Saab Trolling For Money

Today, 3,700 employees of Saab received an invitation to come to an all hands meeting tomorrow, Wednesday. It will be a break from the doldrums. In Trollhättan, the lines have been down for three weeks now because Saab has no money to pay parts suppliers, reports Automobilwoche [sub]. Tuesday ended in Sweden without a solution. Suppliers, unions and Swedish politicians demand immediate action, or Saab will go down the drain.

Talk about a Chinese savior has died down. All hopes hinge on Vladimir Antonov, and the sale of the factory to the Russian, well, business man. The problem is: The real estate is collateral for a loan from the European Investment Bank (EIB). Saab told Automobilwoche that the sale is “no sure” due to harsh demands by the EIB.

Saab Still Waiting For Rescue Approval, Now Looking To China?

The Swedish National Debt Office has approved Saab’s deal to sell property to its Russian backer, Vladimir Antonov, but the Swedish firm is still waiting on approval of the deal from the European Investment Bank. Saab’s production operations have been shut down for two weeks, since the automaker began having trouble paying its suppliers. The EIB says its must simply review the deal, which would include the sale of Saab’s property to an Antonov-owned bank as well as the release of the remainder of Saab’s EIB loan, although GM gets to review the deal as well before it goes through according to thelocal.se. And since GM has long opposed Antonov taking a large share of Saab, which owns rights to some of its latest technology, Saab is reportedly also talking to several Chinese firms about partnerships that could save the struggling automaker.

Fiat Gets A Deal On Chrysler: Majority For $1.27 Billion

In a few months, Fiat will own 46 percent of Chrysler, Fiat announced today in Turin. With another 5 percent milestone reached by the end of the year, Fiat will have the 51 percent majority in Chrysler. According to Germany’s Automobilwoche [sub], the 46 percent level will be reached after Chrysler has paid back the government loans. Payment of the loans is expected for the second quarter of 2011.

Is Ford… Underperforming?

Ask an industry-watcher to name an automaker that seems to be doing things right, and chances are one of the top choices would be Ford Motor Company. And though Ford is enjoying favorable perceptions in the media, according to the company’s own internal goals, it’s actually underperforming. And in a key metric, no less: retail market share. Bloomerg reports:

Fiat To Pay $1.5b For 16% Chrysler Call Option

That’s right folks, for the first (and likely only) time, Fiat will be putting cash on the table for Chrysler’s equity, as Reuters reports that Fiat’s new credit facility will include $1.5b with which to exercise the 16% call option in its agreement with the US Treasury. At that rate, Chrysler’s market value would be under $10b, considerably less than the nearly $13b spent on Chrysler’s rescue (not counting assistance to Chrysler Financial). But what is Chrysler actually worth? Hit the jump for a look at what Chrysler’s Shareholder Agreement says about valuation in a Fiat Call Option scenario.

Lotus Overlooked For Government Loan, Snags Private Funding

Chrysler Bailout ReFi Coming Together

With Fiat flying towards taking a majority stake in its Chrysler subsidiary, Reuters reports that the necessary private loans are very close to being arranged.

Goldman Sachs Group Inc, Morgan Stanley, Citigroup Inc and Bank of America Corp are in advanced discussions with Chrysler to finalize a deal that will replace all of its roughly $7 billion government loans with term loans and bonds, these people said on Thursday.

In addition, the banks will also arrange a revolving credit facility for the automaker’s future liquidity purposes that will remain undrawn, these people said. The revolver will not be used for paying down government loans.

Look for Chrysler to wrap up a deal sometime after it reveals its Q1 financial performance next month.

The Chrysler Coincidence: Bailout Loan-Shuffle To Help Fund Fiat Takeover

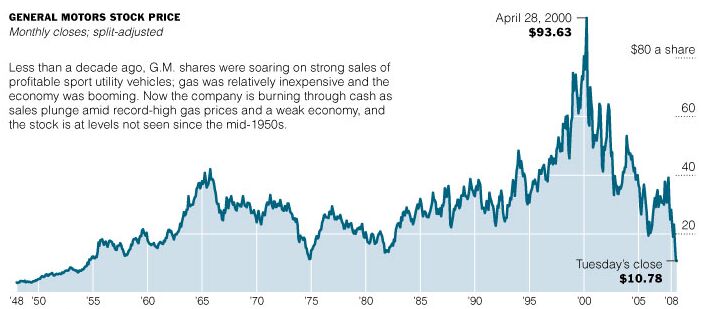

Back in November of 2009, when GM announced that it would repay its government loans, it didn’t take much investigation to realize that The General was simply shuffling government money from one pocket to the other and that true “payback” was still a ways off. The New York Times asked me to write an op-ed on the subject, and I took the opportunity to point out the reality of the situation and note

G.M.’s global interests are far too diverse for it to serve its taxpayer owners faithfully, and it can’t afford to subjugate its business prerogatives to the political needs of its major shareholder in the White House. So, unless Americans develop a sudden obsession with G.M.’s $40,000 Volt electric car just in time for an I.P.O., taxpayers will be stuck with tens of billions of dollars in losses.

