Buyout Begone: Ford Says You Can Never Own Leased EVs

Ford Motor Co. will be suspending end-of-lease buyout options for customers driving all-electric vehicles, provided they took possession of the model after June 15, 2022. Those who nabbed their Mach-E beforehand will still have the option of purchasing the automobile once their lease ends. However, there are some states that won’t be abiding by the updated rules until the end of the year, not that it matters when customers are almost guaranteed to have to wait at least that long on a reserved vehicle.

Fresh Off the Boat, Hyundai's Veloster N Makes for a Dicey Lease Deal

Hyundai’s hottest hatch isn’t breeding any smoking lease deals. The pinnacle of the revamped, second-generation Veloster three(?)-door definitely puts the power down, providing a Korean entry in a class dominated by Germany, Japan, and, until recently, America (via Germany), but the first lease seen for the Veloster N might leave potential owners shopping elsewhere.

There’s cheaper alternatives for those wanting 250-plus horsepower in a small package.

Lexus Jumps Into the Subscription Fray

No doubt courting Millennials who’ve grown used to bundled costs, Lexus plans to offer its new subcompact crossover — hey, something else Millennials seem to like! — for an all-in-one monthly payment. The vehicle, the insurance, and the maintenance are all covered by a no-haggle price over a two-year term.

Lexus hasn’t listed what the monthly prices might look like, but its UX crossover isn’t the first vehicle to see a subscription-style lease treatment. Volvo popularized the idea with its recent XC40 crossover, also targeted at young, urban professional types with stable incomes and an aversion to dealership salespeople.

If Only the Range Matched the Price: Honda's Clarity EV Leasing for $199 a Month

By that, we mean the figure “199,” not the overall cost of leasing. Moving on…

Honda’s only true EV, the Clarity Electric, began arriving at dealers in California and Oregon Thursday, completing a green trifecta that includes a plug-in hybrid variant and hydrogen fuel cell model. It also carries a lease price that undercuts its rivals by quite a bit.

While Clarity EV lessees stand to pay significantly less for their eco-conscious ride, both up front and on a monthly basis, they’d best familiarize themselves with the location of charging stations.

Accord Sales Are Declining, so Honda Figures You Might Like a Cheaper Lease

There’s no danger of discontinuation, but customers aren’t beating a path to the Honda Accord’s door in the kind of numbers the automaker hoped for. Sales of the revamped-for-2018 midsize sedan fell 9.9 percent in the U.S. last month, with volume over the first three months of 2018 down 11.8 percent. That’s a problem.

What to do? If you’re Honda, the time-honored tradition of piling cash on the hood doesn’t seem all that attractive. Better to make those in the mood for a lease happy.

Paranoid of the Government? BMW's Got Your Back

As sometimes happens, there’s a war brewing in the heart of Europe. This one isn’t like the others, though — instead of nation versus nation, it’s a case of lawmakers versus privately owned vehicles, primarily those of the diesel persuasion.

So eager are some city governments to ban the operation of diesel-powered cars and trucks in or near urban centers, BMW Group has taken the unusual step of issuing a promise. In a bid to allay fears of new (or newish) vehicles becoming useless to their owners, the automaker claims it will let German lessees return their diesel vehicles and switch to a gas-powered model.

Don’t worry about the government, BMW wants its customers to know. Just enjoy that compression ignition engine while you can.

That Awful Hyundai Kona Lease? It's Already Dead

Mere hours after we published a story on the attractively priced but awful-to-lease Hyundai Kona yesterday, it seems Hyundai had a change of heart.

The initial advertised lease for the volume SEL trim lasted less than a week, after the automaker apparently decided it wasn’t a good thing to make the brand’s smallest crossover more expensive to lease than the larger Tucson and Santa Fe Sport.

Hyundai Kona Rolls Out of the Gate With a Less-than-ideal Lease

As we told you earlier this month, Hyundai’s newest offering, the B-segment Kona crossover, arrived with a base price below that of its subcompact competition. At $20,450 after delivery for a base, front-drive SE, the Kona slots below the entry MSRPs of the Honda HR-V, Toyota C-HR, Chevrolet Trax, and Mazda CX-3.

