Report: Honda e:Ny1 to Drop Terrible Name

Honda is said to be changing the naming of its electric cars after customers, particularly those in China, found its name to be exceptionally difficult to pronounce. However, they weren’t the only ones. Europeans likewise didn’t appreciate the name, nor the odd choice of punctuation and capitalization that seems to plague some all-electric vehicles.

White House Vows to Investigate Security Risks Posed by Foreign-Connected Vehicle Tech

On Thursday, the Biden administration announced plans to investigate the potential national security risks being confronted by American automakers and any threats posed by connected vehicle technologies controlled by foreign adversaries — including China.

China’s BYD Says Prospective Mexican Plant Won’t Export to U.S.

Chinese automaker BYD has been seeking to build an automotive plant in Mexico, with the company’s regional chief executive confirming the plan on Wednesday. CEO Stella Li has stated that BYD has yet to decide upon a final location. But that plan is for the site to boast a production capacity of 150,000 vehicles annually, with none being slated for export to the United States.

Senate Bill Seeks to Tariff Chinese Vehicles Out of Existence

This week, Senator Josh Hawley (R-MO) is introducing legislation to increase tariffs on imported Chinese vehicles this week with the stated goal of dealing with the “existential threat posed by China.”

The bill seeks to raise the base tariff rate from 2.5 percent to 100 percent, including vehicles owned by Chinese-based automakers that are assembled in places like Mexico. With Chinese exports already under a 27.5 percent tariff, the changes would effectively make those products prohibitively expensive.

Imported Audi, Porsche, and Bentley Models Held Back Over Forced Labor Allegations

Thousands of vehicles manufactured under the umbrella of Volkswagen Group are being held at U.S. ports for allegedly violating the Uyghur Forced Labor Prevention Act (UFLPA). Enacted in 2021, the law is supposed to prohibit the utilization of slave labor in Western China. While the impacted automakers include Porsche, Bentley and Audi, we’ve seen plenty of brands being accused of leveraging forced labor in the Xinjiang region of China, where the country is said to have forcibly concentrated the Uyghur ethnic minority.

Report: BYD Plotting New EV Factory in Mexico

China’s BYD is reportedly prepared to set up a new production facility in Mexico with the alleged plan to use the locale as an export hub for the United States.

Mexico has long been a convenient venue for automakers vying to sell products within the Western Hemisphere without having to pay the kind of salaries commensurate with higher living standards. American brands love sending jobs to Mexico, as does every other company interested in moving high volume models through North and South America. With BYD having previously voiced its global aspirations, setting up shop in El Águila Real seems like an obvious play.

China's Huawei Establishes ‘Smart Car’ Unit With Changan Auto

Huawei has announced it will continue becoming intertwined with the automotive sector after signing onto a joint venture with Chinese state-owned carmaker Changan Automobile. The telecommunications giant has established Shenzhen Yinwang Intelligent Technology with a registered capital of 1 billion yuan ($140 million USD) and a focus on smart car equipment manufacturing, artificial intelligence system integration services, and AI software development.

Report: Chinese Export Rule Changes Could Impact EV Battery Production

China has reportedly decided to place restrictions on exports of graphite, which could spell trouble for American EV manufacturers. Starting this month, the Chinese government requires permits for certain graphite products being exported. This includes synthetic and natural graphite meeting the necessary thresholds to be used on electric vehicle batteries.

Report: China’s Chery Considers U.S. Market Yet Again

Chinese state-owned automaker Chery is reportedly still looking to the United States as a possible point of expansion. But this isn’t the first time the brand has said so.

Chery had plans to break into our market back in 2005 and supposedly had things lined up to import a limited supply of its Exeed crossover in 2020 before the world went haywire. Things have been left intentionally vague this time around, with the company only saying that it would like to move product here eventually.

Polestar is Cooking Up a Smartphone for the Chinese Market

China is the world’s largest auto market, with nearly 30 million cars sold there last year, and automakers of all stripes are eager to grab a piece of the action, especially with electric vehicles. Tesla, Ford, General Motors, and most luxury brands offer broad product lines in the country, and that includes Volvo and Polestar, both owned by Chinese auto giant Geely. That relationship with China gives the automakers the ability to offer unique products there, and Polestar’s latest innovation is a great example. It has developed a new smartphone that it plans to sell with its debut SUV in the country, the Polestar 4.

