Chinese Fire Drill, Starring Ford, Volvo, Geely, Chang'an, PSA, Hafei, And Many More

During the courtship stage between Geely and Volvo, and after their recent nuptials in Gothenburg, Sweden, we often raised the matter of Chang’an. Chang’an has had a joint venture with Ford since 2001. Under the JV, they also make Volvos in China, the S40 and S80, to be exact. They don’t make them in large numbers. 22,405 Volvos were sold in China last year, up nearly 80 percent compared to 2008. The S40 has been on the Chinese market since 2006. The S80L, a long version of the S80, was introduced last year. Chang’an had been in play as a suitor for Volvo, but bowed out.

What will happen to Chang’an’s Volvos?

Will Hedge Fund Lawsuits Scupper The VW-Porsche Deal?

Generally speaking, official prospectus information tends to run on the alarmist side, warning investors of any and all possible problems, regardless of how likely they are to take place. Which is why you rarely see news organizations like Reuters pick up on prospectus warnings, like today’s story on a Volkswagen warning that its merger with Porsche could be scuttled by lawsuits filed by angry hedge funds. Porsche’s notorious “short squeeze” of hedge funds who were speculating on VW stock in the leadup to its planned takeover has drawn lawsuits in several countries which, according to VW’s recent capital increase prospectus, could:

GM Sued By UAW For $450m Delphi VEBA Shortfall

As if to confirm that GM’s benefit obligation situation could actually be worse than today’s GAO report lets on, Automotive News [sub] is reporting that the UAW has sued GM over $450m in unfunded healthcare obligations for Delphi retirees. GM promised to fund a $450m Voluntary Employee Benefit Association for Delphi retirees in 2007, and Delphi’s bankruptcy court confirmed the commitment in last October. But, according to the UAW suit:

the UAW made a written demand that the company honor its contractual obligation to make the foregoing payment [last October… but] that UAW demand was rejected and since that time the company has failed and refused to make the contractually required payment.

That obligation apparently was not voided by GM’s bankruptcy, although The General’s spokesfolks have yet to officially comment on the UAW’s suit.

GM Lost $4.3b In The Second Half Of 2009

GM has announced its “fresh-start” post-bankruptcy accounting results, and between July and December of last year, the bailed-out automaker lost $4.3b [press release here, full numbers here, in PDF format]. The loss comes despite $57.5b in global revenue, and $1b in “net cash provided by operating activities.” According to GM’s release:

The $4.3 billion net loss includes the pre-tax impact of a $2.6 billion settlement loss related to the UAW retiree medical plan and a $1.3 billion foreign currency re-measurement loss.

Of course, you have to dig into the numbers to find the bad news, like the $56.4b in “cost of sales,” or the $700m interest cost, or the 48 percent North American capacity utilization in 2009, or the 16.3 percent US car market share. Which is why we’ve included the consolidated statement of operations, consolidated balance sheets and more, for your no-download-necessary perusal, after the jump.

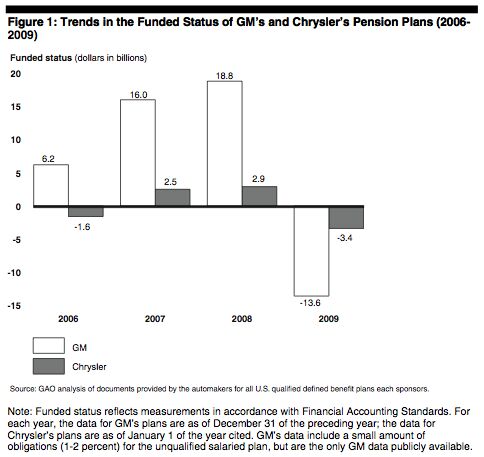

GAO: Pension Plans Will Kill Detroit. Again.

It would be impossible to blame Detroit’s decades-long decline on a single factor, but if one were to make a list, defined pension obligations to workers would be somewhere very near the top. Thanks in large part to the unionization of America’s auto industry, Detroit has groaned under the weight of crushing pension obligations since time immemorial. And, according to a new report by the Goveernment Accountability Office [ full report in PDF format available here], last year’s bailout of GM and Chrysler has not eliminated the existential threat that these obligations pose to the industry. In fact, the taxpayer’s “investment” in GM and Chrysler appears only to have exposed the public to even an greater risk of catastrophic pension plan failure.

