GM IPO Shifts Target To American Retail Investors

GM”s IPO scuttlebutt has been dominated in recent weeks by speculation about possible foreign “cornerstone” investors. But, according to five sources who spoke with Reuters

GM is likely to sell about 80 percent of the common shares in its IPO and more than 90 percent of the preferred shares in North America.

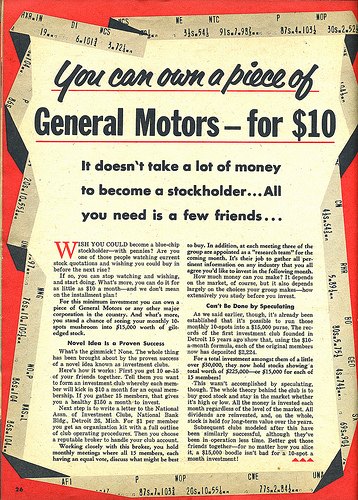

Yes, despite deep skepticism about the GM IPO’s appeal to retail investors, GM will sell most of its equity in North America, and it’s even splitting its share price to bring the per-stock price into retail range. Why the sudden back-away from talk of courting global investment and “cornerstone investors” from abroad? Politics, baby! With Chrysler likely to end up owned outright by Fiat, something had to be done to keep The General at least nominally American-owned. Meanwhile, in news that is sure to thrill prospective retail investors, Special Inspector General of the TARP program (SIGTARP) Neil Barofsky is investigating the IPO… and says GM’s per-share price will have to hit $133.78 (pre-split) for the Government to break even. GM’s highest-ever stock price was $94.63, and that was back in April of 2000. Are we getting excited yet, retail investors?

More by Edward Niedermeyer

Comments

Join the conversation

Ed, GM shares closed at $213.13 on September 11, 1926, the day before a 2 for 1 split. On September 13, 1926, after the split, they closed at $142.00 and were back over $200 a share by June of 1927.

If I buy at $10 and sell at $20, I'm happy. That $134 is a sunk cost, as in we've done been sunk.

Some people are expecting splits up to 7 times to make the price under $20 bucks. Will be interesting to see what happens.