Vstra Gtaland County Sends Saab To Collections

The government of Sweden’s Västra Götaland County has referred Saab to the Swedish Enforcement Service (Kronofogdemyndigheten) over nonpayment of a $16.2m loan, reports thelocal.se. The bill is for repayment of a portion of a roughly $45m in aid extended by the county to Saab during its first weeks of bankruptcy. Because the $16.2m portion was used specifically to guarantee employee salaries, the County is arguing that it is not covered by Saab’s 75% writedown agreement with creditors. Saab insists that the salary guarantee portion is covered by the cramdown, and says it has paid its 25 percent of the total loan.

Quote(s) Of The Day: Rattner Rides Again Edition

This is a company that could not tell you, on any given day, within five hundred million dollars, how much cash it had… not only were they not prepared, but Rick Wagoner had very specifically said he didn’t want to prepare… frankly, it’s an irresponsible position [for a CEO to take].

What do you do when you’ve overseen a divisive bailout and an investment scandal all within the last year? Writing a book goes without saying, but it doesn’t hurt to bash on the executives you ousted while “Overhauling” the industry. That way, people who were (ahem) bearish on GM leading up to the bailout can at least be vindicated in their pessimism (and have the pleasure of imagining what might of happened if Ron Gettelfinger had been fired as Wagoner’s sacrificial lamb). In any case, that’s just what former auto bailout czar Steve Rattner has done in an interview with CBS News, and despite Rattner’s relentless striving to appear respectable and brave, it’s worth a watch. Especially in hindsight, pre-bankruptcy GM makes even Rattner look good.

Motors Liquidation Corp Outsources Plant Liquidation To Community

The New York Times checks in on the cheery scene of Flint North, a giant factory complex that was left to Motors Liquidation Corp (aka “Old GM”) after the GM bankruptcy, and finds that the liquidation process is moving along nicely. It turns out that all Motors Liquidation Corp needed to do was look the other way… Flint North was more than happy to liquidate itself.

Ownership of Flint North was ceded to Motors Liquidation in July 2009, though in a special arrangement, G.M. kept making pistons and other engine parts at one of the factories. The empty plants were essentially abandoned in their as-is condition on their last day of production. “They still have personal goods on the table,” said Captain Swanson of the sheriff’s department. “There’s still ceiling fans going.”

Shortly afterward, thieves began to systematically strip copper — used in heating, cooling and other systems — from one of the nearby vacant plants. Authorities said that a ring of thieves hit the building night after night over a three-month period, taking out more than 150,000 pounds of copper.

The gang would load the metal on flatbed rail cars — owned and once used by G.M. — and roll the cars to a hole in a fence, where the copper was put on trucks and then sold to scrap dealers.

Does GM Have Negative Equity?

Digging through the finances of a company as large as GM is never an easy task, especially when the balance book in question was recently wiped clean in a bailout-bankruptcy. Luckily, Bloomberg columnist Jonathan Weil has the chops to do the task justice, and he’s come up with a fascinating insight: through the power of an accounting tool known as “Goodwill,” Weil claims that GM has juiced its assets and liabilities during its “fresh start.” He notes with TTACian zeal:

It’s as if a $30.2 billion asset suddenly materialized out of thin air. In the upside-down world that is GM’s balance sheet, that’s exactly what happened.

The short version: GM undervalued some assets and overvalued some liabilities during its “fresh start.” The scary result: improvement in GM’s performance and creditworthiness could actually lead to writedowns on its Goodwill… which is currently The General’s largest non-current asset. Oh yes, and without that $30.2b in Goodwill, GM would have about an equity value of -$6.3b. Welcome to the new General Motors…

Secrets Of The Bailout

We can’t pretend to be overly enamored with former “car czar” Steve Rattner, who oversaw the auto bailout before being disgraced for his role in a New York pension fund pay-for-play scandal. Still, the guy was in the thick of things during last year’s negotiations over Detroit’s rescue, so he knows where the bodies are buried. And in his new book, Overhaul, which has been released to select outlets ahead of its October 14 publication, he tells a whole lot of stories about the months of bailout proceedings that led to the rescue of GM and Chrysler. Of course, Rattner has an agenda in all this, namely proving that

The auto rescue remains one of the few actions taken by the administration that, at least in my opinion, can be pronounced an unambiguous successso he’s not necessarily an unbiased source. But with grains of salt at the ready, let’s dive into his spilled guts and see if what secrets lie beneath.

Treasury To Block Foreign Investment In GM?

GM IPO Roadshow To Begin The Day After Elections

Looking for proof that politics are an overriding concern for GM during its forthcoming IPO: look no further than a report by Reuters which claims that

GM’s roadshow is set to begin on Nov. 3 and will last two weeks, the sources said. The IPO is expected to price on Nov. 17 and debut on Nov. 18.

