Under Pressure From UAW VEBA, Chrysler Files For IPO, Fiat Not Thrilled

After Fiat and Chrysler’s retired UAW workers’ health care benefits trust were unable to agree on a price for the Voluntary Employees Beneficiary Association‘s 41.5% share in the Auburn Hills automaker, at the trust’s request C hrysler has filed initial paperwork for a public stock offering to sell part of the VEBA’s stake, about 16% of overall Chrysler shares, the first time in over a decade that the public will be able to own shares in Chrysler, which formerly was wholly owned by Cerberus and before that Daimler. Fiat certainly would rather the IPO not take place now as it complicates Fiat and Chrysler CEO Sergio Marchionne’s plans for the Italian automaker to acquire full ownership of Chrysler. The benefits trust has the legal right to force Chrysler to make the stock offering so the VEBA can cash out on the shares it received in exchange for giving up financial claims against Chrysler during the company’s bankruptcy and bailout by governments in the United States and Canada.

Fiat To Buy GM's 50% Share of Diesel Engine Maker VM Motori For Full Ownership

Ownership of VM Motori, the Italian maker of the V6 diesel engines offered in the Jeep Grand Cherokee and Ram 1500, is currently split 50/50 between General Motors and Fiat. But according to Automotive News, Fiat is looking to buy the other 50 percent, completing its ownership stake.

U.S. DoJ, Consumer Financial Protection Bureau Investigate Toyota, Honda, Other Automakers' Credit Arms For Lending Bias

According to regulatory filings by Toyota Motor Credit Corp., the giant automaker’s car financing arm, and American Honda Finance Corp., which fills a similar role for Honda, the United States Consumer Financial Protection Bureau and the Department of Justice are investigating major auto manufacturers for possible lending bias based on race, which would be a violation of the 1974 Equal Credit Opportunity Act. According to Bloomberg, the agencies are looking into how loans that the automakers’ credit companies provide to auto dealers are priced. Bloomberg reports that as many as seven car companies have been asked for data that may be related to the borrowers’ races and interest rates charged. Both government agencies declined to comment on the matter.

EV Charging Station Maker Ecotality Files For Ch. 11 Bankruptcy, Potential Asset Sale

EV charging system maker Ecotality has filed for Chapter 11 bankruptcy protection from its creditors, saying that it wants to sell its assets in an auction. The Associated Press is reporting that Ecotality might be forced to sell or file for bankruptcy after the U.S. government suspended payments as part of the Department of Energy EV Project. Ecotality, based in San Francisco, makes charging and power-storage systems for electric vehicles under the Blink and Minit Charger. It also makes charging stations for Nissan’s Leaf brands, and provides testing services for government agencies, auto makers and utilities. The company now says that it would prefer to sell its assets through a court approved bankruptcy auction.

U.S. Treasury Sells 110 Million Shares of GM Stock, Reducing Stake to 7.3%

The United States Treasury has reduced its stake in General Motors to 7.3% after selling off another block of the shares it acquired during the bailout of the giant automaker. According to documents released earlier this week cited by Reuters, the Treasury sold at least 110 million shares between May 6 and September 13, raising more than $3.82 billion.

U.S. Dept. of Energy to Auction Off Fisker Loan

The United States Department of Energy has announced on its website that it will auction off the loan that it made to Fisker Automotive, a loan for which the hybrid luxury startup carmaker only repaid a small fraction of the principal. Peter Davidson, the executive director of the department’s Loan Program Office, told Automotive News that the DOE decided to auction off the loan, “after exhausting any realistic possibility for a sale that might have protected our entire investment.”

Marchionne: No Deal Yet For VEBA Shares, Chrysler IPO Would Delay Fiat Merger

On Friday, Sergio Marchionne, who heads Fiat and Chrysler, told reporters in Milan, Italy that he hasn’t gotten any closer to making a deal with the UAW’s retiree health care trust for Fiat to purchase the VEBA’s shares in Chrysler and take full ownership of the Auburn Hills automaker. The UAW health care trust owns 41.5% of Chrysler and the two parties have not been able to agree on a price. The trust is demanding $5 billion for its shares. Marchionne told the LaPresse news agency, concerning the UAW trust’s suggested price, “They should buy a lottery ticket.”

