Bailout Watch 362: Auto Suppliers Seek $10b

Bailout Watch 361: No, You Can't Spend TARP On Lobbying

Newly-confirmed Treasury Secretary Timothy Geithner highlights “President Barack Obama’s firm commitment to transparency, accountability and oversight in our government’s approach to stabilizing the financial system,” in his announcement today of reforms to the Emergency Economic Stabilization Act (EESA). Details on the reforms are sketchy at the moment, as the new President’s commitment to vague details remains firmly in place. Read the Treasury press release here, or hit the jump for the salient points. Still no comment from the DC (neé Detroit) Two on the development, or word from the Treasury on whether this effects Terminator product placement.

Bailout Italia: Fiat CEO Says 60k Jobs At Stake

Automotive News [sub] reports that Fiat CEO Sergio Marchionne is angling for a special Italian-edition auto bailout, echoing a FIM-CISL union official who earlier argued that 60k Italian auto jobs are “at risk.” The playbook should sound familiar. “We expect help from the government for the entire car sector,” Marchionne said. “It’s not about helping Fiat but restarting an entire sector and the whole economy.” This coming from a firm which will likely take a 35 percent stake in Chrysler… if the US government comes through with enough bailout funds to make it worthwhile. Not that double-dipping is in any way unheard of, as bailout mania hits the global automakers. Italian PM Silvio Berlusconi has already met with EU Industry Commish Gunter Verheugen in Turin, Fiat’s hometown. Verheugen had earlier warned that not all European automakers may survive the current auto sector crisis.

Bailout Watch 360: Why GM Refused a $3b Canadian Bailout

TTAC commentator psarhjinian explains GM’s seemingly inexplicable decision to turn down a $3b bailout offer from the Canadian government. “A large part of that would be that, effectively, GM Canada is a dead company walking. St. Catharines Powertrain and Oshawa Truck are both scheduled to close, and with the Lacrosse going Epsilon and Camaro an only child, Oshawa Car isn’t far behind. That leaves CAMI in Ingersoll, which might not survive the new Equinox (it builds the Equinox, Torrent and XL-7—winners all, there) and Windsor Transmission (the old-school four-speeds). Good luck. GM asking for bailout bucks obliges them to maintain a manufacturing presence in Canada. Since, other than St. Catharines—which is scheduled to close—GM Canada makes nothing with a future, this isn’t going to happen. The fiasco of their getting millions of dollars just before announcing the closure of Oshawa Truck did not sit well with the Canadian public or it’s government and I suspect the Canadian bailout came with job guarantees attached that GM has no intention of honouring. They won’t tap the Canadian line until they’re absolutely desperate. On a related note…

Bailout Watch 359: John Horner's International Auto Bailout Scorecard

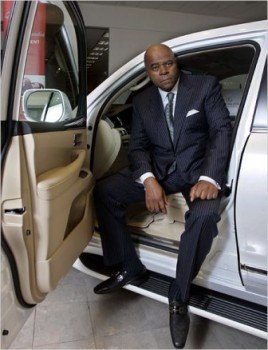

Bailout Watch 358: ChryCo Co-Prez Press Reveals Bailout Strategy

Former Toyota President and current Chrysler Co-Prez Jim Press has been out and about, playing pimp my press. In so doing, he’s revealed his employer’s strategy for scarfing another $3b in bailout bucks from its current (not to say only) financial backer (that’s you). The ailing American automaker must present its case to Congress on or around March 31. And here, via Ward’s Dealer Business, it is…

“Press says there are four points to the auto maker’s turnaround:

* Chrysler has invested in new product – the auto maker has eight new vehicles coming out in the next year and a half and 24 in the next 48 months.

* The company will continue to support its dealers “with record levels of incentives.”

* Credit is improving with the auto maker’s finance company.

* Fiat has some of the best platforms in Europe in terms of cost and performance.”

Now how much would you pay? Well don’t answer! Mr. Press is happy to share some of the philosophy underpinning his Congressional term paper.