Now why would GM wait until the day after midterm elections to file? Well, it could be so GM has time to file 3rd Quarter financial data before offering shares to the public, but GM’s CFO has already warned that 3rd Quarter results will be worse than results from the first half of the year. In other words, waiting to file is likely to materially hurt the IPO (and taxpayers’ chance of payback). But if GM launches its roadshow the day after elections, it won’t turn the midterm election into a referendum on the auto bailout, a situation that would surely exacerbate the already-strong anti-incumbent trend in American politics. And clearly protecting craven pols is far more important than maximizing the return on “investment” for taxpayers, right?

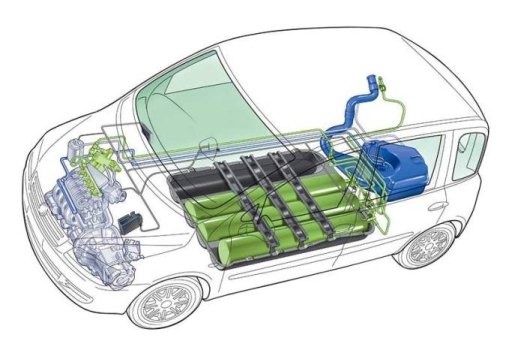

Will American Buyers Subsidize The Chinese-Market Volt?

GM is announcing the arrival of the first “driveable Volt” in China, in a move that GM’s China boss Kevin Wale calls a sign of The General’s “long-term commitment to bringing our industry-leading technology to China.” And despite a distinct lack of Chinese demand for green vehicles, a recent survey that shows as much as 75 percent of Shanghai’s drivers plan to purchase an EV in the next three years (not to mention government plans for increased EV subsidies) is giving GM hope that its plug-in will take off there. But in order to achieve Chinese-market success with the Volt, GM will likely have to offer the vehicle at a price point well below its US-market MSRP of $41,000.

GM Eyed Hong Kong IPO Listing, SAIC Interested In Stake

From a week deep in our “How The Hell Did We Miss That” file comes a Reuters report that shows GM considered floating its IPO on the Hong Kong Hang Seng index. GM’s interest in a Hong Kong float has obvious roots: the company is extremely well-positioned in China, where high savings rates and the prospect of steady local sales growth could have helped bring in both private investors and GM’s partner firms. But according to a Reuters source, GM rejected the idea because it would have delayed the IPO past its Thanksgiving deadline

I don’t think signaling goodwill toward Asia is likely to be a significant enough argument for all the cost and complexity. I don’t want to overstate the cost and complexity but it’s not insignificant

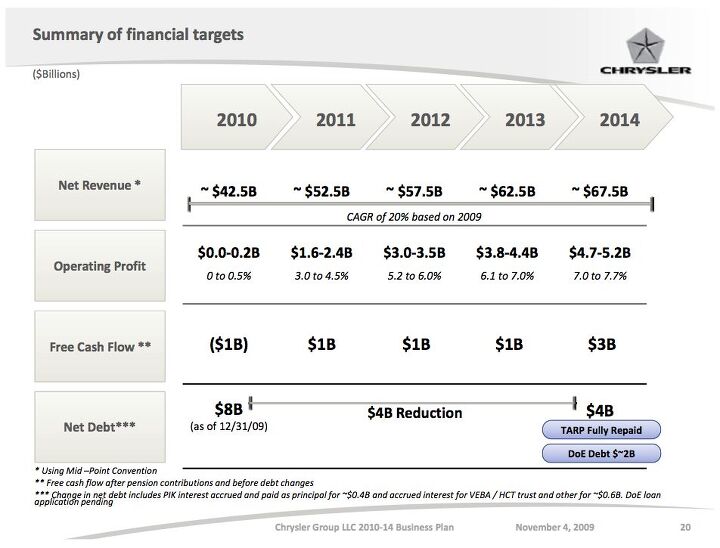

Marchionne Blames Bailout For Profit-Free 2010

We’re hardly shocked by the idea that Chrysler won’t turn profit this year. After all, Auburn Hills has barely made its minimum monthly sales volumes (at best, and with rampant incentives and fleet mix) this year, and lost $50m+ in “industrial inefficiencies” on the Jeep Grand Cherokee launch alone [ Q2 results analysis here]. With plans to close out the year with a non-stop barrage of product launches and attendant media spending, it would take a minor miracle for Chrysler to break even. But we’ve essentially known this all for some time… what’s truly shocking is that Chrysler’s CEO Sergio Marchionne actually admitted to the media that Chrysler won’t turn a profit.

Quote(s) Of The Day: The Coming IPO Edition

Editor’s Note: With GM’s S-1 IPO filing hitting the web today, every IPO and auto industry analyst is weighing in on the offering, and the state of GM. Here’s a collection of some of today’s more notable comments.

It looks to me that GM should be worth no more than Ford. If that’s the case, then the taxpayers will lose about 50% on their investment.

Francis Gaskins, president of IPOdesktop.com, commenting in the WSJ [sub] on GM’s IPO. More analyst commentary on GM’s just-released S-1 filing after the jump.

