QOTD: What Car Do You Not Recommend?

Last week, we asked you about the most underrated car/truck on the market. Since most of you are enthusiasts, I'd guess that some of you recommend underrated vehicles when your friends and family ask you about purchase decisions. But what are the cars/trucks you steer your friends/family away from?

QOTD: Does J.D. Power Matter to Your Car-Buying Experience?

About a week and a half ago, we asked you how the automotive media influences your car-buying process. Now we're going to ask you about J.D. Power, specifically.

Top Vehicles for Ungrateful Whelps

Several schools of thought exist about buying a set of wheels for a teenager or new driver. Some say the youngsters should be forced to drive a knackered hand-me-down, one which builds character and won’t cost a mint when it is inevitably crashed into a tree.

Others are of the mind that the expected tree-crashing is exactly why parents should stuff their newly licensed children into something new packing all the latest safety features. Then, in the middle ground, we find some families reaching for gently used vehicles with decent crash ratings but ones that won’t break the bank.

The Great Pacific Coast Road Trip

The Big Idea

When one’s employer tells you that you are required to go to San Diego, California for a company event I guess most people’s reaction would be “hey, I hear they have a great zoo there”.

I suspect I am slightly an outlier in that my first thought was “I should buy an old car and drive up the Pacific Coast Highway and consign the car with a shipping agent to transport it home”.

BMW 2 Series April's Fastest-Selling Used Vehicles

April’s fastest-selling used vehicles were led by the BMW 2 Series, according to iSeeCars. The 20 fastest-selling used vehicles averaged 28.7 days, 1.2-1.7 times faster than it took to sell an ordinary used vehicle. The fastest-selling used vehicles included a mix of sports cars, luxury vehicles, hybrids, and minivans.

California PHEV Owners Return to Gas Power

Electric vehicles are one way to carbon neutrality. Yet 20 percent of California PHEV owners have gone back to gas-powered vehicles.

QOTD: Does Color Affect Resale Value?

Color counts when selling or buying a car. But which colors help or hurt? iSeeCars.com, a car search engine, performed exhaustive research on this topic, recently publishing the results.

CarMax Invites Customers to 'Do Donuts'

CarMax has invited customers to ‘do donuts’ during their test drives, a promotion with Dunkin’ Donuts. For shoppers who take part in CarMax’s 24-hour test drives today through May 16th, they’ll receive a $10 Dunkin’ Donuts gift card.

Pandemic Changes Car Buying Plans, Or Has It?

The pandemic has changed car buying plans for nearly three out of four shoppers who intended to buy in the next six months. New research from Comscore Automotive Data Mart, cited in a story today by Auto Remarketing, indicated the pandemic tops the concerns of four out of ten who had intended to buy.

What Not to Say When Buying a New Car

Buying a new car usually requires visiting a dealership. That puts you at a disadvantage: You’re on foreign soil, and they know you don’t know your way around.

"A New Kind Of Hybrid": The Terrifying New Way Disadvantaged People Are Buying Cars

It was halfway down an email that was anonymously forwarded to me a few weeks ago, buried between torpid paragraphs grown thick and encrusted with the deliberately Byzantine language of Wall Street analysis. And it said something like this:

In Detroit, Michigan thus far in 2017, nearly one in eight of all available civil lawsuits filed in the city involve (this firm) suing borrowers. Overall, 72% of these lawsuits resulted in the company garnishing the wages or tax refunds of borrowers. In essence, the company is a new kind of hybrid: a debt collector that originates its own loans — a combination that has proved extraordinarily profitable for investors as the business of lending to troubled borrowers has surged since the financial crisis.

A debt collector that originates its own loans, generating more than 10 percent of all civil lawsuits in Detroit. Something wicked this way comes.

Guard Your Grille: It's the End of the Road for Fake Luxury

Ding dong, fake luxury is dead. I should be more specific — I don’t mean Fake Luxury in the Caddy-Calais-vs-Ninety-Eight-Regency sense. I mean just plain old fake luxury. You know what fake luxury is. Invicta watches, Michael Kors suits, everything you could possibly buy at the Pottery Barn or in most American malls. Mass-produced sweatshop junk gilded and pimped for the administrative assistant nervously considering how to spend a $250 Christmas bonus.

Real luxury is on a roll everywhere from Savile Row to Maranello, swept away on a wave of Gilded Age cash and the ever-increasing leverage power of capital, but fake luxury is in a tailspin. Patek and Vacheron will thrive, Rolex will hold steady, Breitling will collapse. Airlines are feverishly revamping their widebodies into “super-high-J” configurations, replacing rows of packed prole seats with sleeper beds and sliding-door suites. It’s a good time to be a private jet pilot, a good time to be an UberPool driver, hell on earth to be anything in between.

Two weeks ago I told you about the Chinese Volvo S90, the Volvo S90 that is built in China. It’s the equivalent of a department store suit “designed in Sweden” but constructed by the lowest bidder. I told readers on my site that the market would adjust for this, that the price of Chinese Volvos would quickly drop into the basement while Swedish Volvos stayed strong.

I was right, young Skywalker… about a great many things.

What Car Did I Buy? Droptop Desires Got The Better Of Me, It's Time To Supplement The Family Minivan

Intending to ask your advice before I actually made a purchase, I was left alone with no family to entertain me last Friday night and, well, something happened. To go along with our long-term 2015 Honda Odyssey EX, I exchanged a large sum of cash for a new vehicle.

