GM Misses Estimates, Doubles Losses In Europe

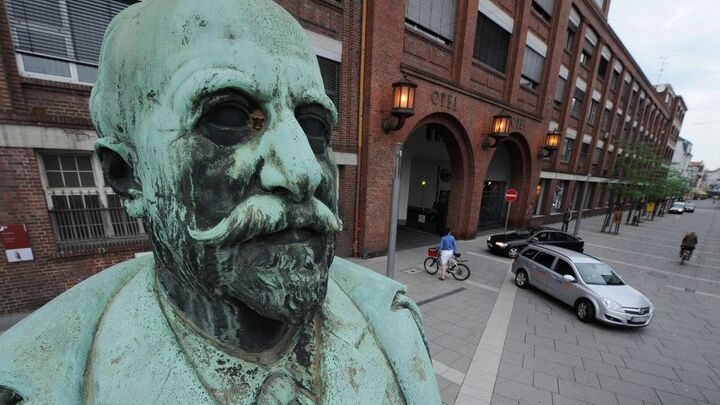

For decades, big corporate profits were blasted as a sign of greed, especially by unions. GM changed all that. When a sheep dipped GM, free of legacy finance costs, and not paying taxes due to losses a normal company would not have been able to carry over after a bankruptcy, declared a record $7.6 billion profit in 2011, chests of GM boosters swelled with pride, as if the profits had been theirs. A year later, there is $2.7 billion less to be proud of. GM’s European millstone, Opel, continues to drag the company down. Opel’s operative losses more than doubled to $1.8 billion for all of 2012.

GM reported as $4.9 billion profit for 2012, and “a weaker-than-expected fourth-quarter profit on Thursday, citing wider losses in Europe and lower vehicle prices in its core North American market,” says Reuters. Analysts had hoped GM would do better.

The situation in Europe is expected to be getting worse. CFO Dan Ammann told Reuters that “GM still sees industry sales in Europe declining in 2013 and is “not betting on” a pickup later in the year.”

GM wrote down $5.2 billion worth of assets in Europe. GM’s $423 million investment for a 7 percent stake in Peugeot, is now carried at half price on GM’s books. Ammann said that GM has “no intention of putting more cash into Peugeot.”

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

Are not G.M.'s "profits" on the backs of the American and Canadian taxpayers and the companies like Ford that managed their companies properly?

There better be special items included in Opel's $1.8B loss, one billion more than 2011. If not, I am really starting to wonder if it is worth keeping Opel around. I know GME cut 2600 jobs in 2012 and the Opel Mokka and Adam are runaway hits. GM is looking at a $7B annual net income if all Opel does is break even. Positives: Automotive free cash flow was $4.3 billion in 2012 compared to $3B in 2011.Total cash on hand is up to $37.2 billion. Profits increased in all regions except Europe. GM South America has swung to a profit.

There are lies, damned lies, and creative accounting. GM has pulled assets out of Opel it wants to keep, and now Opel has increased losses and poor future business prospects. The German core of Opel is being set up for bankruptcy proceedings.

Our government is not good at this stuff: http://www.detroitnews.com/article/20130214/OPINION03/302140335/Another-dud-federal-battery-program?odyssey=tab|topnews|text|FRONTPAGE