GM's S-1 IPO Filing: The Risks

The most interesting section of every S-1 filing is undoubtedly the “risks” section, in which companies are legally compelled to disclose all possible material risks associated with investing in their IPOs. Unfortunately, these risks are typically overstated, as no firm on the verge of going public wants to run into trouble with the SEC for under-reporting risk. As a result, many of the risks disclosed are fairly mundane, everyday risks in the world of business (currency, commodity price, and other economic fluctuations, etc). At the same time, companies rarely give reporters a full tour of their major risk areas the way these sections do, so they’re usually worth a read. GM’s just-released S-1 filing is no exception…

Red GM's S-1 Filing Here

GM has filed its S-1 paperwork with the Securities and Exchange Commission. Read the entire document here.

Ask The Best And Brightest: Who Will Be GM's "Cornerstone Investors"?

GM’s IPO filing still has yet to appear on the SEC’s EDGAR database, but while we wait for the S-1 form to clear, Reuters has some details on what to expect from the sale. The big news:

GM is mulling a plan under which sovereign wealth funds or pension funds would serve as “cornerstone investors,” a technique often used for large initial public offerings to show that key investors are supporting the deal, four people said…

Each cornerstone investor would likely be asked to commit to buying 2 percent to 10 percent of the IPO and cornerstone investors would likely account for 10 percent to 30 percent of the total IPO, one of the sources said.

On the other hand, another source says GM is targeting 15 percent of its equity towards cornerstone investors, with 20-25% is aimed at the retail investment market. Either way, Reuters points out that another recent large IPO of a government-owned business, the Agricultural Bank of China, relied heavily on cornerstone investors… but that the politics of such a strategy could be risky.

Quote Of The Day: Picking Favorites Edition

Government Loan Guarantees Help Ford Beat The Debt

At the end of the second quarter of this year, Ford’s overall automotive debt totaled $25.8 billion. Just three months before, its debt level was at $32.6 billion. The debt reduction is all part of CEO Alan Mulally’s plant to earn an investment-grade debt rating by the end of 2011, a move that will lower Ford’s cost of borrowing as well as lowering interest payments. And though Ford’s been making a healthy profit, America’s bailout-free automaker has had more than its fair share of government help to beat the debt. According to the WSJ [sub], Ford’s extensive collection of government loan guarantees has been key to its ability to pay down more expensive debt accumulated during Ford’s 2006 restructuring.

Quote Of The Day: Escape From Government Motors Edition

We want the government out, period. We don’t want to be known as Government Motors.

GM Chairman and CEO Ed Whitacre channels his inner Rick “Bankruptcy is not an option” Wagoner in the New York Times, telling the taxpayers who put him in charge of a bailout-rinsed General Motors to get lost. Sure Ed, we’ll all go NSFW ourselves just as soon as we get our $49.5 billion back. Talk about putting the throat-clearing guttural in chutzpah…

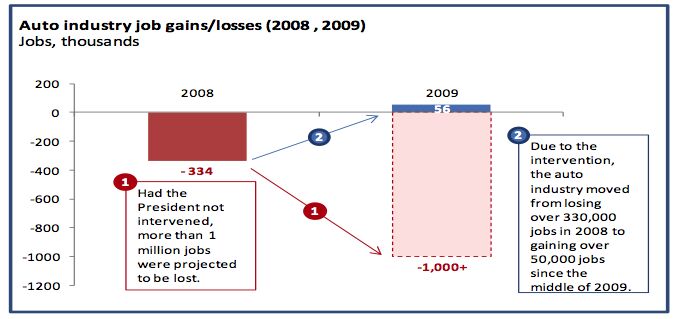

Bailout Logic Bubbles Over In Chicago

Several industry commentators have chided the Obama Administration for its recent “Mission Accomplished” tour of the auto industry, arguing that we’re all still a long ways from knowing the bailout’s true effects, and that declaring victory is grotesquely premature. But by now the logic of bailout has so taken hold that the White House knows it need not even prove that the bailout was a success. The point that is made over and over again is that opposition to bailouts can be motivated only by nihilism. On each stop of his recent tour of auto factories, Obama has emphasized that he “refused to walk away” from the auto industry. He did something when no one else would. What tends to escape notice is how quickly the logic of “doing something” can make otherwise smart people stop questioning the actual impact of government intervention. And as two stories today illustrate, that’s a recipe for the worst kinds of waste.

TTAC In The NY Times: "GM's Electric Lemon"

What's Wrong With This Picture: Saved Or Created Edition

The Truth About The GM/Chrysler Dealer Cull

It is not at all clear that the greatly accelerated pace of the dealership closings during one of the most severe economic downturns in our nation’s history was either necessary for the sake of the companies’ economic survival or prudent for the sake of the nation’s economic recovery

Whoops! Who could have thought that the biggest political fight of the bailout era was picked over something never really needed to happen. At least, not according to the SIGTARP, the Special Inspector General for TARP, Neil Barovsky. In his latest report on the GM and Chrysler dealer cull [ full document in PDF here], Barovsky explodes a lot of the myths surrounding the move to accelerate dealer closings, and even goes so far as to assign real blame… and not to GM or Chrysler either.

