Bailout Watch 307: Keith Crain Has A Chip on His Shoulder the Size of Montana

I’m sorry to keep harping-on about this. But I am flabbergasted by Fortress Detroit’s reaction to the bailout. Today’s the day that GM and Chrysler actually get their checks. And today’s the day that the doyenne of Motown media Keith Crain continues his incessant, indignant whining. The headline of his Automotive News [sub] column asks “Does it matter anymore?” Intriguing. Does what matter anymore? The $60b or so Uncle Sam’s pissing away to sustain a brace of unsustainable automakers? That would, of course, make sense. As the Brits might say, those of you looking for sense should look away now. “Across the globe, governments are reaching out to help their auto companies survive. Other governments are giving assistance without any of the theatrics that the Detroit 3 had to endure to get bridge loans. And General Motors and Chrysler will be required to return to Washington for more hearings so all the politicians can have more TV time, which they find invaluable.” Yeah, ain’t democracy a drag? There’s more of Crain’s paranoid passive aggressive paternalistic pandering after the jump…

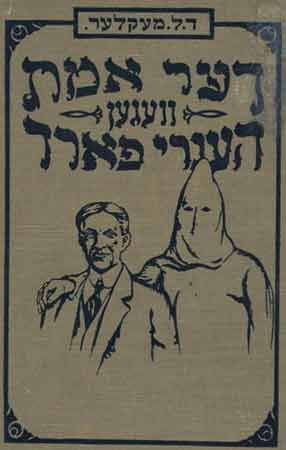

Bailout Watch 306: Detroit News Plays the Race Card

Previously, on “We Can Confabulate the Managerial Incompetence Behind Motown’s Meltdown and Federal Cash Grab by Raising Issues About Race, Regionality, Class and (it’s coming) Religion,” we saw how the Detroit News encouraged hometown supporters to boycott the South (provided, presumably, those supporters aren’t in the South). I was laboring under the impression that we’d could tick the race thing of the list as well, as African American automotive carmudgeon Warren Brown had previously postulated that Detroit deserved the bailout bucks by dint of its contribution to the creation of America’s black middle class. But I guess The DetN couldn’t resist adding fuel to the pyre. “Auto woes rock black work force” makes the case that Detroit’s tough times are tougher on blacks than white folks. And here’s proof:

Bailout Watch 305: I Give Up On Detroit

Well, at least their hometown media. Our hypermiling pal Sam “Is there a draft out here?” Abuelsamid at Autoblog linked me to the straw that broke this camel’s back: a Christmas Eve column by The Detroit News’ John McCormick. “ Maybe it’s time to turn the tables on the South” the title proclaims, proving that prevarication is the first refuge of a journalistic scoundrel. “The unnecessarily long and painful path toward the approval of government bridging loans for General Motors Corp. and Chrysler LLC has exposed a new threat to Detroit. It’s one that Michigan consumers may want to keep in mind as they consider their expenditures, vacation options and even retirement plans.” Breathe Farago. Gentlemen, you won. You got your money. I’m sorry if you found the $66.2b raid on the public purse was a bit… tedious. And embarrassing. But you want to start a boycott? You do realize you’re going back to Uncle Sugar in March, right? Southerners buy a lot of your trucks, yes? Maybe it would be best to just shut the Hell up and be glad that President Bush felt free to ride roughshod over the United States Congress (not to mention the U.S. Constitution). But no. Insult added to injury after the jump.

Bailout Watch 304: GMAC Set to Hoover $23.8b From Feds

Bailout Watch 303: The Backlash Begins?

I know the following letter, first published in the Park Rapids [Minnesota] Enterprise, contains some highly contentious attacks on The Big 2.8 and slurs upon the United Auto Workers. It’s also a bit lacking in the factuality department. But I’m republishing it because I believe the miffed missive mailer represents more than one consumer’s antipathy towards the domestic automakers. If the broad strokes painted here are in any way reflective of a segment of the car-buying public, if that sentiment swells as longtime D2.8 critics become more vocal and visible, well, it’s an abandoned airfield full of not good. And if GM, Chrysler and then Ford belly-up to the bailout buffet for yet more billions, they could well be evoking the law of diminishing returns. (Or endless socialism.) After all, at some point, they have to sell cars to someone.

