Analysis: Tesla Q1 2013 Results

Tesla Motors, Inc. released its first quarter financial results yesterday, which featured a number of milestones for the auto maker. Among them, Tesla’s revenue rose 83% from the last quarter to $562 million, a record high for the company.

Tesla also posted the first ever profitable quarter in its history, with a net income of $11 million, or $0.10 on a per share basis. This large growth in revenue was largely aided by the fact that Tesla was able to recognize revenue on 4,900 out of the 5,000 Model S vehicles it managed to produce in the quarter. It is worth noting that $68 million, or 12% of Tesla’s revenue was earned through the sale of Zero Emission Vehicle (ZEV) credits to other automakers. Tesla notes in its letter to shareholders that they expect the sale of ZEV credits to decline in the future, and expect the amount to reach $0 by Q4 2013. Tesla’s move away from the sale these credits and towards growing the sale of their automobiles demonstrates their confidence in projected global demand of 30,000+ units annually. An improvement in their gross margin, which has moved up from 8% to 17%, is also an extremely important factor in their profitability.

One would expect that Tesla has settled down and is beginning to ramp up their production of the Model S while continuing to lower its costs through managing its supply chain and reaching economies of scale. After all, management reaffirmed its guidance of a gross margin of 25% for Q4 2013. In the Outlook section of the letter, Tesla explains that it expects increases in operating, research and development (R&D), and selling general and administrative expenses (SG&A).

Some of these costs may naturally rise in proportion to sales volumes. However, as Tesla fights an uphill battle to expand their gross margin, it cannot lose sight of controlling its fixed costs. Total Operating Expenses currently amount to 18% of sales. Any increase to this amount threatens to eat up any profitability that Tesla might achieve through an increase in gross margin. From a profitability standpoint, the ideal situation would be one in which Tesla could achieve its margin of 25% on its vehicles, while simultaneously taking advantage of its increase in production to achieve economies of scale and decrease operating expenses.

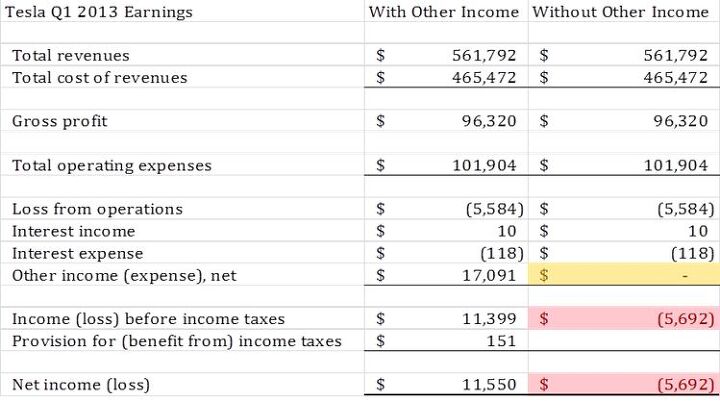

The most interesting line item on Tesla’s quarterly income statement is “Other Income.” Upon examining the statement solely on an operations level, one would notice that Tesla has posted a loss from operations of -$5.5 million. How could Tesla post a net income, yet be posting a deficit through its operations? One need only take a look at the line item “Other Income”, for a better picture. Other Income has a balance of $17 million, $11 million of which is from the elimination of a common stock warrant liability to the Department of Energy, and the remainder is from favorable foreign currency exchange impacts. Both of these items are irregular, specifically the liability elimination, in the fact that they will not likely happen year to year, and are not generated through the company’s regular operations. The liability elimination is also a non-cash item. To get a real sense of how Tesla performed, Other Income can be removed from the income statement (see Figure 1). The result is a net loss of $5.7 million for the quarter. It’s clear that there is still much work to be done before Tesla is truly profitable based on its operations. These types of irregular items cannot be relied upon to achieve profitability every quarter.

