"Old Chrysler" Liquidation Plan Approved, TARP Loan Repayment Not So Much

Having laid into GM today for trumpeting a government loan repayment, it would be churlish not to point out that, by Detroit standards anyway, GM’s “partial refund” is actually kind of a big deal. Take today’s news from the nearly year-long liquidation of “Old CarCo,” the poisoned (in some cases, literally) remains of what was once “Bad Chrysler.” Bloomberg reports that the US Treasury’s $5b line of credit has been placed in the “unsecured” category of Old CarCo’s last debts, meaning recovery is “undetermined.” As in not so very likely at all.

Disputes over environmental cleanup were dragging out proceedings, and a $15m “environmental reserve” for cleanup at polluted former Chrysler sites (that aren’t likely to be sold), had to be allocated from $260m the government had already set aside for Chrysler’s wind-down costs. Chrysler added the $15m trust fund, which groups can sue for cleanup costs, only after their lawyer warned that the government’s wind-down money could run out altogether. So yeah, compared to that, today’s GM loan payback deserves a golf clap… but why invite the comparison?

More by Edward Niedermeyer

Comments

Join the conversation

Why not invite the comparison indeed... Neither has enough viable, competitive product. Neither factually admits its debts. Neither has a snoball's chance of paying us back. Neither would be here save for taxpayer largesse. Neither has truly, honestly, changed. More smoke and mirrors than Goldman-Sachs.

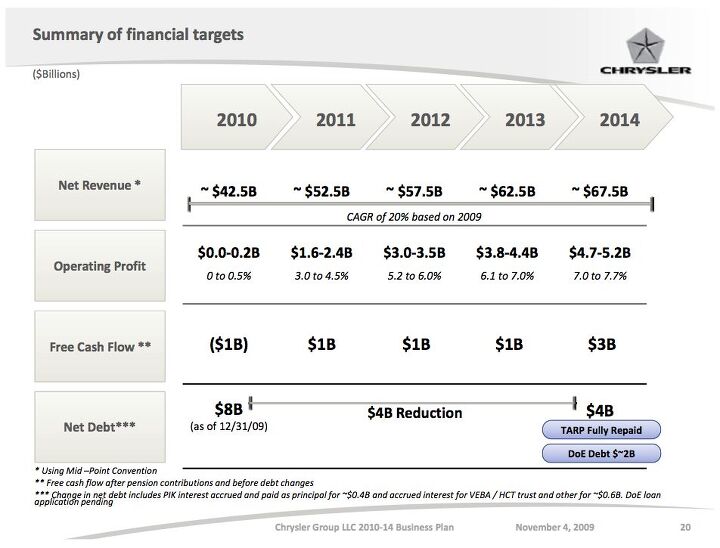

@Ryan Stop being such a party pooper. They made $143 million in operating income, before interest and taxes, and ended the quarter with $1.5 billion in additional cash. That's no small feat from a company hollowed out by years of Daimler mismanagement. Chrysler had $4 billion in cash in June after exiting bankruptcy, $5.9 billion at the end of the year, and $7.4 billion now. That sounds like a pretty solid performance for a company previously written off as dead, if you ask me.

They spent $5B making the Caliber's interior plastic less hard...BWAHAHAHA

...BWAHAAHAHA..I had the pleasure of pushing a young lady's broken down POS Kia out of traffic yesterday. We pushed into,of all things, a Chrysler dealers lot. Made my day.