BYD to Chinese Auto Industry: "Demolish the Old Legends" in the EV Race

Build Your Dreams, or BYD, is likely one of the largest companies you’ve never heard of. The Chinese giant is one of the world’s busiest EV automakers, with almost 1.9 million units manufactured in 2022. Though enormous, BYD isn’t satisfied with dominating its home market and wants the rest of the Chinese electric auto industry to come with it.

QOTD: How to Succeed in China?

Ford is scaling back in China. Yet, at the same time, General Motors' Buick brand survived the brand purges in 2008-2009 in part because of its success in China.

So, what is the best way for non-Chinese makes to succeed in that market?

Ford to Pull Back On Future Chinese Investments

Ford will be scaling down future investments in China, as the company’s chief executive has suggested that there will be “no guarantee” Western automakers can compete with local electric-vehicle rivals. This should have been obvious to American manufacturers who have historically been required to engage in partnerships with Chinese corporations just to sell within the region. But it also speaks to hardships Ford has endured while trying to break into the market.

Report: Ford CEO Says China Strategy Changing

Ford Motor Company is tweaking plans in China and seeking to turn around financial losses after five years of lackluster sales within the region. The new strategy will be focused on exporting to other countries, commercial product, and reinforcing the necessary supply chain for all-electric vehicles.

BYD: Autonomous Vehicles Are "Basically Impossible"

BYD, China’s largest electric automaker, isn’t as gung-ho about autonomous vehicles as many other auto industry giants. A company spokesperson recently said that BYD believes self-driving tech that is “fully separated from humans is very, very far away, and basically impossible.”

QOTD: Do You Actually Care About Chinese Imports?

Following our coverage of the Lincoln Nautilus Hybrid, reader feedback seemed overwhelmingly focused on the vehicle being manufactured in China. This was interesting because the article dealt exclusively with updates to the vehicle, which is technically still a product of North America.

But Ford Motor Co. has confirmed that the next-generation Nautilus will indeed be imported from China so that the Canadian facility currently responsible for U.S. volume can be transitioned into an electric-vehicle plant.

What's Wrong With This Picture: Two Mules, One Market Edition

As we’ve already seen, BMW is building a record number of variants of its next-generation 3 Series, including “GT” hatchback and X4 “Sport Activity Coupe.” But as this photo shows, there is at least one other Dreier bodystyle that we hadn’t heard about yet: the long wheelbase sedan (top). Given the brand’s post-Bangle swing towards extreme styling consistency, the decision between a LWB 3 series and a 5 series seems to have serious head-scratching potential… but it’s not something we’ll have to worry about. The LWB sports sedan will only be sold in China, according to Auto Motor und Sport, where upmarket buyers favor chauffeurs… even in the Ultimate Driving Machine.

BYD Pumps Brakes on Entering U.S. Market

BYD is a massive Chinese company operating in multiple industries, including solar panels, industrial equipment, and autos. Rumors of its imminent arrival in North America have swirled in recent months, and the automaker was expected to mount a strong showing at CES in Las Vegas earlier this month, but nothing materialized.

Indonesia is Suffering the Consequences of China's EV Explosion

Electric vehicle naysayers love to talk about the environmental impact of mining raw materials for batteries. While those arguments are often rooted in some degree of truth, they’re generally made as the only argument and are levied without much evidence for support. Though it’s true that mining and processing nickel, cobalt, lithium, and other materials is awful for the environment, we’re learning more about the geopolitical and financial implications of the practice.

Weird Wheels: GM Selling Tiny Convertible EV Via Chinese Lottery

With a majority of automakers snubbing the upcoming auto show in Detroit, there’s not likely to be much to talk about in terms of new product beyond the next-generation Ford Mustang. But there are interesting things happening elsewhere on the planet if we’re using interesting as a polite euphemism for strange.

General Motors’ joint operation in China, SAIC-GM-Wuling Automobile Co., is releasing a poverty-tier convertible that makes the long-dead Chrysler Sebring look positively decadent by comparison. Based on the Wuling Hongguang Mini EV – a boxy microcar that only measures 114.8 inches in length – the Cabrio will be a limited production convertible requiring Chinese customers to participate in a lottery.

