What Will GM Announce This Friday in Oshawa?

Yesterday, General Motors issued a release stating it will announce big news in Oshawa on Friday. According to The Star, that announcement will include 1,000 new jobs at GM’s engineering center, which now focuses on driverless and connected vehicles.

However, the announcement comes as uncertainty swirls around GM’s Oshawa Car Assembly Plant, a facility that many analysts believe is slated for closure.

NEVS Lays Off 200 In Reorganization Plan

With the Saab name reclaimed by the mothership, a host of financial problems, and no product beyond a 10-year-old platform, what else is left for National Electric Vehicle Sweden to do? If you said, “Tap out,” then you just might see that hand pounding the mat rather quickly.

US Treasury Begins Second Divestiture Plan Of Ally Stock

Ally Financial, the lending artist formerly known as GMAC Financial, inches closer to freedom from government ownership as the United States Treasury begins a second trading plan to shed its shares.

PSA-Dongfeng Deal Backed By EU, Skepticism Remains

The PSA Peugeot Citroen-Dongfeng-French government deal agreed upon by the three parties earlier this week received initial backing from the European Union, though skepticism remains as to whether the deal will bring stability to the ailing French automaker.

Tavares-Led Peugeot Gains 5.27 Billion Euro Makeover

Former Renault executive and incoming PSA Peugeot Citroen CEO Carlos Tavares aims to use the 3 billion euro investment made in the three-way pact between the automaker, the French government and Dongfeng as part of a 5.27 billion euro makeover of the automaker’s line of vehicles over the long-term.

PSA-Donfeng Deal Injects New Capital, Extended Life Into Peugeot

The 3 billion euro ($4.1 billion USD) three-way deal between PSA Peugeot Citroen, Dongfeng and the French government, signed this week, is set to inject new capital and a much needed life extension for Peugeot, though at the expense of the Peugeot family ceding control after two centuries.

PSA-Dongfeng Deal Approved, Chairman Urged To Scrap Deal

The founding family behind PSA Peugeot Citroen has approved the 3 billion euro ($4.1 billion USD) deal between the French government and Chinese automaker Dongfeng just an industry analyst penned an open letter for PSA chairman Thierry Peugeot to reconsider before it becomes too late to turn back.

PSA Peugeot Citroen, Dongfeng, France Reach Outline Deal

PSA Peugeot Citroen, Dongfeng and the French government have reached an outline deal to raise $5.5 billion in capital through a planned share sale in a last-ditch effort by PSA to remain alive after General Motors walked out of a similar deal over the Iranian market last year.

Toyota Shuttering Australian Factory By 2017, Local Industry Dead

Toyota announced Monday that as of 2017, the automaker will no longer manufacture any of their vehicles in Australia, driving in the final nail to the coffin containing the nation’s local automotive industry following similar announcements by Holden and Ford.

One-Time Tax Gain Nets Chrysler $1.6 Billion In Q4 2013

The American half of the newly dubbed Fiat Chrysler Automobiles reported a net income of $1.6 billion in Q4 2013, the majority of which came from a one-time tax gain of $962 million.

U.S. Government Sells Remaining General Motors Stock

It’s official: the United States government has sold off its remaining $49.5 billion investment in General Motors.

General Motors to Divest Remaining Ownership of Ally Financial

Ally Financial, the bank holding company formerly known as GMAC, is still a major part of the United States federal government investment portfolio in the five years since it was bailed out at the start of the Great Recession. Yet, it may be able to soon divest its ownership in part due to General Motors selling their remaining shares.

Ally Exits Superprime Loans, Enters Used Car Market

Best known for underwriting public radio programming such as “All Things Considered” and “Marketplace,” Ally Financial — formerly known as GMAC until the subprime market collapse kicked off the Great Recession — has decided to go for the gold in the used car and leasing markets, citing “irrational” pricing found in the superprime mortgage loan sector for its move from the latter toward the former.

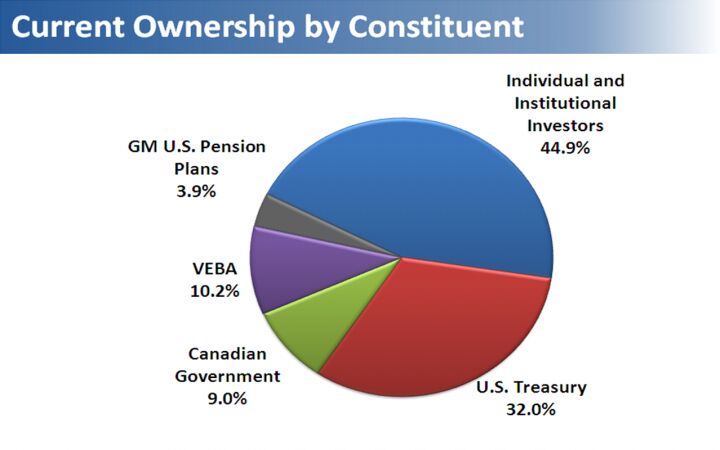

U.S. Treasury Sells 110 Million Shares of GM Stock, Reducing Stake to 7.3%

The United States Treasury has reduced its stake in General Motors to 7.3% after selling off another block of the shares it acquired during the bailout of the giant automaker. According to documents released earlier this week cited by Reuters, the Treasury sold at least 110 million shares between May 6 and September 13, raising more than $3.82 billion.