Figure 1(in millions)

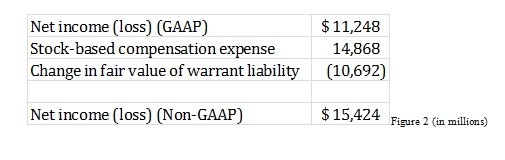

Perhaps a more relevant dataset is Tesla’s non-GAAP figures. The non-GAAP figures, which are intend to be used by management for internal purposes, can sometimes more accurately reflect a company’s performance on the interim, without being hindered by stringent accounting regulations. Figure 2 displays Tesla’s reconciliation of Net Income from GAAP to non-GAAP.

Figure 2 (in millions)

The non-GAAP measure of Net Income is slightly higher than the GAAP reporting, at approximately $15 million. Non-GAAP starts with the GAAP reported income of $11 million. Notice how almost $11 million is subtracted from net income in “Change in fair value of warrant liability.” This represents the Department of Energy liability elimination mentioned earlier. What Tesla is doing here is effectively removing this amount from its GAAP net income, not unlike the similar calculation done above. Tesla has management has realized that this liability is a large contributor to its profits, and has removed it to create a figure more representative of its operational profitability.

The next item is stock-based compensation expense. This amount was originally included in “Total cost of revenues.” For those of you who are unfamiliar with this concept, an article by Ian Gow, an assistant professor of accounting information and management at Northwestern’s Kellog School of Management, explains it as stock options that are granted to employees. Gow explains that recently accounting standards have required companies to disclose stock-based compensation expenses, as Tesla has done by including it in cost of revenue. The article continues to elaborate that stock-based compensation expense is an area for managers to manipulate accounting data in order for them to reach their targets or benchmarks. The accounting for this type of expense becomes increasingly tricky when considering that it is a non-cash expense. While it is harder for management to toy around with this expense due to revisions to GAAP, Tesla has elected to add this expense back to their net income in its non-GAAP reporting. This is not an attempt to discredit the integrity of Tesla’s management, rather to illustrate the importance that non-GAAP figure must be taken with a grain of salt.

Regardless, Tesla has made huge strides in its earnings. Just last quarter (Q4 2012) Tesla posted a net loss of almost $90 million. Accountants and analysts can debate the significance of line items for eternity, the larger point being that of an upward trend for Tesla. In Q2 it will be interesting to see is Tesla can build on its profitability, or fall back into the red without the help of irregular account balances.

All figures taken from Tesla’s SEC Filing

Graeme Kreindler is an HBA Candidate at the Richard Ivey School of Business at The University of Western Ontario.

More by Graeme Kreindler

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Akila Hello Everyone, I found your blog very informative. If you want to know more about [url=

- Michael Gallagher I agree to a certain extent but I go back to the car SUV transition. People began to buy SUVs because they were supposedly safer because of their larger size when pitted against a regular car. As more SUVs crowded the road that safety advantage began to dwindle as it became more likely to hit an equally sized SUV. Now there is no safety advantage at all.

- Probert The new EV9 is even bigger - a true monument of a personal transportation device. Not my thing, but credit where credit is due - impressive. The interior is bigger than my house and much nicer with 2 rows of lounge seats and 3rd for the plebes. 0-60 in 4.5 seconds, around 300miles of range, and an e-mpg of 80 (90 for the 2wd). What a world.

- Ajla "Like showroom" is a lame description but he seems negotiable on the price and at least from what the two pictures show I've dealt with worse. But, I'm not interested in something with the Devil's configuration.

- Tassos Jong-iL I really like the C-Class, it reminds me of some trips to Russia to visit Dear Friend VladdyPoo.

Comments

Join the conversation

One of Tesla's real opportunities is in Europe. The difference between gas prices and electricity prices is far greater there, and the reduction in operating costs means that the car is about half the price that it is in the US. Supposedly in Norway, where the strength of the currency makes any imported goods seem ridiculously inexpensive, Model S production is already sold out through the end of the year. Why is the Norwegian currency doing so well? Oil of course!

All I know is that I saw 2 of them last week. Driving around the South Shore. One was on Rt 24 heading south at 65 MPH.