GAO: $34b Left On Bailout Bill

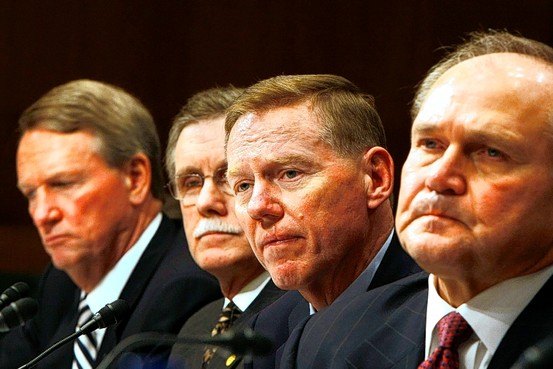

Some taxpayer-funded turnarounds just have a little more turnaround than others, according to the GAO’s recent report on the auto bailout [ PDF here], which tracks the progress of the Detroit patients and considers their futures. Sure, GM received quite a bit more government money than Chrysler, but the improvements in GM’s financial performance compared to Chrysler’s are clear. But the GAO still has a number of concerns about the “more than $34 billion” of taxpayer value that’s still floating around, unrecouped, in the rescued automakers. Feel free to peruse the GAO’s full 59-page report, or you can hit the jump for the highlights.

Quote Of The Day: Parsing Chrysler's Payback Edition

Now, our strategy continues to be to exit these investments, and just today Chrysler announced that it intends to raise the money it needs to repay the government. Two years ago, no one would have expected us to be in this position today, and it shows the success of the strategy the President implemented and the skill and dedication of Chrysler’s employees. We are looking forward to the full repayment of our loan to the company.

Treasury Secretary Tim Geithner, speaking in Detroit, makes strategic use of the singular tense in order to use the phrase “full repayment” without actually revealing the losses taxpayers have already taken. After all, the $1.9b Debtor-in-Posession loan made to “Old Chrysler” in May 2009 isn’t the loan Geithner is referring to (that one was “extinguished” in liquidation). Nor is the $4b “bridge loan” from January 2009 the loan Geithner is referring to, as a mere $2.1b repayment was counted as “satisfaction in full of the remaining debt obligations associated with the original loan.” Geithner may be “looking forward to full repayment” of the one loan he considers “ours” (as are we), but that’s not the whole story. Once again, a slickly-phrased “payback” claim trumps any sense of responsibility at Treasury to be transparent with taxpayers. And a quick survey of the media indicates that Geithner’s use of the singular has worked quite effectively.

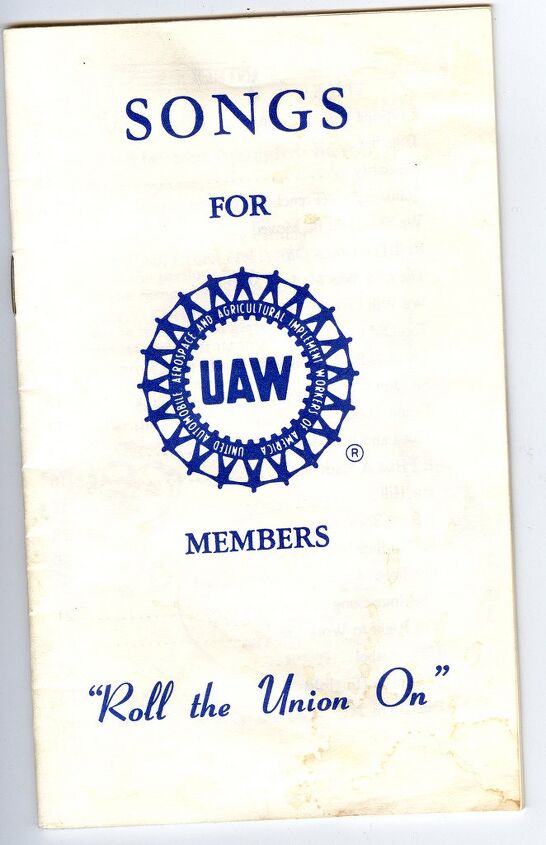

A Salute To The American Taxpayer, From The United Auto Workers (Local 1268)

Does the UAW owe taxpayers a thank you? Chrysler’s attempts at thanking the taxpayers in the midst of bailout-mania seemed to draw more ire than respect, so it’s understandable why the UAW has not made any effort to thank taxpayers for the auto bailout, without which the union surely would not have survived long. But now that UAW local 1268 has made a somewhat belated, but nonetheless earnest gesture of thanks, the national UAW’s silence on the matter suddenly seems a bit deafening.

Industry: Bailout? What Bailout?

TTAC has always taken pride in its outsider status, and we’ve taken pains to cover the industry from a safe distance in order to continually bring a fresh perspective to developments. As a result, we’re not always on the same page as trends in the industry at large, which tends to be far more given to wild optimism than the average TTAC analysis. But, based on a new study by Booz & Company [ PDF], it seems that the “carpocalypse” of recent years has driven the industry to a more TTAC-esque pessimism. According to responses by executives at both OEMs and suppliers, the industry generally feels that the bailout was either a missed opportunity or it didn’t do enough to address fundamental weaknesses… and as a result, executives see challenges ahead.

Fiat To Pay $1.5b For 16% Chrysler Call Option

That’s right folks, for the first (and likely only) time, Fiat will be putting cash on the table for Chrysler’s equity, as Reuters reports that Fiat’s new credit facility will include $1.5b with which to exercise the 16% call option in its agreement with the US Treasury. At that rate, Chrysler’s market value would be under $10b, considerably less than the nearly $13b spent on Chrysler’s rescue (not counting assistance to Chrysler Financial). But what is Chrysler actually worth? Hit the jump for a look at what Chrysler’s Shareholder Agreement says about valuation in a Fiat Call Option scenario.

