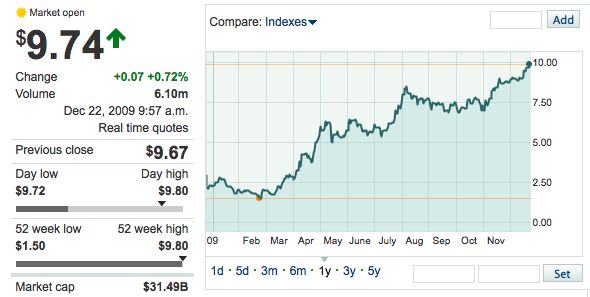

Is Ford's Stock Price Sustainable?

The Wall Street Journal‘s Liam Denning figures it isn’t. He writes:

Ford expects to resume profitability in 2011, and the consensus forecast is for per-share earnings of $1.13. The implied price/earnings multiple of 8.6 times doesn’t sound too demanding. But as Chris Ceraso of Credit Suisse points out, it translates to a margin of earnings before interest, tax, depreciation and amortization of nearly 10%, something Ford hasn’t enjoyed since the late 1990s.

Such margins aren’t impossible, and Mr. Ceraso sees potential increases in Ford’s valuation to almost $13 a share under this scenario. But this assumes a vehicle market of 14.5 million in 2011, up from about 10.5 million this year, and Ford gaining an extra 1.3 percentage points of market share. At 13.5 million units and a more modest market-share rise, Mr. Ceraso’s model spits out a valuation of about $6 or $7 a share.

More by Edward Niedermeyer

Comments

Join the conversation

From a April 22, 2009 news article: On Friday, Credit Suisse equity analyst Chris Ceraso said that even while Ford is making progress, its stock price is over-valued... "We think the stock is worth about $3," Ceraso said. "Thus, with the stock trading closer to $4, we do not think investors should chase it." This analyst clearly can't get ahead of the stock price. I pity his clients who sold F for less than $4.

Ford's sales are really lacking. The Mustang is DOWN, F-Series DOWN, Taurus already down from October to November, the Flex has been a disaster (40K sales for the year versus the predicted 100K), the "new" for 2008 Focus is DOWN 10%, The Lincoln Taurus has been down over 20% for the past 5 months, The Edge is DOWN, etc. The only thing Ford has going for it is the Fusion (for some reason) which is not making any money due to the re-skin and the Escape (again...why?)...which has not seen any significant upgrades since the introduction in 2001...so that may actually be making money. Ecoboost is a joke (unless you call a V6 getting V8 mileage "ECO"). Ford has carelessly invested a lot of money into gimmicks...and the sales are not there. Lincoln is a fancy trim level on a Ford and Mercury needs to go away ASAP. And Ford has already screwed up the Fiesta by making it ugly (grille and LED "fog" lights with tin foil behind them), decontenting the HID/projector headlights...and not offering it with a nav system or a moonroof...yet they still overprice it at $23K...for a cheap rollerskate. Add to that the mounting Ford debt and dwindling cash pile...and you have a severely inflated stock.

Ford is at the top of their game right now with fresh product and a competent outsider CEO. Being the only one of the artists formerly know as the D3 that does not carry a scarlet "B" also helps. If I held their stock right now I'd be chanting "burn baby burn" for RenCen. Ford, Hyundai and Subaru are best positioned to capture GMs declining market share.

Is Ford sustainable at 10? Yes. I don't have a bit of doubt about it. Remember this is an opinion on a stock price that you're reading on the internet, but I think there's a better than average chance that it will be pushing 20 at this time next year. There are all the reasons that have been mentioned already. They have the strongest lineup in the US market and they're as strong as anyone in Europe. China is growing. (But GM is still outselling them there by 8:1.) They've done a great job of lowering their costs, they have a stable management team that knows what the hell they're doing, they're increasing their market share while lowering their average incentives, their cash burn is beating predictions, they have money to develop new product, unlike Honda they're in a good position to grow market share - (breathe) - bottom line Ford is as well run and well positioned as any car maker on the planet. If car sales rebound before GM, Fiat/Chrysler or Toyota get their shit together, Ford is in an excellent position to make a fairly major move in the industry. But very little of that is likely to have anything to do with their stock price in the next year. The two big reasons why I'm bullish on the stock price in 2010 is 1) the company smells like a winner and 2) for the next eight or nine months they're going to be compared overwhelmingly against the worst sales numbers in a generation, which is going to reinforce #1. It sounds insane, but the perception people have about a company has a massive effect on its share price. Look at Apple and Microsoft. Microsoft is a larger and more diversified company, their profit margins are 40% higher than Apple's, their return on assets and equity is 50% higher than Apple, they have twice the operating cash flow, MSFT insiders own 50 times the percentage of shares in their company as AAPL insiders - and Microsoft pays a dividend. Yet when you compare the earnings per share to the difference in the stock price (to equal out the difference in the number of shares) investors have decided that the two companies are equal. It's totally irrational, except that a lot of people like Apple and they want to be associated with it. The same is becoming true with Ford. There are thousands of better companies to invest in if you just look at the pages on Yahoo Finance. But Ford smells like a winner right now in an industry that is otherwise filled with doom and despair. Even though Ford isn't profitable now, the (not irrational) belief that they will ties in with a part of investor psychology that wants to be successful, too. (It applies to consumer psychology, too. Ford will pick up market share if people perceive them to be more successful than the competition.) That can only carry you so far. But luckily for Ford they are going to start comparing against some brutally ugly numbers from last year. It's entirely possible that Ford could report in March or April that its sales are up 20% over the same month in 2009. Yes, it's a number that has a huge neon asterisk next to it because 2009 was such a crappy year, but the stock market usually doesn't care about that. Show a double-digit increase in anything, for any reason, and more people are going to want to buy stock in your company. This happened with Chrysler when it came back from the grave in the early 80's, and it's happened with companies that have grown profits through acquisitions more often than I can remember.