Marchionne Moving Fast to Shuffle Chrysler's Management

Feds' Surprise GM C11 Exit Strategy: There Isn't One!

Marchionne's Hello to the Troops

Sergio Marchionne’s introductory epistle [via the Detroit Free Press] isn’t blessed with the same opportunities for self-congratulation as outgoing Chrysler CEO Bob Nardelli’s. Instead, optimism is name of the game. And as Marchionne puts it, this isn’t the first time he’s stepped into “[what many perceived as] a failing, lethargic automaker that produced low-quality cars and was stymied by endless bureaucracies.” But, “through hard work and tough choices, we have remade Fiat into a profitable company that produces some of the most popular, reliable and environmentally friendly cars in the world.” Sergio thinks the same thing can happen at Chrysler. Could it possibly get worse?

Nardelli's Goodbye to the Troops: More Mush From the Wimp

Readers of a certain age will recognize the latter part of this headline as the “gag” title above a Boston Globe editorial about President Carter—that somehow made it into print. I evoke it here because ex-ChryCo CEO Bob Nardelli’s goodbye letter to his troops involves a different sort of gag response. While you’re invited to read the full text after the jump, here’s the short version: I didn’t fuck up. I mean, he. Nardelli. Bob the Un-Builder. The Home Depot despot. A man who drove not one but two large corporations into the dirt.

Feds Order 17,205 "Fuel Efficient" Chrysler, Ford and GM Vehicles

We’ve given you the heads-up on the federal government’s plans to favor domestic automakers with “stimulus sales.” And so it has come to pass. The U.S. General Services Administration (GSA) reports—eight days after the fact—that they’ve ordered 17,205 “fuel efficient vehicles” at a cost of $287 million. Breaking it down: Uncle Sam bought 2,933 Chryslers ($53 million); 7,924 Fords for ($129 million); and 6,348 General Motors vehicles ($105 million). Does it strike anyone as odd that FoMoCo gets the largest contract? Not-so-secret hat tip for NOT taking bailout bucks, while competing against those who have? Or just a reflection of the fact that the Crown Vic rules! Which reminds me: by NOT revealing the exact models ordered, one has to wonder about the depth of the GSA’s commitment to greening-up the fed’s fleet. On this point, the press release is suitably vague, and yet completely revealing . . .

Download New GM New Dealer Agreement(s) Here

An anonymous reader sent us the before and after agreements sent to GM dealers by the post-bankruptcy corporate mothership. Here’s the controversial post-bankruptcy GM dealer agreement before the National Automobile Dealers Association intervention (and media condemnation). And here’s the controversial post-bankruptcy GM dealer agreement after they faced the dealer revolt. The differences between these two documents are not as profound as their similarities. As Casey Raskob (a.k.a. Speedlaw) points out in a comment below, “In short, Dealer agrees to let GM dictate cars purchased, the buildings they are sold in, and this deal is subject to change at the whim of GM. Now GM dealers know how we normal folks feel signing a car lease.” Make the jump to read the analysis provided by our sharp end tipster.

Saab To Beijing?

China’s BAIC is not giving up on its aspirations to buy a foreign brand, if Gasgoo is not mistaken. Beijing Automotive Industry Corp (BAIC), already a joint venture partner of Germany’s Daimler in China, may bid for General Motors’ Saab unit. Saab piqued their interest, as BAIC’s attempt to acquire Opel looks unlikely to succeed—at least for now.

Fiat CEO: Deadline, What Deadline?

Opel Watch: We've Got Headaches by the Number

The hangover following the late night rescue of Opel is causing bigger headaches by the day. Last week, the German magazine Focus wrote that half of the €1.5 billion bridge loan, guaranteed by the German government, could escape “abroad”—€600 million to Spain, €150 million to the UK. Today, Opel denied that report. According to Die Welt, a drive for charitable donations yielded €200 million from Spain. The governments of Belgium, Austria, Poland, and the UK also pledged hitherto unspecified amounts to keep their Opel factories open. Then, German media wrote that GM wouldn’t hand over the Opel patents gratis. Oh no, they would want €6.5 billion in license fees over the next 10 years, €200 million in preferred stock, and €300 million in cold, hard cash for the patents that had been supposedly “sold” by Opel to Delaware. That topic is currently open, but “sources” say it ain’t true. Then there’s the matter of €4 billion for the Opel pension fund. The German government was asked to come up with the money, the answer was: “Nein!” Will it ever end? Nein.

