QOTD: Will Foxconn Make Fisker's PEARs?

Foxconn, also known as Hon Hai Technology Group, announced that it signed a development and manufacturing agreement with Fisker. Foxconn is one of the world’s largest electronics manufacturers and the producer of Apple’s iPhone.

California PHEV Owners Return to Gas Power

Electric vehicles are one way to carbon neutrality. Yet 20 percent of California PHEV owners have gone back to gas-powered vehicles.

Stellantis Merger Now Playing at a Dealer Near You

Stellantis, the merger between Peugeot and Fiat Chrysler Automobiles, became effective on Saturday, January 16th. The world’s fourth-largest carmaker has emerged, a surprise to no one.

General Motors Not Giving a Damn in Three Photos

It wasn’t long ago that the Detroit Three were fending off the Japanese on home soil as the Land of the Rising Sun cranked out reliable car after reliable car for the American masses. Then came the Koreans — Kia and Hyundai — who brought over cheap metal to win market share but quickly turned around their quality and reliability woes and produced some of the best products in the industry.

So why is it that, after 108 years of building automobiles, General Motors still manufactures abysmal garbage?

Was The Government's Divestment of GM Stock Insider Trading?

Back in 2004, perfectionist homemaker and well known TV personality Martha Stewart was charged with insider trading. As presented, the facts in the case were simple. Martha owned stock in a medical research company called ImClone and, like a lot of people who invest in tech firms, she was hoping for a big payout when their product, a promising new cancer treatment, went on the market. Unfortunately, the FDA chose not to approve the drug and the value of the stock looked set to take a beating once the decision was announced. According to the charges initially brought against her, Martha and many of the company’s top executives learned of the FDA’s decision though their inside connections the day before it was publicly announced and were able to sell their shares before they crashed. That’s against the law and many of the people caught up in the scandal, including Martha who was convicted on the charge of making false claims to a federal investigator, ended up going to jail.

Government Reports $9.7 Billion Loss On GM Shares

With the vast majority of the government’s General Motors shares sold, the U.S. government is reporting a $9.7 billion loss, according to a Congressional report cited by the Detroit News.

The Juggling Show: GM Calls Its European Dealers Worthless, Receives A $35 Billion "Stealth Bailout"

GM’s European dealers had their run-ins with the company lately, but wait until their read GM’s annual report to the Security and Exchange Commission. In its 2012 10K, GM writes about its European dealer network:

“To determine the estimated fair value of the dealer network, we used the cost approach with adjustments in value for the overcapacity of dealers and the sales environment in the region. We determined the fair value to be $0.

Wait, there is less …

How GM Avoided A $30 Billion Loss: With A Little Juggling

So you think GM had a big profit last year? There are other people who say that GM should have reported a $30 billion loss. At least as long as GAAP (Generally Accepted Accounting Principles) are applied. How did that happen? It’s a puzzle palace of assets out of thin air, of non-paid taxes on assumed future earnings. It started in 2010 …

The Truth About Post-Bailout Pay Restrictions: They Are A Lie

What’s 10 million these days – give the man a raise!

Up until the mid-1800s, debtor’s prison did await those who could not pay their debts. To this day, more than a third of U.S. states allow debtors to be jailed for non-payment. If you run a company called GM, Ally, or AIG, not only do you keep your freedom, you will be bailed out by the government, and given a $10 million salary. Waitaminute, you say, aren’t executive salaries of bailed-out companies limited to a still very generous $500,000? This is exactly the question the special inspector general for the Troubled Assets Relief Program asked. The answer, provided in a report to Treasury Tim Geithner, and the public, is scathing: The Treasury Department ignored its own rules and approved “excessive pay packages” for the leaders of bailed-out companies.

Le Bailout: Ford Is Against It

Stephen Odell, CEO of Ford Europe, thinks that state aid of ailing carmakers is a dead-end street.

