TTAC News Round-up: Volkswagen Finished Second in China, Big Trouble for Takata, and Apple's Longtime Car Guy Gone

Volkswagen’s chief in China says they’re probably not retaking the crown from General Motors there anytime soon.

That, Apple’s lead car guy is gone, Takata’s in trouble and more … after the break!

Spyker Emerges From Bankruptcy Charged With Enthusiasm

Spyker — the former Saab owner, F1 contender, and builder of aircraft-inspired supercars — has emerged from moratorium and plans to merge with Portland, Oregon electric aircraft manufacturer Volta Volare, said the company in a release on Thursday.

As part of Spyker’s future plans, electrification seems to be the common theme, whether it be for airplanes or automobiles. Now silver-tongued Skyper CEO, Victor Muller, only needs to find an electric train company to complete the set for a modern movie remake.

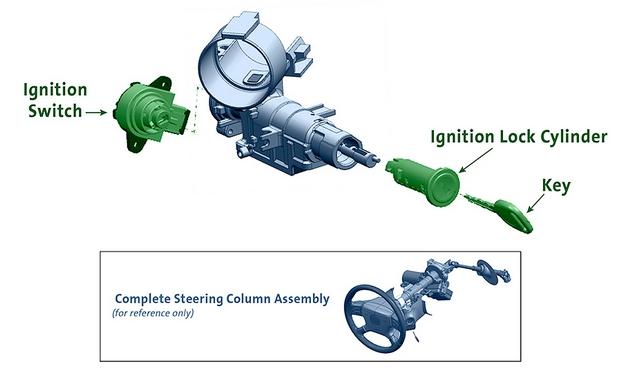

Dealers Still Waiting For Replacements, DeGiorgio Linked To Original Design And Upgrade

Automotive News reports dealers are still waiting for the ignition switches meant to replace the out-of-spec switch at the center of the ongoing recall crisis at General Motors. The switch was to have arrived at dealerships beginning this week, yet most dealers are in a “holding pattern” on deliveries. Once the parts do arrive, service bays will begin work on affected customer vehicles immediately before turning toward the used lot, where vehicles under the recall are currently parked until the customer vehicles are fixed.

NHTSA Asked To Investigate Impala Airbags, GM May Compensate Recall Victims

Bloomberg reports the Center for Auto Safety, citing a government petition from former General Motors researcher Donald Friedman, is asking the National Highway Traffic Safety Administration to open a defect investigation into 2003 – 2010 Chevrolet Impalas over a glitch in the car’s software that could “misread a passenger’s weight,” preventing frontal airbags from deploying. The agency has 143 records of fatalities linked to failed airbags in the Impala, 98 of which noted the occupants were wearing seat belts at time of death.

The request reflects growing concern over the algorithms used in advanced airbags, designed to meet strengthened U.S. regulations in 2003 after previous airbags were found in 300 cases to prove fatal to small adults and children due to excessive force upon deployment, and where improvements could be made.

GM Recalls 1.3 Million Additional Vehicles As Barra Heads To D.C.

The Detroit News reports General Motors CEO Mary Barra boarded a commercial flight from Detroit to Washington, D.C. Sunday in order to prepare for two separate hearings before Congress regarding her company’s handling of the ongoing 2014 recall crisis. While in the nation’s capital, she also met with 25 family members whose relatives were killed in crashes linked to the ignition switch behind the recall.

Congressional Hearings Loom As Switch Swap Raises Questions At GM

General Motors is facing two separate lawsuits related to failures of the ignition switch recalled last month, while also preparing to bring their case before the U.S. House Energy and Commerce Committee next month, led by a representative who honed his skills upon Firestone.

Meanwhile, reports of a quiet swap between the defective ignition switch and an improved switch in 2006 – a swap that may have violated internal protocols -may have serious repercussions for GM and now-bankrupt supplier Delphi.

Finally, a test drive gone wrong results in a GMC Yukon left to burn, whose prompt investigation is only the beginning of a long learning process in how GM handles safety in the future.

Delaware Bankruptcy Judge Approves Sale Of Fisker Automotive to China's Wanxiang

Last week, Rueters reported that Wanxiang, a Chinese parts supplier, had won the bankruptcy auction for Fisker Automotive. The bid was valued around $149.2 million. The deal comes to close after a bidding war between Wanxiang and Hybrid LLC — a group who includes Richard Li, a Fisker investor and Hong Kong billionaire. In November, Fisker asked for Hybrid Technology LLC to purchase the bankrupt company for $25 million, but creditors objected the deal in November and brought Wanxiang into the case in December.

Today Delaware, U.S. Bankruptcy Judge Kevin Gross approved of the sale to Wanxiang. He stated that the auction “shows that a fair process is a good thing.”

Fisker Files For Chapter 11 Bankruptcy

What do Justin Bieber, Ashton Kutcher and Al Gore all have in common? They may soon — baring a miracle — become the proud owners of the first orphan cars made in the 21st century for well-moneyed consumers by an automaker born in the 21st century, as Fisker Automotive has filed for Chapter 11 bankruptcy protection.

Fitch: GM Not To Go Bust Anytime Soon

While there is renewed chatter about a renewed GM bankruptcy, ratings agency Fitch thinks otherwise. The agency that assesses the chances of defaults by companies and countries raised GM’s default rating from BB to BB+, which is once notch below investment grade.

