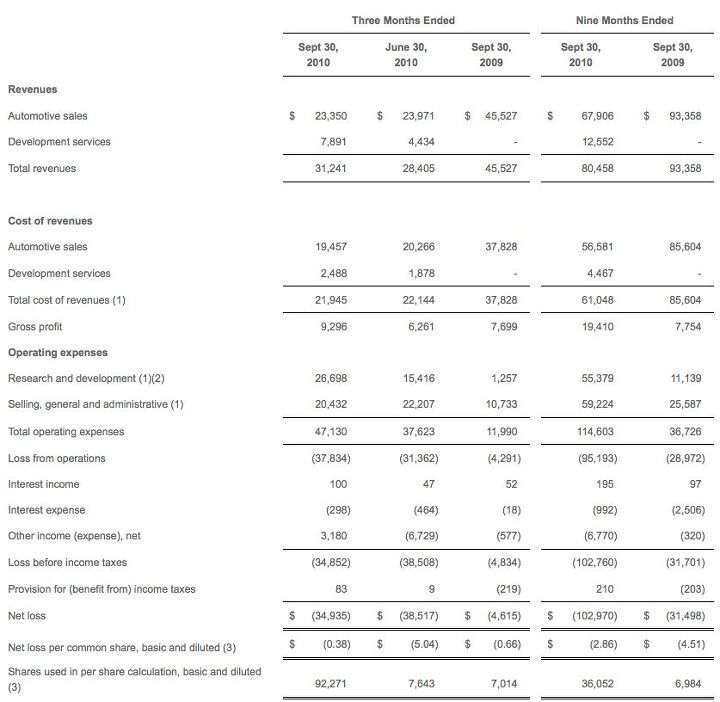

Tesla Lost $34.9m In Q3, Dropped $103m Year-To-Date

California EV maker Tesla has reported its Q3 results, and they’re a sizable helping of not great. But before we dive into the messy reality, let’s check in with CEO Elon Musk for an unreasonably rosy take on the loss:

We are very pleased to report steady top-line growth and significant growth in gross margin, driven by the continued improvement in Roadster orders and our growing powertrain business. Roadster orders in this quarter hit a new high since the third quarter of 2008, having increased over 15% from last quarter. While some of this is due to seasonal effects associated with selling a convertible during the summer months, we are pleased with the global expansion of the Roadster business and the continued validation of Tesla’s technology leadership position evidenced by our new and expanding strategic relationships

Translation: Toyota is investing in us… now get out of here with your awkward questions. Unfortunately for Mr Musk, it isn’t quite that simple…

What Musk leaves out is, well, there’s a lot he leaves out. For one thing, Tesla managed to lose only $4.6m in Q3 of 2009, so these latest results are a disaster when compared year-over-year. And the picture is even worse for year-to-date results: Tesla has lost $103m so far this year, over three times the $31.5m loss accrued in the first three quarters of last year. And even using Musk’s generous comparison to Q2 2010, Tesla’s operating loss actually widened (on massively increasing operating expenses), and was offset only by an increase in “other income.” And no surprise: automotive sales revenue was nearly half its Q3 2009 level.

UPDATE: Elon Musk tells the San Jose Mercury News that

attaining quarterly profitability isn’t a goal… We’re very focused on long-term profitability.

So… mission accomplished. Except that making profit on a blue-sky luxury electric sedan is typically a long-term (to say nothing of expensive) proposition. And the Model S won’t be the only green luxury game in town come 2012. But then, that kind of negative thinking has a history of not bothering Musk. If and when it starts affecting Tesla’s stockholders, things could get ugly.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kwik_Shift_Pro4X Where's the mpg?

- Grg These days, it is not only EVs that could be more affordable. All cars are becoming less affordable.When you look at the complexity of ICE cars vs EVs, you cannot help. but wonder if affordability will flip to EVs?

- Varezhka Maybe the volume was not big enough to really matter anyways, but losing a “passenger car” for a mostly “light truck” line-up should help Subaru with their CAFE numbers too.

- Varezhka For this category my car of choice would be the CX-50. But between the two cars listed I’d select the RAV4 over CR-V. I’ve always preferred NA over small turbos and for hybrids THS’ longer history shows in its refinement.

- AZFelix I would suggest a variation on the 'fcuk, marry, kill' game using 'track, buy, lease' with three similar automotive selections.

Comments

Join the conversation

Their operating profits increased, which is a good thing. Their financial situation improved compared to 2009. They had a 34M loss because their Research and Development costs increased by 20 folds. Please compare apples with apples. Maybe they could make a profit from this research.