Renault, Daimler, Nissan Say Oui", Hai", Ja" In Three-Way Tie-Up

So today, Renault, Daimler, and Nissan did what we said they would do and announced a three-way tie-up. Which is good, because we are running out of inappropriate pictures. The marriage goes far beyond the exchange of symbolical stock holdings.

Daimler, Renault And Nissan Expected To Tie The Knot Wednesday

After reading the tealeaves and other more reliable indicators, it looks like Renault, Nissan, and Daimler will announce their happy three-way partnership and cross-shareholdings on Wednesday.

China's Booming Car Market Takes Its Toll: SAIC Profits Up 900%

When you are a Chinese car company, especially one that is mostly government owned, reporting profits is not one of your prime objectives. As long as you don’t lose money hand over fist, as long as you provide jobs for many people, as long as you grow in market share and influence, having money left over is sometimes just a (taxable) nuisance. But in times like these, it’s unavoidable. And it doesn’t hurt your stock when you are a publicly traded company. Shanghai Automotive Industry Corporation, better known as SAIC, has announced that their net profit for 2009 jumped 900 percent from the previous year, reaching a record of nearly $1b ($966m, to be exact.)

Marchionne: Chrysler Will Break Even This Year. Really.

Poor Sergio Marchionne… the man can’t go anywhere without being interrupted. The Fiat/Chrysler CEO’s speech today in the buildup to the New York Auto Show was interrupted twice, once by the the ubiquitous Teamster protesters, and once by a test of the hotel’s fire alarm system. But then, maybe people would let him speak if he had more to offer than the same lukewarm assurances that everything is going marvelously in Chrysler-land. The Detroit News summarizes his speech by saying Marchionne believes Chrysler will sell the 1.1m vehicles in needs to break even this year, and that it will do so without getting pulled into an incentive war.Which would be hard to do anyway, considering Chrysler spends more on incentives at “normal” levels than any of its competitors.

GM Will Miss Financial Results Filing Deadline

My, My, Maybach: Bad Yarn Debunked

Yesterday, Chinese site auto.sina.com had what our Ed Niedermeyer called “a belly-laugher of a wild-ass rumor: they say BYD has its eye on Daimler’s zombie luxury brand Maybach.” Funny as it may be, media all over the world jumped on the story. Now, the story is heading right to Snopes. After what must have been a round of heated phone calls between Stuttgart and Shenzhen, Daimler denounced the dumb-ass tale:

With GM And Chrysler IPOs AWOL, VEBA Auctions Ford Stock Warrants

The UAW’s VEBA health care trust fund currently owns 17.5 percent of GM and 55 percent of Chrysler, but with IPO plans still nebulous at both, the fund is short on options for improving cash flow. Remember, the union doesn’t want to own these companies… it would have preferred cash, thanks. But since bailout negotiations allowed the automakers to fund their VEBA obligations with stock and warrants, VEBA has little choice but to monetize them. And while GM and Chrysler limp towards an eventual IPO, VEBA’s 362.4m Ford stock warrants are actually doing pretty well relative to their $9.20 exercise price. So it’s no huge surprise to hear [via Automotive News [sub]] that VEBA is planning on dumping its entire allotment of Ford warrants, in a move that could be worth “at least” $1.27b. And it’s no coincidence that this news comes on the same day that Ford is announcing a $3b debt prepayment, and the day after its sold Volvo to Geely for $1.8b.

How To Make Hundreds Of Millions Without Even Trying

Last week, we shared with you an ingenious method of the U.S. Department of Justice to contribute to the deficit-afflicted holdings of the U.S. Treasury. The method involves shaking down foreign companies who grease the wheels to get deals in even more foreign lands. Or who even think about greasing the wheels. Caught between European laws and U.S. laws, these companies pay and promise to sin no more.

Confirmed: Volvo-Geely Deal To Be Signed Today

As predicted by TTAC, the sale of Volvo from Ford to China’s Geely will be signed this Sunday. A Volvo spokesman confirmed this today to Reuters. Details of the deal will be announced at a news conference in the Swedish city of Gothenburg.