Chrysler to Emerge From C11 on Monday

Provided, that is, the Supreme Court of the United States (SCOTUS) turns down Indiana’s request to overrule the sale of assets from Old, Crap Chrysler to New, Italian-controlled Chrysler. This after the U.S. Appeals Court told the gearbox-factory-jilted state’s lawyers to piss off. Or, more specifically, “You can’t wait for a better deal to come in from Studebaker.” Wait schmait; the three judges returned their decision about 10 minutes after Indiana’s lawyers finished their arguments. “There’s one more stop on the train,” Tom Lauria, a lawyer for the Indiana pension funds said, after the court’s ruling. Yes, well, New Chrysler left the station a while ago. One of our Best and Brightest has an interesting take on this (after the jump), but again, I reckon this is a done deal.

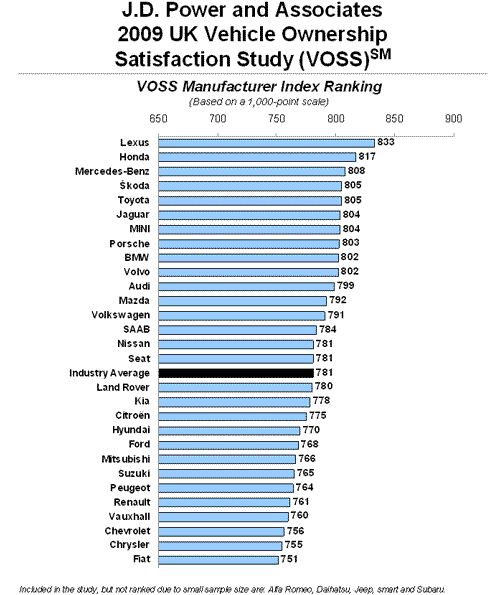

Fiat Places Dead Last in J.D. Powers' UK Satisfaction Study

Saturn Sold to Penske

GM Profitable by 2014! Or Not.

And there I was, calling “profit” GM’s new “Voldemort.” Yesterday, Government Motors’ federally-funded advisers used the ‘p” word in documents filed with federal bankruptcy court. Evercore Partners predict that the zombie automaker will return to life (though not as we know it) by 2014. What’s more, stock in New GM will be worth $48 billion straight out of the gate. Hang on. I’m lousy at math (as you know). But if the United States government owns 60 percent of a $48 billion New GM, our share on day one would be worth $28.8 billion. So, if the feds dumped those shares, we’d “only” lose $19.2 billion. SELL! Of course, it doesn’t work that way. But then, I’m betting dollars to donuts (heads-up: it’s national donut day) that it won’t work the way Evercore Partners says it will, either. With a little help from the Detroit Free Press, let’s look at their numbers . . .

The Fix Is In! Rep. Barney Frank Delays Local GM Plant Closure

You, TTAC’s Best and Brightest, knew it was going to happen: that unfortunate intersection of business and politics, where the taxpayer-supported GM would be forced by its new masters to place the latter ahead of the former. In other words, brain dead zombies are easily led. The Hill reports that Massachusetts Congressional Representative Barney Frank has “convinced” GM to keep a parts operation in his district open for business. “Frank’s staff said the lawmaker spokes with GM CEO Fritz Henderson on Wednesday and convinced him to keep the Norton, Mass., plant open for at least 14 months.”

GM Backtracks on Promise to Make Cull Public

“It’s our obligation to be open and transparent in all we do to reinvent GM, particularly with the American taxpayer as our largest investor.” That was the second sentence out of GM CEO Fritz Henderson’s mouth in sworn testimony before the U.S. Senate re: GM’s dealer cull. When pressed by Senator Rockefeller, Henderson reluctantly promised to release the list of all the dealers sent their walking papers by the corporate mothership. And then . . . nothing. In fact, behind the scenes, GM is desperately trying to quarantine/suppress the information.

Ask the Best and Brightest: How Long Can "New GM" Claim to Be "New"?