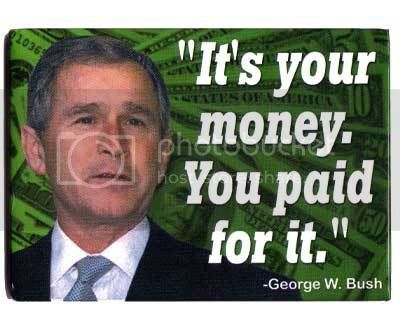

Bailout Watch 357: GM Spends $3.3m to Score $13.4b

That’s one Hell of a ROI. And in case you hadn’t figured it out, we’re talking about lobbying costs to score bailout bucks. The Wall Street Journal reports GM’s ’08 spend on D.C. power brokering totaled $13.1m. (The $3.3.m spend covers the period of bailout begging.) That’s down from ’07’s $14.3m, but times are tough. Hence the bailout. Anyway, GM spokespinner Greg Martin assured the WSJ that no taxpayers were hurt during the buttering-up of federal legislators. “Lobbying is the transparent and effective way that GM has its voice heard on critical policy issues… that companies should not be required to forfeit if they receive federal funding,” Martin said, endearing himself to taxpayers throughout the country. Martin added that no funds lent from the Treasury would be used for lobbying. Huh? I thought GM promised the SEC yesterday not to cook the books. I mean, from what “ring fenced fund” does the lobbying money come from, pray tell? Ready to listen a bit more of that song “Fool on the Hill?’ Then let’s talk about the recently nationalized GMAC…

Bailout Watch 356: "Taxpayers Should Own Chrysler, Not Fiat"

Bailout Watch 355: Stormclouds Gather Over The Chrysler-Fiat Wedding

The man who knows how to get something for nothing (Fiat’s Sergio Marchionne) has “absolutely no intention” of running Chrysler as part of the two firms’ automotive axis, reports Automotive News [sub]. Marchionne will fill one of Fiat’s three seats on Chrysler’s seven-seat board, as he attempts what he describes as the “mission impossible” of turning Chrysler around. But before the dramatic-but-overplayed theme music cues a Fiat-led revamping of the ailing automaker, Chrysler’s stakeholders will have to make meaningful concessions, including debt-for-equity swaps. But will Marchionne accompany ChryCo CEO Bob Nardelli for future rounds of bailout beggary? Of course not. After all, the Fiat deal confirms the suspicions of at least one US Senator, that injecting cash into Chrysler would simply invite a takeover. And sure enough, Automotive News [sub] reports that officials concede that giving U.S. taxpayer money to an automaker tied to an overseas-based company will raise red flags in DC. Chrysler spokesfolks insist that the Fiat deal is consistent with the “stipulations and obligations” of the U.S. Treasury Department loan, but then they wouldn’t be insisting if there weren’t some question, would they? As Farago reported earlier, the promise of more federal money is what got Fiat sniffing around in the first place. And now there’s trouble afoot.

Bailout Watch 354: Chrysler + Fiat = Ponzi

During the first round of Motown bailout begging, professional wordsmiths made the connection between Detroit’s $17.4b “bridge loan” request and Alaska’s “bridge to nowhere.” Thus “bridge loan to nowhere.” In fact, the Granvina Island Bridge project would have opened-up the Alaskan archipelago to real estate and tourist development. Boondoggle yes, but one with a long historical precedent and a reasonable expectation of some sort of commercial (i.e. taxpayer) return. In contrast, Chrysler’s supposed tie-up with Fiat is a genuine scam. The idea that Chrysler can become a viable automaker by re-engineering Fiat automobiles for the hugely competitive U.S. market is patently ridiculous. But not for Congress, the entity that offers the ailing American automaker its only hope for survival (cash). At least that’s the plan. And the man with the plan is ChryCo 300 designer Ralph Gilles. Speaking at The Automotive News World Congress [sub], Ralph told the world that he loves him some Italian. Well he would, wouldn’t he? But the details have to be seen to be believed. Or not, as the case may be.

Bailout Watch 353: Pimco Kills GM

To qualify for additional bailout billions on March 17, Congress dictated that GM must clear two main hurdles: reduce its public debt by two-thirds (via debt-for-equity swaps), convince the United Auto Workers (UAW) to accept half of contributions to a retiree healthcare trust in the form of GM stock, and lower union workers’ wages to parity with foreign automakers. OK, three. Three main hurdles. Oh, and eliminate the union jobs bank. So, four. Four hurdles. Within two hours of the Bush’s bailout bonanza, the UAW considered the conditions and said uh, no. And now GM’s third largest bondholders have left the investor committee considering the mandatory d-for-e swap, claiming “We’re just not good committee members.” Not so funny now, eh Mr. Bond holder? More specifically, Bill Gross of Pacific Investment Management Co. (a.k.a. Pimco) has just administered the official kiss of death to GM’s shot at meeting Congressional loan conditions. Either the pols will change the rules (the “we’re sorry we were so mean” scenario), or this is it: the remaining money will be used for GM’s post Chapter 11 debtor-in-possession financing.

