Reuters Poll of Economists Say Euro Recession Has Ended But Recovery to Be Slow

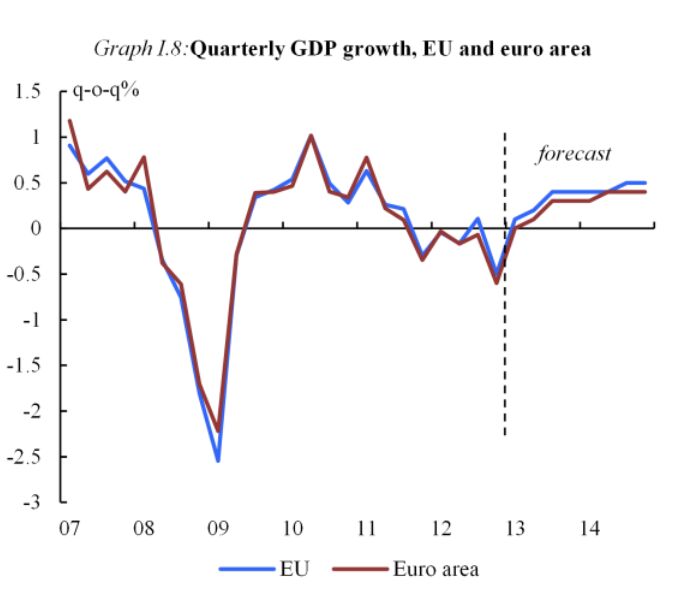

According to a Reuters poll of 30 economists, data to be released next week will show that the recession in Europe has ended, but that the euro zone will not start growing significantly until 2015. The consensus prediction for the second quarter of 2013 was 0.2% growth.

That prediction was supported by industrial production figures released earlier this week showing a 0.7% increase in June. Most of the economists expect a very slow recovery, echoing what auto executives like Sergio Marchionne have been saying for a while. GDP for the euro zone won’t surpass 0.4% in any quarter until 2015, according to their predictions. Inflation is expected to stay at or below 2%, allowing the European Central Bank to keep its lending rates at record lows for the next two years. When asked about potential risks to the recovery, those economists who answered the question referenced political instability. Southern European countries have had some political turmoil recently and German federal elections are being held next month.

More by TTAC Staff

Comments

Join the conversation

Germany is the country that had the most significant positive impact on the Eurozones figures. Even then I think growth was a palrty 0.1%. In September the Germans' will have their election and I think the German people don't like the idea of bailing out their southern failed countries. The Germans started restructuring after the collapse of the Berlin Wall. The rebuilding of the also allowed for the restructuring of their economy. Germany might be better off getting out of the Eurozone or forming a new trading region with Scandanavian, Dutch, etc (the more solvent countries). The Eurozone is still hanging together by a thread, Greece will need another bailout next year, not to mention Portugal, Spain, Italy, Greece, Cyprus, Ireland and even the French are finding it hard. The Euro saga is far from over. If they can hold together most Europeans will live in a stagnated world for some time to come. From the very regulated work place arrangements to social/agri/industrial welfare needs to restructure. In the early 70s NSW in Australia was the second most regulated governement region in the world after Sweden. Changes were needed to be made. Manufacturing jobs where falling over, real wages were dropping. But all of our country needed a broom put through it. This half occurred and it took 20 years to turn the country around. But we didn't have a sick banking sector and a huge soverign debt. Europe and even the US can restructure their economies to become more efficient and profitable. There will be people who hurt and their will be people who fear the necessary changes, but they will occur somehow even if the Europeans go screaming and kicking.

Riiiiiight...The global fiat currency counterfeiters need to keep the con going until after the German elections.

I was bowled over a few weeks ago when Top Gear (UK) had the show where the boys were monkeying around on a (new) abandoned airfield and abandoned housing projects in Spain. With no choice but to adopt austerity, the troubled economies of Europe are in for a long struggle.

Why would anyone expect growth from a region that seems to be bent on economic suicide? The watermelons that control the EU are too busy defining how many tons of CO2 you may properly emit as you drive, and how high your front bumper must be. Economic growth is the last of their concerns.