VW To Magna: "Us Or Opel"

It has been commented widely (and it doesn’t take a tall IQ to do so) that Magna might get problems with its parts customers (a.k.a. OEMs) when Magna starts competing with them through Opel. Didn’t take long: “Volkswagen AG said Wednesday Canadian auto parts supplier Magna International Inc. will face conflicts of interest following the planned takeover of General Motors Corp.’s (GM) Adam Opel GmbH unit,” Dow Jones Newswire reports from Germany. The threats are carefully worded:

Hummer to China. Any Questions?

The sale of the Hummer brand to a widely unknown maker of cement mixers and bridge pontoons, located in China’s wild west of Chengdu, left many questions open.

Like, how much did they pay?

Opel Wedding In Doubt

Magna expects to consummate the marriage of Opel by September. This doesn’t surprise; it just so happens that the German elections are on 9/27/2009. In the meantime, Deutschland develops distinct doubts about the deal. “The German government made it clear that the door remains open to rival bidders,” Reuters reports. “The process is still open to all the bidders,” government spokesman Ulrich Wilhelm told reporters in Berlin. The German government keeps repeating that other bidders, including Fiat and China’s BAIC, still have a shot if they improved their bids. Doubts reach all the way to the top . . .

Bailout Watch 545: GM Dealer Kiss Off Could Cost Feds $1.3 Billion

Chrysler Co-Prez Jim Press and GM CEO Fritz Henderson faced congressional opprobrium this afternoon, as our duly elected representatives lamented the fact that the two zombie automakers are pulling the rug from under the pols’ financial backers—I mean, cutting car dealers. Never mind the bollocks; the bailout bonanza just got a big bigger. Detroit News reports that Henderson told the Senate that “GM could have 3,500-3,800 dealers by the end of next year, a reduction of 2,300-2,600 dealers. He said the reductions were painful but unavoidable.” Applying this morning’s pay-off formula (an average of $500,000 per dealer), that raises the price of the federally-sponsored sayonara to $1.1 billion to $1.3 billion. But don’t worry, ’cause Fritz feels their pain and promises this is the last last time GM will downsize.

Hybrid Hummers?

As the news of Hummer’s sale to a widely unknown Chinese maker of cement mixers and bridge pontoons hit the wires, James Taylor was on a plane to Chengdu, China. The city, close to the golden triangle was hitherto more famous for its illicit substances and certain kinds of clubs. Now, it will be Hummer Central. Hummer CEO James Taylor (no relation to Sweet Baby James), went to Chengdu to shake hands with his new employers. They’ll keep him for now.

Chrysler Dealer Cull Not a Done Deal

Although Judge Gonzalez has so far given Chrysler-Fiat just about everything it has asked for, approval of the dealer cull still isn’t a done deal. The AP reports that: “U.S. Judge Arthur Gonzalez will hear arguments Thursday on the Auburn Hills, Mich.-based automaker’s motion to eliminate the franchises. Chrysler executives are also expected to testify. The motion was expected to be heard Wednesday.” In parallel actions, the Senate is holding hearing today on the very same issue. Again from the AP : “Lawmakers contend the dealership closings will put thousands of people out of work and offer few savings to GM or Chrysler, which have received billions in federal aid as they attempt to restructure and return to profitability.”

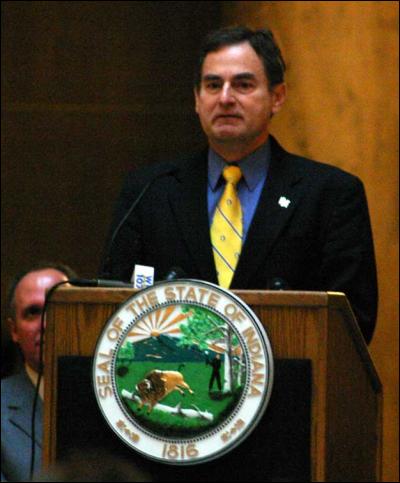

Chrysler Sale Appealed By Indiana Treasurer

According to Automotive News [sub], the Second Circuit Court of Appeals has granted a stay of Chrysler’s asset sale, pending a hearing scheduled for Friday. The stay comes on a motion ( PDF) filed by the Treasurer of Indiana, Richard Mourdock (motivation found here) on behalf of several Indiana funds which hold first-lien secured Chrysler debt. A panel consisting of Chief Judge Dennis Jacobs, Judge Amalya Kearse and Judge Robert Sack will hear Mr Mourdock’s appeal on at 2pm Friday, delaying the Chrysler asset sale which has already been approved by Chrysler’s judge Arthur Gonzalez. If the appeal delays the asset sale past June 15, Fiat could walk away. The appeal follows the arguments of earlier “hedge fund holdouts,” making the case that government is overturning bankruptcy law and screwing secured bondholders to move the UAW to the front of the line. Only the state of Indiana apparently isn’t scared of the alleged government strong-arming that squelched previous bondholder opposition. Hit the jump for selected quotes from their appeal.