GM Asks IPO Underwriters To Buy Its Cars

Bloomberg reports that GM has already pulled off one of the ballsiest IPO moves ever, by asking banks bidding to underwrite its IPO to use fees to subsidize the purchase of GM vehicles by its employees. According to the report, a GM document sent to bidding banks solicited

ideas as to how we can use the IPO to reposition GM and its vehicles within the investment community including your firm’s willingness to reinvest any portion of any underwriting fees into the purchase of GM vehicles for your employees and/or company use.

Ford Scores More European Aid

GM's IPO: Faster, Harder And Less Satisfying

Despite having more cash than debt for the first time in decades, GM is going back to Wall Street in search of fresh debt. Over the weekend, The General has been in talks with several banks to secure a $5b revolving line of credit to shore up its liquidity position ahead of an IPO that’s rumored to take place in August. At $5b, GM’s desired line of credit would essentially replace the $5.8b the automaker has repaid to the Treasury, and will help it deal with a number of pressing cash needs to maintain its shaky global empire. But with so many pressing uses for the cash, and political pressure mounting for a rapid IPO, can GM deal with its issues and take on more debt and be worth what the government wants it to be worth? Troublingly, the answers to these questions are not to be found on GM’s balance sheet.

Without EVs, Chrysler Gets Gassy. Will Washington?

Today, natural gas is a rational alternative to gasoline that can provide a near-term environmental solution on the road to vehicle electrification. It is the most effective solution, in terms of costs and timing, to lessen this country’s reliance on oil

Chrysler/Fiat CEO Sergio Marchionne tells the Detroit News that despite not having an electric vehicles in the works until 2012 (can you believe ENVI was just vapor), Chrysler can sell environmentally-friendly vehicles sooner than that. After all, Fiat sells a grip of natural gas-powered vehicles in Europe (130,000 last year), offering the alt-energy drivetrain on nearly every model. Of course, there’s a hitch. Or three.

France, Russia Considering Swapping Stakes In State-Owned Automakers

You take some of my rescued state-owned automaker, and I’ll take some of yours. That seems to be the cunning plan cooked up by presidents Putin and Sarkozy, as the two face the prospect of rescuing struggling firms in the midst of a weak European market. And actually, it seems that the idea was really Putin’s. French-owned automaker Renault is “more than happy” with its 25 percent stake in the moribund Russian automaker AvtoVAZ, reports Bloomberg, but Russia is offering to buy 15 percent of the French firm if France in turn takes on more AvtoVAZ equity. Considering that Reanult paid $1b for 25 percent of a firm that has been kept alive only by government intervention, a closer embrace of VAZ does not seem advisable. Nor, frankly, does any form of “Franco-Russian Leyland” sound like a good idea.

Desperately Seeking Subprime: White House Admits GM's IPO Dash Hurting Ally's TARP Payback

The WSJ [sub] reports that GM is officially looking outside of its former captive finance arm Ally Financial (formerly GMAC) as it seeks more subprime loan deals to drive sales volume ahead of its IPO. GM execs tell the WSJ that The General could do even better with an in-house finance arm, but that these deals will help. And, according to Experian Automotive’s Melinda Zabritski, GM needs the help because

By not financing [subprime] consumers, they are locking out about 40% of the U.S. population

GM’s restructuring consultants AlixPartners add that loyalty improves for customers who buy using a captive lender. The downsides? Higher default risks, the temptation to overload on incentives, and then there’s one more biggy…

GM Filing IPO Paperwork As Soon As Next Week

How Big Will GM's IPO Be?

Ed does things that are bolder and bigger rather than small and timid. All things being equal, Ed would like it bigger versus small. But all things aren’t equal. He needs to get the government the best value for its stake, too.

Former AT&T exec James Kahan tells BusinessWeek what kind of IPO GM’s Chairman would prefer. Unfortunately for “Big Ed,” that’s not up to him. GM’s value must be determined by the market, and due to political pressure on the government to end its ownership of GM and Chrysler, it will have to happen as soon as possible. A fourth-quarter IPO with “about half of the government stake [being sold] to the 20 top institutional investors” is in the cards. So we know the government won’t get out of GM entirely in the IPO… but how much will the market give the Treasury for half of its 61 percent stake?

Canada Won't Sell GM Stake In IPO… What About The US?

Quote Of The Day: Wall Street's Burden Edition

Handling [GM’s] IPO assignment is something of a vanity project for the Wall Street banks, given the relatively small fees the banks will earn through the process. One person familiar with the offering said that the banks may earn less than 1% of the overall deal. At a valuation of $10 billion, that would equal a total fee pool of $100 million.