Canada, Ontario Sell Off $1.1 Billion in GM Shares, Reduce Stake By 20%

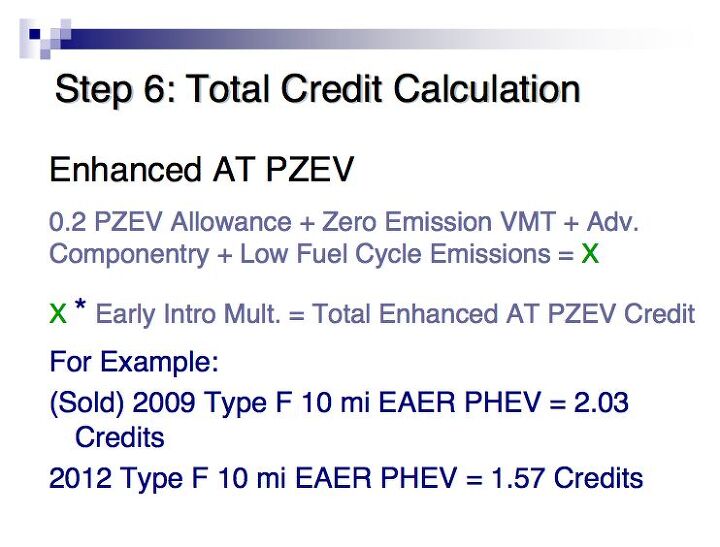

Nissan to Start Selling California ZEV Credits, Joining Tesla

Tesla recently released financial figures that the company says demonstrate profitability. According to Automotive News, analysts have pointed out that some of Tesla’s revenue comes not from selling cars but rather by selling zero-emission credits to other car companies that want to do business under California’s clean-air regulations. If they want to sell cars in California, companies have to comply by either producing ZEVs or by obtaining credits from companies that make those vehicles. Now Nissan Motor Co, whose Leaf is the best selling electric car of all time, has joined Tesla in selling those credits. Tesla was able to sell those credits because they only make electric vehicles. Makers of conventional cars and trucks buy the credits to theoretically offset the pollution caused by those cars. Since Tesla has no such conventionally polluting cars to offset, they can sell their credits. Nissan executive VP Andy Palmer told reporters earlier this week that at this point Nissan has sold enough Leafs to cover its own needs to comply with the California Air Resources Board‘s rules and will now start selling surplus credits to other automakers. “We’ve got carbon credits to sell, and we’re selling them — California ZEV credits.” No details were forthcoming on time, price or to whom Nissan will sell their credits.

U.S. Dept. of Energy to Resume ATVM Alternative Vehicle Loan Program

Though it has been criticized by those who oppose government financing of business, in part because of the failure of Fisker, one of the recipients of the U.S. Department of Energy’s Advanced Technology Vehicle Manufacturing loan program, the DoE has announced that it will resume marketing the ATVM to industry and possible applicants. About 60% of the $25 billion that Congress allocated to the program still remains. No loans have been made since 2011.

“With no sunset date and more than $15 billion in remaining authority, the program plans to conduct an active outreach campaign to educate industry associations and potential applicants about the substantial remaining funds available and the application process in general,” a Dept. of Energy spokeswoman said.

Fed Reports Auto Loans at Six-Year High, Average Balance Up, Delinquencies Down

According to a report issued last week by the U.S. Federal Reserve Bank of New York, car and light truck loan originations have reached a six-year high. Automotive News reports that for the second quarter of 2013, new loans went up 11% to $91.8 billion, including consumers with all credit ratings. U.S. light vehicle sales were up 9% for the quarter from last year.

The Fed said that the biggest year to year change was in the 621-660 credit score range, just below “prime” rankings. That tranche rose 16% to $12.1 billion. Loans to those with worse credit, a score below 620, were up ~11% from 2012 to $21.2 billion.