Hot Off The Presses: Youngman Might Also Sue GM Over Saab

Bringing suit against GM for not letting Saab live another day could be turning into a popular sport. Lars Holmqvist, former head of Europe’s automotive supplier body CLEPA, and as such an insider when it comes to the latest Saab dirt, says that spurned Youngman of China is also thinking of suing GM.

General Motors Canada Pension Plan Faces $2.2 Billion Deficit

Even after Canadian taxpayers contributed $3.2 billion (Canadian) to General Motors’ pension fund after GM’s bankruptcy proceedings in 2009, the company’s pension fund for unionized employees is still short $2.2 billion – a fair amount for a plan that’s responsible for 30,000 employees.

Saab NA Chapter 11: It's A Matter Of Perspective

A group of 41 Saab U.S. dealers today petitioned a U.S. Bankruptcy Court to put Saab Cars North America into involuntary Chapter 11 bankruptcy protection, Automotive News [sub] reports. Last Friday, the dealers had threatened to file a Chapter 7 for involuntary liquidation, but changed their minds. Leonard Bellavia, a lawyer representing most of Saab’s U.S. dealers, explains:

Our Daily Saab: A New Administrator, A New Deal, Same Old, Same Old

After enduring a rocky relationship with Saab’s management, Guy Lofalk is officially out as court-appointed administrator for the ailing Swedish brand. But although Saab boss Victor Muller had long hoped for Lofalk’s ouster, the news wasn’t all good for his slow-motion “rescue,” as Lofalk’s first replacement had to step down before he even began his duties. Reuters calls the abortive administratorship of Lars-Henrik Andersson Saab’s “latest embarrassment,” but TTELA reports that Andersson’s “defection [was] not based on a pessimistic assessment of Saab.” On the other hand, at least one of Andersson’s colleagues thinks he dropped out because Saab is “screwed.”

In any case Soderqvist seems to be the last remaining Saabtimist in Sweden, insisting he believes in the new plan to save the zombie brand, and he will serve as long as he continues to have faith… so what’s the new plan anyway?

Our Daily Saab: Chapter 11 In The UK. Swedish Unions Going For The Kill

Saab’s supposed saviors in China have not sent any money (not that this is surprising). Saab’s other savior Vladimir Antonov is out on bail, had to surrender his passport and report with the coppers in West London three times a week. Which adds new revs on Saab swirling down the drain.

Saab Officially Gives A Thumbs Up To GM Facebook Squatters

For more than two weeks, Saabhuggers have taken over GM’s Facebook page, plastering “Let Saab go!” all over the site. Yesterday, the occupation has been officially endorsed by Saab.

GM sources which requested anonymity, citing possible legal implications, mentioned to TTAC that the attacks have “all signs of a coordinated campaign.” That is putting it mildly.

Our Daily Saab: No Salaries (Blame The Chinese). And A Duncecap For Saabsunited

It has become a tradition at the „iconic” Saab: For the sixth month in a row, former carmaker Saab can’t make payroll. Saab employees did read the familiar note on their website today that salaries are “delayed.” Their head of HR, Johan Formgren, told them that sadly, he cannot “confirm any exact date when the salaries will be paid.” Saab spokesman Eric Geers told the media that he also does not know when wages will be paid. And who is to blame? Victor Muller? Fugitive Valdimir Antonov? All-around-whipping post GM?

No way. It’s the Chinese.

In a text message cited by Göteborg Expressen, Victor Muller writes:

Our Daily Saab: With Plans Expired And Dealers Waiting On Cash, GM Takes The Wheel

Saab’s Memorandum of Understanding with PangDa and Youngman expired today, returning Saab to what must by now be a rather comforting, familiar state of limbo. Of course, the MoU in question was already dead, as GM had publicly nixed it, saying it wouldn’t supply parts or license technology to a 100% Chinese-owned Saab. But now, without an official agreement to rally around, Swedish Automobile, PangDa and Youngman are desperately pitching new ownership structures to GM in hopes of approval. Swedish Auto’s Victor Muller tells the WSJ [sub]

We are submitting an information package to GM and we will have to await the feedback that GM has on that package and then we’ll know.

Muller says the lesson of the failed MoU is that GM won’t accept Chinese control, and as a result the new proposed ownership structure is “very carefully crafted” so that none of the three partners has complete control. But since the previous deal, in which PangDa and Youngman would split a 54% stake in Saab, is also off the table, it’s tough to say what Muller’s “carefully crafted structure” entails. And while Saab and its Chinese suitors wait for GM approval that may never come (but don’t tell Keith Crain [sub] that!), it seems both time and money are getting tight. Again. Still.

Our Daily Saab: SWAN Examines The Endgame Options

With Saab’s latest MOU with PangDa and Youngman expiring on Tuesday, the heat is on for parent company Swedish Automobile (SWAN) to hash out the many problems and disagreements between GM and the proposed Chinese buyers. And now that it’s fairly obvious that a deal won’t happen, as GM and the Chinese Government seem fairly well set against it, the question is “what next?” How do you plan an endgame that should have been initiated months, if not years ago? That’s the challenge being considered by the few remaining shareholders in SWAN, who are meeting in Holland to pick through the none-too appealing options.

Our Daily Saab: TTAC On Swedish Radio

Lyssna: Kinesiskt ja kan tvinga fram ett godkännande

“We will try to get clarity about what the decision from GM means and if there is any way ahead,” court-appointed administrator Guy Lofalk told Reuters. “I hope that I will know more before the end of the week.”

