Today's Chrysler Court Docs: Non-TARPies Revealed

GMAC Fails Stress Test: There Goes Another $11.5 Billion of Your Money

Chase Terminates Chrysler Dealer Loans

"Let's Face It. We're Making a Lot of Difficult yet Necessary Decisions These Days to Ensure GM's Long-term Future"

Let’s face it? I’ve been covering GM’s slide into bankruptcy for well over four years now, and it never ceases to amaze me how the people inside the company persist in trying to paper over cracks in the company’s operations that make the Grand Canyon look like a paper cut. In this case, a personage no less than Vice Chairman Tom Stevens gets in the Fastlane to tell the world that GM doesn’t have a fucking clue what it’s doing with its products or brands. “Although Saturn’s future is likely not to be within GM now, I can assure you our commitment to hybrid, plug-in hybrid and advanced battery technology is a key element of GM’s reinvention. I’m pleased to let you know the plug-in hybrid technology will be applied to one of GM’s four core brands. Stay tuned for which one, and in the meantime, I’ll enjoy reading the speculation.”

Oh and By The Way . . .

Judge OKs Chrysler Sale

Federal bankruptcy judge Arthur Gonzalez has pulled the trigger on Chrysler’s reorganization. Late last night, Arty cleared the way for the bankrupt automaker to review and accept bids on the company’s assets. Gonzalez said there’s an “urgent need for the sale to be consummated.” What’s more, the bidding process offers the prospect of “a fair and orderly sale.” The ruling extends the bidding deadline by five days, to May 20. One week later, the judge will hold the hearing to approve the sale of assets. Not-so-coincidentally, that’s just three days before GM’s drop deadline for its [theoretical] pre-C11 reorganization.

SEC Filing: GM Wipes Out Stockholders

General Motors has filed papers with the Securities and Exchange Commission detailing plans for financing the new, “good” GM. If/when realized, the scheme will wipe out GM’s current stock holders. The plan would:

* Increase the number of authorized shares to 62 billion

* Reduce the par value to one cent

* Effect a 100:1 reverse split for the existing shareholders (that’s one cent on a dollar)

Today's Chrysler Court Docs II: When Bailouts Collide: Chrysler Financial Vs. GMAC

Toxicroach clocks in with today’s ChryCo court action. And here’s one from left field: Chrysler FInancial attempts to short-circuit the plan—put forward by the President of the United States no less—to transfer all of the zombie automaker’s business to GMAC. Turns out they would do anything for love, but they won’t do that.

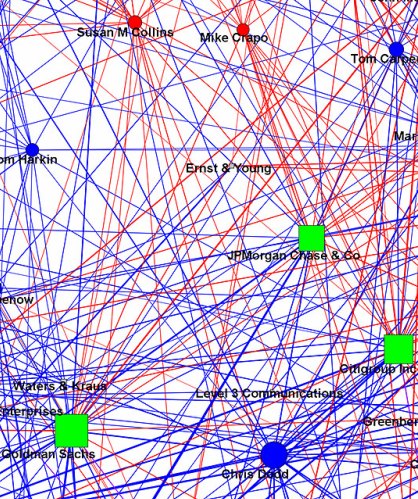

“Chrysler Financial got into the act today, objecting to GMAC providing financing going forward ( download pdf here). First, they complained about the celerity of the proceedings. Then they pointed out that Chrysler Financial has liens on, oh, all of the Chrysler product on dealer lots, and that the agreement with the dealers prohibits them from financing through anyone else. Since the dealers are not debtors in bankruptcy, the court can’t really protect them. Chrysler Financial’s remedy: kick GMAC to the the curb, replace them with Chrysler Financial. Failing that, let ChryFi see the terms of the agreement between GMAC and Chrysler proper (which had previously been sealed by the court to protect competitive information). The Non-TARP bondholders also filed a motion to protect their identities because Obama is defaming their reputation! The judge shot that down fast. Looks like we will get to find out who all the non-TARP bondholders are by tomorrow at 10 a.m. ( download opinion here).