Report: Honda Considering Seperate Supply Chain for Chinese Market

Honda is reportedly considering tweaking its global supply chain to create a firm distinction between the Chinese and global markets. While the whole world has seen production stymied by restrictive protocols introduced in response to COVID-19, the Chinese Communist Party has retained a zero-tolerance policy that appears to have totally upended its economy and resulted in continued factory stalls. That's bad news for several Japanese automakers that have stepped up their reliance on Chinese production.

Last year, roughly 40 percent of Honda's automotive production (which includes part sourcing) came through China. This year, the company is allegedly wondering how to tear itself away from the market without losing the ability to sell cars to its massive population.

Chinese Toyota Plant Runs Out of Electricity

Toyota has suspended operations at a factory in China because local authorities issued an order for the region to conserve electricity. Sichuan province is reportedly rationing energy for both residential and industrial zones, complicating things for manufacturers. Toyota has said that the plant is likely to be closed through Saturday — adding that it would be monitoring the situation and taking guidance from the Chinese government. But the issue could have sweeping ramifications because the area is also home to numerous part suppliers.

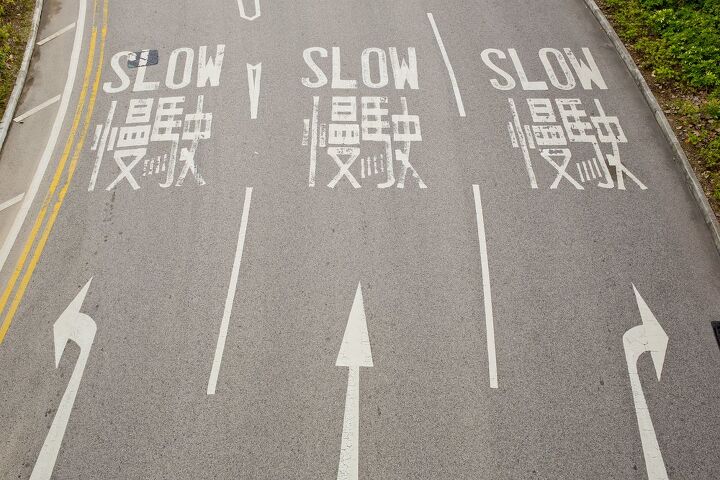

How Shanghai Lockdowns Are Changing the Auto Industry

While the semiconductor shortage was long considered the excuse par excellence for why the automotive sector couldn’t produce enough vehicles during the pandemic, some manufacturers have begun pivoting to blaming supply chains that have been stymied by Chinese lockdowns. Toyota is probably the best-known example. But the matter is hardly limited to a singular automaker and market analysts have already been sounding the alarm bell that strict COVID-19 restrictions in Asia will effectively guarantee prolonged industrial hardship around the globe.

Back in April, Shenzhen was emerging from a month-long lockdown. However, the resulting downtime severely diminished the tech hub’s output which exacerbated global component shortages. While Chinese state-run media claimed regional factories maintained full-scale production during the period, the reality was quite a bit different. Meanwhile, Shanghai has remained under harsh restrictions since March and more look to be on the horizon. As an important industrial center and the world’s busiest port by far, the situation has created an intense backlog of container ships that are presumed to create some of the sustained problems that we’re about to explore.

Audi Urbansphere: A Trojan Horse

Back when everyone still bought into the hype surrounding self-driving cars, automakers were releasing concept vehicles framed as a “lounge on wheels.” The theory was that once autonomous vehicles hit the mainstream, companies would begin dropping futuristic models with swanky interiors because drivers would no longer be responsible for piloting the car for the duration of its journey. However, the public eventually learned that autonomous driving technologies had failed to progress as promised and would likely come with a host of restrictions plenty of drivers wouldn’t be interested in once the wrinkles had been ironed out.

But there are a whole host of markets to be tapped, the public has a relatively short-term memory, and there’s always a chance that some major headway was made during the last few years of development. So we’ve seen a resurgence of mobility talk from the industry, especially as it relates to all-electric vehicles. Case in point is the Audi Urbansphere — an autonomous concept vehicle designed for “Chinese megacities” but allegedly perfect for a metropolitan area near you.

