Bailout Watch 526: Supplier Bailout Fails Dramatically

The $5 billion bailout of Detroit’s suppliers has “flopped” according to Automotive News [sub]. Even though the bailout funds were made available in mid-March, money has yet to be disbursed even to firms which have been blessed with OEM approval. Problems seem to be traceable back to the decision to use Citigroup to manage the funds. “All our paperwork has been in for weeks,” says one supplier CEO. “But Citibank does not return phone calls or e-mails.” With reports of Citi being “overwhelmed” by supplier applications (aka anyone owed money by GM or Chrysler) and rampant government red tape, what do Citi, GM, Chrysler and the Treasury say about the unfolding boondoggle? Nada. “A Treasury spokeswoman said the government has no information on how the car companies have disbursed the money or to whom. She referred all questions to GM and Chrysler.”

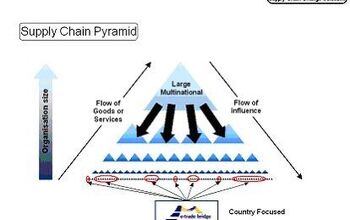

Luckily for suppliers, the supplier bailout is no longer the best taxpayer-funded way to claim what is due to them. Chrysler has received $1.49 billion from its government-funded Debtor-In-Posession financing to pay suppliers. That sum that should cover 88 percent of its supplier debt. According to supplier lobbyists, qualifying firms are likely to fight hard for their portion of that money. After all, supplier firms had to pay a 3 percent fee to have receivables paid earlier than the typical 45 days and 2 percent to have their receivables guaranteed under the initial bailout program. No such premium exists for bankruptcy payments. Unfortunately for Chrysler suppliers, these payments don’t make up for business lost to the Pentastar’s production shutdown.

Meanwhile, GM is moving up a payment to suppliers, according to Automotive News [sub]. 1,500 North American suppliers will be paid on May 28 instead of June 2, in a move aimed at keeping suppliers viable going into a likely GM bankruptcy. No word on the amount to be paid, but with GM looking at a long summer production shutdown, it probably won’t be enough to keep many suppliers from going out of business. Faced with the current Chrysler shutdown and a long summer with little to no production and cashflow, suppliers are now requesting direct aid from the federal government. Citing the apparent Citi mismanagement, government red tape and the Tier-1-only requirements of the current bailout effort, suppliers tell AN [sub] they need direct assistance to prevent rampant bankruptcies.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts You expect everything on Amazon and eBay to be fake, but it's a shame to see fake stuff on Summit Racing. Glad they pulled it.

- SCE to AUX 08 Rabbit (college car, 128k miles): Everything is expensive and difficult to repair. Bought it several years ago as a favor to a friend leaving the country. I outsourced the clutch ($1200), but I did all other work. Ignition switch, all calipers, pads, rotors, A/C compressor, blower fan, cooling fan, plugs and coils, belts and tensioners, 3 flat tires (nails), and on and on.19 Ioniq EV (66k miles): 12V battery, wipers, 1 set of tires, cabin air filter, new pads and rotors at 15k miles since the factory ones wore funny, 1 qt of reduction gear oil. Insurance is cheap. It costs me nearly nothing to drive it.22 Santa Fe (22k miles): Nothing yet, except oil changes. I dread having to buy tires.

- AZFelix 2015 Sonata Limited72k when purchased, 176k miles currentlyI perform all maintenance and repairs except for alignment, tire mounting, tire patching, and glass work (tint and passenger left due to rock hit). Most parts purchased through rockauto.com.Maintenance and repairs during three years of ownership:Front rotors and all brake pads upgraded shortly after purchase.Preparing for 17th oil change (full synthetic plus filter c.$50), one PCV valve.Timing & accessory belts, belt tensioner.Coolant full flush and change.Fibrous plastic material engine under tray replaced by aftermarket solid plastic piece $110.One set of tires (c.$500 +installation) plus two replacements and a number of patches due to nails, etc. Second set coming soon.Hood struts $30.Front struts, rear shocks, plus sway bar links, front ball joints, tie rod ends, right CV axle (large rock on freeway damaged it and I took the opportunity to redo the rest of items on this list).Battery c.$260.Two sets of spark plugs @ $50/set.Three sets of cabin and engine filters.Valve cover gasket (next week).Averages out to c.$1400 per year for the past three years. Minor driver seat bolster wear, front rock chips, and assorted dents & dings but otherwise looks and drives very well.

- 3-On-The-Tree 2014 Ford F150 Ecoboost 3.5L. By 80,000mi I had to have the rear main oil seal replaced twice. Driver side turbo leaking had to have all hoses replaced. Passenger side turbo had to be completely replaced. Engine timing chain front cover leak had to be replaced. Transmission front pump leak had to be removed and replaced. Ford renewed my faith in Extended warranty’s because luckily I had one and used it to the fullest. Sold that truck on caravan and got me a 2021 Tundra Crewmax 4x4. Not a fan of turbos and I will never own a Ford again much less cars with turbos to include newer Toyotas. And I’m a Toyota guy.

- Duke Woolworth Weight 4800# as I recall.

Comments

Join the conversation

If you think the 3% discount for immediate payable, or the 2% discount for 50 days payable (up from 45 days normally) is bad... Chrysler wanted suppliers: - to sign a Retraction Agreement cancelling all claims; - stay in the program 12 months (life of the original program); - 10% holdback for potential disputes (with no explanation of when or how the 10% would be returned to the supplier); - potentially requiring the suppliers to stay a supplier until the end of each program they supplied; - if the supplier sold in a currency other than USd ,then the supplier had to convert to USD at an undetermined exchange rate... The whole deal was just so odeous that I know more than one supplier that was scared away...

@buzzliteyear wins the cigar! -I think it was Citibank that was one of the stress-test banks that was ultimately in trouble.