Afterward, while our government contemplates its runaway deficit and getting rid of its 8 percent of Chrysler’s equity, perhaps we’ll get an admission that General Motors still owes the American people. Without one, the relationship between the public and the automaker, and the Obama administration as well, may never be the same.

And now that our government finds itself “contemplating a runaway deficit and getting rid of its 8 percent of Chrysler’s equity,” would you believe that a similar federal money-shuffle is under way? Believe it.

Fiat To Pay Back Shyster Loans

In a few weeks, Fiat will be handed another 5 percent of Chrysler as brownie points for meeting another milestone in its agreement with the U.S. and Canadian governments. Another milestone will be reached in the fourth quarter, Sergio Marchionne told Reuters today. That will bring Fiat’s ownership in Chrysler to 35 percent. But Fiat and Marchionne want more: Majority control, i.e. 51 percent. That needs a bigger milestone: Repay a $7 billion government debt. Marchionne thinks he can do it.

No Solution In Sight For Stalled Saab

Saab’s inability to pay suppliers led it to request a release of some of its debt collateral by Sweden’s National Debt Office, reports Reuters. The NDO has loaned Saab €400m, but with its Russian backer Vladimir Antonov still unable to inject cash into the company, Saab was forced to ask for some of its NDO loan collateral in order to cover its supplier debts. But, according to another Reuters report, NDO spokesfolks say

It is clear what the problem is and everyone possible is trying to solve the problem… a solution to the problem had seemed in sight, but that in the end it did not work out.

The NDO says it will keep working with Saab, and the automaker predicts a resolution by next week (without offering any further details). After a year of independence from GM, the Swedish brand could well be reaching the end of the line.

Saab Story: No Money, No Name?

Earlier this week we learned that Saab can not pay its supplier bills until its Russian sugar daddy, Vladimir Antonov, gets Swedish government approval to buy into the company that owns it. Now, suppliers are speaking out, telling Automotive News [sub] that the brand and its owner, Spyker Cars, owes “tens of millions” of Swedish crowns (10m crowns equals about $1.6m). A representative of the Swedish suppliers association explains

There is a perception in the media that there are discussions on extended credit times and such. But it is not about that, it is about the fact that Saab must pay its bills. If they cannot sort out their financial situation, things look very bleak.

With a “desperate” hunt for investment underway, Saab’s only hope appears to be Antonov, who says he has $71.5m to invest, an amount that should cover the $4.7m+ supplier debts. Meanwhile, work at Trolhattan has been stopped for at least the rest of the week. But even if Antonov gets Swedish government approval to invest, another, equally dire problem appears to be materializing: a dispute over the use of the name “Saab.”

What's Wrong With This Picture: Just What Tesla Needed More Of Edition

HYPE! Yes, according to a pimptastic Morgan Stanley report [via BusinessInsider], Tesla is about to become “the 4th American Automaker,” despite the fact that it hasn’t actually built a car in any kind of volume. The report enthuses

The confluence of structural industry change, disruptive technology, changing consumer tastes and heightened national security creates an opportunity for significant new entrants in the global auto industry. California dreaming? We don’t think so. In our view, the conditions are ripe for a shake-up of a complacent, century-old industry heavily invested in the status quo of internal combustion. The risks are high. So is the opportunity. Enter Tesla.

Did you just throw up in your mouth a little? Don’t worry, there are highly convincing charts to help you learn to stop worrying and love the auto industry’s answer to Apple. After all, when it comes to Tesla, charts always tell the whole story.