Ally Financial Explores Options For Treasury Exit, Seeks Immunity From ResCap Related Lawsuit

Ally Financial, what used to be known as the General Motors Acceptance Corporation, GMAC, before GM’s bankruptcy and bailout, itself received over $17 billion from the U.S. Treasury during the bailouts of 2009. On Tuesday the company said that it was looking into options on how to repay that money and comply with the Federal Reserves’ latest stress tests for financial institutions. Ally is 74% owned by Treasury and it is trying to buy back some taxpayer-owned stock and reach an agreement with the Fed on its capital structure (known as the “Comprehensive Capital Analysis and Review”) so it can offer stock in an IPO. Ally had originally planned on a 2011 IPO but having to resolve claims against its bankrupt Residential Capital mortgage unit delayed that. ResCap hopes to be out of bankruptcy by 2014.

The TARP Is Lifting: Government Motors No More, In About A Year Or So

It has been repeatedly suggested that GM should use its ample profits to buy back the shares held by the U.S. government (don’t forget the Canadians.). Finally, GM listens to reasons. Or, possibly, strong suggestions from Washington. GM will purchase 200 million shares of GM common stock held by the U.S. Department of the Treasury for $5.5 billion, or $27.50 per share, the company said in a statement The share buyback is part of the Treasury’s plan, also announced today, to fully exit its entire holdings of GM stock within 12 to 15 months, subject to market conditions.

FT: GM-PSA Tie-up On The Ropes Due To Irreconcilable Differences

A while ago, I chatted with an industry executive who had “done time” (his words) at GM. I asked him how that was, and he said: “There is always that talk about the current Big Deal that will bring the company back to its former glory. When that Big Deal fizzles, it’s on to the next Big Deal.” A formerly Big Deal is fizzling in Europe.

As we reported yesterday, General Motors and PSA have put the brakes on a broader alliance. Allegedly after PSA accepted financial assistance from the French government, as Reuters says, which broke the story. GM’s stock price immediately changed course southwards, because the consequences can be enormous..

How The GM Bailout Turned Into Foreign Aid

Longtime reader and new contributor Tyler Vandermeulen is a financial analyst by day. He took a deep dive into the EDGAR database to unearth how much of GM’s money flows abroad. Please welcome Tyler with the respect he deserves. Rude comments will not be tolerated.

Before the bailout of General Motors, it was well understood that the world’s largest automaker was losing huge amounts of money in the US and was staying afloat thanks to stronger performance in overseas markets. Since the bailout, however, that dynamic has been turned on its head. Thanks to a leaner manufacturing footprint, debt eliminations and steadily recovering sales, GM’s US operations have generated the lion’s share of the company’s profit since the bailout. And now, as the rest of the world economy slows, GM is spending more and more of its taxpayer-enhanced cash pile to shore up its faltering foreign divisions. In fact, according to an analysis of GM’s SEC filings, the company is likely to incur over $6.5 billion in losses and expenditures overseas in the 2011-2014 period, not counting over $1.6b in foreign potential legal liabilities or several other incalculable expenses that could add up to billions more. Not only are these expenses a challenge to GM’s overall financial health at a time when it also faces billion-dollar expenditures on pensions in the US, it shows the basic problem with national bailouts of global companies. Taxpayers who were told they were saving an American company are now seeing their tax dollars flowing overseas by the billions.

Fitch: GM Not To Go Bust Anytime Soon

While there is renewed chatter about a renewed GM bankruptcy, ratings agency Fitch thinks otherwise. The agency that assesses the chances of defaults by companies and countries raised GM’s default rating from BB to BB+, which is once notch below investment grade.

Bailed-Out GM Wants To Help Bailed-Out Ally With Some Of Its Bail-Out Money. Investors Not Amused

Bailed-out GM might sink $2 to $4 billion into likewise bailed-out Ally Financial to buy some of the lender’s international operations. Ally “ironically wants to use the proceeds to help repay its own federal bailout aid,” says Reuters. That plan does not sit too well with some observers. Says the wire: “Analysts and investors disagree on whether that would be the best use of cash, with some preferring a stock buyback or dividend payment.”

Report: Treasury Behind Delphi Pensions Debacle

The Daily Caller says it has emails that prove that the pensions of 20,000 salaried retirees at Delphi were terminated “solely because those retirees were not members of labor unions.”

The emails, says the conservative website “contradict sworn testimony, in federal court and before Congress, given by several Obama administration figures. They also indicate that the administration misled lawmakers and the courts about the sequence of events surrounding the termination of those non-union pensions, and that administration figures violated federal law.”

Paper: Auto Bailout Was A UAW Bailout

Moody’s has been less than impressed with GM’s recent pension cuts/buyouts:

Government Motors On

After GM’s IPO, stockholders looked with great anxiety at the 32 percent the U.S. government still holds in General Motors. Allegedly, the U.S. government wanted to shed that share as quickly as possible, and someone dumping the stock does not make for rising stock prices. Now, GM is sending out smoke signals that a sale is far from imminent. GM’s chief spokesman Selim Bingol wrote in a blog that “the day will eventually come when the Treasury sells its GM stake. When is anybody’s guess (we have no say in the matter).”