Bailout Watch 352: Chrysler – Fiat Deal Depends on ChryCo Bailout Bucks

Chicken and egg this. If Chrysler doesn’t score an additional $3b worth of bailout bucks, Fiat can/will walk away from their agreement to “buy” 35 percent of the ailing American automaker. The Wall Street Journa l quotes “people familiar with the pact” to substantiate the proviso. Equally anonymous sources told the Journal (we hope) that if the loans go through, Fiat will take three seats on Chrysler’s Board of Directors. And then, “If Fiat meets goals for improving Chrysler’s operations within 12 months of the agreement, Fiat would have the option of buying an additional 20% of Chrysler for about $25 million, said people familiar with the matter. Details of the goals weren’t clear.” Twenty-five million? They’re joking right? Or is that the amount Cerberus would pay Fiat for 20 percent of Chrysler?

Bailout Watch 351: GM Running On Fumes. Again. Still.

Fritz Henderson is not a happy camper. Speaking at the Automotive News World Serious, GM’s Chief Operating Officer came off all emo, revealing a string of bad news without the usual spin. Of course, the event’s host chose to focus on the more, uh, upbeat side of Fritz’ speech. Henderson washed his hands of HUMMER, Saab and Saturn, albeit without announcing a “final solution.” And although “Pontiac is toast” isn’t the brand’s official tag line, it might as well be. “Henderson said the four core brands [Chevy, Cadillac, GMC and Buick] comprised 83 percent of GM’s total sales volume in the United States last year. Going forward, the Pontiac brand will ‘shrink substantially,’ Henderson said. But the fact that GM is investing heavily in the Buick brand in China will benefit that brand in the United States. ‘When you see the new LaCrosse, it will be very familiar to the one you’ve seen GM reveal in China,’ Henderson said.” And now, the real deal, brought to you by the MSM…

Bailout Watch 350: Europe's Subsidy Schizophrenia

One of the myriad unintended consequences of America’s bailout bonanza is the prospect of an international trade war. Though the WTO moves slowly, the European Union often takes a firm line on American subsidy regimes. And a report in Automotive News Europe [sub] indicates that the EU is prepared to take a firm line on automotive subsidies, as it has in the past with steel and agricultural protective measures. “Europe cannot just look on if someone offers subsidies and market forces are dispensed with,” declares German Chancellor Angela Merkel. “We have to watch carefully what the new president of the United States … will do with the American automotive industry,” growls EU Industry Commissioner Guenter Verheugen. But what’s this? Auto Motor und Sport reports the details of France’s latest 300m Euro effort to rescue the Renault and PSA Peugeot Citroen’s supply chains.

Bailout Watch 349: UAW Boss: GM Won't Meet Loan Terms

Bailout Watch 348: Jet-Gate Becomes Jet Hate

Bailout Watch 347: Suppliers Eye the Trough

Auto industry suppliers have been stuck between a rock (penny-squeezing OEMs) and a hard place (volatile commodity prices) for some time now. And though the Detroit Three argue relentlessly that their own bankruptcy would doom them in the eyes of consumers, bankruptcy protection has practically become the norm for their suppliers. Which is why supplier firms need a bailout of their own in order to give Detroit’s bailout a chance. Chrysler’s endless winter break, GM’s half-sized Q1 production plan and general industry turmoil is about to cause exactly what the bailout was supposed to prevent: cascading supplier bankruptcies. Bloomberg documents the doom in detail, concluding with American Axle’s Dick Dauch’s assessment that “there’s a shakeout occurring.” Unless…

Bailout Watch 346: Feds Turn on the Taps, Bailout Bonanza Begins

Even before President Obama becomes President Obama, the democrats have put a light on that Hill (go Jumbos!). In other words, the bailout bucks are flowing freely, with House Democrats unveiling an $825b stimulus bill. Here’s a challenge: define “stimulus” without using the words “pork” or “special interest.” And one of those special interest groups that’s especially interested in sticking their snouts in the federal trough: the U.S. auto industry. Surprised? “The money for advanced battery support includes $2 billion — half in loans and half in grants — and $200 million to encourage electric vehicle technologies,” The Detroit News, no stranger to industry encouragement, reports. “The bill also calls for $300 million to retrofit older diesel engines and replace some diesel vehicles, such as school buses, and use $400 million to help state and local governments buy more efficient alternative-fuel vehicles. Additionally, the measure includes $600 million for the federal government to replace older vehicles with alternative-fuel automobiles.” And get this: Motown’s hometown heroes are feeling shortchanged.

