Quote Of The Day: Mission Accomplished Edition

Taxpayers, your partial refund is in. Now quick, make with the pension bailout and EV subsidies. Oh, and be sure to pick up a new Chevy, Cadillac, Buick or GMC as a “thank you” present for this act of patriotic largess.

Is GM Worth More Than Ford?

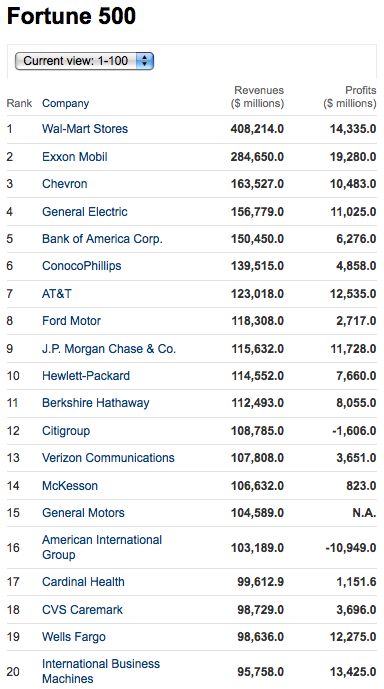

Since GM has only recently come out with GAAP-approved financials, determining the company’s value isn’t easy. Still, The Detroit Free Press‘s Tom Walsh reckons The General is worth more than Ford, despite the fact that GM recently fell out of the Fortune 500’s top ten (and below Ford) for the first time in its 100+ years of history. What gives?

Ford Bashes GM's Opel Bailout Begging

It’s a line of attack that Ford has been careful to avoid in the US, but Ford Europe is lashing out at GM’s request that European governments help finance the restructuring of its Opel division. Businessweek reports that Ford of Europe’s vice president of government affairs Wolfgang Schneider laid into GM’s request for $2b, saying:

Restructuring your business is your own job and you should pay for it yourself and you should not use taxpayer money. We are definitely against any support for Opel. The Europeans have made the choice that they would use their tax money to sustain companies and business and to sustain capacity levels that from an economical point of view are not sustainable. We do not believe that governments will be able to continue that policy forever. Governments run out of money, as well.

Smackdown! Now, why hasn’t Mulally been saying the same thing for the last two years?

Poll: 48 Percent Believe Government Has "Conflict Of Interest" In Auto Regulation

Did GM Lose Money Again In Q1?

Don’t ask Chairman/CEO Ed Whitacre. His only comments so far on GM’s Q1 2010 performance comes from a memo leaked to Reuters, in which he says:

In January, I said we could earn a profit in 2010, if everything falls into place. Our first quarter financial results will show us an important milestone, and I’m pleased to say that I anticipate solid operating results when we report our first quarter financials in May

“Important milestones”? “Solid operating results?” What the hell is Whitacre trying to say?"Supplier Bailout" Ends

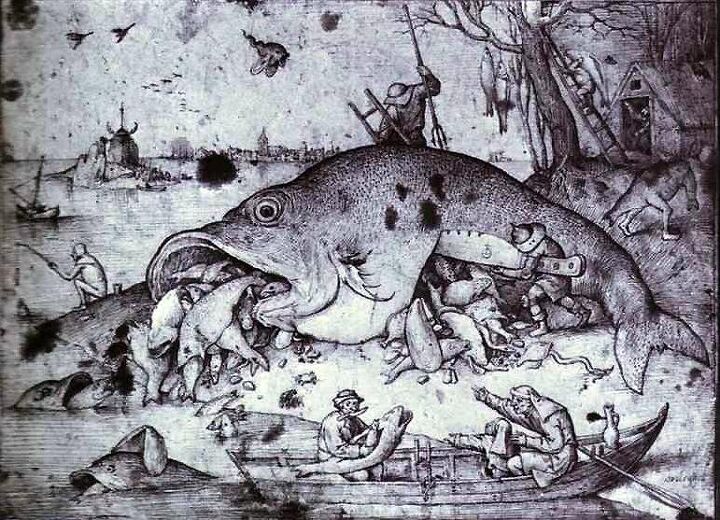

If there’s a single phrase dominating the imaginations of auto executives right now, it’s the infamous neologism of “too big to fail.” Whether executives justify their obsession with consolidation with their fear of a Chinese planet, efficiency-standard ramp-ups, or mere groupthink, there’s no doubt that consolidation is currently the name of the game. And it should be, not only for these reasons, but also because the last several years have proven that the car game is no industry for small companies. Nothing illustrates this quite like the US government’s “bailout” of auto industry supplier firms, which ended on April Fools Day.

