"Supplier Bailout" Ends

If there’s a single phrase dominating the imaginations of auto executives right now, it’s the infamous neologism of “too big to fail.” Whether executives justify their obsession with consolidation with their fear of a Chinese planet, efficiency-standard ramp-ups, or mere groupthink, there’s no doubt that consolidation is currently the name of the game. And it should be, not only for these reasons, but also because the last several years have proven that the car game is no industry for small companies. Nothing illustrates this quite like the US government’s “bailout” of auto industry supplier firms, which ended on April Fools Day.

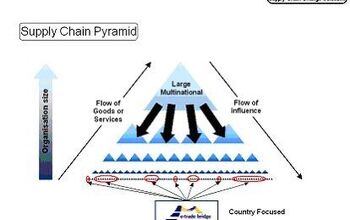

The $3.5b “supplier bailout” came only after GM and Chrysler had been given access to the federal trough, based largely on fears that their failure would put hundreds of small supplier companies out of business in a “cascading bankruptcy” scenario. Ironically, however, supplier aid wasn’t actually given to suppliers at all, let alone the mom and pop shops that form the basis of GM and Chrysler’s emotional appeal for government assistance. Instead, the program gave money to GM and Chrysler to pay back the largest suppliers that the two firms already owed significant amounts of money to, in effect, perpetuating the unsustainable relationships between these firms until private capital became more available. According to a recent GAO repor t:

Treasury had rejected appeals from the auto supply sector for direct aid to assist a broader portion of the supplier industry because, according to Treasury officials, it had become clear that the vast network of suppliers had to engage in a substantial restructuring and capacity reduction to achieve long-term viability.

In other words, the only difference between the bailed-out automakers and their un-bailed-out suppliers was scale. After all, GM and Chrysler were given billions in aid (including this $3.5b supplier debt-enabling slush fund) to restructure and reduce capacity. And their largest suppliers, who were carrying hefty OEM accounts receivable, were able to survive on cash funneled to them through this program. As the Detroit News reports:

According to GM, 74 percent of its 1,300 suppliers were eligible for the program, but only 28 percent of its suppliers received funds under the program.

Nearly half of the $947.8 million in program funds that GM dispersed went to 31 of its top 40 suppliers.

The moral of the story: if your supply firm was big enough to allow GM or Chrysler to carry a balance, you survived. If not, you became just one more bankruptcy in a supplier sector that had already been enduring hundreds of Chapter 11 filings per year before GM and Chrysler ever went a-begging to Washington. Forget all the other motivations for industry consolidation: “too big to fail” is the operating term here. And as the Cretaceous-Tertiary Event proved, bigger isn’t always

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Wjtinfwb Ford can produce all the training and instructional videos they want, and issue whatever mandates they can pursuant to state Franchise laws. The dealer principal and staff are the tip of the spear and if they don't give a damn, the training is a waste of time. Where legal, link CSI and feedback scores to allocations and financial incentives (or penalties). I'm very happy with my Ford products (3 at current) as I was with my Jeeps. But the dealer experience is as maddening and off-putting as possible. I refuse now to spend my money at a retailer who treats me and my investment like trash so I now shop for a dealer who does provide professional and courteous service. That led to the Jeep giving way to an Acura, which has not been trouble free but the dealer is at least courteous and responsive. It's the same owner group as the local Ford dealer so it's not the owners DNA, it's how American Honda manages the dealer interface with American Honda's customer. Ford would do well to adopt the same posture. It's their big, blue oval sign that's out front.

- ToolGuy Nice car."I’m still on the fill-up from prior to Christmas 2023."• This is how you save the planet (and teach the oil companies a lesson) with an ICE.

- Scrotie about 4 years ago there was a 1992 oldsmobile toronado which was a travtech-avis pilot car that had the prototype nav system and had a big antenna on the back. it sold quick and id never seen another ever again. i think they wanted like 13500 for it which was steep for an early 90s gm car.