Chrysler Bailout ReFi Coming Together

With Fiat flying towards taking a majority stake in its Chrysler subsidiary, Reuters reports that the necessary private loans are very close to being arranged.

Goldman Sachs Group Inc, Morgan Stanley, Citigroup Inc and Bank of America Corp are in advanced discussions with Chrysler to finalize a deal that will replace all of its roughly $7 billion government loans with term loans and bonds, these people said on Thursday.

In addition, the banks will also arrange a revolving credit facility for the automaker’s future liquidity purposes that will remain undrawn, these people said. The revolver will not be used for paying down government loans.

Look for Chrysler to wrap up a deal sometime after it reveals its Q1 financial performance next month.

The Chrysler Coincidence: Bailout Loan-Shuffle To Help Fund Fiat Takeover

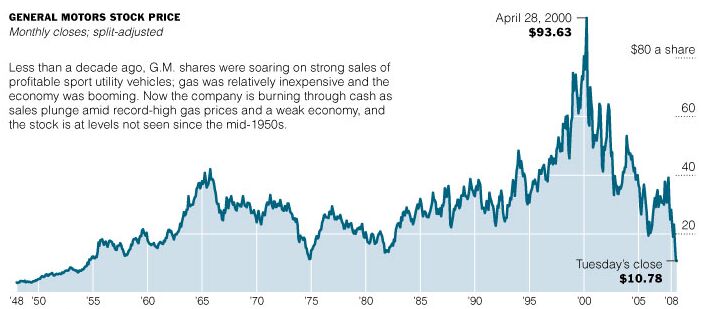

Back in November of 2009, when GM announced that it would repay its government loans, it didn’t take much investigation to realize that The General was simply shuffling government money from one pocket to the other and that true “payback” was still a ways off. The New York Times asked me to write an op-ed on the subject, and I took the opportunity to point out the reality of the situation and note

G.M.’s global interests are far too diverse for it to serve its taxpayer owners faithfully, and it can’t afford to subjugate its business prerogatives to the political needs of its major shareholder in the White House. So, unless Americans develop a sudden obsession with G.M.’s $40,000 Volt electric car just in time for an I.P.O., taxpayers will be stuck with tens of billions of dollars in losses.

Afterward, while our government contemplates its runaway deficit and getting rid of its 8 percent of Chrysler’s equity, perhaps we’ll get an admission that General Motors still owes the American people. Without one, the relationship between the public and the automaker, and the Obama administration as well, may never be the same.

And now that our government finds itself “contemplating a runaway deficit and getting rid of its 8 percent of Chrysler’s equity,” would you believe that a similar federal money-shuffle is under way? Believe it.

Fiat To Own 30% of Chrysler "Within Weeks"

Automotive News [sub] reports that Fiat is “weeks” away from concluding an agreement in which 90 percent of its Latin American dealers will sell Chrysler vehicles, triggering a government clause that will increase Fiat’s stake in Chrysler from 25% to 30%. Known as the “Non-Nafta Distribution Event” in the Chrysler operating agreement, it calls specifically for

execution by the Company of one or more franchise agreements covering in the aggregate at least ninety percent (90%) of the total Fiat Group Automobiles S.p.A. dealers in Latin America pursuant to which such dealers will carry Company products.

And that’s it. Why does it matter that this agreement isn’t any more specific? Because Fiat has no plans to sell any Chrysler Group brands anywhere. Products, yes. Brands, no.

Trade War Watch 17: China Slams GM And Chrysler For Illegal Dumping, Subsidies

The trade war that erupted between the US and China late last summer may have cooled to an angry simmer, but its effects are once again being noticed in the automotive industry. After President Obama slapped a 35% tariff on imports of Chinese-produced tires, the Chinese government started casting around for potential objects of retaliation, and, as Bertel reported, US auto exports to China made “a good tit-for-tat.” The US imported $1.8b worth of Chinese tires in 2009, while China imported $1.1b worth of US-built cars (including transplant brands) in 2008. You shoot our dog, we’ll kill your cat.”

Now, the Chinese Ministry of Commerce has concluded its “investigation” into US auto dumping and illegal subsidies in the Chinese market, and it just so happens to single out the two automakers who are partially owned by the US. Coincidence? Not so much. [Hat Tip: Michael Banovsky]

GM Books $1.6b Gain On Delphi Share Sale/Pension Shell Game

As galling as the auto bailout was for many Americans, the hidden “stealth bailouts” that occurred during the government-led industry reorganization are often even more galling. Today the final chapter of one of those “stealth bailouts” has taken place, as GM has sold its stake in its spun-off supplier Delphi for $3.8b, booking a $1.6b gain on the deal. So, how is GM divorcing its former in-house supplier a stealth bailout? Back in the dark Summer of 2009, the government organized a GM-led rescue of Delphi, which had been languishing in bankruptcy since 2005 (after GM. By buying a chunk of Delphi for $2.5b of the government’s money and selling it back for a profit, GM’s helped itself to a little extra bump of public money. Oh, and did we mention that GM dropped all kind of pensions in Delphi’s lap when it spun the supplier, including workers who had never been employed by Delphi.