Fiat Wants Larger Share Of Chrysler Pie, Has Difficulties At Home

In June 2009, Fiat was handed 20 percent of a washed and rinsed Chrysler for no cash, and despite protests, the deal was rammed through. The UAW was given 55 percent, the U.S. and Canadian governments controlled 8 and 2 percent, respectively. Often overlooked, or forgotten, the deal came with an option for Fiat to raise its stake to 35 and eventually as high as 51 percent if it meets some rather vague financial and developmental goals, hashed out with the U.S. government.

Sergio Marchionne thinks the goals are met. He plans to increase Fiat’s holdings in Chrysler to 35 percent within two years, says Reuters.

GM, Pay Me My Money Down

Reuters says GM is making a big deal out of sending a $1b check to the U.S. Treasury next Wednesday, “attempting to settle the loan with the government ahead of schedule.”

Who are they kidding?

Boys Gone Wild In Brazilian Car-Naval

In the world of automobiles, it appears that China isn’t the only fruit ripe for the plucking. Brazil is buzzing. They’re weathering the current economic fragility very well, and companies are looking to invest in there. Down in Brazil, economically speaking, it’s car-naval time!

Volvo-Geely: It's Going Down

If you think Volvo will stay chaste and out of the grips of the Chinese, abandon all hope. The Chinese are coming to take away your Svenska flikka away for good. Chinese Vice-President Xi Jinping is on his tour of Europe. This weekend, he will arrive in Sweden.

Renault, Nissan And Daimler To Be Tied-Up In Unholy Matrimony

I’m running out of gratuitous tie-up pictures, so let’s celebrate the good news with a video: The Nikkei [sub] sends us the news that Nissan and Daimler “are in the final stages of negotiations to obtain stakes of less than 5 percent in each other.” This comes on the heels of yesterday’s news that Daimler and Renault will exchange shares. With Nissan joining the couple, the tripartite axis will be perfect. No Italians this time.

Lack Of BS Causes Big Loss At Brilliance

2009 was a great year for China’s auto makers with a record growth of 45 percent that propelled the market to 13.6 million units and gave it unassailable #1 status. It wasn’t all roses for everybody. For China’s Brilliance, joint venture partner of BMW, 2009 was downright rotten.

Nasty Securities Laws Make Spyker's Muller Use The Cyprus Connection

Ah, the tangled web of automotive high finance. Victor Muller, CEO and largest shareholder of Dutch automaker Spyker Cars said “oops” (or Dutch words to that effect) and reduced his voting interest is Spyker from 34.3 percent to 26.8 percent.

Why? It just dawned on Muller (or his CPAs) that with more than 30 percent he would have had to make a buyout offer for the rest of the shares. After having gobbled up Saab through complex dealings involving Russian money of dubious provenance, being forced to buy out the whole company because of some silly law wasn’t a high priority for Muller.

Rules are rules, so what’s a newly minted tycoon to do?

Daimler And Renault To Tie The Knot. Symbolically

After long hand-holding and necking, Daimler and Renault finally seem to progress to third base. The Financial Times reports that the French and the Germans “are in the final stages of wide-ranging strategic partnership talks that would involve the German and French car makers taking ‘symbolic’ minority stakes in each other.”

Killing Me Softly: The Slow Death Of Opel

Opels head shop steward Klaus Franz is mightily mad at Opel’s CEO Nick Reilly. Reilly told the London Times that the Ampera, Opel’s counterpart to the Volt, may be built in the Ellesmere Port plant in the UK:“The chances are quite good that the Ampera will come to Ellesmere Port as it is close in production terms to the Astra and will share many components,” Reilly said. In the meantime, Berlin cues Roberta Flack’s “Killing me softly” as a prelude for Opel’s funeral.

Daimler In The Grips Of U.S. Graft Police: "Pay $185m And We'll Let You Walk."

Money-wise, the United States is in a bit of a tough spot. Must create revenue wherever it can. From red light cameras to shaking down foreign companies. On Tuesday, Germany’s Daimler AG was charged with violating U.S. bribery laws “by showering foreign officials with millions of dollars and gifts of luxury cars to win business deals,” as Reuters has it. After asking “how much will it take for this to go away?” Daimler plans to pay $185m to settle charges by the U.S. Justice Department and Securities and Exchange Commission.