Fed Grants GMAC Bank Status– Provided GM and Cerberus Piss Off

Thanks to its enthusiastic participation in the sub-prime mortgage market and billions in low-interest, low-FICO score auto loans, GMAC was headed for bankruptcy. There was only one way out: convert to a bank and suckle on the federal teat labeled Trouble Asset Relief Program (TARP). Only… GMAC couldn’t convince enough of its investors to swap debt for equity to meet the Fed’s regs for the transformation. To forestall GMAC’s C11, and the domino destruction of General Motors, the Fed did what comes natural to our August federal institutions these days: they changed the rules. The Wall Street Journa l reports that The Fed has granted GMAC bank status– despite its failure to meet the letter of the law. As the Fed’s statement clearly indicates, they’re making it up as they go along. “As part of the approval, the Fed is requiring GM and Cerberus Capital Management LP to reduce their ownership stakes in Detroit-based GMAC. GM must reduce its ownership interest in GMAC to less than 10% in voting shares and total equity. Cerberus, which owns Chrysler, must reduce its interest to a maximum of 14.9% in voting shares and 33% in total equity.” And that ain’t all…

Bailout Watch 302: 70% of Americans Oppose More Bailout Bucks

A new CNN/Opinion Research poll brings Detroit one of those good news/bad news deals. The survey of 1000 voters reveals that “63% of Americans said they supported the government’s automaker bailout unveiled Friday. But if the companies ask the government for any more money, 70% said Washington should let the companies enter bankruptcy rather than give them any additional assistance.” To paraphrase the Temptations, get ready, ’cause here it comes! Uncle Sugar is set to dole out an additional $4b, already promised under the terms of the deal. Not to mention the $25b retooling loans– which seem to have disappeared off the outrage radar. And when the final final reckoning arrives in March… “With the current credit situation, it has been very hard getting debtor protection financing, so any automaker bankruptcy would have to be assisted by the government,” said David Weiss, chief economist at Standard and Poor’s. “If one of them enters Chapter 11, they would still need government funding to avoid failing.” CNN dutifully reports that “Some analysts estimate that the cost of an auto bailout will eventually run as high as $125 billion.” MORE? You want MORE? And there’s a twist to this tale…

Bailout Watch 301: $200b Acronym To Provide Floorplanning

Bailout Watch 300: GM's Mark LaNeve: There's Got to Be A Morning After…

Mark LaNeve is GM’s Vice President, North America Vehicle Sales, Service and Marketing. Still. As such, the marketing maven must motivate the masses of metal movers who are morose at the moribund market. Of course, LaNeve has a major victory to report: the corporate mothership no longer depends on its dealers for its immediate and, let’s face it, longer term survival. That sponsorship has been transferred to the U.S. taxpayer. Still, in a letter to the stores [full text below], LaNeve reminded the troops what it’s all about. “I pledge to all of you that my team and I will continue to work together with you as we make the necessary structural changes to prove the viability of a new General Motors –to the current and incoming Administration, to Congress and, most of all, to our current and future customers.” Ah, customers. Now you’re talking!

Bailout Watch 299: Chrysler "Government Loan Unlikely To Be Repaid"

With GM, the bailout is pretty straightforward. Give us money or the economy dies. With Chrysler, it’s a lot more… complicated. In case you hadn’t noticed, ChrCyo owner Cerberus is looking for an exit strategy. Give us the money and we’ll sell/give our 80 percent share of the company to someone else. The United Auto Workers. Suppliers. Someone. Anyone. The New York Times quotes the official statement: “Cerberus has advised the Treasury that it would contribute its equity in Chrysler automotive to labor and creditors as currency to facilitate the accommodations necessary to effect the restructuring.” How… magnanimous. Meanwhile, president Bush is throwing a quartet of billions Chrysler’s way– without anything resembling a specific plan for recovery (’cause there ain’t one). And here’s the [non] money shot, from the privat eequity firm’s own mouth : “Unless Chrysler’s labor costs can achieve parity with the foreign transplants and without the restructuring of Chrysler’s debt,” Cerberus announced. “Chrysler cannot be restored to long-term health and the government loan will be unlikely to be repaid.” So, unless the UAW capitulates (which it won’t) and the feds bailout Chrysler Financial Services (which it will), you can kiss the Chrysler bailout bucks goodbye. It’s an extraordinary, and extraordinarily honest, admission. But it seems that honesty’s got nothing to do with it…

Bailout Watch 298: Why Give Cerberus Federal Money?