Value, the Kona trumpets, has arrived.

Well, not if you’re leasing the Kona’s volume trim: the SEL model.

Don't Be Fooled by Misleading Ads This President's Day

It’s not fair to say there’s no truth in advertising; commercials often show vehicles driving in a straight line down a dry road, and we all know they can do that. Only the most gullible among us thinks a new muscle car will improve their love life faster than Billy Dee Williams can crack open a can of Colt 45.

All too often, smokin’ deals do not await shoppers who leave the house without reading the fine print. And even that fine print can hide whether you’re actually getting a bargain. With President’s Day coming up on Monday, here’s a few examples of juicy car promotions that are sure to waste someone’s time.

Leasing a Wrangler? If You're Really Cheap, You Might Want to Choose the Newer Model

Unlike other vehicles in the Fiat Chrysler lineup, and we could list off a number of them, Jeep’s Wrangler line has a near supernatural ability to hold on to its value. Does worrying about depreciation keep you up at night? Forget that compact sedan and shell out a little more for a Wrangler.

For non-buyers, however, the leases offered by Jeep on both the 2018 JK Wrangler Unlimited and next-generation 2018 JL Wrangler Unlimited present both an opportunity and a mystery. Strangely, the cost of leasing an all-new Wrangler amounts to one dollar a month less than the cost of leasing the old Wrangler. What gives?

Kia Niro Plug-in Looks to One-up the Toyota Prius Prime in One Key Way

Kia’s well-regarded Niro, the boxy, decent looking hybrid five-door that’s a cross between a crossover and a hatch (it doesn’t offer all-wheel drive), spawns a plug-in sibling for 2018.

Positioned as a mainstream offering for green yet thrifty families, both Niro and Niro Plug-in offer more than 100 cubic feet of passenger volume in an incognito body while delivering fuel economy approaching that of the Toyota Prius. In plug-in form, the Niro travels 26 miles before requiring the assistance of gasoline.

While the Niro Plug-in’s price tops that of a base Prius Prime, we’ve learned Kia has a strategy for scoring value-minded buyers.

America's Love for Luxury SUVs Is Screwing With Off-lease Sedan Sales

North America’s love affair with SUVs and crossovers arose so suddenly and with such passion that manufacturers were left scrambling to meet demand. Luxury brands certainly aren’t exempt from this but, unlike mainstream marquis, the sudden shift in product demand has thrown those marques a bit of a curveball.

Since prestige brands tend to possess substantially higher leasing rates than their more-affordable contemporaries, luxury automakers are getting stuck with off-lease sedans that nobody seems to want. While that’s terrible news for corporate accountants, it’s good news for anyone looking for a good deal on a used Lexus ES or Audi A4.

Two Classes of Toyota-built Sports Coupe and the $5 Difference

With the aggressively styled LC 500 garnering most of the Lexus coupe headlines, what with its eight-cylinder engine and look-over-here sheetmetal, its RC stablemate often gets short shrift. Meanwhile, the more attainable Toyota 86 (formerly the Scion FR-S) seems to make headlines for not offering extra horsepower than for anything else.

America is not a forgiving place for coupes these days.

Still, which of these rear-drive Toyota-built coupes holds the most appeal to a buyer? The 86’s handling and youthful intentions aside, it’s arguably the RC, as Lexus’s coupe offers more interior room, horsepower, and clout. Even the base RC 200t, which becomes the RC 300 for 2018, brings a 241-horsepower turbocharged 2.0-liter to the table, handily besting the 86’s turboless 2.0.

Of course, it’s not really a fair comparison. The price gulf between the two models is quite significant. Or is it?

Uh Oh, Your Car's Worth Less Than You Owe - What Comes Next?

Years back, after the desire to purchase one particularly fetching model became too great, you walked into the dealership, marched right over to the salesman’s cubbyhole, and signed over several years’ worth of payments on your ride du jour. Bliss ensued.