Quote Of The Day: Government Motors By The Numbers Edition

My first day back at the helm of TTAC has been accompanied by an embarrassment of riches, in the form of both a GAO report on GM and Chrysler’s pension obligations, and the release of GM’s first post-bankruptcy, GAAP-approved financial results. We will continue to mine these documents for the most revealing quotes and statistics, but for now let’s take a moment to consider the political tensions caused by the auto industry bailout. TTAC has long held that political conflicts over the government’s stewardship of GM and Chrysler is a pressing concern, nearly on par with the financial ramifications of the auto bailout, and today’s GAO report confirms our concerns. As the following quote reveals, Treasury is under constant pressure to accommodate political concerns over the management of its stakes in GM and Chrysler, and has received no fewer than 300 official letters from congressional representatives, eager to subordinate the long-term health of the bailed-out automakers to their local concerns.

GM Lost $4.3b In The Second Half Of 2009

GM has announced its “fresh-start” post-bankruptcy accounting results, and between July and December of last year, the bailed-out automaker lost $4.3b [press release here, full numbers here, in PDF format]. The loss comes despite $57.5b in global revenue, and $1b in “net cash provided by operating activities.” According to GM’s release:

The $4.3 billion net loss includes the pre-tax impact of a $2.6 billion settlement loss related to the UAW retiree medical plan and a $1.3 billion foreign currency re-measurement loss.

Of course, you have to dig into the numbers to find the bad news, like the $56.4b in “cost of sales,” or the $700m interest cost, or the 48 percent North American capacity utilization in 2009, or the 16.3 percent US car market share. Which is why we’ve included the consolidated statement of operations, consolidated balance sheets and more, for your no-download-necessary perusal, after the jump.

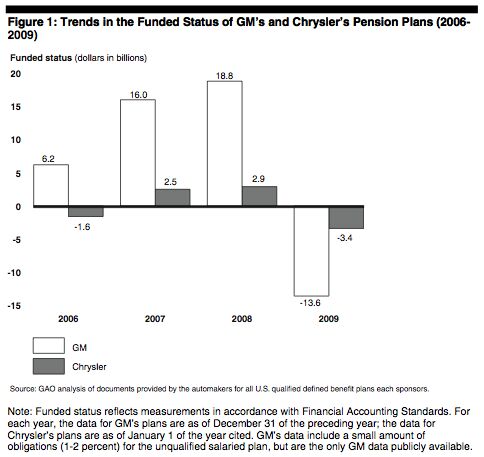

GAO: Pension Plans Will Kill Detroit. Again.

It would be impossible to blame Detroit’s decades-long decline on a single factor, but if one were to make a list, defined pension obligations to workers would be somewhere very near the top. Thanks in large part to the unionization of America’s auto industry, Detroit has groaned under the weight of crushing pension obligations since time immemorial. And, according to a new report by the Goveernment Accountability Office [ full report in PDF format available here], last year’s bailout of GM and Chrysler has not eliminated the existential threat that these obligations pose to the industry. In fact, the taxpayer’s “investment” in GM and Chrysler appears only to have exposed the public to even an greater risk of catastrophic pension plan failure.

With GM And Chrysler IPOs AWOL, VEBA Auctions Ford Stock Warrants

The UAW’s VEBA health care trust fund currently owns 17.5 percent of GM and 55 percent of Chrysler, but with IPO plans still nebulous at both, the fund is short on options for improving cash flow. Remember, the union doesn’t want to own these companies… it would have preferred cash, thanks. But since bailout negotiations allowed the automakers to fund their VEBA obligations with stock and warrants, VEBA has little choice but to monetize them. And while GM and Chrysler limp towards an eventual IPO, VEBA’s 362.4m Ford stock warrants are actually doing pretty well relative to their $9.20 exercise price. So it’s no huge surprise to hear [via Automotive News [sub]] that VEBA is planning on dumping its entire allotment of Ford warrants, in a move that could be worth “at least” $1.27b. And it’s no coincidence that this news comes on the same day that Ford is announcing a $3b debt prepayment, and the day after its sold Volvo to Geely for $1.8b.