For the time being, Lofalk will not recommend to the court to end the bankruptcy protection process. He said it could happen though.

On Monday, GM said they would yank all licenses and oppose the deal if Saab would be sold 100 percent to China’s Pangda and Youngman.

Both Victor Muller and his mouthpiece Saabsunited now say they knew that all along.

We are in rare agreement on that. Last Friday, Sweden’s national publicly funded radio broadcaster Sverigesradio reached me and asked what I think of the deal.

GM Issues Death Sentence To Saab Deal With China

While the flagwavers at Saabsunited wallow in the good news that the Swedish king announced at an annual moose hunt near Trollhättan that Victor Muller is a great guy, far away in Detroit, GM spokesman Jim Cain issued to Reuters what sounds like the death sentence to the sale of Saab to China’s Youngman and Pangda:

“GM would not be able to support a change in the ownership of Saab which could negatively impact GM’s existing relationships in China or otherwise adversely affect GM’s interests worldwide.”

The exactly same statement was sent to the Wall Street Journal, and GM will send it to anyone who asks what GM thinks of the deal. If Muller would have asked before announcing the sale, he most likely would have received the same answer.

Translation:

Our Daily Saab: Saab Lives Another Day, Waits For Chinese Money

Today, Saab creditors met in a packed-beyond capacity courtroom on Vänersborg. After a short deliberation, the district court approved the reorganization plan, Göteborg’s Posten reports. It will cost 500 jobs in Trollhättan. On Friday, China’s Youngman and Pangda had agreed to take over Saab 100 percent – in a Memorandum of Understanding, which isn’t worth much, and which is littered with caveats.

The reorganization plan, ( full text here), was feted in a lengthy press release. It starts like this:

Our Daily Saab: Saab "Saved" As 100% Chinese Firm… Pending Those Pesky Approvals

On the last possible day to work out a deal before being forced into bankruptcy, the Victor Muller era has ended at Saab. The Swedish brand will now become a completely Chinese-owned company… if all goes to plan. A press release explains

Swedish Automobile N.V. (Swan) announces that it entered into a memorandum of understanding with Pang Da and Youngman for the sale and purchase of 100% of the shares of Saab Automobile AB (Saab Automobile) and Saab Great Britain Ltd. (Saab GB) for a consideration of EUR 100 million…

…The administrator in Saab Automobile’s voluntary reorganisation, Mr. Guy Lofalk, has withdrawn his application to exit reorganisation. The MOU is valid until November 15 of this year, provided Saab Automobile stays in reorganisation.

But remember, this is Saab… and its fate rests in the hands of many, many people not named Victor Muller. Despite the air of finality that is surrounding some of the media coverage of this latest announcement, this is not a done deal. The Saab saga rolls on…

Our Daily Saab: Pang Da And Youngman Bail After Muller Rejects Buyout

With a Halloween deadline to get its restructuring back on track looming, Swedish Automobile has rejected an offer by Youngman and Pang Da to buy 100% of Saab’s shares. Moreover, the struggling Swedish brand has canceled the existing agreement with Youngman and Pang Da, its erstwhile would-be rescuers. A Saab presser notes:

Today, Swedish Automobile N.V. (Swan) announced that it has given notice of termination with immediate effect of the Subscription Agreement of July, 2011 entered into by Swan, Pang Da and Youngman.

Swan took this step in view of the fact that Pang Da and Youngman failed to confirm their commitment to the Subscription Agreement and the transactions on the agreed terms contemplated thereby as well as to explicit and binding agreements made on October 13, 2011 related to providing bridge funding to Saab Automobile AB (Saab Automobile) while in reorganization under Swedish law.

Pang Da and Youngman have presented Swan on October 19 and 22 with certain conditional offers for an alternative transaction for the purchase of 100 percent of the shares in Saab Automobile which are unacceptable to Swan. However, discussions between the parties are ongoing

Quote Of The Day "Bankruptcy Is No Option For Saab" Edition

Lyssna: Saabs vd, Victor Muller, om företagets situation

Whenever a CEO says “bankruptcy is not an option,” you know the game is up. After complaining in this Swedish Radio interview (in English) that his court-appointed administrator is trying to sell Saab off wholesale to the Chinese, Victor Muller trots out Churchillian and Nietszchian calls to arms… in fact, he does everything short of bursting into a spirited rendition of “I Will Survive.” Unfortunately, Muller’s credibility is long gone, and he doesn’t help himself by trying to portray Lofalk as some traitorous backstabber. With Saab months (years? decades?) into its death-flails, and the most recent “rescuer” turning out to be a non-player, is it any wonder Lofalk wants to hand over the mess to the only viable companies involved (especially when Muller calls North Street a “strong partner”)? Muller continues to labor under two basic delusions: first, that he can sell a majority share to the Chinese while keeping Saab an essentially Swedish (or at least European) company and second, that anyone cares whether Saab becomes a Chinese company. Sorry Victor, there’s just nothing left here to fight for…

Our Daily Saab: This Man Gives His Last Shirt To Save Saab

The man in the weineresque photograph is Alex Mascioli, head of North Street Capital in Greenwich, Conn. Supposedly, he will come up with $70 million by this weekend to save Saab form the abyss once more. Not much is known about the man – Wait, I take that back.

Our Daily Saab: Lofalk To Request Mercy Killing, Saab To Request Lofalk's Ouster

Guy Lofalk, the administrator of Saab’s reorganization, will ask the court in Vänersborg to terminate the reorganization process. Before, Saab expressed “ doubts that the bridge funding of Youngman and Pang Da, of which a partial payment has been received, shall be paid in full on 22 October 2011.” Finally something we can agree on.