Le Bailout Watch: Peugeot Saved By French Government

Europe’s second-largest automaker and GM alliance partner PSA Peugeot-Citroen is being saved from the brink for the time being. PSA is putting the final touches on an agreement with creditor banks on 11.5 billion euros ($14.9 billion) of refinancing, in addition to 7 billion euro ($9 billion) in government guarantees for its captive financing arm Banque PSA Finance, Reuters says.

Le Bailout Watch: France To Save Peugeot, Germans Say Verboten

The French government will provide multi-billion euro guarantees to GM’s alliance-partner PSA Peugeot-Citroen via PSA’s banking arm, Reuters says. Don’t bet on it happening: There is already opposition from Germany, and wait until Brussels officially hears of the deal.

How The GM Bailout Turned Into Foreign Aid

Longtime reader and new contributor Tyler Vandermeulen is a financial analyst by day. He took a deep dive into the EDGAR database to unearth how much of GM’s money flows abroad. Please welcome Tyler with the respect he deserves. Rude comments will not be tolerated.

Before the bailout of General Motors, it was well understood that the world’s largest automaker was losing huge amounts of money in the US and was staying afloat thanks to stronger performance in overseas markets. Since the bailout, however, that dynamic has been turned on its head. Thanks to a leaner manufacturing footprint, debt eliminations and steadily recovering sales, GM’s US operations have generated the lion’s share of the company’s profit since the bailout. And now, as the rest of the world economy slows, GM is spending more and more of its taxpayer-enhanced cash pile to shore up its faltering foreign divisions. In fact, according to an analysis of GM’s SEC filings, the company is likely to incur over $6.5 billion in losses and expenditures overseas in the 2011-2014 period, not counting over $1.6b in foreign potential legal liabilities or several other incalculable expenses that could add up to billions more. Not only are these expenses a challenge to GM’s overall financial health at a time when it also faces billion-dollar expenditures on pensions in the US, it shows the basic problem with national bailouts of global companies. Taxpayers who were told they were saving an American company are now seeing their tax dollars flowing overseas by the billions.

Rattner Defends Bailout With Old Talking Points

Ford did not receive a government bailout. Not directly. It would have gone down the tubes along GM and Chrysler, if they would have been allowed to die, Steve Rattner, the head of the auto task force, told Bloomberg.

Blind Spot: Digging Deeper Into GM's Fuel Economy Record

Old habits die hard. Whether it’s GM’s desire to slice-and-dice its fuel economy achievements to make them look better than they are, or our instinct to correct the record, it’s all just a little bit of history repeating.

Should The Treasury Dump Its GM Stock?

Today’s Rasmussen poll results, which show that Americans are arguably less likely to buy from a bailed-out automaker, raise some interesting questions. Like, does receiving a bailout constitute an inviolable black mark on an automaker? Do the size of the bailout, and the amount the government recovers make a difference? With a presidential election looming, these factors are worth knowing: after all, the government still has the choice of when to divest its shares in GM. And with GM’s stock down over 40% from its $33 IPO price last November, the government is looking at a significantly larger loss than it would have endured had it divested immediately aftter the IPO. So, should the government dump now, anticipating larger losses in the near future, or should it hang on in hopes of a rebound, increasing the risk that “Government Motors” will become a political hot potato going into 2012? The latest clue, via CNBC, remains as cryptic as ever…

"Volt Scam" Debate Misses The Point

Mark Modica, a former Saturn dealer GM bondholder, has leveraged his financial loss at the hands of the government bailout into a blogging position at the National Legal and Policy Center, a conservative nonprofit that “promotes ethics in public life through research, investigation, education and legal action.” At the NLPC, Modica focuses on what he believes to be corruption surrounding the auto bailout, and has written a series of anti-GM posts that make TTAC look like a Detroit hometown newspaper (TTAC “bias police,” take note). Most recently, Modica has caught the attention of the auto media, including Automobile Magazine and Jalopnik, with a series of posts accusing Chevy dealers of “scamming” taxpayers by claiming the Volt’s $7,500 tax credit and then selling Volts as used cars. TTAC welcomes anyone seeking to cast more light on the bailout, but unfortunately, Modica’s attacks are too focused on making GM look bad and not focused enough on providing relevant information to the American people. Let’s take a look and see why…

Remember Our Fallen Heroes: Was The Bailout Worth It?