Treasury: Loss On GM Bailout Rises To $23.6B

One of the great mysteries to many inside the auto industry is why is GM’s stock price so low? Though the company had a weak third quarter, its stock price has been stuck well below its IPO price for much of the last year, despite a return to profitability. Though GM faces challenges, few inside the auto industry understand why its stock price remains so low. One theory: the government’s mere continued presence as a major stockholder creates uncertainty around the company. If this is the case, it creates something of a vicious cycle: the lower the stock price, the less likely the government is to sell its shares, leaving it lingering with no exit strategy, in turn driving the stock lower. Though that’s not likely to be the whole story, one thing is certain: the government has been forced to increase its loss estimate for the GM bailout. The Detroit News reports that the Treasury’s losses on GM are now estimated at $23.6b, up from $14.4b. And with an election looming, it seems likely that the White House will sell within the next six months. But will the government’s desire to protect itself politically trade off with GM’s PR? After all, whatever the Treasury’s final loss is, that number will be pinned to GM as a symbol of what it owes the American people. On the other hand, with most analysts insisting that GM stock is undervalued, another year of government ownership could convince investors to bid up the price, greatly reducing GM’s public debt. Too bad electoral politics will probably prevent that from happening….

Half of American Car Shoppers "More Likely" to Buy Fords Because of Bailouts

Whether or not the White House pressured or even contacted Ford Motor Company after the company released their recent ad appealing to anti-bailout sentiments we’ll probably never know. We’ll also probably never know if this was all just a symphony of leaks and disclaimers orchestrated by Ford. What we do know, thanks to a Rasmussen opinion poll [Sub. required, some data here], is that Ford had good reason to stoke American consumers’ resentment against it’s domestic competitors because they were bailed out by the government. The poll shows that the bailout is clearly a factor, sometimes an overriding one, in automobile purchase decisions. Not only did nearly one in five recent Ford buyers say that they or family members specifically chose Ford products because they didn’t take a government bailout, about half of all consumers surveyed said that they were more likely to buy Fords than GM or Chrysler products specifically because Ford didn’t get bailed out. [Note: Yes, Ford took Dept. of Energy loans and other government funds, but this survey was looking at people’s opinions, not facts.]

EPA Inspector General Questions GHG Emissions Science, Issa Attacks On All Fronts

In a report released earlier this week [ PDF], the EPA Inspector General criticized the Technical Support Document for the portion of greenhouse gas regulation dealing with “Endangerment,” or the possible effects of greenhouse gasses. Inspector General Arthur A. Elkins Jr. summed up his office’s findings [ PDF], writing

The OIG evaluated EPA’s compliance with established policy and procedures in the development of the endangerment finding, including processes for ensuring information quality. We concluded that the technical support document that accompanied EPA’s endangerment finding is a highly influential scientific assessment and thus required a more rigorous EPA peer review than occurred. EPA did not certify whether it complied with OMB’s or its own peer review policies in either the proposed or final endangerment findings as required. While it may be debatable what impact, if any, this had on EPA’s finding, it is clear that EPA did not follow all required steps for a highly influential scientific assessment. We also noted that documentation of events and analyses could be improved.

Oy vey. Greenhouse gas science controversy. So, what’s the problem really about?

Why Did Ford Drop Its Bailout Ad? House Oversight Chair Investigates

Ford Restores Bailout Ad To Youtube, Calls Takedown Part Of "Planned Rotation"

As I noted in the comments of this morning’s piece on the Ford Bailout ad controversy, if the White House did contact Ford about the ad and the company did take down the video in response to the pressure, it certainly wouldn’t admit as much. After all, the whole point of caving to White House pressure would be to defuse, not inflame, a political standoff. And sure enough, one hour ago, Ford reposted the video (currently with around 300 views) and shared it on its Facebook account. Ford says the ad “ran as part of a planned rotation and continues to run online,” predictably avoiding any reference to reports of White House concern. And though the low view count proves that Ford took down, then reposted the video, a Youtube message to the uploader of what earlier today was the only remaining version on Youtube reveals that mainstream media news reporters were unable to find other copies of the ad.

The White House has not yet commented on the situation, but hit the jump for more details on Ford’s curious response…

Howes: Ford Yanks Bailout Ad After White House Pressure

[UPDATE: Ford has restored the video to Youtube. More details here.]

Detroit News columnist Daniel Howes reports in a column that Ford has pulled its controversial “bailout ad” after the White House asked “questions” about it. And apparently the take-down decision makes this a threatened piece of footage: in addition to yanking the spot from the airwaves, the version of the video we posted two weeks ago has been taken down from YOutube as well [a home recording of it can still be found here]. So what happened that Ford would throw its most popular ad in ages down the memory hole? Howes is cryptic…

Ford pulled the ad after individuals inside the White House questioned whether the copy was publicly denigrating the controversial bailout policy CEO Alan Mulally repeatedly supported in the dark days of late 2008, in early ’09 and again when the ad flap arose…

With President Barack Obama tuning his re-election campaign amid dismal economic conditions and simmering antipathy toward his stimulus spending and associated bailouts, the Ford ad carried the makings of a political liability when Team Obama can least afford yet another one. Can’t have that.

Obama: Banks Should Pay For The Auto Bailout

At the height of “bailout fever,” after TARP had been instituted but before the automakers had been completely bailed out, one argument that we heard a lot of from Detroit’s defenders was “how can you begrudge the manufacturing base a few billion when speculators at the banks are receiving far more support?” At the time, the argument seemed to me like a convenient way to shift attention away from Detroit’s failures and undercut the argument that consumers, not a credit crunch, were responsible for killing off GM and Chrysler… but at least then it still had some validity. Fast forward to today, and history has stripped it of all relevance, as it turns out the banks will likely be picking up the automakers’ bailout tab.