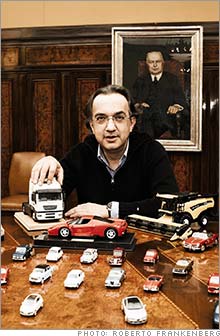

Opel: Fiat, Magna And The 14 Steps To Heaven

In German politics or the corporate world, the secret weapon to destroy any progress is the feared “12 point program.” Any similarities to a 12-step program of substance abusers are purely coincidental. Since there is no way that all 12 points will ever be met, the project languishes and dies on its own with nobody having killed it.

The German government has increased the mega-tonnage of its secret weapon and presented Fiat’s Marchionne with a 14-point program as he visited Berlin on Monday to meet government and union officials. His intent: Secure political (and financial) backing by the end of this month for a dream. Marchionne wants to combine Fiat, Chrysler and Opel/Vauxhall to a car group that cranks out more than 7 million units a year and has combined revenues in excess of $100 billion. Second to Toyota. Bigger than Volkswagen. (That should make the plan popular in Germany.) Not so fast:

Today's Chrysler Court Docs: Debtors' Lawyers Get $24.7 Million. So Far.

It's Official: Kiss Chrysler's $8.34 Billion Bailout Bucks Goodbye

Today's ChryCo Court Action II: Non-TARP Creditors Claim C11 is C7 in Disguise

Toxicroach says he’s not a C11 guy by training; C7’s more his style. Still, it’s obvious that he shares our OCD. Which is not so good for him. But very good for the greater good. Thanks, bug man.

“Nuts & Bolts: The first day emergency motions were granted for the most part. Chrysler can continue on and doesn’t have to file a complete list of creditors or a complete petition until June. Some minor creditor action that I’m going to mostly ignore. We already covered the main objections, but Uzzi (counsel for Chrysler’s non-TARP engorged creditors) filed another objection to the use of DIP financing ( download pdf here). This sums up their argument quite nicely:

Chrysler Requests $753 Million For Incentives-Based Dealer Culling

After crying that bankrupt automakers can’t sell cars (as in, “there but for the grace of the taxpayers go we”), Chrysler is requesting $753 million to do what it said was impossible. And who minds profit-draining record incentives when taxpayers are picking up the tab? Automotive News [sub] breaks down Chrysler’s request for $4.6 billion of DIP financing, and reveals that incentives are no longer just about moving metal.

Today's ChryCo C11 Court Docs: Chrysler/Feds Try to Pull A Fast One

GM Factories, Dealers Tool Up For War

With up to 1,200 dealers and 16 factories set to be uninvited from “the reinvented GM,” union locals and dealerships with their livelihoods on the line are preparing to fight the future. With the UAW leadership on board for an equity position in the new GM, locals are scrambling to show their willingness to give up once-cherished perks to keep their plants open. Bloomberg reports that workers at GM’s Spring Hill plant have ratified a local agreement that “allows GM to schedule its hourly workers for weekend shifts without paying special premiums, ends the policy of paying overtime based on a daily shift instead of a 40-hour workweek and loosens the work rules so that workers may be used for a broader variety of tasks.” Sadly, since Spring Hill’s Chevy Traverse production is likely to be moved to Lansing Delta to take over Saturn Outlook production capacity, this sudden rash of reality probably won’t save the plant.

ChyrCo Court Docs: Dodge Viper Part of "Bad" Chrysler

Section 2.15 Viper. (a) Subject to Section 2.15(b) below, notwithstanding any provision of this Agreement to the contrary, (i) Seller may, at its option, sell Intellectual Property and Purchased Inventories that relate solely to Vehicle Production (as defined in the Transition Services Agreement) and are not necessary or useful in any other line of business (the “Viper Assets”) prior to the Closing Date in an arm’s-length transaction to a party other than Purchaser on terms and conditions reasonably acceptable to the Purchaser, provided that the right of the Seller to sell the Viper Assets shall terminate on June 8, 2009 if no binding written agreement to purchase the Viper Assets has been executed and delivered by a bona fide purchaser at such time, and (ii) in connection with any such sale, Seller and Purchaser, as applicable, shall grant to the purchaser of the Viper Assets on terms and conditions reasonably acceptable to the Purchaser a non-exclusive license of other Intellectual Property of the Seller necessary for Vehicle Production as currently conducted.