What happens if the court accepts Lofalk’s recommendation? Stockholm News explains it:

Our Daily Saab: Youngman Prolongs The Agony, As "Criminal Consequences" Loom

Death with Dignity apparently does not exist in Victor Muller’s vocabulary, as Reuters reports that the CEO of Saab’s parent company will receive loans from prospective investor Youngman in order to ward off liquidation in Swedish bankruptcy court. Youngman has committed some $97m in bridge loan financing to the troubled Swedish automaker, of which Saab has received $15m so far and will receive more payments this week in order to pay salaries and other expenses. Saab spokeswoman Gunilla Gustavs explains

“We are putting bridge financing in place so we can fund business during the reorganisation — so we don’t incur new debt. We have running costs, such as electricity, that we need to take care of. There are a number of business-critical operations that need to be funded”

Saab’s salaries are currently guaranteed by the Swedish government as part of Saab’s bankruptcy protection, but that guarantee expires on October 21, just before October salaries are due. Missing that payment would likely have spelled the end of Saab, but with Youngman’s money arriving in dribs and drabs it seems that we may be documenting the firm’s undignified collapse for another month or so.

Our Daily Saab: Do Not Resuscitate Order Rescinded

Saab is on court ordered life support. On appeal, the Court of Appeals for Western Sweden has approved Saab’s request for protection from creditors. Saab can now attempt a business reconstruction without the threat of imminent bankruptcy, The Local reports.

Our Daily Saab: A Very Iffy Situation

Writing these Saab stories is becoming as much fun as visiting a fading relative in a hospice: You have to do it, but you want to get it behind you, quickly. Today is the day a court in Sweden will decide whether it admits Saab’s appeal of a prior court decision that would have forced the Swedes into bankruptcy. In the meantime, Victor Muller came up with another plan.

Our Daily Saab: Could Be Done By Tuesday

That’s not us making the prediction. Stockholm News says that “Saab’s fate could be decided on Tuesday.” On Monday, the Court of Appeals will meet and will deliberate whether Saab will be allowed to appeal the District Court’s denial of a reconstruction.

Stockholm News does not expect a decision until Tuesday. But it predicts:

Our Daily Saab: Bankruptcy Filing And A Hat Trick

The white-collar unions Unionen and Ledarna filed bankruptcy petitions today against Saab, everybody from Associated Press to inside.saab reports. On the same day, Saab announced that it had licensed its PhoeniX architecture to China’s Youngman at firesale prices – a move that could possibly buy another month or two. But first things first:

Victor Muller Plays Maharajah While Suppliers Go Belly-Up

Whenever we report about the machinations around Saab, the faithful remind us that there are real people affected. They are right. Some of the real people work for IAC for instance, one of Saab’s largest suppliers. Half of the production of its factory in Färgelanda went to Saab.IAC Sweden could be bankrupt in a few weeks because they don’t’ have the money to pay a 95 million kronor ($ 14.8 million) tax bill, Sweden’s Göteborg Posten reports.

Bertel Schmitt Fired From TTAC - Saab Saved

This was the headline many Saab aficionados were looking for (and we have the emails to prove it.) On Saab’s darkest day, we might as well put a smile on the faces of Saab’s most militant missionaries – even if the smile lasts only a few seconds.

Two days ago, Saab filed for court protection – the Swedish variant of Chapter 11. That must be approved by the court – and today, the court denied it. Says the Wall Street Journal:

Saab Files For Court Protection - Everything is Beautiful

Yesterday, Sweden’s Dagens Industri reported that Saab would seek court protection today. We did not report it, because honestly, we are tired of the story. On the other hand, there were signs that things are heading to the court: Saabsunited tried its hand again on amateur spin and wrote that bankruptcy, should it happen, wouldn’t be all that bad: “It does NOT mean that SAAB is in any way dead tomorrow!” Glad this is cleared up.

This morning, employees of Saab were woken from sleep (they’ve become used to sleeping in since April) and called for an all hands meeting at 12 noon. At the meeting, they heard:

Saab "Close" To $157m Bridge Loan, Situation "Dire"

Bloomberg [via the Financial Post] reports that “one of the five biggest European banks” is “close” to loaning Saab $157m so that it may pay workers and suppliers, in order to move towards restarting production. According to DI.se, the deal is predicated on Saab securitizing the loan with shares of Saab Great Britain or other “alternative assets.” But apparently whatever the banks ask for, Saab will try to give, as Theodoor Gilissen Bankiers analyst Tom Muller explains

They need the money immediately. I hope they solve it this week, otherwise I think it’s over for Saab. It’s a very dire situation.

He’s not kidding…

Saab Refuses To Confirm (Or Rule Out) Court-Protected Reorganization

Swedish radio cites an unnamed source close to Saab as saying the troubled automaker was preparing to file for court-protected reorganization, as it struggles to pay workers and restart production. Under that scenario, Sweden would pay worker salaries while reorganization takes place. But at the company’s official mouthpiece, inside.saab.com, a press release refuses to deny or rule out that Saab has chosen this route. The release reads:

Swedish Automobile N.V. (Swan) is aware of certain reports in Swedish media related to a possible filing by Saab Automobile AB (Saab Automobile) for a voluntary reorganization under Swedish law.