Pentagon Backs Dealer Finance Regulation,

Funny or Die’s Presidential Reunion from Will Ferrell

Remember when we reported that the cash cow known as in-house dealer finance wouldn’t be covered by the Consumer Financial Protection Act, currently making its way through congressional committees? That version of the bill passed the House Financial Services Committee (with some questionable support), but now Automotive News [sub] reports that the Senate Banking Committee has passed its own version which does make dealer finance subject to regulation by the Consumer Financial Protection Bureau. The Senate version would also make the CFPB an office of the Federal Reserve, rather than a stand-alone agency. So, should an agency set up to prevent another financial crisis extend regulation to dealer finance operations? Dealers aren’t happy about the idea, but traditional consumer advocates aren’t the only ones saying yes…

Germany To GM: No Money, No Honey

Germany’s Economy Minister Rainer Brüderle poured cold water on hopes for a quick decision on state aid for GM’s ailing Opel. GM expects $2.5b in state aid to come from European countries, most of it from Germany. But Germany, represented by Reiner Brüderle, is dragging its heels.

Volvo Deal Expected To Be Sealed This Weekend

China’s vice-president Xi Jinping (above) is packing his bags for a state visit to Sweden, where he and his entourage will arrive this Saturday. He doesn’t go there to watch pretty blondes. (He doesn’t fancy blondes, see picture below.) Xi Jinping wants to come back to Beijing with a Swedish souvenir: A signed contract between Ford and Geely that will seal the sale of Volvo.

Volvo-Geely Deal: Trouble In Paradise?

Ford And Geely Swear: No Volvo Troubles

China’s Geely and Ford say they are on track to sign a deal on Volvo, says Reuters after checking back with the players. Spokesmen for Ford and Geely said their companies still plan to sign on the dotted line by the end of the month. Then, the deal would close sometime in summer.

Doubts were raised by China Daily, China’s government-owned and English speaking newspaper. They speculated that “financing and technology issues could delay Zhejiang Geely Holding Group, the parent of Geely Automobile, in its plan to acquire the Volvo brand from US automaker Ford Motor Co,” after talking to “sources familiar with the matter.” The same sources said that “the chances of a short-term deal now looks bleak, unless the two sides make major concessions.” At first glance, this smells like some last minute arm-wrestling, not too foreign to anybody living in China. However, China Daily sees two problems, far beyond the usual haggling:

Akio Toyoda Vows Quality Before Quantity

Volkswagen may be much closer to its goal of surpassing Toyota as the world’s largest automaker. In an exclusive interview with The Nikkei [sub], Akio Toyoda said, Toyota will make its top priority the quality, not the number of the cars it makes.

So far, VW wanted to subjugate Toyota by 2018. But Toyota has decided to go slow. Said Toyoda-san:

Quote Of The Day: Old Lines From New Faces Edition

GM, GMAC Go Their Own Ways

In their latest report, the Congressional Oversight Panel suggested that GM’s formerly captive finance arm GMAC shouldn’t have been split from the automaker it still supports. If this led you to believe that GM would take the troubled finance firm back under its corporate wing, you have another thought coming. The WSJ [sub] reports that

The idea appealed to GM, in part because auto maker would have more control over lending practices. GMAC’s move in 2008 to dramatically restrict leasing amid the U.S. financial crisis helped trigger the spiral that sent GM into bankruptcy the last year… But taking over GMAC would have many complications. GM sold a majority stake in GMAC in 2006 as a way to buck up the auto maker’s credit standing and its access to capital. As it turned out, GM still remains largely cut off from the markets.

VW And Porsche To Set Up Major Research Center In Qatar

Volkswagen and Porsche will set up a research and development center in Qatar, reports Arabian Business. Yes, you did read right, Qatar. Qatar Holding has signed a memorandum of understanding with Qatar Science & Technology Park (QSTP), Volkswagen and Porsche. According to the MOU, research and development, testing and training facilities will be built in Doha. “Other avenues of cooperation” may also be visited.