Chrysler C11: "Non-TARP" Lenders Balk; One Day Delay Granted; Death Threats?

Toxicroach will be here any moment to give us his take on the Chrysler C11 case’s “relax don’t do it” anti-auction action. Meanwhile, here’s a quick heads-up [via Bloomberg]: “The group, calling itself Chrysler’s non-TARP lenders, in reference to the Troubled Assets Relief Program, said the proposed sale to an entity to be managed by Fiat is ‘tainted’ because the process was dominated by the U.S. government, according to papers filed today in U.S. Bankruptcy Court in Manhattan. The group also said the short period of time given to evaluate the sale was improper and the hearing set for today on the bid procedures should be delayed.” And so it was. For a day. Meanwhile, the money shot: “The court should not permit a patently illegal sales process to go forward.” As TTAC reported earlier, the kvetching could well be a simple negotiating ploy to force the feds to pay off the non-TARPies, at a higher rate than the big banks (no less).

Stop the Presses! GM May Sell Saturn. Still.

When GM banned TTAC from its press cars some thirty-five years ago, I told the local delivery guy not to fret (as if). After GM filed for C11, things would change. The warm winds of glasnost would sweep through the company’s corridors, opening the company’s corporate culture to outside criticism. A new era of openness and honesty would begin. Man did I get the munchies that day. Anyway, we shall see. Meanwhile, with 27 days left to go, TTAC’s not riding phat in no Pontiac and it’s the same old spinmeistery at RenCen. Here’s what I discovered in GM’s increasingly taciturn press site this morning:

DETROIT – General Motors is proceeding to the next step with respect to the sale of Saturn. A number of potential buyers have surfaced and expressed interest in the Saturn brand and retailer network. GM will be reviewing expressions of interest from the potential buyers and will look to secure an agreement with a specific buyer later this year. S.J. Girsky&Co. has been retained by GM as advisor for this transaction. Saturn will continue to keep its retailers updated on its progress throughout this process.

Japanese Parts Makers Want Government $$$

Let’s see what comments this one gets: Seven Japanese companies have applied for the US government’s relief program for auto parts and materials suppliers of GM and Chrysler, the Nikkei [sub] says.

The program earmarked $5 billion in public funds to make suppliers whole who are owed money by the two artists.

Today's Chrysler Court Action: The Sharks Feed

More documents were filed in the Chrysler bankruptcy case. TTAC ace commentator and bankruptcy briefer, Toxicroach, gives us the 411 on the latest C11 maneuvers:

“Only four events today as of 5 p.m., only one of value. Either I misread prior docket entries or the 5/1/09 hearing was just to set a date for the real hearing, but the hearing on the emergency motions (first day motions is what they have been calling them) will be 5/4/09 at 10 a.m. I imagine it will be a zoo in Courtroom 523 this Monday. Still no bankruptcy ‘fast track’ 363 motion.

Are You Ready For The New New Chrysler?

We got a few “so what’s” a couple of wild-ass days ago when we whispered that Chrysler would be launching a new ad campaign using government funds earmarked for struggling parts suppliers. But setting aside the supplier screwing (yes, advertisers “supply” Chrysler, and with no production, why worry about components?), this means we will be treated to the launch of yet another New Chrysler. This will mark the second such dawning in just about a year. AdAge (via Automotive News [sub]) confirms the rumor, reporting that the responsible ad firm (BBDO, Detroit) also just happens to be Chrysler’s second-largest unsecured creditor ($58.1 million). And Judge Gonzalez still gets to decide whether the Mad Men will be paid out by the government’s “critical vendor” program. Anyway, the new campaign is being termed “educational,” with Chryco spokesfolks explaining “companies in this kind of situation need to communicate more rather than less.” Because sometimes having the President for a pitchman just isn’t enough.