Tell people what you’re going to name your baby, and they will tell you what they really think. Tell people what you named your baby, and they’re more likely to say, “Oh, how nice,” even if you named him Dwayne.

Similarly, tell people what car you’re planning to buy, and they’ll be forthright with their opinions. Tell them what you’ve already bought, and they’ll be more likely to say, “Oh, how nice,” even if you bought a Outlander.

So we’re going back in time to last Thursday. The automotive universe is littered with options. My choices are limitless. Major life changes have presented our family with new opportunities, but also new challenges. Regardless, it’s time to double the size of our fleet.

Waste of Base: Deals Don't Always Extend to Base Models

Most readers are aware of my unbridled enthusiasm for base model cars. Sure, there are a few luxury models that spring to mind where it’s imperative buyers select the top trim, lest they run the risk of an arch nemesis pulling alongside them in an Escalade Platinum when they are piloting a lowly Escalade Luxury.

Thing is, it behooves the frugal customer to pay attention before they sign the note on a set of base wheels. For years, commercials told us “ America Runs on Dunkin” when we all know that America Runs on Monthly Payments. Most shoppers have a monthly or biweekly figure in mind and, examined through that lens, base cars aren’t always the best deal.

What Do You Do When a (Former) Friend Says, "I Want a Honda HR-V"?

It’s time for a new car, I told Mae last night.

She was explaining to a group of friends how she tore the passenger side mirror off and drove across the MacKay Bridge, on a particularly windy evening, with the mirror swinging about like an unchoreographed contemporary dancer.

The dangling power mirror, which another friend disconnected at Mae’s request, was only the latest issue. First, it’s a Saturn Ion Quad Coupe. Issue number two: the air-conditioning died long ago, and Mae’s reluctant to spend a single penny redeeming this car. It’s bitterly cold in eastern Canada now, but A/C is needful for one-third of the year and helpful for the other nine months. Finally, it’s a Saturn Ion Quad Coupe with a manual transmission.

“Ooh, aah, save the manuals,” you say. And I’m with you. Mae’s with you, too. But I’ve spent enough time — way too much time — in manual shift Ions to know that in an extremely hilly city, the Ion’s shifter/clutch combo is worthy of dread. Not all manuals are worthy of saving.

Now the mirror’s off, and the conversations Mae and I have had over a period of many months culminated in her succinct statement last night: “I want a Honda HR-V.”

Insert awkward pause.

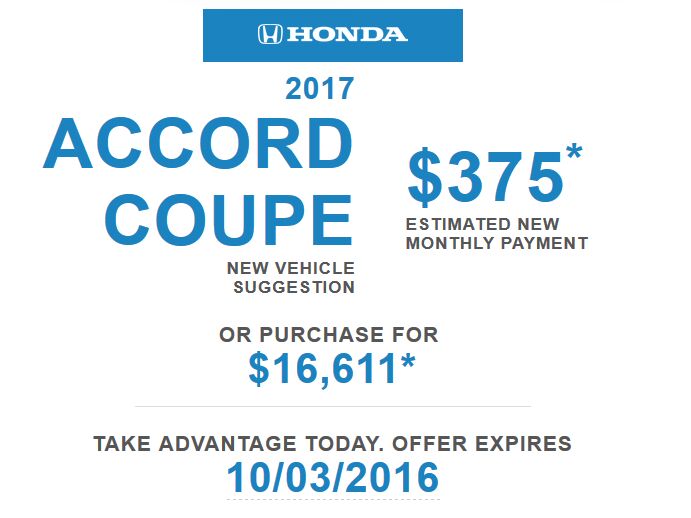

When Is a New Accord for $16,000 Not a Deal After All?

Hey! Did you know that I, your favorite writer on this or any other forum, with the possible exception of Penthouse Forum, am the proud owner of a Honda Accord EX-L V6 manual transmission coupe? Maybe you didn’t know! But now you know! So in the future there will be no excuse for you not knowing, with the exception of “utter apathy,” which would be a legitimate excuse, should you need one.

Let me give you the name of somebody who didn’t need to be reminded about my Accord ownership; my local Honda dealer. Not the guys who walljobbed me, but the good dealer. The one that actually puts new oil in the car when you pay for an oil change. I like this dealer. Were I to purchase another Honda, I would purchase it from them. Perhaps they know this, because they’ve just sent me an email with a GRRRREAT DEAL! on a new 2017 Accord Coupe. $16,000 and change — and this ain’t just any old Accord coupe, it’s an EX-L V6 manual, just like my current car.

There’s just one little catch.

Poor Prior Pre-Purchase Planning Promotes Pao Problems

Some cars seem to excite a primordial part of our lizard brain, prompting us into ill-advised purchases.

A brother of mine once bought a Pantera sight-unseen, based on eBay thumbnail photos and boundless faith in his fellow man to Do The Right Thing. The De Tomaso rust bucket that arrived on a flatbed a month later might as well have been the trash can that Mookie heaved through Sal’s window in a fit of pique.