Where Are Those DOE Retooling Loans Anyway?

With a mere $9b awarded so far, the Department of Energy’s Advanced Technology Vehicle Manufacturing Loan program is a long way from fulfilling its $25b promise to fund a turnaround in America’s green auto sector. So far, Ford has received $5.9b for a wide range of retooling projects (not a bailout, per Ford PR), Nissan has received $1.6b for Leaf production in Smyrna, TN, while startups Tesla and Fisker have received $465m and $529m respectively. According to the Detroit News, the rest of the 100-odd applicants for the $25b pool are stuck waiting, and with about $42b in total pending requests, not everyone is going to get a rose from the Feds. Predictably, the whining has begun.

What's Wrong With This Picture: Obama Motors Edition

GM, Pay Me My Money Down

Reuters says GM is making a big deal out of sending a $1b check to the U.S. Treasury next Wednesday, “attempting to settle the loan with the government ahead of schedule.”

Who are they kidding?

Detroit Compensation Report: Mulally Made $12.8m, GM and Chrysler Cut Back

The Detroit Free Press reports that Ford’s Alan Mulally made $12.8m last year, nearly double the $7.53m he made in 2008. Despite a considerable increase in Mulally’s overall compensation, his cash salary actually declined to $1.4m, from about $2m in 2008. In addition to the $12.85m he made in salary, bonuses and other compensation, Mulally banked a further $5.05m in stock options. Chairman Bill Ford Jr. continues to work without compensation, although he continues to accrue stock options worth $16.8m. Those options can not be exercised until the firm’s auto operations are profitable. And while Ford’s 2009 profits justify big executive payouts, federal pay czar Ken Feinberg has cut back on executive compensation at bailed-out automakers GM and Chrysler.

GM, GMAC Go Their Own Ways

In their latest report, the Congressional Oversight Panel suggested that GM’s formerly captive finance arm GMAC shouldn’t have been split from the automaker it still supports. If this led you to believe that GM would take the troubled finance firm back under its corporate wing, you have another thought coming. The WSJ [sub] reports that

The idea appealed to GM, in part because auto maker would have more control over lending practices. GMAC’s move in 2008 to dramatically restrict leasing amid the U.S. financial crisis helped trigger the spiral that sent GM into bankruptcy the last year… But taking over GMAC would have many complications. GM sold a majority stake in GMAC in 2006 as a way to buck up the auto maker’s credit standing and its access to capital. As it turned out, GM still remains largely cut off from the markets.

GM's Foreign Relations Suck

Over the daily Toyota runaway stories, it’s easy to forget the plight of GM and its children abroad. If you think that’s the idea, then you are a miserable conspiracy theorist, and you should stand in the corner. With that in mind, let’s check in with GM and its worldwide siblings to see how they are doing.

Congress: The GMAC Bailout Might Have Been A Bad Idea

After three separate bailouts totaling over $17b, Congress is beginning to wonder if keeping auto-finance giant GMAC alive was worth it. Forbes reports that the Congressional Oversight Panel reckons at least $6.3b of that money could be gone forever, as GMAC flounders towards barely breaking even. And like the rest of the bailouts, the fundamental problem is that the influx of federal cash has allowed GMAC to pretend like it’s not struggling for survival. The panel report [ full document in PDF format here] notes [via Automotive News [sub]]

Treasury’s previous and current support is not underpinned by a mature business plan. Although GMAC and Treasury are working to produce a business plan, Treasury has already been supporting GMAC for over a year despite the plan’s absence. Given industry skepticism about GMAC’s path to profitability and the newness of the non-captive financing company model, it is critical that Treasury be given an opportunity to review concrete plans from GMAC as soon as possible.

Sound familiar?

Steve Rattner's Fuzzy Math: GM Worth $90b, Taxpayers Will Make Money

In a conversation with The WSJ [sub]’s Paul Ingrassia, former Car Czar Steve “Chooch” Rattner did some “back-of-the-envelope calculation” to show why he believes the US taxpayers will see their $50b “investment” in GM recouped when The General goes public sometime in the next year.

