Will Chrysler Cut More Dealers?

Bailout Watch 576: Whitacre Keeps GM's Payback Lie Rolling

Culled Dealers "Win," Don't Stop Whining

If you haven’t been following the drama surrounding the effort to restore dealers culled during GM and Chrysler’s bankruptcy, you might need to be brought up to speed. In essence both the cut dealers and the automakers have agreed to send create an arbitration process by which dealers could have the decision to cut their franchise reviewed by a neutral third party. The remaining conflict is over the criteria arbitrators should use to judge dealer viability, as the GM and Chrysler proposition would have forced arbitrators to use the same criteria GM and Chrysler did in the initial cuts. That would obviously have yielded the same results as the initial cull, so the dealers pushed for a set of criteria that is more favorable to their interests. Automotive News [sub] reports that a compromise has been reached in conference committee that would allow dealers to present “any relevant information” to make their case. That bill is now been approved by the House [sub] and is headed to the Senate, where its passage is “virtually assured.” But despite having all but guaranteed an independent review, culled dealers still aren’t happy.

Opel Rescue Delayed

GM was supposed to have a restructuring plan for Opel in place by the end of December, but it’s looking like that deadline is DOA. In a blog post at GM Europe’s “ Driving Conversations” blog, GME supremo Nick Reilly explains:

While it is indeed exciting to see that things are coming together, bear in mind this is going to be one of the largest, most complex industrial reorganisations in European manufacturing in years. It will affect thousands of people and their families; impact plants and other stakeholders.

We are determined to do this right. We must do this right. Although we had hoped to have the new business model finalised in December, it appears that more work needs to be done and further consultations will not be rushed.

I said earlier that we would have a plan in place by year-end. Now it looks like an announcement may slip into January. This is not a broken promise. It is a pledge to do something right.

Culled Dealers Dig In Over Deal

As soon as GM and Chrysler agreed to review their dealer cull decisions, the culled dealers in question began complaining that the review would not improve their situations. According to the aggrieved dealers, the new review would be based on the same allegedly flawed data as the initial cull, meaning nothing would be changed. By GM’s own admission, only 39-51 of the over 1,000 dealers cut would even stand a chance at reinstatement. Now, Automotive News [sub] reports that a new measure has passed the House of Representatives which would allow dealers to “present any kind of relevant information during the arbitration.” The measure comes in the form of an amendment to the House Financial Services bill, which is headed to a conference committee in which House and Senate leaders must arrive at a compromise in order to send the bill to President Obama.

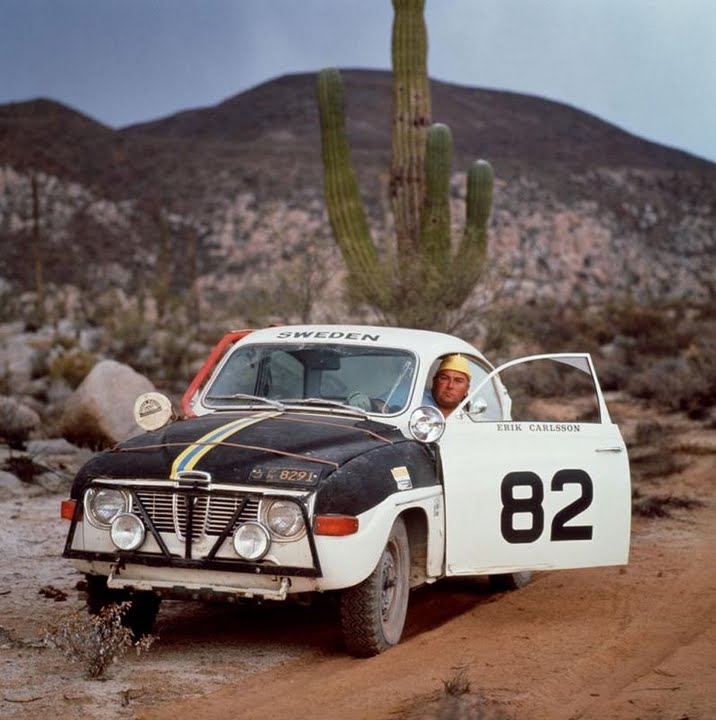

Ka-Ching! BAIC Has The Funds To Buy Saab

China’s BAIC has received a $2.93 billion line of credit from the Bank of China, says Reuters.

The question of course is: What for?