Hard-headedness must be genetic. I also stepped on the same metaphorical rake in the shape of an engine swapped Honda Insight, its K20a drivetrain from a JDM Acura RSX-R being the siren song that lured my ship onto the rocks … but that’s a tale I’ll save for another day. As a result, I’ve resolved to stop being a ready-fire-aim kinda guy: from now on, when buying distant cars, I’m getting a pre-purchase inspection.

Now my eccentric fiancée has her heart set on a 1989-91 Nissan Pao, a car that has graced these hallowed pages before.

Never Buy a Car Alarm From a Dealership

Visiting a dealer’s Finance and Insurance office is usually the last excruciating step when buying a car. The F&I rep will go through an endless stack of documents to finalize the sale while attempting to sell as many pointless add-ons as possible.

Many of us know to avoid add-ons like pin striping, paint protection, and extended warranties since they are either overpriced or valueless — but we may be letting the worst offender of all slip by.

Car alarms seem like sensible choices, especially if they’re offered at a good price, but the alarm that many buy in the F&I office can barely be considered more than a dealer profit device. These alarms are often presented as add-ons to the factory alarm that are supposed to improve on the factory security system, but in reality are usually nothing more than a shock sensor and some hacked wires.

How To Buy Your Dream Car Sight Unseen From The Internet

Let’s give a hearty “Welcome back!” to our friend Rebecca, who previously wrote about her Tacoma on these pages. She just picked up this beautiful Z4 from a dealership hundreds of miles away from her home. This is her story on how she did it.

This journey started in October of 2007 when the lease on my 2005 Z4 3.0 matured, and I had to give the car that I dreamed of, and built on BMW NA’s site for two years, back to the dealership.

Since then I’ve had the recurring dream that I still had that car — it’s just been in storage all this time. I have serious commitment issues with cars, so it dawned on me three years ago that this was the one that got away. Fast forward to April 2016, I’ve saved for this car for a couple of years, and casually checking out the market with the plans to purchase before the end of the year. I happened upon a couple of white ones just outside my price range, and decided it was worth the stretch.

So what was my process?

Auto Leasing Insider Tips, Tricks, Myths and Misconceptions

A record 31 percent of all new vehicles sold this year in the U.S. are leased. I spent a good part of my career studying why some people refuse to lease. Much of their resistance stems from bad buzz. Some say it’s because of the stories they heard about ’80s-era open-end leases where owners were responsible for paying the car’s residual value at lease end. (These are the same customers who will not buy a Hyundai today because they produced crappy cars in the ’80s.) Others oppose leasing because they heard about a guy whose cousin’s neighbor had to pay $5,000 in wear and tear or excess mileage charges at lease end. And there are those of you who will brag comment below about how you always pay cash for your cars and don’t understand why other people won’t follow your lead.

This article is not designed to convert such non-believers to leasing. This advice, drawn from my years in the auto finance business, is for buyers who know the basics and benefits of leasing, want some timely tips on how to get the lowest possible payments, and want to pay less money on lease-end charges.

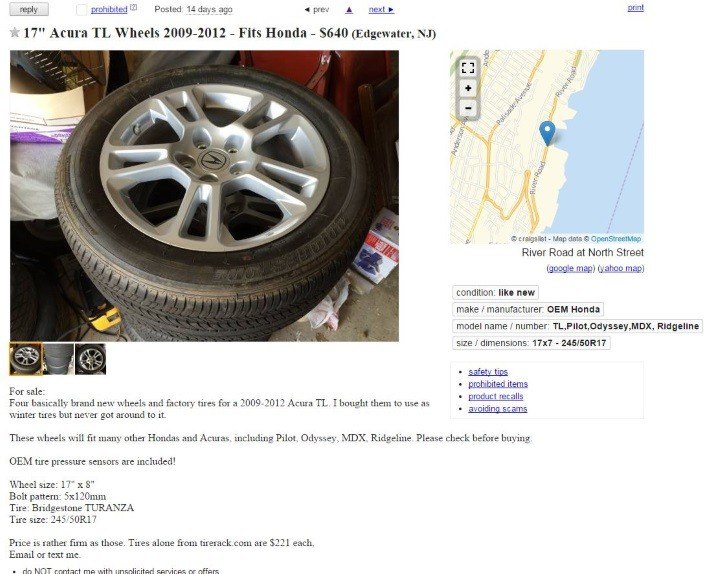

A Tale of Craigslist Wheels

Note: This story originally appeared on Hooniverse.com. It is republished here with permission.

My mother used to have a very nice 2005 Acura TL. For almost nine years she used that car to commute from her home in Edgewater, NJ to work in the Bronx. Those of you that have not traveled between New Jersey and New York over the George Washington Bridge, and further north over the Cross Bronx Expressway, should know that this may be the worst road in the United States. The bridge converges four highways into one. The traffic jams are constant, as is construction. Someone always breaks down or rear-ends someone else. Due to heavy truck traffic the pavement is extremely wavy. It’s bad, really bad.

The third generation Acura TL came standard with 17-inch wheels wrapped in 235/45-17 tires. The car handled very well right out of the box while retaining a ride that was comfortable. With a 270hp engine, it was a fun car to drive, even with the ever-present torque steer. The problem was that its wheel/tire combination did not resist road imperfections very well. Bubbled-up tires and bent wheels were the norm for my mom and many other TL owners. I did my best to ensure that she always had a good set of wheels and tires on the car, which meant frequent Craigslist searches.