Here’s how Rattner gets to his latest calculation: Bonds of GM’s bankruptcy estate – known as Motors Liquidation – are currently trading around 30 cents on the dollar, according to Thomson Reuters. Those bondholders were owed $27 billion.

As part of GM’s restructuring, those bondholders were promised a 10% stake in GM when it goes public. In very rough calculations, those bonds are currently valued at about $9 billion (because they currently trade at around 30 cents and were originally worth $27 billion).

Assuming that $9 billion represented 10% of GM if it went public now that would imply GM had a value of around $90 billion. The taxpayer’s stake: 60% of that $90 billion, or $54 billion — Rattner’s magic number.

GM Dealer Activists Left Out Of Reinstatement

The Revenge Of The Son Of Jet-Gate

The personal transportation choices of auto executives has always been an easy point of reference for members of the mainstream media looking for an easy story. From Alan Mulally’s Lexus to Akio Toyoda’s Davos Audi getaway, auto execs’ use of non-company vehicles is always good for a quick “gotcha” headline. But no story in this rich oeuvre has had quite the impact of Jet-Gate, the name given to the mini-scandal that erupted when the executives of Ford, Chrysler and GM arrived in Washington DC for bailout hearings in three separate private jets, prompting derisive comments from members of congress. The PR misstep has haunted Detroit ever since, inspiring federal rules barring bailed-out automakers from using executive jets, and making transportation choices for auto-related DC hearings a major priority for automaker PR: Toyota’s Jim Lentz clearly had the episode in mind when he arrived for recent hearings in a recalled and repaired Toyota Highlander. And thanks to a recent revelation about GM Chairman/CEO Ed Whitacre’s use of executive jets, furor over auto-exec transportation is clearly a long way from playing itself out.

Romney: White House Calling The Shots At GM

Presidential campaigns always start with books, and Mitt Romney’s ‘No Apology’ is rolling off the presses. For a guy who unapologetically strapped his dog (in a carrier) on the roof of the Family Truckster, that seems a fitting enough title. But the White House is asking for one; well, not exactly an apology, but it is firmly denying that it is “calling the shots” at GM. According to a Detroit News story, “Romney writes that that an unnamed CEO of an automotive industry corporation told him that despite what is said publicly, ‘the government is calling the shots on every major decision at GM, including which plants to expand and which to close.'” Romney also calls on the government to distribute its GM shares directly to the American people.

New New Chrysler Buys Sterling Heights Plant From Old New Chrysler

Lutz: GM Execs "Way, Way, Way" Underpaid

Everyone in every business everywhere thinks they are at least somewhat underpaid, and for most, there’s a certain amount of truth to the sentiment. But then, most Americans don’t have jobs that allow them to destroy billions of dollars in value over the course of their careers. Nor does the Detroit News give most of us a forum to whine about our perceived underpayment. Having helped lead GM into bankruptcy and bailout (with thousands of Americans losing their jobs along the way), Bob Lutz still isn’t happy about executive pay limits at GM, and he clearly has no compunction about airing his grievances to the DetN.

What you see is what you get, and it ain’t a lot. All I know is, right now, we are given our responsibility, and given the rigors of the job and demands and the accountability, I would say we are being paid way, way, way below market. Right now, that isn’t a problem, but over time, clearly a company that undercompensates senior executives is going to have a retention or recruiting problem

GMAC Needs More Loan And Lease Subsidies To Survive

Having recently posted a nearly $5b loss, bailed-out auto finance giant GMAC says it needs more help from automakers to remain competitive. Automotive News [sub] reports that GMAC CEO Mike Carpenter told reporters that “the success of GMAC Financial Services hinges on more loan and lease subsidies from General Motors Co. and Chrysler Group,” and that “GMAC requires additional marketing funds from the automakers to provide competitive loans and leases to the GM and Chrysler dealer networks.” GMAC’s Chrysler business has nearly doubled in the last quarter of 2009, now providing about 26 percent of Chrysler’s retail financing and about 30 percent of GM’s.