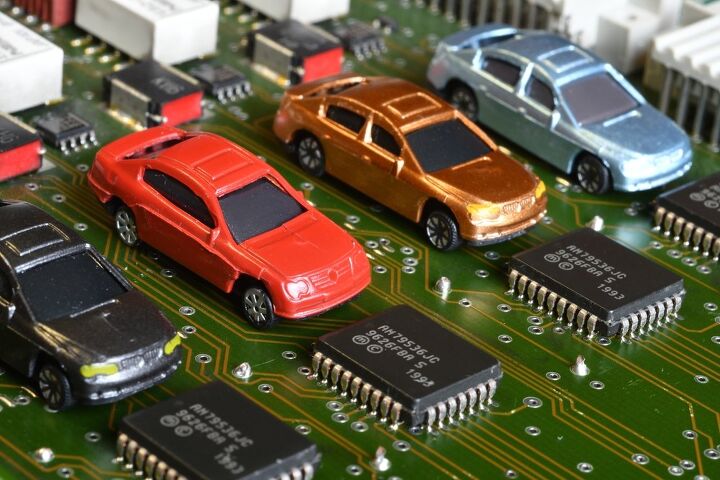

Chip Shortage Lambasts Europe, Supply Chains Confront New Problems

Even though the global semiconductor shortage has been going strong for about two years now, the world has failed to successfully manage the situation. Production stoppages remain relatively common within the automotive sector, with manufacturers continuing to attribute factory stalls to an inability to procure a sufficient number of chips. But the excuse seems to have evolved into a catch-all explanation for supply chain issues that continue that go beyond a single missing component.

That makes it a little hard to determine precisely how much of the ongoing production shortfalls can be pinned on semiconductors. But AutoForecast Solutions (AFS) was keen to take a whack at it and determined roughly 1.4 million vehicles have been removed from the automotive industry’s targeted output for 2022 — that’s on top of the 10.5 million units we lost in 2021. While the issue is indeed global, AFS stated that the last batch of vehicles to get the ax was predominantly from Europe.

SEC Subpoenas Faraday Future Executives

Several executives from perpetual automotive startup Faraday Future have reportedly been subpoenaed by the U.S. Securities and Exchange Commission as part of an investigation into inaccurate statements made to investors. Though, considering the nameplate’s history, it would be impossible to assume which item the SEC will be focusing on thanks to FF’s exceptionally long history of industrial misgivings.

We’ve covered Faraday Future’s long and bizarre story from the early days of delivering half-baked, though otherwise impressive, concepts to its more recent status as an automaker in the ethereal sense. It’s promised the moon and only managed to deliver a handful of production husks that never surpassed the body-in-white phase and some “production-intent” prototypes of the FF91. Though the larger story is the SEC’s sudden interest in electric vehicle startups that went public via mergers with blank check firms, better known as special purpose acquisition companies (SPACs), over the last two years.

GM China Has Employees Living Inside Factories

General Motors’ joint venture in Shanghai is reportedly having employees sleep on factory floors to remain operational during regional COVID-19 lockdowns. The facilities are operated collaborative by GM and state-owned Chinese partner SAIC Motor Corp, with government restrictions being in place until at least Friday. Due to the tens of million people affected, it’s one of the largest lockdowns instituted since the pandemic started.

Initially reported by Reuters, the situation was framed as GM finding a workaround to ongoing Chinese lockdowns while other companies simply stopped production. But that seems to be glossing over some of the relevant context, mainly that the plant is now loaded up with workers who are sleeping inside the factory and living in relative isolation to ensure the facility is compliant with China’s stringent zero-tolerance policy while still managing to remain competitive.

Tesla Pauses Production in Shanghai

Tesla Inc. is briefly suspending production at its Shanghai factory for two days, starting today, as China upgrades restrictions pertaining to a new COVID outbreak. While the rest of the world has been scaling back pandemic-related restrictions, the Chinese Communist Party has begun issuing new mandates after locking down 51 million people at the start of the week. The government has said its part of its no-tolerance approach to the virus after citing roughly 1,700 infections spread across a dozen cities.

This has already started impacting supply chains that have been beleaguered by two years of restrictions already, apparently catching Tesla in the process. Despite Shanghai not having been issued any official orders, there’s been mounting pressure for businesses to temporarily shut down or reinstate protocols to have people work from home.

Volkswagen Shifting Production Out of Europe, Into U.S. and China

Volkswagen Group will be moving some of its European production out of the continent and into facilities located in China and the United States, citing the war in Ukraine as the largest contributing factor. Though if you’ve been following the company, it had already signaled a desire to raise its capacity in China ever since the region shifted into becoming its largest market.

