The Juggling Show: GM Calls Its European Dealers Worthless, Receives A $35 Billion "Stealth Bailout"

GM’s European dealers had their run-ins with the company lately, but wait until their read GM’s annual report to the Security and Exchange Commission. In its 2012 10K, GM writes about its European dealer network:

“To determine the estimated fair value of the dealer network, we used the cost approach with adjustments in value for the overcapacity of dealers and the sales environment in the region. We determined the fair value to be $0.

Wait, there is less …

Further to our story about the financial juggling acts performed to arrive at GM’s $4.9 billion net profit, a few commenters asked how GM arrives at these conclusions. The 10-K has an answer: They make them up. Or rather, in accountant’s speak:

“Determining the fair value is judgmental in nature and requires the use of significant estimates and assumptions, considered to be Level 3 inputs.”

And what’s a “Level 3 input”?

The Financial Accounting Standards Board (FASB) has the answer: “Level 3 inputs are unobservable inputs for the asset or liability.” It’s whatever management says.

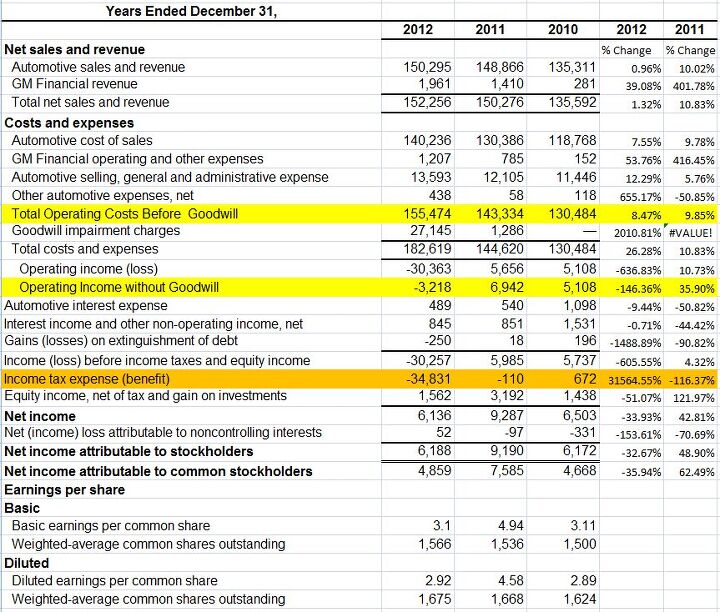

For folks who don’t want to sift through GM’s earnings release, and its ”dizzying array of accounting gains and losses for tax credits” ( CBC). Seeking Alpha did a little sifting of its own. The analysis comes to these conclusions:

- GM arrived at the $4.9 billion gain by assuming a $27.1 billion write-off on goodwill, off-set by an assumed future tax savings of $34.8 billion

- Ignoring the write-offs of assumed goodwill, and ignoring the assumed “earnings” from future tax savings, GM had an operating LOSS of $3.218 billion in 2012

- Operating costs rose 8.47% in 2012, while sales only grew 1.32%.

Seeking Alpha’s Spreadsheet

Also of note: Past losses can be used to off-set your future tax liability, fair enough. After a bankruptcy, these tax losses are usually wiped put. They turn into assets and are given to the creditors. Just like a bankruptcy discharges debt, it also makes loss carry forwards disappear, also fair enough. The TARP shenanigans unfairly protected the carry forwards, creating what Elizabeth Warren, former chairwoman of the Congressional Oversight Panel called a “stealth bailout.”

Harvard professor Mark Ramseyer called it “an arcane and hard-to-follow way of disguising billions of dollars paid to firms that, for whatever reason, are politically favored.” If GM can save $35 billion in taxes other companies would have to pay, then this is just another gift, taken from your pocket.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Brandon I would vote for my 23 Escape ST-Line with the 2.0L turbo and a normal 8 speed transmission instead of CVT. 250 HP, I average 28 MPG and get much higher on trips and get a nice 13" sync4 touchscreen. It leaves these 2 in my dust literally

- JLGOLDEN When this and Hornet were revealed, I expected BOTH to quickly become best-sellers for their brands. They look great, and seem like interesting and fun alternatives in a crowded market. Alas, ambitious pricing is a bridge too far...

- Zerofoo Modifications are funny things. I like the smoked side marker look - however having seen too many cars with butchered wire harnesses, I don't buy cars with ANY modifications. Pro-tip - put the car back to stock before you try and sell it.

- JLGOLDEN I disagree with the author's comment on the current Murano's "annoying CVT". Murano's CVT does not fake shifts like some CVTs attempt, therefore does not cause shift shock or driveline harshness while fumbling between set ratios. Murano's CVT feels genuinely smooth and lets the (great-sounding V6) engine sing and zing along pleasantly.

- JLGOLDEN Our family bought a 2012 Murano AWD new, and enjoyed it for 280K before we sold it last month. CVT began slipping at 230K but it was worth fixing a clean, well-cared for car. As soon as we sold the 2012, I grabbed a new 2024 Murano before the body style and powertrain changes for 2025, and (as rumored) goes to 4-cyl turbo. Sure, the current Murano feels old-school, with interior switchgear and finishes akin to a 2010 Infiniti. That's not a bad thing! Feels solid, V6 sounds awesome, and the whole platform has been around long enough that future parts & service wont be an issue.

Comments

Join the conversation

You guys are concentrating on all the wrong things. There are two numbers that matter- sales and expenses. GM sold 152 billion dollars worth of cars (and other income) and spent 155 billion dollars doing it. Everything else is smoke and mirrors. GM can only privatize its earnings and socialize its costs for so long. This company is NOT PROFITABLE right now, four years after its bailout. And it would appear to be going in the wrong direction, with expenses growing at 9% and sales flat.

What is wrong is the conclusion that GM is not generating income from operations. The reason for this is Automotive cost of sales includes non cash losses and the buyout of salary pensions that relieves the balance sheet of tens of billions of future liability. GM is that much stronger. The lazy journalist at Alpha's flawed analysis and your spinning it into a "stealth bailout" is what is wrong. You make it appear as if the company is losing money on operations with this analysis, which is certainly not true. You put me to too much work. Going out of town!