GM Filing IPO Paperwork As Soon As Next Week

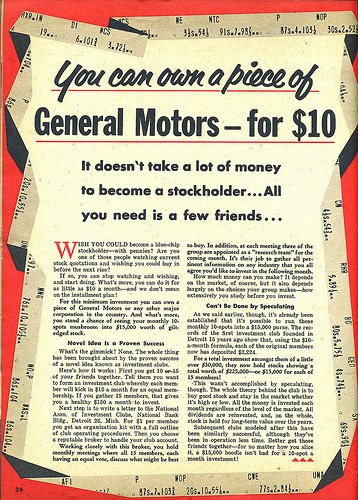

The Detroit News reports that GM will file paperwork to register its initial public offering as soon as next week, citing anonymous sources. This registration will be our first look at exactly what GM and its masters at the Treasury Department are trying to achieve with the offering. Analysts are predicting that the government will sell only one-third of its 61 percent stake in GM, which would rid it of an absolute majority stake but would preserve its status as the largest GM stakeholder. The Canadian and Ontario governments, the UAW’s VEBA fund and bondholders in Motors Liquidation may sell parts of their stakes as well, but there are still no estimates as to just how much of GM’s equity will be up for grabs in this offering. Or what the market response will be. And with the car market still shaky, Opel demanding more of GM’s cash, IPOs being canceled right and left, and only one profitable quarter under GM’s belt, voices are already starting to wonder if GM isn’t rushing this offering for political reasons.

More by Edward Niedermeyer

Comments

Join the conversation

No matter when it happens, it's going to be interesting. The thing is I haven't heard anyone in the government articulate a back up plan if it all goes to hell. (No body wants the stock, it doesn't raise money, ect.) BTW I'm a registered Libertarian, and I don't care what the politicians affiliation is, I just want to hear them articulate back up plans when they seem to pinned all their hopes on one big thing. (Which means I've basically been disapointed since I started paying attention to politics in my teens.)

Since institutional investors have minimum quality standards as to which companies they will invest in through stock purchases, it seems unlikely any would buy a recently bankrupt company's stock.

Hang on kids, this gonna be fun!