GM Dumps Ally Shares, Announces Dividend

Automotive News [sub] reports that GM has sold $1b worth of preferred stock in Ally Financial, the bank holding company that emerged from the wreckage of GM’s former in-house lender GMAC. GM will book $300m on the deal, which will take its ownership stake in the lender to 9.9 percent. GM will likely continue to reduce its exposure to Ally, which is 74% owned by the US Treasury, as its new CFO seeks to rebuild its in-house lending capabilities. GM’s move away from Ally has intensified competition between the financial firm and GM’s new financing arm, which has been built on the acquisition of subprime lender AmeriCredit. This mounting competition has been criticized by the TARP Congressional Oversight Panel, which rapped GM for failing to find a win-win solution for its own financing needs and the viability of the taxpayer-owned Ally. Amman’s strategy for avoiding further conflict: sticking with subprime and floorplan lending, leaving prime auto lending to Ally. But, argues analyst Maryann Keller

Floor-plan lending is about building an individual relationship with a lender. To get them to switch, you need to get people on the ground and get out and talk to dealers and build those relationships.

Meanwhile, with its stock struggling to achieve the value projected for it by several analysts, GM has approved a second quarterly dividend of $0.594 per share on its Series B mandatory convertible junior preferred stock. More cash and a new dividend seem likely to pump up GM’s stock price a little, but it is unlikely to reach the $55-ish price needed to pay back the government’s equity investment in the short term.

Missouri Groups Fight Back Against Traffic Camera Astroturf Campaign

Grassroots anti-camera activists in Missouri yesterday charged that a photo enforcement firm was creating fake advocacy groups to promote the use of red light cameras and speed cameras. Wrong on Red and the Jefferson County Tea Party blasted American Traffic Solutions (ATS) for hiding its involvement in a slick advertising effort designed to persuade the legislature to allow photo ticketing to continue uninterrupted in the state.

GM's CFO Departs

General Motors has announced that Chief Financial Officer Chris Liddell will be leaving the company on April 1, “having completed the largest public offering in history and stabilizing the company’s financial operations.” CEO Dan Akerson has denied that Liddell’s departure has anything to do with GM’s first-quarter financial performance or his relationship with the departing CFO, saying “we could finish each others sentences.” The former Microsoft man was brought into GM in January of last year, and helped guide the automaker through its IPO and eliminated its material weaknesses in internal financial controls, apparently the two tasks he needed to complete before riding off into the sunset.

Volkswagen Announces $12 Billion Profit

Volkswagen looks back at its best year in history. At a press conference today, Volkswagen CEO Martin Winterkorn announced a consolidated group profit before tax of €9 billion ($12.45 billion). €1.9 billion ($2.6 billion) of that is Volkswagen’s share out of their China businesses.

BMW Profits Up More Than Tenfold

Luxury cars, pronounced an endangered species two years ago, are back with a vengeance and enrich their makers. After reporting record sales, BMW follows with record profits. The Bavarian Motor Works are looking at a 2010 pre-tax profit of €4.8 billion ($6.7 billion) on sales of €60 billion ($83 billion). Not bad for a company that delivered only 1,461,166 BMWs, MINIs and a few Rolls-Royces last year.

Chrysler Turns $14b Into $4.8b

According to Steve Rattner, Chrysler was such a sick puppy in the immediate pre-bailout period that it would have only generated about $1b had it been liquidated in bankruptcy. Thanks to around $14b in government assistance, however, Chrysler is now worth a whopping $4.8b according to a Reuters analysis of its filings. But wait, you say, how does Chrysler have a valuation if it hasn’t yet launched an IPO?

Chrysler arrived at the valuation to set pay for its top executives, including Marchionne. Senior executives are paid partly through so-called deferred phantom shares, which will convert to shares in the company at a later date.

In June 2009, each share was worth $1.66, according to the filing. By the end of 2010, the value of each share was $7.95.

Honda Not Exiting India

Some overly excited blogs may report that Honda is exiting the growth market India. Careful. Indeed, Reuters reports that “Hero Investments has agreed to buy Honda Motors Ltd’s 26 percent stake in Hero Honda Motors for around $851 million in a deal that will see the Japanese automaker exit its joint venture in India after more than 26 years.” So are they outta there?

$6.6 Billion Profit For Ford? Bah Humbug! Wait Until The End Of This Year!

Ford reported a $6.6 billion profit for 2010, its highest in more than 10 years. This year, they could add $13 billion to the profit line, without selling an extra car. How will Ford pull off the miracle of the loaves and profits? With a simple bookkeeping entry.

Quote Of The Day: Abandoning The Bailout Edition

The Detroit News reports that top White House economic adviser Austan Goolsby indicated today that the government would be exiting its equity position in GM in the short term. The DetN’s David Shepardson quotes Goolsby as saying

The writing is clearly on the wall that the government is getting out of the GM position. The government never wanted to be in the business of being majority shareholder of GM. It was only to prevent a wider spillover, negative event on the economy. So we’re trying to get out of that. We’re not trying to be Warren Buffet and figure out what the market is doing

And he’s not kidding: GM’s stock just closed at its lowest level since the IPO, after GM’s Q4 results came in below analyst expectations and the overall market experienced turmoil due to Middle East unrest.