Renault-Daimler Tie-Up? Nissan Wants a Threesome

Time to break out the (tasteful) shibari pictures. “Nissan would seriously consider joining a comprehensive tie-up between Renault S.A. and Daimler AG if the alliance they are discussing happens,” says The Nikkei [sub]. With Renault and Nissan tied-up both at the hips and on top, such a move would make more than just sense.

Tata's Busy Week

Last week was an eventful one for Tata Motors. First, Daimler announced that it had completed selling off its 5.34% stake in the Indian automaker, for USD $422 million. Investors including Citibank and Tata Sons, the largest current Tata Motors stockholder, acquired the shares. Daimler explained the move by saying that it is now well enough established in India in terms of passenger and commercial vehicles, to no longer need an equity share in a local company. Daimler already builds CVs in Pune and its new CV plant in Chennai will go online in 2012. Daimler and Tata have a relationship that dates to 1954, when Tata started assembling Mercedes-Benz trucks. The two companies started local assembly of M-B cars in 1994 under the Telco joint venture.

Renault And Daimler Seen Making Out Again

Again, Renault and Daimler are reported to having a serious tête–à-tête that could lead to a formal marriage. According to the Financial Times, “Daimler and Renault are discussing acquiring mutual equity stakes as part of a possible alliance that would go beyond their current talks on small cars.” Their source? “Two people briefed on the matter.”

Stakes to be bought or swapped were likely to be smaller than 10 per cent.

BYD Charges Ahead

Chinese battery maker and aspiring automaker BYD earned $215m in the fourth quarter of 2009, bringing its net profit for last year to $555.2m, reports Automotive News [sub]. BYD’s performance outstripped analyst estimates, which projected fourth quarter profits of $130.5m, and full-year profits of $473.2m. Though the Chinese auto market grew 46 percent to 1.6m vehicles, 47 percent of BYD’s 2009 sales came from the firm’s cell phone battery business, which is expected to give back recent gains as the global economic crisis takes its toll. Not so with BYD’s auto business: the firm has raised its 2010 car sales projections 14 percent, with sales of 800k foreseen. And as China’s car market takes off, BYD, which has one of the nation’s best-selling cars in its F3 compact, is expected to keep growing. Says one JP Morgan analyst:

BYD is a company that can’t be underestimated. If the Chinese vehicle market expands 10 percent this year BYD’s sales will grow at least 40 percent — 50 or even 60 percent is also a possibility.

Congress: The GMAC Bailout Might Have Been A Bad Idea

After three separate bailouts totaling over $17b, Congress is beginning to wonder if keeping auto-finance giant GMAC alive was worth it. Forbes reports that the Congressional Oversight Panel reckons at least $6.3b of that money could be gone forever, as GMAC flounders towards barely breaking even. And like the rest of the bailouts, the fundamental problem is that the influx of federal cash has allowed GMAC to pretend like it’s not struggling for survival. The panel report [ full document in PDF format here] notes [via Automotive News [sub]]

Treasury’s previous and current support is not underpinned by a mature business plan. Although GMAC and Treasury are working to produce a business plan, Treasury has already been supporting GMAC for over a year despite the plan’s absence. Given industry skepticism about GMAC’s path to profitability and the newness of the non-captive financing company model, it is critical that Treasury be given an opportunity to review concrete plans from GMAC as soon as possible.

Sound familiar?

Daewoo-wo-wo-wo: White Flags Over Korea?

All kinds of strange news are coming from GM’s Korean foster child Daewoo. Two days ago, Daewoo CEO Mike Arcamone announced: “In 2010, GM Daewoo will be profitable. That is my target.” That didn’t get much traction. Reporters wanted to know how bad last year’s numbers were. Arcamone remained tight-lipped. He admitted red ink for 2009, how much remains anybody’s guess. In 2008, it was $773m worth of red. Last October Daewoo-is-me had to be bailed out by the bailed-out GM to the tune of $413m. Arcamone has some soothing news: “We currently do not seek any other financial support from our creditors.” The operative word is “currently.” There is one way to stop the hemorrhage for good: Pack it in.

Volkswagen And Suzuki Beginning To Breed

Volkswagen and its freshly hitched 20 percent bride Suzuki will have a sit-down next week to “flesh out their joint projects by welding together a number of ideas,” reports The Nikkei [sub] from an earnings briefing in Wolfsburg.