GM, Chrysler Agree To Reconsider Dealer Cull

Bowing to legislative pressure, GM and Chrysler have announced today that they will initiate reviews of the dealer cull undertaken during bankruptcy. GM is announcing a “Comprehensive Plan To Address Dealer Concerns,” while Chrysler characterizes its agreement as a “Binding Independent Review Process for Discontinued Dealers.” Both firms take pains to thank Senator Dick Durban and Rep Steny Hoyer for their leadership in preparing the non-legislative conclusion of months of bitter acrimony. Culled GM and Chrysler dealers, you know who to make your campaign donations to… unless you’re a member of the dissident group the Committee To Restore Dealer Rights. According to Automotive News [sub], the group says the new plans will only allow “between 39 and 51” culled GM dealers to be reinstated. “The GM proposal guarantees that they would win every arbitration,” says one member of the committee, who alleges that the new process is based on the same allegedly flawed data the initial cull was based on. Hit the jump for the plan outlines.

GM's Casual Culture Club

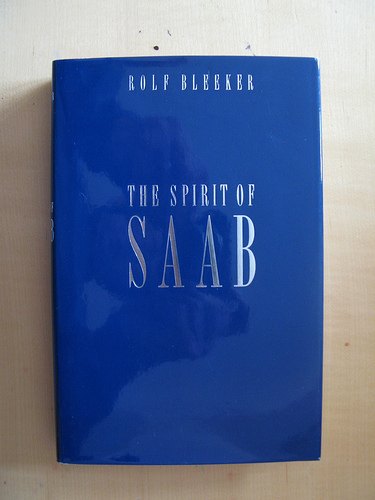

Saab Employees: Save Our Company!

Courtesy of saabsunited.com comes this letter from Saab’s Swedish employees to General Motors.

[the following section was originally written in English]

To our owners, General Motors

We at Saab have lived with our brand and our cars for more than 60 years. It is a brand that accommodates great passion. Ever since the beginning in 1947, when engineers from the aircraft industry were lying on the floor outlining the body lines of the first prototype, we have been bearing the stamp of new thinking, desire for continuous improvement, willpower and commitment.

We call that “the Saab Spirit”, and during the last year it has been more evident than ever. We have not given up. In times of extreme uncertainty we have delivered and created new prerequisites for our company, and we have built a new vision where to bring our brand and our products. We believe in our future. We know we have the ability.

Trust us. Don’t count Saab out. Allow us to bring our roots into the future. It is not only important to us, but also to our 1.5 million customers around the world and all of those people passionate about our cars and our brand.

Pontiac Is Still Dead

Saab To Die Another Day

DetN Bailout Report: White House Forced Rapid Bankruptcy, UAW Refused Hourly Pension Freeze

On October 13th of last year, when TTAC’s Bailout Watch clocked in at a mere 115 entries, GM’s then-CEO Rick Wagoner and board members Erskine Bowles and John Bryan approached the Treasury for a “temporary” bailout. Not that we knew it at the time. “In this period of continued uncertainty in the markets, you really can’t rule out anything,” said GM spokesfolks at the time. “Stand by for another big public investment in a failing firm,” warned TTAC. As subsequent events proved, the rush to bailout had already begun. Funny then, that we’re only now learning some of the most crucial details of the chaotic maneuvering of late 2008, thanks to a Detroit News investigation. Though the industry’s disastrous hearings before congress nearly derailed the deal, the initial strategy of approaching the White House would prove to be the key to the eventual bailout. In fact, President Bush was ready to provide $25b to GM, Chrysler, GMAC and Chry-Fi on December 19, only to have talks with the two finance firms break down. Instead, GM and Chrysler were given $9.4b and $4b respectively, with GMAC getting $7b 10 days later and Chrysler receiving $1.5b in January.

Opel Rescue Up To European Taxpayers?

Volvo Sale: Crown To Out-Bid Geely This Week?

For weeks now, the only realistic bid for Volvo has has come from the Chinese automaker Geely. They’ve been Fords’ “preferred bidder” for about a month ago, and last week, Geely’s management were in meetings with Volvo’s unions, and with Volvo AB (commercial vehicle company) about the Volvo trademarks – which are owned 50/50 between Ford and Volvo AB. At the same time time, Ford seemes to be in no hurry to sell Volvo, leading many to speculate that Ford was dragging their feet waiting for new and improved offers. We’ve been posting about the two other possible bidders, Consortiums Jakob and Crown earlier, and reports in Swedish media today say that Crown are now ready to make an offer, to be presented this week.