Bailout Watch 345: Chrysler Extends Shutdowns at 5 Factories

Bailout Watch 344: GM Lowers Sales Forecast to 10.5m, Ups Bailout Ante

Bailout Watch 343: CAR Says GM's Recovery Plan Sucks

You remember The Center for Automotive Research (CAR). They’re the Detroit-based automaker and union-funded think tank that progated the “soup lines beckon if you don’t bailout Detroit” study. The mainstream media repeated CAR’s stats– debunked on TTAC by both myself and our Best and Brightest— as gospel. Now that CAR has had its wicked way with $17.4b of your tax money, they’re back from hiatus with fresh apocalyptic visions for policy makers. Only this time, they’re right. “McAlinden, director-economics research for the Center for Automotive Research, predicts auto makers will sell 11.5 million units in 2009, down from 13.2 million last year and 16.2 million in 2007,” Ward’s Dealer Business reports. ‘The U.S. will not see 14 million new-vehicle sales again until 2012 and 16 million in 2013. The downturn will last a long time.'” OK, so… “Whether the two auto makers can meet the loan requirements set by the Bush Admin. remains to be seen. However he does not believe GM can meet the obligations as they are written now, adding, the ‘conditions will be changed so GM can keep them.'” Make no mistake: McAlinden has no faith in GM’s recovery plans.

Bailout Watch 342: UAW Stonewalls on Concessions

Bailout Watch 341: GM's "Partnership" Proposal (PNGV II)

GM’s VP For R&D Larry Burns has a new post up at Fastlane, calling for a “partnership between the U.S. government, auto manufacturers and suppliers, the energy and infrastructure industries, and other key stakeholders focused on transforming the automobile.” After all, as Burns says “we all seem to be coming to the conclusion that the automobile as we know it — powered by a combustion engine — must eventually go the way of the horse and buggy. It is simply not sustainable.” And so Burns humbly offers GM’s solution: The Cadillac Converj, A concept car that is powered by electricity. Unless it wants to go more than 40 miles, in which case it’s back to the ol’ ICE. But luckily “significant challenges” are actually a good thing when you are going for government handouts and not the Standard Of The World.

Bailout Watch 340: GM CEO Contemplates C11

The Wall Street Journal carries the surprising news that General Motors management might be starting to edge closer to reality: “Speaking at the North American International Auto Show in Detroit, Rick Wagoner, GM’s chairman and chief executive, said the company wants to avoid a Chapter 11 filing, but also said its viability is ‘not 100%’ certain at this point.” Rick backing away from the position that GM hasn’t even thought about C11 is news. “The Treasury Department has said GM must have a plan by March to become ‘viable’ and have ‘positive net value.'” Nobody actually expects GM to have worked out details with bondholders or the UAW before the March deadline. The March deadline was chosen by the current administration as a way to act tough while kicking the can over to the new team, and everyone involved knows it. The UAW says it isn’t clear what is being asked of it and hasn’t started negotiations. Meanwhile, regarding the bondholder negotiations; “GM Chief Operating Officer Frederick ‘Fritz; Henderson suggested Monday that it could be some time before substantive discussions can be held.” So, nothing is really happening with the UAW or the bondholders yet. How about pulling the plug on dead brands?

Bailout Watch 339: Ford's Good at 12m P.A. Or Is That 10m?

Ford’s El Presidente de las Americas has been out and about, doing the rounds, talking up the company’s prospects to the media. And Mark Fields has a good story to tell: Ford’s not Chrysler or GM. Thankfully, Bloomberg cuts through the chatter to ask the key question: at what point would FoMoCo tap into Uncle Sugar’s Blue Oval-shaped $9b bailout– I mean, line of credit? Fields said he’ll only proffer the begging bowl if “the economy continues to deteriorate well beyond our assumptions.” Define “well beyond.” Nope. Well, at least we get a look at Ford’s assumptions. “Ford Motor Co. is forecasting that this year’s U.S. sales of cars and light trucks may fall as much as 9 percent from 2008, when they reached a 16-year low. Industry sales will be 12 million to 12.5 million, with the first half weaker than the final six months.” “After the last couple years, we hope we’re at a bottom because it’s a pretty low level of activity for the industry,” Fields said. Again with the hope. Oh, and did I mention that Ford CEO Alan Mulally didn’t get the memo on the 12m bailout floor?

