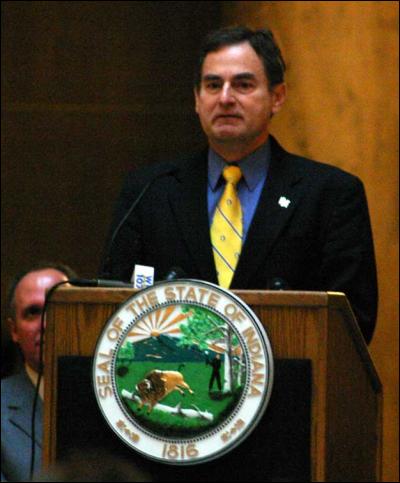

Chrysler Sale Appealed By Indiana Treasurer

According to Automotive News [sub], the Second Circuit Court of Appeals has granted a stay of Chrysler’s asset sale, pending a hearing scheduled for Friday. The stay comes on a motion ( PDF) filed by the Treasurer of Indiana, Richard Mourdock (motivation found here) on behalf of several Indiana funds which hold first-lien secured Chrysler debt. A panel consisting of Chief Judge Dennis Jacobs, Judge Amalya Kearse and Judge Robert Sack will hear Mr Mourdock’s appeal on at 2pm Friday, delaying the Chrysler asset sale which has already been approved by Chrysler’s judge Arthur Gonzalez. If the appeal delays the asset sale past June 15, Fiat could walk away. The appeal follows the arguments of earlier “hedge fund holdouts,” making the case that government is overturning bankruptcy law and screwing secured bondholders to move the UAW to the front of the line. Only the state of Indiana apparently isn’t scared of the alleged government strong-arming that squelched previous bondholder opposition. Hit the jump for selected quotes from their appeal.

“In their Sales Motion, the Debtors seek authority to sell substantially all such collateral, and to distribute the proceeds of such collateral to, among others, unsecured creditors, primarily trade creditors and the UAW. Following such proposed sale and distribution, there will be nothing substantive left in this case. Indeed, the government has repeatedly stated its objective of reorganizing Chrysler within a 30-day time period. To do so, the government needed to avoid the requirements of Chapter 11. The government has done exactly that, by seeking approval of a sub rosa plan without following any of the required procedures for confirmation.”

“The Indiana Pensioners are holders of first priority secured claims. Their claims arise out of nearly $10 billion of loans taken in 2007. These loans financed the purchase of the company, and were hailed at the time for

“Even though the cases were filed under chapter 11 of the Bankruptcy Code, it is very clear that the Debtors have no intention (or even possibility) of reorganizing these estates. Instead, the Debtors have filed the Sale Motion seeking approval to sell substantially all of their assets, free and clear of liens, to a newly formed company created for the

“In particular, the VEBA trust (which has an unsecured claim of approximately $10 billion), will receive a new note with a value of $4.5 billion as well as 55% of the equity interest in New Chrysler. (Hr’g Tr. 234:3-235:6) Fiat, one of the Debtors’ foreign competitors, is slated to receive 20% of New Chrysler (with the right to acquire a total of 51%)

“The Debtors abdicated… critical management decisions to the Treasury Department, whose only legally cognizable interest in these cases is that of a third-lien lender.”

“The President branded those Senior Secured Lenders with fiduciary duties to their own investors as “speculators” who were unwilling to make ‘sacrifices.’ He accused these lenders of refusing to compromise and instead seeking ‘an unjustified taxpayer-funded bailout.’ This was not true. First, the Senior Secured Lenders not accepting the unfair deal are not ‘speculators.’ They invested in first-lien secured debt, which is (or at least should be) a conservative investment. Second, certain of the Senior Secured Lenders did offer to compromise. They offered to accept a 50% reduction of their debt, even though they might receive a better recovery in chapter 7 liquidation. Their offer was in stark contrast to other Chrysler stakeholders, whose ‘compromise’ will enable them to receive a much larger recovery then they are entitled to receive under the Bankruptcy Code. Finally, the Indiana Pensioners have never sought a government bailout. Indeed, they are among the few Chrysler stakeholders that can make that statement. Unlike Chrysler and the TARP banks, who accepted billions of taxpayer dollars, the Indiana Pensioners have never received a dime of bailout money from the government. To the contrary, it was the government that was taking from them. Under the government’s plan, billions of dollars of collateral belonging to the Senior Secured Lenders will

The big question now: do appeals courts understand irony?

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SCE to AUX My B5.5 was terrible, but maybe the bugs have been worked out of this one.

- Zerofoo 5-valve 1.8T - and OK engine if you aren't in a hurry. These turbocharged engines had lots of lag - and the automatic transmission didn't help.Count on putting a timing belt on this immediately. The timing belt service interval, officially, was 100,000 miles and many didn't make it to that.

- Daniel J 19 inch wheels on an Elantra? Jeebus. I have 19s on my Mazda 6 and honestly wish they were 18s. I mean, I just picked up 4 tires at over 1000 bucks. The point of an Elantra is for it to be cheap. Put some 17s on it.

- ToolGuy 9 miles a day for 20 years. You didn't drive it, why should I? 😉

- Brian Uchida Laguna Seca, corkscrew, (drying track off in rental car prior to Superbike test session), at speed - turn 9 big Willow Springs racing a motorcycle,- at greater speed (but riding shotgun) - The Carrousel at Sears Point in a 1981 PA9 Osella 2 litre FIA racer with Eddie Lawson at the wheel! (apologies for not being brief!)

Comments

Join the conversation

@Pch101 : June 4th, 2009 at 4:40 pm "All I am pointing out is that (a) your leadership in Indy is trying to use this to blow smoke and evade responsibility and (b) it would serve the interests of the local voters to figure out why and how this was screwed up so badly...." I understood those points several posts ago, as far as I know at least with some of the folks I know people are asking questions and asking for this stuff to be looked into. It will happen I'm sure, the others aren't home free either yet but I think it's wrong to suggest we shouldn't try to recover what belongs to us and just take it in the backside when we feel we are being done wrong. Or that we are motivated by hate for doing so.