Bailout Watch 297: Is the Bailout a "Managed Bankruptcy" in Disguise?

Nothing like last minute preparations. Just as I waited until two hours before the first major snowstorm of the year to Blizzak my minivan, President Bush waited until the eleventh hour thirty to provide life-sustaining bailout bucks to Chrysler and GM. At first glance, the deal looks like something of a giveaway: here’s a $13.4b TARP under which you can shelter. Get back to us with the real plan in 90 days. I’m outahere. At second glance, it looks like the bailout is designed to fail. Our Torygraph friends across the pond get straight to the meat of the matter. “Bush’s Detroit bailout looks like a path to bankruptcy for General Motors and Chrysler. Billed as a way to give the two automakers breathing room, the deal actually imposes tough targets that must be hit in only three months. It’s likely the companies will fall short, which would force them to file for Chapter 11 protection. But that’s not necessarily bad – so long as they use the coming months to cut the deals with workers, creditors and others that they’ll need to get out of bankruptcy fast.”

The Guns Of February

Bailout Means Look Into Cerberus and Chrysler

Bailout Watch 296: GM, Chrysler Get $17.4b Bailout

Bailout Watch 293: Did This Report Convince The Prez to Bankrupt GM and Chrysler?

As Detroit holds its collective breath on President Bush’s plan to pull the automakers’ collective fat from the metaphorical fire, the autobologosphere’s been quiet. No doubt something’s up, including GM’s stock. [NB: a large percent of bupkis is still bupkis.] And the longer this jury stays out, the more likely bankruptcy’s the final verdict. Yesterday, Moody’s published this report pegging the odds of a pre-pack with (federal debtor-in-possession financing) C11 at 70%. To which nobody said nothing (excluding own Bertel Schmitt). Today, The Wall Street Journal published a piece saying consumer resistance to buying a car from a bankrupt automaker is declining. And then there’s this, from Bloomberg…

Bailout Watch 292: Yeah, Too Quiet…

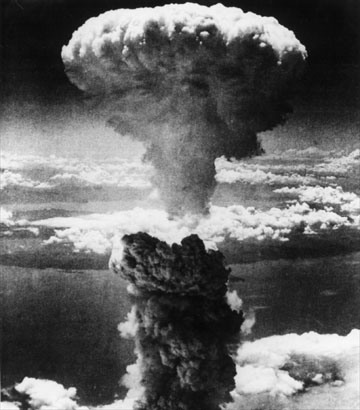

It seems scarcely credible that GM and Chrysler’s fate– or lack thereof– now rests entirely in the hands of The President of the United States. Or, more precisely, his staff. Who, according to The Wall Street Journal, “spent the weekend poring over the auto makers’ books to assess their financial needs.” Which, to my mind, is a bit like saying they’re pawing over the automakers’ entrails. Of course, I would never stoop that low, busy as I am wetting my metaphorical finger and sticking it into the rarified air of the autoblogosphere, trying to divine which way the Divine Wind is blowing. Ominously, The Journal reports “The administration is trying to determine how much money it will take to help the car companies, and is discussing a rescue totaling $10 billion to $40 billion or more.” Sneaking in $14b or so from the remaindeer [sic] of the much-vilified $700b Troubled Asset Relief Program by executive fiat to shove this mess on Messr. Obama’s plate is one thing. Finding 40 billion dollars or more for the failed automakers is quite another. In other words, there are only two ways this thing can go. Either a short term “bridge loan to nowhere” or…

Moody's : Prepackaged Bankruptcy Filing Most Likely

Bailout Watch 290: The Truth About GM, Ford CEOs' D.C. Commute

Bailout Watch 289: Is the Bailout a Ponzi Scheme?

Bailout Watch 288: WaPo Warren Brown: "The Bailout Isn't Enough"

Perception: All Detroit needs is deep restructuring and federal bailout money for long-term viability.

