GM CEO Rick Wagoner Takes a $8.7m Haircut

Auditors: GM May Not Be A "Going Concern"

GM’s auditors have looked at the books and made their determination: “our recurring losses from operations, stockholders’ deficit and inability to generate sufficient cash flow to meet our obligations and sustain our operations raise substantial doubt about our ability to continue as a going concern.” The filing with the SEC is refreshingly blunt, in a carefully coded way. “Sales volumes may decline more severely or take longer to recover than we expect . . . and if they do, our results of operations and financial condition and the success of the Viability Plan will be materially adversely affected.” I wonder how many billions of dollars lie between the terms “affected,” “adversely affected” and “materially adversely affected.” The Detroit News finally makes the transition from cheerleader to smokin’ hot crime scene investigator—at least for this piece.

Return Of The Wirtschaftswunder: German Car Sales Up 21 Percent

No, you are not hallucinating. Germany’s February car sales are out. Bottles of champagne will soon follow. Unbelievably, German cars sales rose in February by 21 percent. This is what the Verband der Automobilindustrie (VDA) told Automobilwoche [sub]. 278.000 units were moved. “These are the highest February sales numbers in the last ten years, ” VDA-President Matthias Wissmann said at the Geneva auto show. “For the first time in six months, registrations are growing. We expect that domestic sales of the complete first quarter will be above prior year numbers,” Wissmann said. It’s getting even better, much better:

Fastlane Knows Best

Think bankruptcy might be an option worth exploring for General Motors? Worried that the Volt might have been a tad too ambitious? Clearly you must be sick in the head. Reasonable people just don’t think that way. After all, why listen to bankruptcy lawyers and university researchers when you can get the truth straight from GM. You think those eggheads know more about GM than GM? Think about it. And while you’re suspending your disbelief, head down to GM’s Fastlane blog. You’ll get your facts straightened out faster than you can say “Stockholm Syndrome.”

It's True: Toyota Asks Japanese Government-Backed Bank For $2b

Time to Nationalize GM?

That ain’t me talkin’ (no, no, no, it ain’t me, babe). The headline comes straight to you from CNNMoney, with a little help from Chris Isidore—a reporter who literally laughed down the phone a year or so ago when I suggested GM would go Tango Uniform. So, from what industry could Mr. Isidore find anyone with a shred of credibility—without a bust of Lenin on their desk—who’d argue to nationalize GM (other than the people who’ve already done it)? Rail!

Larry Kaufman, a former rail executive and consultant, argued in a railroad industry newsletter Monday that the U.S. Railway Association, the special government agency set up in 1974 to deal with bankrupt railroads, is a good model for saving the U.S. auto industry…

Kaufman suggested that a special government agency would help the companies continue to sell cars while they reorganize because it would assure consumers that the companies and their warranties were not about to disappear.

GM Leads League of Extraordinary Inventory at 161 Days Supply

Dear God, will no one pull the plug on this company? I know the Obama administration needs to wait until March 31st to appear as if they’ve fully contemplated all the options. But even for me, a professional General Motors Death Watcher, charting the final dissolution of what was once the world’s largest automaker has become a painful pursuit. The breakup of the global empire. The raiding of the pension fund. The kow-towing to politicians. Automotive News [sub] gives us a way-point, reminding us that GM’s epic cash conflagration is getting worse, not better.

In a conference call last week, CFO Ray Young said GM’s cash burn this year would be less than last year, which it put at $19.2 billion — but admitted the cash burn in 2009 would be “front-loaded.”

Translation: The short-term bleeding will continue. It will be hard in this quarter for GM to reduce its cash-burn much below the $5.2 billion consumed in the last three months of 2008.

All this while GM inventory piles up, everywhere. The post-jump run-down is sobering stuff. One hopes.

Say It Like You Meme It: Gas Guzzlers Killed Detroit

I could write a book about Detroit’s decline. It’s a complex story of greed, arrogance, intransigence, incompetence, ignorance and more greed. Hopefully, a book reviewer wouldn’t boil it down to “Detroit built gas guzzlers when everyone wanted alternative energy cars.” That’s a misleading simplification that takes us to the wrong morality play: Motown as mustache twirling planet killer faces well-deserved comeuppance at the hands of kindler, gentler foreign car companies. In fact, Detroit built plenty of higher mileage vehicles (just not many good ones) and spent billions (many of them yours) exploring alt-power vehicles. Their product lineup conformed to all US fuel economy legislation (unlike several fine-paying foreign manufacturers). In terms of self-destruction: production efficiency, labor relations, reliability and branding are far more significant. But the big, stupid, insensitive greedy planet-killer meme is more politically effective. Just ask the president’s chief of staff Rahm Emanuel . . .

