Bailout Watch 530: CO2 Scheme Becomes Detroit Handout?

The Detroit News reports that Michigan’s congressional delegation has secured an agreement with House Democrats that could send three percent of the revenue from carbon emissions permits to American automakers starting in 2012. That would amount to billions of dollars every year, says DetN, and that’s not all. The new compromise also includes changes to carbon-cap proposals that “could ease the impact on states such as Michigan that rely heavily on coal for electricity generation.”

Are You Ready To Own GM For "At Least Two Years"?

You’d better be, because the White House told Wall Street Journal that it will hold onto its GM stake for “at least two years.” Out of “necessity,” no less. And burning $10bn in cash per quarter all the way. According to the WSJ report, the White House still doesn’t want to involve itself in day-to-day operations. Is that offer only good outside of bankruptcy? If Chrysler is the canary in the coal mine, the answer seems to be yes.

Bailout Watch 528: GM to Sell Chinese Vehicles in the U.S.

"GMAC is a Financial Black Hole Stuffed Into a Governance Black Box"

The mainstream media is beginning to wake up to GMAC’s seemingly endless call on the public purse. Thanks to chronic mismanagement—and an 11th hour, last-minute back room deal with The Fed and the US Treasury that turned the virtually bankrupt lender into a bank that couldn’t pass a stress test if it was doped-up to the eyeballs with Thorazine—GM’s former cash cow has become a cow-sized vampire bat, feasting on US taxpayers’ blood, sweat and tears. It’s sucked-up $6 billion in federal funding so far, heading for another . . . wait for it . . . $15.5 billion. The Wall Street Journal is shedding a little heat (not light) on this “hidden” auto bailout, which is heading for another one of those dumb-ass “your money for government equity in a born loser” jobs. Without the slightest hint of accountability.

PTFOA Halves Chrysler Ad Budget

Remember the whole “we do not want to run the automakers” routine? Cue up the laugh track. President Obama’s PTFOA has intervened to halve Chrysler’s ad budget during its taxpayer-funded bankruptcy, reports Automotive News [sub]. Chrysler had requested $134 million for advertising during its alleged nine-week bankruptcy. That request was halved by the PTFOA because that body “believed that it was not feasible to not spend anything on marketing and advertising for fear of eroding the image of the brand,” says Chrysler Chapter 11 consultant, Robert Manzo, in court documents. We knew Chrysler’s DIP budget was being drawn up “in consultation with the Treasury,” but this is the first glimpse of a struggle between Chrysler management and its government paymasters.

Bailout Watch 526: Supplier Bailout Fails Dramatically

The $5 billion bailout of Detroit’s suppliers has “flopped” according to Automotive News [sub]. Even though the bailout funds were made available in mid-March, money has yet to be disbursed even to firms which have been blessed with OEM approval. Problems seem to be traceable back to the decision to use Citigroup to manage the funds. “All our paperwork has been in for weeks,” says one supplier CEO. “But Citibank does not return phone calls or e-mails.” With reports of Citi being “overwhelmed” by supplier applications (aka anyone owed money by GM or Chrysler) and rampant government red tape, what do Citi, GM, Chrysler and the Treasury say about the unfolding boondoggle? Nada. “A Treasury spokeswoman said the government has no information on how the car companies have disbursed the money or to whom. She referred all questions to GM and Chrysler.”

Review: 2009 Acura RDX

Bailout Watch 525: Is Bob Lutz' Chrysler Pension Bankruptcy Proof?

Bailout Watch 524: C11 Chrysler Busy Bouncing Checks

Bailout Watch 523: GM to Boost Foreign Production 98%

The Detroit News has obtained a confidential memo from GM to federal legislators. The smoking gun reveals that the soon-to-be-taxpayer-owned (officially) automaker plans to boost US sales of vehicles built in China, Mexico, South Korea and Japan by 98 percent (to 365k units). In the face of union criticism of the plans, GM claims that the percentage of its imports will remain at 33 percent. By 2014. When its sales recover to 3.1 million vehicles per year. Providing it maintains its current market share. All things being equal. With the wind in the right direction.

