Is GM Worth More Than Ford?

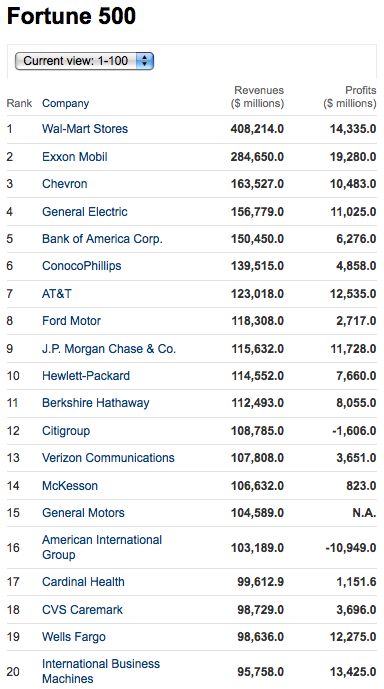

Since GM has only recently come out with GAAP-approved financials, determining the company’s value isn’t easy. Still, The Detroit Free Press‘s Tom Walsh reckons The General is worth more than Ford, despite the fact that GM recently fell out of the Fortune 500’s top ten (and below Ford) for the first time in its 100+ years of history. What gives?

Lest you think that Walsh is merely trolling for pageviews, and not actually suggesting that the unlisted GM is definitively worth more than the insurgent Blue Oval, consider his distinct lack of equivocation in saying:

strange as it may sound, GM is worth more than Ford

The strangeness of this assertion is beyond question, but whence cometh Walsh’s credulousness of this myth? The short answer is that Walsh has been drinking Steve Rattner’s fuzzy math Kool-Aid. Walsh breaks it down:

The task force pushed GM into bankruptcy last June, wiping out common stockholders and squeezing the holders of $27 billion in GM bond debt into accepting a 10% share of the nebulous value that a future, post-bankruptcy GM might achieve. Bondholders also got warrants to buy more stock in a New GM if its future value exceeds $15 billion, and again if it exceeds $30 billion.

That old bond debt, along with old lawsuits, contracts and other trash, was dumped into Old GM, or Motors Liquidation.

The GM bonds no longer function as traditional interest-earning bonds, but as bets on the future value of an initial public offering of stock in the New GM.

Since GM emerged from bankruptcy, confidence in its survival and possible rebound has grown. Bonds that were trading for a paltry 12 cents on the dollar a year ago rose to around 20 cents in November, and last week traded at about 34 cents.

That trading reflects estimates that GM’s total equity value may be somewhere in the range of $50 billion to $66 billion based on its current cash and debt and projections of future profits. By comparison, the total market value of Ford stock was $45.4 billion, based on Friday’s closing price of $13.43 a share.

On a positive note, at least Walsh had the decency to back away from Rattner’s laughable $90b valuation of GM’s theoretical market cap. Still, as we’ve already discussed, Rattner’s Motors Liquidation analysis is no more predictive of an actual valuation than any other vague analyst’s tool. And $50b-$66b doesn’t exactly speak wonders about the bailout’s effectiveness, considering that GM has received about that much in bailouts, finance-unit support, and loan guarantees from the feds in the last two years. Besides, both GM and Ford will need to part with hefty portions of their cash over the next year or so, as they deal with pension costs and foreign division bailouts (GM) and service debt (Ford).

Ultimately, Walsh might actually just be trolling. At the end of his post, he notes a few “ifs” standing between GM and a bigger market cap than Ford’s:

So, because GM has more cash than Ford (Thanks, taxpayers!) and less debt than Ford because of bankruptcy, GM is worth more than Ford? Yes. Well, maybe:

• If GM can post operating profits of $8 billion this year, as Ford is expected to do.

• If GM can deliver a couple of clean quarters of coherent financial reports, without special charges or bankruptcy-related legal and retiree costs, to build investor confidence before an IPO.

• If Wall Street stays enthusiastic about stocks and IPOs.

• And if the overhang of Uncle Sam’s desire to sell its 61% ownership stake doesn’t unduly depress GM’s future stock price.

These minor quibbles aside, GM is bigger, better and badder than Ford… even if it’s the only company in The Fortune 25 that doesn’t turn a profit (except for bailed-out financial giants Citi and AIG). If Walsh’s dissembling strikes you as weakly-argued and deceptive, get used to it. Until GM pulls of a successful IPO, we can expect a whole lot more in the way of imaginative valuations aimed at pumping up said IPO. When it comes to markets, perception is reality, a fact that GM is more than prepared to exploit.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lorenzo They won't be sold just in Beverly Hills - there's a Nieman-Marcus in nearly every big city. When they're finally junked, the transfer case will be first to be salvaged, since it'll be unused.

- Ltcmgm78 Just what we need to do: add more EVs that require a charging station! We own a Volt. We charge at home. We bought the Volt off-lease. We're retired and can do all our daily errands without burning any gasoline. For us this works, but we no longer have a work commute.

- Michael S6 Given the choice between the Hornet R/T and the Alfa, I'd pick an Uber.

- Michael S6 Nissan seems to be doing well at the low end of the market with their small cars and cuv. Competitiveness evaporates as you move up to larger size cars and suvs.

- Cprescott As long as they infest their products with CVT's, there is no reason to buy their products. Nissan's execution of CVT's is lackluster on a good day - not dependable and bad in experience of use. The brand has become like Mitsubishi - will sell to anyone with a pulse to get financed.

Comments

Join the conversation

FYI- Financials are not "GAAP" approved. There is no organization called GAAP. Financials are prepared in accordance with Generally Accepted Accounting Principles (GAAP) Cue a bunch of posts of people saying "who cares" "I am glad I am not an accountant". I regard these posters as simpletons. The important point is NOT the meaning of GAAP, but rather, if one is going to write professionally about something and use an acronym, one ought to know what it means. A fundamental error like this makes the writer look out of his depth.

GM say 'hi' to Chrysler for me when you arrive in the 5 digit range on that chart.