What's Wrong With This Picture: The Case For GM's IPO Edition

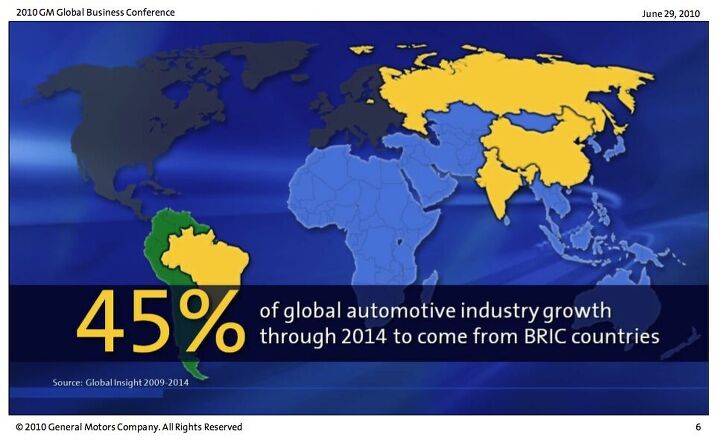

Will the North American market for cars go up 45 percent in the next four years? I’m not convinced. Certainly the momentum hasn’t shown up yet. But this slide is from GM’s “Global Business Conference” which the company is holding in Michigan this week to drum up support for its forthcoming IPO. So… a little over-optimism is hardly surprising. But we’re not the only ones skeptical of GM’s ability to take flight as a public company. Automotive News [sub] reports that

Mirko Mikelic, a fixed income portfolio manager at Fifth Third Bank in Grand Rapids, Michigan, said he expected GM to face grilling about the risks of a return to recession in the United States.

“There’s concern about a double dip out there. That’s probably the biggest thing that’s weighing over GM coming to the market because that’s going to keep (auto sales) down for another year or two,” he said.

Check out the complete presentation in PDF format here, and decide for yourself if The General is worth an investment. The slides after the jump are certainly more convincing…

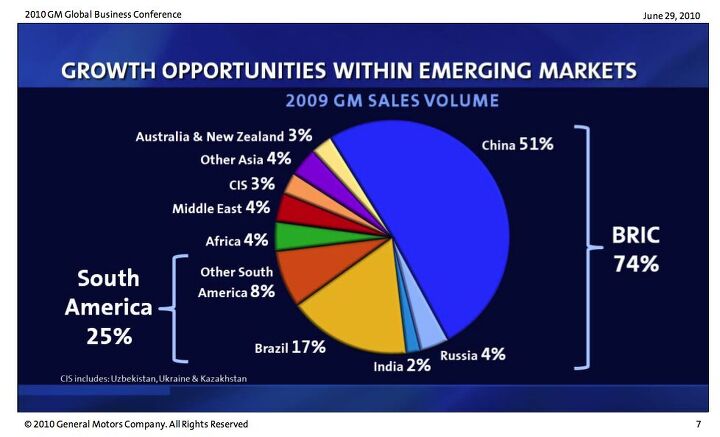

Luckily GM doesn’t have to rely completely on the US market… and it’s definitely the best-placed US automaker in key growth markets. No wonder its IPO fundraising is taking such an international tack.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts Poorly packaged, oddly proportioned small CUV with an unrefined hybrid powertrain and a luxury-market price? Who wouldn't want it?

- MaintenanceCosts Who knows whether it rides or handles acceptably or whether it chews up a set of tires in 5000 miles, but we definitely know it has a "mature stance."Sounds like JUST the kind of previous owner you'd want…

- 28-Cars-Later Nissan will be very fortunate to not be in the Japanese equivalent of Chapter 11 reorganization over the next 36 months, "getting rolling" is a luxury (also, I see what you did there).

- MaintenanceCosts RAM! RAM! RAM! ...... the child in the crosswalk that you can't see over the hood of this factory-lifted beast.

- 3-On-The-Tree Yes all the Older Land Cruiser’s and samurai’s have gone up here as well. I’ve taken both vehicle ps on some pretty rough roads exploring old mine shafts etc. I bought mine right before I deployed back in 08 and got it for $4000 and also bought another that is non running for parts, got a complete engine, drive train. The mice love it unfortunately.

Comments

Join the conversation

45% in 4 years means an increase of 9.7% per year. Is it me, or are they over confident?

The total U.S. market growth is more likely to be fits and starts with last year’s numbers to be about the mid-point. Also likely is General Motor’s continued market share erosion. They had better be able to show they can consistently show a profit at 75% of last year’s numbers or they are just burning through the government’s money with another nasty surprise when it's gone. Seeing their top cars at 12 of 15 and 19 of 20 in the August 2010 Consumer Reports list of family sedans doesn’t cut it.