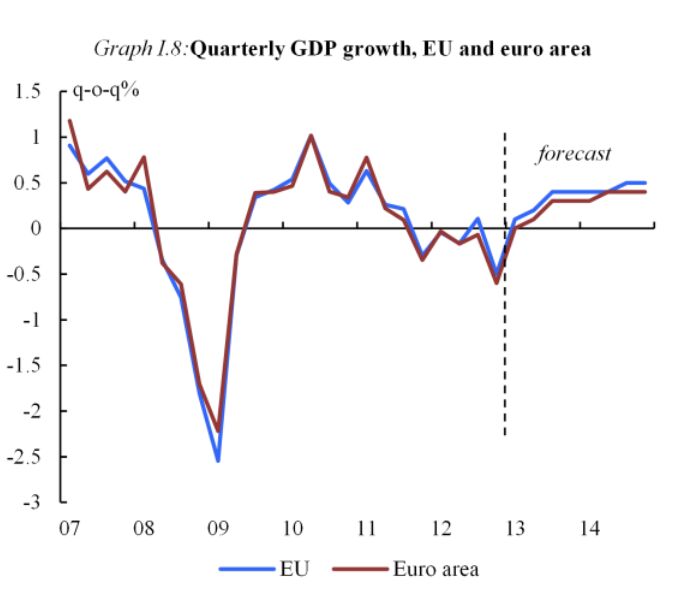

Reuters Poll of Economists Say Euro Recession Has Ended But Recovery to Be Slow

According to a Reuters poll of 30 economists, data to be released next week will show that the recession in Europe has ended, but that the euro zone will not start growing significantly until 2015. The consensus prediction for the second quarter of 2013 was 0.2% growth.

Visteon Continues to Divest Interior Trim Operations, Focuses on Electronics and HVAC

Visteon, the large automotive supplier, continues to reshape itself from a vendor of interior trim to one that focuses on electronics. Visteon announced that it is selling its half of Yanfeng Visteon Automotive Trim Systems to it’s Chinese joint venture partner Huayu Automotive Systems, for ~$1.2 billion. At the same time, Visteon will be buying majority ownership of the JV’s electronics unit, Yanfeng Visteon Automotive Electronics Co., for $68 million.

U.S. Treasury Continues Sell-Off of GM Shares, UAW Sells Warrants

Continuing its divestment of the shares it obtained in General Motors for bailing out the automaker in 2009, the United States Treasury told Congress yesterday that it has sold $876.9 million dollars worth of GM stock last month, somewhere between 23 and 26 million shares, based on the trading prices during July. By those calculations, the U.S. government still holds about 136 million shares of GM, which closed yesterday at $35.98. At the rate that Treasury is selling off its GM shares, the government’s equity will be completely divested by early 2014. The government originally held a 61% stake in GM following the $49.5 billion bailout, over 500 million shares. By selling some of those shares, Treasury has recouped $34.6 billion of the $49.5 billion.

Politically Connected EV Startup GreenTech Automotive Subject of SEC Investigation

Electric car startup GreenTech Automotive, which set up a factory in Horn Lake, Mississippi to manufacturer their low speed neighborhood EV called MyCar, is being investigated by the U.S. Securities and Exchange Commission for the way it solicited foreign investors. GreenTech Automotive was co-founded by Virginia gubernatorial candidate Terry McAuliffe, who is a former chairman of the Democratic National Committee. McAuliffe resigned as chairman of GreenTech in late 2012 when he started his campaign.

Canada Preparing to Sell Its 10% Stake in GM, Reports Say

Bloomberg and Sky News have reported that the Canadian government has started a selection process to find investment banks for selling off of the stake the government took in General Motors as part of its own contribution to bailing out the automaker. Late last year, Finance Minister Jim Flaherty said that Canada had no intention of holding those shares long-term. Together the federal Canadian and provincial Ontario governments own 140 million shares of common GM stock, valued at $5.1 billion (US), a 10% stake in the automaker, which makes Canada the company’s third biggest shareholder behind the U.S. Treasury and the UAW’s VEBA health plan. The governments had originally invested $9.5 billion in GM back in 2009, selling off 35 million of its shares when GM made its initial public offering of stock in the reorganized company.