Ford's "Bailout Guy" Fires Back

Ford Takes the Gloves Off About the Bailouts

Wow. I don’t know if Ford is broadcasting this particular commercial [Ed: They are, although possibly not in the Detroit area], but it’s part of a series of ads that Fred Goss directed for Company Productions. The ads were set up by recruiting recent Ford buyers to come in and answer some market research questions. Those Ford owners did not know that they would be walking into a press conference with, apparently, real journalists [Ed: Huh?] asking them about their purchase. Company Productions released a video on the making of the ads. In this particular case Ford got lucky when a F-150 owner named Chris sat behind the microphone. Answering a reporter’s question, “Was buying American important to you?” Chris came up with something that advertising copy writers dream of writing.

DOE "Green Car Retooling" Loan Program Under Republican Assault, Are Chrysler's Finances At Risk?

Reuters reports:

Republican leaders in the House of Representatives want to halve the balance of a U.S. government loan fund established to help the auto industry make more fuel efficient cars and trucks.

If plans to shift some $1.5 billion from the Energy Department advanced technology fund to disaster assistance are carried out, serious questions would be raised about Chrysler’s ability to fully capitalize on its bid for new financing.

That the DOE loan program is under attack comes as no surprise: it’s been savaged by both the GAO ( twice) and the Center for Public Integrity for a lack of clear goals, weak oversight, misappropriation, and political patronage (more on the patronage bit here). And with the Solyndra DOE loan scandal blossoming, it’s no surprise to see ATVM going under the axe (although Rep Steny Hoyer is leading the Democrat pushback). What’s worrying about this development, however, is that Fiat-Chrysler CEO Sergio Marchionne has said that the DOE loan was “a crucial part” of negotiations over its recent Wall Street bailout loan refinancing. When GM quit the program earlier this year, Marchionne also said that

I have neither the arrogance nor the cash to show any disdain toward the DOE process.

Chrysler also cites its ability to secure the DOE loans as a major risk factor in its latest 10-Q SEC filing. And with only about $10.2b in cash and equivalents on hand at the end of June, there’s a chance that this attack on the ATVM loan program could deal a body blow to Chrysler’s finances. Here’s hoping Sergio has kept the runt of the bailed-out automaker litter from dependence on this apparently corrupt, and politically vulnerable loan program.

Quote Of The Day: "Don't Blame Me For The Bailout" Edition

The Detroit News reports that former Vice President Dick Cheney claims to have opposed the decision to bail out GM and Chrysler, writing in his forthcoming memoir:

“The president decided that he did not want to pull the plug on General Motors as we were headed out the door… Although I understood the reasoning, I would have preferred that the government not get involved and was disappointed — but not surprised — when the Obama administration significantly increased the government intervention in the automobile industry shortly after taking office.”

Cheney notes he had voted against the 1979 $1.5 billion loan guarantee for Chrysler Corp. in the House. “I had continued throughout my career to be philosophically opposed to bailing out specific companies or industries,” he wrote.

GM: Impala Suspension Problems Are "Old GM's" Liability

The Detroit News’s David Shepardson reports that GM has requested the dismissal of a lawsuit alleging rear-suspension problems on 2007-8 model-year Impalas, on the grounds that

“New GM did not assume liability for old GM’s design choices, conduct or alleged breaches of liability under the warranty, and its terms expressly preclude money damages,” the response says.

The suit “is trying to saddle new GM with the alleged liability and conduct of old GM.”

Congress Does The Detroit Auto Show, Taxpayers Foot The Bill

Photo Credit: Autoblog Green

It’s getting a little predictable. Go to a big car event like the North American International Auto Show or the Society of Automotive Engineers (SAE) World Congress and you’re going to see politicians and government officials. I suppose that’s to be expected, but to be honest, I’m a little ticked off at how our public servants get a large megaphone at those events without bearing any of the costs that you, I, or a car company would have to pay for for the same treatment.

For the past three years particularly because of the meltdown of the domestic automakers, the bailout and the US Treasury’s subsequent stakes in GM (still held) and Chrysler (divested so that Fiat could own more), but really since the beginning of time, politicians and auto shows went together. I remember, after a press conference where Wayne County (MI) executive Robert Ficano exchanged gifts with the chairman of the People’s Army owned automaker Changfeng, asking Mr. Ficano just how many Changfeng employees voted in Wayne County. During the ’08 presidential election, most of the primary candidates on the Republican side visited the show’s press preview.

GM To DC: Take A Look At Me Now

Chrysler Is Now Officially An Italian Company, Total Taxpayer Cost: $1.3b

Fiat And Chrysler To Make It Official, Unified Management Coming "Soon"

When Fiat and the US government collaborated to bail out and restructure Chrysler, many hailed the news as nothing less than the rescue of the American auto industry. Though Fiat CEO Sergio Marchionne became CEO of the Auburn Hills-based automaker, he maintained much of its management corps on the strength of brief interviews, only relieving a few key members of the old guard. But the debate over whether the rapidly-aligning Fiat-Chrysler is more Fiat or Chrysler is going to be resolved “pretty quickly” according to Marchionne, as Bloomberg reports that a unified management structure is in the works.

Marchionne is working on management changes as he steps up the integration of the two companies. He plans to merge the carmakers to reduce costs and achieve a target of more than 100 billion euros ($140 billion) in combined revenue by 2014. The executive said in May that the timing of a merger hasn’t been decided yet, adding that a combination isn’t likely this year.