Reality: Wrong. Detroit needs what America sorely needs — a Congress with the leadership chutzpah to devise and implement industrial and energy policies that will help to keep native manufacturing industries alive. Detroit’s problem isn’t poor products or lack of products. It’s a national government still wedded to the debilitating siren song of cheap gasoline. It’s a nationally collapsed financial system. And it’s governmental hypocrisy — our willingness to pour tax dollars into foreign enterprises, most of them not unionized, while griping about doing the same for homegrown, unionized manufacturers largely responsible for building America’s middle class.

Sunday Follies: Guess That Was A No

Video re-enactment of last week’s attempts to get the bail-out plan through both chambers.

Bailout Watch 285 (no Less): LaNeve to GM Dealers: Call Bush

Important Message Update: White House Statement

Mark LaNeve, Vice President, GM North America

12/12/2008

Dear U.S. Dealers:

Last night the United States Congress failed to reach agreement on a $14 billion emergency bridge loan in support of the domestic auto industry. Obviously, we’re very disappointed in this development. As critical a situation as this is, GM’s leadership continues to look at options to restructure and stabilize the business in this exceptionally difficult economic period.

I can’t possibly express my appreciation and pride for your participation in this effort. General Motors dealers could not have done more to show support for the loan legislation. You and your teams made thousands upon thousands of contacts with our congressional leaders. Many of you traveled to Washington to meet with your representatives personally, while others organized funds to place ads in local media. I truly believe that your voice was heard and that your efforts will impact the future outcome…

Bailout Watch 284: White House Promises GM and Chrysler TARP Funds

Bailout Watch 283: UAW Balks; $14b Bailout Bill D.O.A.

And there you have it: Senate republicans have scuppered the Detroit bailout. Automotive News [AN, sub] reports that democratic Senator Harry Reid has thrown in the towel at the the eleventh hour (literally). “”We have not been able to get this over the finish line,” Senate Majority Leader Harry Reid said after 10 p.m., following daylong negotiations to broker a deal among lawmakers, automakers, auto workers and other interest groups.” AN clearly identifies the United Auto Workers as the gordian knot that could not be unpicked. “But few could have predicted the final stumbling block: A dispute over when UAW workers would consent to have their wages reduced to match those paid to nonunion workers in U.S. import-brand factories. ‘We are three words away’ from an agreement, said Sen. Bob Corker, R-Tenn. He said workers wouldn’t accept a 2009 deadline for the parity demand.” And why would they? They’ll get less of a “haircut,” and more power, in bankruptcy court. Meanwhile, GM released a statement on the bill’s failure…

Bailout Watch 282: DetN's Howes Promises Payback

I’ve been watching the polemics coming from the media within Fortress Detroit with increasing fascination. As the bailout bill has stumbled, faltered and face planted; the hometown cheerleaders’ tone has evolved from arrogant and bombastic, to arrogant and vindictive, to plain old vindictive. Detroit News carmudgeon Daniel Howes has always been one of the less aggressive of this cohort. His commentary has consisted of equal parts commiseration, head shaking and exhortation. Now that the Detroit bailout bill is DOA, Howes is struggling to put what Jalopnik calls the “carpocolpyse” into palatable perspective. Last night’s column, written as the bill went up in flames, frames the defeat as a North – South deal. “[The unions’ Political Action Committees] ignored the Republicans, even auto state Republicans, who represent the so-called ‘New American Manufacturers’ in places such as Kentucky, Tennessee and Alabama… Stripped bare and put in the regional context of union vs. nonunion and domestic vs. foreign, the toughened conditions pushed by Sen. Bob Corker, R-Tenn., are legislative cruise missiles aimed directly at Detroit’s business model, the UAW’s Solidarity House and 70 years of Big Three bargaining tradition.” While Howes considers Southern senators’ attempt to force the UAW to modernize is “understandable,” given “given Detroit’s glacial pace of change,” he predicts bad, bad things. In that “don’t tug on the tiger’s tail” kinda way…