GM Raids Pension Fund: $11.6b for Buyouts, VEBA

Sunday? Sunday! That’s the day The Detroit Free Press chose to tell the world that GM’s recent accounts contain a time bomb: the revelation that the company raided—sorry, “borrowed from”—its employee pension fund to buy out United Auto Workers employees and pay into their health care fund. Even though we’ve become used to gigantic numbers, the sums involved are staggering. “Details are emerging about how General Motors Corp.’s U.S. pension funds went from a $20-billion surplus at the end of 2007 to a $12.4-billion deficit 12 months later.” I make that a $32.4-billion swing. It’s also approximately $11.4 billion more than GM’s CFO estimated its pension deficit, as declared in The General’s December pre-bailout report.

Chrysler Joins Clock Cutting Craze

What do you do when you’re out of time? Get rid of all your clocks! GM has already taken the humiliating measure of cutting clock maintenance from the RenCen budget, and Chrysler is now following suit. William Wolf of Chrysler Paint, Pilot and Facility Operations notes over at Chrysler Blog that “every little bit helps.” But Wolf wasn’t satisfied with the mere $10K in savings that cutting clocks yielded. Eliminating rooftop parking to save plowing costs will save over $300K, while halving the number of fluorescent bulbs at the Auburn Hills Chrysler Technical Center will yield $400K. And despite the bitter Michigan winter, Chrysler has dropped the temperature at the CTC by four degrees, saving $70K annually. And yet, somehow, not everyone’s happy.

GM Posts $9.6 Billion Q4 Loss

General Motors has finally announced their fourth quarter results and its terminal. The ailing American automaker’s cash burn was a staggering $6.2 billion. That might have a little something to do with the fact that GM’s revenues shrank by 34.2 percent, from $46.8 billion to $30.8 billion. Q4 operating loss: $5.9B. Net loss: $9.6B (compared to a not inconsequential $1.5B a year previous). For those of you keeping score, today’s results mark GM’s fourth year without booking a profit and the second largest loss in GM’s entire history. Reacting to the carnage, the man at the helm recycled a press release from somewhere in the middle of this slide into bankruptcy. “2008 was an extremely difficult year for the U.S. and global auto markets,” CEO Rick Wagoner said in a statement. “We expected these challenging conditions will continue through 2009, and so we are accelerating our restructuring actions.” At GM, restructuring actions accelerate you. Nose first. Pro forma mea minimus culpa filed, Red Ink Rick is headed to DC with his well-worn begging bowl . . .

The News Ford Doesn't Want To Talk About

As compelling as Ford’s executive paycut for Easter Monday holiday “ compromise” is, there are still plenty of stormclouds brewing around Dearborn. For example, Ford’s supplier spin-off Visteon is tanking, telling Automotive News [sub] it “cannot assure that it will remain in compliance with the terms of its outstanding debt instruments.” The firm’s $328m fourth-quarter loss is being blamed on a billion dollar revenue drop and “asset-impairment charges” of $200m. This coming from a firm that has never turned an annual profit. Amid growing rumors of bankruptcy filings (and 13 cent stock price), Visteon’s only other choices are asset sales or government bailout. Meanwhile, inquiring minds (OK, MSNBC) are beginning to wonder when Ford will succumb to the siren song of the federal bailout.

GM Shipping Camaros? GM Shipping Camaros!

GM's Bankruptcy Bonanza

Bloomberg reports that a GM bankruptcy filing could result in an up to $1.2b payout to its advisors, lawyers, accountants and affiliated toadies. According to UCLA Bankruptcy professor, Lynn LoPucki, the GM bailout bonanza could easily shatter the previous record for bankruptcy fees, set at $906 million by Lehman Brothers. “The bonanza has already begun and will continue through the bankruptcy,” LoPucki tells Bloomberg. Her estimate is based on bankruptcy statistics that she collects, and she says the size and complexity of GM would make its bankruptcy significantly more expensive than even the Lehman filing. And of course news of these fees has anti-bankruptcy politicians downplaying rumors that the Obama administration will arrange a Chapter 11 reorganization for GM.

Chrysler Almost Out Of Cash. Again. Still.

The Freep reports that Chrysler’s cash reserves will fall well below the $2.5 billion the firm needs to survive sometime in March. Based on a liquidation analysis in Chrysler’s latest viability plan, Auburn Hills will be down to $1.3 billion by the first of April. According to the same analysis, Chrysler would need $25 billion in Debtor-In-Posession (DIP) financing to survive through Chapter 11 reorganization, a process the firm expects to last two years. And if the private sector won’t provide it (it won’t) and the government won’t cough up DIP financing or more loans (it shouldn’t), Chrysler will begin to liquidate its assets in April. After all, why should Cerberus lift a damn finger? But if liquidation does occur, Chrysler would dump $2 billion in pensions and $20 billion in health care obligations on the government, not to mention defaulting on the loans it currently owes the government. Meanwhile . . .