In fact, Chief Executive Herbert Diess said during Tuesday’s press call that China will be taking precedence as the automaker reorganizes its manufacturing.

Toyota Confronting Widespread Factory Stalls in Asia

Toyota Motor Corp is currently having to contend with idle factories in Asia, reducing the automaker’s estimated output by over 47,000 units this month. Shockingly, it’s not alleged to have anything to do with the semiconductor shortage that’s been wreaking havoc on Western markets.

With chip production having been localized primarily in China and Taiwan, Asian suppliers have had better access to them. But Eastern markets have still been subjected to other routine plant closures due to supply chain restrictions stemming from the pandemic. Existing protocols in China, combined with renewed restrictions in Japan, have created a situation impacting numerous automakers with Toyota announcing this week that it probably won’t reach its goal of manufacturing 9 million cars this year — though it made sure to include the ongoing semiconductor issue as relevant.

Elon Musk Continues Insulting Biden Admin's EV Tax Credit Scheme

Elon Musk has continued bashing the Biden administration’s tax credit legislation designed to spur electric vehicle adoption, this time suggesting that the entire bill be scrapped. Included as part of the Build Back Better Act that’s focused on addressing various social, infrastructure, and climate issues, Musk suggested the entire text simply be done away.

“Honestly, I would just can this whole bill,” he stated at The Wall Street Journal’s CEO Council Summit, appearing remotely from Tesla’s construction site in Austin, Texas.

Tesla Keeps Raising Prices for U.S. But Not China

This year has already seen price increases across the board, thanks largely to the supply crisis created in the wake of our response to the pandemic. As it turns out, shutting down the global economy wasn’t ideal for maintaining business as usual and nobody in charge seems all that interested in returning things to normal. Automotive prices have become particularly troublesome, as manufacturing costs have risen and a deficit of product has made this a seller’s market.

Tesla has been raising rates all year, particularly on its higher-volume models. By June, price bumps had become so common with the brand that CEO Elon Musk had to address the matter. He blamed industry-wide supply chain pressures, noting that raw materials had become particularly costly. While a totally rational explanation, there are problems with it when you realize those end-of-line price hikes aren’t being extended to China.

Volvo Buying Itself Out of Chinese Joint Venture

Volvo Cars is plotting to buy out parent company Zhejiang Geely Holding and free itself of its Chinese joint venture. The Swedish (currently Swedish-Chinese) manufacturer has been hinting at the prospect of going public with an IPO, which most analysts believe would be bolstered by creating some distance from Geely.

While the Chinese Communist Party has ended mandates requiring electric vehicle firms from entering into joint ventures with established domestic businesses, the rule still exists for traditional automakers. However, the general assumption is that most will attempt to regain full ownership of their Chinese assets when the law is lifted next year. But critics are cautioning that the nation is under no obligation to maintain any commitment to foreign entities once they’ve split with their local partners.

Tesla 'Recalling' 285,000 Vehicles in China Over Autopilot Issue

The Chinese Communist Party seems to have it out for Tesla. Following bans that prohibited the brand’s vehicles from parking themselves anywhere near a military base, China’s government has decided to recall over 285,000 Tesla automobiles sold in the country. We’ve also seen state-run media outlets begin branding the automaker as irresponsible and arrogant amid consumer protests some are concerned might have been staged for political reasons. Though it’s painfully hard to get inside the head of the CCP while you hope for concrete evidence of any of the above. Propagandizing and censorship have reached a level where just about everyone is having difficulties distinguishing up from down.

What is certain, however, is that Tesla’s regional volume has taken a noteworthy hit in 2021 despite sales more than doubling the previous year. While this may have nothing to do with the bad publicity and recall campaigns, we’re betting the latest example — which pertains to customers misusing Autopilot — won’t help matters.

Audi Transitioning Solely to EVs Doesn't Include Chinese Market

Volkswagen Group has been prattling on about electrification for years and ultimately decided that Audi would be the tip of its progressive spear. The brand has cachet as both a luxury and performance division, while simultaneously possessing VW’s magical ability to produce vehicles that don’t become an eyesore after you’ve had them in the garage for a decade.