In Electric Leasey-Land, Up Is Down And Suburbans Are Cheaper Than Tahoes

Okay, I admit: I subscribe to the Wall Street Journal. It’s not really for me; Mrs. Baruth works in finance. (Without which, as you pimps and players out there should know, there’s no romance.) Rarely do I read the whole thing. This past Saturday afternoon, however, I broke the pull-cord of my son’s TopKart. Then he ran out of gas for his motorcycle. Which consigned us both to an early afternoon inside the house, because I was too lazy to address either situation.

Imagine my surprise to find an advertisement for an independent leasing agent in the last of the Saturday sections, back among the lifestyle articles and the usual Dan Neil attempt to sound like a more fey version of Oscar Wilde. Those members of the B&B who were born prior to the release of “Appetite For Destruction” will remember that stand-alone leasing shops were once very big business. They bought their cars from franchised dealers, often well after they’d obtained the customer’s signature on their own paperwork, and they relentlessly cross-shopped banks for rate and residual deals.

Often, these firms focused exclusively on members of the professional class; the big hitter in central Ohio during the ’80s was un-self-consciously titled “Physicians Leasing Co.” They were largely driven from the field by the beginning of this century by aggressive captive finance providers like BMW Financial. The tendency on the part of most banks to view the end-of-lease termination process as an additional and very lucrative profit center, a tendency that became more exaggerated as the prime rate fell and banking profits sank accordingly, didn’t help their business model one bit.

Nevertheless, here we are, in $THE_CURRENT_YEAR, with a manufacturer-agnostic leasing company advertising in the WSJ. So let’s see what the deals are, and what lessons we can learn from looking at them.

Why Spot Delivery Needs To Go Away, Now

Spending hours or days negotiating for a vehicle can be a taxing experience, so reaching an agreeable price feels like a big accomplishment for car shoppers. It seems reasonable to let your guard down and relax as you enter the F&I office to finish up the paperwork, but that can lead to a big mistake.

The finance manager or clerk will start going over the paperwork, representing the car as sold and financed while showing you a specific rate. You skim through the mountain of paperwork and quickly sign all of the forms so you can drive off in your new car.

At this point, most people are brimming with excitement — they show off the car to their friends and family and share pictures on social media — but that jubilation can quickly be deflated with a call from the dealer telling you that the financing has fallen through and you don’t own the car after all.

GTI or S3? Nah, It's Easy To Make The Case For The 2016 Volkswagen Golf R

$26,415.

$36,470.

$43,395.

The jumps in price from the four-door Volkswagen Golf GTI to the Volkswagen Golf R to the Audi S3, three closely related cars, are not insignificant. Yet in spite of the dollar differences, or perhaps because of the dollar differences, the trio inevitably undergoes the value proposition comparison, as if “value” is the reason 460 buyers per month spend around $40,000 on a Volkswagen hatchback.

I’ve now been privileged to spend a week with each car. Sadly, a Lapiz Blue 2016 Volkswagen Golf R just left my driveway to make room for, as fate would have it, a 2016 Toyota Prius.

And I have no trouble making the case for the Golf R as the fast VeeDub to own.

Goodbye, Saturn Astra

Over the weekend and earlier this week, my girlfriend and I negotiated over and agreed to purchase a new car. No, it isn’t that.

How Sleazy Car Dealers Pass Off Frame Damage Cars As Clean

Carfax has become so commonplace that it’s now standard practice for many car buyers to ask for it when shopping for a used car. Its database has grown over the years to the point that it now claims to to have the most comprehensive vehicle history database in North America.

The reports include such valuable information as title brands, accident history, and even service history for some vehicles, but it has some limitations that unscrupulous dealers are using to their advantage. The missing data allows these dealers to represent damaged cars as clean and use the Carfax report to support those claims.

The Internet Pricing Bait and Switch

The Internet brings transparency to the car buying process and allows us to search the whole country for our favorite car. While shopping for a WRX a few months ago, I got quotes from dealers as far as 1,500 miles away. I ended up skipping the local dealers and travelling to a dealer 80 miles away in order to get the best price.

Leaving your immediate geographical area can be beneficial in many instances, especially if you can find a more competitive market that’s reasonably close. Unscrupulous dealers have caught on to geographical buyers who are only looking for the lowest price. These dealers combine geography and psychology in order to dupe buyers to come in and often get rewarded for their shameless behavior by making the sale.

From Auction to Flip, This Is How a Salvage Car Makes It to Craigslist

Salvage and rebuilt vehicle listings on Craigslist (and other classified sites) are ubiquitous. They often manifest themselves as late-model metal with low prices and even lower standards of ad copy.

But have you ever wondered how those vehicles end up on Craigslist in the first place? What happens to a salvage or rebuilt vehicle between the time it’s sold at auction and its first appearance on your local classified site?

How An 86-Year-Old African-American Woman Was Charged Over Sticker For Last Year's Buick

Imagine the following scenario: You’re a Buick salesman. An elderly woman comes into your showroom to inquire about a replacement for her Regal. You decide that she’s a great candidate for an Encore, and since you have some previous-year Encore stock you decide that she’s a great candidate for a 2015 Encore instead of the new model. There’s a $149/month lease deal available from GM Financial. What kind of deal do you make for this woman?