Ford Reaches VEBA Deal With UAW. Apparently

Well, the headline is there and the news is there. But is it? The Freep reports that a UAW-Ford deal on VEBA has been announced by the UAW, but there’s nothing there that you can’t find in the UAW’s press release. Go figure. Sure, it may be the first reported agreement on the future of VEBA, but there’s basically nothing to go on. “We appreciate the solidarity, understanding and patience the members have demonstrated throughout the bargaining process,” says UAW President Ron Gettelfinger in his press release and nearly every news report on the item. “The modifications will protect jobs for UAW members by ensuring the long-term viability of the company.” But how? The UAW rejected stock for VEBA out of hand a few short days ago, as VEBA became the sticking point that kept union concessions out of last Tuesday’s viability plans. And like all UAW “concessions,” this one has to go to the membership for ratification. Furthermore, according to the Freep, “proposed changes to the VEBA will require court approval.” Meanwhile the only possible insight we have into the UAW’s strategy comes from a boilerplate Gettelfinger op-ed in the Washington Times. And there’s little there to indicate a VEBA deal.

GM Press Release: "Saab On The Road to Independence"

Trollhättan – As a result of GM’s strategic review of the global Saab business the Saab Board announced today that it will file for reorganization under a self-managed Swedish court process to create a fully independent business entity that would be sustainable and suitable for investment.

The reorganization is a self-managed, Swedish legal process headed by an independent administrator appointed by the court who will work closely with the Saab management team. As part of the process, Saab will formulate its proposal for reorganization, which will include the concentration of design, engineering and manufacturing in Sweden. This proposal will be presented to creditors within three weeks of the filing. Pending court approval, the reorganization will be executed over a three-month period and will require independent funding to succeed.

Saab and GM Wrangle Over Billion Dollar Bye-Bye

Now that’s its all over bar the shouting (Saab has filed for the Swedish equivalent of bankruptcy), the shouting begins. Saab’s new owners (themselves) say they need $1B to stay in the game, and they want GM to pay it. (Reparations?) Automotive News [sub] reports that GM is willing to surrender a big chunk of your taxes to cut bait and [Swedish] fish. But not a billion. “GM Europe’s head of communications Chris Preuss said GM was prepared to provide some funding for Saab but the brand needed outside money as well.” And who in their right mind would provide the lion’s share of this IV drip? “We have asked the Swedish government for loan guarantees for $600 million to give Saab a balance sheet as an independent unit which will allow it to continue.” The Swedish government has said no. So Saab is hitting up the European Investment Bank for a €500m loan. So . . . now what?

Saab Declares Bankruptcy

Today, the Supervisory Board of Saab decided to declare bankruptcy, Automobilwoche [sub] writes. The 4000 employees of Saab are being informed at a meeting how the company will continue. The company is now under the supervision of an insolvency administrator. Since Sweden’s government had turned down bailout requests of the mother ship GM, according to Swedish media, one possible solution would be a merger of Saab with a spun-off Opel.

[Here’s a link to the document filed today at the court. The English version starts on page 7 of the pdf.]

Supplier Stops Delivery to Saab

More news from Sweden:

“On thursday, supplier P-E Plast stopped their delivieries of parts to Saab in Trollhättan.

The owner, Patrik Ekwall, who runs the company since some months back, is afraid he won’t get paid for his deliveries, reports Swedish Radio (SR).

At Saab, no one answered when he phoned them. “We are wating for a reply” he says.

The last month, P-E Plast has delivered parts for 400 000 kronor (around 80 000 dollars) to Trollhättan. The company makes plastic details for the car industry, and a third of its sales goes to Saab.

In spite of the current circumstances, Patrik Ekwall hopes to keep the eleven employees.”

[thanks to Ingvar for the link and translation]

100k UK Auto Jobs Under "Imminent Threat"

TARP Insufficient For Automakers And Banks; Good Thing GM Doesn't Need More

The Washington Post reports that “many analysts say the [TARP] pot isn’t big enough to address current plans to fix the financial system, let alone prop up the auto industry.” Since the first round of auto industry bailouts came from TARP, many considered the Toxic Asset Recovery Program the logical source for tranche deux. But if that money is needed for banks, as analysts indicate, the Obama Administration may have to return to congress for more funds. “From where I sit, it’s an executive decision,” says Republican Senator and bailout critic Bob Corker. “[The Treasury] fully understands we’re coming in with additional requirements,” said GM’s Ray Young after GM’s viability plan was released on Tuesday. “It will come as no surprise.” Who looks surprised?