While transitioning toward EVs runs the risk of spoiling that, Audi is clearly the VW property best positioned to come after would-be Tesla customers and is not hesitant to issue reminders that it’s serious about being a global leader when it comes to battery-driven vehicles. On Tuesday, the Ingolstadt-based company announced plans to exclusively launch electrically driven automobiles from 2026 onward — adding that it doesn’t even plan on selling internal-combustion vehicles by 2033.

But these rules won’t apply to the Chinese market, which will be flush with internal-combustion vehicles produced within its borders years after the rest of the world has apparently lost the option to purchase them.

Senate Approves Bill Injecting Cash Into Semiconductor Industry

Apologies for all the semiconductor news. But it’s the topic of the day, with the United States Senate recently approving $52 billion in emergency spending to help bolster domestic chip production and another $190 billion for R&D programs.

Passing the vote (68-32) under the premise that boosting localized chip production would help prevent domestic automakers from having to cut corners, the Senate is also suggesting the funding could give the U.S. a competitive advantage against China. The Communist Party of China (CCP) has opposed the U.S. Innovation and Competition Act (formerly the Endless Frontier Act), with statements released from the National People’s Congress (NPC) demanding the legislation be halted immediately.

GM's Cruise Asks White House to Dissolve AV Testing Restrictions

General Motors has a long and illustrious history of receiving government favors, with 2021 likely to continue the trend. Having recently seen its request to have federal EV tax credits reset approved by the Senate Finance Committee, GM-owned Cruise is now seeking to double down by asking regulators to scale back restrictions on autonomous vehicle testing. With practically every automaker simultaneously requesting government hookups on a weekly basis, it’s hardly surprising to see this.

What is unique is the rationales given for government help and it’s often the only way to measure their merit. While most claims tend to boil down to “ we need more money,” Cruise wants regulators to get out of the way so the United States can become more competitive against China’s AV programs and is hardly the first company to make such a suggestion.

QOTD: Will Foxconn Make Fisker's PEARs?

Foxconn, also known as Hon Hai Technology Group, announced that it signed a development and manufacturing agreement with Fisker. Foxconn is one of the world’s largest electronics manufacturers and the producer of Apple’s iPhone.

Report: Tesla Won't Be Buying More Land in Shanghai

Tesla has reportedly canceled plans to expand its Shanghai plant. The electric vehicle manufacturer originally intended to make a land purchase and create a global exportation center for its products. But tensions between China and the United States have persisted, making any vehicles shipped to our market substantially less profitable for the company.

Automobiles exported from China are currently subject to a 25-percent tariff issued under the Trump administration as retaliation for the Chinese Communist Party’s heavy restrictions on foreign manufacturers. While Tesla is one of the only companies in existence that isn’t subject to China’s mandatory joint venture, resulting in a factory it wholly owns, the firm would still be subject to tariffs on every vehicle shipped to the U.S. and has recently endured a campaign of negative publicity in the region. China seems suddenly less friendly toward Tesla and it’s responding with the maximum amount of caution.

QOTD: Change the World's Climate by 2030 or Just Talk About It?

The world’s climate has been centerstage the last two days. President Biden and other world leaders have vowed to reduce global warming by making drastic changes. Will they follow through?

At the 2015 Paris climate accord, then-President Obama set greenhouse gas reduction at half what Biden has proposed. Former President Trump, Obama’s successor, did little to forward this, but is it realistic for Biden, who served as Obama’s vice president, to double down on Obama’s goal in a relatively short time frame?

Biden to Slash U.S. Fossil Fuel Emissions 52 Percent by 2030

Today President Joe Biden committed to cutting U.S. fossil fuel emissions up to 52 percent by 2030. His statement came during a virtual climate change summit with 40 world leaders.

2023 Vantas VX SUV and T-Go Coming to the U.S.

The Vantas VX SUV will go on sale in the U.S. in late 2022. HAAH Automotive Holdings and Sicar announced yesterday that they will import Vantas and T-Go vehicles. This is a prelude to HAAH and Shanghai Sicar Automotive Technology manufacturing vehicles stateside. The COVID-19 pandemic delayed their U.S. manufacturing startup.

Ford Evos: Blueprint for the Fusion Active?

