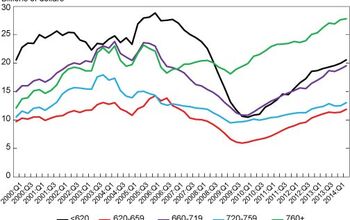

Auto Loan Delinquencies To Rise In 2010?

Credit reporting agency TransUnion is forecasting a rise in auto loan delinquencies next year, adding to the list of factors that could slow a turnaround in auto sector sales and profits in 2010. 60-day auto loan delinquency has been rising throughout 2009, reports the WSJ, as tighter lending standards have increased the ratio of delinquencies in outstanding loans. Those tighter standards sill contribute to a slight downturn in delinquencies in the first half of next year TransUnion’s Peter Turek tells Automotive News [sub], but by halfway through the year those numbers should increase again. Nationwide, TransUnion reckons .92 of all auto loans will be in delinquency by the end of 2010, compared to .86 at the end of this year. The average national auto debt is $12,542, and the Freep reports that loan terms are falling and average credit scores for approved loans are rising.

More by Edward Niedermeyer

Comments

Join the conversation

So let's say 10 million new cars are sold in the US in 2009, .92% of those sales would equal 9,200 in delinquent status. Out of 10 million. That's nothing. Why is this news??

Sorry, but this is NOT the national rate.

It has pretty much been running at a 10% to 12% rate for quite a while now. By the way, the numbers incorporated here do not incorporate buy-here pay-here lots or other large dealerships that do self-financing. When that's taken into consideration the real delinquent rate is closer to the 15% to 17% range.

The numbers in the article may be referring to a monthly rate.

Thanks for the pointing out it was a monthly figure. Mannheim says about 1.4 MM repos this year, IIRC. Pretend the sales number around 12MM, very roughly about 12% repo annual. I should've clarified too.

skor> Welcome to the US :-) IMHO if you can't pay cash for a new car or put 20+% down, you should be buying used w/ cash.