With IPO Looming, Ally Financial Goes To War With GM

One of the strongest criticisms issued in the Congressional TARP Oversight Panel’s most recent report on the auto bailout concerned GM’s lack of effort to bring its former captive lender GMAC (now called Ally Financial) back to the fold, an omission the Panel termed “disconcerting.” After all, Ally’s business is still closely intertwined with GM’s, as the financial firm provides 82% of GM’s dealer floorplanning and 38.2% of GM’s consumer loans. And, as bailed-out businesses (Ally is now 73.8% owned by the US Treasury), any competition between GM and Ally will result in a lose-lose scenario for taxpayers. In recent months it seemed that the two firms were moving towards a deal at the initiative of GM CEO Dan Akerson (and likely motivated to some extent by the COP’s criticisms), but now Bloomberg reports that there are no negotiations between GM and Treasury about a reconciliation of the two firms… in fact, with an Ally IPO planned for this year, it seems the two firms are going to war.

GM Earned $4.7b, Beat "Financial Control" Issues In 2010

GM has announced its full-year results for 2010 [Highlights here, Chart set here, in PDF], and has achieved its first full-year profit since 2004 by pulling in $4.7b. Perhaps more significant than the numbers alone, however, is GM’s claim that it has whipped its “material weakness” in terms of financial reporting and internal controls, an issue that had haunted The General since being disclosed in the runup to its IPO. Still, GM’s earnings were well below the $5b+ full-year profit expected by analysts, and its half-billion Q4 profit was considerably more “pinched” than the $1b that Wall Street expected. More importantly, GM burned $1.7b in automotive operating cash (including a $4b pension contribution) and another $1.1b in CapEx in the fourth quarter, resulting in a $2.8b automotive free cash burn for the quarter. Over the course of 2010, GM’s cash pile has gone from $36.2b to $27.6b, although GM has access to over $5b in new credit facilities while cutting debt from $15.8b to $4.6b. Still, a weakly-profitable Q4 is better than last year’s $3.4b Q4 loss.

GM Profit Projections: Over $5b On The Year, But "Pinched" Q4

Analysts are reporting that GM could announce full-year 2010 profits of over $5b tomorrow, although Q4 profits may have dipped to $1.06b. That would make its full-year results the best since a $6b profit in 1999, but Q4 results could be the second-worst since emerging from bankruptcy. Why the slowdown? Analysts give Bloomberg a number of possible explanations, including

- GM’s spending on cars including the Chevrolet Volt plug-in hybrid and future products may lead to higher costs similar to those that restrained profits at Ford and Daimler AG.

- Automakers are paying more for materials such as steel and are struggling to pass the costs to consumers amid a “somewhat weak” economy

- Restructuring unprofitable European operations

Of all these dynamics, however, CEO Dan Akerson’s rush to revamp GM’s lineup and expand the applications of the Volt’s drivetrain could end up driving the most cost. Though GM is making a healthy profit again (and not paying taxes on it), an overly-ambitious speed-up in product cadence could combine with rising costs to slow The General back down (as they have already done to some extent at Ford). In any case, we will certainly have a better picture of GM’s financial performance tomorrow, when the firm’s results are announced.

Tesla Gets A Deal. And An Endorsement

Last year, Toyota invested $50 million into Tesla. Tesla turned around and spent $42 million of the new money and bought the land and buildings of site 2 of NUMMI in Freemont, CA. As it turns out, the deal did not include the fixtures. Nothing another $17 million could not fix.

Tesla Loses $154m In 2010

Despite launching a frothy IPO, EV maker Tesla’s net loss nearly tripled last year, losing more than $154m compared to a $55.7m loss in 2009. Total revenues were up nearly $5m, but only due to a nearly $20m bump in “development services” income. Revenue from “automotive sales” was down by around $15m. R&D costs skyrocketed from $19.3m to nearly $93m, while “selling, general and administrative” costs doubled to $84m. Still, CEO Elon Musk is all optimism in the firm’s press release, crowing

We are very pleased to report continued revenue growth, improving margins and a steady progression in our Roadster and powertrain activities,. Our powertrain team delivered solid results, with an increase in orders and record deliveries of battery packs and chargers for the Daimler Smart fortwo electric drive, the completion of our development program for the Daimler A-Class, and the commencement of the phase 1 development program for the Toyota RAV4 EV.