Unfortunately, come trade-in time, your once-desirable ride isn’t even worth the amount left owing. You’re in negative equity, pardner. Still, buyers faced with this situation have a number of options at their disposal.

Thanks to a recent study of new car buyers, we now know exactly how owners of low-value trade-ins chose to deal with their unexpected debt.

Now Is the Time to Get Yourself a Midsize Sedan on a Dirt Cheap Lease Deal

“Stepping up to a midsize is basically a no-brainer for buyers at this point,” CarsDirect’s senior price analyst Alex Bernstein tells TTAC.

With demand for midsize sedans drying up, deals on aging models are warming up.

Now in its sixth model year, the 2017 Volkswagen Passat 1.8T S — the entry-level Passat — is available in June for a 36-month lease at $189 per month and $1,999 due at signing.

The 2017 Honda Accord, a new version of which is due later this year, is also available in June in basic LX trim on the same terms.

Meanwhile, the mid-grade 2017 Toyota Camry SE 2.5, set to be replaced in the coming months by an all-new model, is likewise available in June for $189 per month with $1,999 down over 36 months.

“This is about as cheap as lease deals have ever been on these midsize sedans,” Bernstein says. But it actually gets even cheaper, marginally cheaper, according to CarsDirect’s examination of 500 lease deals.

'Deep Subprime' Auto Loans Are Becoming the New Normal

A third of all subprime car loans are now being categorized into the ominous-sounding “deep subprime” group. The designation has become progressively more inclusive since America clawed its way out of the recession and now accounts for 32.5 percent of all high-risk loans — up from just 5.1 percent in 2010.

While consumers have fallen behind on most subprime auto loans, the deep classification is responsible for the most serious cases of nonpayment. Delinquencies surpassing 60-day periods have tripled since 2012 and indicate little sign of stabilizing.

GM's Maven Reserve: Book a Tahoe for the Same Price as an Escalade or CTS-V

As urban populations grow and analysts continue to predict dwindling car ownership, alternatives have sprung up and automakers are gradually getting in on that sweet car-sharing action. Currently active in 17 North American cities, General Motors’ hourly ride-sharing unit Maven has been building slowly.

GM is now expanding Maven to include long-term rentals which, come to think of it, sounds identical to what it was doing with its Book by Cadillac premium subscription service. While the Caddy offering is intended to be a monthly subscription serving as an alternative to normal vehicle ownership, nothing is really stopping customers from using “Maven Reserve” in a similar manner.

Also similar is the pricing. While the special Maven Reserve vehicles don’t yet encompass all GM’s fleet, a Chevrolet Tahoe runs $1,500 for 28 days, which is identical to the subscription fee for Cadillac Book, which also includes curbside car delivery and mid-month vehicle swapping.

In essence, GM is allowing you to have simultaneous access to a CTS-V and Escalade or a Tahoe for the same amount of money.

The Ford Focus Electric is Now the Cheapest Car in America

The Ford Focus Electric is one of the most unloved models in North America right now, and its lonely existence translates into big savings for thrifty shoppers willing to make do with a less-capable EV. Ford cut $6,000 from the car’s price in 2015, and sales continued to fall despite a $4,000 price reduction the year before. You can also lease one right now for little more than a smile and a handshake.

Electric cars remain a difficult sell, especially considering there is always something better right around the corner, but leasing them is exceptionally popular — comprising roughly three-quarters of the EV market. It makes sense when lease-rate comparisons typically work out to EVs being more affordable than a similarly priced internal combustion vehicle.

24/7 Wall St. Declares 'Book by Cadillac' a Failure; Cadillac Shrugs Off Questions

General Motors’ luxury division isn’t content with brewing coffee and showing off fashionable new threads at its new SoHo space — it also wants you to drive its cars.

Book by Cadillac, a monthly subscription lease service that launched one month ago, aims to get more people in the metal to the tune of $1,500 a month — and 24/7 Wall St. is already calling it a “major flop.”