At the same time, The General aims to shrink production in Canada, Australia and European countries by about 130k. For a sneak peak at the less tortuous justification for this outsourcing on Uncle Sam’s dime, we turn to veteran Detroit apologist and Washington Post car critic, Warren Brown . . .

Bailout Watch 522: Feds Ready to "Facilitate" GM C11

The US Treasury Secretary had a little chin wag with Reuters re: GM. It seem that Mr. Geithner is as pleased as punch with his minions’ work with Chrysler’s bankruptcy. So pleased, in fact, he sees ChryCo’s dissolution solution as a template for GM’s C11. You know “if”. “There is a range of ways to achieve [GM’s restructuring]. You saw what we did in the Chrysler context as one way to do it and if that proves necessary in the GM context, we’ll do that.” And then the aforementioned “if”. “But we’re not at the point where we need to make that judgment yet.” Sure. They’ve got 28 days to convince GM’s bondholders—a motley crew of “investors” looking at differing payout and maturity dates—to take a flyer on a company that hasn’t made a profit for . . . sorry, debt for equity swap. And here’s some fuel for those who see the government’s role in the US auto industry as reprehensible.

Bailout Watch 521: Canadians Hosed by Chrysler

Update: Details of US Car Scrappage Scheme Emerge

In a follow up to E. Niedermeyer’s previous post, details have emerged about the scheme to give rebates to buyers who trade “clunkers” for new, fuel-efficient vehicles. FT.com (Financial Times) reports that the program will cost taxpayers about $4 billion and will spur, according Brian Johnson, an analyst at Barclays Capital, the sale of 3 million units in the “near term” (whatever that means). With the US’ SAAR projected at approximately 9 million, this is a very optimistic prediction.

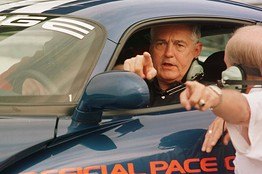

Bailout Watch 520: Clunker Bill, Retooling Loan Double-Down Move Forward

Who would have guessed it? As soon as we start reflecting on what exactly this little government foray into the auto sector will cost us, DC goes and prepares to bump up the sum. From ABC News comes a report that Democrat wranglings on the upcoming climate bill have yielded a compromise on forthcoming “cash-for-clunker” provisions. Details are still sketchy, but according to ABC, “under the new agreement, consumers will be able to trade in a “clunker”—a car that gets 18 miles per gallon or less—for a voucher for a new fuel-efficient car. The amount of the voucher will range from $3,500 to $4,500, depending upon the fuel efficiency of the new vehicle.” Want more details? Too bad. All you get for now are the assurances of one John Dingell (D-MI) that “it’s a good agreement. It means sales of autos, it means fuel efficiency and it means progress.” No word on cost to taxpayers, limits, “buy-American” clauses or other potential sources of trouble.

Bailout Watch 519: Help Wanted

Wild Ass Rumor Of The Day: Non-TARP Chrysler Holdouts To Be Paid Off

Bailout Watch 518: How Much is This Boondoggle Going to Cost Me?

Some Detroiters honest-to-God believe that Chrysler and GM will repay the money “loaned” to them by the federal government. That’s a leap of faith that would have taken Evil Knievel across the Grand Canyon (proper) and on to Maui. But you know what? In all this excitement, I’ve lost track of how many billions we’re actually talking about. I reckon the government’s to-date contribution towards keeping the zombies alive lies just north of $37 billion. That doesn’t include the duo’s share of the $25 billion Department of Energy retooling loans (should they live that long). Or the $5 billion blessed upon GMAC. And the $1.5 billion loaned to the now-defunct Chrysler Financial. Or Canada’s contribution to the kerfuffle. Or the cost of running a 25-member Presidential Task Force on Automobiles. And the phalanx of lawyers employed by same. And the community organizer assigned to help out affected communities with, wait for it, federal funds. And now . . . the rest.