This is the Memorial Day weekend, when we commemorate our fallen heroes and raise our cancer risk by burning chopped beef. Listening to the media, it looks and sounds like the fallen heroes of the year are not the ones who gave and give their lives in ceaseless wars, but the auto industry. It didn’t quite die. It was medevaced in a TARP and helped by the PTFOA to get over its PTSD.

Instead of thanking the nation’s heroes (he did so in an afterthought, asking for “single acts of kindness”) VP Biden thanked himself:

"Government Motors": The Exit Strategy

With GM’s share price slipping below $30, the cries are going up again around the internet about the government’s stake in the bailed-out automaker. Thus far the Treasury has remained mum on its exit strategy, only indicating that it would emphasize speed rather than maximum return as it charted the course for its sell-off. But now, Reuters reports that “a big chunk” of the government’s 33% remaining stake in GM could be sold “in the summer or fall.” With the government’s shares “locked up” until May 22, that could mean the government is bailing as quickly as possible at a time when GM’s stock is hitting post-bankruptcy lows, and its CEO offers little in the way of explanations beyond blaming the Japanese tsunami and rising fuel prices. The Wall Street Journal figures taxpayers would lose $11b on its “investment” in GM equity if the government sold at today’s prices (the stock must hit $53 for break-even), but reports that political motivations outweigh fiscal considerations. The White House does not want “Government Motors” to be an issue in the next election.

Treasury Lowers The Bar, Fiat Snags Another 5% Of Chrysler

Exactly a week ago, Fiat said it would up its stake in Chrysler “within weeks,” and according to the Detroit News, the deed is now done. Having earned 5% of Chrysler’s equity by building a FIRE-family engine in the US (for use in the Mexico-built Fiat 500), Chrysler had to confirm that it has brought in $1.5b in non-NAFTA foreign revenue, and (according to Chrysler’s LLC agreement [ PDF])

[execute] one or more franchise agreements covering in the aggregate at least ninety percent (90%) of the total Fiat Group Automobiles S.p.A. dealers in Latin America pursuant to which such dealers will carry Company products

in order to bring its stake up from 25% to 30%. We already know that Fiat will achieve this goal by rebadging Chrysler vehicles as Fiats for Latin American markets, a move that is technically compliant with the letter (if not the spirit) of the LLC agreement. But, it turns out that Fiat still had to get the Treasury to amend its agreement in order to bend the rules just a little bit more.

Fiat's 40 MPG Fiction

Yesterday’s release of the Congressional Oversight Panel report on the auto bailout pointed out several fundamental problems with the government’s intervention in the auto industry, all of which stem from what the report termed the “mutually exclusive” goals of the Treasury in overseeing its investment in the industry. But that report focused entirely on the post-bailout management decisions by Treasury, ignoring the decisions made during the bailout itself. And though the White House has, in recent months, redefined its goals in bailing out GM and Chrysler to focus on the improved financial performance of the bailed-out automakers, this is clearly a recent recalibration of its political message. As I pointed out in my latest New York Time Op-Ed,

what Mr. Obama called his “one goal” — having Detroit “lead the world in building the next generation of clean cars” — is nowhere near being achieved.

And, as it turns out, the Administration’s actions in the bailout will inevitably come up well short of that goal in at least one important respect.