GM: US Taxpayer-Funded Opel Plans By Christmas

Automotive News [sub] reports that GM will rush out its $4.9b restructuring plan for Opel in December, as it seeks to ease worries on the continent about the fate of the troubled division. “Our plan is very similar to Magna’s. I don’t think it’s worse,” GM’s Nick Reilly told reporters near Opel’s largest plant in Zaragoza, Spain. Reily has said that as many as 10,000 jobs and 20 to 25 percent of Opel’s production capacity could be cut in the restructuring. Though Reilly refused to indicate where cuts could take place, he did say that GM would not transfer production from Zaragoza to Eisenach in eastern Germany, as Magna had planned to do. He also previously implied that British government loans could prevent or mitigate a planned 800-job cut at Opel’s Vauxhall operations in Britain.

Bloom More "Encouraged" By Chrysler Plans Than Most

“U.S. encouraged by Fiat plan for Chrysler,” runs Reuters‘ headline, attributed to car czarlet Ron Bloom. After commenting extensively about GM, in which Bloom controls a 60 percent taxpayer stake, he had only this to say about the eight percent government owned Chrysler and its recent plans:

We see management with a huge sense of urgency. We see a huge dedication and commitment, working extremely hard. It’s an ambitious plan.

But did Bloom see the 7 hours of Powerpoint presentations? “Encouraged” wasn’t exactly the description being flung around at the line for porta-potties. Hell, even Detroit’s cheerleader-in-chief and Automotive News [sub] publisher Keith Crain beats Bloom’s take hollow with his headline “This Year The Math Adds Up To 110%.”

Swedish Government: Saab's Books Were Cooked

Looks like GM may have done some creative accounting after all – at least according to Swedish Government and their consulting firm KPMG. As we’ve reported the last couple of days, Saab’s rescue has been hanging by a thread due to questions around the company’s financial situation prior to the start of the financial crisis. Saab needs the EU to approve the Swedish Government’s guarantee of an EIB loan to Koenigsegg group if the deal is going to go through. If Saab, during the summer of 2008 – when the financial crisis started – were not in sound financial condition, the EU cannot, will not, approve Swedish government’s guarantees to the EIB loan, and the loan will not be granted. And reports from di.se yesterday almost laid that possibility to rest, with reports that GM had lost $ 5.100,- on each Saab-car sold during the last 8 years. Now, as commentator dlfcohn and others at ttac, as well as several commentators at di.se have pointed out, creative accounting can be useful in major corporates i.e to avoid taxes in tax-heavy countries. This, apparently (at least according to Swed.gov’t/KPMG) was the case with GM/Saab.

New GM's Projected Cash Burn is . . . Unspecified

Visteon: The Supplier Skeleton In Ford's Closet

Pay Czar Removes Salary Cap for GM's New Hires; Who Is GM's $500k Man?

Automotive News [sub] reports that President Obama’s Pay Czar has done an about face. Kenneth Feinberg pledged to remove the $500,000 salary cap for NEW executives hired for TARP-recipients—if he’s convinced that a rule-busting pay boost would help the bailout queens return U.S. taxpayer’s money. Feinberg’s climb-down comes just two days after New GM’s federally-appointed Chairman of the Board said that Uncle Sam’s pay caps could be, indeed should be, “modified.” Of course, Ed Whitacre didn’t make his suggestion directly. Nor did Feinberg reveal the locus of his “come to Jesus with cash” moment. “[Feinberg] said the automotive firms did not appeal his rulings. But he said he would be open to requests to hire in new executives at competitive pay. ‘If General Motors or any other company wants to bring someone in laterally — laterally — and competitive pay packages require that lateral hires get certain competitive pay, what have you, we’re perfectly willing to examine that.'” So the new rule: GM can hire someone for more than $500,000 in cash per year if that person was already making $500,000 per year doing the same job, only better (one would hope). Which would exclude, uh, no one. And create mucho resentment at that special place where RenCen’s express elevators ascend to glory. More Feinbergian 180 after the jump, and a mystery to be solved . . .