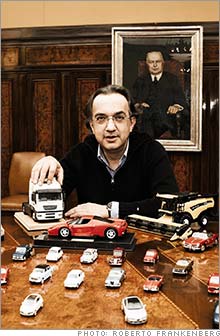

Bailout Watch 517: Fiat CEO Sergio Marchionne's Official Statement On Chrysler Alliance

“This transaction represents a constructive and important solution to the problems that have plagued not just Chrysler in recent years, but the global automotive industry as a whole. Bringing together Fiat’s world-class technology, platforms and power-trains for small and medium sized cars, and its extensive distribution network in Latin America and Europe with Chrysler’s rich heritage, strong North American presence and talented and dedicated workforce will create a powerful new automotive company, while helping preserve jobs and a manufacturing industry that is critically important to the U.S. and Canadian economies.”

Bailout Watch 516: PTFOA Fires Chrysler CEO Nardelli

Chrysler Gets $8 Billion For 60-Day Bankruptcy

Or, as President Obama puts it, “a new lease on life.” Chrysler (“a company with a particular claim on our American identity”) will file for Chapter 11 bankruptcy in Manhattan court today, as Obama has promised $3.5 billion in federal aid over the next 30 days in hopes of hitching the troubled automaker to Fiat. The case will be handled by judge Arthur Gonzalez, a veteran of the Enron and WorldCom bankruptcies. When the deal is concluded and Chrysler emerges from bankruptcy, the federal government will inject another $4.7 billion. That more than doubles the current taxpayer investment in Chrysler, which had reached $4 billion (not counting ChryFi). See President Obama’s full statement at C-SPAN.

Bailout Watch 515: President Obama's March 30 Statement on Chrysler

And that’s why we’ll give Chrysler and Fiat 30 days to overcome these hurdles and reach a final agreement—and we will provide Chrysler with adequate capital to continue operating during that time. If they are able to come to a sound agreement that protects American taxpayers, we will consider lending up to $6 billion to help their plan succeed. But if they and their stakeholders are unable to reach such an agreement, and in the absence of any other viable partnership, we will not be able to justify investing additional tax dollars to keep Chrysler in business.

Bailout Watch 514: Would American Leyland Violate Anti-Trust Laws? And What About the UAW's Tax Status?

TTAC Commentator 70 Chevelle SS454 raises some good points about rumors (perpetually perpetuated here) that the feds’ plan to combine Chrysler and GM into “American Leyland.” The clever member of our B&B wrote his analysis in response to John Horner’s comment, which addressed the UAW’s role should they parlay their (allegedly) forthcoming shares in Chrysler and GM into shares in the combination of the two.

100% mergers of competing companies are happening all the time, so I don’t think one entity having major ownership stakes in two competitors is going to run afoul of whatever is left of anti-trust enforcement.

70 Chevelle SS454‘s reply

No. That’s not how DOJ/FTC review of mergers goes. They look to see whether the resulting company would have power over price, or market power. There’s actually a formula that’s used to combine market shares and calculate the resulting company’s market power, called the Herfindahl-Hirschman Index (HHI). Anything with an HHI score above 1800 is considered “highly concentrated,” and is rarely approved.

From The Obama Press Conference

(Via AP/Google)

Deb Price, Detroit News: Thank you, Mr. President. On the domestic auto industry, have you determined that bankruptcy is the only option to restructure Chrysler? And do you believe that the deep cuts in plant closings that were outlined this week by General Motors are sufficient?

Bailout Watch 511: S&P: We Do Not View Possible Further Government Support As Open-ended

“Our ‘CC’ corporate credit rating on GM continues to reflect our opinion that there is a high likelihood that the company will undergo a distressed debt exchange (which we would consider tantamount to a default under our criteria) or file for bankruptcy protection toward the end of May or shortly thereafter.