Swan confirms its earlier announcements that it is in discussions with several parties to secure the short and medium term funding of Saab Automobile to restart and sustain production. In order to secure the continuity of Saab Automobile, Swan and Saab Automobile are evaluating all available options. Swan will update the market in case of new developments.

This non-denial might be read as a confirmation that Saab is considering filing for court protection, but hasn’t yet decided on that course of action. Meanwhile, Saab has delayed its latest financial report, and its online PR rep continues to blame the media for concluding that because Saab can’t sell cars, pay suppliers, restart production or even pay salaries on time it’s destined for bankruptcy court.

Saab Unions: Bankruptcy Two Weeks Away If Pay Is Delayed (And It Will Be)

Saab has already warned its workers that paychecks due tomorrow could be delayed until “committed” funds from investors arrive, but Bloomberg reports that the warning may not be enough. According to the report

Any delay in the August payments will prompt the unions immediately to start a process aimed at ensuring state coverage of wages in the event of the carmaker’s failure, officials from the IF Metall and Unionen labor groups said. The unions, after gaining employees’ backing, would first file payment requests with Saab. If salaries remain unpaid in seven days, the unions may then ask a district court to declare Saab bankrupt.

That could put Saab into bankruptcy in as little as two weeks. Saab’s long nightmare seems to be drawing to a close.

With Less Than $1m In The Bank, Saab Hits Up The Wall Street Loan Sharks

I know I’ve said this several times before, but the end really is near for Saab. The WSJ [sub] reports that Sweden’s Debt Enforcement Agency began auditing Saab’s finances after several debts came due earlier this week, and found only 5.1 Kroner ($796,291) in its Skandinaviska Enskilda Banken account. That’s barely enough to cover the 5.06m Kroner in debts that came due this week alone… and Saab’s total outstanding debt is ten times that amount, around 50m Kroner. And as if the financial trouble weren’t dire enough, key stakeholders are abandoning Saab in embarrassment, like Benny Holmgren, one of Sweden’s largest car dealers. Holmgren tells SvD.se that his contract to sell Saabs has expired and that he won’t renew, explaining

“For me, it is important to be proud of the brands that we have in our halls. Saab does not deliver cars they promised, they do not pay wages to their employees, nor debts to their suppliers while the owners pick out big money. It does not feel right for a [my] car dealers.”

But among the hardcore Saab faithful, today is not a day of sorrowful resignation… but a day of totally overblown and unrealistic hope for their dying brand. Yes, really…

Saab Board Pay Bump Sparks Union Anger

With debt collectors closing in on all sides, Saab’s shaky PR took another hit today as the Swedish media repotred that members of the board of Swedish Automobile (SWAN), Saab’s parent company, received pay increases of some 633 percent over 2010. Thelocal.se reports that

New chairman of the board, Hans Hugenholtz, received a raise of 633 percent, from 147,150 kronor (about $23k) to 611,163 kronor (about $950k). Others also had their pay increased significantly.

Though the amounts are relatively small, and the dwindling ranks of unquestioning Saab supporters argue that the compensation is low compared to the Dutch average (SWAN is incorporated in The Netherlands), this is just the latest PR disaster to hit the struggling automaker. One Saab employee sums up the mood:

It feels like everyone is out to grab what they can get.

And no wonder they feel that way. Not only did worker paychecks arrive late, but Sweden’s national debt office has begun foreclosing on the first of its outstanding claims… and the initial amount (about $58k) could have been covered by the chairman’s pay increase alone. Sending the message that board compensation is more important than staying out of insolvency has to be some of the worst PR imaginable. Still, some will defend Saab no matter what…

Saab Working On "The Deal," As Bill Collectors Close In

Bloomberg BusinessWeek reports that Saab has to pay some $620,000 today in order to keep Sweden’s Debt Enforcement Agency at bay. Should Saab fail to pay suppliers Kongsberg Automotive and Infotiv within the next 24 hours, Swedish Debt Enforcement Agency officials say

The collection process that may start tomorrow would include investigating Saab’s bank accounts and potentially also other assets.

Assets will be frozen while Saab’s worth is assessed, a move that would essentially end the existence of Saab as it currently (barely) exists. Saab spokesman Eric Geers says

We’re of course totally aware of this situation with the collection agency, but I can’t comment on what we’re going to do,

but other than pulling out from the Frankfurt auto show in order to focus funds on restarting production and selling another tranche of value-diluting shares, Saab hasn’t done much to respond to the latest crisis. And with another $795m due to suppliers in “about a week,” time is slipping away. Luckily for the True Believers, there’s still a shred of hope-against-hope to hang on to, as Saab’s PR man Steve Wade says something called “The Deal” is in the works.

Aptera Refunding Deposits: Run While You Can!

Three Suppliers Request Saab Bankruptcy, August 16 Is Judgement Day

Just three weeks after Saab narrowly avoided being pushed into bankruptcy by supplier SwePart, SvD.se reports that three other suppliers have now initiated the bankruptcy process by requesting that Sweden’s national debt bailiffs pursue their debts. One Spanish supplier is reported to be foreclosing on €2m ($2.8m in debt), while two of the rebelling German firms are said to be owed at least €5m each. And though Saab says it is meeting with the Spanish firm to try to hammer out a deal, SvD reports that four of the 14 outstanding claims against Saab have run out of time. Lars Holmqvist, head of the European Association of Automotive Suppliers argues that, by paying some suppliers and not others, Saab is de facto bankrupt, and that a trustee should be brought in to pay suppliers in order of priority, rather than order of Saab’s necessity. Meanwhile, Saab CEO Victor Muller has been in Brazil and the US, trying to bring new investors on board, as its Chinese funding won’t be approved for two-to-three months, if ever. Meanwhile, “taxes and fees” must be paid by Friday, August salaries are due in just two weeks, and Muller cut his latest money-raising trip short to reassure workers back in Trolhättan. But according to thelocal.se, even the most optimistic of union leaders hope Saab will have a new CEO soon. Do I hear the fat lady warming up her vocal cords?