Musk noted that the firm is on-track to start delivery of its forthcoming Model S sports sedan in mid-2012. It had better be, because Tesla’s clearly not going to sustain itself on Roadsters.

Guess Why There Is a Trading Halt For SAIC

As reported here, GM’s and Volkswagen’s Chinese partner SAIC will halt the trading of its shares on Monday in anticipation of a major plan. The plan doesn’t appear to be fully hatched: According to People’s Daily, “SAIC will make an announcement on the plan in five trading days.”

But what’s that secret plan? Speculations by our commenters range from buying more of GM to buying Saab. One of the Best & Brightest appears to be close to the truth – as far as we can fathom at this point.

GM Chinese Partner Suspends Shares, Says "Major News" Coming

Toyota Surprises With Numbers, Waits For DOT Findings

Toyota’s Senior Managing Director Takahiko Ijichi had a surprise for the press that congregated today in the windowless basement conference room of Toyota’s downtown Tokyo office. They were invited to hear the results of the 9 month period from April to December. The scribes had prepared for the worst. As the numbers were released, some furiously begun retyping the prepared stories in which they had planned to insert the expected bad numbers before hitting SEND. Instead, Reuters reports: “The world’s top automaker posted a smaller-than-expected fall in third quarter profits and hiked its sales forecast for the year to March 31 by 70,000 vehicles to 7.48 million, thanks to better than expected sales in Asia, Japan and Russia.”

Marchionne: Sh ... I Didn't Mean It

Porsche And Volkswagen Will Stay Separate For A While

Impatient souls who already count Porsche and Volkswagen as one will have to exercise restraint for a while. The planned amalgamation of the Wolfsburg monster with the racy shop from Zuffenhausen can drag on for a while, reports Automobilwoche [sub]. The reason: Pricks Lawyers.

Chart Of The Day: The Expectations Game Edition

Chrysler Posts $652m Net Loss For 2010

How did Chrysler do last year? It all depends on how you slice the numbers, isn’t it? As warned, Chrysler’s Q4 was a bit of a letdown, as net revenues dropped from $11.018b in Q3 to $10.763b, resulting in a $199m Q4 net loss. Interest expenses continue to be a major drag on Chrysler’s performance, costing $329m in Q3 and a whopping $1.228b over the course of the year. Cash dropped by nearly a billion dollars from Q3 to Q4, ending the year at $7.347b (not counting $2.3b in undrawn government facilities). Chrysler nearly hit the 1.6m worldwide sales number touted in its Five Year restructuring plan, as well as the 1.1m US-market target (although fleet mixes appear to have been higher than anticipated). Chrysler also hit its goal of $40b+ in net revenues and exceeded Operating Profit and EBITDA projections, but as the slide from Chrysler’s Q4 financial presentation [ PDF here] shows, Both debt (which will likely be restructured this year to reduce costs) and depreciation/amortization have killed Chrysler this year… which is why EBITDA and Modified Operating Profit take the top billing in Chrysler’s financial reporting.

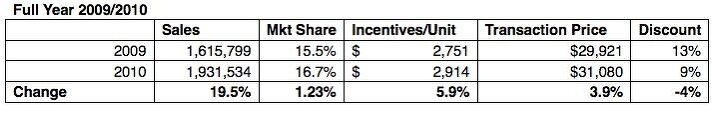

Inside Ford's Best Year In A Decade

Regular TTAC readers know that there’s more to a successful performance from an automaker than pure volume alone. Average transaction prices, market share, and incentives all play a role in translating production numbers into profits. Luckily, our pals at TrueCar have broken all that lovely data down, and they’ve sent over the numbers behind Ford’s recently-announced $8.3b profit, the Blue Oval’s best performance in over a decade. And, as you can imagine, a performance like that requires not only a hefty increase in volume (up nearly 20% on the year) but also improvements in market share (up 1.23%), and transaction price. Yes, incentives stayed stronger than they perhaps needed to be, but they now make up a lower percentage of the average transaction price. And that, ladies and gents, is how you make a $5.4b pre-tax operating profit in the US market alone [Q4 and historical data after the jump].

Chew On That: Ford Announces $8.3 Billion Profit

Ford did not disappoint and today announced its biggest annual profit in a decade. According to a Ford release, the company booked $8.3 billion in pre-tax profits for 2010. That is a $3.8 billion increase from a year ago.

Can You Make 15% Per Year Investing In Classic Cars?

GM Withdraws $14.4b Government Loan Request

GM And GMAC: Together Again?