But just as there was furor in Italy when Marchionne suggested that the unified Fiat-Chrysler could be headquartered in Detroit, the unified management structure could be yet another source of controversy. It will, after all, be the most direct signal yet as to whether Fiat-Chrysler is an Italian firm with global operations, an Italian-American alliance or a truly global firm. For one thing, unified management should force Marchionne to commit to a single headquarters for the group, reviving a controversy he temporarily cooled by fatuously suggesting there be four Fiat-Chrysler “headquarters,” in Turin, Detroit, Brasil and “Asia.” Having masterfully finessed the PR messaging transition from “rescue of an American automaker” to “wholly owned subsidiary” thus far, a unified management could bring up a lot of unresolved issues. In short, it’s a branding challenge that makes the Chrysler-Lancia transformation look like child’s play…

The Downsides Of "Culture Change": GM Sued For Age Discrimination

I love General Motors. I’m bringing this age-discrimination suit action because it’s the right thing to do — for me, my family, as well as my GM peers who have been severely affected by GM’s conduct.

A critical aspect of GM’s turnaround was breaking a culture that has been held up for decades as an example of insularity, stagnation and inefficiency [for more read Ron Kleinbaum’s classic four-part editorial on the subject here], a task that various recent CEOs have gone about differently. Fritz Henderson had a “change agent” vanguard approach, while Ed Whitacre took more of a “set tough goals and fire regularly” tack towards GM’s culture wars. But regardless of differences in tactics, everyone’s agreed that GM’s culture needed to be seriously retooled if the company’s huge advantages after a government-backed bankruptcy-bailout weren’t going to be pissed away, and as a result a lot of GM’s “lifers” found themselves on the outside looking in. And rather than slinking away, one of those jilted lifers is suing GM for age discrimination.

Frustrations Flare At GM Bailout Hearings: Did Ron Bloom Perjure Himself?

Well, I just wrote about 1,500 words on this topic which our post editor just obligingly disappeared into the digital void, wiping out over an hour of work. This was, perhaps, an appropriate turn of events, however, as the majority of those 1,500 words were used to describe the frustrating political stalemate that played out over the last two days of hearings on “The Lasting Implications of the GM Bailout.” The dynamics of the government’s exit from GM seem to have changed little since I wrote “Government Motors: The Exit Strategy,” and the hearings focused on the political implications of the bailout. Having determined that the bailout will help the President’s reelection in midwestern states, the White House (as represented by auto task force member Ron Bloom) sought to retrench its “things would have been worse” position, and Republicans attacked on all fronts for the very same reason. The government’s favorable treatment of UAW-represented workers, especially in comparison to Delphi’s non-UAW retirees was a major point of attack, and the committee caused Bloom deny (under oath) having ever said that “I did this all for the unions,” despite the fact that both the Detroit News’s David Shepardson and Bloom’s task force colleague Steve Rattner have quoted him directly. Emails obtained by The Daily Caller were also presented as ( more) evidence that the government intervened in a number of day-to-day decisions at GM, including the Delphi retiree issue.

Ultimately, the Republicans landed some serious body blows on the policy, although nothing radically new was presented. Bloom, meanwhile, defended the bailout by arguing that the alternative would have been much worse. In short, the political stalemate over the auto bailout continues… much to GM’s dismay. And since insiders are indicating that any collusion to boost GM’s stock price in order to improve the taxpayers’ return would be worse than a larger loss, a $10b+ loss is as good as guaranteed. Which means the Republican attacks will continue and the political trench warfare over the issue will only continue.

GM's Orphaned Brand Buyers Have Moved On

How many former Saturn buyers do you figure have come back to GM for their next car? What about consumers who last purchased a Pontiac? How about HUMMER? Since we’re not bound to a strict inverted pyramid around here, why don’t you think of an answer (in terms of percentage of customers retained) for each brand and then hit the jump to see how close you were.

DOE Loan Program Knocked For Lax Oversight, Risk-Related Costs

The Department of Energy’s Advanced Technology Vehicle Manufacturing (ATVM) loan program has come under fire from the Government Accountability Office before, and was the subject of a patronage investigation by the Center for Public Integrity and ABC News. And the bad news keeps piling up, with yet another nasty GAO report [ PDF] taking the program to task for running up higher-than-expected lending costs due to “industry risks” and for failing to provide required technical oversight.

Fact Check: Motor Trend Needs To Research Fiat's "40 MPG" Car Commitment

At the suggestion of a well-wisher, I picked up the July copy of Motor Trend for my flight back home Iowa yesterday. Though some of the stories showed improvement in that publication’s quality of coverage, the item pointed out by our tipster [online here] was disappointing indeed. The piece, on Fiat’s ongoing acquisition of Chrysler’s equity includes the following paragraph:

Fiat is expected to obtain another 5 percent of Chrysler soon to bring its interest to 51 percent, provided it introduces a 40-mpg (highway) EPA-rated car built in the U.S. wearing a Chrysler brand badge before the end of 2011. With Fiat and Chrysler pulling the plug on electric car development, the 40-mpg car is likely to be a 1.4-liter Multijet-powered Dodge Caliber. The Caliber is scheduled for replacement in model year 2013, so the Multijet version could be a 2012 model only, with the powertrain carried on to its replacement.

So, what’s the problem? Well, as TTAC (and precisely nobody else) has reported, the government’s agreement with Fiat is not for that firm to build “a 40-mpg (highway) EPA-rated car.” It takes some digging through the corporate agreement between Fiat, Chrysler, the UAW and the Treasury, but it’s clear that the government requires that Fiat build a car that tests at 40 MPG combined, using the old “unadjusted” (Pre-1985) CAFE fuel economy rating. Which means that, although Fiat could build a car capable of 40 MPG EPA highway, the government’s agreement requires as little as 31 MPG EPA Combined. Which means M/T’s write-up technically falls on the wrong side of the truth. Although, to be fair, I have yet to find a media outlet that has got this story right…

Treasury Won't Sell GM Until Stock Improves. GM To The Rescue?