According to the self-described “financial news and opinion” website, “[Uwe] Ellinghaus [Cadillac’s chief marketing officer] in particular has to be humiliated,” as there aren’t enough subscriptions available to supply the demand.

Say what now?

Cadillac Will Let Fickle People Borrow From Its Fleet for $1,500 a Month

If you’ve ever found yourself buying someone a $10,000 handbag or worrying that not enough of your clothing is made from cashmere or silk, you’ll want to know that Cadillac will let you “subscribe” to its cars for a tidy monthly sum of $1,500.

“Book” by Cadillac is a $500 app that lets you select the most premium offerings from the brand and have it delivered to your door. However, you’re not leasing or purchasing a vehicle from General Motors’ flagship brand — you’re just borrowing one. Cadillac is touting this as some sort of transformative, fancy-free way to own a car. Still, it doesn’t actually alleviate most of the problems associated with car ownership, especially not in the urban markets it plans to test the service in.

You'd Value Your Car More If You Paid Cash For It

Want to feel a real connection to something? Pay cash for it.

Research shows the act of handing over real, honest-to-God paper money and coins for a product has a profound impact on the value a person places in that product. Suddenly, it turns into a possession.

Auto Leasing Insider Tips, Tricks, Myths and Misconceptions

A record 31 percent of all new vehicles sold this year in the U.S. are leased. I spent a good part of my career studying why some people refuse to lease. Much of their resistance stems from bad buzz. Some say it’s because of the stories they heard about ’80s-era open-end leases where owners were responsible for paying the car’s residual value at lease end. (These are the same customers who will not buy a Hyundai today because they produced crappy cars in the ’80s.) Others oppose leasing because they heard about a guy whose cousin’s neighbor had to pay $5,000 in wear and tear or excess mileage charges at lease end. And there are those of you who will brag comment below about how you always pay cash for your cars and don’t understand why other people won’t follow your lead.

This article is not designed to convert such non-believers to leasing. This advice, drawn from my years in the auto finance business, is for buyers who know the basics and benefits of leasing, want some timely tips on how to get the lowest possible payments, and want to pay less money on lease-end charges.

This BMW Dealer is Giving Away Cars Right Now

Have you been considering a new BMW but only have enough coin to buy one of Bavaria’s finest? At least one BMW dealer in the U.S. might have a solution.

If you don’t mind buying a new BMW that’s been languishing on the lot for a year, Century West BMW will throw in a lease on a BMW i3 on the house.

Sales Are Rising, But Incentive-Happy Automakers Are Kneecapping Profits

Light vehicle sales haven’t peaked in the U.S., but the way they’re being sold is putting automakers in some financial peril.

That warning was delivered by Thomas King, vice-president of the Power Information Network, ahead of this weekend’s National Automobile Dealers Association, Wards Auto reports.

Speaking at the J.D. Power Automotive Summit, King said retail sales of cars and light trucks will rise this year and next, even after a very healthy 2015. Last year saw 14.2 million units reach customers, with volume projected to hit 14.7 million in 2017.

Despite moving more vehicles and rising MRSPs, automakers risk forgoing the financial benefits due to incentives and a growing trend towards leasing.

Act Fast, and Get a Ford Focus Electric for Pennies

If you live in California and your demographics are right, your electric car dream is within reach. Yes, even you, baristas and struggling actors!

The website Leasehackr stumbled upon a killer deal for lower-income Californians (assuming they live near charging stations), and spelled out how leftover 2015 Ford Focus Electrics can be leased for essentially nothing.

If your personal life aligns with Ford’s customer incentives and California’s revamped EV rebate program, it can be done.

Cadillac (and Its Resale Values) Still Haunted by Troubling Past

The lowly Cimarron might be be a distant, nightmare-fuel memory, but Cadillac’s current sales strategy is still being impacted by a history of not measuring up to European rivals.

The luxury automaker’s newest offerings — the CT6 sedan and XT5 crossover — have been saddled with so-so resale values by residual forecaster ALG, according to Automotive News, making it more difficult for Cadillac to offer competitive lease rates.