Bailout Watch 338: GM Car Czar Stays In Lousy Hotels, Flies With the Rabble

“I’ve never quite been in this situation before of getting a massive pay cut, no bonus, no longer allowed to stay in decent hotels, no corporate airplane,” GM Car Czar Bob Lutz tells NPR radio. “I have to stand in line at the Northwest counter. I’ve never quite experienced this before. I’ll let you know a year from now what it’s like.” Hopefully not. Meanwhile and before that, Maximum Bob was busy comparing the Chevy Malibu to the VW Phaeton. On one level, I’m down with that. The VW Phaeton was a stunning car, in an absurdly misbranded, high-tech kinda way. I mean, we’re talking about a vehicle that automatically adjusts the angle of its sunroof at speed to protect occupants from sonic distress. But during his don’t call it The Detroit Auto Show interview, GM Car Czar Bob Lutz proudly reveals that the Chevy Malibu took its styling cues from the ill-fated Phaeton. What styling cues? Of course, there’s more Maximum Bobage to be savored here.

Bailout Watch 337: New York Times Calls for 40mpg by 2020

The federal bailout bucks propping-up GM and Chrysler’s bankrupt businesses come with political strings attached– that will turn into piano wire with each successive snuffle at the trough. And so it begins… Yesterday’s New York Times editorial called for higher federally mandated fuel economy standards. “[Now that Bush is history] The Obama administration now has a free hand to set its own standards that will save consumers money at the pump, reduce oil dependency and greenhouse gases, and help make the American car companies more competitive. The 2007 energy bill required new cars and trucks to meet a fleetwide average of 35 miles per gallon by 2020, a 40 percent increase over today’s average of 25 m.p.g. Congress intended this as a floor, not a ceiling, and ordered the National Highway Traffic Safety Administration to write specific regulations.” Uh-oh…

Bailout Watch 336: Have You Heard the One About the Automaker That Borrowed $7b From the Federal Government and Then Went Bankrupt?

Bailout Watch 335: GM Has Prepared Uncle Sam for Bigger Bailout

Bailout Watch 333: Chrysler Seeks an Additional $3b From Treasury and Chrysler Financial Bailout– by Friday

Bailout Watch 331: Bill Ford Waits for the World to Implode

Bailout Watch 330: Car Czar Welcomes Car Czar

Bailout Watch 329: Congress Wants to Give UAW Free Ride

Bailout Watch 327: UAW Holds Secret Trump Card

Bailout Watch 326: A Tale of Two Bailouts

Bailout Watch 325: GM CEO Rick Wagoner Wants It All, Today

GM CEO Rick Wagoner is out and about today, peddling his company’s ability to be all things to all people save, perhaps, enough customers to avoid bankruptcy, bailouts and brickbats. The AP reports that Red Ink Rick reckons retirees are golden. “General Motors Corp. Chief Executive Rick Wagoner said Thursday the Detroit automaker can survive long-term without cutting benefits to retired workers. Wagoner made the remarks on NBC’s Today Show, where he was joined by United Auto Workers President Ron Gettelfinger. The two made the appearance from Detroit ahead of their renewed labor negotiations scheduled to begin next week.” Nothing like a good long suckle on the taxpayer tit to bring out a little media-pleasing solidarity. I wonder how Ron’s base feels about that one. Prety good if they’re retired, and think Uncle Sugar will cotinue to fuel the gravy train for the next twenty years or so. Perish the thought. Now, about those congressionally mandated concessions…

Bailout Watch 324: U.S. Porn Industry Wants A Suckle (Car Reference at End of Post)

India’s Economic Times can’t believe it: “Porn baron Larry Flynt says that the US Government should help rejuvenate the industry, which has been bearing the brunt of the ongoing global economic crisis, with a financial assistance of five billion dollars. The Hustler magazine founder has even joined forces with ‘Girls Gone Wild’ video series’ creator Joe Francis to approach Congress so as to sustain the same kind of financial aid as was recently approved for automakers.”

A Bollywood fantasy? No, says Xbiz Newswire, the adult entertainment industry news authority. Xbiz says Flint and Francis are serious. Or at least seriously looking for headlines. Xbiz talked to Larry Flint’s flak Owen Moogan, who made a compelling case: “With the Big Three automakers asking for assistance, and with banks asking for assistance, we thought, ‘Why not us?’ The adult industry is another great American business entity. We represent the all-American pursuit of sexual gratification.”