Wild Ass Rumor Of The Day: Non-TARP Chrysler Holdouts To Be Paid Off

Fiat To Opel: Ti Amo Molto

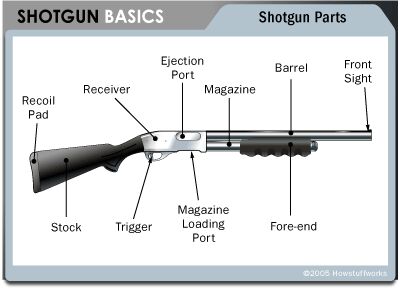

Now that the no-money Fiatsco is (sort of) done and in the hands of the courts and armies of lawyers (what a reassuring thought), Fiat is fixing the sights of its lupara [see pic above] on another target that carries the ripe fruit of billions of government money: Opel.

“Now we have to concentrate on Opel,” Sergio Marchionne said in an interview with La Stampa. “They are our ideal partners.” (Reassuring thought #2: Chrysler must then be less than ideal . . . .) Reuters reports that “Marchionne coughed throughout the interview and admitted to being tired after months of talks leading up to the Chrysler deal,” giving rise to suspicion that Marchionne had contracted swine flu—an inherent risk when rolling with the pigs. Or it could be something worse than what a dose of Tamiflu could heal:

Chrysler C11 Filings for May 1: Where's the Good/Bad Motion?

TTAC’s Johnny-on-the-spot, Toxicroach, is moving offices. But his efforts on your behalf continue apace. This is his summary for the yesterday’s (May 1st) legally action.

“I’m about to pass out and I’m really sore, so please excuse me for the late filing (mine). It doesn’t especially matter since nothing too huge happened yesterday. Chrysler filed the debtor-in-possession motion (download pdf here). The Govt. is offering $4.5 billion to old Chrysler @ 3% interest. That’s $1.8 billion upon the filing of the motion, the rest on approval of the motion. There are a ton of things, and I’m too wiped out to get into every detail (and I’m not sure most of the terms are really newsworthy or unexpected) This, however, is amusing (if you’re of a lawyerly persuasion):

Chrysler To Close 8 Plants, Workers To Be Miraculously Unharmed

Bloomberg reports that if Chrysler fails to secure a deal with Fiat and rapidly exit Chapter 11, some 38,500 jobs could be lost in a liquidation. According to one of Chrysler’s lawyers, anyway. But an Automotive News [sub] story says that, in addition to Chrysler’s plant idling during bankruptcy, no fewer than eight of its factories will be permanently closed by December 2010. The best part? According to Chrysler sources, the proposed Fiat deal would allow ChryCo “to retain substantially all our employees.” Huh? “Any employee displaced by the bankruptcy will be given an opportunity at other Chrysler facilities,” explains spokeswoman Dianna Gutierrez. Not only did Chrysler deny that shutting eight plants would cause the negative impacts (job loss) that government billions were supposed to prevent, it went as far to suggest that the Fiat alliance would add about 5,000 employees to the payroll. In fact, if you believe the Pentastar line, there are only two victims in in the Chrysler plan: Sebring and Avenger.

LaSorda: Chrysler Tried to Hook-Up With Toyota. And Everyone Else.

No, really. The Detroit News reports that prior to its Chapter 11 filing, Chrysler sought to sell off parts of the company to everyone. “Chrysler sent letters to parties, primarily in China, whom we thought would be potentially interested in purchasing our assets,” writes ChryCo’s Tom LaSorda in a bankruptcy filing affidavit. “Over the next two months, several companies, including Beijing Automotive Industry Holding Co., Tempo International Group, Hawtai Automobiles, and Chery Automotive Co., expressed interest in purchasing specific vehicles, powertrains, intellectual property rights, distribution channels and automotive brands.” But guess what? Not even these ambitious firms were tempted to spend a dime on Chrysler’s alleged assets. And the major OEMs in the global auto game? Chrysler’s efforts to form alliances with Nissan, GM, Volkswagen, Tata Motors, Magna, GAZ, Hyundai, Honda and Toyota “have been determined and undertaken in good faith but have met uniformly without success,” admits LaSorda.