Suzuki Denies Renewed Talks With VW

Not so fast…again

Though recent reports claim that VW Chairman Ferdinand Piech and Suzuki President Osamu Suzuki are involved in board level talks to resolve the differences in their on again off again relationship, at a news conference for quarterly earnings, Suzuki Executive Vice President Toshihiro Suzuki denied any such talks have taken place. According to Reuters, Suzuki claimed that “There have been various reports, but there absolutely are no such facts, so there is nothing I can talk about on this topic.”

Fuji Has Record Profit On Surging Subaru Sales in North America

Fuji Heavy Industries, the Subaru’s corporate parent, had a 400% increase in operating profit due to strong U.S. sales for that brand. North American sales for Subaru in its largest market were up 30% to 116,000 unites in the quarter just ended. Fuji’s operating profits were 69.64 billion yen ($739.6 million), up from 17.33 billion yen ($184.05 million) last year, a record for quarterly profits for that company.

Chancery Judge Rejects Fiat's Valuation of UAW VEBA's Chrysler Shares, Merger Delayed

Sergio Marchionne’s plans to merge Chrysler and Fiat have been delayed because Fiat failed to convince a Delaware Chancery Court judge to set the value of Chrysler stock owned by the UAW’s health care fund known as VEBA. Judge Donald Parsons rejected Fiat’s request to find that a call-option agreement covering at least 54,000 Chrysler shares valued the stock at slightly less than $140 million. That decision means that the dispute over the shares’ value will now proceed to trial.

Chrysler Profit For Q2 Up 16% to $507 Million, Full Year Forecast Reduced

Chrysler Group reported net income of $507 million in the second quarter, with strong sales of SUVs and pickup trucks helping the car company make a profit for the eighth consecutive quarter. Earnings were up 16% from the same period a year earlier when $436 million was made. However, the company reduced its projected full year profit. Second-quarter revenues grew 7 percent to $18 billion, up from $16.8 billion in 2012.

PSA Peugeot Citroen Wins EU Approval For 7 Billion Euro Loan From French Government

Europe’s second biggest automaker, PSA Peugeot Citroen, has gotten approval from the European Union for the French government to guarantee $9.28 billion (7 billion Euros) in bonds to provide Banque PSA Finance, the car maker’s finance arm, with funds so they can sell cars on credit at competitive interest rates.

Aston Martin & AMG Announce Technical Partnership, Daimler to Buy Up to 5% Stake in AM

As part of an announced technical partnership between AMG, the performance subsidiary of Mercedes-Benz and Britain’s Aston Martin, Daimler will buy up to a 5% interest in the luxury performance car maker. The agreement will give AM “significant access” to the technical resources of both AMG and its parent. Aston Martin will use those resources to develop V8 engines and have access to Mercedes Benz’s electronic architecture and components.

PSA's Financing Unit Set To Win EU Approval For State Aid By Next Week

A $9.25 billion (€7B) loan guarantee from the French national government for the Banque PSA Finance arm of PSA/Peugeot-Citroen, Europe’s second largest car company, will likely gain approval from European Union regulators next week, according to sources cited by Reuters and Bloomberg.

Marchionne: Fiat-Chrysler Could Be Dutch, Not Italian or American

Once the merger he plans for Fiat and Chrysler goes through, Sergio Marchionne says that Fiat-Chrysler could be registered as a corporation in the Netherlands, not Italy or the United States. Marchionne wants to have the combined company’s primary stock listing on the New York Stock Exchange and rules for corporate governance in the Netherlands are similar to those in the States.

Lotus Gets Three Year Reprieve From Owner DRB-Hicom But New Esprit Dead

Final assembly at Lotus’ Hethel plant

DRB-HICOM, which owns the Proton car company in Malaysia and Lotus in the UK, announced at the Jakarta launch of the Proton Preve that the British specialist sports car maker and engineering firm has been “cleaned up” and is proceeding with a three year product plan based on variants of the Elise, Exige and Evora cars, starting with the £52,900 Exige S roadster.