Bailout Watch 510: GM To Terminate 40% of Its U.S. Dealers

Bailout Watch 510: Toyota Stockpiling Parts for GM C11

Well, they would, wouldn’t they? Makes sense. Why be caught flat-footed when the inevitable occurs? What makes less sense is that this story, hailing from our good friends over at Automotive News [AN, sub], doesn’t mention Chrysler or GM until the eighth paragraph, and then only in passing. And not before the scribes take a swipe at the Japanese automaker for abandoning The Toyota Way: “The moves violate Toyota’s vaunted ‘just in time’ production philosophy,” AN writes. “which views warehousing as a symbol of muda, or waste and inefficiency.” But hey it’s muda out there!

Bailout Watch 508: Let's Blame the Bankers (Jews?) Pt. II

As the Motown meltdown rushes towards its not-so-final denouement, a clear meme is emerging: blame the bankers. Last week, Detroit News columnist Daniel Howes suggested that Americans will finger Wall Street suits for Chrysler’s collapse. It was an odd not-to-say-jarring proposition—given that Chrysler’s management has done just about everything it could do destroy the automaker’s rep save impregnating car seats with swine flu. Ditto GM. And there’s a darker side to this idea, which I’ve previously resisted mentioning. I believe this line of thinking raises the specter of ye olde “international Jewish banking conspiracy.” I know, I know. Call me a paranoid fantasist (I’ve been called worse). But try reading this Automotive News “analysis” from an anti-Semite’s perspective: “The debate over the U.S. government’s bid to reshape the American auto industry through bankruptcy comes down to this: the spreadsheets of a handful of former investment bankers pitted against the street sense of thousands of U.S. auto dealers fighting to survive.”

Bailout Watch 507: CA Finance Minister Uses the "L" Word Re: ChryCo

Government Accountability Office, Meet The Auto Industry Bailout

Move over, Neil Barofsky. The SIGTARP may make the media rounds, but he’s got three trillion worth of TARP to cover. Which is why his recent Quarterly Report to Congress ( PDF file available here) wasn’t exactly breathtaking for Chrysler/GM watchers. The Government Accountability Office, on the other hand, has just dropped a report specifically covering the Treasury’s execution of the auto bailout. If you’ve been following TTAC’s coverage through these strange days, the 48-page Summary of Government Efforts and Automakers’ Restructuring to Date ( PDF file available here) won’t exactly brim with new insights either. It’s the fact that anyone in the government (sandbagging senators aside) is acknowledging some seriously inconvenient truths.

Bailout Watch 506: None of the Responsibility, None of the Blame

For some reason, The Detroit News columnist Daniel Howes reckons the average Joe will blame the bankers when—sorry “if”—Chrysler goes Tango Uniform. Yes, the money men will take the hit “whether they deserve it or not. I say this not because it would be entirely fair, either, unless ‘fiduciary responsibility’ and the duty of lenders to determine whether a Chrysler allied with Italy’s Fiat SpA would have a shot at survival now are quaint notions that no longer apply. In normal times, lenders are supposed to decide where credit-worthiness ends and recklessness begins. But these are not normal times and bankers, as one of them quipped privately to The Detroit News, ‘are the most hated people in America.'” I know TTAC is guilty of first degree inside baseball, but I’m not feeling that at all. The average American will place the blame squarely on Chrysler for not building competitive products. But it’s interesting that Danny “I can’t get off the fence but I know who’s on either side” Howes would see it that way; it shows that Detroit still can’t take responsibility for its failures. Or admit defeat . . .