Bailout Watch 323: Chrysler "Full Transparency" Worth More Than $4b

Bloomberg reports today that despite receiving $4b in government aid, Chrysler refuses to open its books to the public which involuntarily bailed it out. It turns out that when Robert Nardelli pledged “full financial transparency” while begging the government to buy into his Pentastarred hell, he was really offering “partial financial transparency.” As in, ChryCo will share the numbers with the Treasury, but nobody else. The weekly status reports, biweekly cash statements and monthly certifications to the Treasury are required to demonstrate that Chrysler is complying with policies on expenses. But as Chrysler Spokesperson Lori McTavish puts it “we are not in a position to mirror publicly traded companies, as our investors remain private. However, the company is obligated to our private investors and lenders, and as such, keeps them apprised.” Earth to Chrysler: your major investor is the public. And we expect more than just a thank you card.

Bailout Watch 322: U.S. Rep Dingell (D-MI): "I Screwed Up"

Once again, The Detroit News is giving free reign to D2.8 boosters to boost the D2.8 and, by extension, themselves. Today, we get an epistle from Congressman John Dingell (D-Dearborn), who feels obligated to come clean about his role in “enabling” Motown’s hometown heroes’ self-destruction and, perhaps, Uncle Sugar’s $33.4b “take the money and run it the way you always have” auto bailout buffet. (That’s excluding GMAC.) “Americans are angry about what has happened to our country. No one seems to be willing to take responsibility. I will take some. I should have held the automotive companies more accountable for their actions, or inactions, over the years. My colleagues voted to make another member, who views the auto industry in a much different way than I do, the chairman of the House Committee on Energy and Commerce. I find that some members voted against me because I was perceived to be sympathetic to the auto industry.” Translation: if loving you was wrong, I don’t want to be wrong. And I still love you. “I don’t regret fighting for millions of Americans who work in the auto industry, even if that fight might have hurt me. I will fight for those workers, the UAW and others in the industry until they kick me out of this place.” They? I know democracy is a difficult concept for a politician who’s been in Washington since 1955, but shouldn’t that be YOU, as in Michigan voters? Anyway, things are going to be different now…

Bailout Watch 321: UAW Boss: "GM, Chrysler May Not Need More Bailout Bucks"

At first glance, this makes no sense: the head of the United Auto Workers (UAW) telling the world that GM and Chrysler are done feasting at the bailout buffet. “If we can get by without more money, that’s what we want to do,” Big Ron Gettelfinger told Automotive News [AN, sub] in an interview at Solidarity House. And if I could convince my Lexus dealer to give me a new IS-F with a handstand, that’s what I’d want to do. Clearly, Ron Gettelfinger is promising someone a rose garden– while he’s painted the ailing automakers into a corner. Ish. First, this is what car salesman call an “if then” close. Second, Ron told AN that “how well the money holds out will depend on sales volume this year.” Gettelfinger is hopeful that “sales will not dip more than 1 million units below 2008’s depressed 13.1 million.” So, IF U.S. new car sales DON’T dip below 12.1m per year, THEN GM and Chrysler recover without any more federal funding? Nonsense. Make no mistake: Ron’s statement is part of a calculated plan to avoid making any concessions during the federally-mandated negotiations to reduce his members’ pay and benefits. In other words, the UAW doesn’t need to make concessions because everything’s going to be alright. It is, in fact, Ron’s opening gambit. And it’s not bad. But shame on AN for swallowing the union boss’s bait; hook, line and sinker. I mean, what is this…

Bailout Watch 320: What's Not To Like About The GMAC Bailout? How Much Time Do You Have?

The New York Times’ Dealbook blog takes it to the GMAC bailout with TTAC-like zest today, methodically doling out blame to all sides of the deal. Many of their points have been covered in TTAC’s ongoing coverage of the deal, but the Dealbook post does a good job of summarizing everything there is to hate about the handout. For one thing, there’s the fact that (unlike other TARP packages) the Treasury failed to secure warrants backed by GMAC common equity. This means that we the American taxpayers have no upside to the deal beyond earning back our money with eight percent interest. Furthermore, the warrants that Treasury did receive are worth only five percent of our $5b investment in GMAC, far less than the 15 percent warrants required of other TARP borrowers. Oh yeah, and the $1b that GM received to invest in GMAC is secured only by GM’s stake in GAMC. Not only do these considerations increase taxpayer risk, they also destroy the “our bailout is better/more fair than theirs” relativism that the auto biz rode into Bailout City.