GM to Become the Soul of Discretion

Well, that’s how the Freep puts it. So will GM be leaving the toilet seat down? Will it apply for a separate credit card to pay for its extramarital liaisons? Will it be hiding its Playboy inside the latest Economist? Want to clear this up for us, CFO Ray Young? “As a privately held company, it’s likely we’re not going to disclose information except to the shareholders,” says Young. “We do not have to file all of the same documents that we do when we are a public company,” clarifies Chairman Kent Kresa. All of which creates more mind-benders than Will Shortz on a weeklong acid bender.

Your Tax Money Hard at Work: GM Offers Discontinued Dealers a $1M Kiss Off

For the last ten years or so, the United Auto Workers (UAW) has pretended to make “concessions” to General Motors while doing nothing more than accepting pay-offs consisting of lump sums and promises to pay lump sums from fictional future earnings. Exhibit R: the fed’s recently promised $2.5 billion cash “top-up” of the UAW’s health care VEBA, ahead of other payment of other lump sums AND a slice of fictional future earnings. Automotive News [sub] reports that GM’s deep-sixed dealers are now playing grease my palm at wounded knee. “General Motors is offering some dealerships $100,000 to $1 million to wind down their businesses over the next 17 months, according to three sources familiar with the proposals.”

Hummer to China. Why In The World?

The—mind you, tentative—agreement of Government Motors to sell Hummer to China’s Sichuan Tengzhong Heavy Industrial Machinery has people worried. No, it’s not the Americans who are scared of military secrets escaping to China. “The deal has observers in China worried,” writes Forbes. And worried they should be. The deal as it is makes little sense for a Chinese manufacturer. Especially for a manufacturer that has never built passenger cars. Tengzhong makes heavy industry vehicles, highway and bridge components, construction machinery and energy equipment.

What worries the Chinese is exactly what made GM so happy: According to the Memorandum of Understanding, Tengzhong will keep Hummer’s core management and operations team and existing dealership network. Reuters reports GM saying that “the buyer of Hummer would contract to build the H3 model SUV and the H3T pickup truck at GM’s plant in Shreveport, Louisiana — through at least 2010.” Why, oh my?

More Good News: Hummer Finds New Home

GM Bankruptcy Documents Show a Fast Start

Our man on the ground has passed along a few documents from GM’s first day filings in bankruptcy court. And it seems that Fritz Henderson’s “ Faster, Pussycat Kill! Kill! Kill!” strategy is for real. This looks to be one mother of a fast bankruptcy. As the sale agreement states, “Consumers must have confidence in GM’s products, i.e., that a new GM will exist in the future so that it can stand behind its products. It is in this context that the timing of the transformation of the assets, in connection with the approval of the sale, becomes critical.” The fact that GM is filing a sale agreement on its first day shows that speed is the critical factor. Even Chrysler’s relatively rapid sojourn in Chapter 11 didn’t start with a sale proposal on the first day. Debtor-In-Possession financing has been lined up as well (big hand for your US taxpayers), including an expected $950 million “wind-down” loan. The lawyer carve-out is also limited to $20 million. Hit the jump to find out how it all could go wrong (but probably won’t).

Dan Neil Is Insane

Dan Neil’s April 2005 review of the Pontiac G6 ended by calling for fresh blood at the top of GM. His comments triggered the GM advertising boycott that inspired TTAC’s General Motors Death Watch. As you might expect, the Pulitzer-prize winning carmudgeon has a few things to say about GM’s bankruptcy. But I bet you wouldn’t have guessed that GM’s most famous (and talented) nemesis would mark the occasion by suggesting that failing to fully support Al Gore’s bid for the U.S. presidency was the company’s ultimate undoing. No really. Writing in the LA Times, Neil claims that “by backing Gore, who had the support of organized labor, GM would have gained enormous goodwill with the United Auto Workers, goodwill it desperately needed as it attempted to downsize in the new century. Gore also argued for universal healthcare, a program that, had it become reality, might have relieved GM and the other domestic carmakers of that burden . . .