Bloomberg reports that a “person familiar with the matter” says the US Treasury won’t sell its remaining stake in GM as long as the automaker trades below its $33/share IPO price. Previously the government’s auto team had said it would not try to “time the market” and our analysis showed that the Treasury was likely to sell sometime late this Summer. But it’s been months since GM spent more than a few days above its IPO price, indicating that Treasury may be waiting considerably longer if the IPO-price floor is set in stone. And with $36.5b in cash equivalents on hand and only $5b in debt, GM’s $45b market cap is hardly encouraging… especially with investors waiting for The General to match Ford’s profitability levels. Heavier discounts mean a lower operating profit for GM in the US market, and the first quarter shows a $1b swing in pricing between the two firms (with Ford improving $700m and GM dropping $300m) according to Bloomberg. Lower finance earnings are also holding The General back relative to Ford. So, what’s GM’s response?

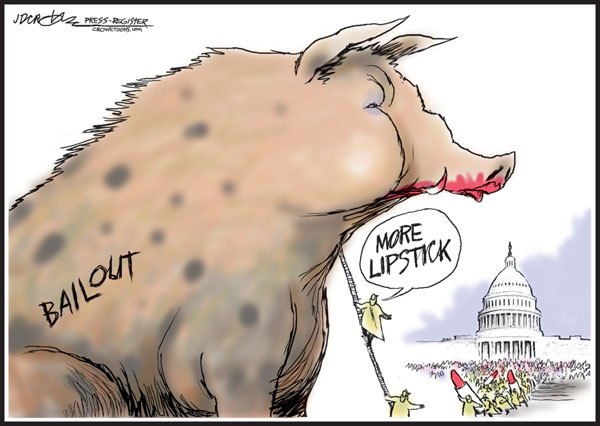

Lipstick On A Bailout, 2.0

The U.S. jobless rate just rose to 9.1 percent. Employers added the fewest workers in eight months during May. The housing market is double-dipping. Only 16 month to go until the next presidential election. It’s the economy, stupid. The President has to do something. What does he do?

“President Obama’s visit to a Chrysler plant in Toledo, Ohio, on Friday was the culmination of a campaign to portray the auto bailouts as a brilliant success with no unpleasant side effects. “The industry is back on its feet,” the president said, “repaying its debt, gaining ground.”

If the government hadn’t stepped in and dictated the terms of the restructuring, the story goes, General Motors and Chrysler would have collapsed, and at least a million jobs would have been lost. The bailouts averted disaster, and they did so at remarkably little cost.”

He’s wrong, writes David Skeel, a professor of law at the University of Pennsylvania, in his op-ed piece in the Wall Street Journal.

Quote Of The Day: Truer Words Were Never Spoken Edition

I am sorry I am being brash but when you owe money to people and you pay them back you shouldn’t be celebrating. You just cut them a check and send them home and say thank you on your way out

We’ve given Fiat/Chrysler CEO Sergio Marchionne some grief for his somewhat unseemly self-congratulation at his repayment of “every penny loaned less than two years ago.” This quote, given to CNBC, is more what we were looking for. After all, one imagines that Chrysler doesn’t hold such celebratory spectacles for folks who finish paying off loans on their Calibers and Caravans. Acknowledging the mundanity of Chrysler’s Wall Street re-fi is a much better way for the firm to re-boot its post-bailout relations with the American people. For this quote, as much as for the promising but still-wildly-uncertain turnaround of Americas most troubled automaker, I am happy to extend Mr Marchionne and his team a modest, unceremonious word of thanks.

Quote Of The Day: The State Of The Bailout Bill Edition

According to the White House’s just-released report titled “The Resurgence of the American Automotive Business” [ PDF here]:

The U.S. Government provided a total of $80 billion to stabilize the U.S. automotive industry through investments in General Motors (GM), Chrysler, Chrysler Financial, Ally Financial, and programs to support automotive suppliers and guarantee warranties. As of today, $40 billion has been returned to taxpayers. While the government does not anticipate recovering all of the funds that it invested in the industry, the Treasury’s loss estimates have consistently improved – from more than 60 percent in 2009 to less than 20 percent today.

Independent analysts estimate that the Administration’s intervention saved the federal government tens of billions of dollars in direct and indirect costs, including transfer payments like unemployment insurance, foregone tax receipts, and costs to state and local governments.

This is as close as we’ve gotten to a thorough accounting of the full cost of the auto industry bailout, as both GM and Chrysler have erred on the side of counting as little of their own taxpayer support as possible (leaving out aid to their predecessor firms, finance companies and suppliers). On the other hand, it’s also two short paragraphs in a ten page report… and the rest of the document hews pretty closely to Democrat strategist Ron Klain’s advice to the White House, specifically

tell the story with fewer numbers and more emotion; less prose and more poetry

While the media debates whether this means the bailout bill will come to $14b or $16b, it’s becoming clear that the final number won’t make a big difference… at least politically.

Ghosn Kowtows To French Government, Promises Nice, Domestically Produced Luxury Car

Bloomberg reports:

Renault SA Chief Executive Officer Carlos Ghosn agreed to make development of upscale cars for French factories a “priority” as the government steps up its influence in the wake of a botched spy investigation.