Chrysler C11: Cerberus Lost $7.4b, Daimler $37b

Bankruptcylitigationblog.com provides its readers—and there’s bound to be a whole new audience these days—with a ChryCo C11 crib sheet. The facts are predictably startling (if that makes any sense). The top 50 unsecured creditors’ claims total $730 million, with total trade at about $1.5 billion. The senior lenders’ claims total $6.9 billion. As you know, Chrysler owes the you, the people, $4 billion for your extremely generous bridge loans to nowhere (secured by a third priority lien). Chrysler owes Cerberus and Damiler AG $2 billion (secured by a second priority lien). Chrysler owes the United Auto Workers VEBA health care fund approximately $8.5 billion. Also highlighted: German automaker Daimler paid $37 billion for Chrysler when it purchased it in 1998. And lost it all. The “smartest guys in the room” (a.k.a. Cerberus) paid $7.4 billion for an 80 percent stake in Chrysler in May 2007. And lost it all. Checking the balance sheet, Chrysler has $52.6 billion in real liabilities, broken into the following categories: Trade and Related Payables ($5.7B), Accrued Expenses and Other Liabilities ($33B) and Financial Liabilities ($13.9B). The bloggers’ summary of the new plan after the jump.

U.S. Treasury Hearts Fiatsler

TTAC commentator and bankruptcy lawyer Toxicroach’s hits keep happening. This time, the member of our Best & Brightest sends us a filing by the US government ( download pdf here) in support of Fiatsler’s motion to extend its filing ( download pdf here).

Check out the Treasury motion in support. I think you will have a laugh a minute with that one. Then you will cry. The lease rejection—quick Google of some of the addresses . . . apparently, $60K a month gets you a Dodge dealership. They are dumping multiple car rental places and dealerships. Must be some pretty lame properties to get rejected on day one.

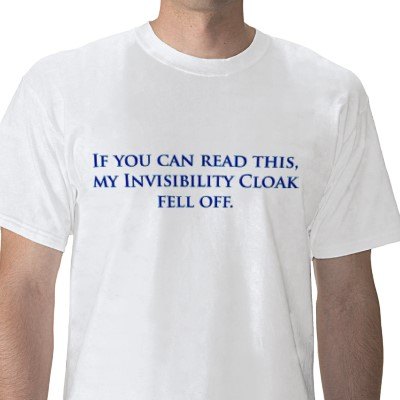

Chrysler Seeks Cloak of Invisibility

Chrysler: "An Indirect Wholly-owned Subsidiary of Fiat"

We have a new sub-series to our new series: the Toxicroach papers. Turns out our longtime member of the TTAC’s Best and Brightest is a bankruptcy lawyer with access to the Chrysler C11 filing. He’s going to present these documents for our edification with some “what’s it all about, Tony?” analysis. We begin with a motion from Chrysler ( download pdf here) to do what they should have done a decade or more ago: consolidate.

Check this out—the last half is mostly about them consolidating the 25 cases into one for the sake of efficiency, but the first half lays out in pretty decent detail exactly what the plan is.

Bailout Watch 517: Fiat CEO Sergio Marchionne's Official Statement On Chrysler Alliance

“This transaction represents a constructive and important solution to the problems that have plagued not just Chrysler in recent years, but the global automotive industry as a whole. Bringing together Fiat’s world-class technology, platforms and power-trains for small and medium sized cars, and its extensive distribution network in Latin America and Europe with Chrysler’s rich heritage, strong North American presence and talented and dedicated workforce will create a powerful new automotive company, while helping preserve jobs and a manufacturing industry that is critically important to the U.S. and Canadian economies.”