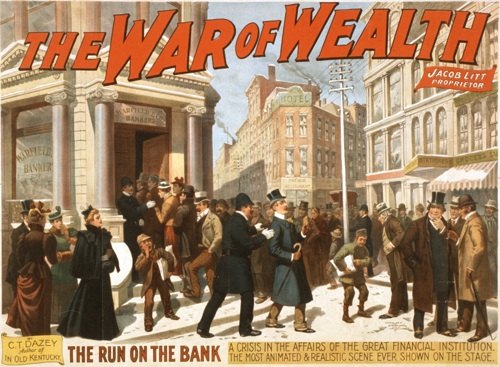

TARP Oversight Report: Bailout Goals Conflict, Moral Hazard Alive And Well

The Congressional Oversight Panel, which oversees the TARP program on behalf of the legislative branch, has released an update on the auto bailout [ full PDF here] acknowledging the successes of the government intervention, while airing a number of important concerns. As has been typical of mainstream media coverage of the auto bailout, the good news has already been well-reported. The report, for example, notes that the bailout brought GM and Chrysler’s capacity utilization up, labor costs down, and allowed them to “[start] to reverse” their decades-long declines in market share. Furthermore, estimated government losses on the bailout have been halved, from $40b to $19b. The report’s summary concludes

While it remains too early to tell whether Treasury‟s intervention in and reshaping of the U.S. automotive industry will prove to be a success, there can be no question that the government‟s ambitious actions have had a major impact and appear to be on a promising course. Even so, the companies that received automotive bailout funds continue to face uncertain futures, taxpayers remain at financial risk, concerns remain about the transparency and accountability of Treasury‟s efforts, and moral hazard lingers as a long-run threat to the automotive industry and the broader economy.

Which brings us to the concerns that have received considerably less media attention…

On Detroit's Guzzling Ways

One of the more admirable qualities of the blogging culture is a relentless underdog streak. Anyone who mans the ramparts of a decent blog is forever scouring the worlds of business, media and opinion for an opportunity to attack the most prominent voices of the day. And TTAC is no exception: we certainly came up by attacking the apologists and Polyannas who are still massively overrepresented in the world of automotive commentary. But what a difference a bailout makes. While the mainstream automotive media spent much of the leadup to the auto bailout making apologies and excuses for Detroit’s decline, TTAC told the unpleasant truth, gaining us new readers and credibility every step of the way. Now that I find myself being asked to contribute to one of the most prestigious opinion outlets in the world (the NY Times op-ed page) on a regular basis, TTAC is no longer the underdog, and other blogs have stepped into the breach to attack us as the new status quo. Fair enough… let’s do this thing.

TTAC In The New York Times

Ed Niedermeyer is too humble to say it, so it’s left to me: Ed just had his second third op-ed piece in the New York Times. Required reading. Two core sentences:

Is Detroit's "Perception Gap" Dead?

According to our latest sales data, the Detroit Three have enjoyed something of a comeback relative to the “foreign” competition this year. And though it’s not clear how long that trend will last, the media is catching the Detroit-boosting bug again. The NYT’s Bill Vlasic epitomizes the mood, focusing on improvements in GM and Ford’s products in a piece titled American Cars Are Getting Another Look. Between IQS score improvements and anecdotal evidence of consumer interest in Ford and GM’s “gadgets” and “value,” Vlasic’s sidekick, Art Spinella of CNW Research, forwards an interesting theory for the death of the “ perception gap” (a construct he helped create, by the way):

Ford has become almost the ‘halo brand’ for G.M. and Chrysler. Because of Ford’s success, people are less resistant in general to considering all of Detroit’s products.

Well, that’s not the dumbest thing ever said about the destruction of the perception gap… but it sure is a head-scratcher. Did Nissan and Honda just spend the last several decades skating by on Toyota’s sterling reputation (RIP)? Still, it might be interesting to hear Ford’s perspective on all this.

GM's AmeriCredit Deal: Awaiting Approval

Now that GM’s acquisition of the subprime lender AmeriCredit has had 24 hours to sink in, howls of protest are starting to surface. The charge is being led by Senator Chuck Grassley, who has requested a review of the deal from the SIGTARP, saying

If GM has $3.5 billion in cash to buy a financial institution, it seems like it should have paid back taxpayers first. After GM’s experience with GMAC, which left GM seeking a taxpayer bailout, you have to think the company and, in turn, the taxpayers would be better off if GM focused on making cars that people want to buy and stayed clear of repeating its effort to make high-risk car loans.