Bailout Watch 281: House Passes $14b Bailout Bill

Automotive News [AN} reports that the U.S. House of Representatives has passed H.R. 7321 by a margin of 237-170. Thirty-two Republicans and 205 Democrats approved the measure. The bailout bill authorizes the Department of Energy to loan General Motors and Chrysler $14b (in total) at a rate of five percent for the first five years and nine percent thereafter (until?). The car czar is a go! Under the terms of the legislation, the de facto bankruptcy judge can “compel automakers, their creditors, workers, suppliers and dealers to agree on restructuring for long-term viability– or emergency loans would have to be returned.” Collateral? An equity stake for taxpayers and “go to the head of the line” debtor repayment positioning. Prohibition against payment of stock dividends, no corporate jets, limits on executive compensation, yada yada yada. If they are to return to the Hill to say the magic words (please sir, can I have some more?), General Motors and ChryCo must bend to the will of the car czar by March 31. Or April 30, depending on… the car czar. So where does this leave the bailout bill?

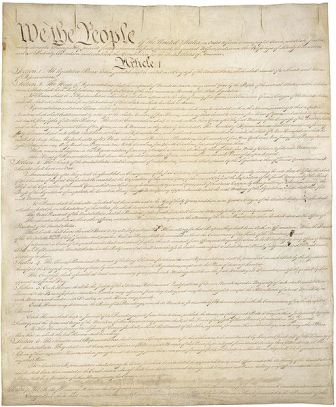

Bailout Watch 279: Is The Bailout Unconstitutional?

I’m not a constitutional law expert. But I’m a fan (of the document, not the lawyers). And I’m extremely uneasy at the prospect of the United States government assuming control of Chrysler, GM and (maybe) Ford ahead of the company’s legal owners AND its creditors. Of course, I’m not the only one. And, once again, we turn to the just plain folks at The Heritage Foundation for a heads-up on a bailout-related issue. “A key provision of proposed legislation to bailout the General Motors and Chrysler, which say they are on the brink of insolvency, may be an unconstitutional taking of private property… General Motors and Chrysler already carry significant loads of ‘senior’ debt with priority over other claims, and it is a standard feature of such debt agreements that borrows cannot subordinate this senior debt—that is, as a condition of the loan, the borrower agrees not take on additional debt that has a higher priority and would therefore imperil the senior debt. But that’s precisely what the bailout bill purports to do.” In other words, “Without providing any compensation to senior creditors, the bailout legislation would convert their loans to junior debt, increasing the likelihood that they will not be paid, which amounts to a partial or total taking. There is also a real question as to whether this taking would be for a ‘public use,’ as also required by the Constitution.”

Bailout Watch 277: House Republicans Offer Alterna-Plan

From Politico, we have a counter-proposal on auto industry assistance by House Republicans, led by Rep John Boehner. In essence, it advocates for a pre-packaged bankruptcy with major concessions from all sides. More importantly, it suggests that instead of $15b in interim financing and a Czar to keep things in line, the government should “provide insurance, funded by the participants with a modest FDIC-like fee, which would cover up to 50% of the losses of new investment in the case of default, helping to unlock immediate private investment (not unlike debtor in possession financing). Such insurance would expire on March 31, 2009.” Hit the jump for a complete statement from Boehner and more details.

Bailout Watch 276: Midwest Credit Unions Offer $10b Worth of Loans for GM Cars (fine Print Below)

Bailout Watch 274: GM's Call to Action to Its Dealerships

Date:12/10/2008Ref. number:Leadership Messages / Leadership Messages / Corporate-Global / Corporate-Global / G_0000017224Subject:

Dear GM Dealership Employees:

We are at a critical juncture in our efforts to get Congress and the current administration to provide federal loans to domestic auto manufacturers to help bridge our nation’s economic crisis. Your support in the form of phone calls is urgently needed in the next few hours as a number of Republican Senators are threatening to block the vote on the Auto Rescue Bill recently announced.

If you are located in the states listed below, please contact your legislators by calling 866 874-9356 and remind them that dealership employees in their districts are counting on them for their support and leadership. Additionally, please share the hotline number with family, friends, business partners or other contacts in these states and ask them to call their Members of Congress immediately. Talking points and other materials to assist these calls can be found at www.gmfactsandfiction.com.

Your efforts to call legislators have been crucial in getting us to this point. Please urge everyone you know in these key states to place their phone calls in the next few hours and remind legislators that their vote is about the survival of America’s auto industry and they will be held accountable for job losses in their states.