But that’s not the worst part: any guesses as to why GM’s stake in Delphi is suddenly worth so much more? A recovering industry, perhaps? Wrong. Shortly after GM bought back its stake in Delphi, the supplier dumped $6.5b worth of pensions onto the government’s Pension Benefit Guarantee Company, causing huge benefit cuts and hidden government costs. What did the PBGC’s stake, given as “partial compensation” for that pension dump, yield it? A cool $594m. Meanwhile, thanks to the government ‘s arguments, GM still had to top-up UAW retiree pensions, leaving non-union retirees and members of other unions out in the cold [read all about it in a just-released GAO report in PDF here]. A shell game inside of a political payoff inside of another shell game, in other words. There’s nothing to not love here…

GM Dumps Ally Shares, Announces Dividend

Automotive News [sub] reports that GM has sold $1b worth of preferred stock in Ally Financial, the bank holding company that emerged from the wreckage of GM’s former in-house lender GMAC. GM will book $300m on the deal, which will take its ownership stake in the lender to 9.9 percent. GM will likely continue to reduce its exposure to Ally, which is 74% owned by the US Treasury, as its new CFO seeks to rebuild its in-house lending capabilities. GM’s move away from Ally has intensified competition between the financial firm and GM’s new financing arm, which has been built on the acquisition of subprime lender AmeriCredit. This mounting competition has been criticized by the TARP Congressional Oversight Panel, which rapped GM for failing to find a win-win solution for its own financing needs and the viability of the taxpayer-owned Ally. Amman’s strategy for avoiding further conflict: sticking with subprime and floorplan lending, leaving prime auto lending to Ally. But, argues analyst Maryann Keller

Floor-plan lending is about building an individual relationship with a lender. To get them to switch, you need to get people on the ground and get out and talk to dealers and build those relationships.

Meanwhile, with its stock struggling to achieve the value projected for it by several analysts, GM has approved a second quarterly dividend of $0.594 per share on its Series B mandatory convertible junior preferred stock. More cash and a new dividend seem likely to pump up GM’s stock price a little, but it is unlikely to reach the $55-ish price needed to pay back the government’s equity investment in the short term.

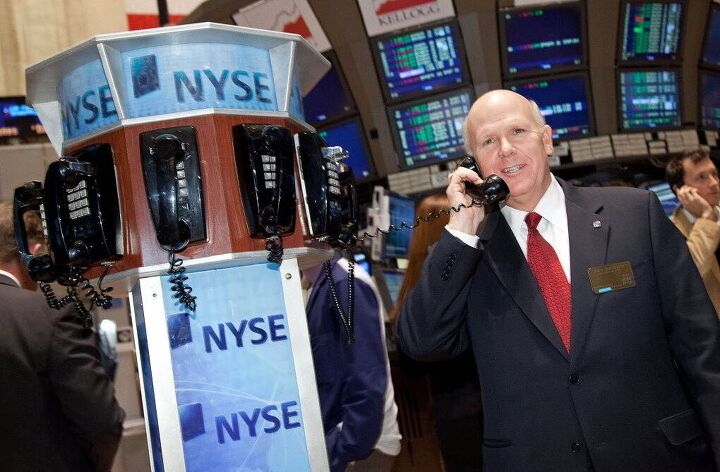

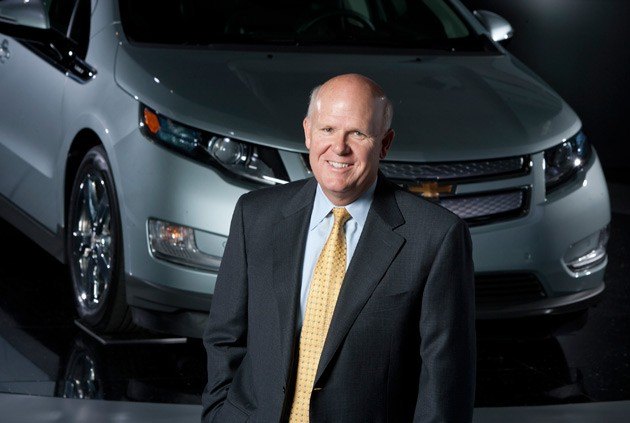

Rattner Reacts To GM's Sub-IPO Stock Price

As the former “car czar,” who led the government’s restructuring of GM and Chrysler, Steve Rattner has a considerable interest in portraying his pet projects as having turned the corner. But in a recent CNBC appearance, Rattner acknowledges that the market is “spooked” by GM’s increased reliance on incentives and the “unexpected” departure of its Chief Financial Officer. Ford, meanwhile, simply gets rapped for not communicating a slightly lower Q4 profit than Wall Street expected. And though Rattner’s not the guy to press the point home, there’s a clear distinction to be made between a much-hyped stock aligning itself with expectations (while making a tidy $6b+ profit) and a company that’s losing key personnel while leaning on incentives to recover the volume lost on brand and dealer cuts. But Rattner’s got bigger worries than short-term financial performances, or incentives or personell changes… he sees another, equally familiar problem that’s fixing to give GM (and, to a lesser extent, Ford) the fits: rising gas prices.

Final COP Bailout Report: The Lessons Of The Auto Bailout

The Senate’s Congressional Oversight Panel, which has been charged with monitoring the TARP program, has released its final report [ PDF] before it disbands next month. Given TARP’s importance in this country’s historical sweep, we’d recommend that everyone at least glance through the document. But, if nothing else, TTAC’s readers should at least check out the section on the Auto Bailout, which not only summarizes the government’s actions, but also points out problems that arose during the bailout as well as problems that could still emerge as a result of the bailout. The “Lessons Learned” portion of the Auto Bailout section is of special interest, and so we are republishing it below the fold. For all of the hot air and ink that’s been spilled over the bailout, the reality is that it was simultaneously a success and a failure. As a purely short-term, cost-no-object effort, it very clearly prevented what could have been a messy collapse in the auto sector. But because the true costs and long-term effects of the bailout aren’t yet known, it’s still impossible to say if that short-term rescue was worth the costs or will even prevent another industry meltdown in the future.