The Nikkei guesses that Volkswagen will provide hybrid and electric-vehicle technologies to Suzuki. In turn they are interested in know-how on manufacturing subcompacts at low cost. As far as distribution goes, the two will most likely compare notes on China, where VW is strong, and on India, where Suzuki rules the roost.

Steve Rattner's Fuzzy Math: GM Worth $90b, Taxpayers Will Make Money

In a conversation with The WSJ [sub]’s Paul Ingrassia, former Car Czar Steve “Chooch” Rattner did some “back-of-the-envelope calculation” to show why he believes the US taxpayers will see their $50b “investment” in GM recouped when The General goes public sometime in the next year.

Here’s how Rattner gets to his latest calculation: Bonds of GM’s bankruptcy estate – known as Motors Liquidation – are currently trading around 30 cents on the dollar, according to Thomson Reuters. Those bondholders were owed $27 billion.

As part of GM’s restructuring, those bondholders were promised a 10% stake in GM when it goes public. In very rough calculations, those bonds are currently valued at about $9 billion (because they currently trade at around 30 cents and were originally worth $27 billion).

Assuming that $9 billion represented 10% of GM if it went public now that would imply GM had a value of around $90 billion. The taxpayer’s stake: 60% of that $90 billion, or $54 billion — Rattner’s magic number.

Suzuki (And VW?) Wants Bigger Footprint In India

India is going to be an economic powerhouse, just like China. With 1.1 billion people, that’s a lot of potential customers for your goods. Suzuki knew this, which is why they pushed hard in India. Suzuki is the undisputed market leader in India. Whenever there are developments in that market, we should probably listen. Listen up:

Carmageddon? Audi Rakes It In

Carmageddon was hell for makers of premium brands. For all but – Audi. Audi closed out the crisis year 2009 with a after tax profit of €1.3b, reports Automobilwoche [sub]. And all that despite sinking sales. Speaking of sinking sales, Audi emerged relatively unscathed from 2009. Their sales sunk by only 5.4 percent, mostly due to booming business in China. Even the workers profit.

Daimler Dumps Tata

Uh-oh. Daimler must be needing money really bad. Reuters has on their wire that Daimler is trying to sell their complete 5.34 percent share in Tata Motors for cheap. They are offering the package at a discount of 4 to 7 percent below the stock’s Monday close, and hope to raise $429 million.

Need Some Non-Strategic Assets? Renault Can Use The Cash

Should you be working at a Renault (or Nissan) outfit that is not directly involved in the making and selling of cars, be on the lookout for people from headquarters. Renault is combing its assets all over the world for “non-strategic” ones that could be sold off to raise cash.

PSA And Mitsubishi Call Off Tie-Up

Last December, France’s PSA group and Japan’s Mitsubishi Motors seemed to get really tight (and set off the memorable TTAC series of shibari illustrations.)

Something must have happened during their courtship. The main players met on neutral ground at the Geneva auto show and called off the engagement.

High Stakes Opel Poker: GM Kicks In 1.9b, Wants To See 1.8b In Aid

Maruti Suzuki Gets Touchy

Last November, Suzuki received a fuel leakage complaint on three cars in Europe and one in India. Suzuki did what Suzuki was required to do: Send owners of the “A-Star” (A.K.A, Suzuki Alto, Nissan Pixo) an invitation to go to their dealer and have the fuel pump fixed. As usual, this story received next to no media attention. In the years BT (before Toyota,) who cared about a yet another recall?

That was then, this is AT. Today, someone said “Suzuki has a recall” on the floor of the New Delhi stock exchange. Holy cow!

JLR Profits Up, VW Down. Say What?

As a car company, closing out 2009 with a profit is a commendable feat. Generally, you count yourself amongst the blessed if you are still alive (or bailed-out by friendly governments.) Let’s look at two companies that made money in 2009. At least, at some time in 2009.