GM Suspends Dealer Warranty Payments

President Obama on the GM Bankrutpcy

President Obama has made his case for his government’s purchase of a restructured GM. We’re still working to get a full embed of the speech. Meanwhile, if you can forgo the rhetorical flourishes for a moment, check out Obama’s fact sheet on GM’s restructuring. The first subheading is “General Motors Restructuring: Shared Sacrifice.” Hit the jump for more details.

Meet GM's Dismantler: Brian Deese

Chrysler Asset Sale Approved

Judge Arthur Gonzalez has approved Chrysler’s asset sale to Fiat, reports CNN Money, moving Chrysler closer to emerging from bankruptcy. Is it a coincidence that we are learning that the ChryCo bankruptcy is going swimmingly on the very day that General Motors files for bankruptcy protection? Probably not. It’s highly likely that everyone involved wants there to be only one automaker in Chapter 11 by the time a fresh batch of congressional hearings on the bailout (that was incidentally inspired by the fear of multiple, cascading auto-sector bankruptcies) roll around on Wednesday. Because nobody likes to look that foolish.

Henderson Promises "Transparency," Web-Chat

“Today,” writes GM CEO Fritz Henderson at his firm’s Fastlane Blog, “marks a defining moment in the history of General Motors.” And it’s true. GM has literally been skidding towards this day for decades. And though June 1, 2009 should have come years ago, it seems that there’s one possible benefit to its long, expensive delay. In this blog-driven year, GM knows that it can’t expect public largess without giving up some corporate privacy. That, or as a publicly-owned institution, GM is now subject to the Freedom Of Information Act. Either way, our tens of billions of tax dollars have bought American taxpayers an opportunity. An opportunity to webchat. Again.

GM Court Docs Emerge: Bankruptcy Petition, What GM Owns

General Motors Death Watches 1 – 75 in PDF

GM Files for Bankruptcy

Michael Moore on General Motors' Bankruptcy: "Goodbye GM"

Here’s a no-no: Michael Moore’s open letter, on this day of GM’s bankrupty, in its entirety, via the Daily Kos.

I write this on the morning of the end of the once-mighty General Motors. By high noon, the President of the United States will have made it official: General Motors, as we know it, has been totaled.

As I sit here in GM’s birthplace, Flint, Michigan, I am surrounded by friends and family who are filled with anxiety about what will happen to them and to the town. Forty percent of the homes and businesses in the city have been abandoned. Imagine what it would be like if you lived in a city where almost every other house is empty. What would be your state of mind?

Germany Picks Magna to Buy Opel

GM to Announce Bankruptcy "Around Mid-Day" Monday

Iaccoca To Lose Retirement Benefits

Apparently no good deed goes unpunished in Auburn Hills, as Reuters reports that Lee Iacocca will lose his retirement benefits under Chrysler’s bankruptcy reorganization. The man credited with saving Chrysler from bankruptcy in 1979 will lose all of his supplemental executive retirement plan (SERP) benefits and his lifetime use of a company car, according to CEO Bob Nardelli’s testimony before Chrysler’s bankruptcy court. Although Chrysler’s employee FAQ states that “SERP contributions are placed in a trust fund and are not subject to creditors in the event of bankruptcy,” it seems that applies only to tax-qualified contributions. “We are required by law to stop the payments of non-tax qualified SERP benefits,” the FAQ reveals. Clearly Iacocca’s benefits fall into this category. Time to make another ad with Snoop Dogg?

Opel Watch: GM OKs Magna. Government to Decide Tonight

The marathon meeting at the Adlon may not have been for naught after all. “After hours of talks with Canadian auto parts supplier Magna International, GM has reached an agreement, in principle, ” Reuters reports. Now they have to agree on a memorandum of understanding that will serve as the basis for bridge financing of €1.5 billion ($2.1 billion) and the trustee plan that comes with it. The German government will not give the bridge financing without the trustee scheme. Otherwise, their money and Opel will be drawn into the black hole of the Chapter 11 filing that is expected for Monday.