Chrysler Turns $14b Into $4.8b

According to Steve Rattner, Chrysler was such a sick puppy in the immediate pre-bailout period that it would have only generated about $1b had it been liquidated in bankruptcy. Thanks to around $14b in government assistance, however, Chrysler is now worth a whopping $4.8b according to a Reuters analysis of its filings. But wait, you say, how does Chrysler have a valuation if it hasn’t yet launched an IPO?

Chrysler arrived at the valuation to set pay for its top executives, including Marchionne. Senior executives are paid partly through so-called deferred phantom shares, which will convert to shares in the company at a later date.

In June 2009, each share was worth $1.66, according to the filing. By the end of 2010, the value of each share was $7.95.

Quote Of The Day: Abandoning The Bailout Edition

The Detroit News reports that top White House economic adviser Austan Goolsby indicated today that the government would be exiting its equity position in GM in the short term. The DetN’s David Shepardson quotes Goolsby as saying

The writing is clearly on the wall that the government is getting out of the GM position. The government never wanted to be in the business of being majority shareholder of GM. It was only to prevent a wider spillover, negative event on the economy. So we’re trying to get out of that. We’re not trying to be Warren Buffet and figure out what the market is doing

And he’s not kidding: GM’s stock just closed at its lowest level since the IPO, after GM’s Q4 results came in below analyst expectations and the overall market experienced turmoil due to Middle East unrest.

GM Profit Projections: Over $5b On The Year, But "Pinched" Q4

Analysts are reporting that GM could announce full-year 2010 profits of over $5b tomorrow, although Q4 profits may have dipped to $1.06b. That would make its full-year results the best since a $6b profit in 1999, but Q4 results could be the second-worst since emerging from bankruptcy. Why the slowdown? Analysts give Bloomberg a number of possible explanations, including

- GM’s spending on cars including the Chevrolet Volt plug-in hybrid and future products may lead to higher costs similar to those that restrained profits at Ford and Daimler AG.

- Automakers are paying more for materials such as steel and are struggling to pass the costs to consumers amid a “somewhat weak” economy

- Restructuring unprofitable European operations

Of all these dynamics, however, CEO Dan Akerson’s rush to revamp GM’s lineup and expand the applications of the Volt’s drivetrain could end up driving the most cost. Though GM is making a healthy profit again (and not paying taxes on it), an overly-ambitious speed-up in product cadence could combine with rising costs to slow The General back down (as they have already done to some extent at Ford). In any case, we will certainly have a better picture of GM’s financial performance tomorrow, when the firm’s results are announced.

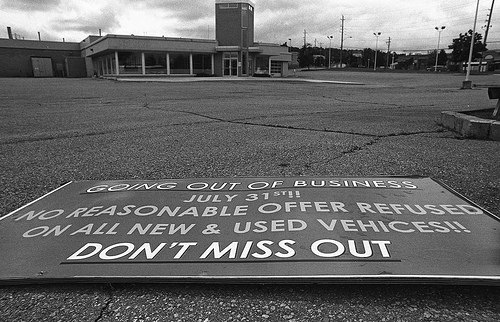

Breaking: 64 Culled Chrysler Dealers Sue Feds For $130m

Automotive News [sub] reports:

Sixty-four dealerships that were terminated during Chrysler’s 2009 bankruptcy reorganization sued the U.S. Treasury Department today, seeking at least $130 million.

The suit, filed in the U.S. Court of Federal Claims here, alleges the government violated the Constitution by taking the stores’ franchises and their state legal rights without adequate compensation.

Lawyers for the plaintiffs say that more dealers could come on board, as the 64 suing dealers represent only eight percent of Chrysler’s cull. Neither Treasury nor Chrysler (which is not named in the suit) have commented. The suit, which can be read in its entirety in PDF format here, claims violation of Fifth Amendment rights, arguing that:

[the dealer cull] served the public purpose of promoting stability to the financial system of the United States… This is a loss that should not, however, be borne by a few individual dealers but, by reason of its broad and salutary public purpose, must in fairness and justice be borne by the public as a whole.

Will GM and Chrysler's White Collar Bonuses Draw UAW Ire?

Bloomberg reports

GM plans to pay bonuses to most managers equal to 15 percent to 20 percent of their annual salary and as high as 50 percent to less than 1 percent of its 26,000 U.S. salaried employees, said one of the people, who asked not to be named revealing internal plans. Bonuses for Chrysler’s 10,755 salaried workers will average about $10,000, with a small group getting as much as half of their salary, one of the people said.

And with GM and Chrysler heading into contract negotiations with the UAW, this is not going to be winning the manufacturers many friends among the union.

“The union is going to be very angry about this,” Gary Chaison, a professor of industrial relations at Clark University in Worcester, Massachusetts, said in an interview yesterday. “If these kinds of bonuses are paid to salaried workers, then the union’s demands will increase, knowing management can’t claim an inability to pay.”

But wait, isn’t GM giving hourly workers the biggest bonuses in company history? What’s going on here?

Will Fiat-Chrysler Become An American Firm?