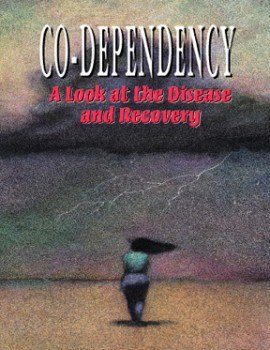

Volvo Sale To China: A Tale Of Denial, Enabling, Co-dependency. And India

The story of Ford hawking Volvo to China is getting curiouser and curiouser. That story appeared first in China’s respected National Business Daily. Then, via TTAC, it hit the fan, the wires, and the MSM. The story made the rounds from Forbes to the Chicago Tribune, even the DetNews headlined: “Ford partner in China considering buying Volvo.” Ford’s partner in China is Changan. The codependent joint venture produces Volvo cars for the Chinese markets. Buying the Volvo brand outright would enable Changan to enter the lucrative export market with an established brand at a competitive price point. And now, the denials.

Today, Gasgoo reads the Wall Street Journal Asia. To everybody’s surprise, the WSJA found “a person familiar with the matter.” The familiar person says that Ford and Changan have not talked about a sale of Volvo. WSJA’s deep throat comes up with a rather flimsy story: According to Mr. Mole, Ford execs had met Changan execs simply to inform them “as a courtesy” that Ford was looking for a Volvo buyer. As in “We just happened to be in Chongqing, so we thought, we come by, say hello, and by the way, we are looking for a buyer for Volvo. Know anyone who might be interested?” A search of the WSJ database comes up empty. Strange. It’ll get stranger …

Bailout Watch 273: Yes Way. Dems and Prez Reach $15b Deal

Before you delve into the fact and substance of this “new deal” for Detroit, note: Senate Republicans are threatening to torpedo this boat before it leaves harbor. The Detroit News reports “Some Republicans remain strongly against the idea of bailing out Detroit automakers. Sen. John Ensign, R-Nev., told CNBC on Tuesday he was considering trying to thwart a vote. “I think that not only myself, but several of us will be looking at possibly blocking this package,” Ensign said. White House chief of staff Josh Bolten plans to attend a Senate Republican lunch today to try and win over skeptical lawmakers. Democrats need 15 to 20 Republican votes to reach 60 in the Senate — the hurdle to end debate and proceed to a vote.” OK, the new “key provision:” the automakers must prove that they’re doing the right things to a car czar by March 31. Otherwise, it’s C11 for you bub. Oh wait, sorry. The czar has the power to grant a one month extension. And he or she could call back the loans at any time. And he or she must approve all transactions over $100m (up from a paltry $25m). Gentlemen, meet the new boss. Is there more? What do you think?

Bailout Watch 271: Lutz: GM Will Ask For More Money.

With Bob Lutz pounding the media pavement for his credibility-challenged boss, it was only a matter of time before someone really hit the Maximum-quote jackpot. Chalk up a doozy for CNN, who snagged Lutz for its “American Morning” show, and got an interview which proves why Lutz was being kept away from bailout talk in the first place. The honesty flowed like single-malt in a boardroom from the very first question. When asked what GM would do with the $15b to ensure its survival, Lutz hedges, answering “this is simply a bridge loan which will get us into the next administration, where we hope we can do something more fundamental. Because the main problem is the lack of liquidity and the lack of revenue flowing in as we’re facing absolutely the lowest, lowest car market in history, and it’s not just the domestics.” AM anchor John Roberts, smelling blood in the water, presses Lutz. “You don’t see Toyota and Honda coming to the government for a handout. But based on what you said there — that this is just the beginning — you’re going to need more money next year?” To which Lutz replies “I think that’s a reasonable assumption.” Reasonable, eh?