Bailout Watch 319: Another Damn GMAC Post

I’m sorry. I know. I should move on. I’d like to move on. But the more I read about the federal government’s $6b “investment” in troubled auto and mortgage lender GMAC, the more deranged the deal becomes. Fans of this series (?) will know that Uncle Sugar now effectively owns GMAC. If I were the head of Ford or Toyota or Honda’s lending unit, I would be mighty pissed. As a journalist, I find the cloak of secrecy surrounding the arrangement, from the timing of the Fed’s pre-approval for GMAC to morph into a bank, to the fine print of how this is all supposed to work. A regulatory filing unearthed by Forbes reveals that GMAC has “amended,” but not canceled, its exclusivity agreement with GM. “Purportedly, GM may now offer incentives such as low-interest loans through other financial outfits with increasing flexibility over the next 24 months. While the filing seemed to imply that private competition may be entering the government-backed lender’s universe, both the auto manufactorer and its banker seemed to indicate that nothing material had changed and the two had only altered their pact to satisfy the Federal Reserve’s demands.” Oh, that’s alright then. Or is it?

Bailout Watch 319: Damage Report

Department of Energy “retooling loans” – $25b

GM and Chrysler “bridging loans” – $17.4b

U.S. Treasury “investment”in GMAC – $5b

U.S. Treasury supplement to GM for GMAC – $1b

TOTAL – $48.4b

Bailout Watch 318: "GM Statement on Receiving the First Tranche of the Federal Bridge Loan"

“GM has received the first tranche of $4B from the Federal Government and we look forward to working with the government on all elements of the loan agreement and our viability plan. We appreciate the Administration extending a financial bridge to GM at this critical time for the U.S. auto industry.

“GM remains committed to providing great cars, trucks and crossovers, as well as leading technologies, to our customers. We are committed to successfully executing the plan we submitted on December 2 and remain confident in the future of General Motors.”

Bailout Watch 317: "Statement Regarding Status of Federal Assistance to Chrysler LLC"

Auburn Hills, Mich., Dec 31, 2008 – “We recognize the magnitude of the effort by the Treasury Department to complete these multiple financial arrangements quickly and sequentially. The discussions relating to Chrysler LLC have been positive and productive, and we look forward to finalizing the details of our financial assistance in the immediate future.”

Bailout Watch 316: Chrysler "Thank You America" Blog Blows Up in Their Face

Bailout Watch 315: US Nationalizes GMAC

Now that the frog– fog of war is beginning to lift from the deal between the federal government and troubled auto and mortgage lender GMAC, a few key facts have emerged. First and foremost, Business Week (BW) reminds us that the U.S. Treasury’s $6b “investment” in GMAC leaves it as the lender’s largest shareholder. Not to put too fine a point on it, the federal government owns GMAC. Second, BW reckons that means a boardroom shake-up is on its way. “GMAC’s 12-member board of directors, of which [J. Ezra] Merkin is chairman, is expected to be clipped to seven directors. Cerberus has four executives on the current board, but will get only one voting director on the new board… GM will go from having four voting executives on the board to just one, nonvoting executive.” In other words, GM can’t manipulate GMAC to move the metal. Or can it? More [non-Dodge] ramifications after the jump.

Bailout Watch 314: GM Gets $4b, Refuses to Name Supplier Payment; Treasury Announces "Automotive Industry Financing Program"

Uncle Sugar has completed the transfer of the first $4b of a $13.4b loan to General Motors, under the Troubled Asset Relief Program (TARP). Despite CEO Rick Wagoner’s previous pronouncement that his employer had enough cash to last through 2009, the artist once known as the world’s largest automaker (and the world’s most profitable corporation) was in danger of running out of money. And now it isn’t. Until later. Meanwhile, you might think that a $13.4b “investment” in GM would buy the U.S. taxpayer a little something called “transparency.” As The LA Times reports, you’d think wrong. “The cash-strapped Detroit company plans to use the money for continuing its operations… GM is obligated to make a large payment to a major supplier in early January; it has declined to offer details on the amount it owes or to which supplier.” And there are more strange doings over at Chrysler. (The automaker’s owned by Cerberus Capital, a private equity firm with close ties to the federal government, increasingly famous for bending rules to its advantage while operating under the cover of darkness.) “Auburn Hills, Mich.-based Chrysler is expecting $4 billion in cash as well, but the Treasury has yet to announce the closing of the first round of loan money. ‘We’re working expeditiously with Chrysler to finalize that transaction and we remain committed to closing it on a timeline that will meet near-term funding needs,’ [Treasury spokeswoman Brooklyn] McLaughlin said. Isn’t it wonderful how responsive our federal government is to the public’s– I mean, private industry’s needs? But wait! There’s more! Lots more!