Renault, based in Boulogne-Billancourt near Paris, named Carlos Tavares as Ghosn’s deputy late yesterday. The French state, the carmaker’s biggest shareholder with a 15 percent stake, made support for the appointment conditional on strategy changes, including taking a stronger lead in its alliance with Nissan Motor Co., people familiar with the situation said.

“If it’s this hard just to get your man in place, it suggests we’ll see more, rather than less, government influence going forward,” London-based Credit Suisse analyst Erich Hauser said. France is a “relatively small shareholder with a disproportionate say over strategy, which has to be a concern for other investors.”

…Ghosn said he intends to be “more present in France from now on,” in an interview published today in French daily Le Parisien and confirmed by Renault.

In the face of such ( continued) humiliation at the hands of a minority government partner, one has to admit that America’s auto bailout has been an relatively hands-off affair. Context is important after all (although to be perfectly fair, Renault did embarrass the French government with that “spy scandal”). Besides, it sounds like the brave French pols are simply out to avenge the sad death of the Vel Satis, so hey, at least the French might get the epically weird luxury sedan to end all epically weird luxury sedans out of the deal.

UAW Fights Likely Plant Closures

Though the auto bailout is being widely defended in the political realm as a jobs-saving measure, the industry sees the rescue’s value in precisely the opposite light, as industry and supplier execs rate “capacity rationalization” as the most positive effect of the bailout. And, reports Automotive News [sub], Ford and GM could still end up cutting as many as six more plants over the next few years as questions linger about volume recovery in the larger market. Of the three GM plants likely to be shut down, the former Saturn plant at Spring Hill, TN, is the most likely to survive as it includes a paint shop, a small engine plant and associated parts manufacturing facilities. In contrast, analysts note that GM’s Janesville, WI, plant is the firm’s oldest and is therefore far less likely to survive, and its Shreveport, LA, compact truck plant is part of “Old GM” and will likely be liquidated. Similarly, Ford’s Ranger plant in Minnesota, as well as its Avon, OH Econoline plant and its Flat Rock, MI Mustang plant could face shutdowns. Ranger is running out of production, Econoline has been losing share to Ford’s more-efficient Transit Connect, and Mustang has been losing market share to Camaro while facing a Mazda pullout from the Flat Rock plant.

Because GM is adding jobs at other plants, the net job loss from its three likely shutdowns (two of which are currently idle) could be relatively low, but then cost savings aren’t likely to match those accrued by past shutdowns either. Ford, meanwhile, is facing a bit more disruption if Mazda pulls out of Flat Rock, but could accrue more savings than GM as only the Ranger plant is scheduled to lose its production. In any case, the UAW will have to weigh its desire to keep plants open with its desire to mitigate the inequity of the two-tier wage system… as well as its desire to gain board seats. All of which could make the UAW’s upcoming bargaining session (not to mention the political debate about the auto bailout) much more interesting…

How You Contributed $11.9 Billion To The Presidential Election

“Midwestern auto-industry towns that were hit hard in the recession are becoming an important backdrop for President Barack Obama and other Democrats hoping to use reinvigorated factories to paint a picture of the improving economy ahead of the 2012 elections.”

That’s how the Wall Street Journal starts off an article on how “Democrats hitch a ride on the auto-industry rebound.” As we had noted on Memorial Day, our beloved bail-out is becoming the battle cry of the 2012 presidential campaign. Says the Journal:

Ask The Best And Brightest: Are You Buying Fiat's "Old Carco" Kiss-Off?

When Chrysler celebrated its payback of “every penny that had been loaned less than two years ago” last week, I noted that CEO Sergio Marchionne’s triumphant line was technically correct, but hardly represented the whole truth of the story. I pointed to $1.5b in supplier aid that helped keep Chrysler afloat, as well $1.9b worth of the Bush Administration’s “bridge loan” to “Old Chrysler,” prior to its government-guided bankruptcy and sale to Fiat. Apparently my more-inclusive accounting of the price of Chrysler’s rescue (which was picked up elsewhere in the online media) caused Mr Gualberto Ranieri, Chrysler VP of Communication, to spend some part of his Memorial Day Weekend writing a response of sorts, outlining Chrysler Group LLC’s perspective on the situation. Hit the jump for Ranieri’s statement, and my brief answer to the headline’s question.

Could Chrysler Be Kicked Out Of California?

About two months ago, we heard that Chrysler’s “prototype” Motor Village dealership in the Los Angeles area had been hit with a complaint [ PDF] from the California New Car Dealer’s association, arguing that it violated state laws against manufacturer-owned dealerships. The store, a test bed for what Chrysler terms “new retail concepts,” is in fact a partnership between Chrysler and LaBrea ChryslerJeep, making it appear to fit a legal loophole allowing OEM partnerships in retail ventures. But the CNCDA argues that Chrysler is undercharging for rent on the dealership building which it owns, and according to Automotive News [sub], the California Department of Motor Vehicle’s New Motor Vehicle Board just voted unanimously to open a formal investigation into the situation. And the stakes couldn’t be much higher, as AN reports:

If the DMV finds that Chrysler violated state law, the automaker could have its business license in California suspended or revoked.

Ruh-Roh!