Bailout Watch 269: Supplier "Run on the Bank" Hits GM and Chrysler

Bailout Watch 268: Car Czar Named

Bailout Watch 267: $15b Bailout Plan Revealed

Here’s a copy of the draft Detroit bailout bill. While we digest it, here’s what we know so far… Automotive News [sub] says that yes indeed, there will be a car czar. Appointed by President Bush. The Freep is more specific. “Under the bill, automakers would have to submit a restructuring plan by March 31 to what’s being called a ‘financial viability advisor,’ who would have the power to set negotiations among the company, unions and creditors. If the advisor deems the company isn’t making progress, the loans could be called back.” In other words, he or she could throw The Big 2.8 into bankruptcy, without passing go, without collecting $34b (just some of it). Well, fair enough. But from there, things get seriously gnarly…

Confirmed: Ford Wants To Sell Volvo To China Real Fast

The phone lines are running hot between Detroit and Shanghai. Ford is in talks with SAIC, China’s biggest car-maker, in what UK’s Times calls a “desperate attempt to sell its prestigious Volvo brand.” Ford has already tried before, and had been turned down by the Chinese. The Times quotes “a source close to the American motor giant” who says that earlier talks, which took place in summer, broke down over price. Ford had bought Volvo for $6.5b in 1999, and wanted to clear $5.9b. “Mei xi” (no dice) said the Chinese. The Detroit source that’s leaking to the Times (probably with a nod from higher up) says: “Now that Ford is in dire straits this would be a good opportunity for SAIC to snap up Volvo on the cheap. The price has dropped considerably since seeking a sale in the summer.”

According to Aaron Bragman, a car industry analyst with economic forecaster IHS Global Insight, “the sale of Volvo has become part of the conditions of Government assistance.” Ford is being advised by the investment bank JPMorgan Chase.

A spokesman for Ford confirmed that the company is in talks “with a Chinese car-maker,” but declined to name SAIC. SAIC likewise declined to comment. There are other suitors, just to keep SAIC from thinking they are the only game in town …

Bailout Watch 263: Dodd: "Bring Me the Head of Rick Wagoner"

In his selfless campaign to save Detroit from, uh, Detroit, Senator Christopher Dodd launched a failure-seeking missile at GM. Needless to say, it had GM CEO Rick Wagoner’s name on it. “You’ve got to consider new leadership,” Dodd told “Face the Nation,” referring to GM not CBS (one presumes). Dodd said Red Ink Rick “has to move on.” Now get this: “GM spokesman Steve Harris said he didn’t interpret Dodd’s comments as making Wagoner’s exit a condition for aid, adding that the company management, employees and dealers ‘all feel like Rick is the right guy to lead us at difficult time.'” Is “difficult time” the opposite of “playtime?” And how else would you interpret Dodd’s remark? When the Senator said, “piss off Wagoner” he actually meant “please continue running GM into the ground so we can blow $15b+ of our taxpayers’ money on this doomed enterprise?” And if Harris really didn’t get the message– a completely fantastic proposition, but there you go– President elect Barack Obama offered NBC dark hints about Wagoner’s curtain call…

Bailout Watch 262: A Chrying Shame

Automotive News [sub] reports that the exit of 5,000 salaried employees in the past week has created “chaos” within Chrysler, and bankruptcy rumors have suppliers considering cash-on-delivery demands. According to Chrysler spokeswoman MaryBeth Halprin, “the claim of chaos is unwarranted. There is certainly in this first week without 5,000 employees a transition taking place,” she said in an e-mail to Automotive News. “This is an opportunity to continue the transformation of our company, rethink work processes and focus on core function.” Right. For more on ChryCo’s “transformation,” check out this story from the NYT.

Bailout Watch 261: GM's Mea Culpa

From GM’s ad in Automotive News (Dec 8 edition):

“While we’re still the U.S. sales leader, we acknowledge we have disappointed you. At times we violated your trust by letting our quality fall below industry standards and our designs become lackluster. We have proliferated our brands and dealer network to the point where we lost adequate focus on our core U.S. market. We also biased our product mix toward pick-up trucks and SUVs. And, we made commitments to compensation plans that have proven to be unsustainable in today’s globally competitive industry. We have paid dearly for these decisions, learned from them and are working hard to correct them by restructuring our U.S. business to be viable for the long term.”