Ally Financial Explores Options For Treasury Exit, Seeks Immunity From ResCap Related Lawsuit

Ally Financial, what used to be known as the General Motors Acceptance Corporation, GMAC, before GM’s bankruptcy and bailout, itself received over $17 billion from the U.S. Treasury during the bailouts of 2009. On Tuesday the company said that it was looking into options on how to repay that money and comply with the Federal Reserves’ latest stress tests for financial institutions. Ally is 74% owned by Treasury and it is trying to buy back some taxpayer-owned stock and reach an agreement with the Fed on its capital structure (known as the “Comprehensive Capital Analysis and Review”) so it can offer stock in an IPO. Ally had originally planned on a 2011 IPO but having to resolve claims against its bankrupt Residential Capital mortgage unit delayed that. ResCap hopes to be out of bankruptcy by 2014.

A Look Back At The History Of Auto Financing

"All Is Fine In Sub-Prime Land," Says Someone With A Vested Interest In Its Success

The Detroit Free Press paints a pretty clear picture of the automotive lending landscape: auto loan terms are rising, with 1 in 5 loans now lasting longer than 6 years. At the same time, the average credit score for those taking out loans is dropping. Ominous signs for a car market that’s running on the hype of a perpetually increasing SAAR, right? Well, not according to some.

Auto Loan Delinquencies, Reposessions Up In Q1 2013

Bad news on the subprime front, as credit rating agency Experian reports a rise in delinquencies and repossessions for auto loans in Q1 2013.

Melinda Zabritski offered a rather dubious explanation for the nearly 17 percent rise in repos (as well as the 1.3 percent uptick in 30 day delinquencies and 12.4 percent rise in 60-day delinquencies)

GM Financial Double Crosses Their Ally

Following in the footsteps of Spanish bank Santander, GM Financial announced that it would enter the prime lending market in 2014.

Analysis: Tesla Q1 2013 Results

Tesla Motors, Inc. released its first quarter financial results yesterday, which featured a number of milestones for the auto maker. Among them, Tesla’s revenue rose 83% from the last quarter to $562 million, a record high for the company.

Sub-Prime: Fitch Sends Shot Across Bow Of Auto Lenders

Seeing delinquencies and credit losses going up while used car sales and lending standards deteriorate, rating agency Fitch warned today that “U.S. auto lenders will likely report further weakening in asset quality metrics this year.” Translated into English, lenders will become increasingly dependent on sub-prime loans and exposed to their perils.

America's Next Top Bubble: Delinquencies Down, Deals Up In ABS Land

The largest asset-backed securities deal since prior to the mortgage crisis, worth $1.6 billion, was announced last week. Meanwhile, one ratings agency is touting their low delinquencies as positive signs in the ABS market.

Where Is Currency Manipulation When We Need It: Japanese Complain About A Weak Yen For A Change

The retreating yen allowed Honda and Mazda to report bigger profits for the last quarter of their April to March fiscal year. Now the two are faced with a new problem, one that will also be shared by its Japanese peers: Higher costs of badly needed foreign investments.

Fitch, Moody's, Stand Alone As Subprime ABS Skeptics

Ratings agencies and other players in the finance world are beginning to sound the alarm on auto backed securities. Among the most troubling factors for some investors is the growth of smaller issuers who rely on pools of deep subprime loans. And ratings agencies who are being more conservative with their ratings are missing out on the action.

97 Months And Running

8 years to pay off a car? A report by the Wall Street Journal claims that in Q4 of 2012, the average car loan stretched out to 65 months, or just over 5 years. Loan terms were being stretched out over increasingly longer terms too, with credit firm Experian reporting that nearly 1 in 5 car loans had terms between 73 and 84 months long, with some stretching for as long as 97 months.

How A New Generation Of Sub-Prime Auto Financing Could Cause Another Catastrophe

March was the 5th straight month of a SAAR above 15 million vehicles. Industry analysts have explained the strength of the market in a number of ways. The need to replace older vehicles is one (new car sales were hit hard during the recession as consumers held on to their vehicles for longer. This also caused used car prices to skyrocket, something TTAC has been documenting), while others have cited increasing fleet demand, and the desire to replace vehicles damaged in Hurricane Sandy.

But one factor that is just starting to get attention outside of TTAC is sub-prime financing. Sub-prime lending, which involves giving high-interest loans to customers with poor credit scores, is driving the SAAR in a big way, by letting buyers with poor credit purchase new cars. In turn, the sub-prime bubble is being driven by Wall Street, whose clients cannot get enough of financial instruments backed by sub-prime auto loans.