Bailout Watch 506: Union Think Tank Calls for Mexican Auto Cap

The New York Times really pisses me off. This is not the first Gray Lady story I’ve read based entirely on a report by a “think tank”—where the reporter somehow fails to mention the organization’s ties to labor unions. In this case, scribe Elisabeth Malcolm is happy to share the results of a study from the “Economic Policy Institute, a Washington think tank that studies economic issues that affect workers.” In this report ( download pdf here) EPI economist Robert E. Scott “argues that saving American automakers may instead end up saving — and even creating — Mexican jobs.” And that means that the feds should use the Motown bailout as a lever with which to undermine The Big 2.8’s plans to build cars in non-unionized Mexico. “The conditions Mr. Scott proposes: G.M. and Chrysler (and Ford, if and when it asks for money) should face a limit on their investments in Mexico. The way to do that would be a cap on imports from Mexico as a share of sales. He also suggests a domestic content requirement for American-made cars that would halt the increase in parts imports from Mexico.”

Bailout Watch 505: U.S. Treasury Amassing $40 Billion Post-C11 Bailout Fund

Bailout Watch 504: But Who Will Rescue The Rescuer?

Fiat, the great Italian hope for the American auto industry, has a lot of expectations to live up to right now. Not only are the Torino boyz tackling the miasma of despair that was the Chrysler corporation, but Automotive News [sub] reports that Fiat could “form an alliance with General Motors’ core operations in Europe and Latin America.” Italian-American Leyland, anyone? Fuhgeddaboutit. According to anonymous sources, talks with GM are in the “early phases,” which means that nobody has suggested that an allied Chrysler, Fiat, Opel/Vauxhall and GM Latin America might be too much concentrated fail for one corporation to handle. And Fiat’s got the usual unnamed competition for Opel to contend with. “More than six people have expressed interest, serious people,” says GM CEO Fritz Henderson of his firm’s unwanted Opel/Vauxhall operations. Why so serious? Did previous offers come from folks wearing giant shoes, tiny hats and rubber noses? More importantly, if one of these “more than six serious people” comes from Fiat, might it not be time for a reality check on that firm’s transformative power?

Bailout Watch 503: GM C11 Will Suck

It’s nice when Detroit News auto journalist Mark Phelan and I agree. We recently had a head-to-head on BBC World Service where I called GM and Chrysler zombie automakers, and Phelan didn’t. In a piece in this morning’s Free Press— “Bankruptcy no fast cure for GM“—the Irish scribe shares my belief that a GM C11 will be, as the Brits might say, the bunfight to end all bunfights. But first, let’s put the pro in prolepsis, and begin with Phelan’s final paragraph: “GM’s cost-cutting progress has allowed it to pass on some of the loan money the government has promised, but the company’s own projections say it could need another $4.5 billion to $12 billion if the economy remains moribund.” That’s what I call a big spread. But there’s something else about Phelan’s finale that gets my goat . . .

Bailout Watch 502: Feds Give GM an Extra $1b ($5.5b 'til C11)

Back at the beginning of March, GM and its camp supporters were touting the fact that they could go all the way ’til April without a fresh infusion of federal funds—sorry, “loans.” See? Things aren’t as bad as they seem, GM CEO Fritz Henderson pronounced. Cuts are paying dividends already! Deeper, faster, oh baby! Yes, well, as we said at the time, bullshit. The actual reason for GM’s small push away from the bailout buffet: GM’s outgoing CEO had sucked a cool half a billion dollars from The General’s Canadian subsidiary. And now it turns out that current CEO Fritz Henderson’s prediction that GM would need “between $2 and $4 billion” to get it to June 1 misled taxpayers by a billion dollars. “General Motors Corp. will get up to $5 billion and Chrysler LLC $500 million in short-term aid, according to a 250-page government report obtained Monday by The Detroit News.

Bailout Watch 501: Dire Straits: Money for Nothing and Opel for Free

Got $652m in loose cash sitting around? Boy, does GM have a deal for you! If you are willing to invest that money into Opel/Vauxhall, then The General “is prepared to part with a controlling stake in Opel/Vauxhall for nothing,” Financial Times reports. It gets better . . .