Presidential Task Force Shuns Non-TARP Chrysler Bondholders

“Chrysler’s bankruptcy,” according to President Obama’s statement today, “is not a sign of weakness.” The goal is not to radically restructure the business of a firm that has been failing for decades and currently makes some of the least desirable vehicles on the market. No, for Obama and his task force, this is about going after evil speculators. After lauding the noble sacrifices of the UAW (which will own 55 percent of New New Chrysler), JP Morgan (recipient of $25 billion in TARP funds) and Daimler (who raped Chrysler in the first place), Obama glowers at the mean, nasty speculators who are “forcing” Chrysler into bankruptcy. “In particular,” explains Obama, “a group of investment firms and hedge funds decided to hold out for the prospect of an unjustified taxpayer-funded bailout. They were hoping that everybody else would make sacrifices and they would have to make none. Some demanded twice the return that other lenders were getting. I don’t stand with them.” So who are these shadowy money men who just won’t let Chrysler run free of their oppressive debts?

Chrysler Restructuring Website Tells It Like It Is

GMAC to Get Fresh Bailout Bucks to Finance Chrysler Sales; ChryCo Finance Merger?

Why GM's Debt Swap Won't Work

GM’s major bondholders are asking for a 58 percent stake in a reconstituted General Motors, but there are a number of challenges facing any debt-swap to relieve GM’s crushing $28b debt load. First of all, the Freep reports that some $2.7 billion worth of GM debt is covered by credit-default swaps. Since this means that ten percent of GM’s bondholders stand to receive face value for their bonds, the odds that 90 percent of GM’s creditors will take up any haircut offer seem slim. Add a bunch of angry, populist small bondholders to the equation, and you have yet another obstacle to the restructuring goal.

GM Bondholders' Counteroffer: Give Us the Company, Then

Obama to Announce Chrysler C11 at Noon, EST

Chrysler Files for C11 Tomorrow; Obama Blames Bondholders

Bloomberg reports that not-entirely-unexpected news that President Obama will announce Chrysler’s bankruptcy tomorrow. The president will outline the automaker’s restructuring, along not-entirely-unexpected lines (known in these parts as “good” Chrysler / “bad” Chrysler). In other words, Uncle Sam is reconstituting ChryCo as a partnership between the United Auto Workers (55 percent), Fiat (20 percent) and you, the people (25 percent). And guess who gets to put in the $6b plus to make this happen? That’s right: you! But then you’ve already put in over $4b, so what the heck. Anyway, Chrysler buyers (both of them) shouldn’t worry that C11 will stop Auburn Hills in its tracks; you’re very generous. Automotive News [sub] reports that Chrysler will extend current consumer incentives (a.k.a. employee pricing plus) until Monday. Meanwhile, The Wall Street Journal reports that President Obama is laying the blame for Chrysler’s collapse right where it doesn’t belong: Chrysler bondholders.

GMAC In Peril

Earlier today, I wrote an editorial about the U.S. Treasury Department’s plan to “sell” Chrysler Financial to former GM captive lender GMAC. Motive: Chrysler could continue to function (under union control, no less). The lender could keep lending money to ChryCo dealers to buy ChryCo cars. Means: what are you kidding? Your tax money. Opportunity: none. Well, legally. Legally, a Chrysler Financial–GMAC merger would imperil the bank, in direct contradiction of FDIC rules. Of course, the fact that GMAC is a bank in the first place is a violation of federal rules. OK, not technically. Technically, the Fed bent the rules for GMAC to qualify for bank status at the 11th hour, behind closed doors, screwing over recalcitrant debt holders but good. So anyway, I called the ChryCo Financial–GMAC merger a clusterfuck. (I know: I should stop sugar coating my analysis.) Turns out I had no idea how bad things are over at GMAC. But CNNMoney does . . .

GM Declares War on GM Dealers

As part of Viability Plan III, GM announced its intention to close 42 percent of its bloated dealer network, reducing the number of stores to 3,600. That’s a cut of 2,600 dealers. Our take on that part of that part of the new new new new new new new new turnaround plan: a Mandarkian laugh. American car dealers are covered by 50 states worth of franchise laws; politicians don’t get elected without the support of their local or state dealers’ council. Any dealer cull would have to wait for a bankruptcy judge. Nuff said? Apparently not. Wards’ Dealer Business reports that The General is laying the groundwork for an anti-dealer jihad, regardless of the “niceties” of C11.