Weak Yen, New Models, Has Mazda In Reach Of Profitability

A weak yen and a slew of new models has Mazda within sight of profitability. With Mazda heavily dependent on exports, the yen’s 16 percent decrease in value relative to the U.S. dollar could not have come at a better time for Mazda, as it readies a whole slate of new products for sale.

Subprime Madness: Shotguns Now Accepted As Car Loan Down Payments

Anyone looking for an anecdote illustrating the QE-fueled madness that is subprime auto lending, take a look at this Reuters report on what constitutes a down payment in the subprime world.

And still, though Nelson’s credit history was an unhappy one, local car dealer Maloy Chrysler Dodge Jeep had no problem arranging a $10,294 loan from Wall Street-backed subprime lender Exeter Finance Corp so Nelson and his wife could buy a charcoal gray 2007 Suzuki Grand Vitara.

All the Nelsons had to do was cover the $1,000 down payment. For most of that amount, Maloy accepted Jeffrey’s 12-gauge Mossberg & Sons shotgun, valued at about $700 online.

Tesla Reports Q1 Profit, Cancels 40 KWh Model

Just ahead of their Q1 2013 earnings called, Tesla announced that they were profitable in the first quarter of the year, with deliveries exceeding their own targets. In addition, Tesla has also decided to discontinue the base trim of the Model S due to a lack of demand.

Court OKs Suzuki Bankruptcy Plans

The 30 year run of Suzuki auto sales in the United States is one step closer to coming to an end, as a California bankruptcy court approved Suzuki’s restructuring plans.

Tesla's Q4 Results Raise Questions About Long-Term Future

Tesla Motors Inc. released its Fourth Quarter & Full Year 2012 Shareholder letter on Wednesday. While the letter provides a very positive outlook for Tesla’s future, there are some questions looming in the background once we dig deeper into Tesla’s balance sheet.

Morgan Stanley Auto Product Guidebook Reveals GM Future Product Onslaught

As a journalist, if you ask an OEM rep about any given car’s redesign or next generation, you’ll undoubtedly be met with a terse “we don’t comment on future product plans”. But if you’re an analyst? Different story.

EU Approves Banque PSA Financing, Demands Total Restructuring

After approving a $1.6 billion loan guarantee for PSA’s captive finance arm, the European Commission demanded a restructuring plan for all of PSA within six months.

BMW Pulls Ahead With Investors

The S-Class Mercedes has been the default choice for the global taste-and-wealth set for a very long time, probably since the demise of the Elwood Engel Continental. The 7-Series BMW, by contrast, has always been a slightly embarrassing purchase, the choice of the man cut out from the classy club by birth, ignorance, or a slightly unseemly insistence on driving dynamics. BMW is the striver’s brand, launched into the spotlight by a man who was sort of the Nadia Comaneci of sweaty social climbing. Mercedes is the real thing. Hasn’t it ever been thus?

German investors, on the other hand, seem to like the Roundel.

Suzuki Death Watch 13: Suzuki Gets $50 Million To Buy More Inventory

Suzuki’s death rattle continues unabated as the company’s American distribution arm will receive $100 million in financing, half of which is earmarked to purchase inventory from parent company Suzuki Motor Corp.

New York Times On GM's Fleecing Of Small Town America

In the end, the money that towns across America gave General Motors did not matter… G.M. walked away and, thanks to a federal bailout, is once again profitable. The towns have not been so fortunate, having spent scarce funds in exchange for thousands of jobs that no longer exist.

Ontario Pushing To Dump GM Stock At A Significant Loss

The government of Ontario is calling on the Canadian government to sell off its shares in GM, obtained as part of a bailout package for the automaker in 2009.

The Artist Formerly Known As GMAC Comes Back To Mami - Partially

Bailed-out GM agreed to pay about $4.2 billion for the European and Latin American operations of likewise bailed-out Ally Financial, formerly known as GMAC.

Aston Martin Being Shopped Around By Owners

Aston Martin’s Kuwaiti owners are apparently looking to unload their majority stake in the English sports car maker, but proceedings have been slow to due Investment Dar Co.’s desire to recoup their $800 million purchase price.

