Auto Leasing Insider Tips, Tricks, Myths and Misconceptions

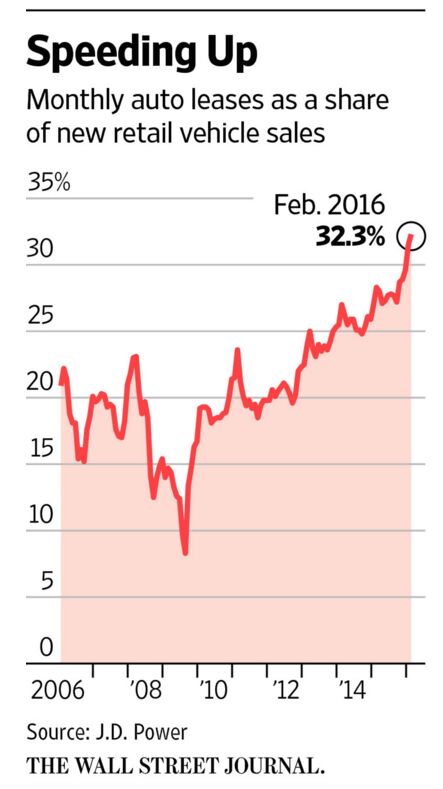

A record 31 percent of all new vehicles sold this year in the U.S. are leased. I spent a good part of my career studying why some people refuse to lease. Much of their resistance stems from bad buzz. Some say it’s because of the stories they heard about ’80s-era open-end leases where owners were responsible for paying the car’s residual value at lease end. (These are the same customers who will not buy a Hyundai today because they produced crappy cars in the ’80s.) Others oppose leasing because they heard about a guy whose cousin’s neighbor had to pay $5,000 in wear and tear or excess mileage charges at lease end. And there are those of you who will brag comment below about how you always pay cash for your cars and don’t understand why other people won’t follow your lead.

This article is not designed to convert such non-believers to leasing. This advice, drawn from my years in the auto finance business, is for buyers who know the basics and benefits of leasing, want some timely tips on how to get the lowest possible payments, and want to pay less money on lease-end charges.

Knowing your lease money factor is not as important as knowing if the dealer marked it up to make more profit on your deal

We’ll start with the mysterious money factor. Even the Consumer Financial Protection Bureau, as it continues its misguided mission to stop dealers from marking up interest rates on auto loans, does not seem to know that dealer’s can mark up lease money factors.

The lease money factor is not disclosed on lease contracts, thus making it a breeze for dealers to add a few points to it, limited only by the bank’s markup policies. As an example, the dealer markup could bump the payment on a $30,000 car with a zero down, 36-month lease from roughly $451/month to $474/month. Dealers cannot alter the other part of the lease payment, the vehicle’s residual value, which has a bigger impact on the payment.

Current standard money factors for folks with excellent credit range from around .00180 to .00210, depending upon bank. We found current manufacturer-subsidized rates (read: for cars that are languishing on the lots) as low as .00001 for a 2016 Volkswagen Tiguan S and several other vehicles according to leasehackr.com.

The widely publicized claim that multiplying the money factor times 2400 to determine your “interest rate” is not accurate say some industry experts. A money factor is a mathematical shortcut, not an APR. Since a lease does not amortize down to zero as does a loan, and instead amortizes down to the residual value, I tend to agree that this is a misleading comparison.

Whether your initial payment quote came from the salesperson or the finance manager, rest assured that it’s probably already marked up. Your goal is to get it back down to the bank’s rate. One strategy is to ask the finance manager to show the money factor and to see a copy of the bank’s rate sheet to verify. If you have less than perfect credit, your application may have scored in a lower “tier” and assigned a higher money factor. You can glean this information by asking the finance manager to show you the “call back” sheet from the bank, which tells the dealer exactly how to price your lease contract.

What if you verify you are getting the lowest money factor and still think it’s too high? There is basically no alternative at this point if you’re going it alone. Unlike a traditional auto loan, you can’t shop rate as very few local banks and credit unions offer leasing.

Find out if your dealer has marked up the acquisition or “bank” fee

The lease acquisition fee, or “bank fee,” is set by the leasing source and can range from around $400 to $1,000. Most banks allow dealers to mark it up an extra $100 to $300, money that goes straight into a dealer’s pocket. One way to determine the actual fee is to search carmakers’ websites for special lease deals, which never include any dealer markup on the acquisition or “acq” fee.

BMW’s site states that its fee is $925. If one of its dealers quotes you $1,125, it’s making $200 in profit. Some automakers like Lexus will not disclose an acquisition fee on its website, instead referring you to the dealer for any fee information.

As with the money factor, ask the finance manager to show you a copy of the bank’s policy on acquisition fee markup. If you are the type of shopper who calls or emails multiple dealerships for price quotes, that is the ideal time to ask what they will be charging for the acquisition fee.