- SunnyGL I helped my friend buy one of these when they came in 2013 (I think). We tried a BMW 535xi, an Audi A6 and then this. He was very swayed by the GS350 and it helped a lot that Lexus knocked about $8k off the MSRP. I guess they wanted to get some out there. He has about 90k on it now and it's been very reliable, but some chump rear-ended it hard when it was only a few years old.From memory, liked the way the Bimmer drove and couldn't fathom why everyone thought Audi interiors were so great at that time - the tester we had was a sea of black.The GS350's mpg is impressive, much better than the '05 G35x I had which could only get about 24mpg highway.

- Theflyersfan Keep the car. It's reliable, hasn't nickeled and dimed you to death, and it looks like you're a homeowner so something with a back seat and a trunk is really helpful! As I've discovered becoming a homeowner with a car with no back seat and a trunk the size of a large cooler, even simple Target or Ikea runs get complicated if you don't ride up with a friend with a larger car. And I wonder if the old VW has now been left in Price Hill with the keys in the ignition and a "Please take me" sign taped to the windshield? The problems it had weren't going to improve with time.

Comments

Join the conversation

This was no bailout. As corporate staff sales and market monitoring manager (basically an internal consultant for all kinds of wierd stuff) for a billion-dollar european Tier 1, I was asked by our board, at the last minute (17:00 on a Friday evening), to take over the issue from the formerly responsible employee, and to make a recommendation as to whether we should participate in this initiative. In our case, we had no significant GM business, but a large Chrysler business. Our board was looking for any solution that would provide a measure of coverage for our receivables (we are not the kind of company that at our level has to go to the markets to secure capital, this is handled by the corporate finance departement of our parent company; so this means we would not have participated in the program as a way of securing loans with receivables as many smaller companies do.) Several hours later, after reading through 2" of program documents and internal correspondence, I came to the conclusion that this program, due to the consditions imposed by Chrysler upon its supply base (essentially having to take and maintain a 5% price cut, and agree to further stretching payment terms, both until the undefined end of the program) made it an unattractive deal (and, in other ways, made the supplier even more dependent upon the OEM, and limited the freedom of the Tier-1 to quit the business if the OEM didn't take proper steps to ensure the supplier recover monies owed to it by the OEM.) So, my memo written in the wee hours of the morning was to skip enrollment in the program. Up until that point, the convention wisdom was that it would be good to enroll in the program, but come the following Monday, that was changed by my memo. Noboby was really sure what would happe if the OEM's entered bankruptcy protection, or if they would emerge, or to what extent a Tier-1 would be able to recover monies owed via the bankruptcy process. In the end, I didn't get burned by events and my recommendation looked pretty good given all the administrative headaches gained by suppliers having to work to get on track with the OEM and Citibank (who administered the programme.) Chrysler filed for BK and in the process, they ensured that their supply base received 100% of receivables owed (this was a rather unusual, but necessary, step taken to ensure Chrysler's supply base didn't go illiquid before Chrysler could emerge from BK. This was also used by Chrysler as a big lever to get Tier-1s to accept Chrysler's new contract conditions.) We, as opposed to many other Tier-1's were lucky, I had seen Chrysler's BK coming in 3Q08 and beat the drum for our company to take some necessary steps to position for a Chrysler BK, when this finally happened in Feb 09, we were then positioned to be able to define the terms for continuing business with Chrysler, and of the post-Ch-11 contract relationship. So we didn't have the urgent need to jump into this program. This program was not free, and it was funded by the supplier cutting prices by 3% or 5% (depending on which of two options the supplier selected), and for some suppliers, who could afford the price cut, so as to ensure they would be able to get their receivables (and keep their bankers happy) during a very uncertain time, the program may have been a good deal. (Keep in mind, no one had been able to get receivables insurance from mid-2008, and this impacted the ability of some suppliers to secure funding for CapInv.) Paul, I was casually tracking supplier bankruptcies beginning in 2007, and watching with interest and concern as these increased thru 2008 and 2009... Perhaps the remark of "hundreds" of suppliers having gone bankrupt includes Tier-2 and -3 suppliers, but I am unaware of "hundreds" (more like dozens) of suppliers having gone BK... I'd be interested to see the references that support this claim.

As we continue to feel the effects of "too big to fail" we have determined to solve the problem by having the small firms that were allowed to fail be absorbed by those that were brought down by their own Brobdingnagian nature. Tomorrow: Save your village by burning it to the ground.