One of the more dangerous conflicts embedded in the US auto bailout that was identified in the recent Congressional Oversight Panel report has been a TTAC hobbyhorse for some time, namely the tradeoff between GM’s success and that of its former captive finance arm GMAC (now known as Ally Financial). As we wrote back in May,

if government-owned Ally isn’t interested in underwriting GM’s volume gains with risky loans but also isn’t interested in seeing its auto lending business bought by GM, there’s trouble brewing. After all, that would leave GM with only two options: partnering with another bank, or starting a new captive lender. Either way, a new GM captive lender would likely force Ally into offering more subprime business anyway, or face losing its huge percentage of GM business.

Fast forward the better part of a year, and GM has indeed bought its own in-house subprime lender, leaving the COP to term The General’s lack of interest in taking care of “the Ally Tradeoff” as “disconcerting.” After all, with over 20 percent of GM’s equity and over 70 percent of Ally’s stick, the Government should have been able to work out some kind of deal that gets GM and Ally back on the same page… right? Not so fast, reports the WSJ. Ally turned down a $5b GM offer for its wholesale lending business earlier this year, and now it seems another deal may be in the works. But it has nothing to do with maximizing taxpayer payback, and everything to do with shoring up GM’s floorplanning credit. And it’s not coming from the government, but from GM’s newly-ubiquitous CEO Dan Akerson.

Ford To Announce Record Profit

On Friday, Ford will show something it didn’t have for a long time: Money, and lots of it. The Freep thinks that Ford will report a profit for 2010 of about $8 billion excluding onetime charges. That would be the biggest annual profit Ford saw in a decade.

Fiat And Chrysler: Alone At Last

Fiat split its auto business from the rest of its industrial operations today, creating two new companies: Fiat and Fiat Industrial. Fiat CEO Sergio Marchionne announced the move as a way for Fiat to unlock its share value and concentrate on its core business, telling the AP [via Newser]

This is a very important moment for Fiat, because it represents at the same time a point of arrival and a point of departure. Faced with the great transformations in place in the market, we could no longer continue to hold together sectors that had no economic or industrial characteristic in common.

But with Fiat Industrial taking care of the truck-and-tractor side of the business independently, Fiat SpA is focusing on the task at hand: Chrysler. With a 35 percent stake in the bailed-out American automaker in the bag, Fiat is aiming for a controlling stake when Chrysler’s IPO hits the markets later this year. And though the spin-off of FIat’s non-automotive business opens the door for a full merger of Fiat and Chrysler, Marchionne denies that a full merger will take place, saying only that

I don’t know whether it is likely, but it is possible that we’ll go over the 50 percent mark if Chrysler decides to go to the markets in 2011. It will be advantageous if that happens.

But don’t mind Sergio’s equivocation. Fiat will almost certainly snap up the remainder of a controlling stake by the end of this year. Here’s why…

Judge Throws Out Hedgies Case, Clears Way For Porsche Anschluss

Phew.

Did you hear that? That was a sigh of relief, emanating from the few souls that are still holding the fort at Volkswagen in Wolfsburg and Porsche in Zuffenhausen. The sudden release of long held breath was caused by U.S. District Judge Harold Baer, who dismissed a lawsuit by 10 hedge funds who accused Porsche of securities fraud during the Wiedeking/Härter hijinx. The hedgies claimed more than $2 billion in damages, which gave Volkswagen pause in fully absorbing Porsche. Now, they can floor it.

Former Car Czar Pays $10 Million, Does Not Go To Jail

Former Obama administration “car czar” and leader of the Presidential Task Force on Autos, Steven Rattner, wrote a $10 million check yesterday to NYS Attorney General Andrew Cuomo, and Cuomo dropped his charges. Rattner will remain a free man. The only thing he’s not allowed is to appear before any state-pension funds for the next five years. Cuomo can close out his desk and go on to become New York’s governor.

Blue Ops: The Clandestine Bailout Of Ford

One of the many reasons for Ford’s surging market share are Americans who refuse to buy a car from a company that has been bailed-out with their tax dollars. In survey after survey after survey, Americans took issue with the bailouts. The backlash was so severe that one of the first measures Joel Ewanick implemented at GM was to get rid of GM. He replaced “General Motors” with “the parent company.” Smart move: You can be against Government Motors. But who dares to be against parenthood?

Ford meanwhile rode high on the perception that they didn’t accept a single dollar. “Ford did not seek a government bailout,” says a very recent Rasmussen Report, “and 55 percent of Americans say they are more likely to buy a Ford car for that reason.”