Motor Trend/Automobile Publisher Files for Bankruptcy

Bloomberg reports that Source Interlink has gone Tango Uniform. You may know Source Interlink as the publisher of Motor Trend, Automobile and [a claimed] 73 other publications. Not to mention [a claimed] 90 websites. Like the formerly octo-branded GM, Source Interlink simply bit off more than it could chew—and then discovered there wasn’t enough to eat. “The company listed debt of $1.9 billion and assets of $2.4 billion . . . US magazine advertising revenue in the first quarter fell 20 percent from a year earlier, according to the Publisher’s Information Bureau, an industry group. US auto sales tumbled 37 percent in March. Source Interlink hasn’t reported a profit since the second quarter of 2007.” This after spending $1.2 billion to buy a package of titles from PrimeMedia in 2007. As for the future . . .

Daimler Pays $2.3 Billion to Jettison 19.9% of Chrysler

When the historians chronicle Detroit’s decline and fall, Daimler’s rape and pillage of the storied American car brand will merit an entire tome. In short form, the Germans came, they saw, they laughed, they lunched, they left. And when they left, they maintained a 19.9 percent share in the hollowed-out American automaker. Wishful thinking? Tax law? A codicil from Cerberus to allow Chrysler’s new masters to sue the shit out of the Germans if things went badly? In any case, thanks to The Presidential Task Force on Automobiles determination to reconstitute Chrysler as a worker’s co-op, by Friday, Daimler gets to see Chrysler implode from afar. [NB: So much for the “The Big 2.8”.] Bloomberg reports that Daimler will “cede” its remaining its stake in “former U.S. division” (ouch) to Cerberus Capital Management LP. More to the point, the “transaction” will result in a $700 million write down in the second quarter. Oh, and Daimler will “forgive” $1.3 to $1.7 billion worth of “loans” to Chrysler. And “contribute” $600 million to the US automaker’s pension plans over the next three years. Meanwhile, Daimler’s own haus is on fire . . .

UAW To Own Chrysler

According to Automotive News [sub], the United Auto Workers (UAW) agreement with Chrysler/Fiat would deliver unto the union a 55 percent share of the reborn Italian – American automaker. As in the proposed (but doomed) GM bondholder offer, ChryCo union workers will forego a multi-billion dollar payment into their Voluntary Employment Beneficiary Association (VEBA) health care fund in exchange for the equity stake. In Chrysler’s case, $6 billion buys them controlling interest in Chrysler. That’s all kind of nuts on all kinds of levels. And as we’re in tail wagging the dog territory . . .

GM Employee Stock Fund Dumps All Company Shares

Late last Friday, GM revealed in a regulatory filing with the Securities and Exchange Commission that its employee stock fund manager, State Street Bank and Trust Co., has unloaded all company shares. According to the Associated Press (AP), “The plan’s financial manager said it began selling off shares of the Detroit automaker in late March ‘due to the economic climate and the circumstances surrounding GM’s business.'” This may help to explain the dead cat bounce GM’s stock experienced today.

GM's Do-or-Die (Mostly Die) $27 Billion Debt Exchange

GM Kills Pontiac, HUMMER, Saab and Saturn

GM has released its press release releasing [both] remaining fans of the Pontiac brand from the suspense surrounding its untimely (as in late) demise. “As part of the revised Viability Plan and the need to move faster and further, GM in the U.S. will focus its resources on four core brands, Chevrolet, Cadillac, Buick and GMC. The Pontiac brand will be phased out by the end of 2010. GM will offer a total of 34 nameplates in 2010, a reduction of 29 percent from 48 nameplates in 2008, reflecting both the reduction in brands and continued emphasis on fewer and stronger entries. This four-brand strategy will enable GM to better focus its new product development programs and provide more competitive levels of market support.” Buick? “The revised plan moves up the resolution of Saab, Saturn, and Hummer to the end of 2009, at the latest.” GM CEO Fritz Henderson put a brave face on the news, ’cause that’s who he is and what he does.