Toyota to Offer Pre-Owned Leasing; Sensible Dreamers Rejoice

A wave of older vehicles is poised to flood Toyota dealer lots, but the automaker is confident it has just the plan to deal with it — pre-owned leasing.

Toyota is certain that adding a leasing option to its certified pre-owned inventory would boost CPO sales and clear lots in the face of a growing compliment of three-year-old product, Automotive News reports.

The plan has already been quietly rolled out in the U.S. Northeast, but a national strategy should be in place by the end of April, dependent on training in each dealer region. The option would allow a reduced commitment for buyers who don’t want to finance the full cost of a pre-owned vehicle.

Americans Loving Their Leases, Not so Much Their Loans

Good times have clearly arrived, because Americans are flinging money at cars like it’s going out of style.

Leasing has never been more popular for American car buyers, reports the Detroit Free Press, and the size of their auto loans have also reached record territory.

Who Wants To Lease A Chevy Cruze For Less Than A Gym Membership?

Leasehackr has a screaming deal on a 2016 Chevrolet Cruze Limited (the old body style) 1LT Automatic if:

1) You can sell it for more than $13,000 after two years;

2) You’re were a Costco Auto member before Sept. 30;

3) You can get $1,800 off of MSRP, or thereabouts;

4) Max incentives;

5) You’re a current lessee of another automaker;

6) You don’t mind driving a Chevrolet Cruze Limited 1LT Automatic for two years.

If you ticked every one of those boxes, congratulations! You can lease a 2016 Chevrolet Cruze for $40 or less*** per month for 24 months.

Car Loans Get Longer, Credit Scores Get Lower, and We're More Reliant on Automakers for Money and Cars Now

In news that will shock precisely no one, the current car blitz is partially fueled by longer loan rates, higher monthly payments and an increasing prevalence to finance our new cars from the automaker themselves — when we’re not renting it from them in the first place.

Experian released Wednesday its data on third-quarter sales and financing and found, on average, that borrowers’ credit scores were at the lowest level since before 2008. According to the credit agency, car buyers had an average credit score of 710 when they financed their car — which happens in 86.6 percent of car transactions, an all-time high.

Buyers opted for longer loans too. According to the data, new car loans longer than six years increased to 27.5 percent for the third quarter, up 17.1 percent from the same period last year. Loans between five and six years accounted for 44 percent of new vehicle financing.

Auto Loans Top $1T; Sub-prime Loans Grow 10 Percent Over 2014

Credit-reporting agency Equifax says that as of June 2015 more than $1 trillion has been loaned or leased in the United States. The total dollar amount is 10.5 percent higher than last year.

The average loan amount is $20,800, which is a 3.65 percent increase over last year, and the average sub-prime loan is $18,200. Sub-prime loans comprised 23.5 percent of newly originated auto loans.

More than 9 million new loans were made up to April 2015, which is a 5.8-percent increase over last year. Overall, more than 73.7 million cars are financed through loans in the U.S.

Nissan Leaf Sales Expected To Fall Steeply This Summer

Like the leaves in autumn, sales of the Nissan Leaf are falling amid a flurry of changes coming to the EV this summer.

VW Offering $39 Monthly Jetta Leases to Hook Customers in Later

The Nissan Versa sedan might be the cheapest car in the U.S., but it isn’t holding candle to the cheap lease rates available for the Volkswagen Jetta. Regardless of the almost $4,500 price differential between the two cars in base model trim, Jetta lessees are spending less than half each month compared to the Versa, as low as $39/month at one San Jose, CA dealership.

It’s all part of an effort to bring customers in now at a loss to have their attention three years in the future when the German marque has more compelling products to offer.

Luxury Brands Doing Well On The Back Of Lower-End Models

Want to know why Mercedes, Audi, Lexus and all of the other luxury players are doing so well these days? Because of less-costly, lower-end luxury models.