Sitting in front of the finance manager and asking for rate sheets might lead to an awkward interaction, but bear in mind that you’re in control at this point. You’re the only calm person involved in the transaction. Your salesperson is worried about finding the next “up.” The sales manager is convinced that the finance manager is about to piss you off by trying to sell you TruCoat and blow the whole deal. The finance manager is stressed because he or she can only make commission by marking up the money factor or selling you products. This hysteria hits its height on the last day of each month.

Take advantage of all this tension. If the answer to your disclosure requests is a flat refusal or “it is against our policy to show you,” threaten to walk away. You may be beaten down at this point, especially after weeks of research, test drives and hours of negotiating, but hang in there and get the payment you deserve. It is unlikely you will leave without your new vehicle.

Do not let a dealer place your lease through an independent bank instead of its manufacturer’s captive finance arm

You will lose any factory lease loyalty incentives by going with a non-captive bank. Captive banks can include waived payments and disposition fees if you stay with your brand and its bank. If your dealership offers you a lease from an independent bank, insist on using the car company’s captive instead. Independents also have a record of charging you for every minuscule scratch and tear on lease-end charges, as they do not have the processes or resources to dispose of off-lease cars without taking huge losses.

For example, occasionally U.S. Bank would pick a high-end Benz and undercut our lease payments at Mercedes-Benz Financial Services by a few bucks and some dealers would contract some clients with them. The bank’s strategy was to offer ultra-low money factors and low residual values with the hope that the client would purchase the car at lease end, apparently forgetting that customers lease because they want a new car every few years.

Three years later, the angry clients would be yelling at the bank and the dealer over their enormous lease-end bill, U.S. Bank would lose its shirt at auction on the car, and Mercedes-Benz would lose a customer for life.

There are some vehicles that the carmaker’s captive bank choose not to lease. Our Kentucky correspondent Bark M. tipped us that Ford Motor Credit does not offer leases on the Shelby GT350R and Focus RS. This is likely due to the fact that many high-end variations of a model historically have lower residual values then a base version. For example, a recent 36-month residual on a 2016 Mercedes-Benz C300 was a respectable 60 percent, while its AMG sibling — the C63 S — has a dismal 47-percent residual. From a payment standpoint, you are being forced to finance such cars or take your chances on an independent lease source.

Leasing companies are car brokers: they are middlemen who will always cost you money and sometimes cost you the entire deal

Most leasing companies are simply brokers who run your deal through a franchised dealer and its captive bank after taking its $300 to $2,000 dealer commission. Many have a history of ripping off automakers and their banks through falsifying customers’ credit applications, identity theft and export scams.

Banks are so tired of being conned by brokers that many require dealers to disclose whether the deal came from a broker or leasing company. If it’s through a broker, the bank will go over your application with a fine-tooth comb plus take a deep dive into your background and the broker’s background. People with less than stellar credit thus have a better chance of being denied a loan or lease than had they applied directly through a dealership.

If your hatred of the dealer experience trumps your need to get the lowest possible price, you may enjoy the convenience that brokers/lease companies can offer. Most can hook you up with any brand of vehicle and may call dozens of dealerships to get you a good deal, which will include a commission fee.

Beware of open-end leases and non-walk-away balloons

I doubt there are many banks still offering open-end leases, where the customer has to pay the residual amount at the end of the term. However, in certain states such as Illinois where tax laws make leasing too costly, banks offer balloon financing in lieu of leasing and most of these are walk-away balloons with no obligation at end of term, other than normal fees.

A few years back, BMW Financial brought back non-walk balloon notes in California, much to our delight at Mercedes-Benz Financial Services. We had faith that certain BMW stores would not disclose that the customers were responsible for paying the balloon amount at the end of the contract and this would result in unhappy clients switching over to Mercedes-Benz products.

If you drive a lot of miles or are accident prone, you should always lease

That is not a typo. Many people think that they “drive too many miles to lease,” when in fact the benefits of leasing are even greater for them.

Suppose you have a lengthy commute and drive 25,000 miles per year and you finance $30,000 at 3.0% APR on a vehicle for 72 months. At the end of three years, the point at which most people trade their cars, you will owe around $16,000 and even a high resale value car like an Accord or Camry would only be worth $9,000 to $10,000 in trade with 75,000 miles on the clock. If your car had a repaired fender, you can deduct a couple grand or more depending upon the number of times the used car manager shakes his head as he inspects your vehicle.

Now suppose you leased for three years and purchased an extra 30,000 miles upfront to cover the amount over the standard lease allowance of 15,000 miles per year. At 20 cents per mile, the additional miles will cost you about $6,000 over three years, so you would be slightly ahead vs. financing. If you had the repaired fender, you would be several thousand dollars ahead as most captive lease companies will not ding you for it unless the repair and paint job was totally botched.

At Mercedes-Benz Financial Services, I refereed many disputes over lease-end charges and I know of only one case where we had to charge for poor body work because the quarter panel’s poor patina appeared to be from Testors model-car paint applied at night.

