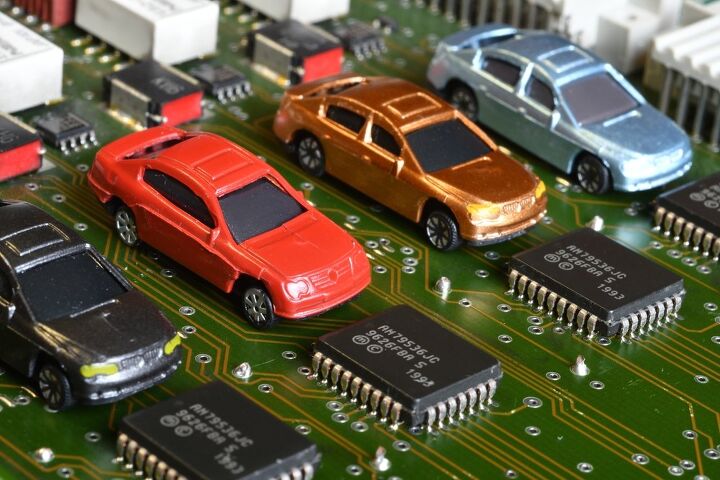

Chip Shortage Lambasts Europe, Supply Chains Confront New Problems

Even though the global semiconductor shortage has been going strong for about two years now, the world has failed to successfully manage the situation. Production stoppages remain relatively common within the automotive sector, with manufacturers continuing to attribute factory stalls to an inability to procure a sufficient number of chips. But the excuse seems to have evolved into a catch-all explanation for supply chain issues that continue that go beyond a single missing component.

That makes it a little hard to determine precisely how much of the ongoing production shortfalls can be pinned on semiconductors. But AutoForecast Solutions (AFS) was keen to take a whack at it and determined roughly 1.4 million vehicles have been removed from the automotive industry’s targeted output for 2022 — that’s on top of the 10.5 million units we lost in 2021. While the issue is indeed global, AFS stated that the last batch of vehicles to get the ax was predominantly from Europe.

According to Automotive News, AutoForecast Solutions identified an additional 98,900 vehicles that will never see assembly this week and all but a handful would have been coming out of Europe. Over a longer timeline, the forecast remains particularly bleak for the region as legacy manufacturers begin signaling their retreat. As an example, Volkswagen Group recently announced it would be deprioritizing the EU in favor of the United States and China — with the latter nation taking precedence.

From AN:

European factories accounted for 97,600 of the increase. So far this year, they have eliminated some 747,000 vehicles because of the global chip shortage.

Assembly plants elsewhere in the world saw relatively little chip-related disruption, however. Only about 1,300 more vehicles were axed at North American factories, while no additional cuts were reported in Asia, South America the Middle East or Africa.

End-of-year projections estimated Europe will be shy well in excess of a million cars. North America has fared better with a short of 341,300 vehicles and end-of-year projections hovering just over 500,000. Asia, which has actually been the least impacted by absentee semiconductors due to it being the world’s primary purveyor of chips, is assumed to see 420,500 fewer vehicles than planned with just 211,700 having already been culled.

Though that doesn’t include China, which is reporting smaller (and potentially less reliable) numbers. Though the alleged People’s Republic doesn’t seem to be losing volume due to missing chips so much as it is to sudden, localized declines in productivity.

China has resumed aggressive lockdowns in places like Shanghai, creating problems for parts suppliers and logistics companies operating within the region. We recently reported on how citizens are being forcibly sealed into dwellings or being carted off to quarantine camps, with those wishing to continue work having to live inside factories full-time. The Chinese Communist Party has also reinstated stringent shipping restrictions that previously delayed the exportation of goods out of the country.

These executive decisions (including similar actions taken by nations other than China) previously upended global trade and are likely to do so again — likely making an already bad situation much worse. For now, the region’s chip shortage problem appears to be minimal. China is only down by an estimated 70,000 vehicles as far as the chip shortage is concerned. However, Shanghai citizens now appear to be in open revolt with the government doubling down on restrictions to spur compliance. This could have severe ramifications for global supply chains if factories are not allowed to operate normally.

In Europe, the war in Ukraine is creating similar problems. Many companies have cut ties with Russian facilities quite literally overnight while the conflict itself creates additional issues for regional supply lines — including those pertaining to chips. If you want to do a deep dive into how all of this works, the Harvard Business Review published a piece foreshadowing how the return of Chinese lockdowns and Russo-Ukrainian might impact the market long-term.

The summary is that Ukraine supplies a lot more raw materials than you probably realize (e.g. neon gas used in semiconductor production) in addition to the stuff you’ve probably heard about, like wheat. The same is true for Russia and both nations are now restricted, albeit for very different reasons, from engaging in their usual trade. Though the resulting conditions are effectively the same for the global market, ushering in higher costs and fewer materials for practically everything.

[Image: Dan74/Shutterstock]

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jkross22 When I think about products that I buy that are of the highest quality or are of great value, I have no idea if they are made as a whole or in parts by unionized employees. As a customer, that's really all I care about. When I think about services I receive from unionized and non-unionized employees, it varies from C- to F levels of service. Will unionizing make the cars better or worse?

- Namesakeone I think it's the age old conundrum: Every company (or industry) wants every other one to pay its workers well; well-paid workers make great customers. But nobody wants to pay their own workers well; that would eat into profits. So instead of what Henry Ford (the first) did over a century ago, we will have a lot of companies copying Nike in the 1980s: third-world employees (with a few highly-paid celebrity athlete endorsers) selling overpriced products to upper-middle-class Americans (with a few urban street youths willing to literally kill for that product), until there are no more upper-middle-class Americans left.

- ToolGuy I was challenged by Tim's incisive opinion, but thankfully Jeff's multiple vanilla truisms have set me straight. Or something. 😉

- ChristianWimmer The body kit modifications ruined it for me.

- ToolGuy "I have my stance -- I won't prejudice the commentariat by sharing it."• Like Tim, I have my opinion and it is perfect and above reproach (as long as I keep it to myself). I would hate to share it with the world and risk having someone critique it. LOL.

Comments

Join the conversation

Lambasts? Chip shortages harshly criticize Europe?

This is worth a watch (CNBC: "Why Russia’s Invasion Of Ukraine Has Sent Automakers Scrambling"): https://youtu.be/BZd8g1s8Fno Bonus: You get to see how modern wiring harnesses are assembled. (I wonder if their hands get tired?) Double Bonus: When you see the vehicles moving through European assembly plants at different 'altitudes' (ex. following the 4:50 mark), the European OEMs tend to do that a lot for ergonomic reasons. They'll even tilt the vehicle sideways in some cases. Most assembly plants in the U.S. don't do that -- the worker adjusts to the vehicle and too bad about your back problems.