And though Grassley’s criticism could be read as mere partisan gamesmanship from a leader of “the party of no,” there are a number of very good reasons for opposing the deal.

GM's IPO: For King, Country, or Cadillac?

After ending the first quarter of this year with $35.7b in cash and equivalents, GM was in the best position it’s enjoyed in decades. And yet, with an IPO prospectus looming, The General is seeking a $5b line of credit and trotting out EBITDAPRO as its in-house measure of financial success. Both of these tactics are hallmarks of companies that are doing poorly, and GM has already learned how problematic loading up on debt and sliced-and-diced financials can be. So why is The General inviting criticism from outlets like Edmunds Autoobserver, which characterizes GM’s push towards an IPO as the rebirth of old bad habits? The simple answer: “business execution.” In other words, GM may have a lot of cash, but it’s got nearly as many demands on its resources as well… and these cash drains hardly add up to a coherent strategy.

GM's IPO: Faster, Harder And Less Satisfying

Despite having more cash than debt for the first time in decades, GM is going back to Wall Street in search of fresh debt. Over the weekend, The General has been in talks with several banks to secure a $5b revolving line of credit to shore up its liquidity position ahead of an IPO that’s rumored to take place in August. At $5b, GM’s desired line of credit would essentially replace the $5.8b the automaker has repaid to the Treasury, and will help it deal with a number of pressing cash needs to maintain its shaky global empire. But with so many pressing uses for the cash, and political pressure mounting for a rapid IPO, can GM deal with its issues and take on more debt and be worth what the government wants it to be worth? Troublingly, the answers to these questions are not to be found on GM’s balance sheet.

Editorial: The Truth About GM's IPO

One might believe that GM’s forthcoming IPO marks the second coming of Christ. GM, once the world’s largest corporation, faced oblivion in the winter of 2009. The train wreck of this former company reemerged from burial last summer through the generosity of the US and Canadian taxpayer as a new company shorn of most of its former financial liabilities, unproductive assets, and brands it no longer could support. Everything that Jerry York (R.I.P.) told the automotive world in January 2006 that GM needed to do to survive back then finally came to pass. And now, it’s preparing an IPO to swap ownership from the governments to the public. Ed Whitacre and his team will get the credit for a most remarkable turnaround while Obama will bask in the light of his stewardship of public monies. Let’s get the story straight.

Editorial: Mr Whitacre Goes To Washington

GM’s government-installed Chairman/CEO Ed Whitacre hasn’t been wildly popular with Detroit insiders, earning dismissive raspberries from more than a few corners of the industry’s peanut gallery. But now that his reign of executive terror is over, Detroit seems to be learning how to stop worrying and love the former AT&T man. As Whitacre prepares for his first visit to Washington DC as head of GM, the local media and other members of “Team Detroit” are making their peace with Whitacre. So what lies beneath the new united front?

Betrayed By Its Own Auditors, Opel Turns Into European Tar Baby

Opel’s Nick Reilly is casting worried glances towards Berlin and Brussels. What he hears from there makes him double his Maalox dosage. Or pop some local Rennies, if the heartburn meds are in short supply at the Apotheke in Rüsselsheim. Which they undoubtedly are. Nobody wants to help Reilly. Berlin doesn’t want to. Brussels doesn’t want to. Even Opel’s own auditors are no help. This tale would be better told by Kafka. He’s dead. I’ll try.

Editorial: GM Can't Read

Editorial: Opel Watch: Henderson: "We Are a Victim of Coicumstance!" Fiat: "Andiamo!" Magna: "Jetzt Reicht's!"

Today, Berlin will re-attempt to save Opel after the disastrous Wednesday night / Thursday morning confab. From most accounts, that meeting was a remake of The Three Stooges, with the actors sent by central casting in Washington and Detroit. Berlin is still fuming about the “impertinence” (finance Minister Peer Steinbrück) of the junior Treasury staffer who demanded an extra $415 million more in short-term cash, above the bridge financing of $2.1 billion Berlin had been ready to sign that night. They also are still grumpy about being lied to, or handed “information with a short half-life” as the finance minister put it ever so politely.

