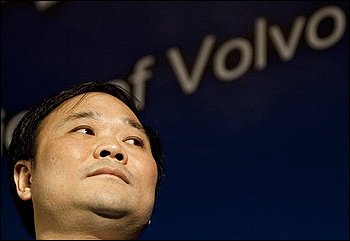

EU Clears Volvo Sale To Geely

The European Commission concluded that the sale of Volvo to China’s Geely would not significantly impede competition in Europe (well, that would have been a stretch), and approved the transaction, says Reuters.

Geely’s $1.8 billion takeover of Volvo from Ford was papered in March. The deal hasn’t closed yet, pending government approval. Now that Brussels has anointed the transaction, it’s up to the Chinese government to put their big red stamps under the deal. Nobody expects any opposition from that side.

The European Commission liked that “the horizontal overlaps between the activities of the companies were very limited, since Geely has almost no passenger car sales in Europe. Furthermore, Volvo’s very limited presence in the field of supply of diverse car components would not allow the merged entity to close off other market players.” Amazing.

Cryptic commission caveat: “The Commission’s approval of the merger is without prejudice to any eventual assessment or decision that it may undertake or adopt in the state aid field that may affect the parties to the present transaction.”

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

“The Commission’s approval of the merger is without prejudice to any eventual assessment or decision that it may undertake or adopt in the state aid field that may affect the parties to the present transaction.” Uh, um, okay... I think...