Watch GM's IPO Pitch Here

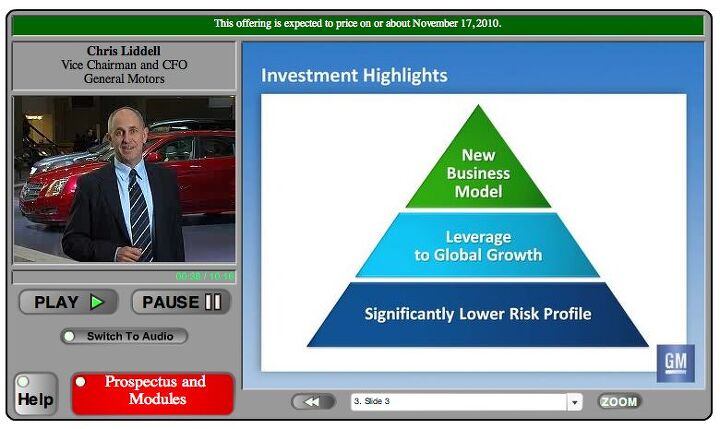

Er, not here… you have to go over to retailroadshow.com for the non-embeddable presentation pitching investors on the new General Motors. But since retailroadshow doesn’t have a comments section, make sure to surf back to TTAC when you’re done taking in the pitch. Meanwhile, consider this: Saudi Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud, a major investor in Citi, EuroDisney, The Four Seasons, AOL, Apple, News Corp, and more has said his investment firm would look “very seriously” at buying into GM’s IPO. Oh yes, and the White House has reiterated its confidence that all the money it invested in GM’s bailout would be repaid. Even though GM pushed against the higher IPO price ($30/share) requested by Treasury, which would have slowed future appreciation of the stock, but would have given the government a higher initial payback. Also, it seems that UBS has been dropped as an underwriter of the IPO after one of its large-cap, non-automotive analysts sent an email that disclosed information restricted by the SEC.

More by Edward Niedermeyer

![Bailout Watch 472: PTFOA Rips GM a New One [Download "Determination of Viability: GM" Here]](https://cdn-fastly.thetruthaboutcars.com/media/2022/07/20/9488903/bailout-watch-472-ptfoa-rips-gm-a-new-one-download-determination-of-viability-gm.jpg?size=350x220)

![Bailout Watch 470: Chrysler RIP, GM Headed for C11? [Download Federal Warrantee Commitment Program Here]](https://cdn-fastly.thetruthaboutcars.com/media/2022/06/29/8410657/bailout-watch-470-chrysler-rip-gm-headed-for-c11-download-federal-warrantee.jpg?size=350x220)

Comments

Join the conversation

I still wonder if the federal government was hyping GM's sales in anticipation of the IPO. GM is now predicting less optimistic figures for Q4, which corresponds with the beginning of the fiscal year. "Salting the mine" before a stock offering was a common practice before the SEC. It's now illegal. Not sure if that applies to the government.

So I got the piece with Liddell to play fine, but I can't get any of the "modules" with Akerson etc to play. Anyone get those to work? What's the secret?

Remember how the Chrysler loan guarantee of the 1980s was decried as a sin against nature by market fundamentalists in the 1980s? Remember how the US government would up making a good profit on that investment. Yes, it is true that two decades later Daimler Benz took over Chrysler and ruined the company, but that was the action of the saints of the Free Market Private Industry doing their thing.

I will not be at all surprised to see the US make a profit on its GM holdings as long as Treasury sells them off patiently over time instead of dumping them as rapidly as possible.

The Obama Administration has been very careful to point out that they expect to recover all of the money that their administration "invested" in GM and Chrysler. They're selectively forgetting about the $13.6 B (IIRC) that the Bush Administration put into GM. I believe the stated rationale is that Bush didn't really put conditions on the first tranche, so it can't be expected to be paid back - or something along those lines. Because of the deferred-tax benefit that surfaced this week, bailout opponents will never be silenced, even if the Obama + Bush money is repaid, because that $45.4 billion is nearly as much as the total bailout handed to GM, and doesn't have to be repaid.