazil. Brazilians do love a good Fiat. But with Volkswagen’s global ambitions, that number one position in Brazil isn’t safe for Fiat. Volkswagen is number 2 there and if it one thing Volkswagen doesn’t like, it’s playing second fiddle. This is why Fiat is going on the offensive.

Will Toyota Leave Japan?

For a while, TTAC has been tracking a strange story: Instead of exporting cars, Japanese carmakers (or should we call them factorymakers?) increasingly resort to exporting car factories. The higher and higher yen makes exports prohibitively expensive. On the other hand, a higher and higher yen buys more and more production capacity abroad. From Nissan to Mitsubishi, there is a chorus that sings the song that suddenly, people in low wage countries can make high quality cars. Now nobody would assume that Japanese carmakers plan a wholesale desertion of the land of Nippon, right? Wrong.

Today, we find an odd statement in The Nikkei [sub]: Toyota denies that they will leave Japan. At least not now …

SAIC: We Want A Share Of GM. A Share? Make That A Bunch

There are increasing possibilities that GM will be owned by two governments: The American and the Chinese. After a lot of rumor and innuendo, Hu Maoyuan, Chairman of China’s government-backed SAIC went on record today and said he does not rule out the possibility of participating in GM’s IPO. That according to Reuters.

Good News From Germany: Opel Loses Only $600m

When GM went on the begging tour around Europe, they had dire projections. They expected a loss of $1.7b or thereabouts for 2009. Can’t have such bad news before an IPO. And imagine the elation when the big bottom line was drawn under the books of the 2009 fiscal – and Opel had lost only $600m. Who dunnit?

GM Pitches IPO To Employees, Retirees and Dealers

GM Has A Lot Of Junk In The Trunk

As GM’s IPO draws closer, GM (and the government) is doing everything they can to make GM as attractive as possible to the market. The Freep reports that GM is promoting the Volt as much as they can to highlight how much GM has changed. Unfortunately, all it takes is one pesky credit rating agency to undo all that hard work.

GM Gets The Same Credit Rating As Ford. Similar Market Cap Valuation Coming?

Europe Tears Down Borders To South Korea. Will Japan Be Next?

When a country gets desperate, it closes its borders to imports. It’s a sign of surrender: We can’t compete anymore, so let’s close the doors. Closed borders rarely create jobs. In the contrary, they drive prices up, and everybody pays. Import restrictions are the most insidious tax a country can levy on its citizens. And they readily pay for it. Trade wars are an easy sell. Especially to people who cannot balance their checkbook. The price will be paid later.

GM's IPO DOA?

When GM was taken over by the US and Canadian governments, a lot of money was pumped into GM in order to make it a viable entity. After all, GM didn’t go into bankruptcy because it was a well run company with a tight balance sheet, excellent management and brand, spanking new factories. The more money that got pumped into GM, the more pressure is put on the IPO to generate enough money for this endeavor to break even. And according to the press, it doesn’t look like it’s going to hit its mark.

Opel Antwerp Sale Fail Sticks GM With Half-Billion Bill

Ford's Tall Order: Debt Free By 2011

When Alan Mulally came to FoMoCo, his strategy was simple. Quite literally. “One Ford.” Jaguar? Out. Land Rover? Out. Volvo? Out. Mercury? Out. Aston Martin? Out (but we’ll keep a small stake, just in case…). It’s all about “Ford.” And it’s worked. Ford is flying high and is closing in on GM in the US market. But there’s one thing that stops Ford flying even higher. It’s that millstone around their neck, called debt. And lots of it. About $27.3b in the most recent quarter. Some economists believe that is what is depressing Ford’s stock price. Well, it seems Mr Mulally is going to have a laser focus on this problem.

GM IPO Shifts Target To American Retail Investors

Analysts: Chrysler Worth More Than Fiat

Vstra Gtaland County Sends Saab To Collections

The government of Sweden’s Västra Götaland County has referred Saab to the Swedish Enforcement Service (Kronofogdemyndigheten) over nonpayment of a $16.2m loan, reports thelocal.se. The bill is for repayment of a portion of a roughly $45m in aid extended by the county to Saab during its first weeks of bankruptcy. Because the $16.2m portion was used specifically to guarantee employee salaries, the County is arguing that it is not covered by Saab’s 75% writedown agreement with creditors. Saab insists that the salary guarantee portion is covered by the cramdown, and says it has paid its 25 percent of the total loan.