Jaguar Land Rover Snags $458m EIB Loan

GM Officially Out Of Control In China

Everybody who’s ever worked in China knows that some things take some time. Nothing that is announced today, happens tomorrow. There are applications to be made, documents to be “chopped.” Sometimes, this process takes forever, as it seems to be the case with Hummer. Sometimes, things move a bit faster. Last December, we reported that GM would sell a crucial one percent of the 50:50 holdings of GM China to their joint venture partner SAIC to bring the shareholdings to 51 percent SAIC, 49 percent GM.

As China’s new year (that of the tiger) came around, China’s biggest automaker SAIC Motor Corp has won regulatory approval to acquire the crucial 1 percent stake in Shanghai GM, Shanghai Daily reports today via Gasgoo. The matter has been officially filed to the Shanghai Stock Exchange yesterday. It’s official now. General Motors officially has been relegated to minority shareholder in its key venture in the world’s largest auto market. SAIC is now calling the shots.

Spyker Confirms Saab Sale Closure

The Strife Of Reilly: Berlin Abandons Opel

Does GM Still Have An Executive Compensation Problem?

The Case Against Saab-timism, Continued

Do you want to believe? You’ll feel at home over at SaabsUnited.com, where the most incurable Saabtimists on the web are (still!) trying to turn their beloved brand around one comment-thread at a time. One current topic, “What to do about Saab dealer finance?” illustrates just one of the major problems facing Saab-Spyker. Other problems include, well, money. CEO Victor Muller has hinted that he’ll list the new Saab-Spyker’s shares in London and Stockholm, “to be closer to investors,” he says. Automotive News [sub] figures it’s because he needs money to develop the new model lines that have been “rumored.” At some point they might want to think about those dealer issues too. Meanwhile, Åke Svensson and Saab’s fourth quarter results epitomize the strained optimism we’ve been hearing for months now.

Saab Deal Backed By Russian Cash After All [UPDATED]

In the confusion of the recent Saab-Spyker deal, an interesting tidbit has flown beneath the radar until recently. Most industry news outlets [ ourselves included] had reported that Spyker’s backing from Russia’s Conversbank had given GM intellectual property nightmares, and that the deal had gone through with backing from other corners. Not so, it turns out. Bloomberg [via BusinessWeek] reports that Alexander Antonov confirms his bank supplied the first $25m in payments to GM. A strange turn of events, considering Russian backing for Magna’s failed Opel bid (and GM’s attendant IP paranoia) was said to have scuttled the deal (and that didn’t even have Convers’s bizarre Chechen blood feud connection).

Daimler Does Diligence

This one’s a bit of a golden oldie, but in light of the recent round of promotions at the Haus of Daimler (not to mention this video’s unintentionally prophetic tagline), it’s worth mentioning. Charges in the 6 year old SEC-DOJ investigations of what was then DaimlerChrysler may be settled by Daimler for “about $200 million” according to anonymous Bloomberg [via BusinessWeek] sources. The probe had looked into allegations that the German firm regularly bribed government officials in a number of jurisdictions (including Sadaam Hussein, in the Oil For Food scandal), the broad strokes of which the firm essentially admitted in 2005. Though Daimler announced that it would cooperate with investigators and that “several” employees were fired, details were never released. At least one whistleblower has alleged that knowledge of slush funds and bribery were known at the highest ranks in Daimler, and the ever-helpful NY Times notes that

As recently as 1997, the German government counted the bribes paid to foreigners by German companies as tax- deductible.

No wonder these guys promote from inside.

GMAC Needs More Loan And Lease Subsidies To Survive

Having recently posted a nearly $5b loss, bailed-out auto finance giant GMAC says it needs more help from automakers to remain competitive. Automotive News [sub] reports that GMAC CEO Mike Carpenter told reporters that “the success of GMAC Financial Services hinges on more loan and lease subsidies from General Motors Co. and Chrysler Group,” and that “GMAC requires additional marketing funds from the automakers to provide competitive loans and leases to the GM and Chrysler dealer networks.” GMAC’s Chrysler business has nearly doubled in the last quarter of 2009, now providing about 26 percent of Chrysler’s retail financing and about 30 percent of GM’s.

![Saab Deal Backed By Russian Cash After All [UPDATED]](https://cdn-fastly.thetruthaboutcars.com/media/2022/07/20/9479948/saab-deal-backed-by-russian-cash-after-all-updated.jpg?size=720x845&nocrop=1)

Recent Comments