Chrysler In Breach Of Arbitration Law Already, Allege Dealers

Even with a government-mandated arbitration process in place, the battle between Chrysler and its 789 culled dealers is a low-down, dirty dogfight. Last week, Chrysler sent out letters to all of its rejected dealers, in its attempt to comply with the arbitration law’s disclosure requirements. But, dealers tell Automotive News [sub], those letters are justifications, but not explanations. Absent concrete evidence for why their franchises were closed (something GM has provided to its culled dealers), lawyers for some 65 rejected dealers are fighting back.

GM To Pay UAW VEBA Director $900k For Advice

A lot of what you hear about Steve Girsky sounds decidedly positive: an outspoken critic of GM, Girsky lasted less than a year as Rick Wagoner’s “ roving aide-de-camp,” reportedly due to frustration with management heel-dragging. He even earned TTAC’s “lesser-of-two-evils” endorsement to be Presidential Car Czar over Steve “Chooch” Rattner. When he was appointed to be the UAW rep on GM’s board, representing the union’s VEBA trust which owns 17.5 percent of GM’s stock, he was lauded as someone who could keep his union allegiances at bay. But as special advisor to GM CEO/Chairman Ed Whitacre, Girsky had better be prioritizing GM’s best interests. Reuters reports that he’s being paid a cool $900k in stock grants for his advice. That’s in addition to $200k director’s salary and reimbursement for “living expenses and travel to and from Detroit.” Not bad considering the fuss people are making over compensation at TARP-recipient financial institutions.

Congressional Oversight Panel: Why Did We Bail Out GMAC Again?

The TARP bailout of GM finance partner GMAC is being criticized by a congressional oversight panel [full report in PDF format here], reports the Detroit Free Press. The panel alleges that the Treasury

has not yet articulated a specific and convincing reason to support the company… It has never stated that a GMAC failure would result in substantial negative consequences for the national economy. If Treasury has made such a determination, then it should say so publicly.

Quote Of The Day: Payback's A Bitch Edition

My commitment is to the American taxpayer. My commitment is to recover every single dime the American people are owed… We want our money back and we’re going to get it.

Without even getting into the politics of President Obama’s proposed “financial crisis responsibility fee,” it’s easy to see that the initiative holds a wealth of implications for America’s TARP-recipient automakers. In Obama’s new rhetoric, taking TARP money put businesses in a new category of special obligation to the taxpayers. Though the fee is targeted at financial institutions, the principle applies just as much to Detroit.

Quote Of The Day: Ed Whitacre's Big Lie Edition

Politics Intrude On UAW, Detroit Auto Show

Thanks to the unionization of the US auto industry, its politics (and accordingly, those of the state of Michigan) tend to be of the center-left persuasion. This tendency was doubtless aggravated over the last year, as a congressional bailout of the industry was denied by southern Republican senators. But even in Michigan, the union-industry alliance isn’t strong enough to counter the trend towards ever more divisive politics, as two recent stories show some of the ideological cracks forming in this now highly politicized industry. First,according to the Freep, the National Tax Day Tea Party will re-open last year’s political wounds by staging a rally outside the RenCen during the Detroit Auto Show this year. The idea behind the rally is to “make a peaceful yet clear statement against government takeover of America,” specifically the government ownership of General Motors. Though it’s clearly an empty gesture intended to rally political support more than change anything, it will be a jarring contrast to the usual convivial mood at the NAIAS. And it’s just one of several ways in which the politicization of the industry is becoming steadily less containable.

Bailout Watch 579: GMAC To Score $3.5b More

Bailout Watch 578: GM Embraces Publicly-Funded Lobbying

The Washington Examiner reports that, having previously moved its lobbying efforts to an exclusively in-house arrangement, GM is now hiring outside lobbyists again [UPDATE: GM’s chief in-house lobbyist just retired]. GM has rehired its old lobbying firms the Duberstein Group and Greenberg Traurig, and has added GrayLoeffler to its K-Street roster. GM is also keeping the “well connected” Washington Tax Group on its lobbying payroll, having picked up the firm’s representation in 2007. From these firms, some 18 lobbyists have registered as GM representatives, including a list of what the Wasington Examiner calls “well-connected revolving-door players from both parties.”