CEO Sergio Marchionne certainly suggested as much in a speech at the NADA convention over the weekend, in which he said

Who knows? In the next two or three years, we could be looking at one entity. It could be based here

From the perspective of the American taxpayer, this would certainly be the favorable outcome. After all, Fiat didn’t put a single Euro into the restructured Chrysler, and national bailouts don’t usually result in the expatriation of the bailed-out firm. But the US Treasury department isn’t the only master Fiat has to serve, and Marchionne’s suggestion that the Fiat-Chrysler alliance has touched off something of a “firestorm.” The Financial Times reports that

Pierluigi Bersani, leader of the [Italian] opposition Democratic party, demanding an explanation from Mr Marchionne said it was unacceptable for “Turin and the country to become a suburb of Detroit”.

Industry Minister Paolo Romani adds [via the Montreal Gazette]

The head of the carmaker must remain in Turin

And with Italian backlash against a possible Detroit headquartering of the Fiat-Chrysler alliance building, Marchionne is backpedaling furiously.

Quote Of The Day: "Shyster" Edition

GM Withdraws $14.4b Government Loan Request

GM And GMAC: Together Again?

One of the more dangerous conflicts embedded in the US auto bailout that was identified in the recent Congressional Oversight Panel report has been a TTAC hobbyhorse for some time, namely the tradeoff between GM’s success and that of its former captive finance arm GMAC (now known as Ally Financial). As we wrote back in May,

if government-owned Ally isn’t interested in underwriting GM’s volume gains with risky loans but also isn’t interested in seeing its auto lending business bought by GM, there’s trouble brewing. After all, that would leave GM with only two options: partnering with another bank, or starting a new captive lender. Either way, a new GM captive lender would likely force Ally into offering more subprime business anyway, or face losing its huge percentage of GM business.

Fast forward the better part of a year, and GM has indeed bought its own in-house subprime lender, leaving the COP to term The General’s lack of interest in taking care of “the Ally Tradeoff” as “disconcerting.” After all, with over 20 percent of GM’s equity and over 70 percent of Ally’s stick, the Government should have been able to work out some kind of deal that gets GM and Ally back on the same page… right? Not so fast, reports the WSJ. Ally turned down a $5b GM offer for its wholesale lending business earlier this year, and now it seems another deal may be in the works. But it has nothing to do with maximizing taxpayer payback, and everything to do with shoring up GM’s floorplanning credit. And it’s not coming from the government, but from GM’s newly-ubiquitous CEO Dan Akerson.

Government Retooling Loans: On Hold For GM and Chrysler?

The Department of Energy’s $25b Advanced Technology Vehicle Manufacturing Loan program was very nearly used as a slush fund to keep GM and Chrysler afloat during the dangerous days leading up to the federal auto bailout. Though President Bush’s decision to use TARP to rescue America’s failing automakers took away the need to tap the so-called “retooling loan” program to fund America’s auto bailout, that decision also contributed to a long delay in the allocation of the ATVM loans. Because the loans require applicants prove “financial viability,” GM and Chrysler’s requests (which account for $17.4b out of the remaining pool of $16.7b in non-allocated loans) have been on hold, and with them, every other automaker still seeking approval for its requests. And now, with no word from the DOE on the loan program since last April, congress is agitating for the DOE to make with the loans already. Senator Diane Feinstein captures the frustration in a letter published by the Detroit News

“On multiple occasions, the department has missed internal deadlines for initial decisions, term negotiations, final decisions and loan closure,” she wrote, saying the department failed to give applicants “a clear timeline.”

But did the DOE miss deadlines and string automakers along out of negligence, or because it had to wait in order to fulfill the loan program’s mission, namely supporting the bailed-out automakers?

Fiat And Chrysler: Alone At Last

Fiat split its auto business from the rest of its industrial operations today, creating two new companies: Fiat and Fiat Industrial. Fiat CEO Sergio Marchionne announced the move as a way for Fiat to unlock its share value and concentrate on its core business, telling the AP [via Newser]

This is a very important moment for Fiat, because it represents at the same time a point of arrival and a point of departure. Faced with the great transformations in place in the market, we could no longer continue to hold together sectors that had no economic or industrial characteristic in common.

But with Fiat Industrial taking care of the truck-and-tractor side of the business independently, Fiat SpA is focusing on the task at hand: Chrysler. With a 35 percent stake in the bailed-out American automaker in the bag, Fiat is aiming for a controlling stake when Chrysler’s IPO hits the markets later this year. And though the spin-off of FIat’s non-automotive business opens the door for a full merger of Fiat and Chrysler, Marchionne denies that a full merger will take place, saying only that

I don’t know whether it is likely, but it is possible that we’ll go over the 50 percent mark if Chrysler decides to go to the markets in 2011. It will be advantageous if that happens.

But don’t mind Sergio’s equivocation. Fiat will almost certainly snap up the remainder of a controlling stake by the end of this year. Here’s why…

Chrysler Moves To Relocate Reinstated Dealers

Chrysler’s bailout-era dealer cull has ended up being something of a nightmare, with a number of dealers successfully fighting for reinstatement as federal investigators look into possible criminal wrongdoing. And whereas GM has basically rolled back much of its dealer cull, Chrysler has consistently used arbitrary calculi for closing dealers and has resisted giving dealers the opportunity to reclaim their franchises. Now, the dealers that have won reinstatement in congressionally-mandated arbitration hearings are facing a new threat: relocation. Automotive News [sub] reports that Chrysler’s method of dealing with reinstated dealers is to force them to relocate wherever Chrysler wants them to go. Chrysler has filed a request in a Michigan District Court, asking for the ability to relocate some 20 dealers in 6 Midwestern states, a move it says it must undertake in order to protect its non-culled dealers. But, having picked the winners and losers among its dealers only to see some of them reinstated, shouldn’t these reinstated dealers be afforded the same rights as the dealers who weren’t culled in the first place?