Tesla's Q3 Losses Widen

Tesla recorded a third-quarter loss of $110.8 million, versus a $65.1 million loss in the third-quarter of 2011.

October Surprise: GM's Q3 Numbers Better Than Expected

GM delivered its October surprise by posting what Reuters calls “a surprisingly strong profit.” In a bit of a hail Mary pass, GM said it is targeting a return to break-even levels in Europe by mid-decade.

Ford Reports Best Third Quarter Ever On Higher Prices And Lower Costs At Home

Shaking off a $468 million loss in Europe, Ford reports better-than-expected profits for the third quarter.

GM Wants A Big Revolver For Less

GM wants to double its $5 billion revolving credit line. However, the junk credit rated company does not want to pay junk credit interest for it. “We think we can get it priced as if we’re investment grade, which is kind of one of our goals going into 2013, to achieve investment grade,” GM CEO Dan Akerson told Bloomberg yesterday in Sao Paulo.

With Junk Status Looming, PSA's Finance Arm May Be Its Savior

How does the French government save an ailing car maker that employs thousands of people without actually bailing out the auto maker? By baling out their finance unit, of course!

VEBA Shortfalls And Rising Health Care Costs: A Recipe For Disaster

The Voluntary Employee Beneficiary Association, or VEBA, was initiated as a way to get retiree healthcare costs off the books of Detroit’s auto makers. While VEBA makes balance sheets look better, they are still an exorbitant legacy costs for the Big Three, and things are about to get a lot worse.

Despite "Buy" Ratings, Wall Street Frustrated By GM

GM’s stock is still considered a “Buy” in the eyes of much of Wall Street, but analysts say that more changes are needed to accelerate the pace of growth in the post-Bailout era.

Ferrari Pricing Heads For Orbit, Porsche Stays Grounded

Ferraris are expensive, Porsches (usually) less so. This is something that every kid on the street knows, right? Turns out that it is, as the song says, truer than true.

How The GM Bailout Turned Into Foreign Aid

Longtime reader and new contributor Tyler Vandermeulen is a financial analyst by day. He took a deep dive into the EDGAR database to unearth how much of GM’s money flows abroad. Please welcome Tyler with the respect he deserves. Rude comments will not be tolerated.

Before the bailout of General Motors, it was well understood that the world’s largest automaker was losing huge amounts of money in the US and was staying afloat thanks to stronger performance in overseas markets. Since the bailout, however, that dynamic has been turned on its head. Thanks to a leaner manufacturing footprint, debt eliminations and steadily recovering sales, GM’s US operations have generated the lion’s share of the company’s profit since the bailout. And now, as the rest of the world economy slows, GM is spending more and more of its taxpayer-enhanced cash pile to shore up its faltering foreign divisions. In fact, according to an analysis of GM’s SEC filings, the company is likely to incur over $6.5 billion in losses and expenditures overseas in the 2011-2014 period, not counting over $1.6b in foreign potential legal liabilities or several other incalculable expenses that could add up to billions more. Not only are these expenses a challenge to GM’s overall financial health at a time when it also faces billion-dollar expenditures on pensions in the US, it shows the basic problem with national bailouts of global companies. Taxpayers who were told they were saving an American company are now seeing their tax dollars flowing overseas by the billions.

Will Creditors' Lawsuit Undo GM Bailout? Bankruptcy Judge 'Shocked' By Undisclosed GM Canada Deal

A couple of weeks ago the Wall Street Journal published an article about a “little-noticed” lawsuit in U.S. Bankruptcy Court filed by a trust representing “old” GM’s unsecured creditors. Those creditors are challenging a 2009 deal between GM Canada and a group of hedge funds that helped keep GM’s Canadian subsidiary out of its own bankrupcy. It’s a bit surprising to me that the WSJ article itself got very little notice in the automotive world because, if successful, the lawsuit could undo at least part of GM’s restructuring or result in a $1.3 billion price tag for the automaker. In regulatory filings GM has said its possible exposure will be less than that, $918 million, though in theory the bankruptcy court could reopen the entire bankruptcy, which would be much more disruptive to GM than just paying out a billion dollars.

Recent Comments