Congress: The GMAC Bailout Might Have Been A Bad Idea

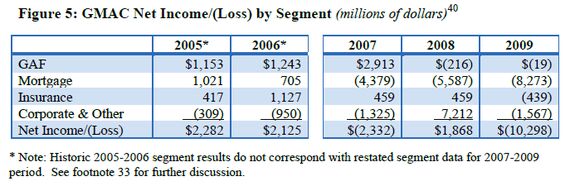

After three separate bailouts totaling over $17b, Congress is beginning to wonder if keeping auto-finance giant GMAC alive was worth it. Forbes reports that the Congressional Oversight Panel reckons at least $6.3b of that money could be gone forever, as GMAC flounders towards barely breaking even. And like the rest of the bailouts, the fundamental problem is that the influx of federal cash has allowed GMAC to pretend like it’s not struggling for survival. The panel report [ full document in PDF format here] notes [via Automotive News [sub]]

Treasury’s previous and current support is not underpinned by a mature business plan. Although GMAC and Treasury are working to produce a business plan, Treasury has already been supporting GMAC for over a year despite the plan’s absence. Given industry skepticism about GMAC’s path to profitability and the newness of the non-captive financing company model, it is critical that Treasury be given an opportunity to review concrete plans from GMAC as soon as possible.

Sound familiar?

So why didn’t congress just let GMAC fail? Is it, like so many other financial institutions claim to be, too big to fail? Not exactly, as The Atlantic‘s analysis of the report shows. According to the COP reportTreasury has never argued that GMAC itself was systemically important, although in 2008 some Treasury staff members believed that GMAC’s failure at that time – independent of its effects on the domestic automotive industry – could have thrown an already precarious financial system into further disarray during the depths of the financial crisis.The real issue? Floorplan financing. Had GM and Chrysler not been delicate taxpayer “investments” there would have been a lot less impetus to send billions to GMAC. Strangely, GMAC’s auto-finance business has very nearly returned to profitability, and the COP suggests that GMAC should have had its auto-finance division stripped away from the firm’s other money-losing ventures (and possibly even returned to GM).

Then there are the other issues with GMAC’s bailout: the lack of Treasury conditions, the possible WTO implications, the stress-test failure, the GMAC-unique Capital Assistance Program, and more. As The Atlantic’s Daniel Indiviglio concludes, “for now, it looks like GMAC will continue to enjoy unconditional government support as long as GM does.” Which is problematic in and of itself. As former Car Czar Steve Rattner has graphically illustrated, the GMAC bailout also helps make the GM bailout look better than it might otherwise, when they should in fact be considered one and the same bailout.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Theflyersfan The wheel and tire combo is tragic and the "M Stripe" has to go, but overall, this one is a keeper. Provided the mileage isn't 300,000 and the service records don't read like a horror novel, this could be one of the last (almost) unmodified E34s out there that isn't rotting in a barn. I can see this ad being taken down quickly due to someone taking the chance. Recently had some good finds here. Which means Monday, we'll see a 1999 Honda Civic with falling off body mods from Pep Boys, a rusted fart can, Honda Rot with bad paint, 400,000 miles, and a biohazard interior, all for the unrealistic price of $10,000.

- Theflyersfan Expect a press report about an expansion of VW's Mexican plant any day now. I'm all for worker's rights to get the best (and fair) wages and benefits possible, but didn't VW, and for that matter many of the Asian and European carmaker plants in the south, already have as good of, if not better wages already? This can drive a wedge in those plants and this might be a case of be careful what you wish for.

- Jkross22 When I think about products that I buy that are of the highest quality or are of great value, I have no idea if they are made as a whole or in parts by unionized employees. As a customer, that's really all I care about. When I think about services I receive from unionized and non-unionized employees, it varies from C- to F levels of service. Will unionizing make the cars better or worse?

- Namesakeone I think it's the age old conundrum: Every company (or industry) wants every other one to pay its workers well; well-paid workers make great customers. But nobody wants to pay their own workers well; that would eat into profits. So instead of what Henry Ford (the first) did over a century ago, we will have a lot of companies copying Nike in the 1980s: third-world employees (with a few highly-paid celebrity athlete endorsers) selling overpriced products to upper-middle-class Americans (with a few urban street youths willing to literally kill for that product), until there are no more upper-middle-class Americans left.

- ToolGuy I was challenged by Tim's incisive opinion, but thankfully Jeff's multiple vanilla truisms have set me straight. Or something. 😉

Comments

Join the conversation

In 2009 GMAC paid $7.7 million to Sam Ramsey, its chief risk officer who was hired in 2007. Is that pay for performance?

If GMAC is barely breaking even then the intervention was successful. Agree on cynical interpretation of anything Senate and Congress does, whatsoever. "Trained professional liars".