WSJ: Some Paid More For The Auto Bailout Than Others

Quote Of The Day: Busted! Edition

If it were up to the candidates for president on the Republican side, we would be driving foreign cars; they would have let the auto industry in America go down the tubes,

These were the words of Democratic National Committee Chair Rep. Debbie Wasserman Schultz (D-Fla.) at a breakfast put on by the Christian Acienec Monitor. But, as TheHill‘s Michael O’Brien reports, Ms Wasserman Shultz owns a 2010 Infiniti FX35 that is built by Nissan in Tochigi, Japan. And, adds O’Brien, “The car appears to be hers, since its license plate includes her initials” (it is, see picture above). The congresswoman’s response (through a spokesperson):

They can try to distract from the issue if they want. But if Republican opposition researchers are snooping around garages, they should know that if Republicans — who said that we should let the U.S. auto industry go bankrupt — had their way, they wouldn’t find a single American made car anywhere.

*Sigh*

Chrysler Celebrates "Payback," Acknowledges Outstanding Obligations (Sort Of)

Chrysler’s bailout “thank you” event today was long on praise for the redemptive power of its government bailout and short on talk of remaining challenges, but at least one important fact was acknowledged: this highly-touted “payback” was only for 85% of the money loaned to Chrysler during the bailout period. Although, to be perfectly accurate, it wasn’t exactly Chrysler who acknowledged the outstanding obligation [the firm avoids any such nuance in its release], as CEO Sergio Marchionne simply stated that

We received confirmation this morning at 10.13 am from Citigroup that Chrysler Group repaid, with interest, by wire transfer to the United States Treasury and by bank transfer to the Canadian government, every penny that had been loaned less than two years ago. [Emphasis added]

That last bit was the important part… as in, the part that was most often repeated in Chrysler’s presentation and in subsequent media reports. But it’s not the whole story…

Watch Chrysler's Bailout "Thank You" Event Here Live At 2:15 PM Eastern

Check out this video feed any time now, to witness an event that Chrysler Communications describes on Facebook as a “Loan Appreciation Event.” Chrysler’s communication describes the shindig thus:

Chrysler Group LLC CEO Sergio Marchionne, Assistant to President Obama for Manufacturing Policy Ron A. Bloom, and Deputy Director of the National Economic Council Brian Deese will join government officials, UAW representatives and employees at the Sterling Heights Assembly Plant to formally acknowledge and express gratitude for the financial support from the U.S. and Canadian governments.

Novelty-sized check, anyone?

Cadillac: The Standard Of… The Chinese Communist Party?

Pop quiz: when does an eight-month-old story generate a huge amount of interest? When it’s got political overtones, of course. And what better way to milk the last dregs of bailout resentment than by telling a story that seems too bizarre to be true: Cadillac is a “proud” chief sponsor of a Chinese Communist Party-produced film entitled “The Birth of a Party” (or “The Great Achievement of Founding the Party” depending on the quality of your translator). The story started last September, at ChinaAutoWeb.com, and was recently revivified by the Washington Times, Commentary Magazine, and Big Hollywood. Our main interest in the story has to do with its lessons about the rise of China, that country’s tortured relationship with luxury goods, its foreign (from the American perspective) political economy and Cadillac’s continued need for better momentum in China… but clearly others are more interested in it for different reasons.

The political point seems to be that government money is being funneled to the Chinese Communist Party via General Motors, an accusation that, though shocking, doesn’t hold up well to scrutiny. After all, nearly anyone doing business of any kind in China ultimately supports the political and economic structure created by the Chinese Communist Party, legitimizing it and lining its pockets. And surely nobody is suggesting GM abandon China altogether, thus eliminating its greatest opportunity for growth. Meanwhile, as the Freep helpfully points out, Caddy needs all the help it can get in China: without a single vehicle in the luxury car top-ten, Cadillac needs to be aggressive in marketing to China. Still, from a PR perspective, Cadillac clearly has a line to walk here… perhaps it should look for less visible (and risible) ways of building up guanxi (connections) with the powers that be in the world’s largest market for cars.

Chrysler: No Product Changes For Loans

Does that headline seem ripped from the pages of TTAC’s 2008-2009 headlines, or what? But really, who’s shocked? Chrysler spent early 2009 trying to convince the government that it was worth a (second) taxpayer-funded second chance, and now that it’s looking for a private-sector bailout in order to escape the terms of its publicly-funded bailout, Chrysler’s still got some ‘splaining to do. The DetN reports:

Chrysler Group LLC does not intend to speed up plans for new cars despite media reports that investors see a high degree of risk in an automaker that has been so dependent on truck sales…

“Nothing has changed from the five-year plan,” [Chrysler Group VP of Design and Dodge boss Ralph Gilles] said.

New small and midsize cars for Chrysler, engineered by Fiat, “are coming strong and heavy,” Gilles told reporters following a speech. “There is no need to speed up.”

Now, nobody would suggest that Chrysler should mess with its product timing simply to please some bankers. If it’s even remotely possible to hurry new products to launch without cutting serious corners, Chrysler should/would be doing it anyway ( ask Sergio). Still, Gilles’ “nothing has changed” sound bite isn’t exactly true.

Chrysler Debt Effort Stalls: Goverment Loans Not So "Shyster" After All?

As Steve Rattner described in his book “Overhaul,” the Presidential Auto Task Force very nearly decided not to rescue Chrysler, with the decision coming down to a single vote. Now, it seems, that with Chrysler blaming the “shyster” interest rates on its government loans for its lack of profitability, Chrysler’s viability now depends on rounding up a “lender of second to last resort.” And, according to the latest reports, that rescue-of-a-rescue effort is still very much hanging in the balance as well. If CEO Sergio Marchionne thought the government’s loan terms were “shyster”-ish, he was clearly in need of some context from Wall Street… and he doesn’t seem to be liking it.

Recent Comments