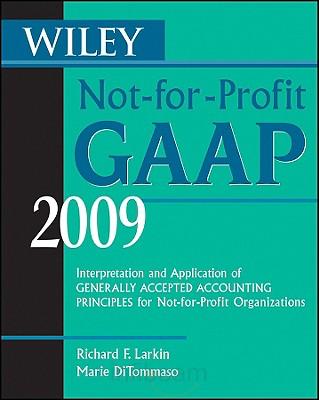

GM's Monday Earnings Report: Mind The GAAP

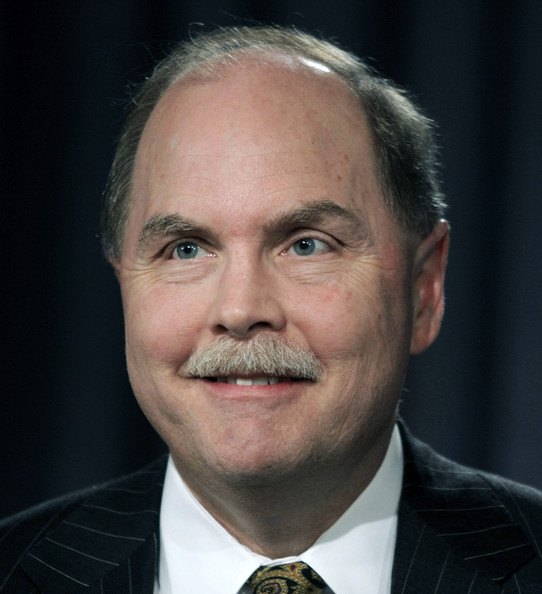

GM Chairman Ed Whitacre: Fitting In Already

GM’s government-appointed Chairman of the Board was out and about last night, speechifying at Texas Lutheran University. Ed Whitacre used the occasion to plea for the “modification” of Pay Czar Kenneth’s Feinberg’s pay caps. To recap the caps, the nationalized automaker’s top 25 executives took a 31 percent hair cut since joining the federal payroll. Aside from CEO Fritz “Opel Eyes” Henderson, that is, who had his cash compensation trimmed by just 25 percent (from $1.26 million to a paltry $950,000). Leaving only one other unnamed GM executive—cough, transparency, cough—who will “earn” more than $500,000 cash money for 2009. ‘Cause $500,000’s the new limit. And Ed’s not happy about that. “To find top-level people where you need them, that’s a more difficult thing to do at that salary level,” Whitacre said. “I don’t think [the caps] will be lifted, but hopefully they’ll be modified.” Now there’s a man who knows the value of politics. As for the value of GM stock, same deal. Or, in this case, no deal.

Edmunds' Karl Brauer: May the Best GM Win

You’ve got to wear some serious blinders to believe that New GM is in on course for that magic day when they de-nationalize themselves and return the U.S. taxpayer’s $52 billion (plus) “investment.” And Canada’s $10.5 billion, eh? In fact, Board Chairman Ed Whitacre just de-committed the company to a 2010 deadline for same. Still, GM and its camp followers have been in denial so long they’re in denial even when they’re telling the world they’re out of denial. Inside Line columnist Karl Brauer illustrates the conundrum: “Let me make one thing clear in the second sentence of this column. I am not saying GM has already pulled off a successful turnaround. But events of the last few weeks have established a momumental [sic] realization (at least for me): I think it’s possible GM might actually pull off a successful turnaround . . . And, as recently as four weeks ago, I commented that — despite GM’s latest rallying cry of ‘Let the best car win’ — I wasn’t convinced GM is offering the best cars on the market. I’m still not convinced GM offers the best cars available, but they do offer the widest range of really good cars I’ve seen from the company in my lifetime.” So what inspired Karl’s almost kinda maybe sorta don’t quote me on this ever faith that American’s nationalized automaker kinda maybe sorta might possibly potentially turnaround its miserable fortures? The new Medusa-class GMC Terrain, of course!

GM CEO Fritz "Transparency" Henderson: We're Beating Secret Targets

Transparency. It’s what GM CEO Fritz Henderson promised taxpayers in sworn testimony in front of Congress, post $52 billion bailout (and the rest). As TTAC pointed out previously, bullshit. After not releasing the dead dealer list promised to Senator Jay Rockefeller, the nationalized automaker is now proud to announce that it’s beating its targets—without revealing the targets. “General Motor Corp. is outperforming the targets set in its earnings viability plan outlined in April, CEO Fritz Henderson said today,” Automotive News [sub] said today. “Henderson declined to list the areas in which GM is outperforming but said the company would provide details in its third-quarter earnings report later this month. ‘I’m not going to get into whether we’re generating cash or not generating cash, but I would certainly say the situation is more stable than what the outlook was even just two months ago.'” And why should we believe His Opaqueness?

Chrysler's Cash Claim: A Cruel Con?