The Wall Street Journal [sub]’s take on the forthcoming GM IPO. Persons anonymous tell The Journal that Morgan Stanley and JPMorganChase are the frontrunners in the vanity project sweepstakes. But as charitable as the one-percent arrangement seems, the Wall Street mavens have their work cut out for them…

Republicans Allege Document Destruction At GM

Two Republican congressmen have written to GM CEO Ed Whitacre, asking him to halt the destruction of electronic documents as long as the automaker is owned by the government, reports the Detroit News [ Full letter in PDF here]. Reps Darrel Issa (R-CA) and Jim Jordan (R-OH) allege that documents destroyed by GM could have helped their House Oversight Committee investigation of GM’s decision to run its infamous “payback” ad, and shed light on government interference in day-to-day operations including influence over plant locations and a “secret agreement” on revised EPA standards. The congressmen write:

In light of these ongoing investigations, we are deeply disturbed to learn that GM is engaging in a continuous process of destroying documents relevant to the Committee’s oversight efforts

GM Dealer Cull: Now With 50 Percent Less Cull?

Thanks to congressional arbitration, GM’s dealer cull has been steadily downsized since The General made the decision to axe nearly 2,000 dealers during last year’s bankruptcy. Going into bankruptcy, GM had about 6,000 dealers nationwide, and it culled nearly 2,00 of them in an attempt to lean out its distribution channels. But now the Detroit News reports that GM’s North American boss Mark Reuss has said that about half of those culled dealers will have been reinstated by this July, bringing GM’s dealer count back to the 5,000 ballpark.

SEC Seeks Three-Year Securities Work Ban On Rattner

Somewhere under a “Mission Accomplished” banner on an aircraft carrier, former car czar Steve Rattner is starting to get a bit lonely. Reuters reports that the Securities and Exchange Commission is seeking a three year ban on Rattner that would prevent him from working in the securities field. The ban stems from a recently-settled investigation into kickback allegations at Rattner’s former investment firm Quadrangle Group (involving a distribution deal for his brother’s low-budget movie “Chooch,” no less).

Quote Of The Day: Mission Accomplished-ish Edition

We don’t need an aircraft carrier and “Mission Accomplished” banner, but isn’t it time to agree that the auto rescue has been a success?

Former auto czar-let Steve Rattner picks an unfortunate choice of metaphors to celebrate the possible success of the auto bailout in an op-ed for the Washington Post. Meanwhile, the latest Treasury estimates still show a projected $24.6b loss on the bailout, so yeah, let’s hold off on that carrier-based victory party.

Opel Aid Headed For Failure Again?

Technical experts analyzing GM’s request for $1.35b in Opel aid from the German government have reported back, and the signs aren’t looking good. According to the Financial Times, the experts advising a political committee that will rule on Opel aid next week returned a negative outlook on The General’s request. German officials tell the newspaper that

the technical experts’ stance was “formally not a complete No” but that it “meant No in practice”

GM is requesting €1.9b in loans for its €3.7b restructuring of Opel. Though it looks like the €1.2b ($1.35b) it is requesting from Germany will be turned down, some portion of that amount might still be awarded by local German state governments. If that scenario plays out though, more employment cuts could be in order for Opel’s German production staff.

One Year Ago Today, General Motors Filed For Bankruptcy

One year ago today, General Motors took the “unthinkable” step of filing for bankruptcy. It was a seminal moment in the history of the American auto industry: the day that once-dominant GM finally shed its illusions, faced up to reality, and plunged into the cold, cleansing waters of bankruptcy reorganization. Or, to use a more accurate metaphor, it was pushed in. After decades of decline masked by decades of PR-driven denial, GM had literally lost the ability to self-correct.

Treasury Hires Lazard As GM Moves Towards IPO

The Detroit News reports that the Treasury Department has hired Lazard Frères & Co. as an advisor to GM’s forthcoming IPO sale. And with news of the hiring comes confirmation that GM’s IPO really is coming soon: the investment bank will receive half a million dollars, according to the DetN, but that amount will drop to $250,000 if the IPO isn’t completed within one year. If you’re one of the GM boosters who believes that an IPO will repay all or most of the government’s investment in GM, it’s time to start saving those pennies. You have less than a year now to put your money where your mouth has been.