And Out Come The Auditors…

Accounting firm Grant Thornton LLP caught our eye with a press release (via PRNewswire) warning the auto industry of possible “going concern opinions” as auditors complete fiscal year-end reporting. “Going concern opinions” are an auditor’s statement in SEC Form 10-K annual reports that there is substantial doubt about the entity’s ability to continue as a going concern. “It’s important for the public, the supply base and all of the parties involved in restructuring the auto industry not to overreact if they start seeing ‘going concern’ opinions,” says Kimberly Rodriguez, co-leader of Grant Thornton’s global automotive team and a principal in the firm’s restructuring practice. “We’re in uncharted waters and auditors face extremely difficult decisions.” Translation?

GM Kills PVO: Performance Sub-Brands SS, V

Well, they didn’t kill the Corvette, but GM’s iced its performance tuning division. Automotive News [sub] reports on the car-nage.

GM today disbanded High Performance Vehicle Operations, which is based at the company’s suburban Detroit technical center, and redeployed its engineers, said spokesman Vince Muniga.

“All high-performance projects are on indefinite hold,” Muniga said. “The engineers are moving into different areas of the organization, and they will work on Cadillacs, Buicks, Chevrolets and Pontiacs.”

Bailout Watch 401: Chrysler Requests $5B To Forestall the Inevitable

Panic In Detroit As Viability Plan Deadline Looms

Our deadbeat automakers will turn in their viability plans today, but, according to a number of reports, these plans (like their predecessors) will be short on workable details. Which helps explain why GM and Chrysler will be turning in their plans after the close of the markets today. The Treasury will receive the “plans” electronically at 4 p.m. today, but a public press conference won’t happen until 5:30 p.m. Which is probably for the better. GM’s stock price has dropped by double digits today, despite reports that their second tranche of bailout cash has already been approved. But having “scored a trillion dollars” as Bowie puts it, there’s still plenty of panic in Detroit.

GM Euro-Union's Case for an Opel/Vauxhall Spin-Off

Open letter from GM’s Union Leaders:

“Renaissance” plan for Europe is not viable. It will finish off the European GM brands and companies and includes unacceptable risks of litigation—the alternative is the spin off of the European operations

UAW Members Get Free Lawyers—And They Ain't Giving Them Up for You

The United Auto Workers (UAW) contracts are facing unprecedented public scrutiny. It could have something to with the fact that it’s now OUR money the automakers are pissing away—sorry, “lavishing upon” union members. Or it could be that the normally passive—sorry, “pro middle class” MSM’s smells blood in the union boss’ water. In any event, here’s one for working class heroes: free legal advice. The Freep: “Established in 1978, the UAW Legal Services Plan provides ‘personal legal services,’ to about 725k workers, spouses and retirees from several companies, according to the program’s Web site. It is the largest pre-paid legal services program in the country. Before I give the jumpers the inside dope (in a non Michael Phelps kinda way), you wanna guess how much 290 attorneys cost the Big 2.8 et al.? Seriously, you gotta guess. ‘Cause the Freep doesn’t even estimate the cost. Blood boiling? Ready for the jump then . . .

"At Best, a New Deal With the UAW Might Save GM North America a Billion Dollars"

That’s TTAC Ken Elias earlier today in Bailout Watch 394. And lo, it did come to pass. Just hours later, Automotive News reported: “General Motors is expected to identify more than $1 billion in savings from additional plant closings and factory work-rule changes when it files a viability plan with the US Treasury on Tuesday, said a source familiar with ongoing stakeholder negotiations.” And no, it wasn’t Ken. Of course, Elias goes on to say big whoop. “[It’s] not enough to right a ship that’s losing $2B+ a month in cash flow.” Somehow that perspective didn’t make it into the AN piece. Still, the article’s well worth a read—if only for a laugh. Ladies and gentlemen, we have a new (yet old) straw man to set alight: True North.

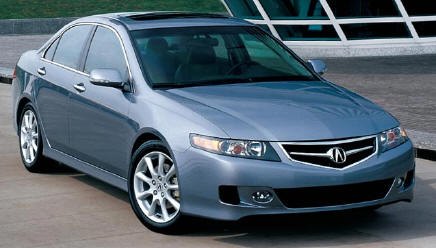

Question Of The Day: What Are Your Warranty Repair Rants and Raves?

My almost-three-years-old Acura TSX has been developing an annoying cosmetic problem: the plastic bumpers and sill trims have slowly but surely been turning a different color from the rest of the car. We live in a mild climate and I work from home, so the vast majority of the time that car sits protected in a garage out of the way of the sun’s UV rays. Even so, the sheet metal is still blue-silver while the plastic bits are turning a pale green. Argh, I know that over time it is just going to keep getting worse, and my warranty is almost up (45k miles down out of 48k).