Opel Workers Set to Strike, Germans Recalling $2.2B Bridge Loan

GM’s last minute (i.e. post-German election) decision to pull out of a deal to sell its European Opel division to a consortium lead by Canada’s Magna Corporation has left chaos in its wake. The Associated Press reports that Opel workers throughout Europe are planning to strike GM on Thursday, protesting the automaker’s planned “rationalization” of over ten thousand jobs. “IG Metall said workers at Opel’s four German plants would halt work Thursday, followed by similar moves Friday at other Opel locations in Europe.” Meanwhile, German Economy Minister Rainer Bruederle vowed “We will get the taxpayers’ money back.” Note: that’s German taxpayers’ money. And there’s only one way the nationalized automaker’s going to pay back that loan: with American taxpayers’ money. Seriously? Seriously. “GM Europe spokesman Karin Kirchner said the company is prepared to repay the euro1.5 billion bridge loan from the German government. ‘If we’re asked, GM will repay the bridge loan in question.'” Uh, that didn’t sound like a “request” to me. And speaking of plain speaking . . .

Jerry York: 2010 GM IPO "The Dumbest Thing in the World"

$13.6 Billion Remaining in GM's Bailout Escrow Account

\

GM was given its last $30B of taxpayer money as it entered bankruptcy in early June of this year. By the time GM exited Chapter 11 protection on July 10, there was only $16.4B left in its bailout escrow account. According to an 8-K form filed today with the SEC, GM now has only $13.6B remaining in that account, less than one-third of GM’s $50B total bailout (not counting assistance to GMAC). GM’s rescue of its major supplier, Delphi, consumed $2.8 billion from its escrow account. According to the form:

Approximately $1.7 billion was utilized to acquire a membership interest in the new Delphi entity and approximately $1.1 billion was expended in the acquisition of Delphi’s global steering business, certain domestic facilities and other related payments

Opel Deal To Close This Week?

Suppliers Still Looking For Bailout

“There must be increased access to capital through the entire supply chain — from the largest tier one to the smallest family-owned firm,” Dave Andrea, vice president of industry analysis and economics at the Original Equipment Suppliers Association told the Senate Banking Committee [via The Freep]. “Without assistance this country will needlessly lose manufacturing capacity, technology development and jobs.” Which is about what suppliers have been telling congress since bailout mania struck. What the Freep fails to properly explain is that the supplier bailout passed earlier this year was an unmitigated disaster for suppliers and their relations with OEMs.

Delphi Exiting Bankruptcy

GM CFO on the Way Out

What a funny coincidence. On the very same day that a government oversight panel rips GM a new one for disappearing billions of taxpayer bucks, the Detroit News brings word that GM’s CFO, Ray Young, will be leaving the company. Young’s departure comes as GM is shaking up its finance department, the division which gave the company such fine leaders as Rick Wagoner and Fritz Henderson. The DetN identifies Young’s announcement that GM would not disclose all of its financial information as a publicly-funded private company as a major cause for his ouster. And if the DetN‘s reporting is to be believed, Young isn’t the only GM exec who should be worried.

GM Chairman Scares Execs With Actual Expectations

Fritz Henderson got a thumbs-up from the Board of Directors just days ago, but it seems that Chairman Ed Whitacre doesn’t want anyone to get comfortable. The Freep‘s Tom Walsh just posted a column describing GM execs as “rattled” by Whitacre’s recent revelation that at the New GM executives must earn their keep.

On Wednesday, Whitacre told a group of GM salaried staff — in one of several “diagonal slice” meetings, so called because they mix people from all levels — that he expects to see lots of changes in the next 12 weeks. Changes every day.

So, is the party over? Surely GM’s brass knew that there would be some accountability, someday. Right?

Opel Watch: GM, Germany and the Gordian Knot

GM is stepping up efforts to retain some control over Opel this week, as political pressure builds to find a solution before German elections on September 27. GM sources told the Wall Street Journal that Spain, Britain and Poland would jointly contribute “about €1B” towards repaying a German government bridge loan. Should the nationalized American automaker pay off the note, they could then sell Opel to their “preferred” third party buyer option, RHJ. The private equity fund dug around in the couch and came up with another €25M, raising its offer to buy Opel from GM to €300M. Coincidence?

GM and Opel: What Part of "Nein" Don't You Understand?

The board of GM convened on Friday to finally decide Opel’s fate. The board did as expected: It did nothing. They left everybody hanging. The board decided to not decide anything.