Trollhttan Official Calls On Saab CEO To Step Down

SvD.se reports that Paul Akerlund, Saab’s former IF Metall (one of Sweden’s largest trade unions) representative and now Trollhättan Municipal Council Chairman, has called for the resignation of Saab CEO Victor Muller, saying

I do not think Victor Muller is a good president. He is an owner and a contractor, but he has not sufficient knowledge about how to manage production and development

And Akerlund is no city government busybody, but a longtime company insider who has been influential in Saab’s post-GM life. Having shepherded Saab through the challenges of the past two years, this is another grim sign that Saab is about to succumb to the realities that have dominated TTAC’s Saab coverage for years now. A commentary in SvD, titled “ Thank Muller for Painful Bankruptcy” sums up the somber mood in Sweden:

[Saab] has been on artificial respiration for nearly two years. It is down now, and from all indications we can only conclude that the whole process was a painfully protracted bankruptcy. And we have only one person to thank for it.

Saab: Collections Comes Calling "In A Few Days," Can Antonov Save The Day?

Over the weekend we told you Saab-watchers to “expect a run on the bankruptcy court in the coming days and weeks,” and according to Bloomberg the process has already begun. Christina Lindberg of the Swedish Debt Enforcement Agency tells the news service that eight suppliers have requested that their portion of the 104 debts registered with the agency be collected and that

We will start the collection process in a few days.

The good news? A previous request to place a Saab subsidiary in bankruptcy has been revoked as the supplier in question there was paid off. Now, however, with eight more debts going to collections (worth an undisclosed amount, we know that one debt alone is worth around $70m and estimates put the total at around $1b), the situation has become dire once again. The answer? Vladimir Antonov, of course! Thelocal.se reports that suppliers are pushing for the EIB to approve Antonov’s ownership stake, seeing the Russian as the only way out of the situation. And because the EIB will clearly never approve Antonov, another report that’s just breaking now says that Saab is seeking to “replace” the EIB loan in order to bring Antonov on board. The looming question: who on earth is going to lend this bleeding-out corpse of a company $350m? Does Antonov even have a billion to spare for his pet project? Needless to say, nobody has the faintest clue… they just know it has to happen. Yikes!

Saab Subsidiary Narrowly Avoids Bankruptcy As Suppliers Lose Faith

One of Saab’s suppliers, SwePart Verktyg AB, asked a Swedish court to declare a key Saab subsidiary, Saab Automobile Tools, bankrupt today reports Automotive News [sub]. Saab Tools owed about $935,000 to SwePart for tooling, and according to the supplier

More than one week has passed from the summons and payment has not yet been made. Saab Automobile should therefore be considered insolvent… We don’t want them to go into bankruptcy, I wish you understand that, that would be horrible, but we are a small company and for us that is a lot of money

Saab Tools was created to guarantee EIB loans for tooling, so had the “subsidiary” been declared insolvent, the whole ship would have gone down. But before a judge could act, Saab somehow managed to put out the fire, as a company press release proclaims

Swedish Automobile N.V. confirms that Saab Automobile Tools AB reached agreement on payment terms with the supplier that filed for bankruptcy, thereby resolving the issue.

Once again, Saab pulls the fat from the fire at the last minute… but the clouds are dark and rolling in fast. Many suppliers are still looking for money, Saab Automobile has 104 claims pending against it, and SwePart’s bankruptcy request won’t be formally withdrawn until Monday. And with the Swedish government and EIB seemingly unwilling to lift a finger to help, even the faithful are losing hope. This feels like the beginning of the end of the end…

$36m Bridge Loan "Saves" Saab, Workers Paid, Production Could Resume. So What's Sweden's Problem?

Almost two months ago, Saab was able to restart production after Gemini Investment Fund extended a €30m six-month convertible loan to the struggling Swedish automaker. Now, after another shutdown, it seems that Gemini has once again ridden to Saab’s rescue, as the company announces another six-month convertible loan from Gemini.

Swedish Automobile N.V. (SWAN) announces that it entered into a EUR 25 million convertible bridge loan agreement with Gemini Investment Fund Limited (Gemini), thereby securing additional short-term funding.

SWAN entered into a EUR 25 million convertible bridge loan agreement with Gemini with a 6 months maturity. The interest rate of the loan is 10% per annum and the conversion price is EUR 1.38 per share (the volume weighted average price over the past 10 trading days). SWAN may at any time during the loan’s term redeem it without penalty and it intends to do so once the funding from Pang Da and Youngman is received, in which case no dilution as a result of this bridge loan will occur.

Attention Chinese, Swedish and European Investment Bank regulators: you’d better cut through that red tape and approve the Pang Da and Youngman investments post-haste, or Saab will be back in the drink when these short-term loans mature. After all, hasn’t Valdimir Antonov been waiting for approval to buy into Saab since.. oh, 2009?