Copycat China Fines Toyota Too

Again, shameless China shows utter disregard for intellectual property. Nothing is sacred anymore. The American government fines Toyota? Great! Let’s copy that! The Nikkei [sub] reports that Toyota has been fined by local authorities in Zhejiang Province. Wait until you hear what for.

Ferdinand Piech's Last Will And Testament: Screw You

If you are one of the richest car executives of the world, if you have “about twelve children. You never can tell for sure”, if those children are from four different women (I did not say wives), and if you are 73, you slowly start doing some estate planning. That’s exactly what Ferdinand Piech, Emperor of Volkswagen and Porsche, did. His heirs are livid.

China Eyeing A Share Of GM

Since I’ve been writing for TTAC, I predicted that Chinese interests will eventually go for GM, if and when price and time are right. GM already sells more cars in China than back home. GM expects that huge business to grow by 10-15 percent next year. It stands to reason that China wants on (the) board. There has been talk about limiting the share of “foreign investors” in the GM IPO. “Foreign investors” of course are Chinese, and the true number of foreign investors interested in the GM IPO probably comes down to one: China’s SAIC, GM’s Chinese joint venture partner for 13 years now. And now it’s official.

China Saves Japan's Bacon

While Japanese automakers are digging in for the big sales drop at home, caused by the evaporating government stimulus money, all eyes are across the China Sea. A large share of this year’s profits will come from China, says The Nikkei [sub].

Does GM Have Negative Equity?

Digging through the finances of a company as large as GM is never an easy task, especially when the balance book in question was recently wiped clean in a bailout-bankruptcy. Luckily, Bloomberg columnist Jonathan Weil has the chops to do the task justice, and he’s come up with a fascinating insight: through the power of an accounting tool known as “Goodwill,” Weil claims that GM has juiced its assets and liabilities during its “fresh start.” He notes with TTACian zeal:

It’s as if a $30.2 billion asset suddenly materialized out of thin air. In the upside-down world that is GM’s balance sheet, that’s exactly what happened.

The short version: GM undervalued some assets and overvalued some liabilities during its “fresh start.” The scary result: improvement in GM’s performance and creditworthiness could actually lead to writedowns on its Goodwill… which is currently The General’s largest non-current asset. Oh yes, and without that $30.2b in Goodwill, GM would have about an equity value of -$6.3b. Welcome to the new General Motors…

Build Your Doghouse

BYD hasn’t been doing so well for months. BYD’s August sales dropped 5.9 percent from previous month and 19 percent from a year earlier, Reuters says. Just a few days ago, BYD blamed force majeure for its misfortunes: Seasonal factors, floods and mudslides had impacted sales, they said.

Toyota Saying Sayonara To Japanese Production?

The ever rising yen makes Japanese manufacturers flirt with the idea of abandoning the land of the rising sun and to shift production abroad. Toyota President Akio Toyoda told Asahi Shimbun that Toyota wants to keep building cars in Japan — for domestic sales. Even that is up for discussion.

Yen Strengthens, Mazda Freaks

You know who is really freaked about the stronger and stronger Japanese yen? Mazda. Mazda is considered the Japanese manufacturer with the highest exposure to currency swings. Mazda builds 70 percent of its vehicles in Japan. In the first half of 2010, Mazda exported nearly 80 percent of its Japanese output. Ouch. A year ago, a dollar bought 110 yen. Today, it buys only 84. As the yen continues its march upwards against other currencies, Mazda is enacting emergency cost reduction measures to protect their profits from being gobbled up by a steadily advancing yen on its earnings. Here is the plan:

Secrets Of The Bailout

We can’t pretend to be overly enamored with former “car czar” Steve Rattner, who oversaw the auto bailout before being disgraced for his role in a New York pension fund pay-for-play scandal. Still, the guy was in the thick of things during last year’s negotiations over Detroit’s rescue, so he knows where the bodies are buried. And in his new book, Overhaul, which has been released to select outlets ahead of its October 14 publication, he tells a whole lot of stories about the months of bailout proceedings that led to the rescue of GM and Chrysler. Of course, Rattner has an agenda in all this, namely proving that

The auto rescue remains one of the few actions taken by the administration that, at least in my opinion, can be pronounced an unambiguous successso he’s not necessarily an unbiased source. But with grains of salt at the ready, let’s dive into his spilled guts and see if what secrets lie beneath.

Treasury To Block Foreign Investment In GM?

GM IPO Roadshow To Begin The Day After Elections

Looking for proof that politics are an overriding concern for GM during its forthcoming IPO: look no further than a report by Reuters which claims that

GM’s roadshow is set to begin on Nov. 3 and will last two weeks, the sources said. The IPO is expected to price on Nov. 17 and debut on Nov. 18.

Now why would GM wait until the day after midterm elections to file? Well, it could be so GM has time to file 3rd Quarter financial data before offering shares to the public, but GM’s CFO has already warned that 3rd Quarter results will be worse than results from the first half of the year. In other words, waiting to file is likely to materially hurt the IPO (and taxpayers’ chance of payback). But if GM launches its roadshow the day after elections, it won’t turn the midterm election into a referendum on the auto bailout, a situation that would surely exacerbate the already-strong anti-incumbent trend in American politics. And clearly protecting craven pols is far more important than maximizing the return on “investment” for taxpayers, right?

The People Vs The People's Car Company

The Automotive World reports that Ford has agreed to a settlement with non-union employees and retirees who incurred stock losses. The plaintiffs brought the suit against FoMoCo because they lost billions of dollars investing their 401k’s into Ford during 2000-2006; a period when Ford’s stock price plummeted. The plaintiffs argue that Ford should not have allowed them to invest huge portions of their pension plans into the company. Now Ford’s defense (which some say invokes a level of personal responsibility) is that the claimants had plenty of time and opportunity to manage their pension plans and leave if they so desired. Who’s right and who’s wrong here? I’ll leave the Bill O’Reillies and Michael Moores of this world to debate that. Or TTAC’s Best and Brightest, whoever is available sooner…

Get Your Japanese Import Now (While You Can Still Afford It)

Sometimes, strength is a weakness. Especially in currencies. The still surging Yen makes Japanese Exports expensive and unprofitable. Despite a lot of talk from their elected officials that the Yen is too high, manufacturers are thinking it will go higher. This could significantly alter the export-heavy Japanese industrial landscape. Case in point. Suzuki and a plot of land.

Car Buying, China Style: No Credit, No Problem

As China’s car market no longer delivers the obscene growth rates it used to deliver (pretty hard when you compare with prior-year months where car sales jumped nearly 100 percent), carmakers are looking for clever ideas to light a fire under their Chinese sales. They all come up with the same solution: Attractive loans.

But nobody wants them.

GM Eyed Hong Kong IPO Listing, SAIC Interested In Stake

From a week deep in our “How The Hell Did We Miss That” file comes a Reuters report that shows GM considered floating its IPO on the Hong Kong Hang Seng index. GM’s interest in a Hong Kong float has obvious roots: the company is extremely well-positioned in China, where high savings rates and the prospect of steady local sales growth could have helped bring in both private investors and GM’s partner firms. But according to a Reuters source, GM rejected the idea because it would have delayed the IPO past its Thanksgiving deadline

I don’t think signaling goodwill toward Asia is likely to be a significant enough argument for all the cost and complexity. I don’t want to overstate the cost and complexity but it’s not insignificant

Spyker And Saab In Deep Trouble

When Spyker bought Saab from GM, they bit off too much than they can chew. Spyker is upside down, under water, or whatever you call it when you have negative equity. They just announced that their debt exceeds their capital. And it looks like they have been dipped by GM: “The negative equity is due to the preferred shares that were issued to GM.”

Recent Comments