Former Reps. William Gray III, D-Pa., and Jim Bacchus, R-Fla., are both on GM retainer, as are fabled Republican and Democratic operatives Ken Duberstein (White House chief of staff under Ronald Reagan) and Michael Berman (counsel to Vice President Walter Mondale and campaign aide to every Democratic presidential nominee since LBJ).

Heading GM’s lobbying push for expanded R&D tax credits is the Washington Tax Group’s Gregory Nickerson, formerly the top lawyer at the tax-writing House Ways and Means Committee and the staff director of the Subcommittee on Select Revenue Measures. Nickerson’s partner is Mary Ellen McCarthy, formerly the top lawyer at the Senate’s tax-writing Finance Committee.

Bailout Watch 577: Auto Task Force Redlines GM Production

The WSJ reports that GM has added a third shift to its Fairfax assembly plant at the request of the US auto task force. The Kansas City plant will now build 6,300 vehicles a week working 21.6 hours a day, up from 4,500 units per week working 14.5 hours per day with two shifts. The move reportedly makes Fairfax the first US auto plant to run three shifts on a routine basis. According to the WSJ,

the auto task force that oversaw GM’s reorganization last spring was startled to learn that the industry standard for plants to be considered at 100% capacity was two shifts working about 250 days a year. In recommending that the government invest about $50 billion in GM, the task force urged the company to strive toward operating at 120% capacity by traditional standards.

Why? That’s not exactly clear. The potential downsides of the move are far easier to identify.

With No Money For Chrysler, Fiat Finds "Hundreds of Millions" For Italian Production

At the urging of the Italian government, Fiat said today that it is willing to shift production of Pandas from Poland to the Pomigliano plant in Naples and invest “hundreds and hundreds of millions” in order to bring its Italian production to over 800k units per year. But, he warns, the Italian government must extend domestic consumer credits in order to sop up the increased capacity or face a rapid market contraction. As part of the deal, the government would allow Fiat to shut a terminally unproductive plant in Sicily, for as Sergio says, “the number of cars produced per worker [in Italy] is totally out of proportion” compared with plants in Brazil or Poland. “It doesn’t correspond with any industrial logic.” He’s right, of course, but you have to admit that it’s strange to see the man who took American taxpayers for a savage ride by snagging a bailed-out Chrysler without putting a penny down, suddenly bankrolling the oblivious nationalism of the Italian government.

Bailout Watch 576: Whitacre Keeps GM's Payback Lie Rolling

Bailout Watch 575: White House Predicts $30b Loss On Auto Bailout

In a NY Times Op-Ed a few weeks back, I laid into the Obama administration for allowing GM to pretend that its $6.7b planned payback is even in the ballpark of what it owes the taxpayers. “If tens of billions in lost tax dollars is simply the inescapable price of preventing a systemic economic collapse, the White House should tell us so,” I wrote. Well, it appears that the White House agrees. Sort of. In an interview with the Detroit News, Gene Sperling, the senior counsel to Treasury Secretary Tim Geithner admitted

The real news is the projected loss [from the $82b+ auto sector bailout] came down to $30 billion from $44 billion

Well, halle-frickin-lujah. Now show us how we’re really going to get $50b out of GM and Chrysler.

Bailout Watch 574: Legal Bills To Pile Up Through 2010

DetN Bailout Report: White House Forced Rapid Bankruptcy, UAW Refused Hourly Pension Freeze

On October 13th of last year, when TTAC’s Bailout Watch clocked in at a mere 115 entries, GM’s then-CEO Rick Wagoner and board members Erskine Bowles and John Bryan approached the Treasury for a “temporary” bailout. Not that we knew it at the time. “In this period of continued uncertainty in the markets, you really can’t rule out anything,” said GM spokesfolks at the time. “Stand by for another big public investment in a failing firm,” warned TTAC. As subsequent events proved, the rush to bailout had already begun. Funny then, that we’re only now learning some of the most crucial details of the chaotic maneuvering of late 2008, thanks to a Detroit News investigation. Though the industry’s disastrous hearings before congress nearly derailed the deal, the initial strategy of approaching the White House would prove to be the key to the eventual bailout. In fact, President Bush was ready to provide $25b to GM, Chrysler, GMAC and Chry-Fi on December 19, only to have talks with the two finance firms break down. Instead, GM and Chrysler were given $9.4b and $4b respectively, with GMAC getting $7b 10 days later and Chrysler receiving $1.5b in January.

