Desperately Seeking Subprime: White House Admits GM's IPO Dash Hurting Ally's TARP Payback

The WSJ [sub] reports that GM is officially looking outside of its former captive finance arm Ally Financial (formerly GMAC) as it seeks more subprime loan deals to drive sales volume ahead of its IPO. GM execs tell the WSJ that The General could do even better with an in-house finance arm, but that these deals will help. And, according to Experian Automotive’s Melinda Zabritski, GM needs the help because

By not financing [subprime] consumers, they are locking out about 40% of the U.S. population

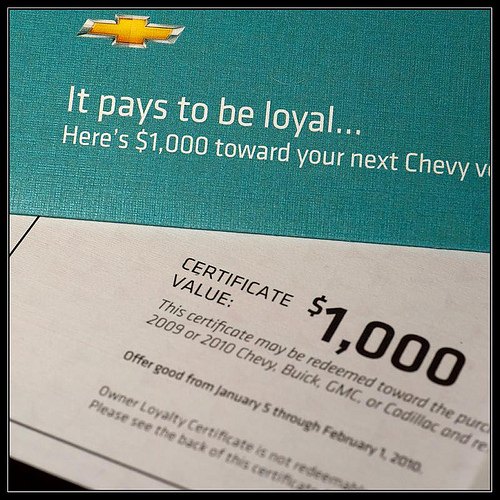

GM’s restructuring consultants AlixPartners add that loyalty improves for customers who buy using a captive lender. The downsides? Higher default risks, the temptation to overload on incentives, and then there’s one more biggy…

Everyone tries to draw you into it. . . . For us, it’s like choosing between your children… We have to keep an eye on what’s going on, for the sake of the taxpayer. But this is exactly why the government shouldn’t be in private-sector business

If the Obama White House is acknowledging the fact, long harped upon here at TTAC, that the auto bailout creates irreconcilable political conflicts, that represents a major shift in tone. It’s just too bad reality can only be acknowledged anonymously.

More by Edward Niedermeyer

Comments

Join the conversation

Sounds like a three legged stool that will not stand on it's own in the long run: 1. Govt bails out automaker 2. Govt bails out sub-prime lenders who finance car maker's loans 3. Govt gives clunker credits to sub-prime auto consumer who gets loan from no.2 to buy car from no. 1 PS And the car buyer might also be in over his head on a house he bought with a tax credit.

Its no change of tone. The White House always maintained that the government involvement in the banking and car industries was an emergency economic act, not a desirable state of affairs.

As did many others. Fear sells.