If your answer is, “I’d charge her over sticker for the vehicle, switch the lease company to make some back-end money, and add nearly a thousand dollars of profit in fees above that,” then you might just be the salesman that Buick GMC of Beachwood, OH needs.

These Are the Long, Rough Roads Traveled by Title Loan Cars

Many people rely on title loans when money is tight, regardless of their infamous predatory nature and high interest rates. However, getting that loan is much like playing Russian Roulette — and with similar odds. According to a recent PEW study, one out of every nine title loans results in a repossession, with the titled vehicle eventually heading to auction.

Recently, I received a notice that a large title loan vendor was to auction off over 500 vehicles. My curiosity got the better of me. Armed with the auction run list and a VIN history tool, I decided to take a look at what ends up at these auctions and how they get there.

Oh! My Aching Back: What Vehicle Has the Plushest Ride?

If you’re a car enthusiast, you likely get asked by your friends and acquaintances for advice on their automotive purchases. If you write about cars, that probability becomes a certainty. When they ask something really general like “what’s the best car?” it’s a bit annoying because what fits your needs best may not be the best choice for your neighbor. However, sometimes you’re presented with a genuine need and you want to give sound advice.

A Tale of Two Dealers

The Ford Focus ST and Subaru WRX were the two finalists in my new car search and the Focus ST seemed to be winning out due the extra incentives that were being advertised. I emailed a few Ford dealers in my area to negotiate an ST2 and a few Subaru dealers to see if they were offering any discounts that were not advertised.

The 2015 Focus ST might appear to be the best deal if you go by the advertised prices, but the 2016 WRX ended up being a great deal after talking to a few dealers. I was interested in the ST2 model of the Focus and got quotes of about $24,800 on a 2015 and around $26,700 on a 2016 based on all the discounts for which I qualified.

Taking The Hard Road To Buying A New Car

The time has come to replace my Cadillac STS with a newer ride, so I have spent the last couple of weeks narrowing down the potential replacements. I have bought and sold enough vehicles that my evaluation process for resale vehicles is somewhat cut-and-dry, but buying a new personal vehicle seems to bring more questions and answers.

The Cadillac STS came from an auction like many of my previous daily drivers. It was a purchase of opportunity, due to low cost at the time. Profitability trumps emotion for many of my car-buying decisions; I care more about how much it costs to buy and recondition a car — and its subsequent profitability when I sell it — than I care about how it feels.

Tracking the Lot Time of Used Cars Can Save You Money

Going to visit a dealer on a rainy day or the third Sunday after a holiday might not help you get a better deal on a used car, but tracking how long it’s been sitting on the lot may work in your favor. Aged inventory takes up valuable lot space while interest adds up every day motivating most dealers to drop the price to sell it quickly.

Most cars arrive on a dealer lot arrive from wholesale auctions or customer trade-in and are paid out from dealer funds or by a loan through floorplan financing. As with most loans, interest and fees are paid until the loan is satisfied for the floorplan. Each day of interest cuts into the potential profit for a vehicle so dealers try to move inventory as quickly as possible.

The True Cost Of Owning A Rebuilt Salvage Car

The prospect of buying a salvage titled car for almost half the price of one of its clean titled counterparts is tempting for many potential car buyers, but increasingly it’s becoming a losing proposition. I have bought and reconditioned a few dozen salvage cars (I currently own three). As I am getting ready to embark on a new car buying adventure, I sat back to look at the math for my current daily driver.

I purchased my 2005 Cadillac STS from an insurance auction a few years ago for about $3,400. After it arrived, I spent another $2,300 to repair it and get it back on the road. I went through the receipts a few months ago and wrote up a summary of the costs. It worked out to be a great deal for me at the time but now that I am getting ready to replace it, I decided to take a look back and see if I actually saved any money in the long run.

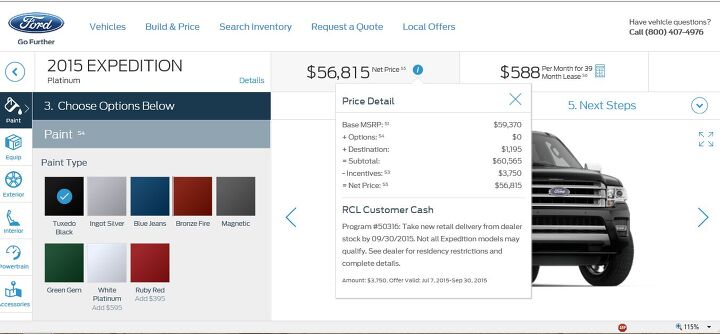

Case Study of Incentives: 2015 Ford Expedition

In my recent test of the 2015 Ford Expedition, I wanted to give a sense of real-word pricing rather than just MSRP, so I quoted TrueCar’s estimate of the average discount available on the vehicle. I had planned to quote available cash and lease incentives direct from Ford’s website, but after 15 minutes of research my head started hurting and the story would have been longer than DeadWeight’s diatribes on what’s wrong with Cadillac.

So let’s take a separate look at the quagmire of incentives that Ford offers you to buy an Expedition. Before you click the jump, do you know the expansion of the above acronym “RCL” ?

Car Buying: Is That New Car Price Too Good to Be True?