ChryCo's Prez Press Delivers Eulogy To American Auto Industry

Shame on us that we’ve overlooked a startling statement made by Crisis LLC’s Prez. In a speech last Thursday at the Economic Club of Chicago, Jim Press basically said that anyone who expects more than 10m SAAR (annual selling rate) anytime soon is on drugs. Instead of getting better, it might get worse,

“It would be a mistake to assume that this ‘10 million market’ is an aberration. Instead, we need to accept and come to grips with it,” Jim Press said. Coming to grips with it means that it will be a 10m market for – gasp – at least for four years. In January, the annual sales rate (SAAR) was just under 10m units. Press is preparing the world for worse: “I’ve told our dealers that one day we may even look back on January of 2009 as the “good old days!”

Then, a second moment of startling truth…

Bailout Watch 390: Brother Can You Spare $18.5 Billion?

Chrysler – Nissan Non-Deal Isn't Going to Happen

Surprised? Neither are we. From the moment Chrysler execs mooted a Nissan hook-up—a moment born of Congress-appeasing desperation—we heard rumblings that it wasn’t gonna happen dot autoextremist. Our sources in The Volunteer State volunteered the information that nothing was happening, Nissan-wise. Again, no surprise. If the Nissan will build us a competitive car (’cause we don’t have a fucking clue, mate) and we’ll sell ’em Rams to rebadge as Titans deal was going down, Chrysler wouldn’t have floated il madre of trial balloons known as the great FIAT giveaway. Still, as any good Catholic automaker knows, confirmation is a big moment in a bogus story’s life. Although they were happy to repeat the propaganda without question at the time, Reuters rocks!

Bailout Watch 389: Chrysler: A Viability Plan We Can Believe In

With the third deadline for Detroit’s viability plans rapidly approaching, President Obama needs something, anything, to work with. “My goal, consistently has been to offer serious help once a plan is in place that ensures long-term viability and that we’re not just kicking the can down the road,” Obama tells Reuters. “What the nature of what that help ends up looking like, I think is going to depend on the plan.” And at first blush, Detroit’s task appears to be an easy one: tell the President what you need to survive and he’ll give it to you. But there’s a catch. “If a plan is presented to us premised on 20 million sales when we just know that’s not going to happen, then we’re going to have to ask them to go back to the drawing board,” says Obama. Seriously though, isn’t a plan premised on 10m sales this year a bit overoptimistic?

Bondholders Threaten GM Bankruptcy

And why wouldn’t they? As attractive as 30 cents on the dollar for equity in a firm that has five frantic days to produce a viability plan is, there seems to be some . . . hesitation. The Detroit News reports that GM is trying to finagle a $9.2b debt for equity swap with the holders of its unsecured debt to fulfill the requirements for federal loans. According to the usual anonymous sources, bondholders are holding out for 50 cents on the dollar. They say the figure mirrors the value of concessions being negotiated with the United Auto Workers. ( Sound familiar?) Luckily bondholders seem to have an ingenious solution for the UAW-bondholder deadlock: the government could just lend GM more money. This is some seriously high-stakes poker.

Cessna Fights Back Against Motown Mauling With WSJ Ad

Well good for them. As we said at the time, when used responsibly, a private jet is an invaluable management tool. An executive lording it over a far-flung empire can use private transpo to gather otherwise unobtainable on-the-ground intelligence. (Body language is 65.7 percent of all human communication.) Not to mention instilling the fear of God by all-of-a-sudden showing-up amongst his or her minions. Of course, as far as we know, and they ain’t sayin’ nothin’ (surprise!), that justifiable jet set savvy doesn’t apply to Chrysler, Ford or GM.

Phil Turland is Mad As Hell And He's Not Going to Take It Anymore

You may recall Phil as one of our Best and Brightest, a forensic accounting gumshoe hot on the trail of who owns Chrysler. You know, the company that sucked-up $3b of your tax money, looking for $4b more. And the rest (DOE loans and whatnot). Well, Phil outed Franklin Templeton Investments as one of the firms holding Cerberus CNG Investor I – III paper. Phil and I wanted to know a few things about Franklin’s folly. Why did they list the funds under “Consumer Credit” in their annual report? What’s with the Cerberus’ bonds paying 12 percent by 2014? So Phil called Big Ben. And . . . nothing. Despite a promise to answer his questions. So Phil’s not a happy camper. Not at all.

GM CEO Rick Wagoner Looks on The Bright Side of Life

I don’t know about you, but if I’d earned $14m in ONE YEAR, and I’d worked for the same company for thirty-two years, at least eight of which delivered unto me similarly (if not equally) spectacular amounts of pay and benefits, I wouldn’t really be all that worried about what happened next. OK, yes, reputation and all that. But we’re talking about Rick Wagoner, the man that’s flown the GM jumbo jet straight into the dirt without once recognizing that funny looking thing called the yoke. Any reputation that remains is purely in Rick’s head, and the heads of the sycophants who wear their “Pay No Attention To That Man Behind the Curtain” T-shirts with pride, without irony. So don’t expect me to be surprised that USA Today reports “GM, [Wagoner] says, is crouched and ready to pounce if the auto market begins to rebound. ‘We just need to get the storm over, and we’re about ready to go.'”