Saab Sells Factory, But Sweden and EIB May Be Killing It Off Anyway

Saab has reached a deal to sell 50.1% of its real estate holdings to a consortium led by Hemfosa Fastigheter AB, for about $40m, and has also received an order for $18.4m worth of vehicles from an unnamed Chinese firm according to AN [sub], giving the dead-alive Swedish firm the faintest, cruelest glimmer of hope. The real estate deal was for about a third less than the property had previously been valued at, and still needs to be approved by the Swedish Debt Office, the EIB and GM. Meanwhile, the real struggle is ongoing, as a Saab spokesperson tells Reuters that

Today’s news takes us a good way in the right direction, but it is the agreement (with suppliers) that matters and only then will we be able to communicate a date when we can restart production

But suppliers aren’t even the first in line for Saab’s much-needed cash injection: that goes to workers who are promising to take the company into bankruptcy if they aren’t paid soon. These two recent deals should be enough to pay worker salaries through July, but if suppliers aren’t brought back as well to restart production, the bulk sale and an earlier order from PangDa will never be filled. And those suppliers are currently mulling over an offer of ten percent of what they are owed until the Chinese inject more cash later in the year… not the greatest deal ever. Meanwhile, Saab says

There are other initiatives still being pursued. There is not much we can say about that until we have something concrete to communicate

Like what? What could there possibly be to communicate?

Put The Two Hottest Italian Brands Together And Get… 59% Off

It seems like only yesterday… New Ferraris were in such demand that it was possible to make six-figure money in some markets merely by taking delivery of a new F430 or F599 and selling it later that day. Meanwhile, that unspeakably crass reanimated Italian psuedo-luxury watch brand, Panerai, had waiting lists chock-full of suckers waiting to pay five, ten, or fifteen grand for a watch with the same amount of technology and craftsmanship as an $899 ORIS.

Three or so years ago, Ferrari ditched staid old Girard-Perregaux for sexy new Panerai. The not-so-special editions flowed like sweet nouveau glacial milk and the “punters” lined up in droves. This was the marriage of true brands, to which no man may admit an unprofitable impediment.

As of today, the party’s officially over. Welcome… to the bargain bin.

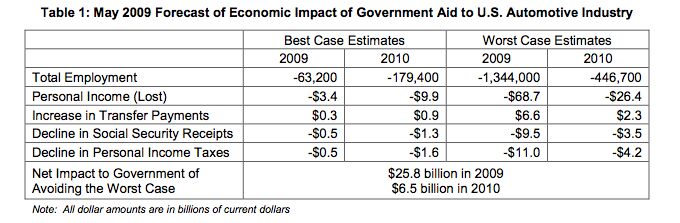

CAR Claims Auto Bailout Saved The Feds $28.6b

As an automaker and union-funded think tank, the Center For Automotive Research often run afoul of TTAC during the bailout debates of 2008-2009. CAR is to Detroit’s apologists what CAR has long maintained that a failure to bail out GM and Chrysler would have resulted in the total destruction of America’s entire industry, and based on that questionable assumption, it’s latest report [ PDF] is claiming that the auto bailout saved the federal government $28.6b over two years. The study is an update of a report CAR issued in May which

produced estimates for two scenarios, as well: a quick, orderly Section 363 bankruptcy (which is what happened), and a drawn-out, disorderly bankruptcy proceeding leading to liquidation of the automakers.

Because those were the choices. A messy, marginally-successful intervention (with demand for GM’s IPO “through the roof”, the firm will still be worth only about what taxpayers put into it) or utter complete annihilation of the industrial Midwest. But if, as CAR takes as gospel, a halfway “normal” restructuring weren’t an option, it was only because the managers of both GM and Chrysler refused to even contemplate the possibility of a bankruptcy filing until it was far too late. And here’s where the long-term impacts get scary: by taking GM and Chrysler under the taxpayer wing, the Government may have saved some money in the short term, but it created a dangerous precedent for the future. Given the events of the auto bailout, why would the leaders of any other failing industry take the difficult path through restructuring when, with the help of think tank apologists, they could simply collapse into a publicly-funded do-over?

Ohio Reps Request Halt To GM Dealer Closures, GM Declines

Ohio Republican Reps LaTourette and Boehner have officially requested that President Obama suspend GM’s dealer wind-down agreements until the Special Inspector General for TARP (SIGTARP) completes an investigation of the government-approved GM and Chrysler dealer culls. The representatives focused on the fact that SIGTARP’s initial report on the dealer cull, which had criticism for GM, Chrysler and the government task force, wasn’t publicized until after arbitration for culled dealers ended. WKYC quotes the representatives’ statement as saying

There is too much at stake to proceed in an atmosphere where dealers were denied so much crucial information in a process rife with secrecy. As the findings of this investigation may shed much needed light on the proceedings affecting hundreds of dealerships nationwide, we believe it is necessary to thoroughly analyze its results before continuing with the closures of hundreds of dealerships, and the potential loss of thousands of jobs.

And Republicans aren’t alone in urging a halt to wind-down proceedings pending the SIGTARP’s latest investigation… Democrat Dennis Kucinich has already staked out the position now occupied by the House Republican leader. And did the artist sometimes known as “Government Motors” blink in the face of bipartisan pressure?