TTAC In NYT: GM "Taking Taxpayers For A Ride"

Bailout Watch 573: GM Bailout Cost Taxpayers $12,200 Per Car

This according to the National Taxpayer’s Union report “ The Auto Bailout: A Taxpayer Quagmire,” authored by Rochester Institute of Technology Professor of Economics, Thomas D. Hopkins. That number includes the $52.9b taxpayer “investment” in General Motors, as well as GM’s portion of the GMAC bailout, which brings GM’s taxpayer tab to over $60b. Chrysler’s GMAC-inclusive bailout bill totals $17.4b, or $7,600 per vehicle, based on estimated 2009/2010 sales. Don’t believe that GM or Chrysler will match their projections over the next twelve months? The NTU estimates that total government support for the auto industry comes out to $800 per taxpaying American family. These numbers do not include the Cash for Clunkers program, likely future bailouts of GMAC (projected at a further $2b), or Department of Energy retooling loans (ATVML). These numbers also do not reflect the very real possibility that GM, Chrysler and GMAC could continue to drain taxpayer money post-2010. “For each year of survival beyond 2010,” the report warns, “the burden per vehicle would decline [Ed: but not disappear] – so long as no additional government funding is provided.”

Bailout Watch 572: Government Fast-Tracking GM IPO, Taxpayer Screwing Confirmed

Ron Bloom, the defacto head of the government’s auto restructuring task force (or what’s left of it), tells Reuters that the government wants to hurry up a GM IPO in order to get out of the “investment” as soon as possible. And as we’ve predicted, this means taxpayers will be getting the fuzzy end of the lollypop.

Private markets would like to see us exit this investment, and I think they will be more comfortable if we’re on a sustained path out the door than if they think we’re going to try to market time it to maximize return.

And really, why would taxpayers expect any kind of a return from $50b dumped into one of the most prolific wealth destruction machines in recent economic history? So when will this IPO/giveaway take place?

Fiatsler's Dilemma: Build Engines In Michigan Or Mexico?

Bailout Watch 571: How GM Won't Pay Off Its Government Debt (But Will Try To Make You Think It Did)

Ford PR: "We Are Also Going to Pay Back Our Loans Unlike Other Companies"

Bailout Watch 570: Your Tax Dollars At Work Overseas

Bailout Watch 569: Exit Strategy? What Exit Strategy?

Next up in today’s series “Selections from the GAO report on the auto bailout which closely resemble TTAC editorials of a year ago” we have the report’s discussion of a possible exit strategy. Or rather, the report’s disclosure that there’s so not an exit strategy it hurts. From the report’s conclusions:

While Treasury has stated that it plans to review all possible options for divesting itself of its ownership interest in Chrysler and GM, Treasury officials have focused primarily on an IPO for GM, both in our discussions with them and in their public statements. However, given the complexity of the economy and the financial markets, considering all of the options in the context of the companies’ financial progress and current financial conditions will be important for Treasury. The past year has indicated the extent to which a company’s financial situation can change within a period as short as a few months. Given the fluidity of conditions and the number of factors that will need to be considered when determining how and when to divest, it is important that Treasury identify the criteria it will use to evaluate the optimal method and timing for selling the government’s ownership stake. Determining when and how to divest the government’s ownership stake will be one of the most important decisions Treasury will have to make regarding the federal assistance provided to the domestic automakers, as this decision will affect the overall return on investment that taxpayers will realize from aiding these companies

Notice the use of future tense to describe these decisions? Not only is there no plan, there’s also no timeline and precious few staff to implement it. More importantly, there’s not much of a chance of a divestiture plan succeeding under any circumstances. Oh, and plenty of potential for unintended consequences. Hurray!