Chrysler Reaches Some Sort of Tentative Agreement With UAW

“The UAW said it reached a deal with Fiat and the U.S. government.” Oops! I forgot the word “also”. I wonder how that happened. Because everyone knows Chrysler’s management is large and in charge, despite the fact that its existence depends entirely on the largesse of the American taxpayer and the success of a cockamamie scheme hatched by a struggling Italian automaker and an unelected quango known as The Presidential Task Force on Automobiles. The Detroit News provides the details of the agreement, which show that the UAW—wait . . . No they don’t. Motown’s hometown paper doesn’t provide any details of the union – Chrysler – Fiat – PTFOA agreement. All we get is this: “The settlement agreement, subject to ratification by UAW members at Chrysler, includes a revision of the 2007 health care deal, and members must approve the deal by Wednesday.” At best, we can assume some sort of health care obligation for equity swap involved. At worst, Uncle Sam will guarantee the union’s health care provisions, regardless of Chrysler’s ultimate fate (i.e., liquidation.) As the DetN recognizes, whatever the fine print, the union deal paves the way for American Leyland.

Ford Drops $1.4 Billion in Q1; Faces "Rabbit in a Python" Problem

You may have noticed that TTAC hasn’t joined the MSM’s celebration of Ford’s Q1 financial report. While FoMoCo didn’t lose as much money as analysts predicted—“only” dropping $1.4 billion in Q1—danger lurks around every corner. For one thing, the “it wasn’t as bad as everyone expected” rejoicing represents exactly the same logic GM deployed as it slouched towards Bethlehem. Look how well that turned out. For another, as we also pointed out during GM’s Long March to C11, you can’t cut your way to profits. At some point, Ford’s going to have to build something the North American car market really really wants. The forthcoming Transit van, turbo’ed Taurus, Fusion, etc. ain’t it. Fiesta? I wouldn’t don those sombreros just yet.

CAW: PTFOA to Create "Good" and "Bad" Chrysler

Buried in the Detroit Free Press story trumpeting the Canadian Auto Workers’ latest agreement with Chrysler: news that the Presidential Task Force on Automobiles (PTFOA) plans to split the zombie automaker into two.

“We’re living to fight another day,” [CAW Boss Ken] Lewenza said. “But the fear and uncertainty is not over. Not by a long shot.” Specifically, he said representatives of Chrysler and Fiat told him that if Chrysler files for Chapter 11 bankruptcy protection next week, the company will be split into “a good company and a bad company. And the bad company would be sold off.”

GM: "Delphi Could Force GM Into an Uncontrolled Shutdown"

Ah, Delphi. I remember predicting—what, two years ago?—that parts maker Delphi’s collapse would drag GM into bankruptcy. Well, just as GM is falling into C11 on its own accord (so to speak), it seems the ghost of subdivisions past are about to . . . drag GM into bankruptcy. The Detroit News reports that GM’s sent up an emergency flare. “In light of adverse developments in the industry, at GM and at Delphi, GM has been in negotiations with Delphi and its lenders to arrive at solutions that would ensure GM’s source of supply under fair and reasonable terms,” GM said in a statement today. “While GM has proposed a potential solution that would allow for the successful and rapid resolution of Delphi’s bankruptcy case, its lenders have rejected this proposal.”

Chrysler To Declare Bankruptcy Next Week?

Unnamed sources tell the New York Times that the Treasury has agreed “in principle” to protect UAW pensions and retiree health care when Chrysler files for C11 “as soon as next week.” Protect with what? Fifty percent new Chrysler stock and 50 percent new Chrysler profits. Or, uh, more Treasury money. Fiat, say the sources, will “complete its alliance” with (i.e., pick the carcass of) Chrysler during bankruptcy. The only loose thread for the sources who “were not authorized to discuss the case,” is the bondholder brigade which recently turned down the Treasury’s haircut offer. Which leads one to believe that this revelation comes from someone negotiating opposite Chrysler’s bondholders (the Treasury) as a none-to-subtle bargaining gambit. Jump, or we file.

Recent Comments