Bailout Watch 500: Chrysler to Fiat, Feds: It's All Yours!

CEO Bob Nardelli is punting. Boot ‘Em Bob has told the troops that Chrysler would cede control of its board and senior management to Fiat if the two automakers “merge.” “The U.S. government and Fiat would appoint a board of directors for Chrysler, with a majority of them independent directors who are not employees of either automaker,” Nardelli said in an internal memo intercepted by Reuters. “The board will have the responsibility to appoint a chairman. The board also will select a CEO with Fiat’s concurrence.” Seeing as Nardelli walked away from Home Depot with over $240 million in severance pay, one wonders how much it would cost management (that’s Uncle Sam now) to get rid of him this time ’round. Cerberus exits stage right. American Leyland enters stage left. Anyway, here’s the weird part: Reuters is a bit more specific about the government’s participation in this newly formed Chrysler Board than Automotive News, even though Reuters credits Automotive News for the info.

Bailout Watch 498: GM CEO: Deeper, Faster, Oh Baby!

OK, so here’s the latest chapter in GM’s decades old inability to face reality. GM CEO Fritz Henderson told Automotive News [sub] that there’s nothing wrong with GM’s viability plan (or the company’s management leading up to its $22.8 illionb federal “loans”). GM simply failed to, uh, perform. “The viability plan, when you look at the finding, they basically said they appreciated what had been done—actually quite a bit of what had been done is correct. What they really said was they wanted things to go deeper and faster.” Uh, not as I recall it: “The plans submitted by GM and Chrysler on February 17, 2009, did not establish a credible path to viability,” pronounceth The Presidential Task Force on Automobiles (PTFOA). “In their current form, they are not sufficient to justify a substantial new investment of taxpayer resources.” Of course, the PTFOA gave GM $4.4 billion to tide them over to C11 anyway. And if you think I’m just milking this “deeper faster” thing for cheap laughs, well, here it is again . . . and again . . .

Bailout Watch 497: GM C11 Will Cost Taxpayers Another $70b Plus

SAIC To Buy Vauxhall? Not Exactly, But Close

“Shanghai car-maker SAIC makes approach for Vauxhall,” headlined London’s Telegraph over the weekend. Of course SAIC doesn’t want just the Vauxhall badge, they are interested in the whole Opel/Vauxhall enterprise. What looks like “Opel” through German eyes looks like “Vauxhall” to the British. It’s one and the same.

According to the Telegraph, “Shanghai-based SAIC has requested a sale document from General Motors (GM), the stricken US car-maker, which has warned that it may file for bankruptcy in an effort to ensure its survival. Commerzbank, the German banking group, is orchestrating the sale process on behalf of GM, which is to establish a new subsidiary comprising Vauxhall and Opel, the German car manufacturer. A new investor would be invited to acquire a controlling stake in the company, with GM potentially retaining a minority interest.” Saab and Chevrolet Europe would not be part of the deal. More Chinese interests are lining up:

Bailout Watch 496: PTFOA Pays Boston Group $8 Million to Laugh at ChryCo – Fiat Deal

Bailout Watch 495: WaPo's Warren Brown Spreads the GM C11 Message

The mainstream media’s (MSM) reporting on GM’s “troubles” has evolved. Initially, the press told its audience that The General’s terminal glide path was all part of the wider economic meltdown. As the company augers in for its June 1 federally mandated Chapter 11, the reality of the situation is filtering down the info-food chain. The story has moved from financial reports to the general news to the sharp end: car reviews. For example: today’s Washington Post carries a review of the Pontiac G8 GXP that lauds the Australian V8 four door as “part old-fashioned American muscle car, part sophisticated European performance ride.” And then . . . “That’s good news. But here’s hoping it doesn’t come too late in the news cycle for GM.” Right: stupid news cycle. I blame the news cycle for GM’s upcoming bankruptcy.