SIGTARP Investigates Possible Criminal Activity In Dealer Cull

Back in July, the Special Inspector General for the TARP program (SIGTARP) released a damning report on GM and Chrysler’s efforts to cull dealers during their government-overseen bailout-bankruptcies. The upshot: GM and Chrysler handled the culls either inconsistently or subjectively, and the President’s auto task force pressed the issue unnecessarily and “without sufficient consideration of the decisions’ broader economic impact.” And though that report, the product of a year’s worth of investigation, made the automakers and their government “saviors” look mighty stupid, the awkward walk-back of most of the dealer cuts had already made the point fairly well. But with the TARP program now largely rolled up, the SIGTARP’s office has been bulking up on investigators, targeting fraud and criminal activity around the entire TARP program. And, according to Automotive News [sub], the dealer cull is on the agenda. SIGTARP won’t “disclose the targets of the investigation or the actions being probed,” but it has “opened a follow-up investigation of possibly illegal activity in the [dealer-cull] effort.”

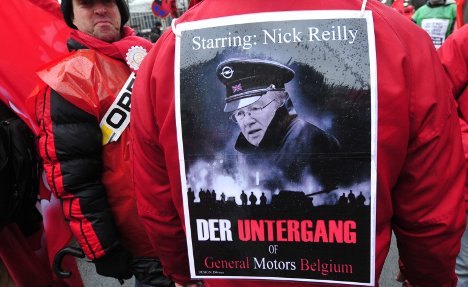

Opel Antwerp Sale Fail Sticks GM With Half-Billion Bill

One Year Ago Today, General Motors Filed For Bankruptcy

One year ago today, General Motors took the “unthinkable” step of filing for bankruptcy. It was a seminal moment in the history of the American auto industry: the day that once-dominant GM finally shed its illusions, faced up to reality, and plunged into the cold, cleansing waters of bankruptcy reorganization. Or, to use a more accurate metaphor, it was pushed in. After decades of decline masked by decades of PR-driven denial, GM had literally lost the ability to self-correct.

Canadian Judge: Forget Arbitration, Culled Dealers Can Sue GM

Automotive News [sub] reports that 19 rejected Canadian GM dealers have been given the green light to sue GM as a class, rather than go through the arbitration process that is being used to resolve dealer cull disputes in the US. The dealers are suing GM for breach of their dealer agreements, and for failing to provide compensation beyond wind-down costs. They argue that the arbitration process would be expensive for dealers, non-transparent to the taxpayers who funded GM’s reorganization, and would put GM at an unfair advantage.

"Old Chrysler" Liquidation Plan Approved, TARP Loan Repayment Not So Much

Having laid into GM today for trumpeting a government loan repayment, it would be churlish not to point out that, by Detroit standards anyway, GM’s “partial refund” is actually kind of a big deal. Take today’s news from the nearly year-long liquidation of “Old CarCo,” the poisoned (in some cases, literally) remains of what was once “Bad Chrysler.” Bloomberg reports that the US Treasury’s $5b line of credit has been placed in the “unsecured” category of Old CarCo’s last debts, meaning recovery is “undetermined.” As in not so very likely at all.

Spinning GM's Bankruptcy

Ber-Porsche Gemballa: Company Bankrupt, Boss Missing, Detectives in Johannesburg

When I met Uwe Gemballa the first time, he looked like he could be the manager of the local strip club down the road: Shoulder long bleach blond hair, a flashy watch, a suit to match the watch, the shirt unbuttoned down to the chest. I then found out that he had brought a Porsche 911, that made upward of 750hp, to a friend of mine, to make it street legal. Gemballa had one of the hottest tuner shops in Germany. His mods to the Porsche Cayenne produced the fastest SUV in the world – at least that’s what Uwe told me. Last I heard from him was some two months ago. He wanted to import Gemballas to China, and could I help him? Then it became quiet. Now I know why.

GM Fighting Colorado Culled-Dealer Bill

The Colorado House’s passage of HB-1049 [ PDF here], a bill requiring restitution for dealers culled during the Chrysler and GM bankruptcies, has drawn a $60,000 “no” campaign from General Motors. The Denver Post reports that GM’s ad campaign, which features lines like “we must keep driving forward to repay our government loans,” and “don’t let special interests stick taxpayers in reverse,” has riled up local lawmakers more than ever, drawing such timeless put-downs as: “they must be spending tax dollars on Botox to say that with a straight face.” The bill would require OEMs compensate culled dealers for signs, parts, dealer upgrades and more, as well as offer them the right of first refusal for any new area dealerships.

Chrysler Suing Four States For Dealer Protections

Here’s a question: You want to do something, but it’s against the law, what do you do? Abandon the idea? No, if you’re Chrysler you sue the government. Detroit News reports that Chrysler LLC are suing officials from Oregon, Maine, North Carolina and Illnois for laws which “unduly burden New Chrysler with the obligation to provide the rejected dealers with rights that this court determined that the rejected dealers do not have,” as lawyers for Chrysler wrote.

Visteon Creditors Blame Ford For Bankruptcy

The Freep reports that creditors in Visteon’s bankruptcy are investigating Ford’s relationship with its spun-off supplier, implying that the Blue Oval could be responsible for its financial downfall. The creditors have requested the release of documents relating to Ford’s 2000 spin-off of its parts maker, and financial transactions between the two firms since then. They’re hoping to show that Ford forced losses onto the supplier, possibly securing better claims for creditors. The creditor committee motion explains:

Since the spin-off transaction, there has been no semblance of arm’s length bargaining between Visteon and Ford. Ford appears to have utilized its insider status to control Visteon to Visteon’s detriment.

Recent Comments