Ford debuted a new concept in Shanghai today, one that might hint at the vehicle that will be filling in for the Fusion (Mondeo in Europe) as the automaker continues removing all traces of the sedan from its lineup. While the Evos is intended to become the manufacturer’s default midsize for the Chinese market, it seems to possess many of the aspects promised on the long-awaited Fusion Active — the presumed successor of the venerable Fusion sedan.

Though the car itself resembles something closer to the Mach-E or perhaps a lowered version of the Chevrolet Blazer. The Evos’ general shape exists somewhere between a crossover and a traditional passenger car, much like the Subaru Outback the Fusion Active has been assumed to be targeting. But it’s not a perfect fit and Ford is keeping many of the details to itself, making it very clear that the concept will be the blueprint for future models and not necessarily a snapshot of something that’s production-ready.

2021 Mercedes-Benz EQB – Electricity Flows

Mercedes-Benz’s 2021 EQB is its third all-electric launch this year, along with the EQA 250 and EQS. The EQB will be produced for the local market in Beijing. The rest of the world will get their EQBs from Kecskemét, Hungary. The EQB will be the first pure EV made in Hungary.

Volkswagen ID.6 Readied for China, Perhaps North America

Unveiled at the Shanghai auto show, Volkswagen’s ID.6 is reportedly ready for the Chinese market as the manufacture strives to present itself as an EV firm. Originally known as the spacious ID Roomzz concept, the three-row crossover will be the VW’s largest product on the Asian market and come in two distinct flavors — each the offspring of separate joint ventures required by the Chinese government.

The ID.6 Crozz (shown in orange) will be produced at the FAW-Volkswagen facility in Foshan while SAIC Volkswagen will be responsible for manufacturing the ID.6 X (purple) at its plant in Anting, near Shanghai. Regardless of which model customers go with Volkswagen is promising a vehicle “tailored specifically to the needs and wishes of Chinese customers in terms of space, functionality, design and, in particular, user experience.” While we may eventually see a version of the ID.6 coming to North America, China is Volkswagen’s largest individual market and ranks higher in the manufacturer’s list of priorities.

Chinese Auto Sales Reportedly Rebounding Robustly

The China Association of Automobile Manufacturers (CAAM) is reporting its home market grew 74.9 percent in March, resulting in nearly 2.53 million new-vehicle deliveries. While we’re often skeptical of the organization’s rosy predictions and tallies, it’s claiming the recent sales surge is the direct result of how bad things had been in the previous year. China instituted some of the most aggressive lockdown protocols of any nation in the initial stages of the pandemic and had already been struggling with a declining vehicle market in 2019.

CAAM is making no illusions about the gains being based on anything other than how horrible March of 2020 was and doesn’t want to overpromise moving ahead. It’s a warning that the semiconductor shortage will likely worsen as the year continues, dampening Q2 projections. But the organization has not yet revised its forecast for next year’s overall sales. Last December, CAMM predicted roughly 26.3 million vehicles would be delivered by the end of 2021 and appears to be running with that target.

Chinese Smartphone Titan Xiaomi Entering the EV Race

Xiaomi, a Chinese smartphone colossus, has announced they are building their own branded electric vehicles (EVs), just like Apple, Huawei, Sony, and Foxconn.

If you’re prepared to lose money, starting a car company is easy. Just ask Tesla. Xiaomi has plenty, enough to sink $10 billion into the venture over the next 10 years.

Volkswagen Reportedly Buying Carbon Credits From Tesla China

One of Volkswagen’s joint ventures in China has reportedly offered to purchase regulatory credits from Tesla in order to adhere to the regional environmental ascendancy. While VW may be doing everything in its power to swap over to an electric-vehicle manufacturer, it’s apparently falling short of government dictums.

FAW-Volkswagen — which shipped a little over 2 million automobiles in Asia last year — happened to be one of the biggest polluters of 2020 according to China’s Ministry of Industry and Information Technology. As it turns out, selling internal combustion vehicles consumers actually want to purchase in large quantities has some kind of environmental cost. Fortunately, it’s one regulators think can be solved by buying green credits from rivals who do all of their polluting during the initial assembly process and launder any future emissions through the national energy grid.

Great Wall Motor's Haval H6 Hybrid – Another Brick in the Wall?

Great Wall Motor (GWM) premiered the new Haval H6 Hybrid SUV at the 42nd Bangkok International Motor Show this week, a reaffirmation of the company’s xEV commitment to Asian if not world domination.