Price is the deciding factor in many new car purchases, so it’s no surprise that dealerships do all they can to advertise the lowest number possible. While the internet has given consumers a lot of power when it comes to purchasing a new car, many consumers still fall for age-old pricing tricks.

One of the easiest ways to reel people into a dealership is to set up an advertisement for a decently optioned popular car at a sale price significantly lower than MSRP. This advertisement will usually be the lowest in the geographic area and would cause a loss for the dealership if sold. The way that deceptive dealers get around honoring the advertised price is by specifying a single stock number that qualifies and then asking a friend or relative to put a deposit on that specific vehicle as soon as the advertisement goes up online or in print.

I Tried to Buy a Charger This Weekend and Failed Miserably

We just had a fight.

Scratch that. We were still having a fight. This was just the tense calm between volleys of verbal mortar fire. I won’t even tell you what we were fighting about. The subject was so stupid it would make my girlfriend and I both look like utter idiots — like those times when you shout at a character in a TV show to grow up and “just say you’re sorry already!”

Instead of doing what any rational human would do, I figured my only chance of peace was to escape the waves of relationship-drama ordnance. I grabbed the keys to this week’s Charger along with my vaporizer and fled the front line to regroup and regain my sanity.

Should I Pay Cash for a New Car? Probably Not.

You have worked hard to save the $20,000 you need to purchase the car of your dreams. You’re ready to step into the dealership, walk straight to the manager in the back, plunk down those greenbacks, and say, “I have cash! Give me your best price!”

This may have worked in the days before electronic banking and factory rebates, but paying cash today will likely cost you more.

Tow Rig Capsule Review: 1999 GMT800 Silverado 2500 3/4 Ton

The last time I looked at my 1969 Chevrolet CST/10, it was a pile of disappointment. After reviving it and replacing a freeze plug, it proceeded to pop three more freeze plugs during warm up. Time was beginning to run out, my dad’s house had gone up to market and quickly sold. The truck was a long way away from driving out of Houston, and I needed to get it out of town. Time and money were a factor, I didn’t have time to spend money running a truck and trailer to Houston, just for the CST/10. Thankfully, three things lined up: A truck, a trailer, and a reason to drive to Houston. The truck is a customer’s, who loans the truck out in return for a few favors on the truck’s maintenance. The trailer came from my friend’s rally shop, which I moonlight at. And the Lone Star Region Porsche Club had invited me to partake in their refreshed autocross program at Houston Police Academy just before the closing deadline on my father’s house. Win-win, right? I packed the suitcase, tools and dog, hemorrhaged a gas pump to fill the truck, and blasted to Houston.

New or Used? : The Unwelcomed Gift Edition

I’ve written before for “New or Used?” regarding my ’04 Scion xB 5MT that I (mistakenly) ended up trading in towards my family’s 2013 Outback 3.6R last year. Since then I’ve been driving my wife’s ’06 Accord EX-L V6, now at 105k. It’s a nice enough car to drive, but was never “my” car, if you know what I mean (and I’m sure you do).

Life Lesson: Falling For The Roadrunner

Like so many broken down old cars, the old Plymouth sat forlorn and alone at the far edge of the driveway. Even from a distance, it looked like it was a mess, its green paint was peeling away and the hood, which for some reason had a flat black square in the middle, was entirely oxidized. Up close I could see that the interior was just as bad as the exterior. The dash pad was totally cooked and the vinyl seats had split wide open along their seams. My buddy Rick, however, insisted the car was cool and to prove his point he raised the hood to show me a tired old engine that he insisted was a 383 big block. I looked it over, noting the four barrel Holley double pumper without an air cleaner and the unpainted valve covers that had leaked an impressive amount of dirty black oil over the years, and tried to find something to be positive about. Finally I found it, bolted to the inner fender was a splash of faded purple and a sticker featuring a cartoon character. Its text proclaimed “Voice of the Roadrunner” and I knew in an instant, with all the certainty that 19 years of life experience had given me, that my friend had been right all along.

Tales From The Cooler: TTAC Writer Buys A Cool Car

Car salesmen call buyers like me, “squirrels.” It seems like whenever I buy a new car, I pull a handbrake 180 turn at the last moment and purchase a completely different vehicle than originally planned. Last week I was so close to buying a new Mustang GT with the Track Package that a friend at Ford was poised to set me up with an insider deal. The only problem was I seemed to have forgotten that this will not be my daily driver so why was I analyzing SYNC Packages, luggage space, resale value and the like?

I regrouped and asked myself two questions: which vehicle will have the soul of the two most fun cars I have ever owned, the 1994 Mazda RX-7 and the 1988 Honda CRX-Si? Why do I live in sunny San Diego and have never owned a convertible? The halogens went off in my head. As fate would have it, a dealer I know had just traded for the exact car I wanted. Say hello to my little yellow friend.

How To Buy A Used Car Part 4: Negotiating

When it comes to buying a used car there are two basic negotiating mindsets. You can either be fair and decent or unfair and obnoxious. If you seek to chisel and deceive then chances are you will get a bad car. Only the desperate and deceitful are willing to put up with that type of BS.

Want a ‘great’ car? Then realize that many sellers respond extremely well to honesty and decency. Win – win is no sin. So, karma lovers, here’s some tips for negotiating the purchase of a used car by observing the Golden Rule.