Americans (and possibly GM and Chrysler) are the victims of a big lie, says Wall Street insider Eric Fry. And he has the numbers to back it up.

GM Buys $2.1b Of Government's Equity

GM Seeks Pay Leeway From Treasury

Subprime Auto Sales Heat Up

The debate over Detroit’s bailout was dominated by a narrative that portrayed the automakers as victims of Wall Street excess, and placed blame for their collapse on the frozen credit market. And though the credit crunch certainly hurt GM and Chrysler as well as their customers, Detroit was a victim of the credit crunch in the same way an addict is a victim of his dealer. By l everaging easy credit to fuel the SUV boom which covered for unprofitability in passenger cars (or didn’t, as the case may be), Detroit binged on zero-percent financing as the market road confidently to 16m annual sales. And then, finally, the music stopped and the Domestics crumpled, victims of their own greed, but with a convenient scapegoat in the hated Wall Street bankers. But if the bailout was intended to not only get GM and Chrysler back on their feet but also to prevent future collapses, there’s some troubling news in the offing: subprime auto lending is starting to roar back, and if it goes unchecked, it could reach pre-recession levels in short order…

GM Drops $4b On Underfunded Pensions

GM-Daewoo Finally Pays Down Its Debt

The Korean Development Bank, which owns 17 percent of GM’s GM-Daewoo Korean subsidiary, has been rolling about a billion dollars in Daewoo’s debt over on a monthly basis for most of this year. The debt, a legacy of a $2b+ loss on currency speculation. Now, The Korea Times reports that GM-Daewoo has paid back about a billion of that mature KDB debt, as GM-Daewoo boss Mike Arcamone explains

this action reflects GM Daewoo’s strong financial performance this year enabling us to make full payment on the outstanding facility … Full repayment of the credit facility will decrease the company’s future borrowing costs

Flush From GM's IPO, UAW Targeting New VW Plant

GM’s stock may be hovering near its IPO price of $3/share, but the UAW doesn’t need much more growth to cash out with every penny it wanted from GM. The UAW’s VEBA account has banked $3.4b in stock sales so far, and Forbes reports

The VEBA will break even on its investment if it can sell the remaining 206 million shares at an average price of $36.96.

Taxpayers, meanwhile, need GM’s stock to top at least $52/share in order to break even on the bailout that it funded. Because it’s just not a bailout unless the least deserving benefit the most. Meanwhile, with its accounts once again flush with cash, the UAW is turning South in hopes of accomplishing what it has never accomplished before: unionizing at ransplant auto factory in a right-to-work, Southern state.

Redflex Approves Executive Raises, Expects Profit

Redflex shareholders on Friday approved big pay hikes for the photo enforcement firm’s top management at the annual meeting in Victoria, Australia. Redflex has cornered 44 percent of the red light camera and speed camera market in the US, although Arizona-based rival American Traffic Solutions (ATS) is catching up to its down under competitor with a 41 percent market share.

Reilly Predicts $2 Billion Loss For Opel

Did you buy the GM share? If the answer is in the affirmative, then you should stop reading immediately. There are great new stories my Murilee Martin, just as a for instance.

Are we entre nous? Ok, here are the bad news: GM’s black hole in Germany, called Opel, turns out to be more humungous and more financial-matter sucking than ever imagined.

OMG! American Dealers Run Out Of American Cars!

Forget about Europeans complaining about missing parts. Over in America, there is an acute car shortage. Dealers blame who they always blame: The manufacturers. “They’ve cut back production so much that we’ve run out of cars,” Boston dealer magnate Herb Chambers tells his hometown paper, the Boston Herald. He says he had to “beg, borrow and steal” Cadillacs from dealers in other parts of the country. Down at the South Shore, dealer Dan Quirk loses 60 to 90 sales a month. “The Big Three just don’t have enough manufacturing capacity any more,” kvetches Quirk. “Some of the automakers, particularly General Motors, closed a lot of their plants when the meltdown hit.” Supposedly it’s not just a Bostonian phenomenon. Supposedly. At closer look, it might be a fire breathing, rip-snorting chimera.

Fiat Fixing Up Ferrari For Quick Sale?

Abu Dhabi’s sovereign wealth fund, via its investment vehicle AMubadala Development Co, has sold back its 5 per cent stake in Ferrari to Fiat. It’s not that the sheiks were tired of Ferrari. Fiat wanted their shares back. Fiat had an option that gave it the right to buy back the stake that Mubadala had acquired in 2005 from Mediobanca, Italy’s largest investment bank for €114 million, domain-b reports.