The Times of London: "Vauxhall in Secret Cash Plea to Save 5000 Jobs"

Bailout Watch 256: TTAC Called It: "Interim" Deal Goes Down

TTAC’s Edward Niedermeyer called it in yesterday’s round-up: Congress will fork-out bailout bucks to “tide” Chrysler, Ford and GM over until… later. Reuters dots a few i’s and crosses a few t’s: “Congressional Democrats and the White House have reached agreement on emergency aid for U.S. automakers of between $15 billion and $17 billion, two senior congressional aides said on Friday.” How Congress will apportion the money between the three supplicants is something of a mystery. But look for GM to get the lion’s share, Chrysler to get some and Ford to get a token amount (“token” as in more money than its workforce earned in the last ten years). Congressfolk are working through the weekend to attach strings to the money– likely to include an oversight board and a deadline for Round Three (March?). So from whence cometh this largesse? From your taxes obviously. More specifically…

Bailout Watch 256: CBS Attacks American Auto Industry

Dear oh dear. Now that The Big 2.8 have slashed their advertising budgets, now that the Congress has their CEOs in their sights, the MSM news nets have grown a pair. In today’s House action (Eddy’s on the bridge), a few pols have poked and prodded Detroit’s opposition to state emissions laws and federal corporate average fuel economy (CAFE) standards. But it’s nothing compared to this slam at Motown’s lobbying efforts. “Nobody is placing bets on whether Congress will end up giving the car companies a bailout. But if investments in Washington politicians count as leverage, then the auto industry has plenty of clout.” Iron fist in a velvet glove? The times they are a changin’.

Bailout Watch 255: Nadelli: "Then Again, Too Few To Mention"

Couric You came from Home Depot to run Chrysler. You had to be a quick study, but from what you’ve learned, what was the U.S. auto industry’s biggest mistake?

Nardelli: Well I think, look, we’ve all made mistakes. I’ve been in business for 38 years, and whether I was at GE or Home Depot or Chrysler, I think the important thing now is to look at this crisis. How do we make sure that we are repositioning ourselves that we break from some of those old paradigms to make sure that we are making new products that we are delivering service to customers, the kinds of cars and trucks they want to drive, have the conficence to drive and will tell their friends about it, Katie.

Bailout Watch 240: DOE Chief Sends Back D2.8's Loan Requests

Bailout Watch 239: Moody's Chief Economist "$125b, But Do It Anyway"

Sadly C-Span‘s coverage of today’s Senate Banking Committee didn’t kick off with a red carpet arrival of America’s automotive future. Similarly, a longish hearing with only the GAO General Comptroller didn’t do much to raise the pulse. It seems that TARP funds are still rhetorically on the table, and some form of oversight board will go along with any bailout. In fact, the seventies were back in a big way, as the 1979 Chrysler bailout is referenced as a model on numerous occasions. As if Chrysler’s CEO weren’t sitting there asking for more money. MarketWatch reports that Comptroller Dodaro said the Federal Reserve also has authority under current law to lend money to the Big Three, if the Fed board of governors determined that the need is urgent and that the loans would be repaid. However, the Fed has determined that it cannot lend to the companies because the loans cannot be collateralized as required.

Bailout Watch 238: Hearings Begin; Wagoner To Admit Mistakes. Kinda.

Bailout Watch 237: Say Bye-Bye to Bailout?

The AP reports that “Senate Majority Leader Harry Reid says the Democrats’ plan to tap the Wall Street rescue fund to save U.S. automakers doesn’t have the votes to pass. One day after Detroit’s Big Three sent survival plans to Capitol Hill in an urgent plea for $34 billion in government aid, Reid said there’s still not enough support in Congress for using some of the $700 billion bailout to help the teetering carmakers.” So it looks like the plan to tap Tarp has tapped-out. Plan B: modify the terms of the Department of Energy’s $25b retooling loans, as suggested by President Bush. Only Detroit is now asking for $34b, and the rest (bailouts for the automakers’ credit divisions). Plan C: new “emergency legislation” to top-up the Big 2.8 until Barack Obama administration can ride to the rescue (or not). Only CNNMoney says 61% of the voting public opposes that plan, and 70 percent it won’t do a damn bit of good for the U.S. economy (sorry Detroit). Plan D: pre-packaged bankruptcy, as suggested and outlined here on TTAC by Richard Tilton. And lo and behold, Bloomberg reports General Motors Corp. and Chrysler LLC executives are considering accepting a pre-arranged bankruptcy as the last-resort price of getting a multibillion-dollar government bailout.” Volte-face.

Recent Comments