Bailout Watch 568: Cash For Clunkers Hurt Bailout Exit Strategy

Bailout Watch 567: Feds Mandate Chrysler Green Car

Bailout Watch 566: Bailed Out Automakers Must Meet US Production Quotas

Bailout Watch 565: Small Business Adminstration Dealer Bailout Grows

Car dealers are some of the most politically connected people in America. As we reported yesterday, more than a few axed GM store owners demonstrated their political muscles by forcing the nationalized automaker to rescind their franchise terminations. Further back in time, we highlighted the Obama administration’s “stealth” dealer bailout: a car dealer-specific Small Business Administration (SBA) loan program. Under the program, the SBA guarantees 75 percent of a car dealer’s floor-plan line of credit, ranging from $500,000 to $2 million. The SBA’s network of private-sector lenders make the loans. In theory. In practice, it’s been what the Brits call a damp squib. Although Automotive News [AN, sub] fails to put any hard numbers to the program’s failure, they acknowledge that the SBA dealer deal “has had trouble attracting lender participation since its May launch.” Needless to say, the “answer” to the SBA lenders’ entirely understandable reticence/prudence is . . . bigger loans and more federal backing.

GM To Draw On Government Funds For Delphi Rescue

Christmas For GMAC: Feds Eye Another $2.8b-$5.6b

Henderson: GM Pay Cuts "Thoughtful"

We’re not public yet but we will be and if we do our job that stock is going to have real value. We thought it was fair. We thought it was thoughtful

GM CEO Fritz Henderson comments on Pay Czar Kenneth Feinberg’s decision to dock his salary to a flinty $950,000. The AP reports Henderson’s total compensation could be worth $5.5m, apparently based on some unfathomable projection of GM’s IPO value. But Fritz is going to work for it. When asked if he’d read Steve Rattner’s magnum opus calling GM management “stunningly poor” and “perhaps the weakest finance operation any of us had ever seen in a major company,” Fritz’s responds in the affirmative…

Bailout Watch 560: Feds Set to Bail Out, Nationalize GMAC

.

The New York Times reports that the “troubled finance company” known as GMAC is hitting-up Uncle Sam for more, as-yet-unspecified billions. The Gray Lady tells us it’s not a question of “if”, it’s a question of how GMAC and the Treasury can sleaze the deal, so that taxpayers don’t end up owning the company. ‘Cause that would “reignite” the “debate” over the bailouts that have already been given. “GMAC and Treasury Department officials have been locked in negotiations over how to structure the third bailout as it approaches a crucial deadline in early November for shoring up its finances [as a $5.6 billion payment comes due]. The government has injected $12.5 billion into the company and already owns about a 35 percent stake from a broader restructuring of General Motors, its onetime parent.”

Bailout Watch 589: GM C11 Lawyers Score $23m

Rattner On His Detroit Adventure

Former head of the Presidential Task Force on the Auto Industry, Steve Rattner has penned a retrospective for Fortune on his time guiding the auto industry bailout. He covers everything from how he assembled his team and developed a strategy to the decision to fire Rick Wagoner and the showdown with Chrysler’s creditors. There are no real surprises if you’ve followed TTAC for the last year or so, but it’s fascinating stuff to read coming from the horses mouth. Take Rattner’s initial impressions of the GM “culture thing”:

Everyone knew Detroit’s reputation for insular, slow-moving cultures. Even by that low standard, I was shocked by the stunningly poor management that we found, particularly at GM, where we encountered, among other things, perhaps the weakest finance operation any of us had ever seen in a major company.

For example, under the previous administration’s loan agreements, Treasury was to approve every GM transaction of more than $100 million that was outside of the normal course. From my first day at Treasury, PowerPoint decks would arrive from GM (we quickly concluded that no decision seemed to be made at GM without one) requesting approvals. We were appalled by the absence of sound analysis provided to justify these expenditures.

Quote Of The Day: Betting Odds Edition

Suppliers Still Looking For Bailout

“There must be increased access to capital through the entire supply chain — from the largest tier one to the smallest family-owned firm,” Dave Andrea, vice president of industry analysis and economics at the Original Equipment Suppliers Association told the Senate Banking Committee [via The Freep]. “Without assistance this country will needlessly lose manufacturing capacity, technology development and jobs.” Which is about what suppliers have been telling congress since bailout mania struck. What the Freep fails to properly explain is that the supplier bailout passed earlier this year was an unmitigated disaster for suppliers and their relations with OEMs.

Recent Comments