Still smarting from the public flogging the German ministers administered after the meeting, GM is in heavy backpedaling mode. It’s all a big misunderstanding, GM CEO Fritz Henderson told Bloomberg. Fritz should have gotten his derriere over to Berlin in the first place, preferably with PTFOA member Ron Bloom alongside.

When the Germans found out during Wednesday night that the Treasury staffer was absolutely useless, they established a quick videoconference with Bloom, desperate for someone who makes at least a bit of sense. To be sure, Germany’s SecState Steinmeier called his colleague Hillary Clinton for help. For what it’s worth, Hillary offered her “utmost support.”

Back to Henderson: Fritz says GM didn’t ask for additional funding for its Opel unit from the German government. Das ist ein Mißverständnis. GM’s request for a $2.1 billion bridge loan remains unchanged. GM just needs the money a bit faster: $630 million upfront. The German government had thought the immediate needs were $140 million, Fritz explained. “Any confusion that was caused by this we take responsibility for,” Henderson says with as much contrition he can muster.

That will go down just swimmingly in Berlin. They were already confused that night in Berlin, because numbers kept changing; some doubted whether the US delegation knew the difference between dollars and euros. Now, it’s $630 million instead of the $415 million that made the Germans hurl carefully crafted invectives westward ho. Everybody: On your knees and pray that nobody reads Bloomberg in Berlin.

Henderson tells the sob story that all GM is doing is try to “protect its European operations, including Germany-based Opel, before a US government-imposed June 1 deadline to restructure or file for bankruptcy.” We’ll see tonight how much sympathy he will get for that one.

One participant of the Wednesday meeting already picked up his ball and went home, to Torino. Fiat’s Sergio Marchionne said he will not make any more concessions, and he will not take part in the second round of meetings tonight, and he did not get full disclosure of the Opel books, and he’s not willing to take on any additional risks. Arrivederla, signora e signori! The other part of the truth is that someone on the inside had leaked that “Fiat is out,” as Der Spiegel reports.

Magna is just about to get up and leave also: Since 6 a.m. (local), Magna has been negotiating with Forster et al. in the Berlin Hotel Adlon, right across from the Brandenburger Tor. Forster must not have talked to the contrite Henderson. The meeting isn’t going anywhere.

Not having learned anything from Wednesday night, GM “is constantly making new demands” BILD Zeitung was told. Yesterday, Magna was ready to help with the $415 million bone of contention. Now they are mad as hell, and are close to saying “Jetzt reicht’s” (Enough is enough.). “They are ready to get up and leave,” BILD reports.

With the negotiations in increasing disarray, a bankruptcy of Opel gets ever more likely. The Frankfurter Allgemeine Zeitung reports that Opel has hired insolvency expert Jobst Wellensiek, along with the Clifford Chance lawfirm, which is working on a bankruptcy package to file with the court. Even chancellor Angela Merkel, who so far had taken the presidential high road, now doesn’t want to rule out an Opel bankruptcy, reports Der Spiegel.

It may be the cheaper solution all around. Germany’s economy department calculated that a shuttered Opel would cost the government €1.1 billion—assuming that all 25,000 workers will remain unemployed and find no new jobs (a nuclear winter scenario). Total government costs for an alive Opel: €4.5 billion under the Magna model, €6 billion if Fiat gets it. Germany’s other car manufacturers would be glad to take up the slack.

GM and Magna have until 2p.m. GMT to agree or disagree on a deal. If they agree, the German government will probably accept the deal without much fuss, says the FAZ. If there’s no deal, then the meeting tonight will be short. The bankruptcy of Opel shall be blamed on the ugly Americans, and Germany will go back to more important things. Who will win the fall elections?

Don’t touch that dial . . .

Recent Comments