How to Buy a Used Car - Pt. 3: Due Diligence (The Inspection)

[Ed: Part one of Steve Lang’s updated used car buying guide is here, part two is here.]

You can rigorously apply the tests described by previous installments of this series without encountering a single setback. However when it comes to buying a used car, it pays to assume one simple salient fact: you don’t know the complete truth.

At least not yet.

How To Buy A Used Car Part Two: The Test Drive

[Editor’s note: Part One of Steve Lang’s updated guide to used car buying can be found here]

Schedule the test drive for a time when there’s no rush. If it’s bad weather, reschedule.

Take a little notebook, write a quick check list based on this article, and make notes.

How Much Did You Spend On Your Car?

Car owners have a warped view when it comes to their automobile’s cost.

When you ask someone the, “How much did you spend..” question, their usual response is to take the price they paid and just let that be that.

“Oh, I got this Mercedes for $50k.” They then will usually go about telling you the options they chose, and other trivial realities related to the car.

But as we all know, that’s not the question.

Half-Price Bimmer: The Story Of A Man And His Search For The Perfect E60

Wherever the hollow tubes of the InterWeb may reach, there you will find the argument that “it’s always a better idea to buy a CPO used car than a new one.” The mean transaction price of a new car in the United States is about $29,000. That kind of money will get you a loaded-up Camcord, a discounted LaCrosse, or any number of other mass-market sedans… but can it get you the BMW of your dreams? A friend and former co-worker of mine decided to find out, using his own time and money.

(Dramatic voice) This… is his story.

Hammer Time Rewind: Depreciation Kills

From the good old days of 2007…

“Is that yours?” Millions of car buyers spend billions of dollars hoping that this statement will be born of admiration rather than pity. When these words come out of a car dealer’s mouth at trade-in time, they can be especially hurtful– even if the salesman is as honest as their spiel is long. That’s the moment when most car buyers finally discover whether or not their automotive “investment” has walked off a cliff and fallen into the financial abyss known as depreciation.

Here’s how to avoid the freefall.

Hammer Time: If You Want A Deal, You Have To Pay For It

BCA Auctions in Derby, UK; Courtesy of Zimbio.com

I get a lot of emails from auto enthusiasts. About 60% of what I get comes down to this question.

“Can you get me a high demand vehicle at a disgustingly low price at the auctions?”

The short answer is no. Just as an athlete can’t contradict the laws of physics, I can’t control the free market aspect of a dealer auction. In my world a car is bid on by dozens of professionals until the last man pays the most. If you want a Toyonda or the latest and greatest wheels that are based on yet another ‘”Fast & Furious” ripoff, then you have to pay the premium.

As for unpopular cars, they are a different story.

Tesla Model S Pricing Analysis

Tesla released the finalized features and pricing for the Model S sedan this week, with deliveries of the most expensive variants to begin in “mid-2012,” the others to follow by the end of next year. More than a few people who thought they were going to be able to buy a “premium electric sedan” for $50,000 seem miffed by the final pricing. Yes, there will eventually be a $50,000 car (after a $7,500 tax credit). But it won’t have full motor power, leather, nav, or the ability to use fast-charging stations. Tick off all the boxes, and the Model S pushes double the hyped number. But, let’s face it, these guys have to turn a profit and must pay at least as much for parts as the big established car companies, on top of that big expensive battery pack. So does the announced pricing seem reasonable?

TrueCar Versus Honda: Online Car Buying Challenges Hit Home

The rise of the internet has had myriad effects on everyday life, not the least of which has been its profound impact on consumer behavior. With ever more data being made available online, and with the rise of independent alternative media outlets like TTAC, car buyers in particular are fundamentally changing their relationship to the car buying process. Dealers have been noting for some time that the internet has created better-informed buyers who, armed with more information, are demanding the car they want at the best possible price, wreaking havoc on traditional car dealer tactics like upselling and opaque pricing policies.

But as the eternal dance between supply and demand shifts in favor of consumers, some dealers and OEMs are having a tough time adjusting to the new reality. At the same time, the need to make money off of online consumer education has created some tension for the new breed of consumer-oriented websites. This conflict has now broken out into the open, as the auto transaction data firm TrueCar has found itself locked in a battle with American Honda over the downward pricing pressure created by more widely accessible transaction data. And the outcome of this conflict could have profound impacts on the ever-changing face of the new car market.

900 Miles And Runnin': Searching For Truth In A Rented Elantra

Sometimes the stars align. Last week’s article about the “Consumer Watchdog” Elantra fuel-economy press release had ruffled some feathers and aroused my personal curiosity regarding the Elantra’s alleged thirst. And then — wouldn’t you know it — I found myself with a chance to run South and visit a few friends. The time frame was short. Had to be there and back in 36 hours, covering about 435 miles each way. And the nice people at Enterprise were willing to rent me a 2011 Elantra for a two-day stretch at a total of $50.36.

This was my math: (900 miles/23.5 mpg) * $3.18 = $121.78. That would be the cost of running my Town Car. A mythical 40mpg Elantra plugged into the same equation would cost $71.55. Difference of $50.23. Clearly some sort of sign, right? Might as well rent the Hyundai and conduct a highly non-scientific test. Along the way, we’d ask the usual questions: How well does the Elantra hold up in rental service? Is this the class killer some people want it to be, or the mid-packer described in TTAC tests up to this point? Can’t this thing go any faster? What time is lunch?