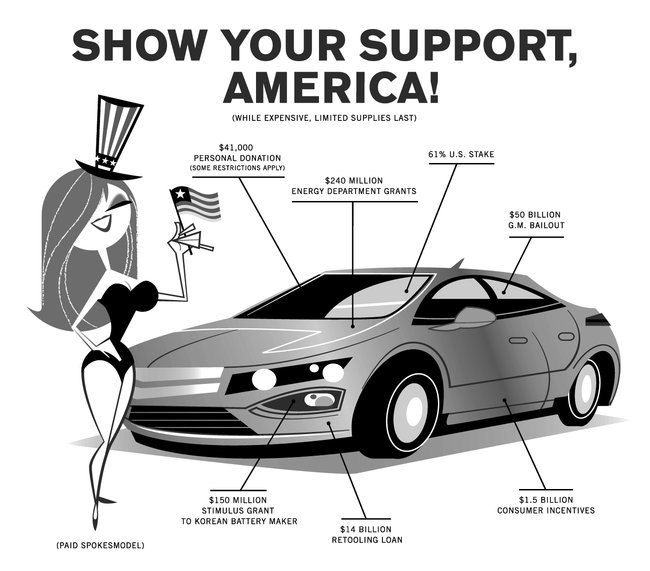

Obama Advisor: Taxpayers Can Expect "Most, If Not All" Of GM's Bailout Back

Speaking at a Brookings Institution summit on cities affected by the auto downturn, National Economic Council director Larry Summers said that taxpayers will likely see “most, if not all” of its $42b outstanding “investment” in GM returned when the automaker goes public. According to the Detroit Free Press:

Summers’ comments were backed up by an analyst estimate today that suggested the new GM’s equity could be worth between $75 billion and $78.5 billion – giving the government more than $42 billion for its 60.6% stake.

Obama Administration officials had previously said that taxpayers stand to lose as much as $34b on its bailout of the auto sector, including GM, Chrysler and their finance unit formerly known as GMAC (now called Ally Financial).

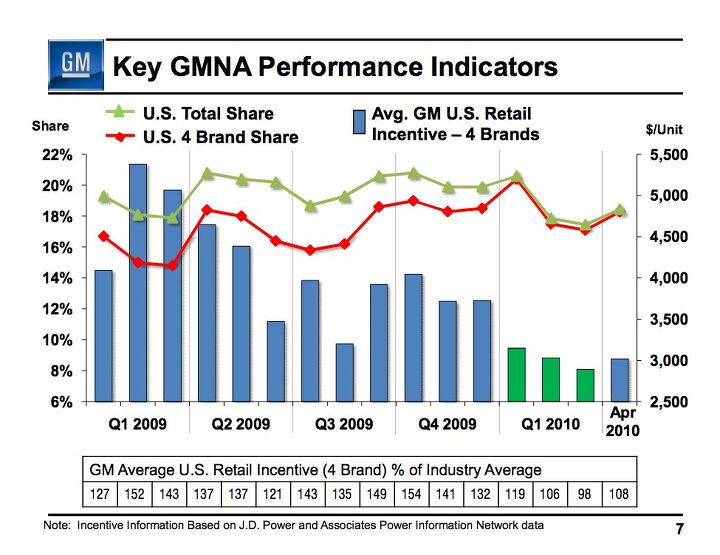

What's Wrong With This Picture: Follow The Incentives Edition

Sadly, my internet came crashing around my ears just as GM’s Q1 results conference call was getting interesting. Typical Monday. I’ll rock myself to sleep tonight with a recording of the call and report back tomorrow, but at this point the big news is plainly visible on this single slide. Yes, GM finally got control of its incentives and wrestled them below the industry average… for a month. That month (March) also just happened to be the worst month this year for GM market-share wise. The next month (April), the incentives went back over the industry average, and market share increased once again. The lesson seems obvious: GM won’t gain market share on promises of high-quality cars and taxpayer payback alone.

Chrysler Repays Federal Loan

What, you want more context from a headline? It’s not like we’ve lied to you or anything. Technically, every word of it is true. OK, OK, here’s the fine print: CGI Holding, owners of “Old Chrysler” and Chrysler Financial paid $1.9b of a $4b pre-bankruptcy TARP loan, according to Automotive News [sub]. Though far less than face value, that payback “is significantly more” than what Treasury was expecting in return. In other words, this is great news if you thought the bailout would be a complete loss. Otherwise, it means that the various remains of Chrysler have repaid $3.9b of the $14.3 invested by taxpayers into the company pre-bankruptcy… and unless Chrysler’s IPO brings in about $100b, Treasury will still take a bath on the rescue.

GM Captive Finance Push Explained: The General Wants More Subprime Business

When we first heard that GM was eying a return to in-house financing, our first reaction was to worry that

the potential for falling back into old bad habits can’t be ignored.

Clearly our concern wasn’t wasted, as the AP [via Google] reports that The General’s major motivation for considering re-creating a captive lender is to chase subprime business its current major lender won’t touch. And considering that that lender is GM’s bailed-out former captive finance lender GMAC (now Ally Financial), which was badly burned by subprime mortgages, it’s not surprising that GM is frustrated by GMAC’s tentative approach. But should The General charge into the low-standard lending sectors where Ally fears to tread?

GM Q1 Profit: $865m After Dividends

DOE Loans In The Works For GM, Chrysler

Officials working with the Department of Energy tell the Detroit News that GM and Chrysler face no major obstacles in their quest for huge retooling loans from the DOE’s Advanced Technology Vehicle Manufacturing Loan program. GM is seeking $14.4b and Chrysler has asked for $8.55b in low-cost government loans. Says Matt Rogers, a senior adviser to the Energy Department

Project finance details need to be worked through, but those things are working out just fine as we work directly with the companies. It’s really a process of making sure that each of the projects that they have are in fact competitive.