Bailout Watch 313: More Auto Industry Bailouts On Their Way!

Bailout Watch 312: Is Delphi Next for Bailout Billions?

Well why not? If the the Fed can justify “emergency” approval of GMAC’s switch to bank status as a necessary step to save GM, it’s not that much of a leap to suggest that bankrupt parts maker and GM spin-off Delphi’s next in line for some bailout bucks. As we’ve said here before, no Delphi, no GM. Bloomberg puts it this way: “GM has already spent more than $11 billion to help Delphi, the largest U.S. auto-parts maker, exit bankruptcy. Delphi has been unable to get further loans to help it leave court protection because of stricter credit requirements and declining revenue from slow auto sales.” And now… “We would not be surprised to see additional government funds to GM to support a Delphi solution,” JPMorgan Chase & Co. analyst Himanshu Patel said in a report today. As JP is up to its eyebillions in GM, Chrysler, Chrysler Financial and GMAC, it’s a good bet this is more of a trial balloon than mere conjecture. Bloomberg points out that the idea of throwing some cash at, I mean arranging some loans for Delphi is no longer beyond the remit of the increasingly vaguely remitted $700b Troubled Asset Relief Program.

UAW Golf Center Inspires Further Confusion, Anger

Not for us though. We’ve had the luxury of several pre-bailout months of foreknowledge of this particular $33m white elephant. The kids at Fox News, on the other hand, seem to have only just found out about the UAW’s Reuther Family Education Center, and they’re downright apoplectic. The $33m resort, nestled on “1,000 heavily forested acres” has lost $23m over the past five years, despite charging as much as $85 in green fees. Besides improving the UAW’s collective handicap, the Family Education Center provides accomodations for retreats and conferences which give members “a deeper understanding of the UAW and the union movement away from the routine of their daily lives,” according to the Center’s website. All of which has Fox reaching for the “union-basher” volume of its rolodex.

Bailout Watch 311: GMAC Missed Bank Conversion Target By $8.8b

Bailout Watch 310: Chrysler's Thank You-gate Grows

It won’t be long now: a parody ad of Chrysler’s thank you for your “investment” ad, to join the bailout parody ad and the anti-anti-bailout (i.e. Toyota) viral email. Meanwhile, Chrysler’s still catching heat for spending big bucks on the post-bailout ads in USA Today, The Wall Street Journal, The Atlanta Journal Constitution, online (even TTAC!) and other media. TTAC flagged the obvious waste ogf taxpayer money and condescension on the 23rd, but the MSM have just caught on. Autoblog reports today on Fox News’ Monday report slamming the automaker for the campaign. Their boy Newt’s minion does the dirty. “‘It’s quite ridiculous to be spending that kind of money,’ said Princella Smith, national spokeswoman for American Solutions, an organization headed by former Republican House Speaker Newt Gingrich. ‘Those ads are just a precise example of the fact that they do not get it … and it’s just in our faces.'” So, now how much did they pay? “A full-page ad in The Wall Street Journal runs between $206,000 and $264,000, and a full-page ad in USA Today runs between $112,000 and $217,000.” Wow. Still, $4b buys you a lot of ad space, if not a single class-leading automobile. Oh, and why haven’t MSM picked-up on the fact that the ad’s picture is a fake?

Bailout Watch 307: Treasury Rescues GMAC With $5b "Investment," Gives GM an "Extra" $1b

CNNMoney is reporting that the U.S. Treasury will “invest” $5b in formerly bankruptcy-bound lender GMAC. In return, “GMAC will issue warrants to Treasury in the form of additional preferred equity in an amount equal to 5% of the preferred stock purchase that will pay a 9% dividend if exercised.” Presumably, the treasury provided your tax money after GMAC failed to convince enough of its bondholders to swap debt-for-equity to qualify for bank status (under the Fed’s “emergency powers”). Now that the Treasury has stepped in, GMAC can make the morph and hoover $6b plus from the Troubled Asset Relief Program and $17.5b in federally guaranteed debt. Folks, that little package right there comes to $28.8b. Oh wait; the Treasury has decided to “lend an additional $1 billion to GM so it could invest in GMAC as the financing company reorganizes.” So if you add GM’s $14.4b, Chrysler’s $4b, GMAC’s $28.8 and the Department of Energy’s $25b retooling loans, you end up with a $72.2b Detroit bailout “plan.” Way hey! GMAC press release after the jump.

Recent Comments