How To Buy A Used Car Part 4: Negotiating

When it comes to buying a used car there are two basic negotiating mindsets. You can either be fair and decent or unfair and obnoxious. If you seek to chisel and deceive then chances are you will get a bad car. Only the desperate and deceitful are willing to put up with that type of BS.

Want a ‘great’ car? Then realize that many sellers respond extremely well to honesty and decency. Win – win is no sin. So, karma lovers, here’s some tips for negotiating the purchase of a used car by observing the Golden Rule.

How to Buy a Used Car - Pt. 3: Due Diligence (The Inspection)

[Ed: Part one of Steve Lang’s updated used car buying guide is here, part two is here.]

You can rigorously apply the tests described by previous installments of this series without encountering a single setback. However when it comes to buying a used car it pays to assume one simple salient fact: you don’t know the complete truth. At least not yet.

When it comes to pursuing the deeper truths about a used car an experienced mechanic will inevitably become your greatest ally and advocate. For most consumers finding a knowledgeable mechanic will be the most important step in the used car buying process.

Before we talk about that, I want to be perfectly clear on this point. A used car is guilty until proven innocent. Do not buy one without taking the car for a professional inspection. If the seller doesn’t agree to let you do so you’re done. Period. No exceptions. Ever.

How to Buy a Used Car Part Two: The Test Drive

[Editor’s note: Part One of Steve Lang’s updated guide to used car buying can be found here]

Schedule the test drive for a time when there’s no rush. If it’s bad weather, reschedule. Take a little notebook, write a quick check list based on this article, and make notes. When you approach the car’s owner, be friendly, polite and courteous. Do NOT try to “beat them down” to get a better deal. While you have every right to ask direct questions, you have no more right to insult their car than one of their children.

"Volt Scam" Debate Misses The Point

Mark Modica, a former Saturn dealer GM bondholder, has leveraged his financial loss at the hands of the government bailout into a blogging position at the National Legal and Policy Center, a conservative nonprofit that “promotes ethics in public life through research, investigation, education and legal action.” At the NLPC, Modica focuses on what he believes to be corruption surrounding the auto bailout, and has written a series of anti-GM posts that make TTAC look like a Detroit hometown newspaper (TTAC “bias police,” take note). Most recently, Modica has caught the attention of the auto media, including Automobile Magazine and Jalopnik, with a series of posts accusing Chevy dealers of “scamming” taxpayers by claiming the Volt’s $7,500 tax credit and then selling Volts as used cars. TTAC welcomes anyone seeking to cast more light on the bailout, but unfortunately, Modica’s attacks are too focused on making GM look bad and not focused enough on providing relevant information to the American people. Let’s take a look and see why…

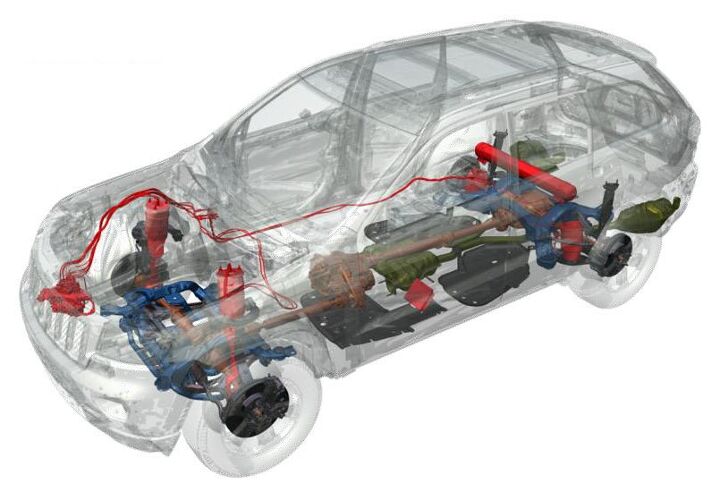

Could This Be The Ideal Colorado Winter Car?

I moved to Denver over the summer and am now experiencing the joys of proper snow driving for the first time in the 29 years since the State of California saw fit to give me my first driver’s license. With just a ’92 Civic and a ’66 Dodge A100 in my personal motor pool, I figure it’s time for me to start shopping for something with four driven wheels. In fact, I need something that can do four-wheel burnouts on dry asphalt!

TrueDelta Crosses Over

I’ve got three kids, so no M Coupe or other common object of pistonhead lust for me. Since 2003 I’ve been stuffing the brood into the back of a Mazda Protege5 while casually looking, off and on (mostly off) for a suitable three-row people hauler. Most people don’t spend six years looking for a car, but I’ve never found the right one at the right price. The right one being quite nice, since I’m picky (about cars at least). And the right price being low, because I’m cheap.

2010 Consumer Reports Survey Analysis: Part Two: EcoBoost Oddity

In Part 1, we found that, despite its large overall sample size, Consumer Reports’ has serious gaps in its coverage. But what about the reliability ratings they can provide? An FAQ asserts CR’s ability to split results by engines, drive types, and so forth. At first glance, this appears valuable, as CR’s reliability scores often differ from powertrain to powertrain. But are these differences valid? Should you avoid the V6 in the Camry or insist that your Flex be EcoBoosted?

Recent Comments