Blue Ops: The Clandestine Bailout Of Ford

One of the many reasons for Ford’s surging market share are Americans who refuse to buy a car from a company that has been bailed-out with their tax dollars. In survey after survey after survey, Americans took issue with the bailouts. The backlash was so severe that one of the first measures Joel Ewanick implemented at GM was to get rid of GM. He replaced “General Motors” with “the parent company.” Smart move: You can be against Government Motors. But who dares to be against parenthood?

Ford meanwhile rode high on the perception that they didn’t accept a single dollar. “Ford did not seek a government bailout,” says a very recent Rasmussen Report, “and 55 percent of Americans say they are more likely to buy a Ford car for that reason.”

Americans (and possibly GM and Chrysler) are the victims of a big lie, says Wall Street insider Eric Fry. And he has the numbers to back it up.

GM Buys $2.1b Of Government's Equity

GM Seeks Pay Leeway From Treasury

Legal Scholars: Bailout Unlawful

The bailout of GM and Chrysler was nothing compared to the giant TARP thrown to bankers and brokerages, or so the argument goes. A panel of constitutional experts, convened at a Stanford Law School conference about the constitution and bailouts, has a totally different opinion: Bank rescue o.k., car rescue not o.k.

GM Drops $4b On Underfunded Pensions

NUMMI, Toyota Sue "Old GM" For Contract Breaches

Both Toyota and the remains of its joint venture known as NUMMI have sued the remains of “Old GM” for breach of contract according to two separate reports in the Wall Street Journal [sub]. NUMMI is seeking $365m, claiming GM caused the collapse of the joint venture by unilaterally pulling out as it collapsed into bankruptcy, sticking Toyota and NUMMI with the bill.

Those decisions breached … commitments to Nummi and sounded its death knell,” said the lawsuit, filed last week. And unlike Toyota, GM’s bankruptcy estate “has refused to contribute to Nummi’s deficit during the wind down”

Toyota, meanwhile, is suing for some $73m in development costs for the Pontiac Vibe, a vehicle that GM was supposed to sell for another two years.

Flush From GM's IPO, UAW Targeting New VW Plant

GM’s stock may be hovering near its IPO price of $3/share, but the UAW doesn’t need much more growth to cash out with every penny it wanted from GM. The UAW’s VEBA account has banked $3.4b in stock sales so far, and Forbes reports

The VEBA will break even on its investment if it can sell the remaining 206 million shares at an average price of $36.96.

Taxpayers, meanwhile, need GM’s stock to top at least $52/share in order to break even on the bailout that it funded. Because it’s just not a bailout unless the least deserving benefit the most. Meanwhile, with its accounts once again flush with cash, the UAW is turning South in hopes of accomplishing what it has never accomplished before: unionizing at ransplant auto factory in a right-to-work, Southern state.

General Motors Has Something It Wants To Say…

Don’t thank us GM… thank George W. Bush. Also, do we remember what happened when Chrysler tried this? History seems to indicate that paying back every penny is the best “thank you” of all.

Majority Of Americans No Longer Oppose Auto Bailouts

General Motors, Public Company

Must Read: "Ghosts Of The Old GM"

If you read one thing today, read “Ghosts Of The Old GM” by Paul Clemens in today’s NY Times. At a time of increasing triumphalism over the “success” of the Auto Bailout, Clemens unflinchingly reminds us of the terrible price we’ve paid to bring America’s auto industry back to halting life. From deserted plants, to the world of “surplus industry service providers” (yes, taking apart industry is an industry), Clemens chases down the the truth with tenacity:

For General Motors, divided into its “Old” and “New” halves, there’s an inescapable paradox: the only possible route to future profitability is to create, through plant closings, monuments to past unprofitability. Old G.M. may have gone away for the purposes of the stock offering, but it didn’t go away in what might rightfully be called actuality.

UAW Boss: "People Want To Reward Our Members"

Let me say this as clear as I can, I do not think there will be any concessions in 2011. People want to reward our members and it will be a key component of the 2011 bargaining. When the industry comes back, just like we’re sharing in the downside we’re going to share in the upside. That’s a key foundation of what we’re doing in 2011.

UAW President Bob King gives his best “we will fight them on the beaches” impression, telling Reuters that his union has sacrificed enough, thanks. And though the people who want to reward UAW members are notably absent from public debate, that assertion wasn’t nearly as double-take-worthy as King’s opinion that

There’s no competitive gap between Ford, GM and Chrysler right now

Huh?

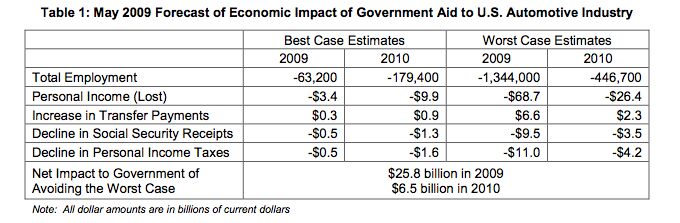

CAR Claims Auto Bailout Saved The Feds $28.6b

As an automaker and union-funded think tank, the Center For Automotive Research often run afoul of TTAC during the bailout debates of 2008-2009. CAR is to Detroit’s apologists what CAR has long maintained that a failure to bail out GM and Chrysler would have resulted in the total destruction of America’s entire industry, and based on that questionable assumption, it’s latest report [ PDF] is claiming that the auto bailout saved the federal government $28.6b over two years. The study is an update of a report CAR issued in May which

produced estimates for two scenarios, as well: a quick, orderly Section 363 bankruptcy (which is what happened), and a drawn-out, disorderly bankruptcy proceeding leading to liquidation of the automakers.