Bailout Watch 493: S&P "Chrysler C7, GM C11"

It’s always interesting to see how multiple media outlets interpret stories carried communally. In this case, here’s the beef: Standard & Poor’s ratings agency cut Chrysler’s senior secured first-lien term loan (due 2013) to CC from CCC; and lowered its issue-level ratings on GM’s $4.5B senior secured revolving credit facility to CCC-. (That’s nine grades below investment quality.) Automotive News [sub] waits all the way to the second paragraph before offering Motown apologists a heart to hang on to. “The rating downgrades put extra pressure on the two iconic U.S. carmakers, whose already declining fortunes have worsened during the ongoing global economic downturn.” The Wall Street Journal [almost] gets to the meat of the matter straight off . . .

Bailout Watch 492: Motown's Missing Meme

Bailout Watch 491: 76% of Americans Say No to More Motown Bailouts

I had a long conversation with Marcy Wheeler, the woman behind the JPMorgan Chase boycott. As I reported yesterday, the action’s designed to force the bailout-fed bank to take a ChryCo debt cramdown to “keep 300,000 workers employed” and “protect America’s industrial base.” Unlike the organization supporting her cause, Ms. Wheeler really knows her onions, from Cerberus’ perfidy to the importance of the FIAT deal to gas prices and the argument for a “soft landing.” Wheeler made as good a case for federal intervention in the US auto industry as I’ve ever heard (even though she insisted that shit-canning GM’s CEO didn’t constitute federal intervention in the US auto industry). CNN reveals that the majority of Americans aren’t buying ANY of it (assuming of course someone’s selling it). “Three out of four Americans would rather see General Motors and Chrysler face bankruptcy than watch the government pour yet another round of bailout cash into the big U.S. automakers.” Uh-oh.

Bailout Watch 490: GM Bondholders' Fear and Loathing

The Presidential Task Force on Automobiles (PTFOA) wants GM to get its NSFW together by June 1. To that end, the PTFOA is pressuring GM’s bondholders to take The Mother of All Buzz Cuts. As The Wall Street Journal reports, that means no cash or federal guarantees. “The Treasury Department is pushing GM to offer its bondholders, who are owed $29 billion, a small portion of shares in the company. That’s a sharp cut from a bond-exchange offer GM made two weeks ago, which included about $8.5 billion in cash and new debt in the company as well as 90% of GM’s stock, said people familiar with the terms. The Treasury, which has pumped $13.4 billion into GM to keep it afloat [plus $4.4 billion to come in June], believed the earlier plan was too generous to bondholders, said people familiar with the matter.” Well then, the PTFOA can put GM in C11 and be done with it, right? I mean, what pressure can they possibly bring to bear on GM’s bondholders now that water-boarding is illegal? Actually, this is a post-C11 wrangle.

Bailout Watch 489: Feds Buy 17,600 Bailout-Mobiles

Bailout Watch 488: Chrysler Supporters Boycott Chase to Force Cramdown

From Progress Michigan’s website:

“Today, JP Morgan Chase has sent a signal to the American workforce that they are more interested in churning greedy profits than saving hardworking families from poverty and joblessness,” said Jane Hamsher, founder of FireDogLake.com. “By closing out our Chase accounts and slicing up our credit cards, we’ll be signaling back to the bank that we are interested in rescuing the middle class and preventing Chase from lining its pockets. Boycott JP Morgan Chase today, and save a working American family.”

While I await direct contact with the plastic snipper (robertfarago1@gmail.com), I called Progress Michigan for a little insight into the organization and their cause. After all, if The Detroit News thinks it’s a big story, it must be a big story, right? Define “big.” To that end, I had a little chat with Emma Richardson, PM’s freelance writer. “We’re focusing on saving American jobs and the middle class,” Ms. Richardson opined. As for how bailout-sucking Chase threatens those jobs, and the reasons behind the bank’s decision not to get a buzz cut, let’s just say Ms. Richardson is slightly uninformed.

