Bailout Watch 512: GM Bondholders Reject Debt for Equity Swap

Automotive News [sub] reports that GM’s bondholders have turned down the firm’s debt for equity offer of 225 shares of “new” GM stock per $1K of debt. The deal, which would have given bondholders a ten percent stake in a partnership with the UAW (39 percent) and the Government (50 percent) and existing shareholders (1 percent) was derided as “neither reasonable nor adequate” and “a blatant disregard of fairness” in a prepared statement. “The offer was made unilaterally, without any prior discussion or negotiation with bondholders and in spite of repeated calls for dialogue,” write advisers to GM’s ad hoc bondholder committee. “We are deeply concerned that GM waited until late April to make its offer.” Money quote? “This offer demonstrates that the company and the auto task force, unfortunately, are pinning their hopes on an extremely risky and legally questionable turnaround in bankruptcy court.” And how.

More by Edward Niedermeyer

Comments

Join the conversation

I just love how the unions get 39%. A good argument can be made they contributed to this mess over the years, yet they are rewarded handsomely for their support. P,J,O'rourke was correct when he referred to the Federal government as a parliament of whores.

My Ford subordinated bonds went through the roof this week. I cashed out yesterday for a 116% gain. I bought it a few months ago after studying TTAC carefully. Reading TTAC has paid off for me, big time.

I have a bet with my law partner that Obama will screw the bondholders, dealers, suppliers, equity, etc., and go easy on the union. he thought Obama would get tough with the union. We'll see who is right. I think I will win the bet. If I do, the result will be terrible, for GM and the rest of us.

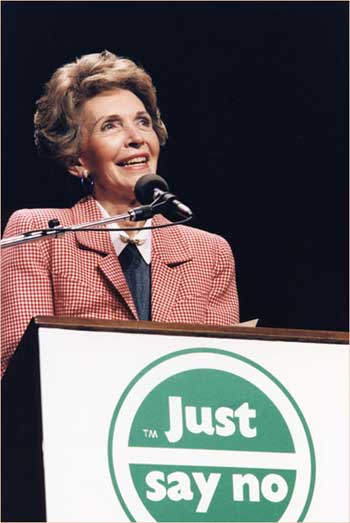

We can learn from Chrysler … the government is being accused of coercing Chrysler debtors to accept the bad deal offered them – sound familiar? Obama is sucking up to the UAW and leaving the bondholders out to dry. The good news is that with all the legal red tape beginning to roll there is no way Chrysler will survive bankruptcy. This will start a ripple effect through the economy and a warning that with GM racing to bankruptcy that we will have a new epic crisis on our hands. Thus, the government will WAKE UP and smell the coffee and discover it cannot allow GM to go into bankruptcy under any circumstances and we will see a new offer come the end of May to bondholders. Sit tight and just say NO.