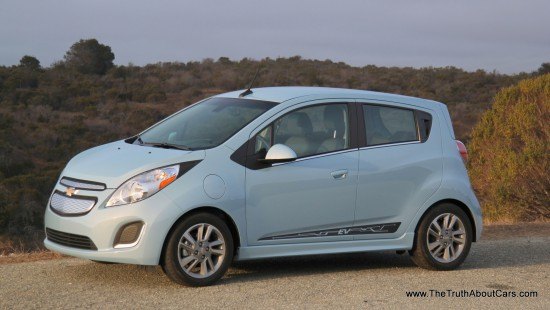

Chevrolet Spark EV Sees Price Drop, Bonus Cash For Base Model

In the market for a 2015 Chevrolet Spark EV? Your wallet will still feel heavy after signing off on the paperwork for the base model.

US New-Truck Leases Rise Thanks To Higher Residuals, Transactions, More Content

Forget about leasing Benzes and Lexuses: trucks are the new hotness, thanks to higher residuals and transaction prices, as well as more content.

Mercedes-Benz Tops In J.D. Power Satisfaction Survey

Another day, another customer survey. This time, it’s J.D. Power with its annual Sales Satisfaction Index Study, with those surveyed placing Mercedes-Benz at the top of the podium.

Tesla, US Bank Team For New Model S Lease Contract

Want to own a Model S without worrying about a long-term commitment or how much it’ll hurt your bottom line? CEO Elon Musk has a deal for you.

Chrysler Capital Waxes, Ally Wanes On Q1 2014 Auto Financing Originations

Doing business with Chrysler proved to be a boom for Santander Consumer USA’s Chrysler Capital during Q1 2014, while former lending partner Ally Financial experienced a painful bust on its Pentastar originations.

Automakers, Dealers Prepare For 2016 Off-Lease Market Flood

Currently, around 2.13 million cars will come off-lease by the end of 2014, up from 1.7 million last year. By 2016 and beyond, however, over 3 million vehicles annually will turn up on many a CPO and used car lot, replacing a long drought with an El Niño-esque flooding of the U.S. used car market.

More Trade-Ins Pulled Underwater As Negative Equity Level Rises

As more consumers trade-in their old vehicles for a newer model, a growing number of consumers are owing more on their trade-in than their vehicle’s actual worth.

Off-Lease Consumers Add Fuel To New-Vehicle Demand

New-vehicle sales are on the rise due not only to demand originally held back by the Great Recession, but by consumers coming off of their leases for their next latest and greatest.

Chevrolet Offers Incentives, Extends Truck Month To Take Back Sales Crown

Though Ram knocked Chevrolet off the monthly sales throne for the first time since August 1999, the brand is ready to reclaim their part of Truck Mountain by offering incentives and extending their annual Truck Month into April.

Ford Raises Incentives To Clear Growing Fusion Inventories

As inventories of Ford’s Fusion continue to outpace demand — the result of a second plant brought online last year to keep up with demand for the newly redesigned midsize sedan — the automaker has been raising incentives to move more Fusions out of the lot.

Off-Lease Vehicles Set to Flood Used Car Market Along With More Former Rentals

In 2013, 3.2 million new cars and light trucks were leased in the U.S., an almost threefold increase from 2009. The 2014 Manheim Used Car Report, produced by one of the larger used vehicle auction companies, says that the auto industry will have to change the way it remarkets cars if it is going to successfully handle the increased volume of off-lease vehicles.

According to Automotive News, the Manheim report also warns that dealers who take in off-lease vehicles on behalf of lessors (so called ‘grounding’ dealers, “will not be willing or able to acquire the same large share of off-lease units that they have in recent years.”

2014 Cadillac ELR to Lease for $699 a Month

If you thought the $75,000 price of admission for ownership of the 2014 Cadillac ELR was too high, the luxury automaker may have another option for your consideration: A lease contract of $699/month with a few stipulations.

Off-Lease Boom Means Major Conflict For All Automakers

The Great Recession has given us so much since it began five years ago with the fall of Lehman Brothers and Washington Mutual, from underwater mortgages and high unemployment, to bailouts of the financial and automotive manufacturing sectors and credit freezes.