Er, competitive compared to what?

GM And Chrysler Racing Towards Captive Finance?

News that GM is considering a number of options for a return to captive finance, has lit a fire under Chrysler CEO Sergio Marchionne, who tells the Detroit News that

One of the things that we do not wish under any circumstance is to have an uncompetitive relationship vis-À-vis GM

That would certainly be the case if GM bought up its recently-bailed-out former captive finance arm, GMAC (now known as Ally Financial). Chrysler relies on GMAC for leasing and loans just as much as GM does at the moment, so an Ally buyout would create major long-term problems. But even if GM created a new finance arm, Chrysler doesn’t seem to think that it will be able to survive without forming its own in-house finance department. Which would then compete with GM and Ally, to say nothing of the industry’s other finance competitors. But is the rush to captive finance going to be good for anyone?Survey Says: GM's "Payback" Ad Is Working

GM’s now-infamous advertisement touting the payback of government loans “may have elasticized the reality of things,” in the words of Steve Rattner, but stretching the truth apparently pays off. Automotive News [sub] reports that a London public perception-tracking firm surveyed some 5,000 consumers, and found that The General’s image has improved since the ad started running. Of course, on YouGov’s brand image scale of 100 to negative 100, GM is up only five points to “17.” Clearly there’s still work to do.

GM Eying Return To Captive Finance?

Quote Of The Day: Stretched Edition

Center For Automotive Research: Detroit Beating The Wage Gap

Speaking at the same Detroit conference on the auto bailout that Steve Rattner and Ron Bloom attended, the Center for Automotive Research’s Sean McAlinden proclaimed the end of Detroit’s era of unsustainable high wages. In 2007, said McAlinden, building a car in North America cost GM about $1,400 more per car than it did Toyota, thanks largely to a $950 health care charge. Since then, GM’s bailout and renegotiated wage and benefit contracts with the union have actually brought GM’s hourly compensation to just under what the CAR says the transplants pay. The AP reports that McAlinden’s estimate of GM’s average hourly worker salary is $69,368 while the transplant average is $70,185. Better still is McAlinden’s prediction that

between 2013 and 2015, Toyota could even be paying $10 more per hour than GM unless the Japanese company reacts and lowers wages.

And all it took was giving the UAW a $17.5 stake in the new GM!

2010 GM And Chrysler IPOs Looking More Likely

Chrysler crowed over its 9.1 percent market share in its Q1 results conference call yesterday, and though CEO Sergio Marchionne refused to be pinned down on an exact time frame, an IPO this year looks more likely than ever. Similarly, BusinessWeek reports that GM’s Ed Whitacre has hinted that a Q1 profit is likely, as is an IPO in Q4 of this year or early next year. This improvement in both bailed-out automakers was underlined by former Presidential Auto Task Force head Steve Rattner, who said the two firms were “meeting expectations,” at a Detroit-area conference. But Rattner also put his expectations into some context by saying

When we did this restructuring we never expected a full recovery of our investment. If it ends up costing us $10 billion we should consider it a success. For about $10 billion we avoided economic and human calamities… I would suggest that that’s a pretty effective cost of government stimulus

That assessment is down considerably from Rattner’s last prediction, which expected a taxpayer profit on the auto bailout.

GMAC Renames Itself Ally Financial

Perhaps the most fundamental challenge facing bailed-out financial and auto firms is convincing consumers to leave aside their anti-bailout prejudices and start buying their products. For GM, the first step in this process was as simple as repaying a loan and airing a “Mission Accomplished” advertisement that did everything but show Ed Whitacre landing on an aircraft carrier. For GM’s former captive finance arm, GMAC, escaping the stain of the bailout is a more prosaic matter. Having already launched an online consumer-oriented banking arm by the name of “Ally Bank,” the finance company is adopting the innocuous Ally moniker for its entire business, reports the Detroit News.

Competitive Enterprise Institute Files Deceptive Advertising Complaint Against GM

The Competitive Enterprise Institute, a public interest group dedicated to free enterprise and limited government, has filed a complaint with the Federal Trade Commission, alleging that a recent advertisement from GM claiming to have “paid back government loans in full” is deceptive [ full complaint in PDF here]. You might be able to guess why the CEI finds the GM ad so misleading, but if not, their explanation is after the jump.

GM Commits $532m To Antwerp Plant Shutdown

Inspired By Quadrangle Scandal, Republicans Call For Investigation Into Rattner's Delphi Dealings

When former auto task force boss Steve Rattner’s former firm Quadrangle recently settled a “pay-to-play” corruption investigation, it threw Rattner under the bus, saying:

We wholly disavow the conduct engaged in by Steve Rattner, who hired the New York State Comptroller’s political consultant, Hank Morris, to arrange an investment from the New York State Common Retirement Fund. It is our understanding that Mr. Rattner also arranged a DVD distribution deal for a movie produced by the Chief Investment Officer’s brother in the middle of the investment decision-making process. That conduct was inappropriate, wrong, and unethical. Mr. Rattner is no longer with the firm and is not a part of today’s settlement. Quadrangle will fully cooperate in the Attorney General’s ongoing investigation of Mr. Rattner and others.