TTAC Outs Chrysler Investors. For Real.

TTAC has been working with our Best and Brightest to uncover the hidden investors behind Chrysler. We’ve made some headway. First, the name of Cerberus’ Chrysler funds: Cerberus CG Investor I LLC, Cerberus CG Investor II LLC, Cerberus CG Investor III LLC. The information came from Daimler [click here then search for “CG Investor”; it’s under structure of the transaction]. Searching for hits on the CG funds, we’ve unearthed Franklin Templeton Investments’ Mutual Recovery Fund. Here’s the money shot: the fund’s 2008 Annual Report. Scroll down to page 5 (their numbering), second footnote. And there it is. And now we can drill down to some interesting info…

GM Pay Cuts Revealed

A TTAC Tipster writes:

According to one of my GM buddies, the May 1 pay cut is as follows: 10% for unclassified (executives); 7% for Levels 8 and 9 (managers, technical fellows, other senior folks); 3% for Level 7 and below. Levels 8 and 9 and unclassified enjoy the use of company vehicles. Last year, a lot of the Level 8s were forced to take demotions to Level 7: no pay cut, but they had to give up their company car, although they got some financial help in getting a new GM car.

All pay cuts are “temporary” and will be under reconsideration in December.

Car Dealers Positioning Themselves for D2.8 C11 Payout

When it comes to “why can’t U.S. car companies kill their dead brands?” TTAC has always pointed the finger straight at America’s 50-state patchwork of franchise laws. If GM killed, I dunno, Saab, every Saab dealer in these here United States would drag The General’s ass down to the local courthouse demanding—and receiving—reparations. Lest we forget, Oldsmobile’s termination cost GM a billion dollars back when a billion dollars was a lot of money. If, however, Chrysler, GM or Ford filed for Chapter 11, they could kill brands and dealers at will—without paying ex-dealers anything more than the cost of their inventory. And maybe not even that. Franchised dealers can see the writing on the wall, and they’re not happy. So they’re proactively legislating a new post-C11 deal for themselves—inflating the claims against the automakers’ assets, increasing the likelihood that the D2.8’s bondholders will file for same.

GM Salaried Cuts To Reach 10k, UAW Drags Heels On Retiree Health Care

Fourteen percent of GM’s global salaried workforce will lose their jobs by the end of the year, reports Automotive News [sub] as the General flails to slash costs. GM’s salaried ranks will drop from 73k to 63k by the time the current cuts are completed. 3,400 of GM’s 29,500 US salaried employees will lose their jobs by May 1, and remaining workers will see their pay cut by between three and ten percent. These cuts will bring GM’s salaried workforce to a lower level than the 65k-67k called for in their initial December 2 viability plan. DId we mention that these fine folks will be losing their jobs without any buyout offers, just as GM slashes its severance pay? Sometimes it doesn’t pay to be a salaryman.

Chrysler CEO Bob Nardelli Preparing For Creditor Payback?

The New York Post reports that Chrysler CEO Bob Nardelli “transferred a $3.8 million, four-bedroom, five-bath Los Angeles spread to his wife, Susan, on Jan. 17, 2008, according to deed records filed in Los Angeles County and recorded with the Assessor’s Office on Feb. 5, 2008.” There are only three possible reasons for this move: divorce, estate planning or a hedge (there’s that word again) against future legal action, when creditors come to call. Strangely, or not so strangely, Bob’s personal spinmeister is denying the facts of the matter. “A spokeswoman for Nardelli early today insisted the records were incorrect and no transfer took place.” The story gets curiouser and

curiouser . . . .

GM in Talks to Take Back Parts of Delphi

The General Motors spin-off of Delphi which never really was, isn’t. Today’s Wall Street Journal [sub] has another “people involved in the negotiations”-sourced story claiming that these latest moves are all “part of a strategy to qualify for additional government loans”. Delphi has never really been an independent company from the start. The obvious reason of course is that GM provides the vast majority of Delphi’s business. But more than that, GM is on the hook for Delphi’s pension costs, has paid the price for voluntary separations at Delphi and has repeatedly been the source of bailout bucks for Delphi. Considering that “since 2005, GM has poured in $11.7 billion to help sustain the company,” they might as well just call it the Delphi Division. But how do federal bailout dollars get wrapped up in this mess?