According to Reuters, the GM board desperately needs critical information from the German government. To wit: What state financing would be available if GM would sell Opel to their darling RHJ International, and not to Magna, which is favored by Germany.

Excuse us?

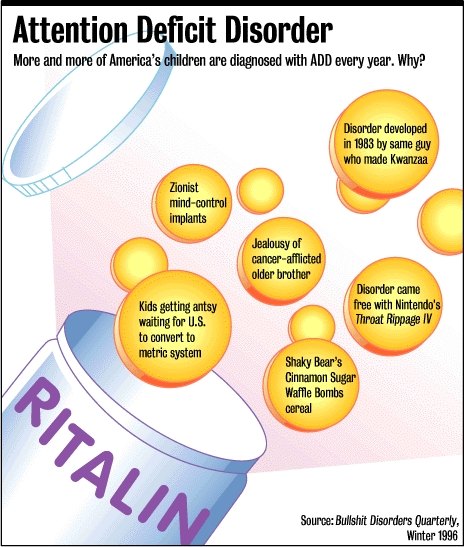

Do we have a serious case of highly contagious ADD, which has befallen the complete GM board? We thought it had been made perfectly clear:

Ask the Best and Brightest: Why Are People Still Buying Old GM Stock?

Saab's New Masters Speak

Christian von Koenigsegg speaks to Automotorsport Sweden about the future of his new acquisition. Managing Director Jan-Åke Jonsson’s interview can be found here.

Ford CEO Alan Mulally: Love Conquers All

Ford has roughly $18 billion in the bank. The company’s CEO has slowed The Blue Oval’s cash burn to about a billion a month. If you take away $10 billion—the amount of float needed to keep the lights on—Crazy Henry’s mob has eight months to stop the arterial spray of red ink before contemplating C11 (or a “proper” bailout). Volvo’s sale looks like it will give them another month (about a billion). Although Ford tapped the credit markets for $1.6 billion in May, another offer may not be greeted with open arms. So let’s call Ford’s drop-deadline a year, maybe 18 months. Oh, did I mention a $5.9 billion dollar Department of Energy “retooling loan?” That’s worth another six months on our timeline. But that’s different. “Ford is the only one of the Big Three U.S. automakers that hasn’t taken government bailout money or declared bankruptcy,” NPR declares, disingenuously. “Ford is still losing $1 billion per month, but it has money in the bank and hopes to be making money by the year 2011.” The media meme in a nutshell. In an interview with publicly-funded radio, Ford’s CEO connected the dots between perceived purity and customer conquest, and hinted that yes, they did stick their noses in the taxpayer trough.

Labor Leader: Volkswagen Blackmails Opel

Having won the battle of the alpha males, Volkswagen now bares its fangs at two new enemies: Big Toyota, which Volkswagen wants to unseat from its #1 position; and moribund Opel, which VW would rather see dead than alive. VW CEO Winterkorn growled that VW might pull its parts business from Magna if the Canadian-owned partsmaker proceeds with their plan to acquire Opel. “We are looking with suspicion at what’s happening here,” Winterkorn said, according to the German edition of the Financial Times. Things are getting nasty, again . . .

Chrysler Organizational Strategy Revealed

BusinessWeek (BW) offers its readers a look inside Brand Spanking New Chrysler, or whatever they call it these days. Although the article’s written in the style of a PR puff piece, there’s plenty to disconcert the inherently skeptical (guess who). For example, does this strike you as the best way to re-jig your executive ranks? “Rather than rely on suggestions from top management, Marchionne asked more than 100 middle- and lower-ranked staffers what they thought of their bosses. Then, say people familiar with the process, he picked people most respected by their subordinates. ‘If he didn’t hear expressions of leadership voluntarily from people, he took it as a sign that they didn’t view the executive as a leader.'” So no one lied about their boss? Or everyone did? Or Marchionne favored the suits favored by brown nosers? And how did he know whether a testimonial was voluntary or inspired by Christmas party pictures? Color me confused about Chrysler.