Because those were the choices. A messy, marginally-successful intervention (with demand for GM’s IPO “through the roof”, the firm will still be worth only about what taxpayers put into it) or utter complete annihilation of the industrial Midwest. But if, as CAR takes as gospel, a halfway “normal” restructuring weren’t an option, it was only because the managers of both GM and Chrysler refused to even contemplate the possibility of a bankruptcy filing until it was far too late. And here’s where the long-term impacts get scary: by taking GM and Chrysler under the taxpayer wing, the Government may have saved some money in the short term, but it created a dangerous precedent for the future. Given the events of the auto bailout, why would the leaders of any other failing industry take the difficult path through restructuring when, with the help of think tank apologists, they could simply collapse into a publicly-funded do-over?

Nader: Government Motors Forever!

We’ve heard a lot of arguments on all sides of the bailout, but we had yet to hear anyone call for prolonged government ownership and involvement in General Motors… until now. What follows is a letter from Ralph Nader, former NHTSA boss Joan Claybrook, Center for Auto Safety honcho Clarence Ditlow and Public Citizen president Robert Weissman, urging the Obama administration to suspend GM’s IPO and take firmer control of the government-owned automaker’s decisions on a number of issues including lobbying, employment and the environment. Because, despite appearing to be stuck in the 70s, Nader and company have never heard of British Leyland. Taste the madness below.

Dear President Obama,

The U.S. government bailout of, and acquisition of a majority share in, General Motors was anexceptional action, taken in response to exceptional circumstances. The U.S. stake in GM obviously poses novel managerial challenges to the government. The appropriate response to those challenges, however, is not to run from the responsibility through passive ownership and premature sale at a loss to taxpayers.

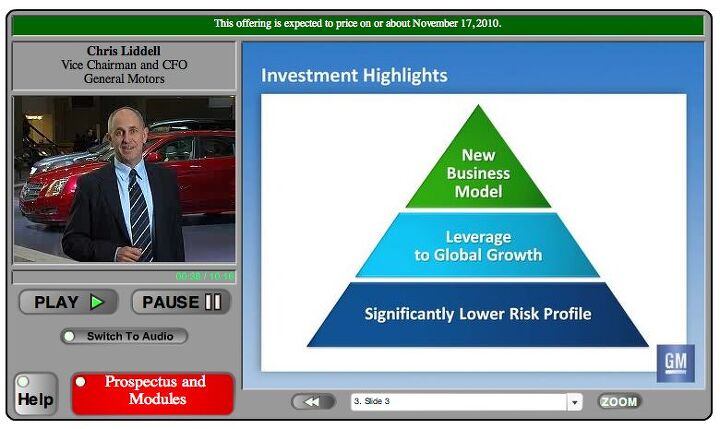

Watch GM's IPO Pitch Here

GM Carry-Forwards Worth $45b Off Future Tax Bills

Ask The Best And Brightest: Does The Auto Bailout Still Matter?

As GM's Dealer Cull Wraps Up, Few Benefits Materialize

As Automotive News [sub] reports, GM has gone ahead and finalized the 500 dealer cuts that made up its bankruptcy-bailout-era dealer cull, despite resistance from some 22 members of the US House of Representatives. And despite the congressional pressure, a damning SIGTARP report, and an ongoing criminal investigation, GM hasn’t changed its tune about cutting dealers, telling AN [sub] that delaying dealer cuts

would only divert our collective attention at a critical time and would ignore the independent decisions of arbitrators and individual settlement agreements between GM and its dealers

Meanwhile, just what affect has the dealer cull had on surviving dealerships? Are they thriving? Well, not exactly…

GM IPO: $10b Of Common Stock, $3b Of Preferred Stock

Reuters has followed up its look inside the Government’s involvement in GM with a breaking report on the specifics of The General’s IPO. According to Reuters sources, the IPO will include 365 million common shares for $26 to $29 each, for a total of between $9.5b and $10b. The Treasury is expected to sell between $1.5b and $2b of its 61 percent stake in GM, likely to “four or five sovereign wealth funds,” bringing its stake down to 43.3 percent. The Canadian and Ontario governments are expected to sell down their stake from 11.7 percent to 9.6 percent, while the UAW VEBA trust-owned stake is likely to to drop from 17.5 percent to 15 percent. A Reuters source concludes that

The IPO would likely value the entire company at close to $60 billion, below the $67 billion needed if U.S. taxpayers are to break even on the common stock held by the Treasury

At the midpoint of the proposed price range, GM’s stock outstanding, including warrants, would be worth about $50 billion, roughly the same level as Ford Motor Co. The IPO’s underwriters are hoping to sell at the top end of the range, and for the stock to rise 20% or more when trading begins. At that level, GM could be worth $60 billion or more.