GM Car Czar Bob Lutz Calls It Quits

GM Car Czar Bob Lutz is calling it quits at the end of the year. Or, as they like to say in the “here’s your golden parachute; see you in Aruba” RenCen echelons, Maximum Bob “will transition to a new role effective April 1, 2009, as Vice Chairman and Senior Advisor.” In other words, we still have MB to kick around until the end of the year or the end of GM, whichever comes first. GM CEO Rick Wagoner was effusive about Lutz’ contribution to the total destruction of GM’s brands—in his own entirely reserved way. “Bob Lutz was already a legendary automotive product guy when he rejoined GM in 2001,” Wagoner’s statement says. “He’s added to that by leading the creation of a string of award-winning vehicles for GM during his time here. His 46 years of experience in the global automotive business have been invaluable to us.” Love that “car guy” stuff. Now, for some more accountant-friendly info . . .

Disney World – GM "Test Track" Ride RIP?

Last Thanksgiving, I took my step-daughter to the GM “Test Track” at Disney World. When we walked up to the heavy steel door, the ride was “temporarily closed” for “technical reasons.” We waited. The ride reopened twenty minutes later. We were cattle herded through a chain link channel, passing various displays designed to educate guests about automotive development: air bags, door longevity, etc. The ten-year-old displays were worn, dated and dusty. There was no branding anywhere; no mention of Buick, Chevrolet, Pontiac, GMC, Saturn, Saab, Cadillac or HUMMER. When we got to the acoustic chamber, the ride broke. Not good: the chamber lacked ventilation. People started leaving the line after 20 minutes. Just before the ride, a short video (on a small TV) extolled the joys of ABS—for a Chevy Trailblazer.

Bailout Watch 380: TTAC Outs Chrysler Owners. Or Not.

As regular readers know, The Truth About Cars is working hard to try to find out who owns Chrysler—now that [ex] President Bush has provided $3b worth of no to low-interest loans to the technically bankrupt automaker. And now that this selfsame beneficiary of our government’s largess is looking for another $4b loan. And the rest. In our pursuit of this information, we are aided by members of our Best and Brightest who also believe that we should know exactly whom we are subsidizing. Are they the “retirees, teachers, municipal workers and ordinary citizens” that Cerberus claims? Or are the 100 or so unnamed investors members of hedge funds, perhaps from abroad?

Ford's $4b Pension Payout Brings It Closer to Bailout Buffet

G’day! The Sydney Morning Herald is first up with news that Ford will have to stump-up $4b for a 2008 pension shortfall. “The collapsing stock market left the fund with a $4.1 billion deficit for its projected obligations, after 2007’s $3 billion surplus, Ford said in its fourth-quarter financial results. That may force an infusion of money starting next year, according to the viability plan filed with Congress in December.”

GM "Accelerates" $50m Payment to Delphi; Delphi Cuts Health Care

If you’re familiar with Delphi—a former GM division with the words “bankrupt since October 10, 2005” over the door—then you’ll know that they’re a not-so-hidden cancer on GM cancerous corpse. Even as The General seeks to survive with a federal IV stuck in its metaphorical artery, it continues to peel off just enough cash—now your cash—to keep the parts maker making parts. For vehicles no one’s buying; but that’s how the industry doesn’t roll these days. So, some bad news from the oracle then. First, GM’s told their pals at the SEC (accounting scandal forgotten) that they’re accelerating a $50m payment to Delphi. [NB: Delphi had asked GM for a $100m hurry-up.] Can you say running on fumes? Delphi can. “The Company believes the amendment and accelerated GM support will enable it to preserve available liquidity given the difficult economic environment, particularly in the global automotive industry,” Delphi said in a filing with their pals over at the federal bankruptcy court. Judge Robert Drain, no less. And the cutbacks keep on happening!

Is Chrysler Lying About Viper Buyers?

Not buyers of Dodge Vipers per se. Some 127 of them found their way to a Dodge dealer in January, a 74 percent gain from last year’s total. Of course, that may have a little something to do with the fact that A) Dodge dealers are dealing as if their life depends on it (which it does) and B) the chances of buying a new Viper are decreasing by the minute. Especially since Chrysler revealed that it wants to sell the model as a brand to . . . someone. Oh how we laughed! Well, not Autoblog obviously, despite having reported that American tuner Saleen was a suitor (after having reported that Saleen’s busy going belly-up). I mention this not because I’ve been dying to put the boot in to Autoblog ever since my reader-inspired vow of fraternity, but because it raises the obvious question. Is Chrysler lying when it told the MSM that it has three companies interested in buying its Viper tooling and trademarks? (Setting aside the question of whether or not Cerberus has already mortgaged these “assets.”) Here’s AB’s take:

GMAC Loses $1.31b in Q4

Think about it. That’s AFTER the U.S. Treasury Department “invested” $6b of your hard-earned tax dollars into the failing auto and mortgage finance company. “Auto sales are in freefall,” Fifth Third Asset’s Mirko Mikelic told Bloomberg. The Michigan money manager (whose company holds a big chunk of GMAC debt) says the bailout “may keep them around at least until they need to restructure.” Confused. May . . . at least . . . until? Bottom line: GMAC’s Q4 new vehicle financing fell from last year’s $13.4b to ’08’s $2.7b. Despite Uncle Sam’s cash infusion and fire sale pricing and lowered FICO score loan eligibility, what’s the bet that the needle doesn’t budge on that number? Meanwhile, Rescap, GMAC’s mortgage unit, famous for its easy credit home loans, is also dying a death. On this subject, Mr. Mikelic leaves the sugar coating on the shelf. “Their mortgage business is basically closed.” With house sales going nowhere slowly, GMAC has a new strategy, related to their free pass bank status.

While America Slept. Tuesday, February 3rd, 2009

Here they come: China’s SAIC will sell its homegrown cars to Spain, UK, and Israel beginning in 2010, Gasgoo reports. Some of the cars will come directly from SAIC’s assembly plants in Shanghai and Nanjing, while others will come from the company’s UK assembly plants, which SAIC acquired from Rover. The UK will get domesticated Chinese. All cars will comply with EU Euro-5 emission standards.

Germany down 14 percent in January: Not quite 19 percent as feared yesterday, but close. Germany sold 14 percent fewer cars in January 2009 than in January 2007, Automobilwoche [sub] reports. If you are looking for a statistical savior: Adjusted for buying days, the drop is only 8 percent. All eyes on the clunker culling money, €2.5K. It was introduced 1/27, too late to save the first week of the year.

Sania rejects Porsche, Porsche happy: Much to the relief of Porsche, Sweden’s truckmaker, Scania, rejected a bid Porsche had to make after taking over VW, the Wall Street Journal [sub] writes.

GM Bondholders Could Emerge With 20 Percent Stake

The Freep reports on the analysis of JP Morgan’s Eric Selle and Atiba Edwards, who argue that GM bondholders could emerge from negotiations with a 20 percent stake in the world’s second-largest automaker. GM must outline a strategy to eliminate two-thirds of its $35b in unsecured debt by February 17. “We expect a bond exchange will settle around 35% of par with an equity component representing 20% of GM’s equity,” write Selle and Edwards. But the JP Morgan analysts warn that the “threat of bankruptcy will have to return in order for GM to achieve the required restructuring goals.” What, again?

Ford Burns $5.5b in 3 Mos., Drops $5.9b in Q4

Tick tick tick. “Ford finished the year with cash reserves of $13.4 billion as it tries to avoid borrowing money from the U.S. government,” Automotive News [sub] reports. So, if the cash burn continues at the pace of the last three quarters—and why wouldn’t it?—Ford has fewer than six months (June ’09) before it’s running on fumes. Fewer, if you consider that the ailing American automaker needs a $10b pad to keep the lights on. More, after they tap their remaining credit reserve. Which they’re doing as I type. OK, let’s drill down.

Saturn Astra RIP

A Letter to the Auto Factory Towns Peering Into the Abyss

In a comment under our most recent United Auto Workers post, Taurus GT500 posted the below. I thought it worthy of lifting into pride of place in our blog roll.

“Bob Cratchit asked us to drop you a line. We’re the Ghosts of Main Streets Past, Present, and Future.

The what?

You know us by our nickname. We’re the (former) steel towns of the Mon River – the Steel Valley. You know, Steelers, Steel City. Get it? That’s us.

We’ve been where you’re going. …But, it wasn’t always like this.

Once, we made rails that connected shining sea to shining sea; girders that put the sky in skyscraper; and when Henry and those Dodge boys and that Durant fellow put America on wheels, where you think all that steel came from?

You and Rosie the Riveter was the Arsenal of Democracy. Maybe with better PR we’d a been the Blast Furnace of Freedom.

Our furnaces’d light the sky for miles. Endless parades of coal barges. And freight train whistles at all hours. Man, like the song said, we were something to see.

But that was then …and this is now.

Aston Martin Death Watch?

The Aston Martin factory in Gaydon is moving to a three-day work week, as demand for the eternally troubled supercar maker’s mechanically-plagued products craters. The BBC reports that the marque’s masters are putting the best possible spin on the move, which is fooling nobody. “The company, based in Gaydon, Warwickshire, said the new Monday to Wednesday shift pattern was temporary and affected just under 600 staff. The employees’ hours will be ‘banked’ and claimed back by the firm later. The firm, which announced 600 redundancies in December, said it had consulted unions over the move. Three hundred staff have already left and it is in the final stages of consultation over the remaining 300. It will employ 1,250 staff at Gaydon following the planned redundancies.” But wait! Here comes the cavalry!

Recent Comments