GM's Transparency Pledge Doesn't Extend to Executive Pay Proposal

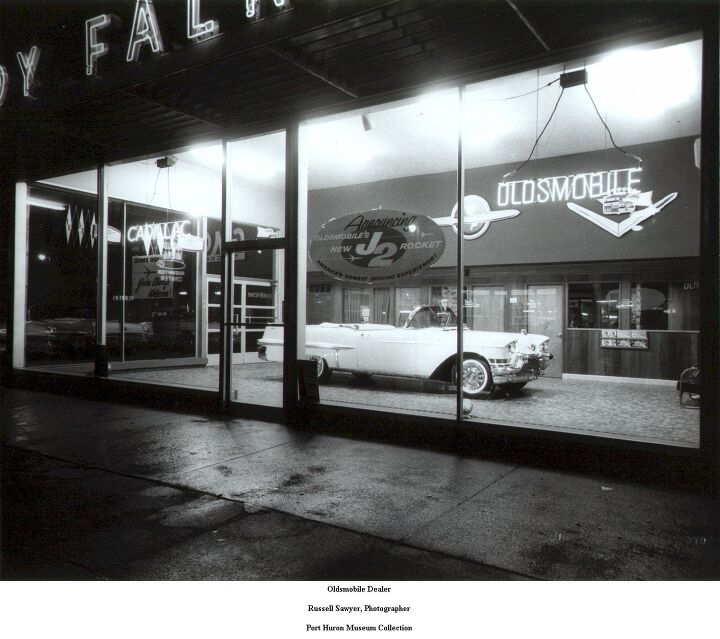

GM Adds Insult to Oldsmobile

Until now, owning an Oldsmobile dealership was kind of like Ford’s logo-and-all, pre-meltdown mortgage: at the time it seemed bad, but history proved that the alternative was worse. After all, the Olds wind-down paid dealers up to $4 million to go away. Only now, several Oldsmobile dealers are getting a little taste of what GM’s less fortunate, bankruptcy-culled dealers have been put through. The Detroit News reports that “a handful” of Olds dealers are still owed annuity payments from the brandicide, and GM is filing those claims as “unsecured” debts of old, bad GM. Nobody likes being shorted in the neighborhood of $20K, but at least Olds dealers got something, right? Shouldn’t they count themselves lucky to be free of GM with any compensation at all? Not according to their lawyer . . .

GM to Attempt July 2010 IPO

The New York Times reports that GM will offer 2.5 billion shares of common stock in July 2010, just a year after emerging from government-backed bankruptcy. The news comes from regulatory filings in which GM says it will also begin sharing financial data after the third quarter. The Wall Street Journal voices serious doubts as to whether GM is ready for such an offering, pointing to its weak showing in the current cash-for-clunkers bonanza, falling sales, and product weakness. Meanwhile, PTFOA chair Ron Bloom tells the NYT that a Chrysler IPO is further off. “I don’t think Chrysler’s IPO is a 2010 event,” Mr. Bloom said at the Center For Automotive Research’s conference in Traverse City. “I think it’s a little further off. But again, that will be the board’s judgment.”

GM's Opel Decision Dragging On, and On, and …

GM and the German government could decide by the end of the week who will take over Opel, Germany’s deputy economics minister Jochen Homann said to Reuters. That’s no improvement.

Board Chairman Whitacre: GM Must Be America's Number One! Again! (But Not Still)

Wall Street Journal had a little post-BOD meeting chinwag with New GM’s federally-appointed Chairman of the Board. Clearly, Edward E. Whitacre Jr.’s busy not kicking ass and not taking names. Whitacre told the WSJ that “GM’s business plan needs to be ‘tweaked.’ Among areas he cited as needing rapid improvement are advertising, revenue and net income.” Do you have any idea how hard it was not to substitute the word “nipples” for “business plan”? Anyway, “Gaining market share is ‘right there at the top’ of his agenda for Chief Executive Frederick ‘Fritz’ Henderson, Mr. Whitacre said. ‘You clearly don’t want to be in a position of losing market share.'” Thanks for the [unintentional] hat tip to the U.S. taxpayer, but didn’t Eddy get the memo about GM bankrupting itself in the single-minded pursuit of market share? No, he didn’t. Make the jump for the most worrying corporate jingoism since, well, all the other GM BS.

GM and Opel: Nuclear Option?

New Round Tonight In Opel Liar's Poker

This evening, at 6pm local, the board of directors of General Motors will meet and discuss whether they should sell Opel to Magna or to RHJ. You won’t hear a decision. They will have to ask their overlords in Washington first. The German government, which is supposed to finance the deal, doesn’t take the meeting seriously anyway. Tomorrow, Tuesday, the German government will continue talks with both suitors, to get a better deal. When a final decision will be made, is anybody’s guess. “If you ask me what will happen when, then I won’t be able to give you an answer,” said a speaker of the German economics minister to Automobilwoche [sub]. Can anyone?