The Invisible Hand Of The United States Treasury

Ever since it became clear that the government would rescue General Motors and Chrysler, the Treasury Department has made it clear that it would stay out of “day to day” decision making at the rescued automakers. Allowing the rescued firms to operate independently was a political calculation based on the desire to keep politics from affecting sales at the two rescued automakers, but according to a Reuters special report, Treasury has not been able to keep its hands completely out of important decisions concerning the future of the two firms. Particularly in terms of setting up GM’s Initial Public Offering, Reuters found that the Treasury made important decisions affecting

its speed and size, the fees paid to the bankers and the potential involvement of offshore investors

Though this has kept the IPO out of election season and all of its potential for political problems, there is some downside to the Treasury’s involvement, particularly because it will not be exiting its equity position in GM until about 18 months after the IPO. As a result, analysts predict problems securing investors in a firm that may still be subject to ongoing government control. Morningstar’s David Whiston tells Reuters

I’m sure that there will be some institutional investors, and even some individual investors, that it scares away

Chrysler Seeks Government Loan Re-Fi

GM To Buy Government Preferred Stock

Carlos Ghosn Sees His Shadow, Requires Two More Years Of EV Subsidies

No automaker has more to gain –and lose– in the early-adopter EV game than Renault-Nissan, and CEO Carlos Ghosn knows how the game is played. Nissan is investing $4b to rollout electric cars in the US, Japan and select Western European markets at the end of this year, but despite being committed, Ghosn insists that EVs aren’t ready to stand on their own yet.He tells Automotive News [sub] that

These are mature markets where governments give incentives to consumers. Two years of government support are needed to jump-start these markets and then the products will grow on their own and take offChrysler Set To Receive $10b In Government Loans

Ohio Reps Request Halt To GM Dealer Closures, GM Declines

Ohio Republican Reps LaTourette and Boehner have officially requested that President Obama suspend GM’s dealer wind-down agreements until the Special Inspector General for TARP (SIGTARP) completes an investigation of the government-approved GM and Chrysler dealer culls. The representatives focused on the fact that SIGTARP’s initial report on the dealer cull, which had criticism for GM, Chrysler and the government task force, wasn’t publicized until after arbitration for culled dealers ended. WKYC quotes the representatives’ statement as saying

There is too much at stake to proceed in an atmosphere where dealers were denied so much crucial information in a process rife with secrecy. As the findings of this investigation may shed much needed light on the proceedings affecting hundreds of dealerships nationwide, we believe it is necessary to thoroughly analyze its results before continuing with the closures of hundreds of dealerships, and the potential loss of thousands of jobs.

And Republicans aren’t alone in urging a halt to wind-down proceedings pending the SIGTARP’s latest investigation… Democrat Dennis Kucinich has already staked out the position now occupied by the House Republican leader. And did the artist sometimes known as “Government Motors” blink in the face of bipartisan pressure?

Quote Of The Weekend: Viva Italia Edition

Fiat could do more if it could cut off Italy

Having been handed a bankruptcy-rinsed Chrysler by the American government, Fiat’s Canadian-born CEO Sergio Marchionne is beginning to see Italy as nothing more than aging, uncompetitive factories and troublesome unions. And now he’s not just telling the Italian media that not only would Fiat be better off without the country that birthed it. According to Reuters

The CEO added that not a single euro of the 2 billion euros ($2.8 billion) of trading profit that Fiat is targeting for 2010 will come from Italy, where all Fiat car passenger plants are loss-making.

The funny part: Chrysler still holds a value of precisely zero dollars on Fiat’s balance book. And with the Fiat and Alfa-Romeo brands headed to the US, Italian-ness is still an important element of Fiat’s identity. But until Marchionne’s Chrysler revival and Italian invasion take hold stateside, and as long as mother Italia is a drain on its resources, Fiat might be best described as a Brazilian company.

Italian speakers can enjoy Marhionne’s interview here.

The Conversion Of a GM Bailout Opposer

Megan McArdle initially opposed the GM bailout. But now, in an article in the November Atlantic Monthly, the magazine’s business and economics editor paints a positive picture—with a little bit of help from Jack Baruth and TTAC.

SIGTARP Investigates Possible Criminal Activity In Dealer Cull

Back in July, the Special Inspector General for the TARP program (SIGTARP) released a damning report on GM and Chrysler’s efforts to cull dealers during their government-overseen bailout-bankruptcies. The upshot: GM and Chrysler handled the culls either inconsistently or subjectively, and the President’s auto task force pressed the issue unnecessarily and “without sufficient consideration of the decisions’ broader economic impact.” And though that report, the product of a year’s worth of investigation, made the automakers and their government “saviors” look mighty stupid, the awkward walk-back of most of the dealer cuts had already made the point fairly well. But with the TARP program now largely rolled up, the SIGTARP’s office has been bulking up on investigators, targeting fraud and criminal activity around the entire TARP program. And, according to Automotive News [sub], the dealer cull is on the agenda. SIGTARP won’t “disclose the targets of the investigation or the actions being probed,” but it has “opened a follow-up investigation of possibly illegal activity in the [dealer-cull] effort.”

GM Pitches IPO To Employees, Retirees and Dealers

Orion Workers To Picket UAW Over "Innovative" Labor Deal

I took some flack from TTAC’s Best and Brightest on Monday when I suggested that the UAW’s deal to give 40 percent of Orion Assemblys returning workers a 50 percent pay cut was “cowardly and despicable.” What I didn’t make clear enough was that I have no problem with the UAW working for a lower wage as long as the burden was spread evenly. Instead, the union has arbitrarily divided its existing workforce into the old guard “haves” and the relatively-recently-hired “have nots” as a ploy to make the union seem capable of profitably building subcompact cars in America. It’s bad enough to prop up the old guard by paying new hires less, but cramming down recalled Tier One workers is totally contrary to the very concept of a union. And I’m not the only one who finds the lack of solidarity and shared responsibility within the union troubling.

Recent Comments