According to the DetN, that stinging indictment by Rattner’s former firm has inspired House Republicans to call for an investigation into whether Rattner was behind a deal in which some Delphi retirees lost their pensions while others didn’t.

Treasury: GM "Payback" Claims Not Misleading

In response to Senator Chuck Grassley’s concern that GM’s claim to have paid back taxpayer loans was misleading, the US Treasury is now saying that it has no problem with The General’s statements. According to the Freep, a Treasury letter to Grassley explains that:

GM’s decision to pay off the loan signaled the automaker did not face “extraordinary expenses,” and that Treasury approved the loan payoff.

“The fact that GM made the determination and repaid the remaining $4.7 billion to the U.S. government now is good news for the company, our investment and the American people,” said Herbert Allison, assistant Treasury secretary for financial stability.

Strictly speaking, GM’s claim to have paid back all US Government loans is correct. The only issue is that GM’s ad touting the payback makes no reference to the fact that it still owes the Treasury upwards of $40b. If that misleads folks, well, apparently the Treasury Department isn’t going to do anything about it.

Auto Bailout "Progress" Defined: "Only" $28b in TARP Losses

Last week’s announcement that had Chrysler turned a Q1 profit and GM had “repaid” taxpayer loans brought a flurry of political posturing about the success or lack thereof of the auto bailout. With Republicans laying into the auto bailout from several angles, President Obama dedicated his weekly address to a defense of industry assistance. Obama still frames the bailout as an unpleasant necessity, but argues that last week’s news means the chances that taxpayers will recoup their “investment” are improving. And apparently the Treasury agrees. According to the Detroit News, Treasury has revised its estimate of auto bailout losses (not counting GMAC) downwards, from $30.6b to $28b. Progress, sure, but hardly a sign that taxpayers can expect full payback from its state-owned automakers.

GOP Reps: Did The White House Pressure State-Owned Automakers Into Accepting GHG Standards?

With Senator Chuck Grassley (R-IA) already taking the White House and Treasury to task for possibly helping GM avoid paying the “TARP Tax,” Republican representatives Darrell Issa (R-CA) and Lamar Smith (R-TX) are attacking the auto bailout from another angle, writing a letter to nine automaker CEOs requesting clarification of the negotiating process that led to recently-passed final rules on a ramp-up of greenhouse gas (GHG) emissions standards. In their press release on the issue, Issa and Smith note:

It is unclear whether the Administration used leverage created by the possibility of a taxpayer bailout of GM and Chrysler to secure their cooperation and support for new fuel economy standards. Moreover, there is reason to believe Administration officials used inappropriate tactics to ensure broad based support across the industry. Given the clear conflict-of-interest issues at play, which naturally arise when the government is in a position to pick winners and losers and impact the future viability of private entities, it was imperative that the Administration act with the utmost transparency. Instead, the White House imposed an unprecedented level of secrecy.

Are Issa and Smith on to something, or is this simply a partisan dogpile on an unpopular policy? Hey, this is politics… does it even matter?

Grassley: Was GM's "Payback" Shuffle About Avoiding The TARP Tax?

While the White House and most of the media spent the last two days parroting GM’s claim that it “paid back” taxpayers, Senator Chuck Grassley was busy writing a letter to the Secretary of the Treasury [ letter available in PDF here]. The three-page note opens:

Dear Secretary Geithner:

General Motors (GM) yesterday announced that it repaid its TARP loans. I am concerned, however, that this announcement is not what it seems. In fact, it appears to be

nothing more than an elaborate TARP money shuffle.

No surprises there: TTAC has been all over this ruse for months now. Grassley does sum the situation up nicely, stating that “A debt-for-equity swap is not a repayment,” but the most interesting part of his letter is his theory for why GM and the Administration approved the tax-money reshuffle. Thus far, we’ve assumed that PR was the driving concern in this transparent deception. According to Grassley though, there may be another reason…

"Old Chrysler" Liquidation Plan Approved, TARP Loan Repayment Not So Much

Having laid into GM today for trumpeting a government loan repayment, it would be churlish not to point out that, by Detroit standards anyway, GM’s “partial refund” is actually kind of a big deal. Take today’s news from the nearly year-long liquidation of “Old CarCo,” the poisoned (in some cases, literally) remains of what was once “Bad Chrysler.” Bloomberg reports that the US Treasury’s $5b line of credit has been placed in the “unsecured” category of Old CarCo’s last debts, meaning recovery is “undetermined.” As in not so very likely at all.

Recent Comments