Fiat paid €122m ($167m) to buy back the stock. Now their holdings climbed from 85 percent to 90 percent. Why would you want 90 percent in a small sports car maker if you already have 85 percent, and you need every penny of cash?

General Motors, Public Company

GM Board Member: The IPO Is Premature

Ready to buy some GM share tomorrow? A consummate insider who sits on the board of an important GM company says: Don’t.

Klaus-Franz, Chair of the Opel works council and Vice Chairman of the Opel supervisory board warns: “The IPO is premature. Sure, GM has delivered three good quarters. But he restructuring in Europe must be finished to give investors the visibility they need.”

Franz knows the skeletons hidden in Opel’s closet. In an interview with Germany’s Focus Magazine, Franz gives valuable investment advice to potential GM shareholders. To repeat: “Don’t.”

GM IPO: Go Ask Opel (Or Daewoo)

With news that GM’s IPO price could be headed as high as $33/share (only $10.67 more per share to taxpayer payback!), boosting the offering to some $12b, some might think that the decks have been cleared of skeptics. Not so. Though GM has emphasized its international flavor during its IPO pitch, it’s stayed away from the fact that its overseas operations haven’t been immune to trouble. Take Opel (please). Though invaluable as a development center for GM’s upscale global products, Opel is miles of bad road away from actual profitability. Just ask the guy who tried to buy Opel back when the General was trying to fire-sale its European operations.There is a lot of euphoria about the IPO, but if you dig into the numbers, they still have a problem in Europe. They are doing worse than when we looked at them two years ago, and it’s going to take a lot of cash to fix Opel. That’s my concern on the IPO.

SAIC Buys 1% Of GM, Gets Keys To World Markets Thrown In

Observers who followed China’s SAIC coveting of shares in the upcoming GM IPO (only 3 days to go!), and who hoped/feared that SAIC would buy a big chunk of GM, will be disappointed/relieved to hear that SAIC is content with a more or less symbolical 1 percent share in the General.

Reuters has it on good authority (“four people familiar with the matter”) that SAIC and GM have reached an agreement in principle that cements the 1 percent deal. The deal is contingent on Chinese government approval, but this is expected to be fast tracked and should happen today before the U.S. even gets up.

So the big Chinese buy-in is just a lot of hot air? Wait until you hear what SAIC received as a deal sweetener.

Chrysler Workers Smoke Pot, Drink Beer At Lunch And Don't Give A Freckle About Quality

Some say, TTAC has an anti-Detroit, pro-import slant. We won’t comment on that, you mommy-fraternizing liars. All we can say is: If you harbor these notions, don’t move to Oklahoma. Oklahoma’s largest newspaper, the Oklahoman, dishes out more anti-Detroit snark in a single serving than even a Farago could have cooked-up in his TTAC lifetime. How about calling the former owners of Chrysler unqualified “idiots?” And not the former owners you think of now. Wait, there is worse.

Swiss EV Firm Pitches Investors On The Niche Mindset

Now that the worst part of the global economic crisis is over, investors are fired up for any investment opportunity that looks good and doesn’t smell funny. Especially in the alternative-energy field. Some ventures make sense while others are based on a rather exotic logic. Better Place, for instance: its institutional investors say it’s “the only EV + infrastructure play”, and therefore something you’d better not miss. I’d just say it requires weird financial reasoning to justify electric filling stations stocked with expensive exchange batteries.

Earlier this week, I was at Mindset Holding’s press conference in Switzerland, where they announced they had received 75 million Swiss Francs of financing from a US fund, GEM Group, with another 108 millions optional. Mindset will be using this money to produce its exotic electric sports coupe — the one I thought was fantastically forward-looking when I witnessed it last year.

Is this madness? After all, Mindset in 2012 will be competing with Tesla’s Model S, the Fisker Karma, and numerous electrified or hybridized German and Japanese luxury cars. Who’d spend 100,000 Francs on a Swiss made electric three-seater?

GM Gets A Deal In China: 10% Of Wuling For $51m

GM appears to be sick of the constant needling it receives about their Wuling joint venture in China. Here is a company that produces half of the 2 million cars GM proudly announced as theirs in China, and GM owns only 34 percent. (The 37 percent that had been bandied about apparently were also exaggerated.) 50.1 percent are owned by SAIC, the rest by Wuling. Contractually, GM is entitled to pull the wool over the heads of the world and OICA, and count the millions of diminutive Wulings as theirs. Now, GM is taking steps to redeem themselves. Or to redeem some of the IPO take. But just a little.

Recent Comments