There are ways to reduce paying some excess mileage and excess wear and tear charges

The only way to completely avoid excess mileage charges is to, well, not drive excess miles. The biggest mistake that people make is not to know the amount of miles they drive and enter into lease contract for 12,000 miles per year when they actually drive 15,000 miles per year. At lease end, they will get a bill for the excess miles driven, typically at 25 cents per mile.

If your life or job situation changes mid-lease and you need to add more miles, a simple call to the bank will solve this problem. Most will be glad to add the miles to your contract and increase your payment, which is a better solution than paying a lump sum at the end.

Many banks have copied a policy we pioneered at Benz where unused pre-paid mileage is refunded to the customer at lease end, whether purchased at time of sale or mid-term. Your bank’s mileage policy may vary.

Banks aren’t typically flexible on waiving excess mileage charges, but that’s not the case with excess wear and tear charges. A call to the bank may yield a 20-percent discount off the top, particularly if you’re a repeat customer to the brand. Better yet is to complain to your dealer’s finance department. Dealers hate heat and love to pass it off on the factory. They may be able to make a call and get a large part of the bill waived.

Another plan is to negotiate with the dealer to have it either pay or roll all the excess charges into the new car purchase, particularly if the amount is extremely high.

Banks will continue to offer used car leasing and will continue to fail for one reason

Auto lending giant Ally Financial recently announced that will offer leasing on select pre-owned vehicles, thus continuing the musical chairs of banks jumping into used car leasing, seeing it fail, and jumping out. What Ally does not understand is that dealers won’t sell pre-owned leasing.

A number of captive banks have recently launched pre-owned leasing to help move an influx of year-old loaner vehicles and lease returns. Most dealers reacted by complaining that payments were not lower than those on a new car, thus forgetting one basic tenet of the pre-owned business: new and used car buyers are different. They rarely cross shop between new and pre-owned. If a used car buyer lands on a used Audi A4, that is the car that he or she wants. At that point, there is no reason dealers can’t offer that customer pre-owned leasing as an alternative to financing, but they don’t.

This product does fill a niche: three- to five-year old high-end vehicles. If a store “stole” a baller car on trade, found a bank with a residual value close to what it paid, and had a finance department that understood pre-owned leasing, you might get a very attractive payment.

In other words, it’s probably not going to happen but it doesn’t hurt to ask. I have seen this work, but in each case it was the dealerships’ used car managers who glommed the deals for themselves.

The same conundrum applies to advanced leasing options on new vehicles, such as multiple security deposit leases and one-pay leases, two products that offer highly reduced money factors. The majority of dealers simply do not have the knowledge or patience to sell them.

You may now know more about leasing than some car dealers

We know of a luxury dealership in a very upscale market whose sales manager had no idea how to structure a new-car lease deal. (He also probably spewed the Standard Dealer Excuse about why its leasing penetration was the lowest in their market: “The customers in our area are different. Their Daddies always told them to buy and never rent.”)

Of all the obstacles hindering people from leasing their vehicles, having dealers who cannot present it is the one that drove us factory guys nuts.

[Images from file, Classic Cars Today, Wall Street Journal]

More by Steve Lynch

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kwik_Shift_Pro4X Making payments on a new car is also killing you.

- Paul I don't know how GM can fail to sell sedans. Other manufacturers seem to be able to, as others have noted. The Impala (which I've had as a rental) was a very nice sedan and the Malibu (which I had as a rental more recently) was a pleasant, competent vehicle also. Maybe they are still suffering from the bad rep they got in the malaise era into the 80s.

- Kwik_Shift_Pro4X How a Versa that's a $18000 car became a $24000 car says a lot. Or even the jacked price of the current Frontiers. Not worth it.

- MaintenanceCosts They should focus on major non-Interstate routes in the flat West. I recently did a central Texas trip with a Model S rental. It was just fine along the interstates but there were significant gaps on the big federal highways, which caused a bit of extra driving to reach charging stations. The one public (non-"customers only") charger in the greater Fredericksburg area was very busy, even at non-peak times.

- Tassos Real Cars are RWD.So if you want a Lexus, try either the GS, or the flagship LS460 (before they mutilated it into the current failed model)The ES used to be a rebadged Camry, then became a rebadged Avalon at $10k more. Not a wise buy, unless you are a silly snob and would not be caught dead driving an econobox.

Comments

Join the conversation

Dumb question, maybe - why do the more expensive model variations have lower % residual values?

When I was in the business, I tried to encourage my dealers to partner with a local bank and offer the leases in house. Mostly for their gold plated designates, of course. They knew the users better than I, especially if they were repeat buyers. It went against corporate policy, but a well-funded and performing lease portfolio was an income stream ignored by many who could afford to self-fund. Subvented rates were always going to be offered by the credit captives, so they always had a back-up plan. I was always an advocate for my guys making every penny they could. And still made my bonus. Win-win-win. I would also guess if you showed every number to to all customers, it would be Greek to 90%. Money factor? What's that? I would guess most would ask.