Another One: Geely Announces Zeekr EV Brand

Geely Auto Group has announced the formation of an electric technology firm and automotive brand called Zeekr Company Limited. With the Chinese group already holding numerous mobility-focused brands with a penchant for electrification, it’s a bit curious to see it launching another one. But Geely has indicated that Zeekr will be aimed at the premium EV market using a similar business model as Lynk & Co.

That likely means selling vehicles as a service, rather than a product owned by the driver — something we’ve been incredibly wary of since the industry starting mulling over things like subscription services and online sales. Owned jointly owned by Geely Automobile Holdings and Zhejiang Geely Holding Group, the plan is to start launching products in China before the end of 2021. It’s quite the swift turnaround, leading us to believe there will be some platform sharing with other Geely-owned automotive brands. New product is said to be introduced every twelve months over the next five years.

The Week of Driving Autonomously in an Xpeng

XPeng, a Chinese maker of EVs, sent a fleet of XPeng P7s on a 2,284-mile, weeklong autonomous driving jaunt across six provinces, the longest by any mass-produced vehicles in the country.

Report: Chinese Military Bans Tesla Vehicles From Facilities

The Chinese military has decided to ban all Tesla vehicles from housing complexes and bases after citing them as a potential security risk. Since the cars use an array of ultrasonic sensors and cameras to create a panoramic view used for advanced driving features, China is concerned the American brand could use the cars to covertly map out sensitive areas.

Ford Cancels EV Joint Venture With China's Zotye

Ford Motor Co. has decided against its plan to launch an electric vehicle joint venture with China’s Zotye Automobile. The American manufacturer confirmed the decision on Thursday, stating that the Chinese Communist Party (CCP) had made sweeping changes to its policies since the deal was initially agreed to in 2017.

Few specifics were given beyond that and Ford hasn’t indicated the move might suggest a retreat from the one-party socialist republic. Ford recently confirmed its plan to build Chinese versions of the all-electric Mustang Mach-E with Chongqing Changan Automobile Co. and maintains numerous joint ventures necessary to continue doing business inside Central Asia.

Amazon's Bezos Transitions to Exec Chair and Names New CEO

Amazon’s founder and CEO Jeff Bezos announced today that he will transition to Executive Chair in the 3rd quarter of 2021, with Andy Jassy to replace him as CEO at that time.

Ford to Offer Chinese Version of Mustang Mach-E

Ford announced that a Chinese version of the Mustang Mach-E, also known by some of us cynical scribes as the Mustang Mock-E, will be built in China by Changan Ford.

Do Cabin Air Filters Combat COVID-19?

Cabin air filters in your car have been around for awhile, but recently companies promoting their ability to filter out the coronavirus have appeared. Is this even remotely possible?

South African Crash Test for Dummies

The Steed 5 pickup, Haval H1 five-door SUV, and the Renault Kwid five-door compact, all achieved poor levels of adult and child protection in crash tests conducted by Global NCAP and AA South Africa yesterday.

Millennials Really Do Intend to Buy Cars. Thank the Pandemic.

Forget all you’ve heard about Millennials (24-39 years old) and their disdain for automobiles. COVID-19 has changed that, as 31 percent of those without a car intend to buy one in the next six months, and 45 percent of them are Millennials.

EY, a global leader in assurance, tax, strategy, and consulting services, and a member of Ernst & Young Global Limited, issued their 2020 EY Mobility Consumer Index, surveying over 3,300 consumers across nine countries. Thirty-one percent of the respondents who don’t own a car plan to buy one in the next six months, while 20 percent that already own a car say they would be open to buying another vehicle. Both groups said that one of their principal reasons to purchase is the pandemic.

Don't Bet on Seeing Chinese Brands in the U.S. Anytime Soon

Over the past decade, regular reports that Chinese automakers were readying a major push into the North American market became commonplace. We started seeing them move out of trade show basements to take up some of the most desirable real estate on the main floor. While some of the product clearly wasn’t yet up to snuff, one could imagine budget-focused products flooding the U.S. and Canada after a few years of polish. However, the last time that seemed like a likely scenario was 2018.

Chinese brands are still trying to break into the untapped North American market; some even have physical office space set up within the United States. However, Sino-American relations have soured dramatically over the past few years, and new financial hurdles have made wrangling a new market extremely difficult.

Recent Comments