Delphi Bailout Takes Shape. Or Not.

Sent to us from a member of our Best and Brightest, who’s been following former GM parts maker, and bankruptcy-stuck, Delphi’s implosion at an unsafe distance:

One bit of news last night, and two old known facts, that may be the tip of something bigger. 1. As expected, yesterday, Judge Drain extended the hearing on Delphi’s emergence plan until Tuesday, the day after the GM C11 2. The PTFOA [Presidential Task Force on Automobiles] has never said, and still won’t say, what price they are paying for the five US Delphi plants. 3 Platinum Equity has been sticking their nose in here [Delphi] trying to get to FMV for Delphi’s stuff. The first two on this list don’t make sense. The Platinum thing does. Here’s what could be going on . . .

Opel Watch: Send Money Urgently - Or Else

Suspense in Berlin runs high. At 2 p.m., a meeting was held, German politicians only, no bidders, no GM, no treasury staffers. Fifteen minutes later, Chancellor Angela Merkel left the building—Opel watchers saw that as a sign of a final breakdown. Then at 3 p.m., GM and Magna show up at the Chancellory. Fifteen minutes later, Angela returns. At least they are still talking. 3:55 p.m.: The summit has been re-scheduled. Will start at 6 p.m.. It will be a long Friday night again in Berlin. If talks break down, it will be lights out in Rüsselsheim . . .

Fiat: Chrysler Has 300,000 Unsold Cars; Plants May Not Fire-Up Soon

Feds to Pony-Up an Additional $30 Billion for Post C11 GM

Automotive News [AN, sub] bears the glad tidings that the Presidential Task Force on Automobiles (PTFOA) has decided how much of your hard-earned money they want to plow into “new” GM: $30 billion. For now. Here’s the deal [ as laid down in today’s 8-K SEC filing]: “the $30 billion federal loan would be converted to equity, with $8 billion of the total U.S. funds to be repaid by GM, the officials said. Most of the rest would be converted to equity, with the government initially holding a 72.5 percent stake in the new company. That portion could be reduced to 55 percent if a UAW trust fund and bondholders exercise warrants.” So how much is this boondoggle going to cost me, really?

GM to File for C11 on Monday (June 1)

Bloomberg reports that GM’s scheduled its Chapter 11 filing for Monday, June 1, 2009. And we were wrong about GM’s bankruptcy becoming the world’s largest. Thanks to Ex-CEO’s Rick Wagoner’s decision to throw all of GM’s “non core” assets into the fiery pit of the company’s endless cash burn, the American automaker’s C11 will only rank as number three. “GM’s bankruptcy will be the third-biggest in U.S. history after Lehman Brothers Holdings Inc. and WorldCom Inc., based on GM’s reported global assets of $91 billion and total liabilities of $176.4 billion as of Dec. 31.” Meanwhile, the company has pulled ahead its US white collar workers’ payroll. Apparently (unconfirmed), they’ve already sent out the checks for the week of May 25, 2009. “Other than the date change, all other payroll processes will remain the same in terms of paying employees at work or if they are on layoff,” a leaked memo from Marketing Maven Mark LaNeve reveals. According to the document, “This action is not an indication that GM plans to file for bankruptcy on or about June 1 . . . GM has determined this simple action — moving up the payroll pay date for this month — is the least the company can do to reduce any potential for disruption regardless of what happens.”

PTFOA Bribes Bondholders With 15% Extra Stake in Post-C11 GM

As GM augers-in for its Chapter 11 face plant, the Presidential Task Force on Autos (PTFOA) has been busy cutting back-room deals with bondholders. Reuters reports that the feds are getting their proverbial ducks in a row for a fast-track fustercluck—sorry, reenergized company. “Under the proposed deal, which is supported by major institutional creditors holding about a fifth of its debt, bondholders representing $27 billion in debt would be offered 10 percent of a reorganized GM — the same stake they had been offered previously. In a sweetener, bondholders would also receive warrants to acquire another 15 percent of the equity in the new company, provided they support a quick Treasury-backed sale process similar to one now being used for rival Chrysler.” GM has released a statement on the new plan, removing any last traces of doubt that it’s headed for the world’s largest bankruptcy proceeding . . .

Recent Comments