GM Treasurer to the Congressional Oversight Panel on Federal Government Assistance to the Auto Industry: We Are Accountable. Now. Ish.

Good morning, Chairwoman Warren and distinguished members of the Oversight Panel.

Thank you for the opportunity to testify about how GM is reinventing our company and how a new GM will repay our nation’s investment.

Emerging from bankruptcy, we are a new company with less debt, a stronger balance sheet, with the right-sized manufacturing, product and dealer network to match today’s market realities. GM can now direct its full energy and resources to where it should be: on customers, cars and a culture to succeed.

We are grateful for our nation’s support. Without it, we would not have this second chance. Equally important, are the many who have been called to sacrifice in order to create a new GM.

Federal Pay Czar to Clamp Down on GM, GMAC, Chrysler, Chrysler Financial Exec Pay

The Wall Street Journal reports that the new federal “pay czar” Kenneth Feinberg is about to cap the execs working for GM, GMAC, Chrysler and Chrysler Financial. Well, restructure or “renegotiate” their salaries, bonuses and benefits. As Dan Rather might say, what’s the frequency, Kenneth? Less obliquely, the four auto industry recipients, all of whom owe their existence to billion dollar blessings from the Troubled Asset Relief Program (TARP), must send Ken new exec pay, perks and bennies guidelines by August 13. At which time the man originally tipped to be President Obama’s Car Czar (mooted by a 25-member task force) will decide whether or not he likes their proposals. If he doesn’t . . .

Lazard's "Secret" Report on Opel Bidders: All Three Suitors Suck

The longer the decision over the fate of Opel drags on, the messier it gets. Last week, three parties handed in their bids: Magna, RHJ, BAIC. Later in the week, BAIC was kicked out of the race. Remaining: RHJ, darling of GM, and Magna, darling of everybody else. Then, more facts surfaced. They didn’t endear the bidders to the decision-makers. Not at all.

Opel Won't Be Chinese

No big surprises in the excruciatingly slow bidding for who will finally take over Opel with the blessing and money of the German government. AFP reports that China’s BAIC has been kicked out of the sluggish race. The field of suitors has been whittled down to Magna and RHJ.

Officially, the race is open and fair. However, it is an open secret that GM favors RHJ, while the German government roots for Magna. GM hopes to be able to buy back a washed, rinsed, and refinanced Opel from a compliant RHJ. Berlin hopes to build a Ribbentropian German/Russian automotive power pact. Says AFP:

Opel Watch: Place Your Bets (By Monday Night)

On Monday, July 20, 2009, GM Europe accepts the last and final bids for Opel. Really. Definitely. They mean it. GM will evaluate the bids, choose a favorite, and then go on an arduous show-and-tell tour: Germany’s central government needs to be convinced, the states where Opel has plants need to be convinced, European countries where Opel has plants need to be convinced, the EU Commission needs to give its approval. The US government needs to be consulted. And then it’s up to the trustees to say “Ja” or “Nein.” So what will it be?

Opel Watch: Who's on First?

GM Topples PR, R&D Heads

GM’s heads of public relations, Steve Harris, and research and development, Larry Burns, have announced their retirements today. Automotive News [sub] spins the move as a “shakeup,” but notes that Harris was already on a contract extension. Burns, meanwhile, is burned at the stake as a hydrogen advocate. Despite Burns’s $1b hydrogen initiative of 2002, “the goal of an economically viable fuel cell vehicle by 2010 foundered on the lack of a national hydrogen fueling system,” notes AN. And as goes the political system, so goes GM. Meanwhile, Group Vice President and General Counsel Bob Osborne also announced he was returning to private practice, while former president of North American operations, Troy Clarke, is still at GM with no job title.

Ex-GM CEO Rick Wagoner Gets $8.2m Pay-Off

Back when TTAC was a voice in the wilderness on GM’s C11, I asked Bob Lutz if his pension was bankruptcy-proof. Maximum Bob scoffed and joked that he’d check with his accountant. Well, I guess he didn’t; the Car Czar recently revealed that hard times had forced him to sell one of his personal jets. After losing his shirt on GM stock options. The fact that MB’s working for New GM also indicates that he forgot to get while the getting was good. He should have had a word with his boss, Rick Wagoner. The ex-GM CEO, the man who wiped billions from the company’s worth and faceplanted the American automaker, made sure his financial future didn’t depend on anything as trivial as success.

Recent Comments