Bailout Watch 487: Toyota USA Prez: We're Ready for GM C11

Holy NSFW. When Toyota’s No. 1 American executive steps up to the microphone and declares that his employer’s ready for the fallout from a GM Chapter 11, you might as well stamp “done deal” on the, uh, deal. The AP reports that “Toyota Motor Sales USA President Jim Lentz says his company shares about two-thirds of its 500 parts suppliers with GM. . . only a small number of Toyota suppliers are critically short on cash.” Of course, we knew that already. Both the GM and the supplier thing. But still. You gotta wonder: is Jim Lentz sticking the knife in GM to goose ToMoCo’s April and May sales. According to Automotive News [sub], Lentz says US auto sales may rise in the second quarter. Well they will for someone.

Bailout Watch 486: GM Looks to "Borrow" Another $4.4b

CNNMoney reports that GM is looking to stoke-up on its federal funding to keep the lights on (and the Segeways humming) until its June first bankruptcy filing. I mean, restructuring deadline. And the winner is. . . not the U.S. taxpayer. The General may take the U.S. Treasury Department for another $4.4b hit before Hune1, bringing its total to date to $17.8b, not including the $1b tip thrown GM’s way to help GMAC makes its eleventh-hour transition from deadbeat sub-prime lender to federally flush bank, and back. ALL of which will be written off when GM files for C11. And THEN, presumably, the feds will pony-up the debtor-in-possession financing to establish the new, “good” GM. As my father would say, how much is that boondoggle going to cost me?

Bailout Watch 485: Ford Heading for $11 Billion Bailout

Bailout Watch 484: Geithner: Wagoner Firing is The Exception That Proves The Rule

Bailout Watch 483: Bye American?

Bailout Watch 482: Frank Rich is Confused. Thank God.

This GM bailout mishegos is driving the mainstream media meshugganah. To wit: conservative pretty boy Sean Hannity has been GM’s bitch for years, happily driving tweaked freebies and working plugs for GM product into his rants and “unscripted” comments. Now that his sponsor is toast, Mr. “We Love GM” has to defend the American automaker (to maintain his flag-wrapped appeal) and criticize Barack Obama for his corporate interventionism—knowing full well that the multi-million dollar Hannity–GM gravy train would have derailed months ago if not for your tax money. New York Times columnist Frank Rich may not be boxed in by GM payola, but the man’s clearly conflicted. “Even Rick Wagoner’s Firing Got Lousy Mileage” starts by kvetching that “pitchfork-bearing populists” (as opposed to Mac-wielding elitists) weren’t satisfied when President Obama brought them the head of Richard M. Wagoner. Although he, Rich, is. Mister! Are you following this?

Bailout Watch 481: GM Restructuring Plan Progress Report 2009 – 2014: Bankruptcy

We’ve got the link to GM’s Report Card to the Presidential Task Force on Automobiles. Bankruptcy is no longer that which must not be mentioned. In fact, the official recognition of this inevitability hardly gets a half turn of spin. End of days for Detroit.

Bankruptcy Considerations-In order to be prepared for events possibly precipitating a bankruptcy filing (for example, unsuccessful bond exchange or VEBA negotiations), the Company continues to evaluate its in-court restructuring options as part of contingency planning activities. The Company believes that the impact of a bankruptcy filing on its business would be substantial, on both wholesale (GM to dealers) and retail (GM dealer to customer) levels, as discussed in the February 17 submission.

General Motors continues to strongly believe that out-of-court restructuring provides the highest value outcome for its customers and this country long term. However, if the changes needed for long-term restructuring cannot be obtained out of court, the Company is prepared and would consider in-court options. Such options would be enhanced by the Administration’s commitment to back GM customer warranties, and to provide support for a rapid emergence from any in-court process.

Recent Comments