Regarding the last item, a byproduct from said freeze will flood automakers with the potential to retain and steal customers when more and more leases draw to completion in the next year.

Ally Exits Superprime Loans, Enters Used Car Market

Best known for underwriting public radio programming such as “All Things Considered” and “Marketplace,” Ally Financial — formerly known as GMAC until the subprime market collapse kicked off the Great Recession — has decided to go for the gold in the used car and leasing markets, citing “irrational” pricing found in the superprime mortgage loan sector for its move from the latter toward the former.

$10,000 Off a Volt, Haters Gonna Hate?

The latest from USA Today suggests now is a good time to buy a Chevy Volt, if that’s what you really want. I checked in with former(?) TTAC scribe Captain Mike Solo, currently helping someone lease a Volt, and he says about the same: lease for $270 a month, with $1500 down. Which includes the government tax credit built into the residual…probably. So what does this all mean?

TTAC Customer Service: Five Lease Deals Under $200

Some TTAC readers complained that they never had the chance to cash in on the great $199 Volt lease deals. We apologize.

Quote Of The Day: Score One For The Car Mags Edition

The New York Times has a story that’s fascinating in its own right: the number of people leasing a car on leasetrader.com without first test-driving the car has doubled since 2007. Troubling stuff for most auto enthusiasts among us, but probably not much of a surprise to readers on the retail side of the business. One auto broker explains the most common reasons for taking this leap of faith:

Generally these are people who know what they want, whether it’s because they’re very brand-loyal or they’ve fallen in love with the styling of a particular model. Same goes for buyers who are strictly interested in getting the best deal, and those with limited choices like a big family that needs a nine-passenger vehicle with 4-wheel drive.

But, as one “enthusiast” explains, some consumers are just so well informed, they don’t need to drive their car before they buy it. That’s what they subscribe to magazines for!

Better Place Announces Business Plan, Signs Israeli Lease Deal

One of the biggest clouds hovering over Better Place’s venture in Israel – and globally – is what stands behind the well-prepared presentations and thoroughly thought out, customer-oriented marketing. What makes the seemingly adventurous venture appealing to the business hounds investing their best capital in it? Such questions from journalists are usually answered with a neat smile, a corporate joke and a dry statement.

While Better Place still isn’t revealing its global business plan, it finally sheds some light on the numbers behind its Israeli venture, as part of a worldwide roadshow in preparation for the company’s upcoming $300 million capital raising.

Hammer Time: Who Should Lease?

Who should lease? Some folks believe that short term non-ownership is the perfect fit for the über-rich and nouveau riche. The rich can afford to drive whatever strikes their fancy after all… and who wants to own a Taurus when you can lease a Bentley?

As for the new rich or the soon to be rich; they also need a taste of their success. So why not a lease? Well, because I have gone nearly blue in my face over the years telling aspiring lessees that the math doesn’t work. Convenience… perhaps… worry-free ownership… maybe. But moneywise? Nein. Nyet. No.

Reason can only go so far in life. Even enthusiasts have a thing for the automotive fling. So here are seven types of lease happy shoppers I’ve met in my travels. In their own words of course.

Rent-An-IQ

The attentive reader of TTAC is not surprised by the news provided by Automobilwoche [sub] that Toyota will introduce a plug-in version of its iQ by 2012. It had been on Toyota’s green roadmap for months. The (not really) surprising news is: You won’t be able to buy the EV iQ when it gets launched.

Not Buying A Car Looks Better By The Minute

Forget two or three year leases. Daimler will rent you cars by the minute and “is stealing customers from Mazda and Fiat with rentals aimed at drivers ready to forgo auto ownership,” reports Businessweek.

Emboldened by the successes of Zipcar and other short term rental or car sharing ventures, Daimler is test marketing its Car2go service Austin, TX, and Ulm, Germany. Soon to follow: Hamburg, Germany, in early in 2011, and dozens more cities in Europe and North America. Car2go rents Smart cars by the minute. Other carmakers, such as BMW and PSA want to develop similar services.

Recent Comments